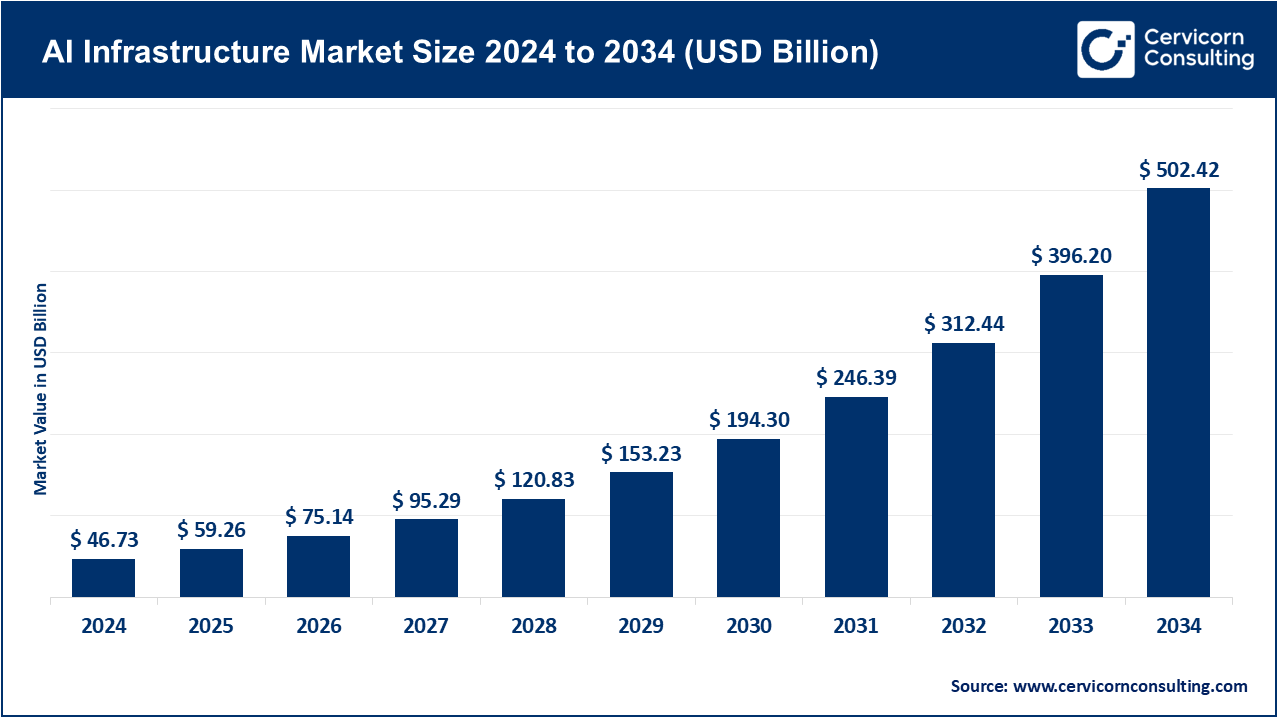

The global AI infrastructure market size was reached at USD 46.73 billion in 2024 and is expected to be worth around USD 502.42 billion by 2034, exhibiting at a compound annual growth rate (CAGR) of 26.81% over the forecast period 2025 to 2034. The growth of the artificial intelligence (AI) infrastructure market is driven mainly by the fast adoption of AI in industries such as healthcare, finance, retail, manufacturing, and autonomous vehicles. As organizations develop and deploy many more AI-driven applications, such as natural language processing, computer vision, and predictive analytics, demand for hardware that supports high-performance computing (HPC), such as GPUs, TPUs, and AI accelerators, without a doubt continues to grow. Additional factors driving growth include advancements in big data, and the need for faster processing and real-time analytics, which is forcing organizations to invest in scalable and energy-efficient infrastructure solutions more than ever before.

Also, major cloud service providers, such as AWS, Microsoft Azure, Google Cloud (and several others), are rapidly expanding their offerings related to AI infrastructure, which essentially facilitates access to AI-enabled infrastructure solutions for organizations of all sizes, without having to burden organizations with heavy upfront capital expenditures. Another important growth factor is the development of edge computing and 5G technologies, which supports greater deployments of AI models closer to the data source, therefore reducing latency and enhancing processing efficiency.

The infrastructure for artificial intelligence (AI) encompasses the combination of hardware, software and networking systems that allow for the development, training, deployment and scaling of AI models. This infrastructure can include HPC (high performance computing) hardware such as GPUs, TPUs, AI chips, data storage systems, networking hardware, AI-enabled servers, and then software frameworks or orchestration systems that manage the workloads of machine learning. Infrastructure can support an AI application such as NPL (natural language processing), computer vision, or predictive analytics. AI infrastructure can be delivered on-premise in a data center or in a cloud-based environment, which provides enterprises the capability to work with massive datasets and to execute complex computations efficiently.

Rising Demand and Investment Growth in AI Infrastructure

Across industries such as healthcare, finance, automotive, and manufacturing, demand and investment in AI infrastructure has skyrocketed year over year as there has been a growing adoption of AI technologies in these industries. The recent emergence of generative AI and large language models (LLMs) like ChatGPT and systems using GPT technology has heightened the demand for high-performing computational resources significantly. In response, major cloud providers and big tech companies have been spearheading substantial investment efforts in order to expand their data centers and GPU clusters to support this demand. Reports indicate that infrastructure spending on AI has grown in excess of 35-40% on an annual basis as a combined result of digital transformation efforts across enterprise organizations, government initiatives in the AI space, and the global race to build AI leadership. The U.S., China, and the EU are all making extensive capital investment in an effort to create advanced court AI computing ecosystem investments that will increase growth in the market over the long-term.

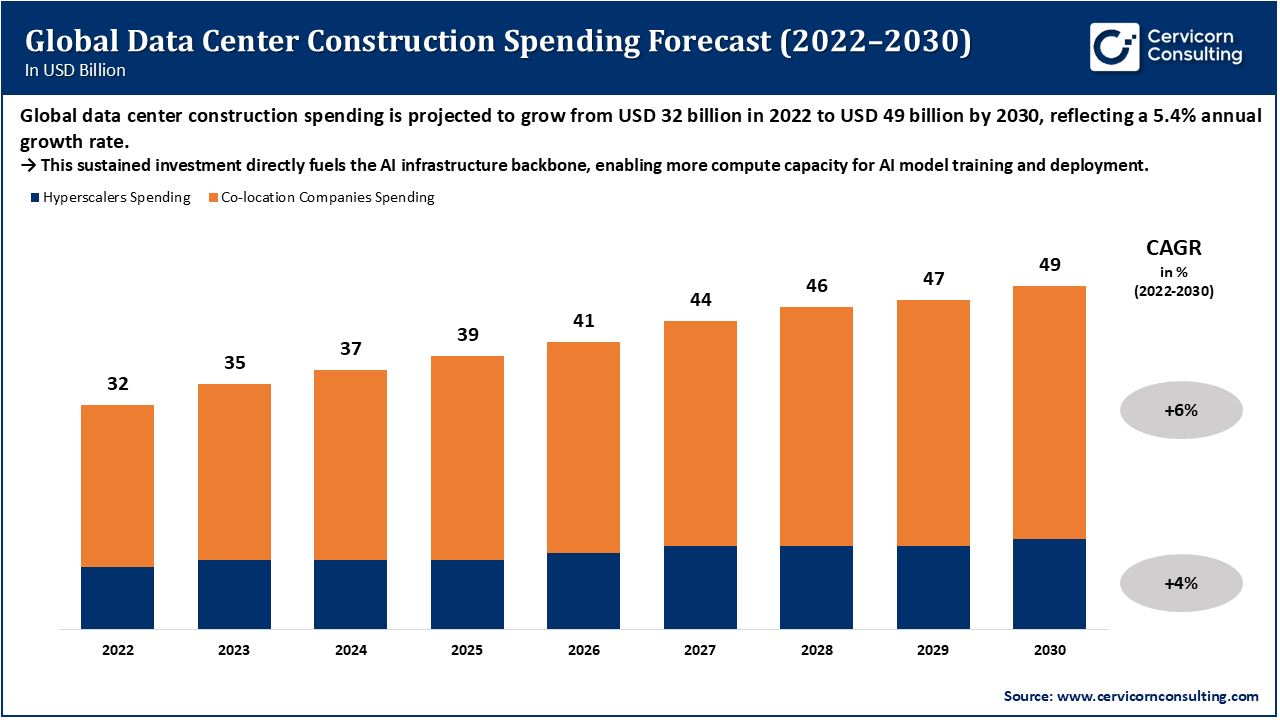

The image illustrates the projected global data center construction spending forecast from 2022 to 2030, which is a steady growth trend due to the increasing demand for AI and cloud infrastructure. The spending increase from co-location companies will occur at a 6% CAGR, in comparison to hyperscalers at a 4% CAGR implied a shift to shared, AI-ready infrastructure is underway. Acceleration of data center construction capacity usage will also fuel spending in the AI infrastructure market as easier access to computational power, storage, and networking will open up increased opportunities for large-scale AI applications. Overall, the data shows strong global momentum in developing the physical infrastructure for the future generation of AI-based innovation.

Year-on-Year Growth of AI Infrastructure Market

| Year | % of Enterprises Using AI | Infrastructure Demand Trend | Major Investment Drivers | Key Developments / Highlights |

| 2021 | 25% | Low to moderate, Mostly early-stage adoption and pilot projects. |

|

|

| 2022 | 55% | Rapid increase, Cloud AI workloads expand significantly. |

|

|

| 2023 | 55% | High demand due to the generative AI boom. |

|

|

| 2024 | 72% | Very high, strong infrastructure expansion globally. | Rise of multimodal AI systems, edge AI, and hybrid cloud architectures. |

|

| 2025 | 78% | Extremely high, AI infrastructure becomes critical national and corporate asset. |

|

|

Development of In-House AI Training Chips

Launch of Rack-Scale AI Hardware Platforms

Massive Expansion of GPU Clusters and AI Data Centers

Global AI Infrastructure Expansion and Sovereignty Investments

The AI Infrastructure market is segmented into various regions, including North America, Europe, Asia-Pacific, and LAMEA. Here is a brief overview of each region:

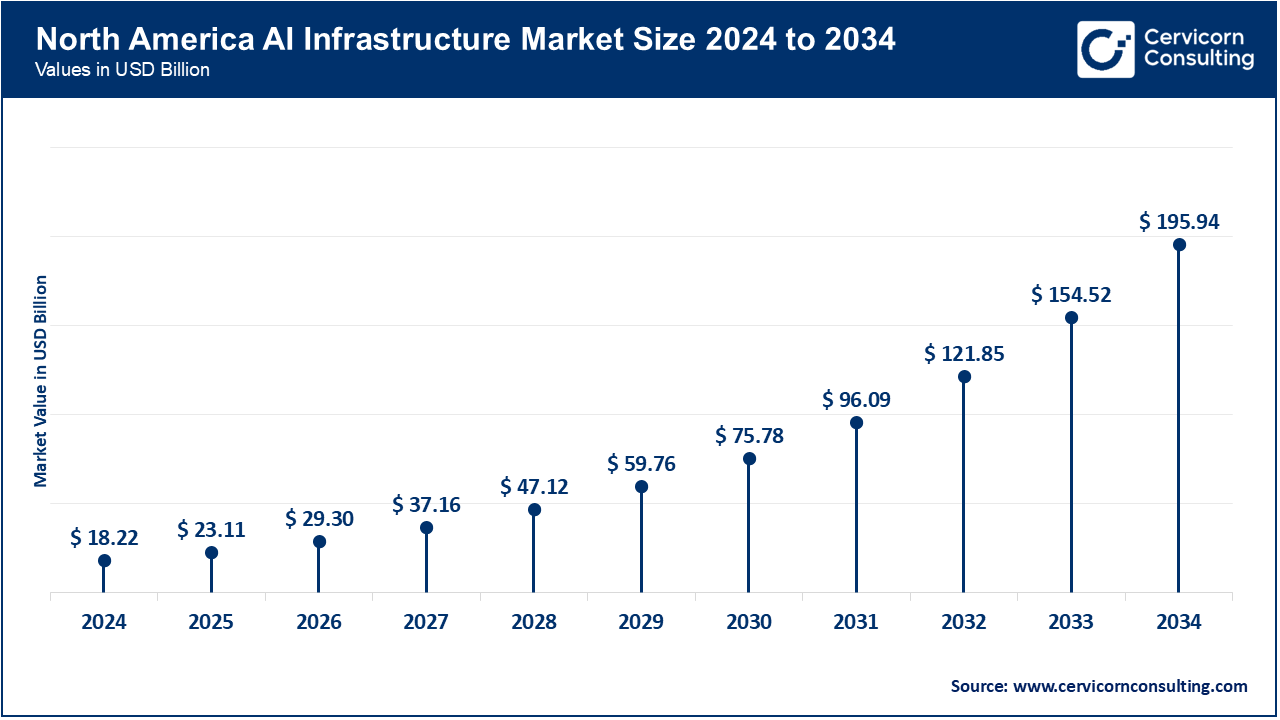

North America leads the market, boasting an ecosystem unmatched anywhere else in terms of hyperscale cloud providers, chip designers, and AI R&D companies. The United States remains the technology center, with both the world's largest AI compute clusters and the most mature data center network. With significant private investment plus government funding (the CHIPS and Science Act), North America remains firmly in the lead worldwide in AI computing capacity. Additionally, the growth of the AI infrastructure market is being stimulated by increasing demand for generative AI, large language model training, and edge AI deployment across various sectors.

Recent Developments

The Asia-Pacific region is experiencing rapid growth due to the implementation of national AI missions, large-scale cloud infrastructure, and semiconductor innovation. Countries such as China, India, Japan, and South Korea are quickly ramping up their AI capacity for throughput and efficiency to support digitization efforts across industries, the buildout of smart cities, and generative AI initiatives. Regional leaders in cloud in APAC (Alibaba, Huawei, and Tencent) are building AI data centers in Southeast Asia, while government mandates are supporting local AI chip and supercomputing investments. The result is an ecosystem that is rapidly propelling APAC to become the fastest growing region of AI infrastructure in the world.

Recent Developments

The Europe is being built around trust, transparency, and sustainability. The EU AI Act (2024) is a law that offers clarity to regulation, the growth of infrastructure, safety, and ethical practices of AI. Governments in Europe are continuing to invest in energy-efficient data centers fueled by renewables, as well as sovereign AI compute clusters to decrease dependence on non-EU providers. In the UK, France, and Germany, public-private partnerships continue to spur innovation and align growth in AI with sustainability, trust, and transparency. Europe is becoming a model for the ethical and sustainable growth of AI.

Recent Developments

Market Share, By Region, 2024 (%)

| Region | Revenue Share, 2024 (%) |

| North America | 39% |

| Europe | 25% |

| Asia-Pacific | 30% |

| LAMEA | 6% |

While the LAMEA region may be in earlier stages of the adoption of AI infrastructure, it has flourished as a rapidly growing strategic opportunity. The Middle East, with Saudi Arabia and the UAE leading the charge, has used national visions such as Vision 2030 and the AI Strategy 2031 to invest heavily into building smart cities and regional data hubs. In Latin America, many countries, like Brazil, Mexico and Argentina, are also modernizing their digital infrastructure to support AI workloads. Even in Africa, notable growth is being made in cloud computing and connectivity to facilitate the production of AI innovation. All these initiatives together, are building LAMEA’s future as the next frontier in the global landscape.

Recent Developments

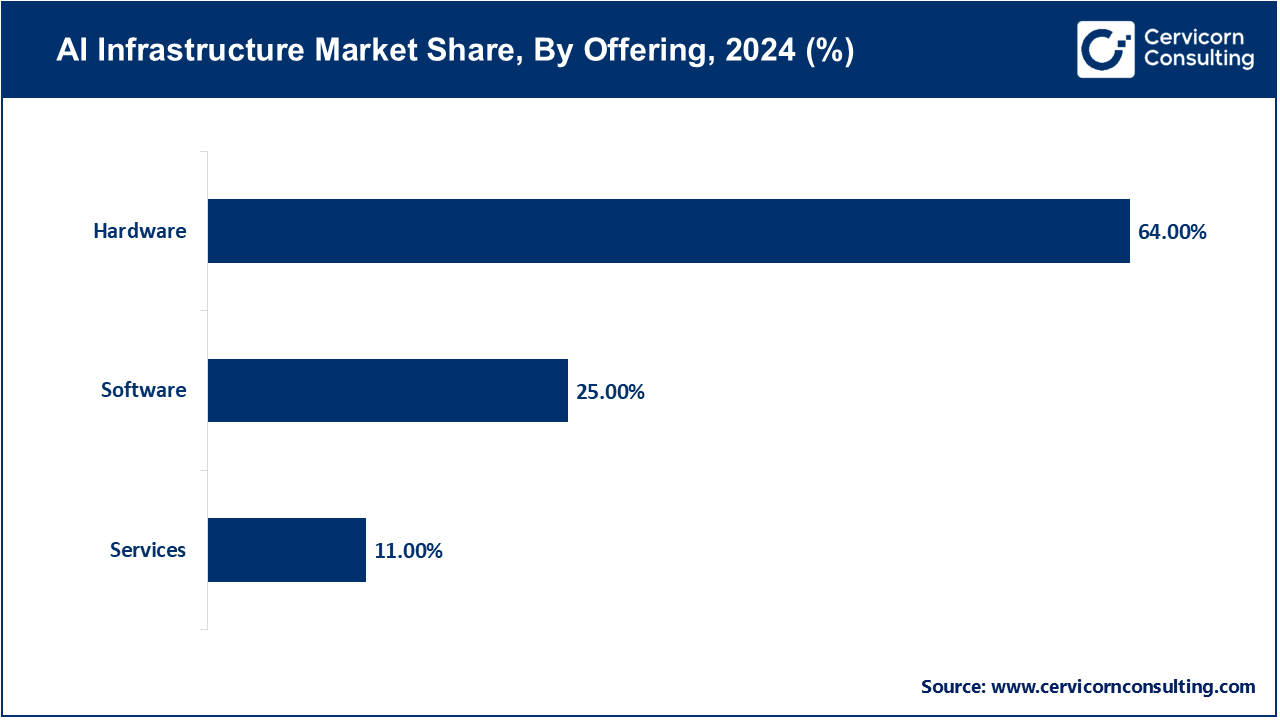

In 2024, hardware emerges as the largest segment, thus representing the physical layer of the AI revolution. Demand for GPUs, TPUs, AI accelerators, and high-speed networking infrastructure has fueled unprecedented growth among suppliers. Major players in the marketplace — Nvidia, AMD, and Intel — are each competing to produce faster and more efficient chips for training and performing AI inference. Just take a look at Nvidia’s data center revenue in 2024, which soared over 400% year-over-year, clearly demonstrating that hardware remains the core of AI performance.

However, the major growth area is in AI infrastructure services. Enterprises are moving toward AI-as-a-Service (AIaaS) and managed cloud services to avoid the costs and complexities of building and operating their own infrastructure. Major platforms are starting to emerge from providers like AWS, Azure, and IBM, to facilitate this transition, by way of scalable, pay-as-you-go AI ecosystems. In summary, hardware fuels AI, but services democratize it.

In the realm of technology, Machine Learning (ML) continues to be the dominant modality, embedded in nearly every modern enterprise function — in predictive analytics, fraud detection, automation and customer experience. ML has matured into a vital enabler of business value, with more than 78% of organizations utilizing ML models, according to research study.

Market Share, By Technology, 2024 (%)

| Technology | Revenue Share, 2024 (%) |

| Machine Learning | 59% |

| Deep Learning | 41% |

However, the fastest-growing force in technology continues to be Deep Learning (DL) — the engine at the heart of generative AI, computer vision and NLP breakthroughs. As models like GPT-4, Gemini, and Claude scale to trillions of parameters, the demand for deep learning infrastructure has also grown exponentially in the past few years. Nvidia and Google are both disclosing upward-to double-digit annual growth in compute for deep neural networks, reinforcing deep learning’s potential for redefining what is possible with “intelligent systems.”

On-premises infrastructure continues to dominate, particularly in industries with high data privacy regulations, low-latency requirements and required compliance — banking, defense, and health care. The organizations in these industries favor direct control over their AI clusters and sensitive data directly stored on-prem, ensuring on-prem can remain the base of mission-critical AI.

Market Share, By Deployment, 2024 (%)

| Deployment | Revenue Share, 2024 (%) |

| On-premises | 57% |

| Cloud | 28% |

| Hybrid | 15% |

However, cloud deployment is growing faster than any other deployment mode. The emergence of cloud-native AI frameworks and hybrid environments supports scalability and affordability that even smaller organizations can take advantage of. Study reported that more than 65% of AI workloads are cloud-hosted today, up from a mere 45% just one year ago (2023). We are now in the age of distributed intelligence, a seamless flow of compute capacity across cloud and edge network architectures.

Enterprises have always been the biggest consumer of AI infrastructure to automate operations, improve logistics and run intelligent decisions. In retail, BFSI and manufacturing, AI went from novel pilots to production systems. Data is projecting that enterprise spending on AI infrastructure will exceed 40% growth in 2024, making it the foundation of the market.

Market Share, By End Use, 2024 (%)

| End Use | Revenue Share, 2024 (%) |

| Enterprises | 52% |

| Government Organization | 19% |

| Cloud Services Provider | 15% |

On the other hand, cloud service providers (CSPs) are the fastest-growing users and have become the AI power grid of the world. Amazon, Microsoft, and Google now invest billions to create massive GPU farms and data centers with the highest performance possible. For example, AWS has announced a USD 35 billion expansion to AI Data Centers for 2025, while Microsoft grows its global AI network in over 30 regions. These investments not only contribute to their cloud dominance, but also support the larger AI ecosystem.

The market is quite aggressive, with Nvidia, AMD, Intel, and IBM driving hardware innovation and AWS, Microsoft Azure, Google Cloud, and Oracle leading cloud infrastructure. Firms are investing massively in AI data centers, AI accelerators, and AI-as-a-Service, while collaborations like Microsoft–OpenAI, Nvidia–Amazon, are reinventing the compute ecosystem on a global scale. The market is characterized by rapid innovation, extensive partnerships, and a race to provide the fastest, most efficient AI Infrastructure in the world.

Jensen Huang, CEO of NVIDIA – “AI Is the New Infrastructure of the World”

Nvidia's founding CEO, Jensen Huang, has consistently stated that AI has progressed beyond a technology and has now become a fundamental layer of modern infrastructure. He stated, "AI is now infrastructure ... just like the internet, just like electricity, it requires factories." Huang further emphasized that next generation (for example, DeepSeek, a reasoning model), will require 100 times the computing power of earlier generations — placing enormous strain on the capacity of global infrastructure. As Nvidia continues to lead the market in GPUs and AI compute systems, the company is well positioned as the core enabler of the AI economy worldwide.

Andy Jassy, CEO of Amazon – “AI Infrastructure Costs Define the Speed of Innovation”

Andy Jassy, the CEO of Amazon, stated that the phenomenon of generative AI represents “demand unlike anything we’ve experienced before,” which is primarily due to the costs of data centers and chips. Jassy noted that the primary hurdle to expand AI usage is lowering the infrastructure costs — which will then, “unleash AI being used in as broad a way as customers want.” Amazon, through AWS, has spent tens of billions on cloud data centers that are AI-ready, which is also developing custom silicon chips (Trainium, Inferentia) to lower costs of AI training at scale.

Market Segmentation

By Offering

By Technology

By Application

By Deployment

By End-use

By Region