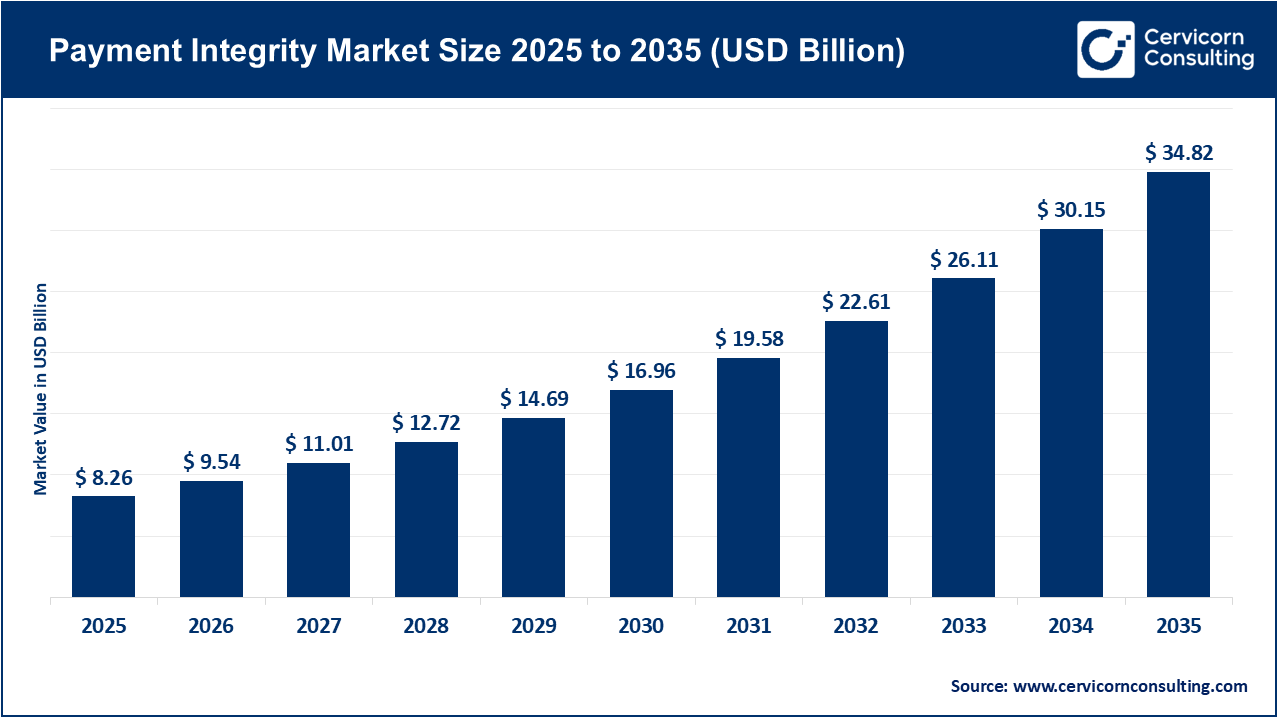

The global payment integrity market size reached at USD 8.26 billion in 2025 and is expected to be worth around USD 34.82 billion by 2035, exhibiting at a compound annual growth rate (CAGR) of 15.5% over the forecast period 2026 to 2035. The payment integrity market is growing as healthcare organizations and payers are more pressured than ever to decrease financial leakage and payment inaccuracies. With pressure on payers and providers to find fraud, waste and abuse in claims, there is an increased demand for advanced analytics and AI-based technology. This trend is also being advanced by value-based care models, as many organizations are determining how to guarantee payments are accurate, and compliant. Additionally, increasing complexity of healthcare billing and coding systems increases the need for technology that can identify errors prior to making payments.

Another major catalyst for the payment integrity market is the complexity of healthcare payments and changes in regulations. New healthcare codes, new policies, and value-based payment models will mean payers need better tools to ensure compliance and transparency. The payment integrity market continues to foster synergy in the marketplace through the adoption of cloud-based platforms and integrated payment integrity solutions. These integrated solutions simplify and accelerate payment integrity initiatives, allow for easier scalability, and eliminate the siloed approach. As healthcare systems globally continue to encourage accuracy and accountability, the payment integrity market will continue to grow due to technological innovation and demand for operational excellence.

What is Payment Integrity?

Payment integrity is the practice of validating the accuracy, authenticity, and proper services and payments that should be paid. It consists of identifying and preventing errors, fraud, waste, and abuse of claims, prior and after payment. Payment integrity programs rely on analytics, automation, and auditing to ensure payers are only paying the legitimate claims while increasing transparency and efficiency throughout the healthcare system.

The importance of payment integrity is:

Increasing Application of Payment Integrity in Healthcare

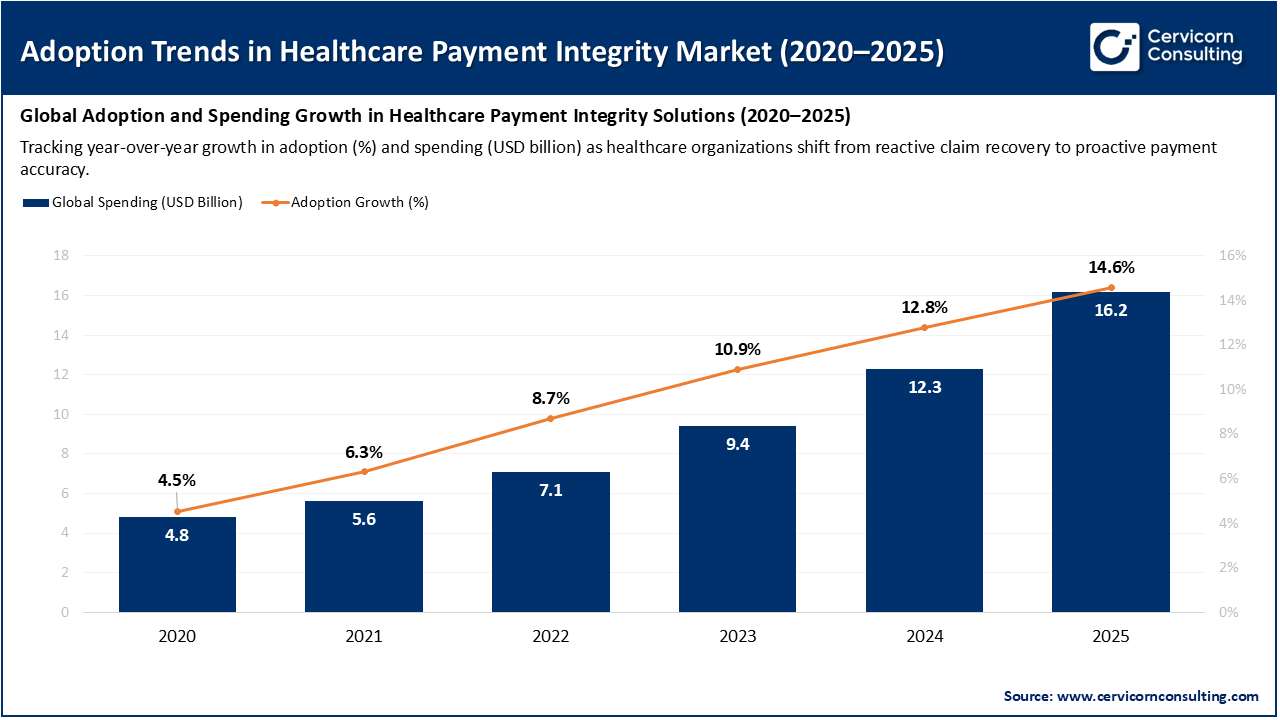

Due to a desire to decrease claim errors and costs associated with unneeded care, the healthcare space is experiencing a larger uptake of payment integrity solutions. Hospitals, payers, and government funded health programs are now able to leverage payment integrity tools in order to validate that billing is correct, or that fraud, duplicate payments, and other claim errors has not occurred. The switch to electronic health records (EHR) and automated claims processing will provide many more opportunities to further apply advanced analytics, machine learning, and AI in support of payment integrity and validation. Such opportunities benefit the overall healthcare system through financial improvement, regulatory compliance, and paying healthcare providers the correct amount for services rendered, which will ultimately fuel the expansion of payment integrity solutions in the healthcare space overall.

The preceding graph delineates the upward trajectory of the costs (in USD billion) and use (%) of payment integrity solutions. Overall, the industry is exhibiting sustained and robust growth, with spending growing from USD 4.8 billion in 2020, to USD 16.2 billion in 2025. The orange line shows the commitment dynamic in the adoption, rising from an estimated 4.5%, to the 14.6% that presides on the cost line each year that goes by more and more healthcare organizations are adopting these solutions.

Report Scope

| Area of Focus | Details |

| Market Size in 2026 | USD 9.54 Billion |

| Expected Market Size in 2035 | USD 34.82 Billion |

| Estimated CAGR 2026 to 2035 | 15.50% |

| Dominant Region | North America |

| Fastest Growing Region | Asia-Pacific |

| Key Segments | Solution Type, Service Stage, End-user, Region |

| Key Companies | Cotiviti, SAS Institute, Optum, EXL Service, Conduent, ClarisHealth, Alivia Analytics, Zelis, Gainwell Technologies, HealthEdge, Ceris, Apixio, NTT DATA, Integrity Advantage, LexisNexis Risk Solutions |

Growing Need to Reduce Healthcare Costs

Adoption of Artificial Intelligence and Automation

Data Privacy and Security Concerns

Lack of Standardization in Claims Processing

Shift Toward Value-Based Care Models

Expansion of Digital Healthcare Infrastructure

High Implementation and Integration Costs

Resistance to Technological Change

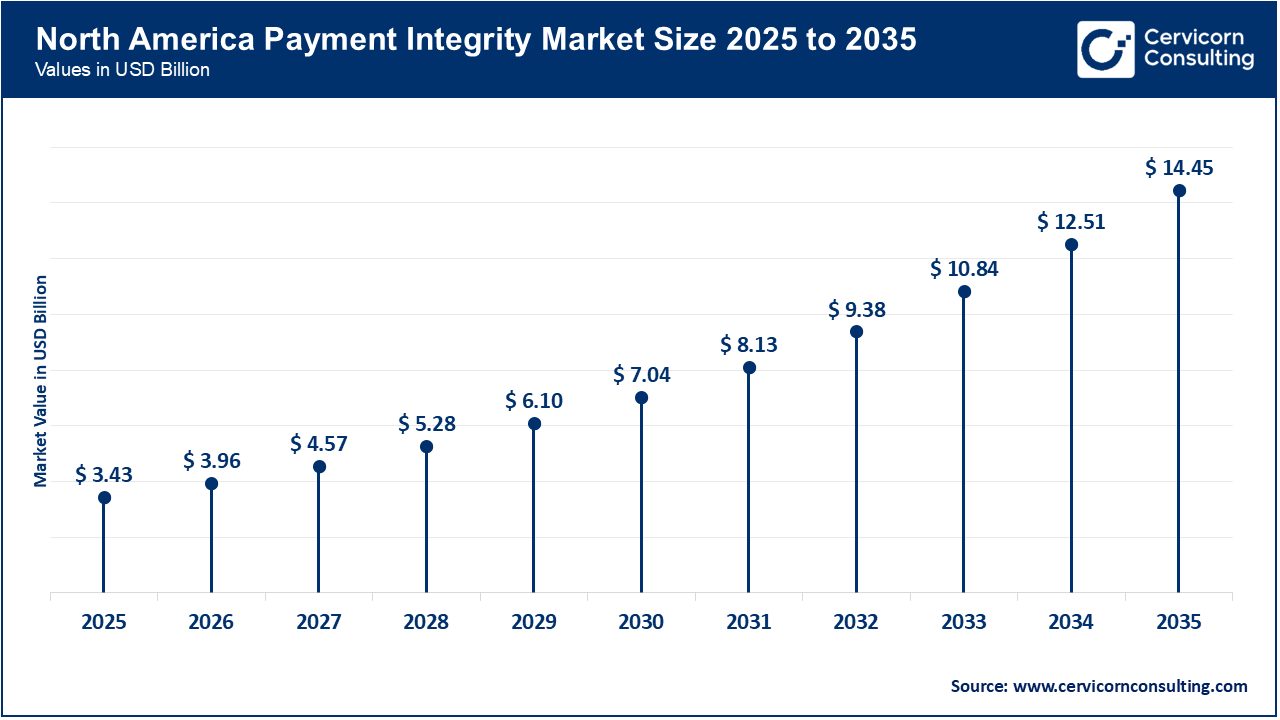

The payment integrity market is segmented into various regions, including North America, Europe, Asia-Pacific, and LAMEA. Here is a brief overview of each region:

North America is shaped by a backdrop of advanced healthcare infrastructure, strict regulatory frameworks, and a high level of healthcare expenditure that necessitates strong solutions for payment accuracy. The impetus represented by preventing improper payments across significant public programmes and commercial insurers is driving the uptake of technologies, such as AI and analytics, to support payment integrity approaches to claim validation and fraud detection. The relative pressure is making payment integrity a strategic imperative among payers and providers across the North American region.

Recent Developments:

The European market has been catalyzed by regulatory reform, increasing complexity of cross-border claims, and an increasing focus on value-based care implicating payment controls and data expertise. In the region, healthcare payers and governments are updating their systems to validate claims in real-time and mitigate fraud providing some momentum for payment integrity solutions through Europe. The new initiatives towards standardisation and pan-European reforms will further provide opportunities.

Recent Developments:

In the Asia-Pacific region is experiencing vigorous growth patterns as healthcare spending increases, insurance coverage expands, and technologies for digital health and payments are adopted. Along with increased awareness of fraud, waste, and abuse in claims, coupled with transitions from legacy systems to cloud-based platforms, payment integrity solutions can be positioned well in the market. Emerging markets in particular are catching up with existing markets, thereby increasing vendors' available addressable markets.

Recent Developments:

Payment Integrity Market Share, By Region, 2024 (%)

| Region | Revenue Share, 2025 (%) |

| North America | 41.50% |

| Europe | 27.30% |

| Asia-Pacific | 22.40% |

| LAMEA | 8.80% |

The LAMEA is shaped by a growing desire to reduce inappropriate healthcare payments, the limited availability of legacy claims management infrastructures, and growing regulatory focus on fraud and abuse. Although the level of investment is lower compared to developed regions, the large population of underserved healthcare markets and increasing levels of digitalisation underpin investment opportunities for payment integrity solutions on-boarding third-party providers within health systems or ensuring the integrity of payments in emerging markets.

Recent Developments:

The payment integrity market is segmented into solution type, service stage, end-user, and region.

Fraud, Waste & Abuse (FWA) Detection is the leading segment in the payment integrity market because it performs a critical process in finding improper claims and reducing a payer’s financial loss. Payers and governments are investing heavily in FWA Solutions as they are attempting to combat healthcare fraud and improve overall compliance. With false claims and billing errors on the rise, FWA Tools will become a necessary part of quality assessment, reimbursement accuracy and cost containment. Advanced analytics and AI-enhanced FWA tools are allowing payers to recognize potentially fraudulent activities quicker, as a result, continuing to solidify this segments leading position.

Payment Integrity Market Share, By Solution Type, 2024 (%)

| Solution Type | Revenue Share, 2025 (%) |

| Fraud, Waste & Abuse (FWA) Detection | 38.60% |

| Claims Editing & Coding Validation | 27.40% |

| Coordination of Benefits (COB) | 14.20% |

| Payment Accuracy / Under-payment Recovery | 12.80% |

| Others | 7% |

The Claims Editing & Coding Validation segment is the fastest growing segment. Increased complexity in medical coding systems and a rise in claims denials has resulted in the use of automated Claims Editing and Validation solutions. These claim editing tools are being adopted by healthcare organizations as they utilize them to ensure data is accurate and compliant prior to submission. The integration of AI and automatic capabilities continues to support growth, as vendors have now combined payers and providers with the latest technology to streamline human involvement to locate and repair coding errors sooner, thereby lessening administrative costs.

The post-payment represents the leading segment of the payment integrity market, as the majority of healthcare payers continue to rely on retrospective claim audits for overpayment and errors. Post-payment generally allows an organization to audit any past claims and recover any funds that were paid in error. While this occurs after payment it continues to play a vital role in protecting financial integrity and identifying claims that are problems over and above the question of payment. The continued substantial market share across public and private simply indicates a strong willingness to accept post-service as a necessary segment of the payment integrity market.

Payment Integrity Market Share, By Service Stage, 2024 (%)

| Service Stage | Revenue Share, 2025 (%) |

| Pre-payment | 34.70% |

| Post-payment | 51.60% |

| Continuous/Concurrent | 13.70% |

Pre-payment represents the fastest growing area of the payment integrity market. As automation accelerates and predictive analytics adds opportunity, healthcare organizations are evolving their focus from recovery to protection. Pre-payment systems are designed to identify errors or inconsistencies before payment is made, thereby avoiding costlier rework and capturing increased claim accuracy. The accelerative nature of this change can be amplified through use of artificial intelligence powered pre-payment claim validation real time.

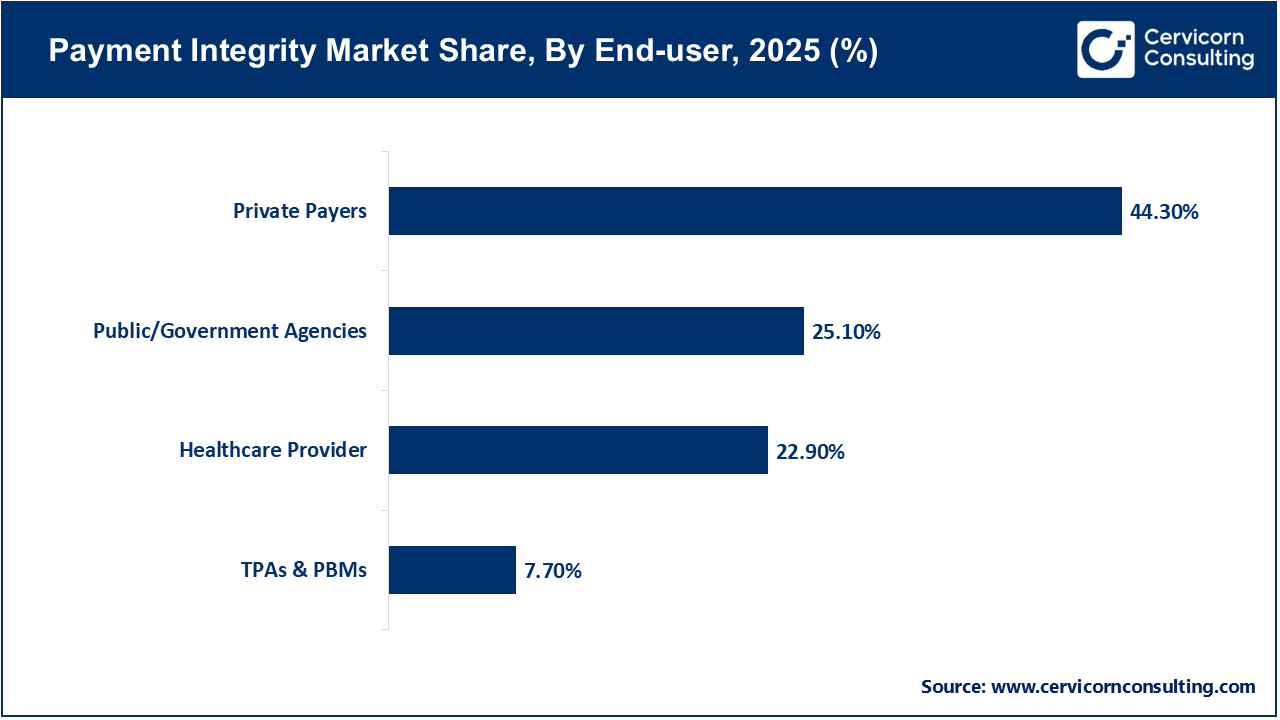

Private payers are the leading end-user segment in the payment integrity market as they are focused on reducing the financial leakage of claims paid and accurate reimbursement. Private payers invest considerably in advanced analytics and automation to effectively manage claim volume. Competition among private payers also drives the implementation of broad payment integrity programs that address claim accuracy and operational performance.

Public and government agencies are the fastest-growing end-users of the payment integrity market. Governments are accelerating payment integrity awareness to address fraud and efficiency in the public health program's, including Medicare and Medicaid. Increased demand for open spending of healthcare and regulatory commission to monitor spending results in significant investments in enhanced claim review systems. As a result, public agencies are quickly expanding the use of payment integrity technology for accountability and expenditure control.

Key Industry Leaders’ Perspectives on the Payment Integrity Market:

Tisha Holden – Market President, Optum

Matthew Hawley – Executive Vice President of Payment Integrity Operations, Cotiviti

Emad Rizk, M.D. – President & CEO, Cotiviti

By Solution Type

By Service Stage

By End-user

By Region

Chapter 1. Market Introduction and Overview

1.1 Market Definition and Scope

1.1.1 Overview of Payment Integrity

1.1.2 Scope of the Study

1.1.3 Research Timeframe

1.2 Research Methodology and Approach

1.2.1 Methodology Overview

1.2.2 Data Sources and Validation

1.2.3 Key Assumptions and Limitations

Chapter 2. Executive Summary

2.1 Market Highlights and Snapshot

2.2 Key Insights by Segments

2.2.1 By Solution Type Overview

2.2.2 By Service Stage Overview

2.2.3 By End User Overview

2.3 Competitive Overview

Chapter 3. Global Impact Analysis

3.1 Russia-Ukraine Conflict: Global Market Implications

3.2 Regulatory and Policy Changes Impacting Global Markets

Chapter 4. Market Dynamics and Trends

4.1 Market Dynamics

4.1.1 Market Drivers

4.1.1.1 Growing Need to Reduce Healthcare Costs

4.1.1.2 Adoption of Artificial Intelligence and Automation

4.1.2 Market Restraints

4.1.2.1 Data Privacy and Security Concerns

4.1.2.2 Lack of Standardization in Claims Processing

4.1.3 Market Challenges

4.1.3.1 High Implementation and Integration Costs

4.1.3.2 Resistance to Technological Change

4.1.4 Market Opportunities

4.1.4.1 Shift Toward Value-Based Care Models

4.1.4.2 Expansion of Digital Healthcare Infrastructure

4.2 Market Trends

Chapter 5. Premium Insights and Analysis

5.1 Global Payment Integrity Market Dynamics, Impact Analysis

5.2 Porter’s Five Forces Analysis

5.2.1 Bargaining Power of Suppliers

5.2.2 Bargaining Power of Buyers

5.2.3 Threat of Substitute Products

5.2.4 Rivalry among Existing Firms

5.2.5 Threat of New Entrants

5.3 PESTEL Analysis

5.4 Value Chain Analysis

5.5 Product Pricing Analysis

5.6 Vendor Landscape

5.6.1 List of Buyers

5.6.2 List of Suppliers

Chapter 6. Payment Integrity Market, By Solution Type

6.1 Global Payment Integrity Market Snapshot, By Solution Type

6.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

6.1.1.1 Fraud, Waste & Abuse (FWA) Detection

6.1.1.2 Claims Editing & Coding Validation

6.1.1.3 Coordination of Benefits (COB)

6.1.1.4 Payment Accuracy / Under-payment Recovery

6.1.1.5 Others

Chapter 7. Payment Integrity Market, By Service Stage

7.1 Global Payment Integrity Market Snapshot, By Service Stage

7.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

7.1.1.1 Pre-payment

7.1.1.2 Post-payment

7.1.1.3 Continuous/Concurrent

Chapter 8. Payment Integrity Market, By End-User

8.1 Global Payment Integrity Market Snapshot, By End-User

8.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

8.1.1.1 Private Payers

8.1.1.2 Healthcare Provider

8.1.1.3 Public/Government Agencies

8.1.1.4 TPAs & PBMs

Chapter 9. Payment Integrity Market, By Region

9.1 Overview

9.2 Payment Integrity Market Revenue Share, By Region 2024 (%)

9.3 Global Payment Integrity Market, By Region

9.3.1 Market Size and Forecast

9.4 North America

9.4.1 North America Payment Integrity Market Revenue, 2022-2034 ($Billion)

9.4.2 Market Size and Forecast

9.4.3 North America Payment Integrity Market, By Country

9.4.4 U.S.

9.4.4.1 U.S. Payment Integrity Market Revenue, 2022-2034 ($Billion)

9.4.4.2 Market Size and Forecast

9.4.4.3 U.S. Market Segmental Analysis

9.4.5 Canada

9.4.5.1 Canada Payment Integrity Market Revenue, 2022-2034 ($Billion)

9.4.5.2 Market Size and Forecast

9.4.5.3 Canada Market Segmental Analysis

9.4.6 Mexico

9.4.6.1 Mexico Payment Integrity Market Revenue, 2022-2034 ($Billion)

9.4.6.2 Market Size and Forecast

9.4.6.3 Mexico Market Segmental Analysis

9.5 Europe

9.5.1 Europe Payment Integrity Market Revenue, 2022-2034 ($Billion)

9.5.2 Market Size and Forecast

9.5.3 Europe Payment Integrity Market, By Country

9.5.4 UK

9.5.4.1 UK Payment Integrity Market Revenue, 2022-2034 ($Billion)

9.5.4.2 Market Size and Forecast

9.5.4.3 UKMarket Segmental Analysis

9.5.5 France

9.5.5.1 France Payment Integrity Market Revenue, 2022-2034 ($Billion)

9.5.5.2 Market Size and Forecast

9.5.5.3 FranceMarket Segmental Analysis

9.5.6 Germany

9.5.6.1 Germany Payment Integrity Market Revenue, 2022-2034 ($Billion)

9.5.6.2 Market Size and Forecast

9.5.6.3 GermanyMarket Segmental Analysis

9.5.7 Rest of Europe

9.5.7.1 Rest of Europe Payment Integrity Market Revenue, 2022-2034 ($Billion)

9.5.7.2 Market Size and Forecast

9.5.7.3 Rest of EuropeMarket Segmental Analysis

9.6 Asia Pacific

9.6.1 Asia Pacific Payment Integrity Market Revenue, 2022-2034 ($Billion)

9.6.2 Market Size and Forecast

9.6.3 Asia Pacific Payment Integrity Market, By Country

9.6.4 China

9.6.4.1 China Payment Integrity Market Revenue, 2022-2034 ($Billion)

9.6.4.2 Market Size and Forecast

9.6.4.3 ChinaMarket Segmental Analysis

9.6.5 Japan

9.6.5.1 Japan Payment Integrity Market Revenue, 2022-2034 ($Billion)

9.6.5.2 Market Size and Forecast

9.6.5.3 JapanMarket Segmental Analysis

9.6.6 India

9.6.6.1 India Payment Integrity Market Revenue, 2022-2034 ($Billion)

9.6.6.2 Market Size and Forecast

9.6.6.3 IndiaMarket Segmental Analysis

9.6.7 Australia

9.6.7.1 Australia Payment Integrity Market Revenue, 2022-2034 ($Billion)

9.6.7.2 Market Size and Forecast

9.6.7.3 AustraliaMarket Segmental Analysis

9.6.8 Rest of Asia Pacific

9.6.8.1 Rest of Asia Pacific Payment Integrity Market Revenue, 2022-2034 ($Billion)

9.6.8.2 Market Size and Forecast

9.6.8.3 Rest of Asia PacificMarket Segmental Analysis

9.7 LAMEA

9.7.1 LAMEA Payment Integrity Market Revenue, 2022-2034 ($Billion)

9.7.2 Market Size and Forecast

9.7.3 LAMEA Payment Integrity Market, By Country

9.7.4 GCC

9.7.4.1 GCC Payment Integrity Market Revenue, 2022-2034 ($Billion)

9.7.4.2 Market Size and Forecast

9.7.4.3 GCCMarket Segmental Analysis

9.7.5 Africa

9.7.5.1 Africa Payment Integrity Market Revenue, 2022-2034 ($Billion)

9.7.5.2 Market Size and Forecast

9.7.5.3 AfricaMarket Segmental Analysis

9.7.6 Brazil

9.7.6.1 Brazil Payment Integrity Market Revenue, 2022-2034 ($Billion)

9.7.6.2 Market Size and Forecast

9.7.6.3 BrazilMarket Segmental Analysis

9.7.7 Rest of LAMEA

9.7.7.1 Rest of LAMEA Payment Integrity Market Revenue, 2022-2034 ($Billion)

9.7.7.2 Market Size and Forecast

9.7.7.3 Rest of LAMEAMarket Segmental Analysis

Chapter 10. Competitive Landscape

10.1 Competitor Strategic Analysis

10.1.1 Top Player Positioning/Market Share Analysis

10.1.2 Top Winning Strategies, By Company, 2022-2024

10.1.3 Competitive Analysis By Revenue, 2022-2024

10.2 Recent Developments by the Market Contributors (2024)

Chapter 11. Company Profiles

11.1 Cotiviti

11.1.1 Company Snapshot

11.1.2 Company and Business Overview

11.1.3 Financial KPIs

11.1.4 Product/Service Portfolio

11.1.5 Strategic Growth

11.1.6 Global Footprints

11.1.7 Recent Development

11.1.8 SWOT Analysis

11.2 SAS Institute

11.3 Optum

11.4 EXL Service

11.5 Conduent

11.6 ClarisHealth

11.7 Alivia Analytics

11.8 Zelis

11.9 Gainwell Technologies

11.10 HealthEdge

11.11 Ceris

11.12 Apixio

11.13 NTT DATA

11.14 Integrity Advantage

11.15 LexisNexis Risk Solutions