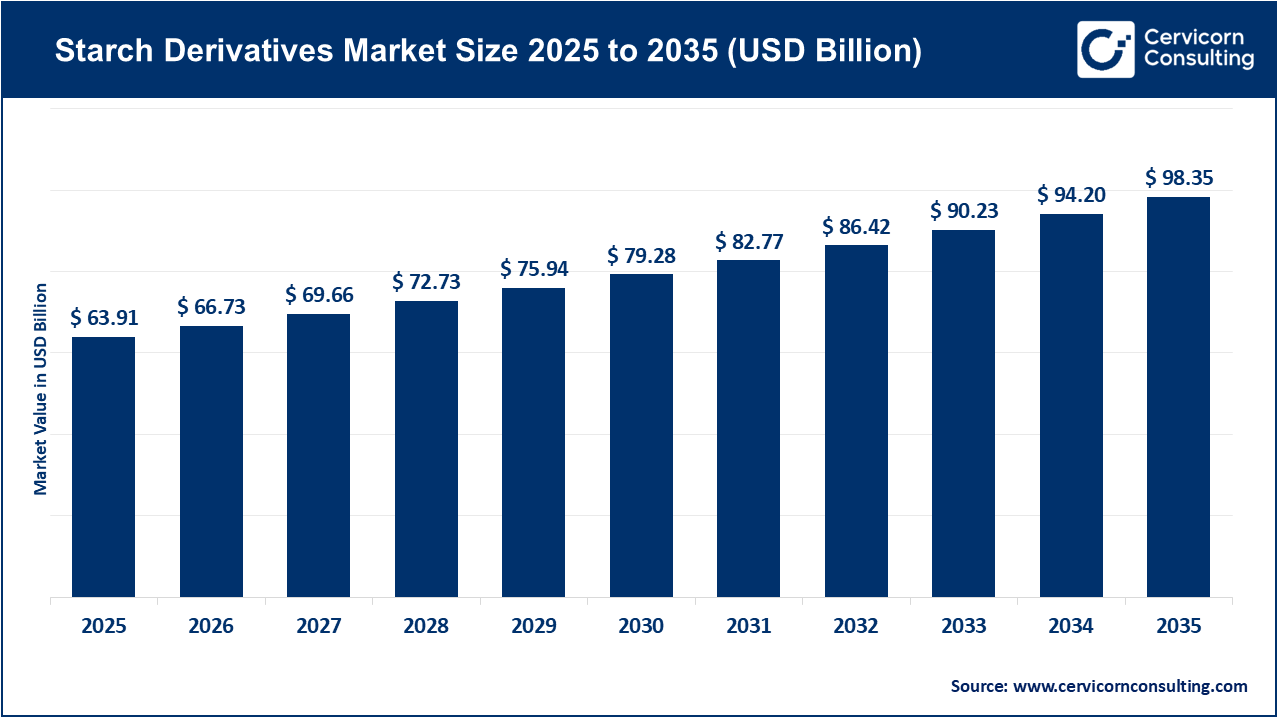

The global starch derivatives market size valued at USD 63.91 billion in 2025 and is expected to be worth around USD 98.35 billion by 2035, exhibiting at a compound annual growth rate (CAGR) of 4.4% over the forecast period 2026 to 2035. The demand for starch derivatives is increasing due to the increased use of prepared foods and drinks by consumers. Demand continues to grow for products like ready-to-eat meals, baked goods, and carbonated beverages that typically contain starch derivatives as thickeners, stabilizers or sweeteners. Increasing growth is also due to the growth of the pharmaceutical and personal care markets where starch derivatives improve product characteristics like texture and workability.

The growth of the starch derivatives market is expected to continue due to the consumer’s desire for natural and “clean” materials. Many manufacturers choose to use starch derivatives for various reasons rather than using synthetic chemicals and are therefore contributing to the continued growth of the industry. The use of starch derivatives in new industries such as textiles, paper manufacturing and bioplastics has also contributed to the overall growth of the market since starch-derived products are able to provide lower-cost, environmentally friendly solutions for a wide variety of applications.

Rising Demand for Clean-Label Ingredients Drives Growth in the Starch Derivatives Market

The starch derivatives market is responding to the increased demand for clean label products among consumers in food, beverage and personal care industries. These consumers are looking for products with simple, readily identifiable ingredients that do not contain any artificial additives or genetically modified organisms.

As a result, many manufacturers have reformulated their products and launched new product lines using "clean label" starches. For instance, the majority of food manufactures are now using starch derivatives from non-GMO sources including cassava, corn and potato for use as thickening agents in sauces, soups and ready-to-eat meals. By 2024, companies will have expanded their portfolios of native starches by producing pre-gelatinized starches and other clean label starches due to an increase in demand from consumers for transparency and purity in the marketplace.

1. Expansion of Clean-Label Starch Technologies

The rapid growth of clean label starch technologies is a major milestone and has enabled many manufacturers to begin using native and minimally processed starch derivatives as direct substitutes for chemically modified additives. This trend is in response to growing consumer preference for natural ingredients in bakery, dairy, and ready meal products. These developments are requiring many manufacturers to use enzyme-based or physical methods of modifying starches while still allowing them to keep their ingredient lists simple and yet continue to be functional, which is helping to drive the use of starch derivatives across the food and beverage industry.

2. Breakthroughs in Starch-Based Bioplastics and Sustainable Materials

The technological advancements that have been made to create biodegradable films and bioplastics from starch derivatives now represent a major milestone in the supply chain as global regulatory bodies create pressure on companies to develop eco-friendly packaging. New and improved mechanical characteristics of the films, including greater strength, moisture barrier, flexibility and structure, have now created an avenue for manufacturers to produce and utilize starch-based materials for packaging, single-use products and agricultural films. This milestone is creating new markets due to the increased industrial applications and the piquing of interest among manufacturers and consumers to use starch derivatives over petroleum-based alternatives.

3. Rising Pharmaceutical and Medical Applications of Modified Starches

The significant increase in the use of starch derivatives as binders, disintegrants and stabilizers in the tablet and drug formulation industries is another important milestone. Recent advancements in the creation of pharmaceutical-grade starch derivatives have increased the amount of starch that can be absorbed into aqueous solutions and thus increased the starch's flow ability and controlled-release capabilities. This milestone has resulted in a significantly expanded use of starch derivatives in the healthcare industry, creating a large demand on behalf of pharmaceutical manufacturers and strengthening the diversification of the market beyond food.

4. Shift Toward Alternative Starch Sources like Cassava, Potato, and Pea Starch

Increased adoption of non-traditional starch sources, including cassava, potato, rice and pea starches, is another significant milestone. The use of these sources, which are allergen-free, gluten-free and frequently non-GMO, will allow companies to create starch-derived products for "clean label" formulations. Additionally, the shift toward increasing dependence on non-traditional starch sources will help to create a diverse range of starch-derived products and drive growth in the starch derivatives industry by continuing to build regional supply chains, particularly in Asia and South America.

Report Scope

| Area of Focus | Details |

| Market Size in 2026 | USD 66.73 Billion |

| Estimated Market Size in 2035 | USD 98.35 Billion |

| Projected CAGR 2026 to 2035 | 4.4% |

| Dominant Region | Asia-Pacific |

| Key Segments | Type, Raw Material, Function, Application, Region |

| Key Companies | Cargill Inc., Emsland Group, Avebe U.A., Tate & Lyle PLC, Roquette Freres, Agrana Group, Grain Processing Corporation, ADM, Ingredion Incorporated, China Essence Group Ltd., Zhucheng Dongxiao Biotechnology Co. |

The starch derivatives market is segmented into various regions, including North America, Europe, Asia-Pacific, and LAMEA. Here is a brief overview of each region:

The North America starch derivatives market size accounted for USD 19.81 billion in 2025 and is poised to hit around USD 30.49 billion by 2035. North America region has a considerable portion of the overall market because of its well-established processed foods industry, high demand for sweeteners, and extensive usage of modified starches in pharmaceuticals, paper and industrial areas. Convenience, ease of use, and a cleaner label are major contributors to the continued growth in the North American markets. Additionally, an increasing number of major players within the market and advanced technologies used to modify starches also help support growth in the North America region.

Recent Developments:

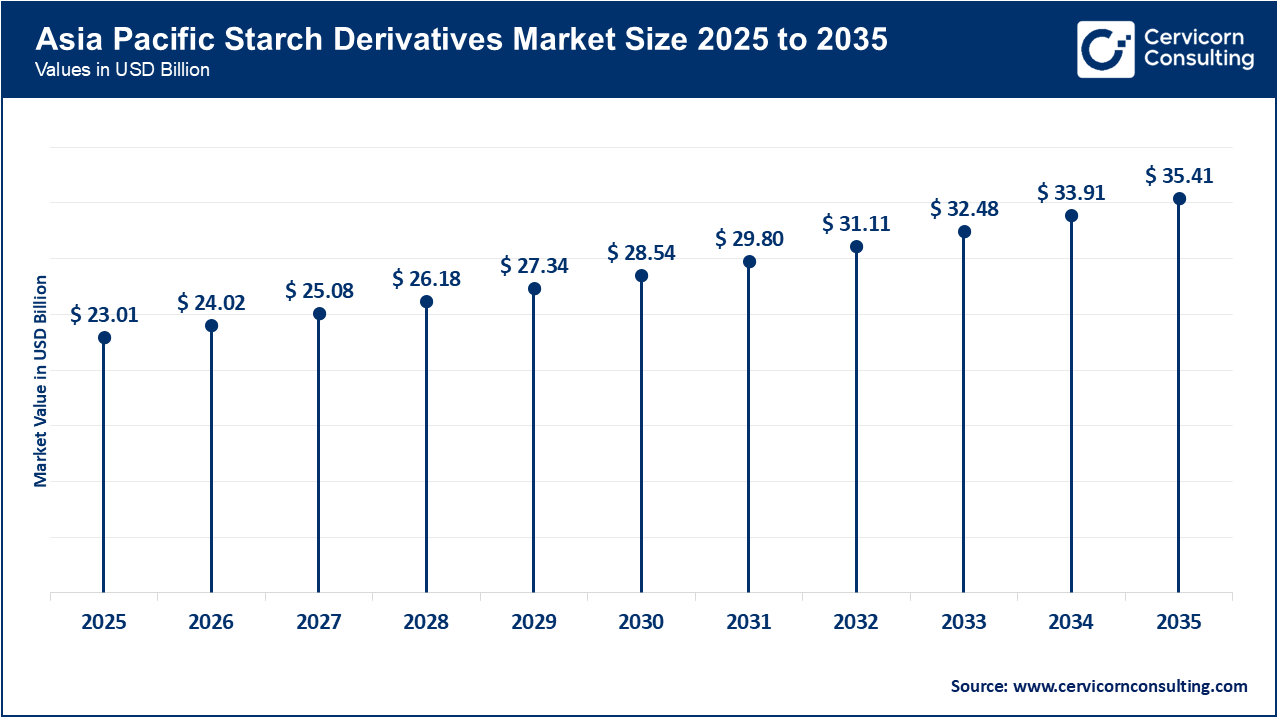

The Asia-Pacific starch derivatives market size estimated at USD 23.01 billion in 2025 and is projected to reach around USD 35.41 billion by 2035. The Asia Pacific is the fastest-growing market, due to rapid urbanization, large population base, and growth of the food and beverage industry. A major factor driving this growth is the increasing consumption of packaged food, beverage, and confectionery products in China, India, Indonesia and Southeast Asia. In addition to being a growing market for starch, Asia Pacific has also traditionally been a major producing region for cassava, corn and rice, which gives it a distinct competitive advantage through abundant supply of raw materials and manufacturing capabilities over other regions of the world.

Recent Developments:

The Europe starch derivatives market size valued at USD 16.62 billion in 2025 and is anticipated to surpass around USD 25.57 billion by 2035. The Europe is influenced by increasing interest in clean labels and natural circuits in addition to food safety regulations. More and more European consumers want chemical-free thickeners, stabilizers, and sweeteners in their organic and bakery dairy foods. The region is also leading the way in adopting biobased materials for eco-friendly packaging and other industrial uses, making modified starches a popular choice.

Recent Developments

Starch Derivatives Market Share, By Region, 2025 (%)

| Region | Revenue Share, 2025 (%) |

| North America | 31% |

| Europe | 26% |

| Asia-Pacific | 36% |

| LAMEA | 7% |

The LAMEA starch derivatives market size valued at USD 4.47 billion in 2025 and is estimated to reach around USD 6.88 billion by 2035. The LAMEA region is poised for consistent growth due to an increase in food processing activities along with a growing demand for sweeteners and an increased area under cassava cultivation across Latin America and Africa. This can primarily be attributed to the increasing usage of starch derivatives being used within the Bakery, Beverage, Paper and Textile Industries in developing economies. As many areas of the industrial infrastructure are still developing within this region of the world, the overall trends indicate an excellent opportunity for continued growth within LAMEA.

Recent Developments:

The starch derivatives market is segmented into type, raw material, function, application, and region.

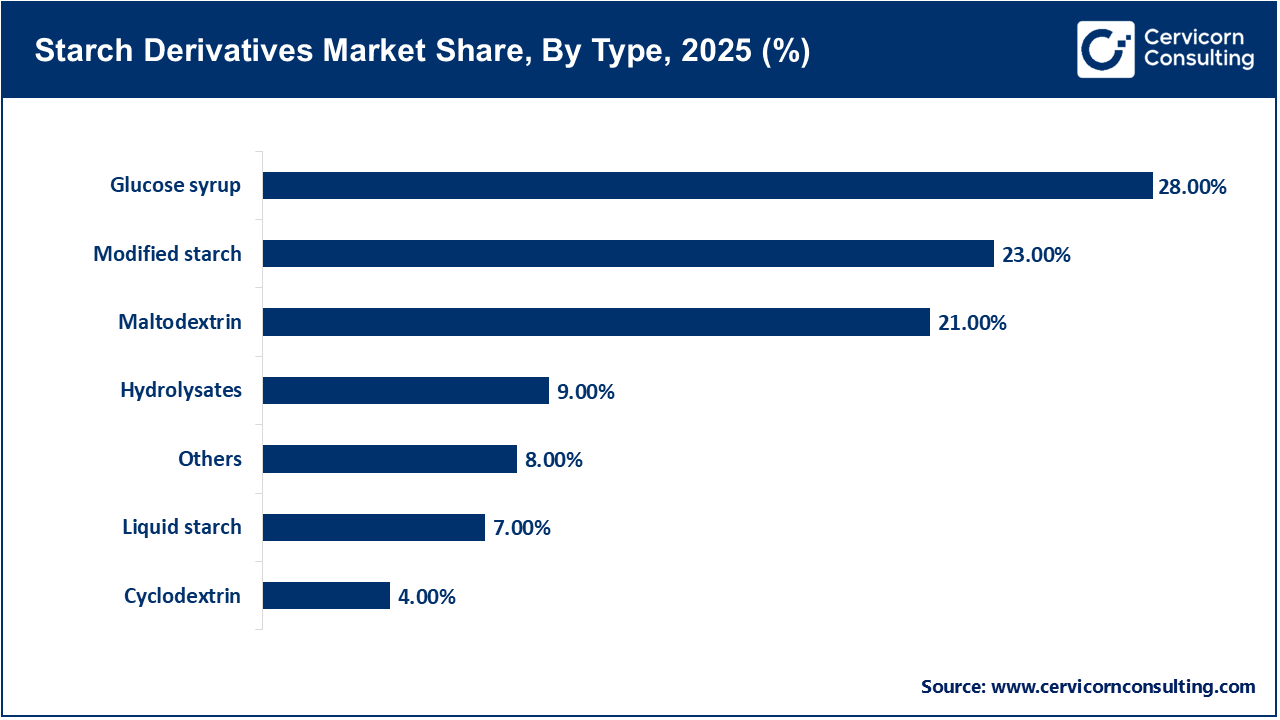

Glucose syrup is the largest segment in the starch derivatives market, utilized extensively as a sweetener, thickener, moisture-retainer in products such as confections, baked goods, beverages and processed foods. As glucose syrup remains stable over long periods of time and requires less processing than many sweeteners, it has become the preferred sweetener for many manufacturers. In addition, there continues to be a growing demand for glucose syrup from large manufacturers; e.g., candy manufacturers, soft drink manufacturers, ice cream manufacturers and sauce manufacturers.

Maltodextrin is expected to be the fastest-growing segment. This is due to the growing applications of maltodextrin in the sport nutrition, infant formula, pharmaceutical, and clean label prepared food industries. Maltodextrin is quickly digestible, has a neutral flavour, and has excellent bulking properties, making it an exceptional ingredient for inclusion in energy drinks, nutritional supplements, and powdered formulations. The rapid growth of health-focused and fitness-minded consumers is a major contributor to the growing demand for low-sugar, functional food products, which are adding to the momentum of maltodextrin's growth.

Corn continues to be the most commonly used raw material because it is available in great quantities at low costs and is a suitable source of starch derivatives such as glucose syrup, maltodextrin, and modified starches. Many corn-based starch manufacturers operate efficiently due to the advantages of being able to grow corn in mass quantities, having an efficient supply chain, and consistent quality of corn starch products. North America and Asia are heavily dependent on corn-based starches, making corn the most dominant segment in the market.

Starch Derivatives Market Share, By Raw Material, 2025 (%)

| Raw Material | Revenue Share, 2025 (%) |

| Corn | 45% |

| Wheat | 15% |

| Potato | 11% |

| Rice | 8% |

| Cassava | 12% |

| Others | 9% |

Cassava is the fastest-growing raw material segment of market. Demand continues to grow for non-GMO, gluten-free, and allergen-free starches, driving increased interest in cassava as a source of starches. Cassava starch derivatives possess superior clarity, viscosity, and stability, making them ideal for clean-label food products and industrial applications. Cassava production continues to grow rapidly in Southeast Asia, Africa, and South America, contributing to the rapid growth of cassava-based products.

Thickening is the dominant function of starch derivatives. Starch derivatives are responsible for providing thickening to products such as soups, sauces, fillings for bakery products, dairy products, and many other types of food products through their contribution to viscosity and texture. Since most food manufacturers use starch-based thickeners because they are derived from plants, economically (financing), and because they have been found to provide acceptable alternatives to synthetic ingredients, the thickening segment is the largest in terms of its overall market share.

Starch Derivatives Market Share, By Function, 2025 (%)

| Function | Revenue Share, 2025 (%) |

| Thickening | 35% |

| Binding | 12% |

| Stabilizing | 20% |

| Emulsifying | 8% |

| Moisture Retention | 10% |

| Gelling | 6% |

| Others | 9% |

Stabilizing is fastest-growing segment of starch derivatives. Stabilizing is the fastest-growing function of starch derivatives, primarily due to the increasing demand for improved texture, uniformity, stability on the shelf, and cost. Starch derivatives are used to create uniformity in emulsions, prevent separation of components in beverages, and enhance the freeze and thaw stability of frozen foods. As global demand for convenience foods and prepared meals continues to grow, stabilizers play an increasing role in ensuring the quality of the finished product.

Food & beverage is the primary application because starch derivatives provide a variety of uses within the baking industry, food service, dairy processing, & candy making. The increased amount of processed food being consumed, coupled with a growing preference for natural ingredients, contributes to the long-term usage of starch derivatives in the food and beverage sector. Additionally, manufacturers use starch derivatives to support the clean label and functional food movements, further solidifying the food and beverage sector's position as the dominant market.

Starch Derivatives Market Share, By Application, 2025 (%)

| Application | Revenue Share, 2025 (%) |

| Food and beverage | 50% |

| Food | 8% |

| Paper | 10% |

| Pharmaceuticals | 12% |

| Cosmetics and Personal Care | 6% |

| Textiles | 4% |

| Industrial Applications | 7% |

| Others | 3% |

Pharmaceuticals is the fastest growing application segment because they are increasingly being utilized as binders, disintegrants, diluents, and coating agents in tablets and capsules. This rapid increase in the number of chronic diseases and the expanding market for generic drugs along with the growing need for quality excipients all contribute to the rapid growth of the pharmaceuticals market. Modified starches with controlled-release characteristics and improved functionality will likely continue to drive the development of the pharmaceutical market, thus becoming emerging markets for starch derivatives.

By Type

By Raw Material

By Function

By Application

By Region

Chapter 1. Market Introduction and Overview

1.1 Market Definition and Scope

1.1.1 Overview of Starch Derivatives

1.1.2 Scope of the Study

1.1.3 Research Timeframe

1.2 Research Methodology and Approach

1.2.1 Methodology Overview

1.2.2 Data Sources and Validation

1.2.3 Key Assumptions and Limitations

Chapter 2. Executive Summary

2.1 Market Highlights and Snapshot

2.2 Key Insights by Segments

2.2.1 By Type Overview

2.2.2 By Raw Material Overview

2.2.3 By Application Overview

2.2.4 By Function Overview

2.3 Competitive Overview

Chapter 3. Global Impact Analysis

3.1 Russia-Ukraine Conflict: Global Market Implications

3.2 Regulatory and Policy Changes Impacting Global Markets

Chapter 4. Market Dynamics and Trends

4.1 Market Dynamics

4.1.1 Market Drivers

4.1.1.1 Growing demand for clean-label ingredients

4.1.1.2 Expanding pharmaceutical and industrial use

4.1.2 Market Restraints

4.1.2.1 Raw material price fluctuations

4.1.2.2 Competition from alternative additives

4.1.3 Market Challenges

4.1.3.1 Need for advanced processing technologies

4.1.3.2 Agricultural supply instability

4.1.4 Market Opportunities

4.1.4.1 Growth of biodegradable and sustainable materials

4.1.4.2 Rising demand in emerging markets

4.2 Market Trends

Chapter 5. Premium Insights and Analysis

5.1 Global Starch Derivatives Market Dynamics, Impact Analysis

5.2 Porter’s Five Forces Analysis

5.2.1 Bargaining Power of Suppliers

5.2.2 Bargaining Power of Buyers

5.2.3 Threat of Substitute Products

5.2.4 Rivalry among Existing Firms

5.2.5 Threat of New Entrants

5.3 PESTEL Analysis

5.4 Value Chain Analysis

5.5 Product Pricing Analysis

5.6 Vendor Landscape

5.6.1 List of Buyers

5.6.2 List of Suppliers

Chapter 6. Starch Derivatives Market, By Type

6.1 Global Starch Derivatives Market Snapshot, By Type

6.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

6.1.1.1 Maltodextrin

6.1.1.2 Glucose Syrup

6.1.1.3 Cyclodextrin

6.1.1.4 Hydrolysates

6.1.1.5 Liquid Starch

6.1.1.6 Modified Starch

6.1.1.7 Others

Chapter 7. Starch Derivatives Market, By Raw Material

7.1 Global Starch Derivatives Market Snapshot, By Raw Material

7.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

7.1.1.1 Corn

7.1.1.2 Wheat

7.1.1.3 Potato

7.1.1.4 Rice

7.1.1.5 Cassava

7.1.1.6 Others

Chapter 8. Starch Derivatives Market, By Application

8.1 Global Starch Derivatives Market Snapshot, By Application

8.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

8.1.1.1 Food and Beverage

8.1.1.2 Feed

8.1.1.3 Paper

8.1.1.4 Pharmaceuticals

8.1.1.5 Cosmetics and personal care

8.1.1.6 Textiles

8.1.1.7 Industrial applications

8.1.1.8 Others

Chapter 9. Starch Derivatives Market, By Function

9.1 Global Starch Derivatives Market Snapshot, By Function

9.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

9.1.1.1 Thickening

9.1.1.2 Binding

9.1.1.3 Stabilizing

9.1.1.4 Moisture Retention

9.1.1.5 Gelling

9.1.1.6 Others

Chapter 10. Starch Derivatives Market, By Region

10.1 Overview

10.2 Starch Derivatives Market Revenue Share, By Region 2024 (%)

10.3 Global Starch Derivatives Market, By Region

10.3.1 Market Size and Forecast

10.4 North America

10.4.1 North America Starch Derivatives Market Revenue, 2022-2034 ($Billion)

10.4.2 Market Size and Forecast

10.4.3 North America Starch Derivatives Market, By Country

10.4.4 U.S.

10.4.4.1 U.S. Starch Derivatives Market Revenue, 2022-2034 ($Billion)

10.4.4.2 Market Size and Forecast

10.4.4.3 U.S. Market Segmental Analysis

10.4.5 Canada

10.4.5.1 Canada Starch Derivatives Market Revenue, 2022-2034 ($Billion)

10.4.5.2 Market Size and Forecast

10.4.5.3 Canada Market Segmental Analysis

10.4.6 Mexico

10.4.6.1 Mexico Starch Derivatives Market Revenue, 2022-2034 ($Billion)

10.4.6.2 Market Size and Forecast

10.4.6.3 Mexico Market Segmental Analysis

10.5 Europe

10.5.1 Europe Starch Derivatives Market Revenue, 2022-2034 ($Billion)

10.5.2 Market Size and Forecast

10.5.3 Europe Starch Derivatives Market, By Country

10.5.4 UK

10.5.4.1 UK Starch Derivatives Market Revenue, 2022-2034 ($Billion)

10.5.4.2 Market Size and Forecast

10.5.4.3 UKMarket Segmental Analysis

10.5.5 France

10.5.5.1 France Starch Derivatives Market Revenue, 2022-2034 ($Billion)

10.5.5.2 Market Size and Forecast

10.5.5.3 FranceMarket Segmental Analysis

10.5.6 Germany

10.5.6.1 Germany Starch Derivatives Market Revenue, 2022-2034 ($Billion)

10.5.6.2 Market Size and Forecast

10.5.6.3 GermanyMarket Segmental Analysis

10.5.7 Rest of Europe

10.5.7.1 Rest of Europe Starch Derivatives Market Revenue, 2022-2034 ($Billion)

10.5.7.2 Market Size and Forecast

10.5.7.3 Rest of EuropeMarket Segmental Analysis

10.6 Asia Pacific

10.6.1 Asia Pacific Starch Derivatives Market Revenue, 2022-2034 ($Billion)

10.6.2 Market Size and Forecast

10.6.3 Asia Pacific Starch Derivatives Market, By Country

10.6.4 China

10.6.4.1 China Starch Derivatives Market Revenue, 2022-2034 ($Billion)

10.6.4.2 Market Size and Forecast

10.6.4.3 ChinaMarket Segmental Analysis

10.6.5 Japan

10.6.5.1 Japan Starch Derivatives Market Revenue, 2022-2034 ($Billion)

10.6.5.2 Market Size and Forecast

10.6.5.3 JapanMarket Segmental Analysis

10.6.6 India

10.6.6.1 India Starch Derivatives Market Revenue, 2022-2034 ($Billion)

10.6.6.2 Market Size and Forecast

10.6.6.3 IndiaMarket Segmental Analysis

10.6.7 Australia

10.6.7.1 Australia Starch Derivatives Market Revenue, 2022-2034 ($Billion)

10.6.7.2 Market Size and Forecast

10.6.7.3 AustraliaMarket Segmental Analysis

10.6.8 Rest of Asia Pacific

10.6.8.1 Rest of Asia Pacific Starch Derivatives Market Revenue, 2022-2034 ($Billion)

10.6.8.2 Market Size and Forecast

10.6.8.3 Rest of Asia PacificMarket Segmental Analysis

10.7 LAMEA

10.7.1 LAMEA Starch Derivatives Market Revenue, 2022-2034 ($Billion)

10.7.2 Market Size and Forecast

10.7.3 LAMEA Starch Derivatives Market, By Country

10.7.4 GCC

10.7.4.1 GCC Starch Derivatives Market Revenue, 2022-2034 ($Billion)

10.7.4.2 Market Size and Forecast

10.7.4.3 GCCMarket Segmental Analysis

10.7.5 Africa

10.7.5.1 Africa Starch Derivatives Market Revenue, 2022-2034 ($Billion)

10.7.5.2 Market Size and Forecast

10.7.5.3 AfricaMarket Segmental Analysis

10.7.6 Brazil

10.7.6.1 Brazil Starch Derivatives Market Revenue, 2022-2034 ($Billion)

10.7.6.2 Market Size and Forecast

10.7.6.3 BrazilMarket Segmental Analysis

10.7.7 Rest of LAMEA

10.7.7.1 Rest of LAMEA Starch Derivatives Market Revenue, 2022-2034 ($Billion)

10.7.7.2 Market Size and Forecast

10.7.7.3 Rest of LAMEAMarket Segmental Analysis

Chapter 11. Competitive Landscape

11.1 Competitor Strategic Analysis

11.1.1 Top Player Positioning/Market Share Analysis

11.1.2 Top Winning Strategies, By Company, 2022-2024

11.1.3 Competitive Analysis By Revenue, 2022-2024

11.2 Recent Developments by the Market Contributors (2024)

Chapter 12. Company Profiles

12.1 Cargill Inc.

12.1.1 Company Snapshot

12.1.2 Company and Business Overview

12.1.3 Financial KPIs

12.1.4 Product/Service Portfolio

12.1.5 Strategic Growth

12.1.6 Global Footprints

12.1.7 Recent Development

12.1.8 SWOT Analysis

12.2 Emsland Group

12.3 Avebe U.A.

12.4 Tate & Lyle PLC

12.5 Roquette Freres

12.6 Agrana Group

12.7 Grain Processing Corporation

12.8 ADM

12.9 Ingredion Incorporated

12.10 China Essence Group Ltd.

12.11 Zhucheng Dongxiao Biotechnology Co.

12.12 Global Bio-chem Technology Group Company Limited