The global resistant starch market size accounted for USD 13.18 billion in 2025 and is expected to hit around USD 24.52 billion by 2035, exhibiting at a compound annual growth rate (CAGR) of 6.5% over the forecast period 2026 to 2035. The resistant starch market is rapidly growing due to increased awareness and demand for healthy food products that promote good digestion and control weight, blood sugar levels, etc. Manufacturers are using resistant starch as a way to enhance the texture, increase fiber content, and develop "clean label" products. Companies are also responding to increased awareness of gut health and the growing demand for natural ingredients by adding resistant starch to a wider variety of products, including snack foods, baked goods, and beverages. Therefore, both developed and developing countries are seeing an increase in the number of products containing resistant starch available to consumers.

The growth of the resistant starch market is also being fueled by ongoing research activities and the development of new products. Companies are producing different types of resistant starch from various sources, including corn, potato, and banana, which improves the functional and stability properties of resistant starch. The increasing development of products in the areas of sports nutrition, gluten-free foods, and low-carb diets provides additional opportunities for manufacturers to meet consumer demand for products containing resistant starch. Companies will continue to invest in and develop solutions based on resistant starch as more consumers search for functional foods with health benefits backed by scientific research.

Rising Demand for Functional Foods and Healthy Products Driving Market Growth

The market for resistant starch continues to grow, with more consumers choosing healthier functional foods over basic nutrition. Consumers want products that help them control their weight, improve digestion, and maintain stable blood sugar levels, all of which can be accomplished by adding resistant starch to food products. Because resistant starch meets all of these criteria, food manufacturers are starting to add it to a variety of products including snacks, baked goods, cereals, and beverages in order to increase the fiber content of their products and develop healthier formulations. This shift away from processed foods towards clean label, edible-environment-friendly, and nutrient dense foods will encourage food companies to innovate by adding more resistant starch to their products, resulting in steady growth for this market.

1. Launch of new dietary-fiber resistant starch products by major ingredient makers

A significant ingredient supplier launched their new insoluble resistant starch dietary fibers, VERSAFIBE™ 2470 & 1490, in July 2024. This new line of products gives food manufacturers the ability to increase fiber in their products while reducing calories without sacrificing taste, appearance, or feel, making it much easier for food manufacturers to promote foods as "high-fiber", "low-calorie", or "clean label", which is appealing to the growing consumer demand for functional foods. With the new line of resistant starch products being readily available to use, the barrier for adopting these products has been reduced dramatically; therefore, the overall market for these types of products has expanded.

2. Scientific evidence showing health benefits (weight loss, metabolic improvements, gut-microbiota effects)

A clinical study of 2024/2025 revealed supplementation with resistant starch (RS type 2) over 8 weeks in overweight subjects resulted in average weight loss (~2.8 kg) while improving insulin sensitivity as a result of changed gut microbiome. The peer-reviewed evidence regarding RS further solidifies its reputation as a functional, health-promoting ingredient and not just a type of fiber or bulking agent, thereby fostering consumer confidence in RS's health-promoting properties while motivating both food companies and consumers towards utilizing resistant starch in areas such as weight management, gut health, and metabolic wellness. With the growing awareness of RS's positive benefits through additional consumer marketing, the demand for RS-enriched products continues to increase, thereby supporting growth within the resistant starch market.

3. Advances in processing and modification technologies

Recent advancements with heat/moisture treatment, retrogradation, and high-pressure processing enhance the stability and usability of resistant starch in a variety of food products. These advancements also preserve the texture, shelf-life and nutritional value of the food products in which resistant starch is added, thus allowing food manufacturers to use resistant starch in snack foods, beverages, dairy alternatives, baked goods and other products without losing quality. The increased functionality of resistant starch will encourage manufacturers to develop innovative new products and to increase the range of food products that include resistant starch. Therefore, the increasing demand for resistant starch will drive continued growth and development of this market segment.

4. Creation of new crop-based resistant starch sources (e.g. high-RS rice) expanding ingredient base

Researchers in China created the world's first commercial rice genome that contains an ultra-high amount of resistant starch content exceeding 30%. Along with this discovery came new varieties of rice flour that can be used for baking and other foods. Utilizing these natural crop sources of resistant starch provides additional options to include resistant starch more broadly in staple products such as rice, pasta, and baked goods in regions where rice is a significant portion of the diet. This transition is moving resistant starch away from only being found in specialty products towards being included in food products that are widely eaten daily. As more staple foods and widely eaten foods include resistant starch, the overall consumption of resistant starch will increase, thus strengthening the entire resistant starch market.

Report Scope

| Area of Focus | Details |

| Market Size in 2026 | USD 14.02 Billion |

| Estimated Market Size in 2035 | USD 24.52 Billion |

| Projected CAGR 2026 to 2035 | 6.50% |

| Dominant Region | Asia-Pacific |

| Key Segments | Source, Product, Application, Region |

| Key Companies | Cargill, Xian Kono Chem, Sheekharr Starch Private Limited, SunOpta, Natural Stacks, MSPrebiotics, Roquette Freres, AGRANA Beteiligungs,, MGP Ingredients Inc. Gut Garden, ADM, Ingredion Incorporated, Arcadia Biosciences, Tate & Lyle |

The resistant starch market is segmented into source, product, application, and region.

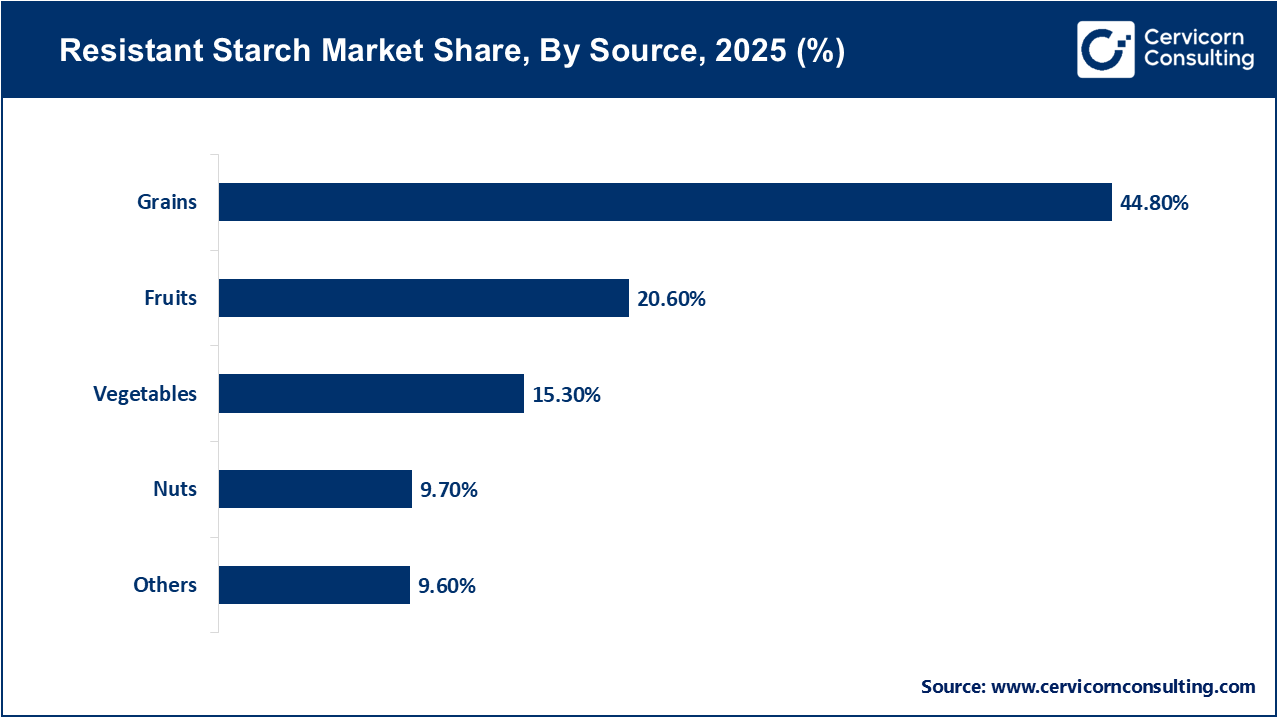

The resistant starch market is dominated by grains, which are abundant, cheap and used in many of the largest food segments such as bakery, cereals and snacks. Corn, wheat and rice are examples of common RS2 & RS3 sources; therefore, they are very easy for manufacturers to use in large-scale manufacturing. The high yield and stable supply chain of the grains also provide a consistency in the quality of ingredients used which encourages manufacturers and food companies to often source grain-based RS in their mainstream products.

Vegetables are the fastest growing segment in the resistant starch market as demand for natural, clean-label ingredients continues to increase. Vegetable RS has very desirable functional properties and higher RS content, and therefore appeals to health-oriented brands. As more consumers want plant-based or minimally processed ingredients, vegetable RS has begun to gain traction, particularly in the premium and functional food segments.

RS2 accounts for the largest share of the resistant starch market as it is utilized predominately by bakery goods and other snack foods, sports nutrition products, and dietary supplements. It maintains its structural integrity during manufacturing, providing a multitude of health benefits through improved digestion and control of blood glucose levels. RS2 has the added benefit of having several readily available sources such as potatoes and green bananas, thus allowing food manufacturers to formulate with the highest degree of flexibility. This creates a positive feedback loop for RS2 by reinforcing its status as the foremost resistant starch for many manufacturers, thereby maintaining its strong market position.

Resistant Starch Market Share, By Product, 2025 (%)

| Product | Revenue Share, 2025 (%) |

| RS1 | 11.60% |

| RS2 | 34.70% |

| RS3 | 29.80% |

| RS4 | 15.40% |

| RS5 | 8.50% |

RS3 is the fastest-expanding resistant starch product in the food industry as it is formed when starch undergoes retrogradation, resulting in its excellent heat-stability. This feature makes RS3 an ideal ingredient for all types of baked or processed food products, including bread, pasta, breakfast cereals, and ready-to-eat meals. Because RS3 is extremely stable through the cooking, cooling, and storage processes, food manufacturers can easily include it in their products without compromising its functionality. As more and more food manufacturers are becoming dedicated to developing high-fiber, shelf-stable food products for consumers, RS3 is rapidly increasing in adoption across all areas of the world.

The bakery product segment has been the main contributor to the sales of resistant starches because breads, cakes, biscuits and pastries are an easy way for consumers to increase their dietary intake of fibre, and improve a product's texture, flavour and reduce fat and calories in a bakery item. Furthermore, the addition of resistant starch in baked goods enhances the overall quality of dough, produces a more tender crumb, improves the nutritional value of baked goods by increasing fibre content. The bakery product segment is also the largest contributor to the overall growth of the resistant starch market due to the growing trend of consumers looking for healthier baked good.

Resistant Starch Market Share, By Application, 2025 (%)

| Application | Revenue Share, 2025 (%) |

| Bakery Products | 40.40% |

| Breakfast Cereals | 20.30% |

| Confectionery | 15.20% |

| Dairy Products | 110.10% |

| Others | 14% |

Breakfast cereals are the fastest growing application for resistant starch because of the increased consumer demand for high fibre breakfast cereals and healthier cereal options. Resistant starch is beneficial for breakfast cereals by adding additional nutritional benefits to consumers without changing the way the cereal looks, tastes or crunches in the mouth. With the growing consumer preference for eating high fibre breakfast cereals that contain prebiotics, breakfast cereal manufacturers are rapidly increasing the amount of resistant starch that they add to their breakfast cereals.

The resistant starch market is segmented into various regions, including North America, Europe, Asia-Pacific, and LAMEA. Here is a brief overview of each region:

The North America resistant starch market size was valued at USD 3.15 billion in 2025 and is estimated to grow around USD 5.86 billion by 2035. North America is experiencing a strong surge in consumer demand for foods that are both high in fibre and gut-friendly, as well as those with clean labels. The sophisticated infrastructure of the North American food industry enables food manufacturers to easily incorporate resistant starch into various food items, including baked products, snack foods, plant-based foods, and dietary supplements. Increased consumer interest in metabolic health, improved weight management, and the use of natural ingredients has reinforced and intensified the demand for resistant starch across all food categories, including mainstream and functional foods.

Recent Developments:

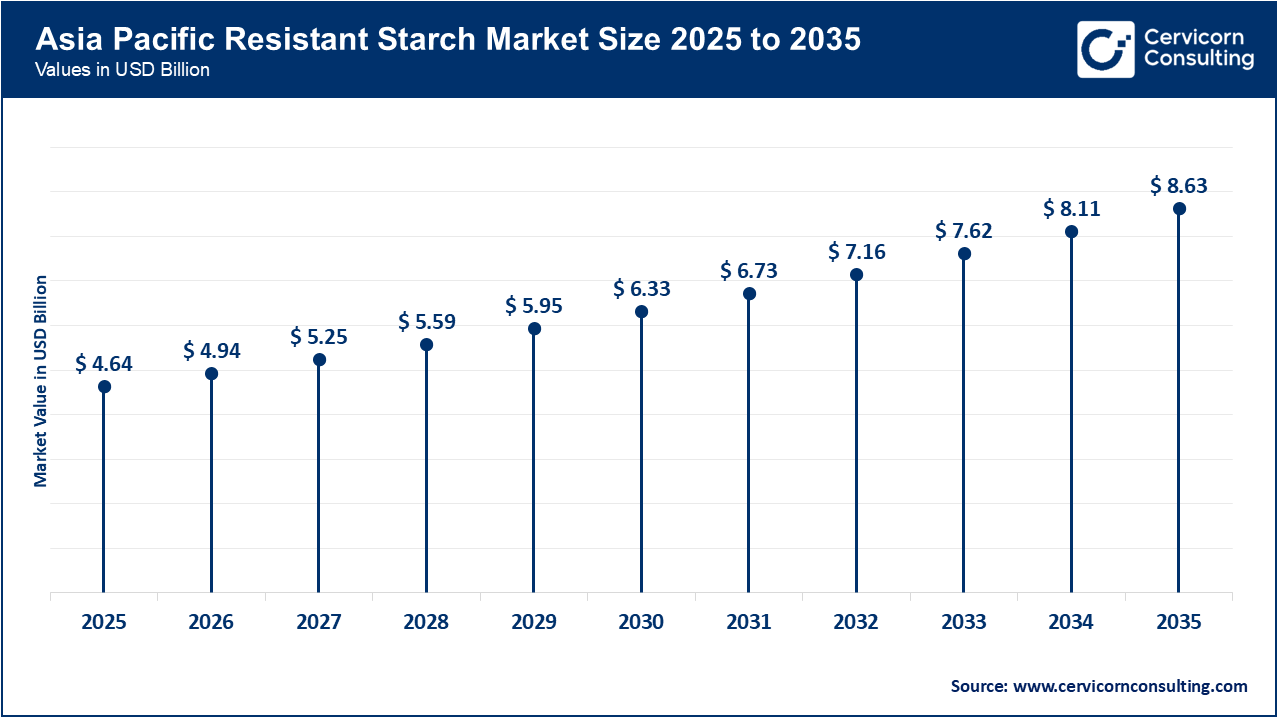

The Asia-Pacific resistant starch market size reached at USD 4.64 billion in 2025 and is forecasted to hit around USD 8.63 billion by 2035. The rapid development of products in Asia-Pacific can be attributed to the rapid growth of urban societies, increased consumption of pre-packaged food products, and increased interest in gut health. Companies based in China, India, and Japan are introducing ingredients containing resistant starch into their bakery, noodle, snack, and functional beverage offerings. There is an increased focus on providing healthier processed foods in this region and a governmental effort to improve nutrition through programs that promote a healthier diet, thereby facilitating this type of product.

Recent Developments:

The Europe resistant starch market size was estimated at USD 3.66 billion in 2025 and is projected to surpass around USD 6.82 billion by 2035. With consumers increasingly becoming aware of the importance of digestive health, fibre consumption and the use of 'natural' products in their diets, the market for resistant starch in Europe is expanding. The traditional industries for baking and cereals in Europe are already utilising resistant starch as a way to improve the nutritional profile of products while maintaining desirable taste and texture. Manufacturers are also increasingly using resistant starch due to regulatory support for healthier food formulations and a growing number of reformulations of existing products.

Recent Developments:

Resistant Starch Market Share, By Region, 2025 (%)

| Product | Revenue Share, 2025 (%) |

| North America | 23.90% |

| Europe | 27.80% |

| Asia-Pacific | 35.9% |

| LAMEA | 13.10% |

The LAMEA resistant starch market was valued at USD 1.73 billion in 2025 and is anticipated to reach around USD 3.21 billion by 2035. The rise in awareness about digestive wellness and the use of functional ingredients is driving growth in the Latin America, Middle East and Africa (LAMEA) region. As consumers seek more nutritious options for baked goods, snacks and quick service meals, the food industry is starting to explore the use of resistant starches to reformulate products. The changing consumption patterns in the LAMEA region and the growing food processing industry are creating more opportunities for increased use of resistant starch in food products.

Recent Developments:

By Source

By Product

By Application

By Region