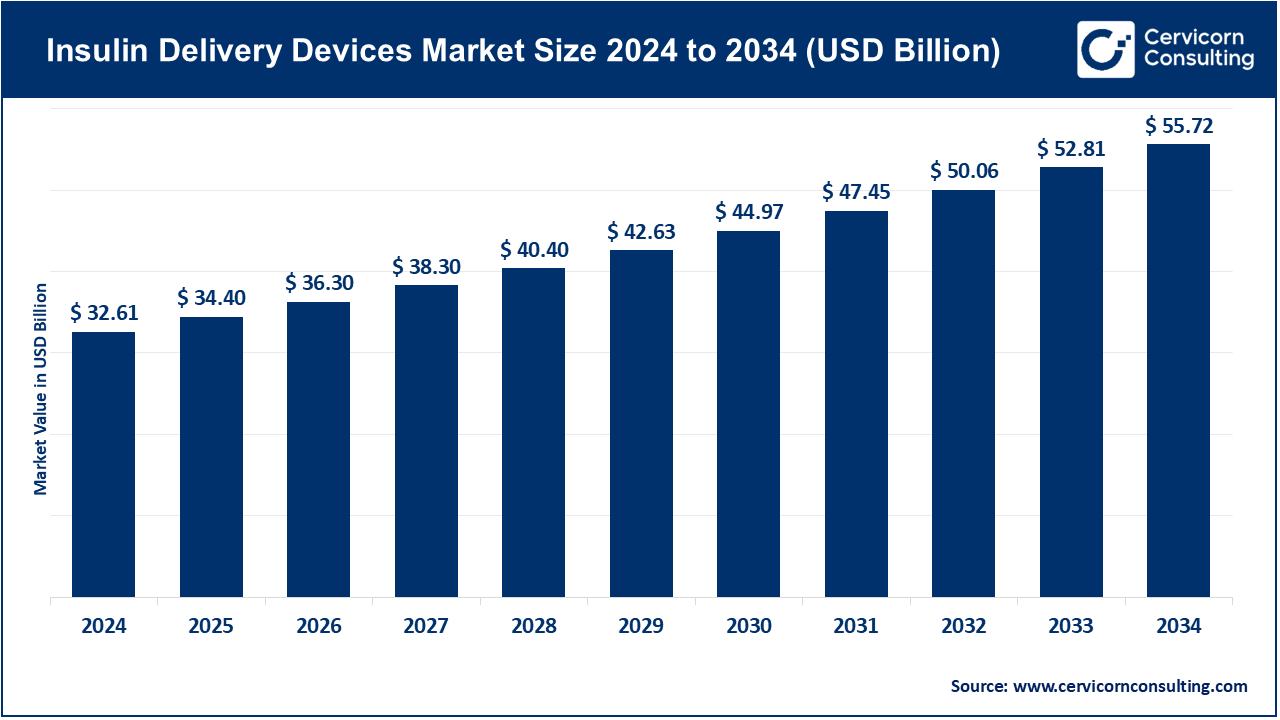

The global insulin delivery devices market size was valued at USD 32.61 billion in 2024 and is expected to be worth around USD 55.72 billion by 2034, growing at a compound annual growth rate (CAGR) of 5.50% over the forecast period from 2025 to 2034. The increasing rate of diabetes across the world, as well as the aging population, is fueling the insulin delivery devices demand. These devices have propelled their usage because they enhance the quality of life of the patients, administration of insulin in the most accurate manner and reduce hospitalization expenses. The development of biocompatible and bioresorbable materials coupled with the advancement of minimally invasive technologies has increased device safety, efficacy, and longevity, which further increased the growth of the market.

Moreover, smarter insulin delivery gadgets with attached biosensors are changing the way diabetes is dealt with. They allow real-time tracking, long-distance monitoring, and individual adjustment of treatment and are not limited to the hospital environment but are also used in outpatient clinics and at home. This enhances the access to patients and also reduces the total cost of healthcare. The next generation of diabetes treatment will involve insulin delivery devices as they will be the key to the better efficiency, outcomes, and transition toward more personalized and cost-effective treatment.

Report Scope

| Area of Focus | Details |

| Market Size in 2025 | USD 34.40 Billion |

| Estimated Market Size in 2034 | USD 55.72 Billion |

| Projected CAGR 2025 to 2034 | 5.50% |

| Dominant Region | North America |

| Fastest Growing Region | Asia-Pacific |

| Key Segments | Type, Application, End User, Distribution Channels, Region |

| Key Companies | Novo Nordisk A/S, Wockhardt Ltd., Medtronic, F. Hoffmann-La Roche, Ltd., Abbott Laboratories, Sanofi, Eli Lilly and Company, Biocon Ltd., Ypsomed AG, Becton, Dickinson and Company |

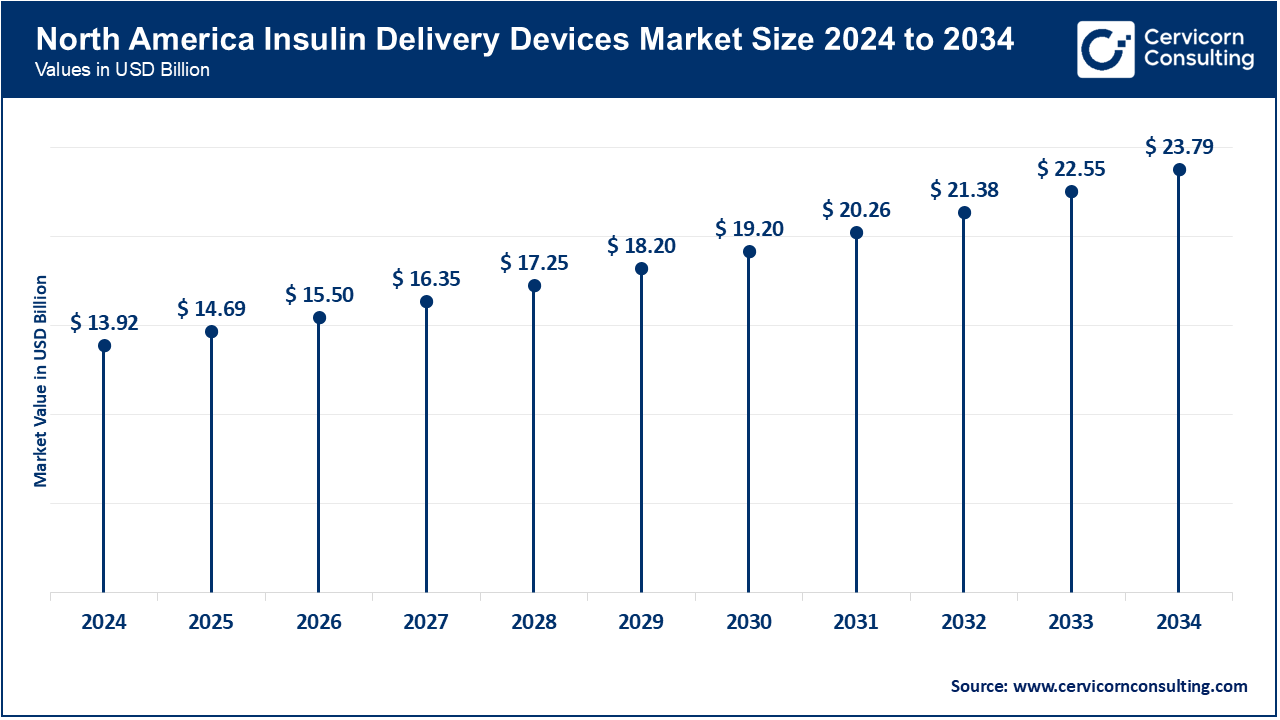

The insulin delivery devices market is segmented into several key regions: North America, Europe, Asia-Pacific, and LAMEA (Latin America, Middle East, and Africa). Here’s an in-depth look at each region.

North America has been dominating the market because of its excellent healthcare system, prevalence rates of diabetes, and its adoption of the sophisticated technologies. In April 2025, the FDA of the United States gave a next-generation closed-loop insulin pump that enables automated insulin delivery with minimal manual interventions to enhance the safety of patients and the level of glycemic regulation. Moreover, AI-enabled solutions are being deployed in hospitals and outpatient clinics in the U.S. and Canada to identify and measure the functionality of the devices, to optimize the insulin dosage or to minimize hospital readmissions. High reimbursement policies and the overall awareness of patients also ensure that North America remains the most profitable market in terms of insulin delivery devices.

The market development in Europe is influenced by strict regulatory requirements, the boost in demand among patients who require the use of minimal invasive devices, and adoption of smart technology. In June 2025, insulin pump training programs in Germany and France were launched with the help of robotics and allowed clinicians to improve device management and patient care. The U.K, Italy, and the Netherlands, among others are adopting bio-compatible and biocompatible insulin pens and smart wearable pumps that maximize therapy and do not compromise patient safety. The emphasis by Europe on regulatory compliance, new materials and superior device designs makes Europe a market leader in the effective and safe insulin delivery solutions.

Asia-Pacific is witnessing strong growth due to the aging population, growing access to healthcare, and a robust governmental support. Japan, South Korea and India introduced nationwide projects in July 2025 to supply cheap insulin pumps and smart pens to diabetics, especially the elderly. In the meantime, there is investment in China in the local production of smart insulin delivery devices with AI-enabled monitoring in order to decrease reliance on importation. Affordability, innovation, and rising access to healthcare are all contributing to the sudden rise in APAC insulin delivery market.

Insulin Delivery Devices Market Share, By Region, 2024 (%)

| Region | Revenue Share, 2024 (%) |

| North America | 42.70% |

| Europe | 26.60% |

| Asia-Pacific | 23.80% |

| LAMEA | 6.90% |

Insulin delivery devices adoption is yet to be realized in LAMEA where most of the growth has been experienced in urban centers and through private healthcare facilities. In August 2025, Brazil began a government subsidies initiative to subsidize insulin pumps to patients with low incomes to enhance access. In Middle East, some of the countries such as Saudi Arabia and UAE are also investing in high-level diabetes care facilities which provide continuous glucose monitoring and automated insulin delivery systems. South Africa is testing mobile health units in Africa with remote insulin devices to follow up on access in rural locations. Although the adoption is still at an initial level, there are government efforts that are focused on ensuring the establishment of the long-term growth of the markets.

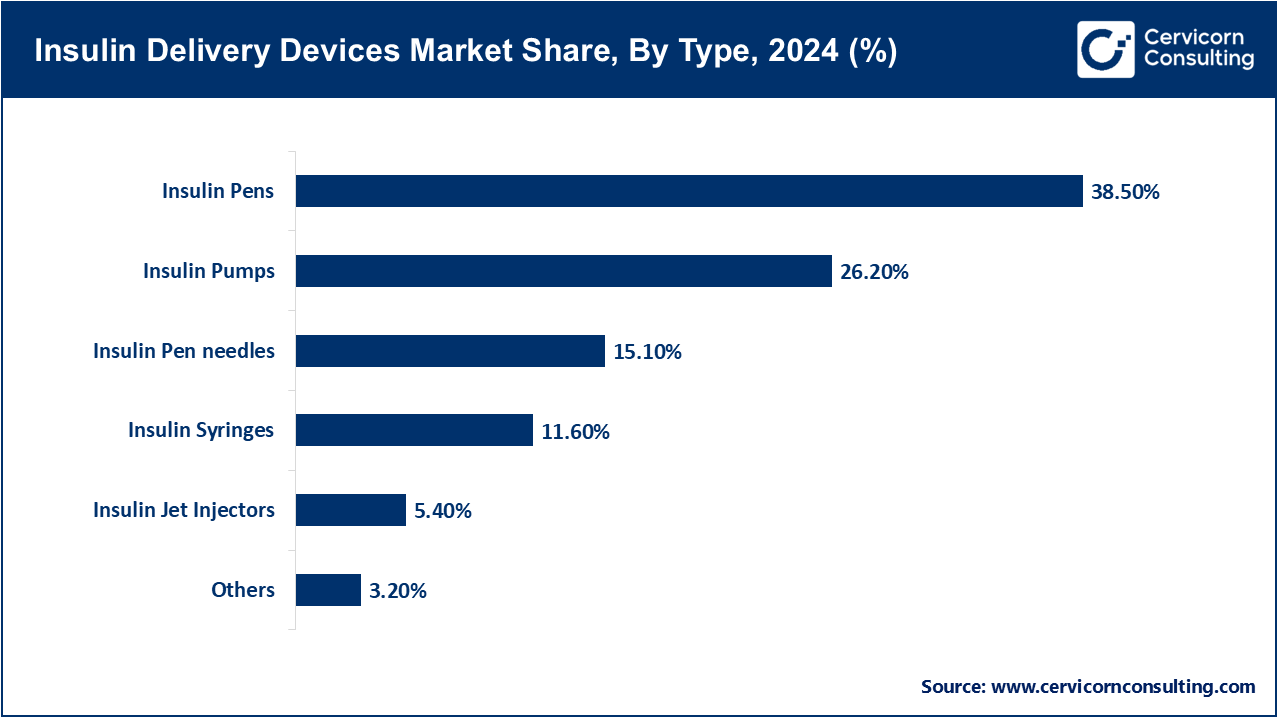

Insulin Pumps: The biggest segment of the products is insulin pumps, which provides continuous insulin infusion subcutaneously and a precise glucose management. Their capability to decrease hypoglycemic episodes and enhance quality of life is increasing its adoption. In April 2025, Medtronic launched its next-generation MiniMed 780G in the U.S. with auto-correction boluses and Bluetooth connectivity, as the trend toward smarter, AI-assisted pumps.

Insulin Pens: Insulin pens are gaining much acceptance due to their convenience, portability and ease of use over syringes. In June 2025, Novo Nordisk released its smart reusable insulin pen in Europe, which transmits dosing data to mobile applications to allow patients and clinicians to better track adherence.

Insulin Pen Needles: This category assists with adoption of pen needles and provides ultra-thin and painless designs. In May 2025, Becton Dickinson (BD) announced its rollout of its new BD Nano 2ndGen pen needles in Asia-Pacific to provide increased comfort and reduce dosing errors.

Insulin Jet Injectors: Jet injectors are a niche product but they provide needle-free administration to needle-shy patients. In March 2025, PharmaJet widened its needle-free injector partnerships in diabetic clinical research in Canada and indicated more research focus in this segment.

Insulin Syringes: Old fashioned syringes are still considered applicable in low-income areas, as they are cheap. In January 2025, India’s Hindustan Syringes and Medical Devices increased the production of low cost insulin syringes by 20 times to cater to the increasing domestic demand.

Others: New wearable patch pumps and micro-implants are transforming this space. Insulet also published a new Omnipod patch pump in July 2025 in Japan that is capable of delivering insulin tubelessly and discreetly.

Type I Diabetes: This category prevails since patients with Type I diabetes rely on external insulin measurements throughout their lives. A big trial with hybrid closed-loop pump systems approved by the Juvenile Diabetes Research Foundation (JDRF) in the U.S. in February 2025, shows the increased use of advanced technologies among Type I patients.

Insulin Delivery Devices Market Share, By Application, 2024 (%)

| Application | Revenue Share, 2024 (%) |

| Type I Diabetes | 38.60% |

| Type II Diabetes | 61.40% |

Type II Diabetes: An increasing proportion with the obesity pandemic in the world and sedentary lifestyle. The move to devices in the management of Type II, even in late disease, was emphasized by the Indian Council of Medical Research in May 2025, as it announced a national effort to offer subsidized insulin pens and pumps to Type II patients in urban areas.

Home Care: This segment is operated by home care because patients can inject insulin through pumps, pens, and wearables. In July 2025, Dexcom collaborated with Abbott in the U.S. to combine continuous glucose monitoring (CGM) and home insulin delivery devices so that real-time adjustments can be made remotely.

Hospitals & Clinics: Hospitals are essential in terms of initial diagnosis, education, and high-tech device-assisted treatment. According to the involvement of hospitals in the pioneering therapies, Cleveland Clinic started to provide implantable insulin delivery trials to in-patients with brittle diabetes in April 2025.

Insulin Delivery Devices Market Share, By End User, 2024 (%)

| End User | Revenue Share, 2024 (%) |

| Home Care | 52.10% |

| Hospitals & Clinics | 40.70% |

| Others | 7.20% |

Others: Community health facilities and non-governmental organizations help in managing diabetes in areas with resources restrictions. In March 2025, Médecins Sans Frontières increased its pilot program in Sub-Saharan Africa to provide low-cost insulin syringes and training of rural diabetic patients.

Online Sales: This is the fastest growing channel owing to the convenience and direct-to-patient supply models. Amazon Pharmacy has delivered insulin pump and pen needles nationwide in June 2025, which makes sure that diabetic patients can gain access to the deliveries at their doorstep.

Hospital Pharmacies: This is also a critical setting because majority of prescriptions of the pumps and devices are made in hospitals. Mayo Clinic began to integrate smart insulin pen data in EHRs of patients in May 2025, connecting the prescription and monitoring.

Insulin Delivery Devices Market Share, By Distribution Channels, 2024 (%)

| Distribution Channels | Revenue Share, 2024 (%) |

| Online Sales | 16.40% |

| Hospital Pharmacies | 32.10% |

| Retail Pharmacies | 45.30% |

| Others | 6.20% |

Retail Pharmacies: Retail chains serve the purposes of continuing prescribed drugs and equipment refills. In 2025, in the U.S., Walgreens extended its same-day delivery service of insulin pens and pumps to make it more accessible.

Other Clinics: There are small outpatient centers and small privately owned clinics that are used as distribution outlets. In April 2025, Singapore-based private diabetes clinics embraced in-clinic dispensing of linked insulin pens and patients who needed the therapy could commence therapy immediately.

Market Segmentation

By Type

By Distribution Channels

By Application

By End User

By Region