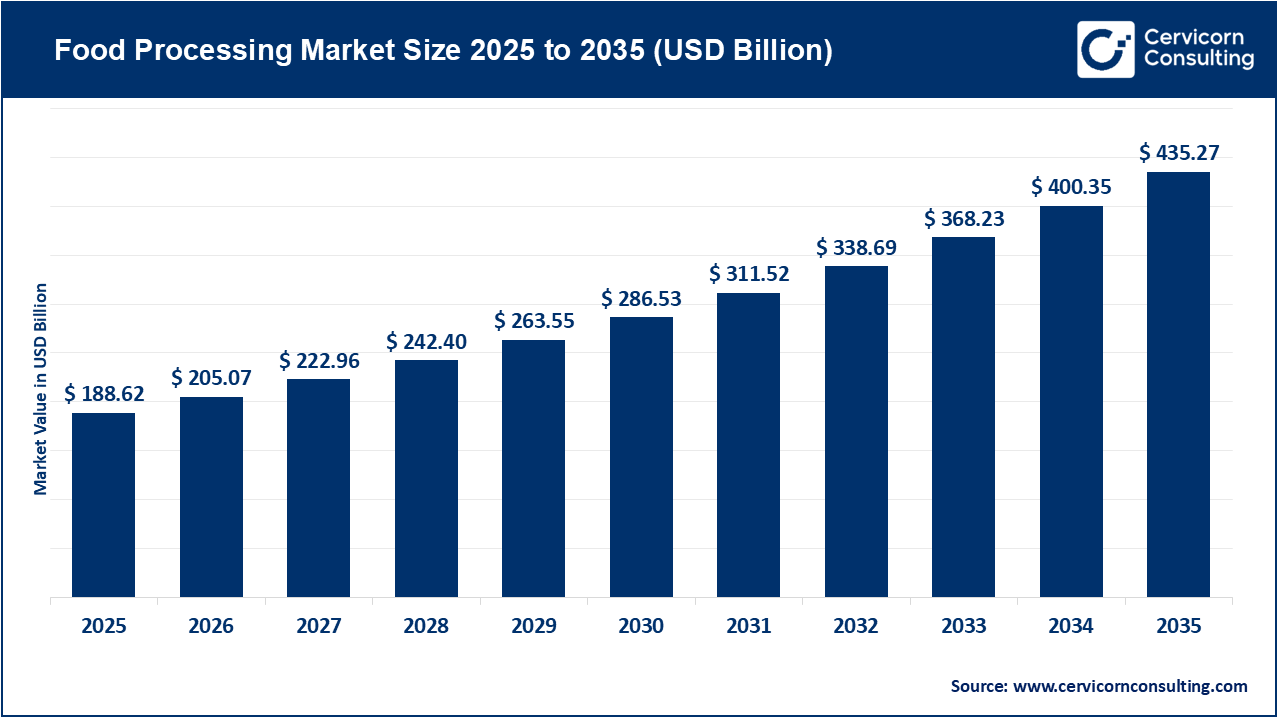

The global food processing market size reached at USD 188.62 billion in 2025 and is expected to be worth around USD 435.27 billion by 2035, exhibiting at a compound annual growth rate (CAGR) of 8.72% over the forecast period 2026 to 2035. The food processing industry is continuously growing as consumers look for healthier, safer, and more diverse options. Health awareness has turned the industry towards developing processed foods low in sugar, fat, preservatives, and other labels, while sustaining taste and shelf life. Rising globalization and exposure to various international cuisines has increased the demand for processed and packaged food products catering to different tastes and dietary requirements. The availability of processed food products through online grocery and commerce has made these products available to consumers everywhere and has seen the market grow even faster.

Sustainability is the next important driver in the food processing market. Companies have started to initiate eco-friendly packaging, energy-efficient production processes, and technologies to reduce waste in order to meet consumers and environmental expectations. Governments are providing subsidies, additional food parks, and generally encouraging players to enter the market. Continued advancements in automation, AI, and robotics will improve production efficiencies and quality of the products. Overall, these factors are helping the food processing industry drives into a more innovative, competitive, and consumer-focused sector.

What is Food Processing?

Food processing is the transformation of raw ingredients into finished food products by physical, chemical, or biological methods. Food processing includes activities like cleaning, cutting, cooking, freezing, packaging, and preserving, makes food safe, convenient, and takes the freshness and longevity of the food items in consideration. The main goal of food processing is to enhance the shelf life, taste and nutritional value of food items while keeping the hygiene and the essence in mind.

Importance of Food Processing:

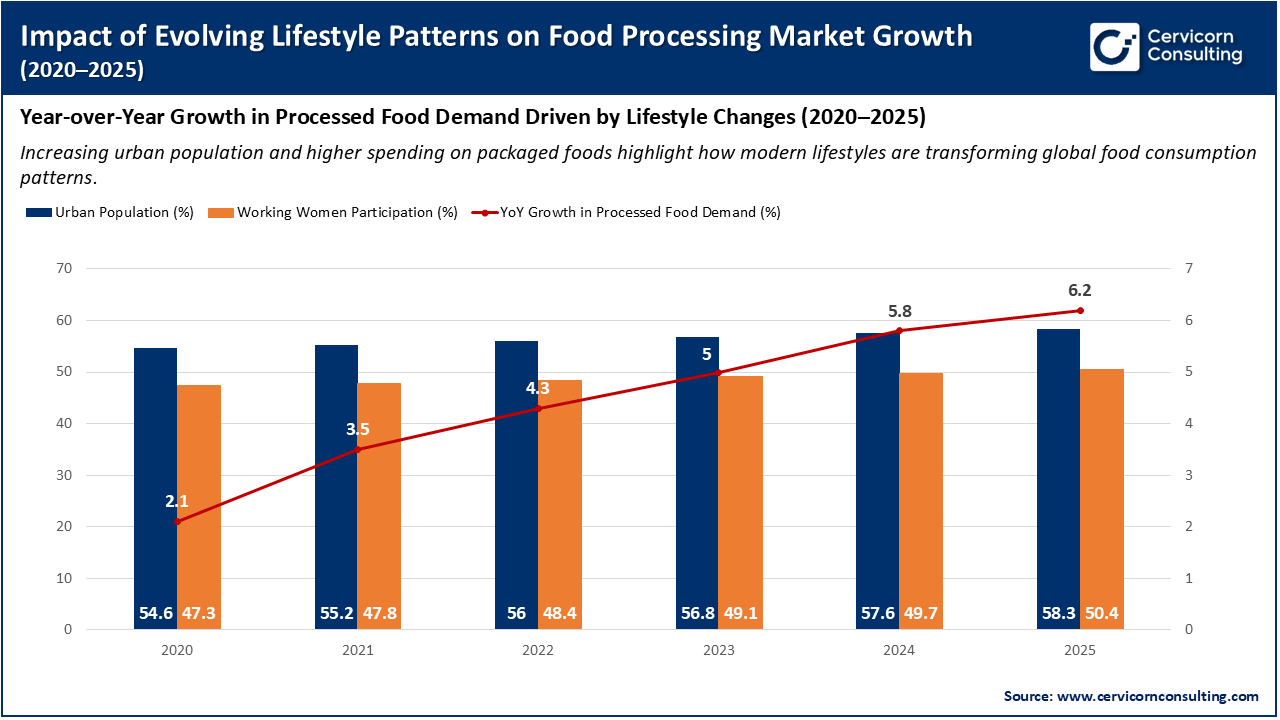

How Rapidly Evolving Lifestyle Patterns Are Fueling the Growth of the Food Processing Market

In India, 35% currently of total population lives in urban areas, but this is expected to rise to 50% by 2047, indicating a fundamental shift towards urban-based lifestyles. When individuals transition to an urban lifestyle, they adopt a quicker and busier way of life, which creates a greater demand for convenient, ready-to-eat, and packaged food products. Reports indicate that approximately 50% of an urban Indian consumer's food budget is now being spent on packaged meals, fast foods, dining out, and food deliveries, as opposed to traditional home-cooked family meals. The rise of food delivery apps, groceries about food and familiar supermarkets has made processed food more accessible than ever.

The food processing industry capitalizes on the modern stocking trend of the urban consumer. The food processing market benefits from the need for time saving, less food preparation, and suitability for a modern way of living. Increasing female workforce participation, smaller family units, and disposable incomes have all driven demand for convenience food. Also, younger adults who increasingly consume global food products, are growing in popularity with processed and fusion food products. Food companies are innovating to provide healthier options for on-the-go consumption in a convenient manner that supports nutrition claims, and parity is supporting the growth of the processed food market.

The chart illustrates how changing lifestyle trends to increased urbanization and female participation in the workforce are causing increased growth in the food processing sector from 2020 through 2025. With the urban population increasing from 54.6% to 58.3% and working women’s population increasing from 47.3% to 50.4%, consumer behavior begins to migrate towards convenient and ready-to-eat food products. The year-over-year (YoY) demand trends of consumer processed foods also indicates that rising demand is consistent, with demand increasing from 2.1% in 2020 to 6.2% in 2025. The result is a clear upward trend indicating modern lifestyles that are fast-paced result in steady growth within the food processing market.

Advanced Plant Launches for Domestic & Export Processing

Surge in Processed-Food Exports

Adoption of Smart Packaging and Automation Technologies

Government Support and Policy Initiatives

Report Scope

| Area of Focus | Details |

| Market Size in 2026 | USD 205.07 Billion |

| Expected Market Size in 2035 | USD 435.27 Billion |

| Projected CAGR 2026 to 2035 | 8.72% |

| Dominant Region | Asia-Pacific |

| Key Segments | Type, Category, Application, Region |

| Key Companies | Marel, BAADER Group, Bühler AG, The Middleby Corporation, GEA Group Aktiengesellschaft, FENCO Food Machinery s.r.l., Tetra Laval International S.A., Krones AG, Alfa Laval, Equipamientos Cárnicos, S.L. (MAINCA), JBT Corporation, LEHUI, SPX Flow Inc. |

The food processing market is segmented into various regions, including North America, Europe, Asia-Pacific, and LAMEA. Here is a brief overview of each region:

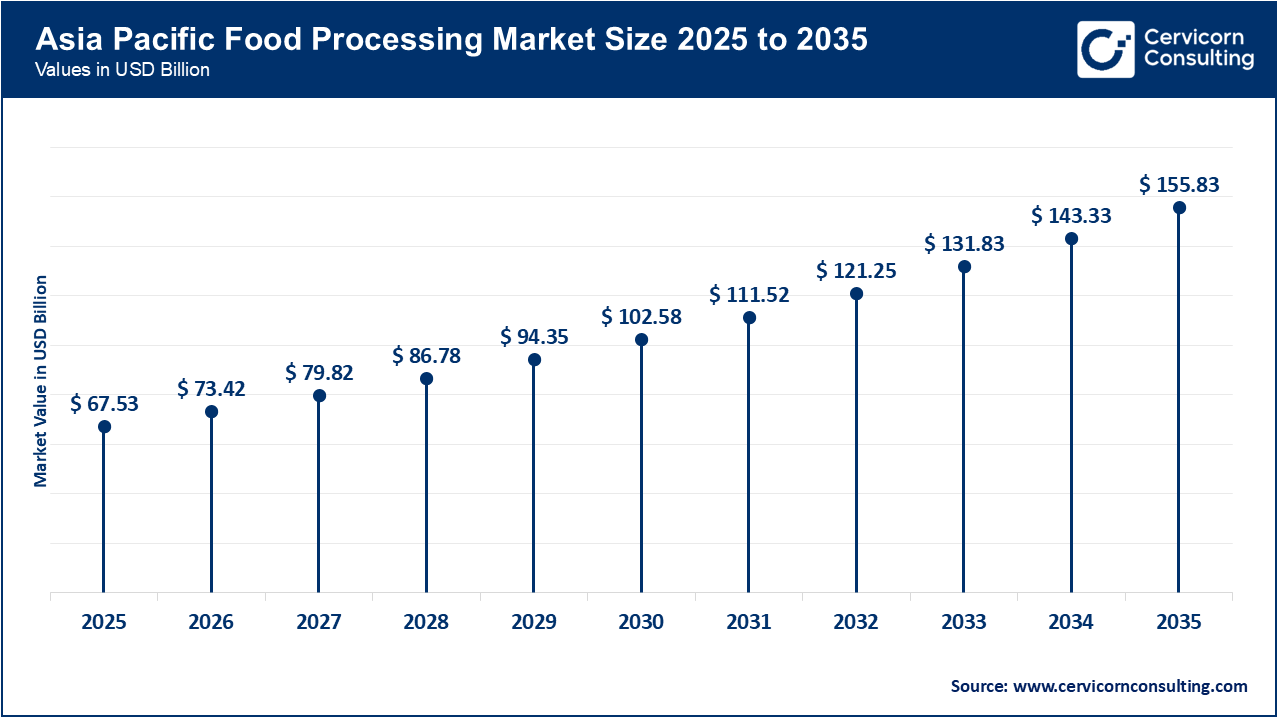

The Asia-Pacific food processing market size reached at USD 67.53 billion in 2025 and is estimated to surpass around USD 155.83 billion by 2035. The Asia-Pacific is currently the fastest growing market in the world, fueled by disposable income, urbanization and an understanding of the hygiene and convenience of packaged food products. Countries like China, India, Japan and Korea are investing heavily in processing technology, cold chain capabilities and production capacity for the export market. Furthermore, the advancements of e-commerce and strong global retailer chains like Walmart and Carrefour and Reliance Retail are providing greater awareness and access by consumers. Moving forward, Asia-Pacific will see a high rate of sophistication in the food processing market as a direct result of change in consumer behavior that is better health aware and centered on fortified and premium products.

Recent Developments:

The North America food processing market size estimated at USD 56.02 billion in 2025 and is forecasted to grow around USD 129.28 billion by 2035. The North American is dynamic yet one of the most mature markets in the world. Consumers prefer convenience foods, plant-based diets, and healthier ready-to-eat food options, which are growing in demand. Busy lifestyles, high disposable income, and a strong retail infrastructure now make processed food a staple in both the U.S. and Canada. North America automates and digitalizes more than other regions, AI, robotics, or smart packaging technologies all lead to efficiencies, reduced waste, and safety. Growth is driven by government investment to promote innovation in food, sustainability of food, and traceability of food safety. Furthermore, the increasing trend toward sustainable or eco-friendly packaging, and/or clean-labeled foods, forces leading brands to reformulate and innovate product new product lines in the deli space.

Recent Developments:

The Europe food processing market size reached at USD 46.40 billion in 2025 and is projected to surpass around USD 107.08 billion by 2035. The European market is propelled by the continent's emphasis on sustainability and health, and strong food safety regulations. European consumers are showing increasing interest in clean-label organic and minimally processed foods, leading companies to improve formulations and to shift to sustainable packaging solutions. The EU's "Farm to Fork" strategy is encouraging sustainable food production, circularity, and reduced waste, which is prompting manufacturers to re-think processes. Innovation in plant-based foods, dairy-free beverages, and meat-replacement foods is also accelerating. While rising energy input and raw material costs create challenges for food manufacturers, increased investments in energy efficient systems and precision automation are helping companies improve long-term competitiveness.

Recent Developments:

Food Processing Market Share, By Region, 2025 (%)

| Region | Revenue Share, 2025 (%) |

| Asia-Pacific | 35.8% |

| North America | 29.7% |

| Europe | 24.6% |

| LAMEA | 9.9% |

The LAMEA food processing market size accounted for USD 18.67 billion in 2025 and is anticipated to reach around USD 43.09 billion by 2035. The LAMEA is likely to grow considerably, driven by population growth, rising income, and urbanization which are driving demand for packaged and processed food. Latin America, led by Brazil and Mexico, is seeing strong demand for processed meats, snack foods, and beverages. In the Middle East, more dynamic and varied dietary patterns facilitated by youth population growth, will be driving demand for processed foods and beverages. In Africa, there is still substantial opportunity even with a less developed food system, as new retail networks expand and government efforts to advance food security and food processing increase. Limited infrastructure, dependency on importing food and rising energy prices remain challenges in this region. With new investment in processing plants and international trade, LAMEA may become a solid potential partner in the global processed food market.

Recent Developments:

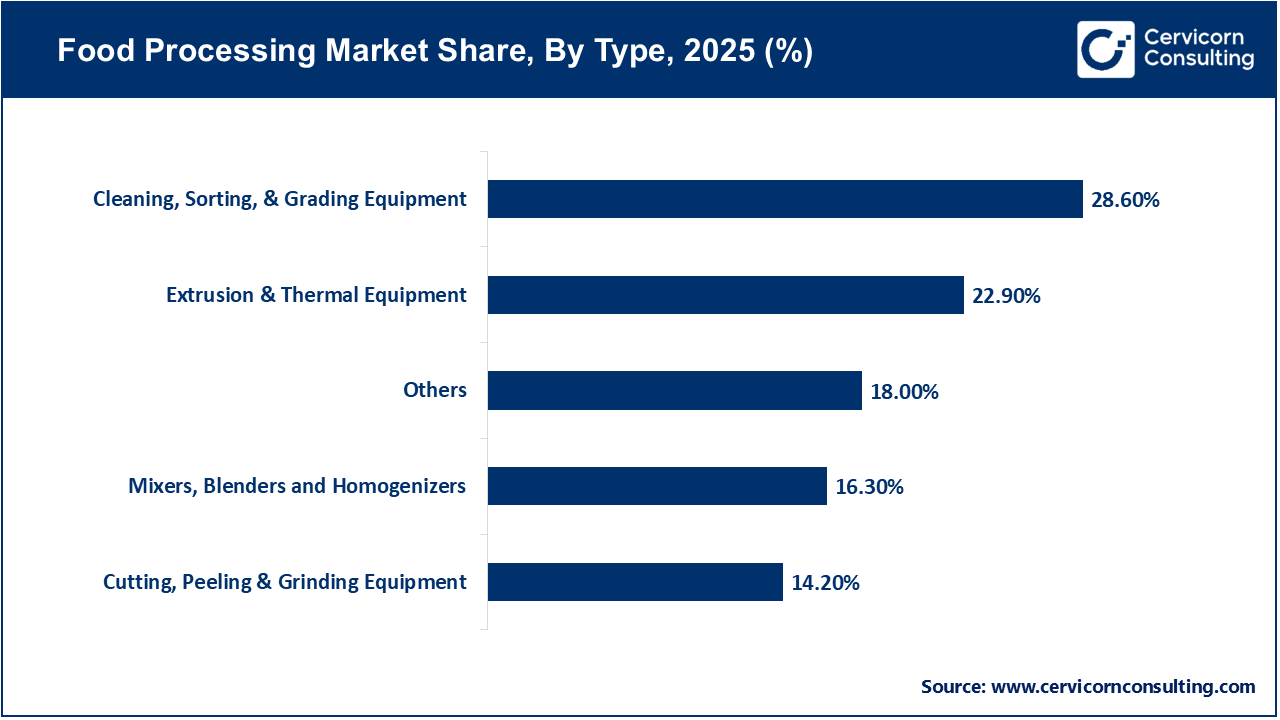

The food processing market is segmented into type, category, application, and region.

Cleaning, sorting, and grading equipment is a leading segment in food processing market since it is the basis for every processing line. Essentially, these machines remove objectionable substances, distinguish raw materials by quality, and prepare materials for use in further operations, such as cutting or packaging. These machines are continually requested in basic food processing operations to some extent across a variety of industries, including dairy, meat, fruits, and vegetables. The growing need for food safety regulation and the need to standardize products means that many manufacturers are beginning to invest heavily into automated cleaning and inspection systems as well as enhanced accuracy using sorting processes and optical detection technology. These pieces of equipment cannot be avoided in all food processing plants and are a required segment in the global market.

Extrusion and thermal equipment has the highest growth rate of type segment, driven by the rise in demand for processed snacks, breakfast cereals, ready-to-eat meals, and plant-based protein products. These machines provide textures, shapes, and nutritional content while also providing energy efficiency. Increased interest in snack food as an acceptable healthy food convenience and fortified foods has prompted producers to invest in new thermal processing that retains nutrients and also provides safety. The utilization of automated extrusion systems is fostering food innovation, especially for gluten-free and/or vegan product lines. This segment is notably growing quickly in both developed and emerging markets.

The semi-automated segment currently dominates the food processing market because of its affordability and flexibility. Small-and medium-sized enterprises (SMEs) in both developed and developing countries often prefer semi-automated because it performs reliably. This function is important since SMEs benefit from lower maintenance costs and capital costs. Semi-automated systems still allow human observation, which allows the end user to still achieve better control over quality and adjust product characteristics on-the-fly. Semi-automated systems are generally found in traditional processing units and small-scale food processing operations or any operation where a fully-automated system is not yet a possibility. Their flexibility and affordability continue to provide a stable product option to the world food processing market.

Food Processing Market Share, By Category, 2025 (%)

| Category Segment | Revenue Share, 2025 (%) |

| Semi-Automated | 56.4% |

| Fully Automated | 43.6% |

Fully automated food processing systems are the fastest-growing segment, as industries are changing to digitalization and smart manufacturing. These systems implement robotics, sensors and real-time monitoring, which increase precision, speed and hygiene in the production chain of the food industry. Automation, and closing the human error risk gap, increases productivity and provides production continuity with quality assurance. Fully automated plants are being adopted by large food corporations to fulfill increasing demands from the global market, in addition to meeting strict food safety regulatory standards for processed food. Furthermore, the advent of Industry 4.0 and the adoption of artificial intelligence for predictive maintenance have positioned fully automated food processing systems as a prospective area for investments in the future.

The dairy segment is the leader of the food processing market due to consistent demand for milk-based products such as cheese, yogurt, butter, and milk powders. Dairy processing equipment is important because it is responsible for pasteurizing, homogenizing, and packaging dairy food products while keeping them safe and fresh. The increase of health awareness and the trends towards more protein consumption both domestically and globally are increasing acceptance of dairy consumption. Dairy innovations of late include lactose-free milk and plant-based dairy alternatives which also leads to new modern dairy processing technologies. Modernization of dairy farms and cold-chain logistics are driven by government support which also drives the international growth and dominance of this segment.

Food Processing Market Share, By Application, 2025 (%)

| Application Segment | Revenue Share, 2025 (%) |

| Dairy | 22.5% |

| Meat & Poultry Processing | 15.2% |

| Fruits & Vegetables | 12.8% |

| Fisheries | 7.4% |

| Beverages | 13.9% |

| Packaged Foods | 18.6% |

| Others | 9.6% |

Packaged foods are the fastest-growing application segment due to rapid urbanization, increasing disposable income, and shifting eating and snacking habits. Consumers increasingly prefer ready-to-eat, frozen, or easy-to-cook meals because they save time and energy. The growth of supermarkets, online grocery delivery, and food delivery apps have made packaged foods much more accessible in most countries around the globe. Manufacturers are even investing in smart packaging and advanced methods of preservation to extend shelf life while preserving taste without harmful additives. Due to the increase in innovations of global cuisines, premium snacks, and sustainable packaging, the new product launches in the packaged foods application segment should be strong for the foreseeable future.

Market Segmentation

By Type

By Category

By Application

By Region