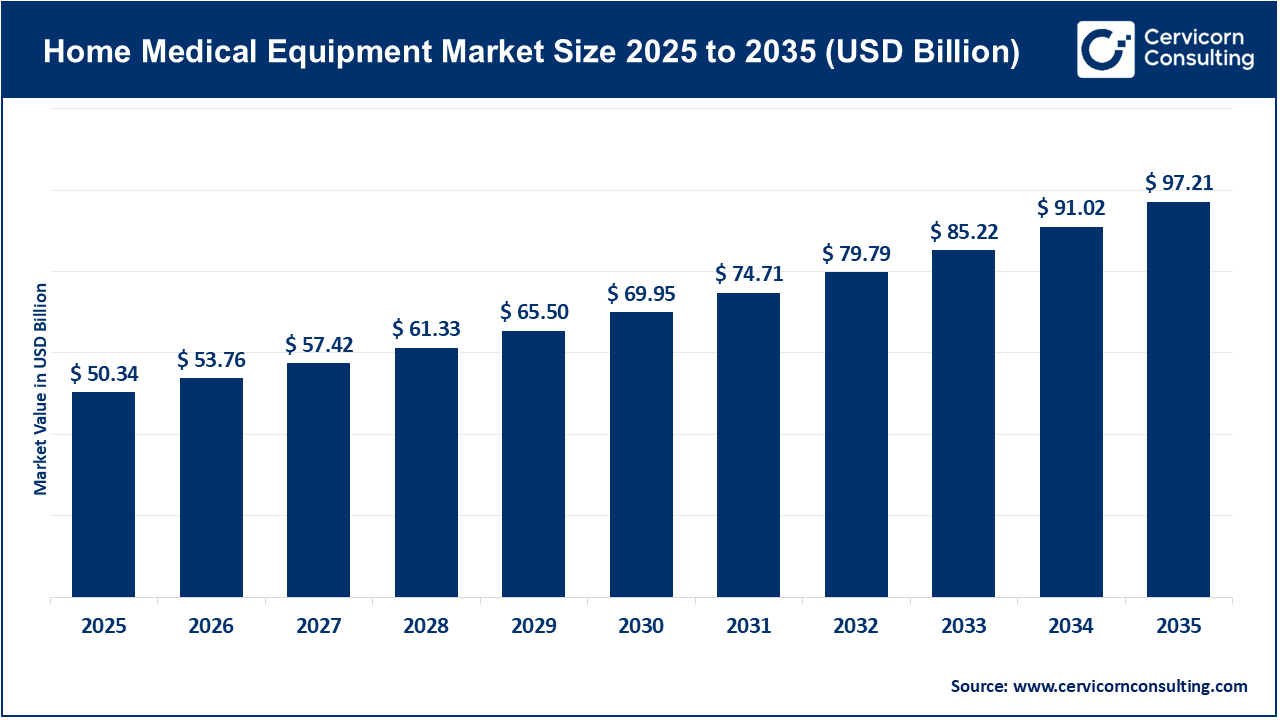

The global home medical equipment market size reached at USD 50.34 billion in 2025 and is expected to be worth around USD 97.21 billion by 2035, exhibiting at a compound annual growth rate (CAGR) of 6.8% over the forecast period 2026 to 2035. The home medical equipment market is growing steadily, driven by chronic diseases, aging populations, and the shift toward home-based healthcare. The home medical equipment market is establishing growth as individuals are increasingly seeking to receive healthcare services outside of a medical facility, in a home environment. The increasing incidence of chronic diseases, such as diabetes, respiratory disorders, and cardiovascular conditions, has led to an increase in the number of home monitoring and therapy devices. The increasing elderly population across the globe will also drive growth, as older patients prefer home medical care, because it is convenient, typically lower cost, and non-hospital care. New technology devices, such as portable oxygen concentrators, smart technology, monitoring systems, and user-friendly means of mobility assist patients in living at home and managing their care individually.

Furthermore, the home medical equipment market is being informed by the trend of increasing awareness of home medical care, supported by governmental initiatives advocating for home-based treatments. The production and increasing accessibility of the devices can improve availability and is now widely through both retail and online capabilities. The social acceptance, cost-effectiveness, and the fact that home care is not usually hospital-based are additional contributing factors to the increased use of home medical equipment. Usage of remote monitoring and telehealth practices, which allow doctors to monitor their patients from afar, support the use of home medical equipment. Overall, these factors contribute to a steady increase in the market for home medical equipment on a global level.

What is Home Medical Equipment?

Home medical equipment includes all the numerous types of medical equipment and supplies that are intended for use in the home for purposes of receiving healthcare, support recovery and the management of ongoing medical needs. Home medical equipment allows patients to effectively manage their chronic, acute, or post-acute needs at home, therefore encouraging mobility, monitoring vital signs, or providing therapeutic treatment to keep them home and avoid the need for frequent visits to the emergency room or clinic. Home medical equipment aids in improving comfort, independence, and overall quality of life of patients receiving episodic or long-term medical care at home.

Types of Home Medical Equipment:

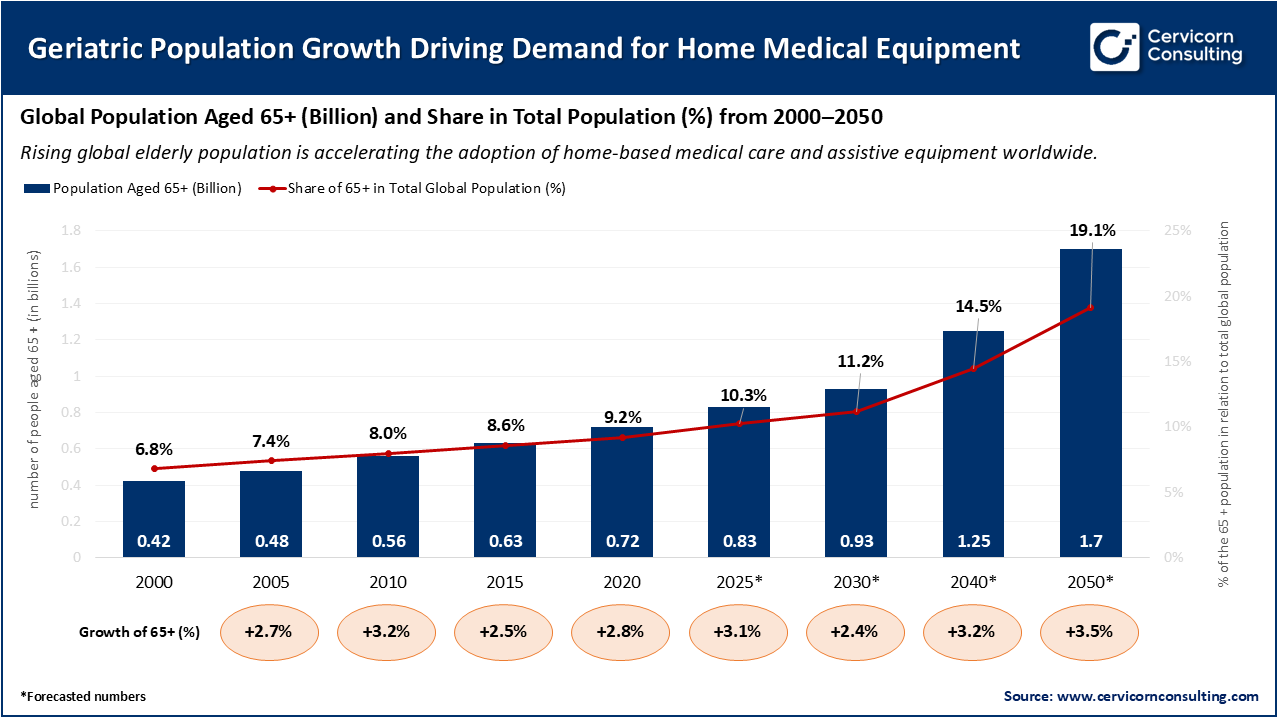

Growing Geriatric Population Boosting Demand for Home Medical Equipment

The rise in the elderly population will cause significant growth in the home medical equipment market since older adults are likelier to experience chronic diseases that require ongoing monitoring and care relative to younger adults. Chronic diseases that are commonly observed in older adults include diabetes, respiratory conditions, arthritis, and cardiovascular disease. Many older adults are interested in receiving treatments in their homes rather in the hospital. This has resulted in an increase for home medical devices to aide them. This is especially true for mobility aids, oxygen therapy products, and home monitoring systems which can support seniors in their independence in the home and improve their quality of life. This influx of in-home care in lieu of hospital care identifies older adults as an impetuous for the developing home medical equipment market.

The chart provides a clear representation of the rise experienced in the global elderly population (aged 65 and older) from 2000 to a potential 2050 snapshot, expressed in terms of total numbers and global population percentage. The population of individuals aged 65 and older is expected to increase from approximately 0.42 billion in 2000 to 1.7 billion in 2050, while the proportion in the total global population will increase from around 6.8 % to almost 20%. Moreover, the year-over-year percentage growth rates will remain steady, ranging from a low of +2.4% to +3.5% annually, representing significant demographic trends associated with the movement toward societies that are aging globally. As this population continues to grow, the prevalence of age-related chronic conditions, mobility impairment, and long-term care needs will dramatically increase. Hence, the demand for home medical devices, such as respiratory assist devices, patient monitoring devices, and mobility assist devices also continues to increase as older adults expressed a high preference for in – home care delivery that is more efficient, less expensive, and comfortable, compared to institutional service delivery.

FDA’s “Home as a Healthcare Hub” Initiative (2024)

Owens & Minor’s Acquisition of Rotech Healthcare (2024)

Rise of Smart and Connected Home Medical Devices

Expansion of Telemedicine and Remote Care Models

Report Scope

| Area of Focus | Details |

| Market Size in 2026 | USD 53.76 Billion |

| Expected Market Size in 2035 | USD 97.21 Billion |

| Estimated CAGR 2026 to 2035 | 6.8% |

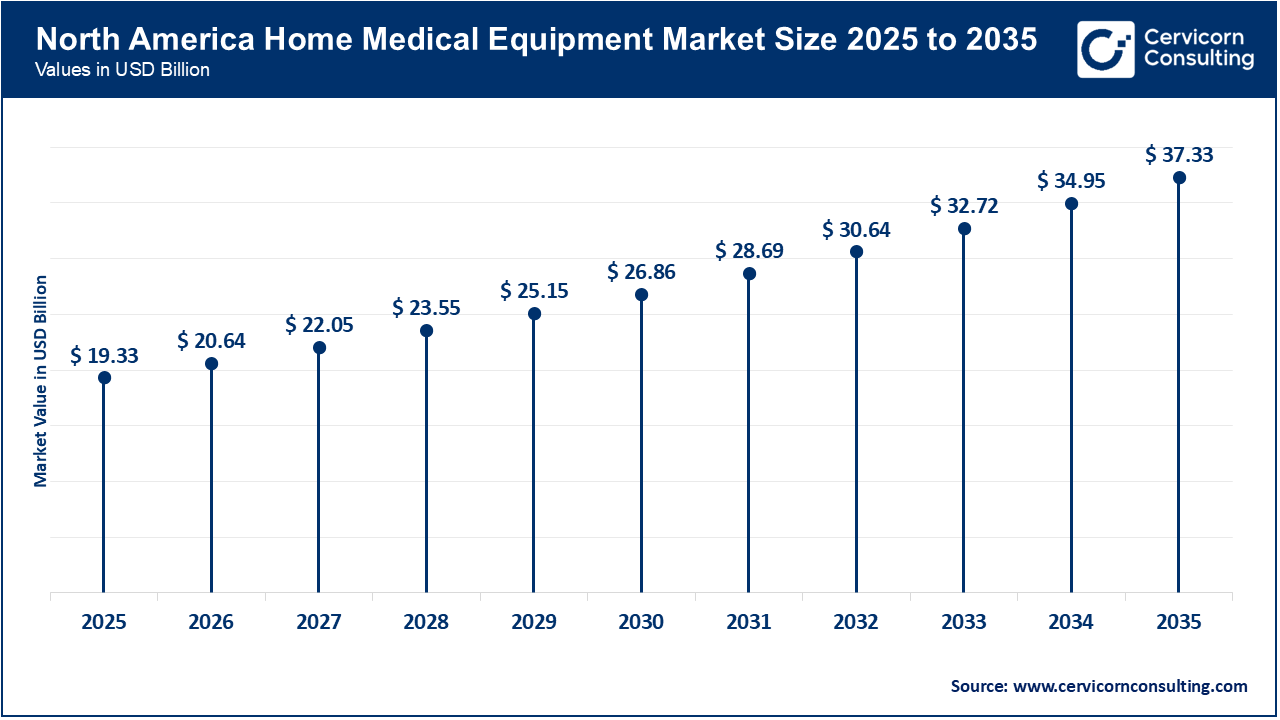

| Prime Region | North America |

| High-growth Region | Asia-Pacific |

| Key Segments | Product, Distribution Channel, Region |

| Key Companies | Abbott Laboratories, 3B Medical, Inc., Becton Dickinson (BD), Drive DeVilbiss Healthcare, Boston Scientific Corporation, Teva Pharmaceutical Industries Ltd., Fisher & Paykel Healthcare, Hill-Rom Holdings, Inc., GE Healthcare, Smiths Medical, Invacare Corporation, Philips Healthcare, Medline Industries, Inc., ResMed Inc., Stanley Healthcare/Stanley Black & Decker |

Increasing Prevalence of Chronic Diseases

Aging Population and Preference for Home Care

High Equipment Costs and Limited Reimbursement Policies

Technical and Maintenance Challenges

Integration of Smart Technology and IoT

Expansion in Emerging Economies

Regulatory and Compliance Barriers

Data Privacy and Security Concerns

The home medical equipment market is segmented into various regions, including North America, Europe, Asia-Pacific, and LAMEA. Here is a brief overview of each region:

The North America home medical equipment market stood at USD 19.33 billion in 2025 and is forecast to rise to approximately USD 37.33 billion by 2035. In North America is supported by its mature healthcare infrastructure, wide-ranging reimbursement regimes, and a rapidly increasing elderly population that prefers care at home. The high prevalence of chronic disease combined with conducive payer settings makes home-use devices (mobility aids, respiratory, monitoring devices, etc.) more prevalent and acceptable. The region benefits from a developed regulatory landscape and a strong uptake of telehealth and remote-monitoring solutions, which supports demand.

Recent Developments:

The Asia-Pacific home medical equipment market reached USD 12.64 billion in 2025 and is anticipated to almost double, hitting about USD 24.40 billion by 2035. The Asia-Pacific region is poised to be the fastest-growing market, driven by rapid urbanization, increases in disposable incomes, growing awareness of home healthcare options, and a relatively massive population of underserved patients. The incidence of chronic diseases and an expanding elder population necessitate home care options, particularly in countries like India and China driving the regional growth. The scarcity of professional home-care alternatives in many regions will also contribute to the spread of home-based equipment.

Recent Developments:

The Europe home medical equipment market size reached at USD 13.94 billion in 2025 and is projected to reach approximately USD 26.93 billion by 2035. Europe is driven by an aging population, an elevated incidence of chronic disease, and mounting pressure on health systems to cut down on inpatient costs. As hospitalization becomes increasingly expensive and less desirable, there is a demonstrable shift of care to the home medical environment that in turn, raises demand for monitoring and assistive devices and home-therapy systems. Furthermore, as noted, the European market remains a tight regulatory environment that fosters innovation, although it can be a bit slower to launch devices into the market than some other faster growing regions.

Recent Developments:

Home Medical Equipment Market Share, By Region, 2025 (%)

| Region | Revenue Share, 2025 (%) |

| North America | 38.40% |

| Europe | 27.70% |

| Asia-Pacific | 25.10% |

| LAMEA | 8.80% |

The LAMEA home medical equipment market reached USD 4.43 billion in 2025 and is forecast to expand to around USD 8.55 billion by 2035. The LAMEA market is experiencing positive momentum in the face of governments and the private sector investing to improve healthcare systems and expand access to home care for patients. Growing burdens of chronic disease and aging populations in countries like Brazil, South Africa and the Gulf States are shifting patients' needs towards devices that facilitate treatment and monitoring at home rather than through hospital stays. The increasing awareness of home care options as well as remote monitoring solutions are also helping grow the regions' use of home medical equipment solutions.

Recent Developments:

The home medical equipment market is segmented into product, distribution channel, and region.

Therapeutic equipment represents the majority of the home medical equipment market due to their widespread use for the management of chronic diseases associated with respiratory illness, sleep apnoea, and renal failure. For patients requiring long-term care, CPAP machines (Continuous Positive Airway Pressure), oxygen concentrators, nebulizers, and home dialysis are critical for home treatment. The dual impact of the increasing prevalence of respiratory and cardiovascular disease as well as the growing elderly population, continues to reinforce the preeminence of the therapeutic segment. Innovations in technology and the emergence of small and easy-to-use therapeutic devices for home treatment have, furthermore, improved the efficacy of home-based treatment.

Home Medical Equipment Market Share, By Product, 2025 (%)

| Product | Revenue Share, 2025 (%) |

| Therapeutic Equipment | 46.30% |

| Patient Monitoring Equipment | 29.70% |

| Mobility Assist & Patient Support Equipment | 15.20% |

| Bathroom Safety Equipment | 4.80% |

| Medical Furniture & Accessories | 3.10% |

| Others | 0.90% |

Patient monitoring equipment is the most rapidly growing product segment in the home medical equipment market due to the expanding telehealth market and remote patient monitoring. Technologies like glucose monitors, blood pressure monitors, and cardiac monitoring systems are appealing more and more to patients that prefer the ability to capture their respective health metrics in real-time from their home. The increasing presence of smart technology and wireless connectivity aims to augment patient convenience and allow health care professionals to access and analyze data remotely. This trend is projected to continue as engagement with digital health accelerates worldwide.

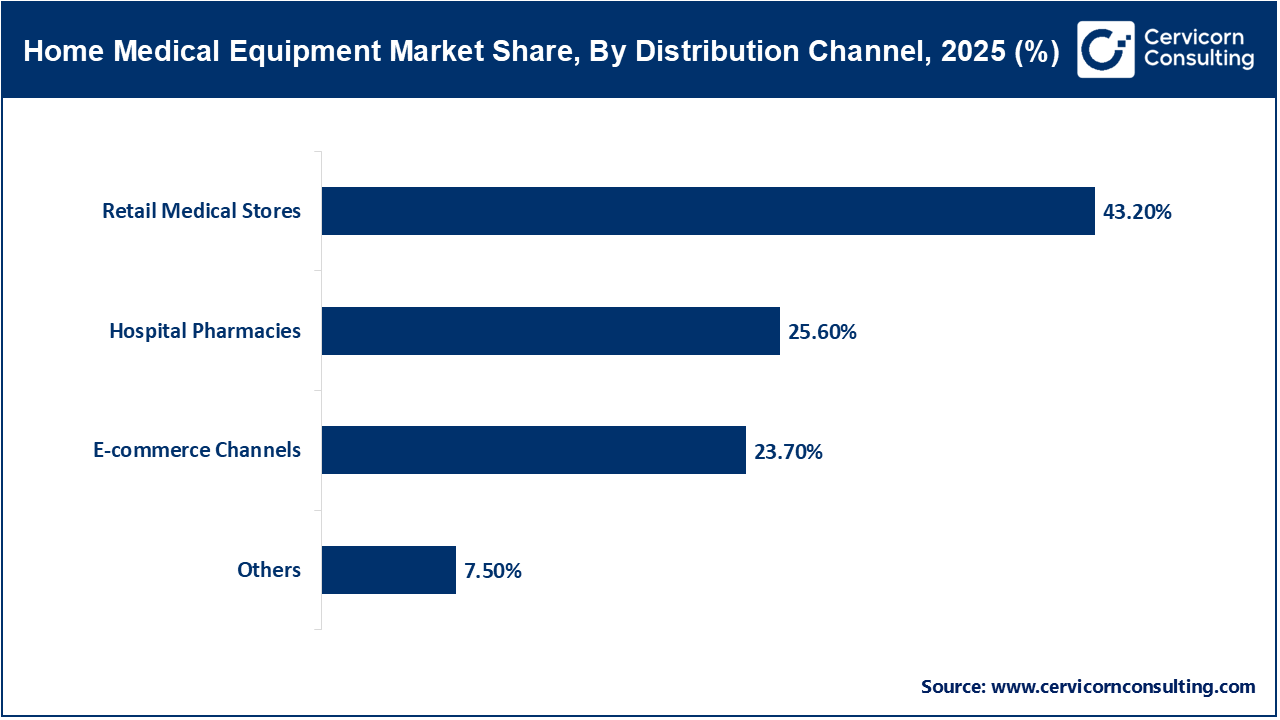

Retail medical stores currently lead the home medical equipment market due to their ease of access, personalised service and readily available products. Patients often like to purchase from a local retail store where they can view the device and receive assistance in its use. The established relationships between manufacturers and retail stores also encourages product variety as well as reliability for product availability. While the medical device marketplace shifts toward more digital and potent method of purchasing products, retail stores will likely remain the preferred and most convenient purchasing channel for elderly patients and chronic-care patients going forward.

E-commerce is rapidly becoming the fastest growing distribution channel for home medical equipment. Increasing numbers of people are using the internet, feeling comfortable purchasing items online, and digital healthcare channels are becoming more robust to support this change. Online stores exhibit an amazing variety of equipment with transparent pricing and home delivery, which are all huge advantages for people who are not mobile. The pandemic only pushed this even more. Manufacturers are now looking for greater reach through partnerships with e-commerce juggernauts and specialized medical platforms.

By Product

By Distribution Channel

By Region

Chapter 1. Market Introduction and Overview

1.1 Market Definition and Scope

1.1.1 Overview of Home Medical Equipment

1.1.2 Scope of the Study

1.1.3 Research Timeframe

1.2 Research Methodology and Approach

1.2.1 Methodology Overview

1.2.2 Data Sources and Validation

1.2.3 Key Assumptions and Limitations

Chapter 2. Executive Summary

2.1 Market Highlights and Snapshot

2.2 Key Insights by Segments

2.2.1 By Product Overview

2.2.2 By Distribution Channel Overview

2.3 Competitive Overview

Chapter 3. Global Impact Analysis

3.1 Russia-Ukraine Conflict: Global Market Implications

3.2 Regulatory and Policy Changes Impacting Global Markets

Chapter 4. Market Dynamics and Trends

4.1 Market Dynamics

4.1.1 Market Drivers

4.1.1.1 Increasing Prevalence of Chronic Diseases

4.1.1.2 Aging Population and Preference for Home Care

4.1.2 Market Restraints

4.1.2.1 High Equipment Costs and Limited Reimbursement Policies

4.1.2.2 Technical and Maintenance Challenges

4.1.3 Market Challenges

4.1.3.1 Regulatory and Compliance Barriers

4.1.3.2 Data Privacy and Security Concerns

4.1.4 Market Opportunities

4.1.4.1 Integration of Smart Technology and IoT

4.1.4.2 Expansion in Emerging Economies

4.2 Market Trends

Chapter 5. Premium Insights and Analysis

5.1 Global Home Medical Equipment Market Dynamics, Impact Analysis

5.2 Porter’s Five Forces Analysis

5.2.1 Bargaining Power of Suppliers

5.2.2 Bargaining Power of Buyers

5.2.3 Threat of Substitute Products

5.2.4 Rivalry among Existing Firms

5.2.5 Threat of New Entrants

5.3 PESTEL Analysis

5.4 Value Chain Analysis

5.5 Product Pricing Analysis

5.6 Vendor Landscape

5.6.1 List of Buyers

5.6.2 List of Suppliers

Chapter 6. Home Medical Equipment Market, By Product

6.1 Global Home Medical Equipment Market Snapshot, By Product

6.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

6.1.1.1 Therapeutic Equipment

6.1.1.2 Patient Monitoring Equipment

6.1.1.3 Mobility Assist & Patient Support Equipment

6.1.1.4 Bathroom Safety Equipment

6.1.1.5 Medical Furniture & Accessories

6.1.1.6 Others

Chapter 7. Home Medical Equipment Market, By Distribution Channel

7.1 Global Home Medical Equipment Market Snapshot, By Distribution Channel

7.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

7.1.1.1 Retail Medical Stores

7.1.1.2 Hospital Pharmacies

7.1.1.3 E-commerce Channels

7.1.1.4 Others

Chapter 8. Home Medical Equipment Market, By Region

8.1 Overview

8.2 Home Medical Equipment Market Revenue Share, By Region 2024 (%)

8.3 Global Home Medical Equipment Market, By Region

8.3.1 Market Size and Forecast

8.4 North America

8.4.1 North America Home Medical Equipment Market Revenue, 2022-2034 ($Billion)

8.4.2 Market Size and Forecast

8.4.3 North America Home Medical Equipment Market, By Country

8.4.4 U.S.

8.4.4.1 U.S. Home Medical Equipment Market Revenue, 2022-2034 ($Billion)

8.4.4.2 Market Size and Forecast

8.4.4.3 U.S. Market Segmental Analysis

8.4.5 Canada

8.4.5.1 Canada Home Medical Equipment Market Revenue, 2022-2034 ($Billion)

8.4.5.2 Market Size and Forecast

8.4.5.3 Canada Market Segmental Analysis

8.4.6 Mexico

8.4.6.1 Mexico Home Medical Equipment Market Revenue, 2022-2034 ($Billion)

8.4.6.2 Market Size and Forecast

8.4.6.3 Mexico Market Segmental Analysis

8.5 Europe

8.5.1 Europe Home Medical Equipment Market Revenue, 2022-2034 ($Billion)

8.5.2 Market Size and Forecast

8.5.3 Europe Home Medical Equipment Market, By Country

8.5.4 UK

8.5.4.1 UK Home Medical Equipment Market Revenue, 2022-2034 ($Billion)

8.5.4.2 Market Size and Forecast

8.5.4.3 UKMarket Segmental Analysis

8.5.5 France

8.5.5.1 France Home Medical Equipment Market Revenue, 2022-2034 ($Billion)

8.5.5.2 Market Size and Forecast

8.5.5.3 FranceMarket Segmental Analysis

8.5.6 Germany

8.5.6.1 Germany Home Medical Equipment Market Revenue, 2022-2034 ($Billion)

8.5.6.2 Market Size and Forecast

8.5.6.3 GermanyMarket Segmental Analysis

8.5.7 Rest of Europe

8.5.7.1 Rest of Europe Home Medical Equipment Market Revenue, 2022-2034 ($Billion)

8.5.7.2 Market Size and Forecast

8.5.7.3 Rest of EuropeMarket Segmental Analysis

8.6 Asia Pacific

8.6.1 Asia Pacific Home Medical Equipment Market Revenue, 2022-2034 ($Billion)

8.6.2 Market Size and Forecast

8.6.3 Asia Pacific Home Medical Equipment Market, By Country

8.6.4 China

8.6.4.1 China Home Medical Equipment Market Revenue, 2022-2034 ($Billion)

8.6.4.2 Market Size and Forecast

8.6.4.3 ChinaMarket Segmental Analysis

8.6.5 Japan

8.6.5.1 Japan Home Medical Equipment Market Revenue, 2022-2034 ($Billion)

8.6.5.2 Market Size and Forecast

8.6.5.3 JapanMarket Segmental Analysis

8.6.6 India

8.6.6.1 India Home Medical Equipment Market Revenue, 2022-2034 ($Billion)

8.6.6.2 Market Size and Forecast

8.6.6.3 IndiaMarket Segmental Analysis

8.6.7 Australia

8.6.7.1 Australia Home Medical Equipment Market Revenue, 2022-2034 ($Billion)

8.6.7.2 Market Size and Forecast

8.6.7.3 AustraliaMarket Segmental Analysis

8.6.8 Rest of Asia Pacific

8.6.8.1 Rest of Asia Pacific Home Medical Equipment Market Revenue, 2022-2034 ($Billion)

8.6.8.2 Market Size and Forecast

8.6.8.3 Rest of Asia PacificMarket Segmental Analysis

8.7 LAMEA

8.7.1 LAMEA Home Medical Equipment Market Revenue, 2022-2034 ($Billion)

8.7.2 Market Size and Forecast

8.7.3 LAMEA Home Medical Equipment Market, By Country

8.7.4 GCC

8.7.4.1 GCC Home Medical Equipment Market Revenue, 2022-2034 ($Billion)

8.7.4.2 Market Size and Forecast

8.7.4.3 GCCMarket Segmental Analysis

8.7.5 Africa

8.7.5.1 Africa Home Medical Equipment Market Revenue, 2022-2034 ($Billion)

8.7.5.2 Market Size and Forecast

8.7.5.3 AfricaMarket Segmental Analysis

8.7.6 Brazil

8.7.6.1 Brazil Home Medical Equipment Market Revenue, 2022-2034 ($Billion)

8.7.6.2 Market Size and Forecast

8.7.6.3 BrazilMarket Segmental Analysis

8.7.7 Rest of LAMEA

8.7.7.1 Rest of LAMEA Home Medical Equipment Market Revenue, 2022-2034 ($Billion)

8.7.7.2 Market Size and Forecast

8.7.7.3 Rest of LAMEAMarket Segmental Analysis

Chapter 9. Competitive Landscape

9.1 Competitor Strategic Analysis

9.1.1 Top Player Positioning/Market Share Analysis

9.1.2 Top Winning Strategies, By Company, 2022-2024

9.1.3 Competitive Analysis By Revenue, 2022-2024

9.2 Recent Developments by the Market Contributors (2024)

Chapter 10. Company Profiles

10.1 Abbott Laboratories

10.1.1 Company Snapshot

10.1.2 Company and Business Overview

10.1.3 Financial KPIs

10.1.4 Product/Service Portfolio

10.1.5 Strategic Growth

10.1.6 Global Footprints

10.1.7 Recent Development

10.1.8 SWOT Analysis

10.2 3B Medical, Inc.

10.3 Becton Dickinson (BD)

10.4 Drive DeVilbiss Healthcare

10.5 Boston Scientific Corporation

10.6 Teva Pharmaceutical Industries Ltd.

10.7 Fisher & Paykel Healthcare

10.8 Hill-Rom Holdings, Inc.

10.9 GE Healthcare

10.10 Smiths Medical

10.11 Invacare Corporation

10.12 Philips Healthcare

10.13 Medline Industries, Inc.

10.14 ResMed Inc.

10.15 Stanley Healthcare/Stanley Black & Decker