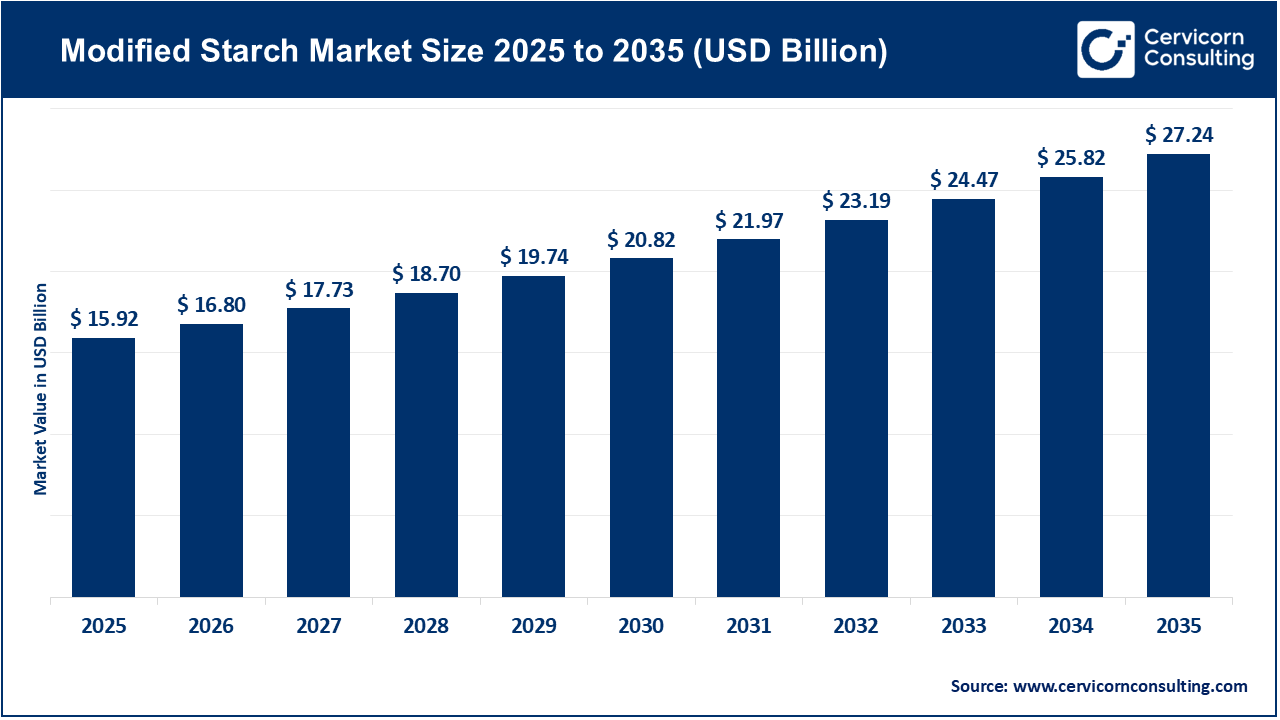

The global modified starch market size accounted for USD 15.92 billion in 2025 and is expected to surpass around USD 27.24 billion by 2035, exhibiting at a compound annual growth rate (CAGR) of 5.52% over the forecast period 2026 to 2035. The modified starches market is expanding as food manufacturers require more innovative and useful ingredients for modern food manufacturing. Modified starch creates improved texture, thickness, density, and shelf stability for many foods, thereby allowing for high volume production of food items. The bulk of the use of modified starches is found in processed food, like canned or packaged foods, baked goods, dairy products, sauces, and snack foods, where the manufacturers are seeking consistent quality and extended shelf life. The increasing demand for ready-to-eat and convenience foods within the urban population.

The expanding use of modified starches beyond the food industry, in other industries, including paper making, textiles, pharmaceuticals, and adhesives, has also created a lot of opportunities for the modified starch market. Many companies are starting to employ modified starches in their processes due to the added benefit of better binding, coating, thickening, and film-forming properties relative to conventional starch. The rapid and continued growth of the packaging and paper industry is also increasing demand for modified starch, since it can improve strength and print quality of both these types of products. In addition, as developing nations continue to industrialize and as starch modification processes improve through advances in technology, the modified starch market will see continuous growth.

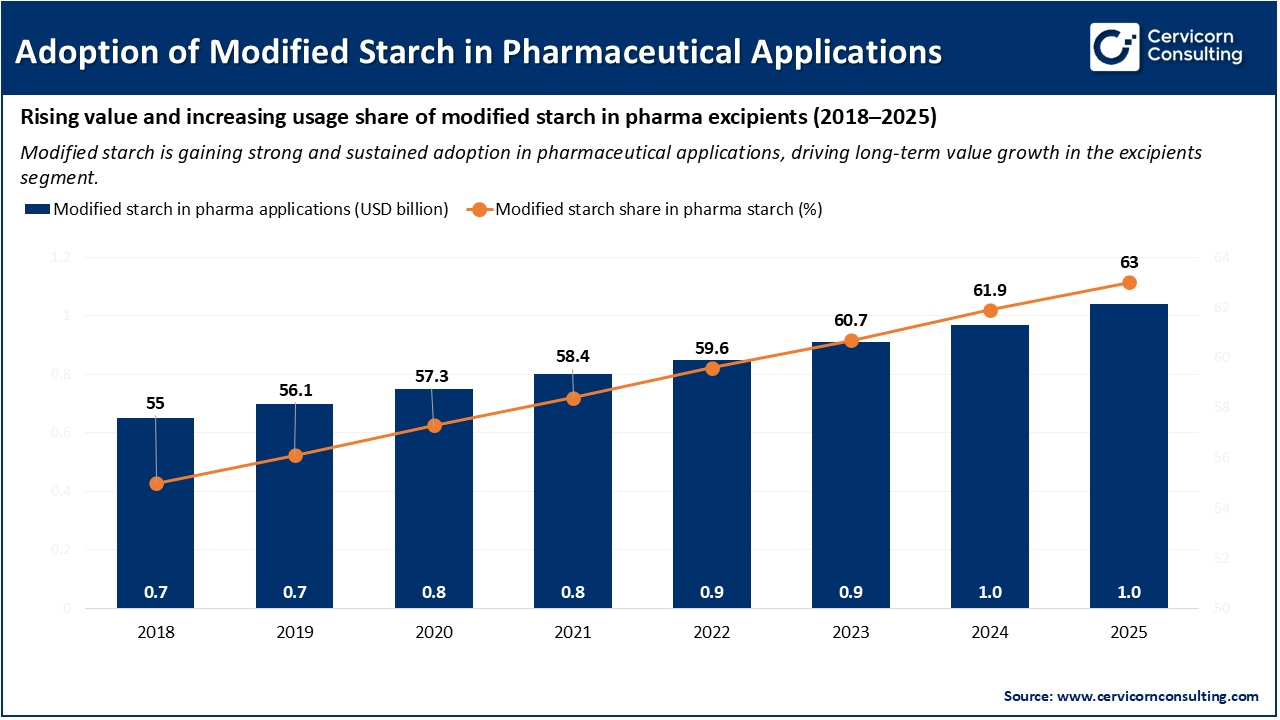

Role of Modified Starch in Expanding Pharmaceutical Applications

Market growth is being driven by an increase in the use of modified starch for pharmaceutical applications because of its important function in both drug delivery and excipients. It serves as a binder, disintegrant and stabilizer in the formulation of tablets and capsules-allowing for improved tablet strength, uniformity and controlled release of the drug. In addition, modified starch enhances the solubility and bioavailability of active pharmaceutical ingredients, which allows for the medicine to be more effective in the body. As pharmaceutical manufacturers continue to develop advanced drug delivery systems such as sustained-release or targeted delivery, more and more companies are turning to modified starch because of its low cost, very low toxicity, and excellent level of biocompatibility. The rapid development of the worldwide pharmaceutical industry and increasing investments in R&D have also created a significant increase in demand for modified starches in pharmaceuticals, thereby supporting the growth of the modified starch market.

As improved starch has attained a steady increase both in market value and adoption share, supported by the growing trend for improved starch to become one of the preferred excipients used in drug formulation. The rise of the pharmaceutical industry is causing significant growth in the modified starch market due to the increased demand for modified starches from pharmaceutical manufacturers. Also, pharmaceutical manufacturers have been encouraged to increase production, invest resources in research and development, and manufacture specific grades of starch to cater towards enhanced drug delivery systems.

1. Genetic- & enzyme-based starch modification for tailored functionality

For the last several decades, the food industry has been using modified starches from corn and other crops, primarily through chemical modification (e.g. acid hydrolysis, oxidation), as a way to improve their quality. However, advances in molecular genetics have given way to a variety of new methods that enable researchers and manufacturers to genetically engineer starches at their source (e.g. through the use of enzymes) to create starches with entirely new properties. In turn, these approaches have opened the door to new types of high-value starches with the ability to be tailored for specific applications, including bioplastics, specialty food additives, and pharmaceuticals.

2. Progress in biodegradable and sustainable packaging - starch-based bioplastics and films

Recent studies have demonstrated that modified starch provides a viable option for producing biodegradable plastic packagings and bioplastics through the blending of modified starch with other natural polymers or additives that improve water resistance, mechanical strength, and barrier characteristics. For example, recently, "starch polymeric films" have been created by combining modified starch with other bio-polymers or nanomaterials to provide packaging with decreased water vapour transmission rates and greater durability. This innovation has contributed to the growth of the modified starch market, with increasing concern about the environment and increasingly stringent regulations regarding plastic usage. The modified starch packaging industry is appealing to a rapidly growing number of environmentally conscious manufacturers and consumers looking for biodegradable, renewable alternatives.

3. Adoption of novel processing technologies to enhance starch performance

Along with chemical and genetic modifications, new and innovative ways of processing starch (including new drying/forming processes and hybrid modification technologies) are being developed to enhance starch's thermomechanical and functional characteristics. New and improved physical methods of treating starch result in a consistently uniform product that is easy to work with (process) and stable when subjected to freezing or high-temperature processes that are typical in today's industries. This leads to a much wider, more comprehensive array of modified starch choices for food, packaging, pharmaceutical and industrial end-users taking advantage of modern processing equipment.

Report Scope

| Area of Focus | Details |

| Market Size in 2026 | USD 16.80 Billion |

| Estimated Market Size in 2035 | USD 27.24 Billion |

| Projected CAGR 2026 to 2035 | 5.52% |

| Top-performing Region | North America |

| Highest Growth Region | Asia-Pacific |

| Key Segments | Raw Material, Type, Function, Application, Region |

| Key Companies | Archer-Daniels-Midland Company, AGRANA Beteiligungs-AG, Cargill Incorporated, Grain Processing Corporation (Kent Corporation), Emsland-Stärke GmbH, Tate & Lyle PLC, Ingredion Incorporated, Roquette Frères, Novidon B.V. (Duynie Group), The cooperative Royal Avebe U.A., SMS Corporation, Tereos |

The modified starch market is segmented into various regions, including North America, Europe, Asia-Pacific, and LAMEA. Here is a brief overview of each region:

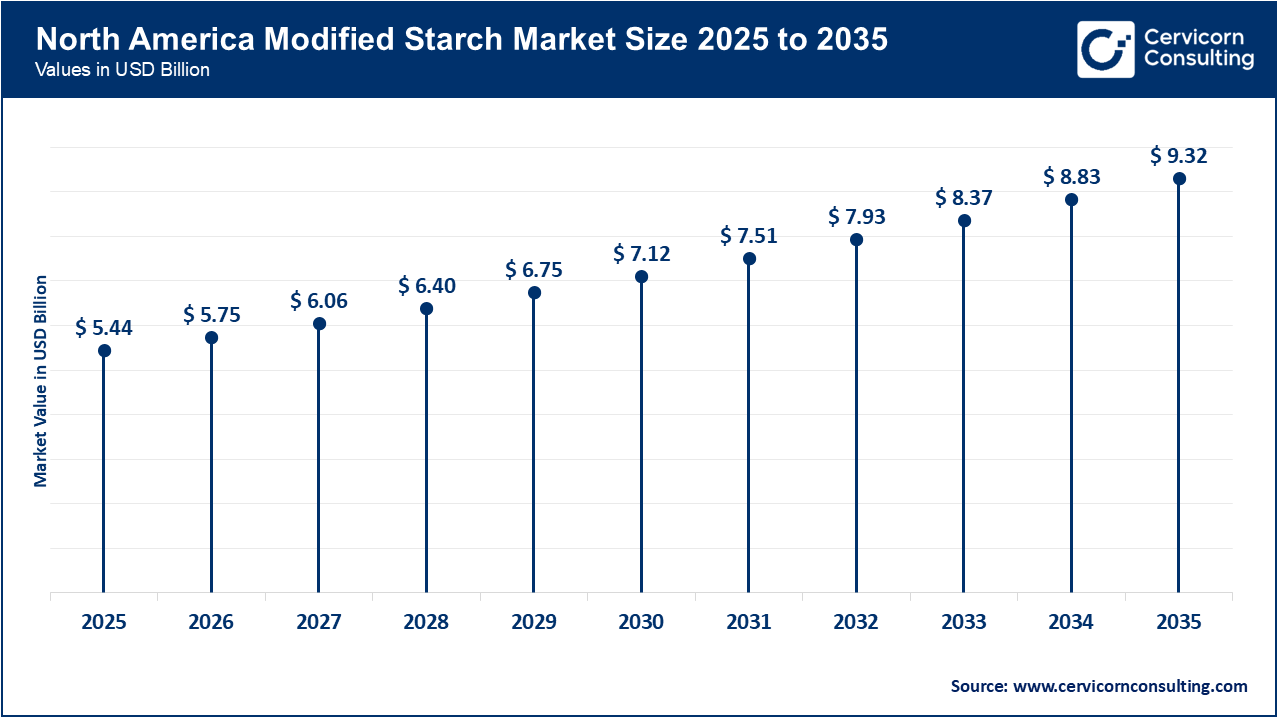

The North America modified starch market size valued at USD 5.44 billion in 2025 and is expected to hit around USD 9.32 billion by 2035. North America has become one of the largest market, due to its highly productive food processing, pharmaceutical, and packaging sectors. Modified starches are in high demand in North America as a result of the growing use and popularity of convenience foods, ready-to-eat meals, and clean label products. In addition, North America's robust physical presence of Major Manufacturers, as well as its advanced research resources, allow for continued development and improvements in modified starch products. With the emergence of new alternative biodegradable packaging and pharmaceuticals with starches, the North American modified starch market continues to be of great importance both regionally and globally.

Recent Developments:

The Asia-Pacific modified starch market size accounted for USD 4.08 billion in 2025 and is forecasted to grow around USD 6.97 billion by 2035. The Asia-Pacific region is experiencing the most rapid growth currently, due to the rapid pace of industrialization along with the increasing pace of urbanization in this region, plus the growth of the food and beverage industry. Key countries producing and consuming modified starch include China, India, Thailand, and Indonesia; these countries have strong agricultural resources that provide the raw materials (corn for example) for producing modified starch. Growth in consumer disposable income (rising middle class), along with changes in dietary habits and preferences, will increase processed food consumption, thus increasing the amount of modified starch required for this application. Additional growth in paper, textile and pharmaceutical markets will also contribute to market growth in this region.

Recent Developments:

The Europe modified starch market size estimated at USD 4.60 billion in 2025 and is projected to surpass around USD 7.87 billion by 2035. Europe market has seen significant growth, due to stringent regulations on the environment and an increasing number of consumers interested in sourcing their products from a sustainable and natural source. Many European countries are focusing on moving away from synthetic additives to plant-based alternatives for food, packaging and related industries. Consequently, an increase in the number of new uses of modified starch can be expected in biodegradable materials, paper production and medicinal formulation.

Recent Developments

Modified Starch Market Share, By Region, 2025 (%)

| Region | Revenue Share, 2025 (%) |

| North America | 34.20% |

| Europe | 28.90% |

| Asia-Pacific | 25.60% |

| LAMEA | 11.30% |

The LAMEA modified starch market size valued at USD 2.20 billion in 2025 and is anticipated to reach around USD 3.76 billion by 2035. The LAMEA is seeing steady progress due to the continued development of industry and food processing. Corn and cassava are two of the most abundant crops produced in the Latin America region, therefore, producing starch from these crops offers an excellent opportunity for growth in this sector. Starch demand in the Middle Eastern and African regions has primarily been supported by the growing importance of the food manufacturing and food packaging industries. In addition, the availability of adequate infrastructure, the increase in urban populations, and government interest in food security has led to an increase in modified starch usage and consumption in these regions.

Recent Developments:

The modified starch market is segmented into raw material, type, function, application, and region.

Corn is the leading raw material in the market due to its widespread cultivation in all major agricultural regions, along with its low cost and high productivity. Its well-established supply chain and easy accessibility make it the preferred feedstock for large commercial processors in the food, paper, and adhesive industries. Corn's modified starch has stable functional characteristics (e.g. excellent thickening, binding, and film-forming properties), thus allowing for widespread industrial application.

Modified Starch Market Share, By Raw Material, 2025 (%)

| Raw Material | Revenue Share, 2025 (%) |

| Corn | 48% |

| Wheat | 14% |

| Potato | 18% |

| Cassava | 12% |

| Others | 8% |

Cassava has the fastest growth rate of any raw material segment and is expected to continue on this path because it is becoming increasingly grown and harvested in tropical and subtropical regions and can be used for both food and industrial uses. Cassava has a high starch content, is naturally gluten free, and is becoming increasingly popular for the production of clean-label products and allergen-free products. The increased focus on sustainable agriculture and the rapidly growing demand from developing regions of Asia and Africa are major factors driving the growth of cassava based modified starch products in markets.

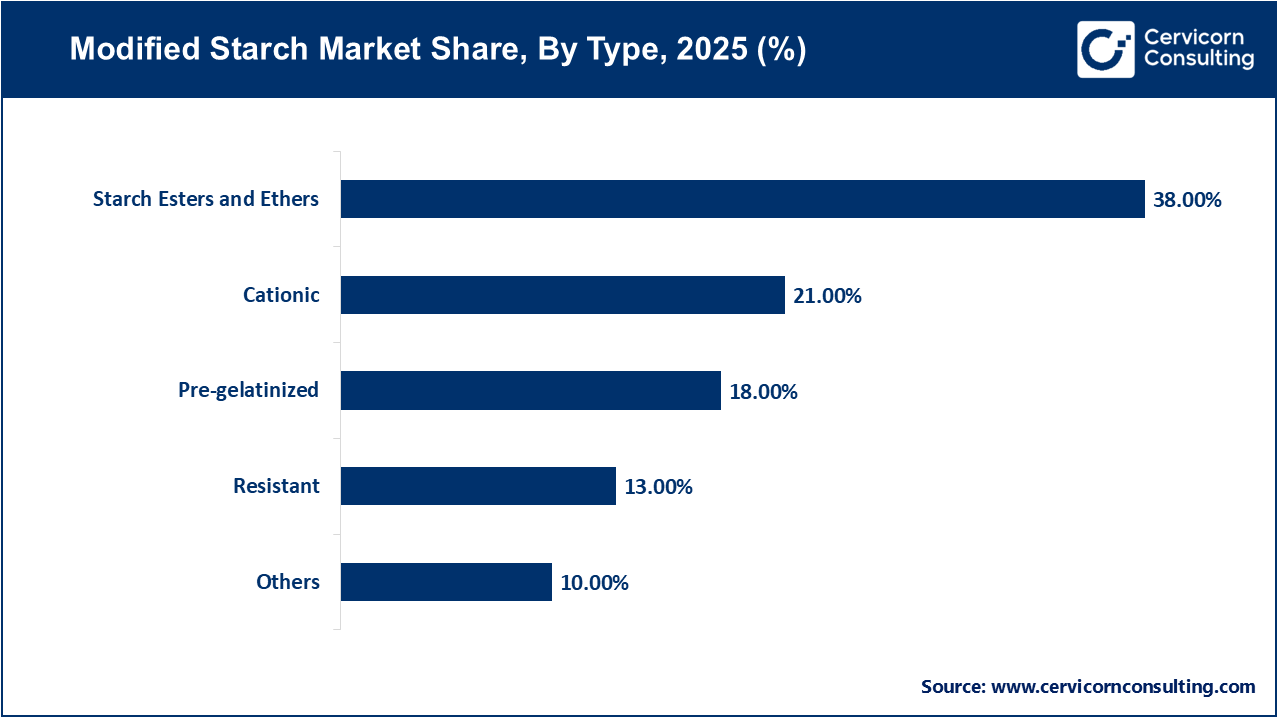

Starch esters and ethers account for the majority of the global modified starch industry, as they offer significantly greater heat, acid, and mechanical durability than their native starch counterparts. Starch esters and ethers are particularly beneficial in many applications that use the emulsifying and thickening properties of starches. Starch esters and ethers are used regularly in a variety of processed foods, in coatings for paper products, and in various textile uses. Their versatility across many different industries makes starch esters and ethers the most widely used modified starches globally.

The resistant starches are fastest-growing segment due to an increased awareness of gut health, blood sugar control, and digestive health among consumers. Resistant starches provide the same benefits as dietary fibers and are becoming increasingly prevalent in functional food applications, low-calorie products, and nutritional supplements. The rise in demand for healthier and fiber-rich food products worldwide is contributing to the rapid growth of the resistant starch segment.

Thickeners represent the largest portion of the modified starch market. Due to their extensive use as thickeners and other ingredients in a wide variety of applications including soups, sauces, ready-to-eat meals, bakery fillings and dairy products. They are crucial for sustaining viscosity, texture and mouthfeel of processed foods during large scale food manufacturing. As the processed food industry continues to expand, so too will the demand for thickeners.

Modified Starch Market Share, By Function, 2025 (%)

| Function | Revenue Share, 2025 (%) |

| Thickeners | 45% |

| Binders | 20% |

| Emulsifiers | 12% |

| Stabilizers | 13% |

| Others | 10% |

Stabilizers will be the fastest growing segment due to their increasing use in frozen foods, dairy drinks, and ready-to-drink products where product consistency and shelf life are paramount. They help to stabilize products from separation, syneresis, and loss of texture during storage and transportation. The increase in demand for convenient foods with extended shelf lives will continue to grow the use of modified starch as a stabilizer.

The food and beverage segment is anticipated to have the largest market share due to the large volume of modified starch that it uses to improve the texture, stability, and shelf-life of its processed food products. It is utilized primarily in bakery products, snacks and dairy items, although it is also used in sauces, instant foods, etc. Global demand for packaged and ready-to-eat food products continues to grow rapidly, keeping this segment as the current and ongoing leader in the modified starch market.

Modified Starch Market Share, By Application, 2025 (%)

| Application | Revenue Share, 2025 (%) |

| Food and Beverages | 51% |

| Paper | 15% |

| Animal Feed | 6% |

| Textile | 9% |

| Pharmaceuticals | 11% |

| Others | 8% |

The pharmaceuticals segment is expected to have the highest growth rate due to the increased usage of modified starch as a binder, filler, disintegrator, and drug-release agent in drug formulations. The properties of modified starch such as biocompatibility, low toxicity, and low cost of production will allow manufacturers to shift away from traditional excipients (inactive ingredients) to modified starches. The increase in global healthcare spending, as well as the overall increase in pharmaceutical production, are projected to continue supporting the growth of this segment of the modified starch market.

By Raw Material

By Type

By Function

By Application

By Region

Chapter 1. Market Introduction and Overview

1.1 Market Definition and Scope

1.1.1 Overview of Modified Starch

1.1.2 Scope of the Study

1.1.3 Research Timeframe

1.2 Research Methodology and Approach

1.2.1 Methodology Overview

1.2.2 Data Sources and Validation

1.2.3 Key Assumptions and Limitations

Chapter 2. Executive Summary

2.1 Market Highlights and Snapshot

2.2 Key Insights by Segments

2.2.1 By Type Overview

2.2.2 By Raw Material Overview

2.2.3 By Application Overview

2.2.4 By Function Overview

2.3 Competitive Overview

Chapter 3. Global Impact Analysis

3.1 Russia-Ukraine Conflict: Global Market Implications

3.2 Regulatory and Policy Changes Impacting Global Markets

Chapter 4. Market Dynamics and Trends

4.1 Market Dynamics

4.1.1 Market Drivers

4.1.1.1 Growing demand from processed and convenience food industries

4.1.1.2 Increasing industrial applications beyond food

4.1.2 Market Restraints

4.1.2.1 Health concerns and perception of processed ingredients

4.1.2.2 Fluctuations in raw material prices

4.1.3 Market Challenges

4.1.3.1 Strong competition from alternative ingredients and polymers

4.1.3.2 Technical complexity in production and application

4.1.4 Market Opportunities

4.1.4.1 Growth of biodegradable and sustainable packaging solutions

4.1.4.2 Rising pharmaceutical and nutraceutical applications

4.2 Market Trends

Chapter 5. Premium Insights and Analysis

5.1 Global Modified Starch Market Dynamics, Impact Analysis

5.2 Porter’s Five Forces Analysis

5.2.1 Bargaining Power of Suppliers

5.2.2 Bargaining Power of Buyers

5.2.3 Threat of Substitute Products

5.2.4 Rivalry among Existing Firms

5.2.5 Threat of New Entrants

5.3 PESTEL Analysis

5.4 Value Chain Analysis

5.5 Product Pricing Analysis

5.6 Vendor Landscape

5.6.1 List of Buyers

5.6.2 List of Suppliers

Chapter 6. Modified Starch Market, By Type

6.1 Global Modified Starch Market Snapshot, By Type

6.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

6.1.1.1 Starch Esters and Ethers

6.1.1.2 Cationic

6.1.1.3 Pre-gelatinized

6.1.1.4 Resistant

6.1.1.5 Others

Chapter 7. Modified Starch Market, By Raw Material

7.1 Global Modified Starch Market Snapshot, By Raw Material

7.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

7.1.1.1 Corn

7.1.1.2 Wheat

7.1.1.3 Potato

7.1.1.4 Cassava

7.1.1.5 Others

Chapter 8. Modified Starch Market, By Application

8.1 Global Modified Starch Market Snapshot, By Application

8.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

8.1.1.1 Food and Beverage

8.1.1.2 Animal Feed

8.1.1.3 Paper

8.1.1.4 Pharmaceuticals

8.1.1.5 Textiles

8.1.1.6 Others

Chapter 9. Modified Starch Market, By Function

9.1 Global Modified Starch Market Snapshot, By Function

9.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

9.1.1.1 Thickening

9.1.1.2 Binding

9.1.1.3 Stabilizing

9.1.1.4 Emulsifiers

9.1.1.5 Others

Chapter 10. Modified Starch Market, By Region

10.1 Overview

10.2 Modified Starch Market Revenue Share, By Region 2024 (%)

10.3 Global Modified Starch Market, By Region

10.3.1 Market Size and Forecast

10.4 North America

10.4.1 North America Modified Starch Market Revenue, 2022-2034 ($Billion)

10.4.2 Market Size and Forecast

10.4.3 North America Modified Starch Market, By Country

10.4.4 U.S.

10.4.4.1 U.S. Modified Starch Market Revenue, 2022-2034 ($Billion)

10.4.4.2 Market Size and Forecast

10.4.4.3 U.S. Market Segmental Analysis

10.4.5 Canada

10.4.5.1 Canada Modified Starch Market Revenue, 2022-2034 ($Billion)

10.4.5.2 Market Size and Forecast

10.4.5.3 Canada Market Segmental Analysis

10.4.6 Mexico

10.4.6.1 Mexico Modified Starch Market Revenue, 2022-2034 ($Billion)

10.4.6.2 Market Size and Forecast

10.4.6.3 Mexico Market Segmental Analysis

10.5 Europe

10.5.1 Europe Modified Starch Market Revenue, 2022-2034 ($Billion)

10.5.2 Market Size and Forecast

10.5.3 Europe Modified Starch Market, By Country

10.5.4 UK

10.5.4.1 UK Modified Starch Market Revenue, 2022-2034 ($Billion)

10.5.4.2 Market Size and Forecast

10.5.4.3 UKMarket Segmental Analysis

10.5.5 France

10.5.5.1 France Modified Starch Market Revenue, 2022-2034 ($Billion)

10.5.5.2 Market Size and Forecast

10.5.5.3 FranceMarket Segmental Analysis

10.5.6 Germany

10.5.6.1 Germany Modified Starch Market Revenue, 2022-2034 ($Billion)

10.5.6.2 Market Size and Forecast

10.5.6.3 GermanyMarket Segmental Analysis

10.5.7 Rest of Europe

10.5.7.1 Rest of Europe Modified Starch Market Revenue, 2022-2034 ($Billion)

10.5.7.2 Market Size and Forecast

10.5.7.3 Rest of EuropeMarket Segmental Analysis

10.6 Asia Pacific

10.6.1 Asia Pacific Modified Starch Market Revenue, 2022-2034 ($Billion)

10.6.2 Market Size and Forecast

10.6.3 Asia Pacific Modified Starch Market, By Country

10.6.4 China

10.6.4.1 China Modified Starch Market Revenue, 2022-2034 ($Billion)

10.6.4.2 Market Size and Forecast

10.6.4.3 ChinaMarket Segmental Analysis

10.6.5 Japan

10.6.5.1 Japan Modified Starch Market Revenue, 2022-2034 ($Billion)

10.6.5.2 Market Size and Forecast

10.6.5.3 JapanMarket Segmental Analysis

10.6.6 India

10.6.6.1 India Modified Starch Market Revenue, 2022-2034 ($Billion)

10.6.6.2 Market Size and Forecast

10.6.6.3 IndiaMarket Segmental Analysis

10.6.7 Australia

10.6.7.1 Australia Modified Starch Market Revenue, 2022-2034 ($Billion)

10.6.7.2 Market Size and Forecast

10.6.7.3 AustraliaMarket Segmental Analysis

10.6.8 Rest of Asia Pacific

10.6.8.1 Rest of Asia Pacific Modified Starch Market Revenue, 2022-2034 ($Billion)

10.6.8.2 Market Size and Forecast

10.6.8.3 Rest of Asia PacificMarket Segmental Analysis

10.7 LAMEA

10.7.1 LAMEA Modified Starch Market Revenue, 2022-2034 ($Billion)

10.7.2 Market Size and Forecast

10.7.3 LAMEA Modified Starch Market, By Country

10.7.4 GCC

10.7.4.1 GCC Modified Starch Market Revenue, 2022-2034 ($Billion)

10.7.4.2 Market Size and Forecast

10.7.4.3 GCCMarket Segmental Analysis

10.7.5 Africa

10.7.5.1 Africa Modified Starch Market Revenue, 2022-2034 ($Billion)

10.7.5.2 Market Size and Forecast

10.7.5.3 AfricaMarket Segmental Analysis

10.7.6 Brazil

10.7.6.1 Brazil Modified Starch Market Revenue, 2022-2034 ($Billion)

10.7.6.2 Market Size and Forecast

10.7.6.3 BrazilMarket Segmental Analysis

10.7.7 Rest of LAMEA

10.7.7.1 Rest of LAMEA Modified Starch Market Revenue, 2022-2034 ($Billion)

10.7.7.2 Market Size and Forecast

10.7.7.3 Rest of LAMEAMarket Segmental Analysis

Chapter 11. Competitive Landscape

11.1 Competitor Strategic Analysis

11.1.1 Top Player Positioning/Market Share Analysis

11.1.2 Top Winning Strategies, By Company, 2022-2024

11.1.3 Competitive Analysis By Revenue, 2022-2024

11.2 Recent Developments by the Market Contributors (2024)

Chapter 12. Company Profiles

12.1 Archer-Daniels-Midland Company

12.1.1 Company Snapshot

12.1.2 Company and Business Overview

12.1.3 Financial KPIs

12.1.4 Product/Service Portfolio

12.1.5 Strategic Growth

12.1.6 Global Footprints

12.1.7 Recent Development

12.1.8 SWOT Analysis

12.2 AGRANA Beteiligungs-AG

12.3 Cargill Incorporated

12.4 Grain Processing Corporation (Kent Corporation)

12.5 Emsland-Stärke GmbH

12.6 Tate & Lyle PLC

12.7 Ingredion Incorporated

12.8 Roquette Frères

12.9 Novidon B.V. (Duynie Group)

12.10 The cooperative Royal Avebe U.A.

12.11 SMS Corporation

12.12 Tereos