Insulin Pump Market Size and Growth 2025 to 2034

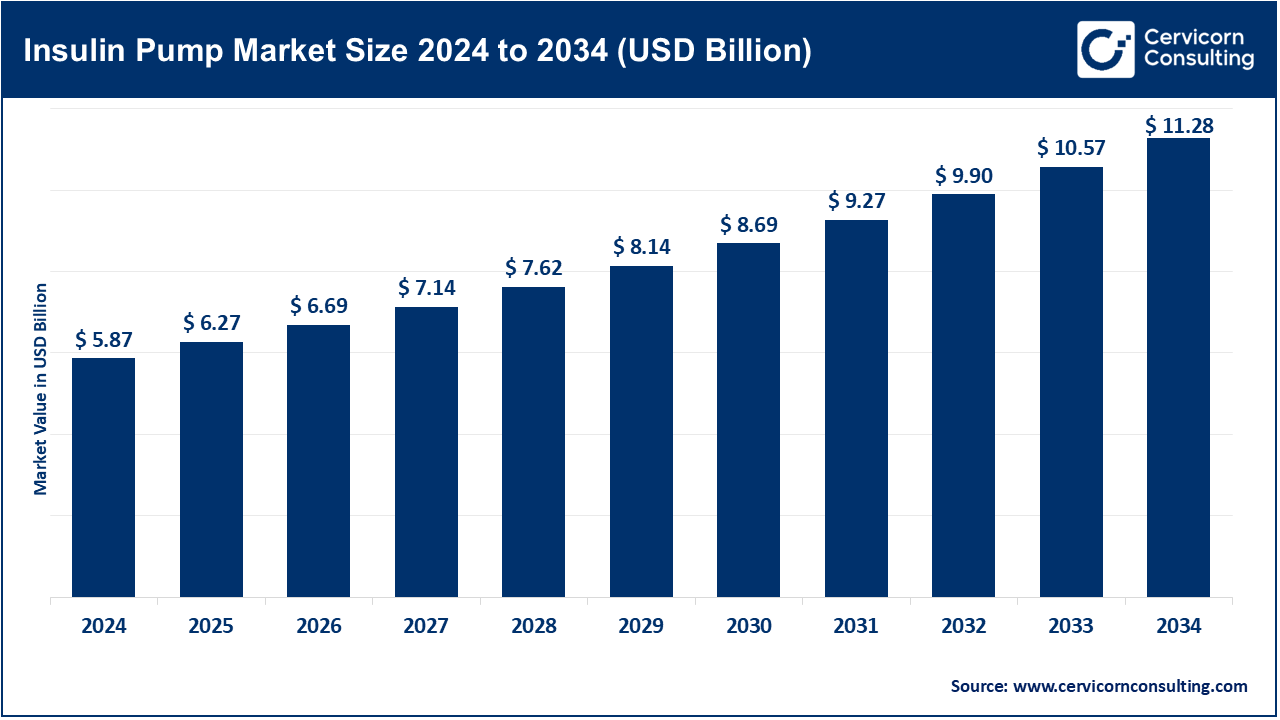

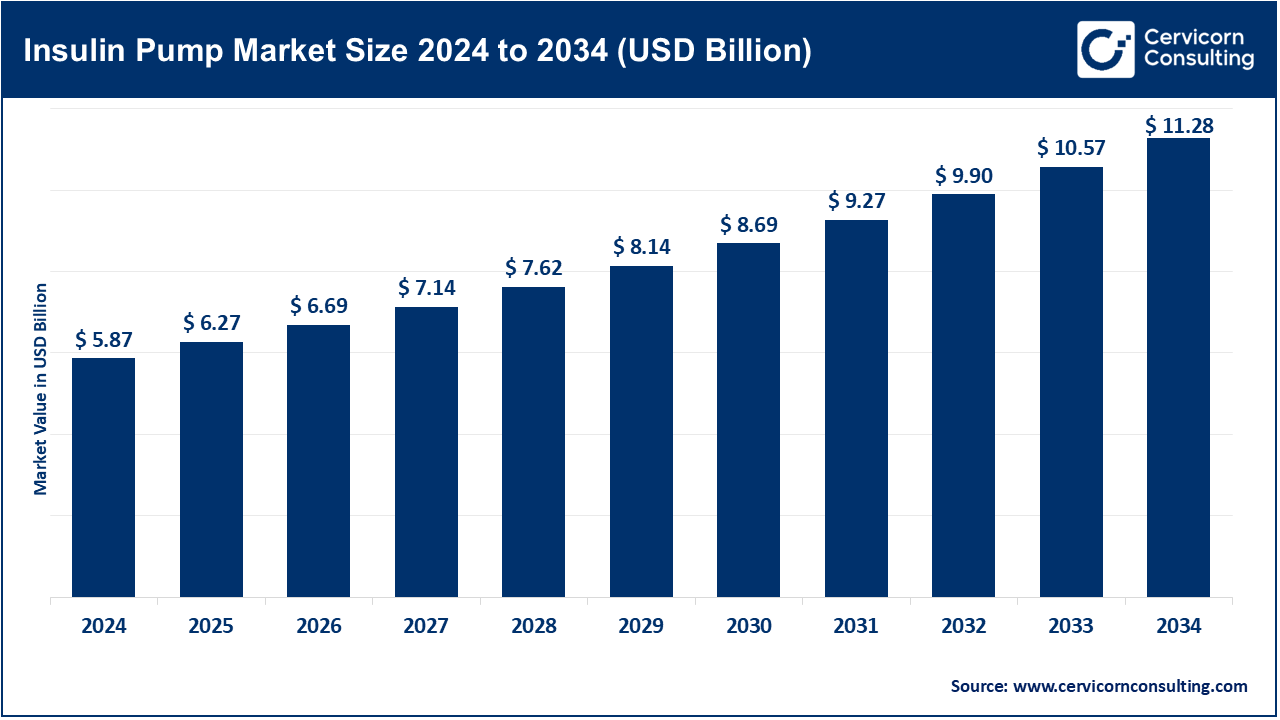

The global insulin pump market size was reached at USD 5.87 billion in 2024 and is expected to exceed around USD 11.28 billion by 2034, growing at a compound annual growth rate (CAGR) of 8.7% over the forecast period from 2025 to 2034.

The global insulin pumps market is expected to grow significantly due to the rising prevalence of diabetes, particularly Type 1 diabetes, and the more sophisticated automated insulin delivery devices. Awareness and adoption by users and healthcare practitioners is shifting in favor of continuous subcutaneous insulin infusion (CSII) because of its advantages over injection-based methods. New technology, including hybrid closed-loop systems, pumps with continuous glucose monitors (CGMs), and smartphone-connected insulin pumps is enhancing both treatment precision and user experience. Moreover, developed and emerging markets are structurally stimulated by favorable reimbursement policies and widening telehealth frameworks.

The adoption of precision smart technologies, which facilitate automated insulin infusion, is transforming the insulin pump industry. The market is advancing due to a rise in diabetes cases, a growing acceptance of insulin pumps and wearable devices, improvements in continuous glucose monitoring technology, along with Bluetooth and smartphone integration with modern pumps. Additionally, closed-loop systems that emulate pancreatic functionality have also been integrated into insulin pumps. Outcomes and convenience for patients are improving via an evolving shift towards real-time, tailored insulin delivery. Innovation is spurred through strategic collaborations among medtech, digital health companies, and supportive regulation and reimbursement frameworks. With the advancement of AI and cloud-based analytics, insulin pumps are able to be manufactured to be smaller, smarter, and more responsive.

Insulin Pump Market Report Highlights

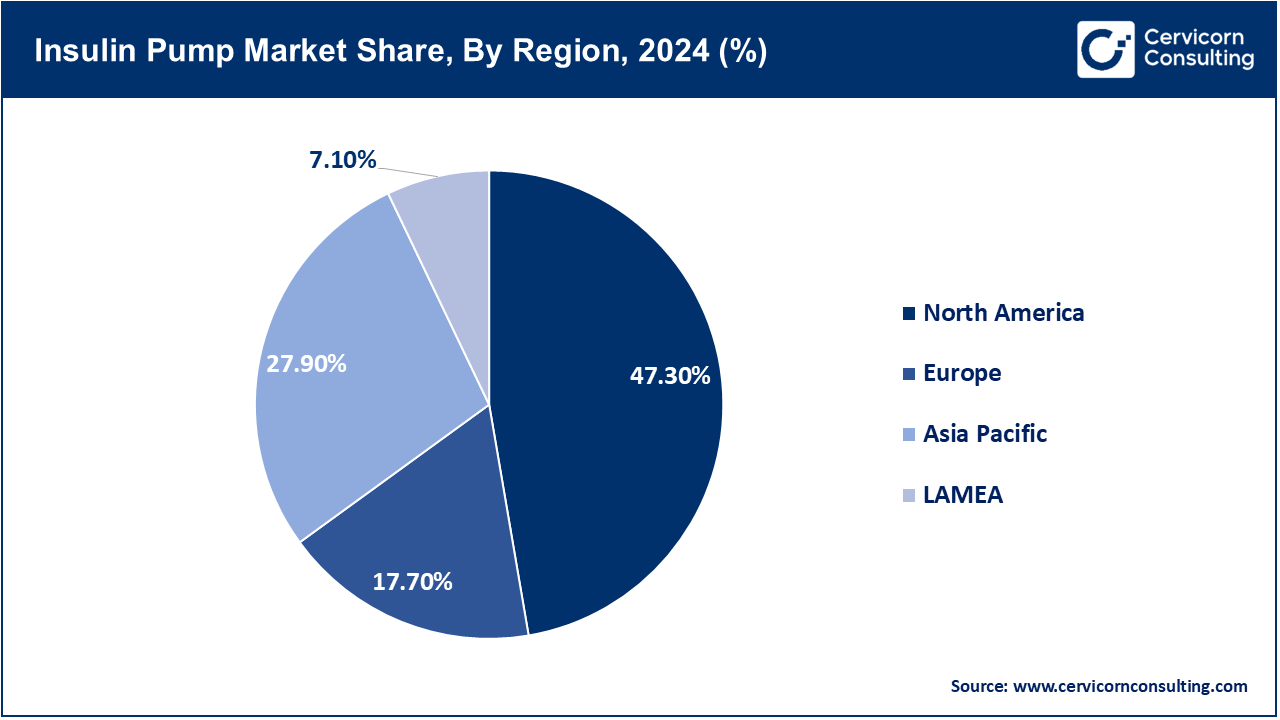

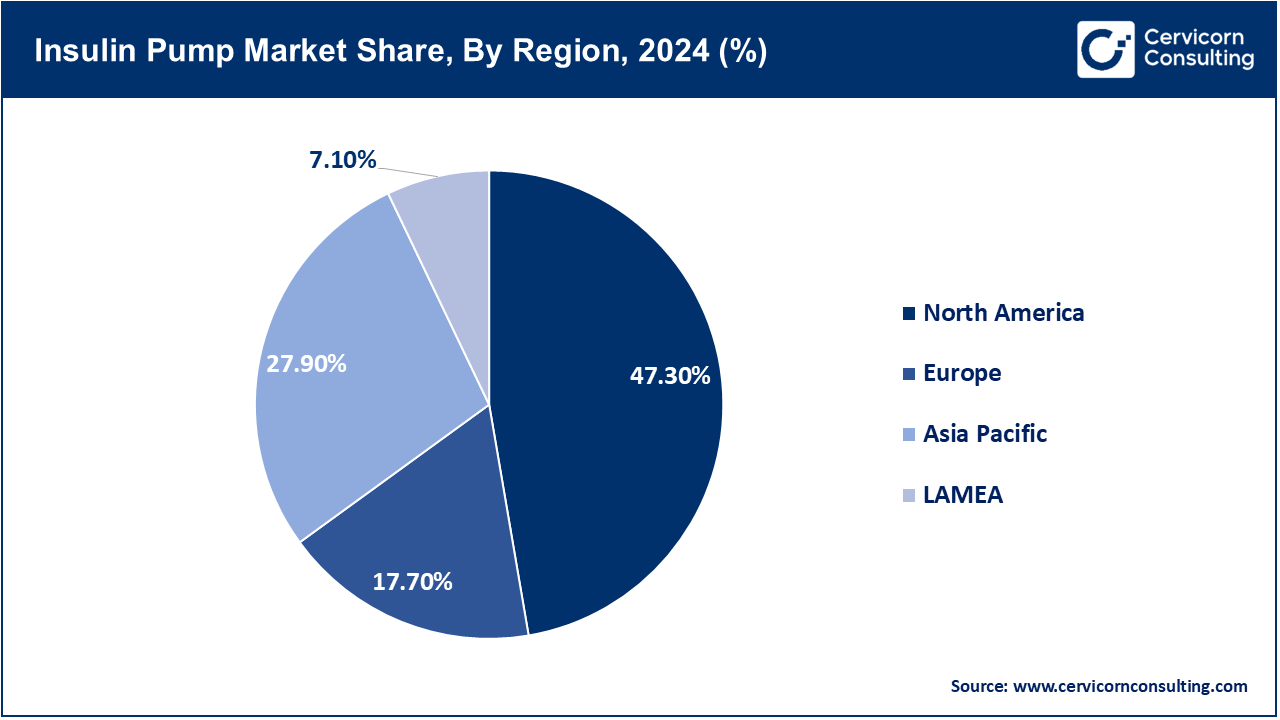

- By region, North America dominates the market with a 47.3% share, owing to high diabetes prevalence, advanced healthcare infrastructure, strong reimbursement policies, and widespread adoption of insulin delivery technologies.

- By type, the Tethered Pumps segment has recorded a revenue share of around 64.8% in 2024, owing to their clinical reliability, continuous insulin delivery, and integration with advanced CGM (continuous glucose monitoring) systems.

- By product, the MiniMed (Medtronic) segment has recorded a revenue share of around 39.6% in 2024, driven by its market legacy, wide physician acceptance, and continuous innovation in hybrid closed-loop insulin delivery systems.

- By disease indication, the Type 1 Diabetes segment has recorded a revenue share of around 69.4% in 2024, due to the essential role of insulin pump therapy in managing insulin-dependent diabetes.

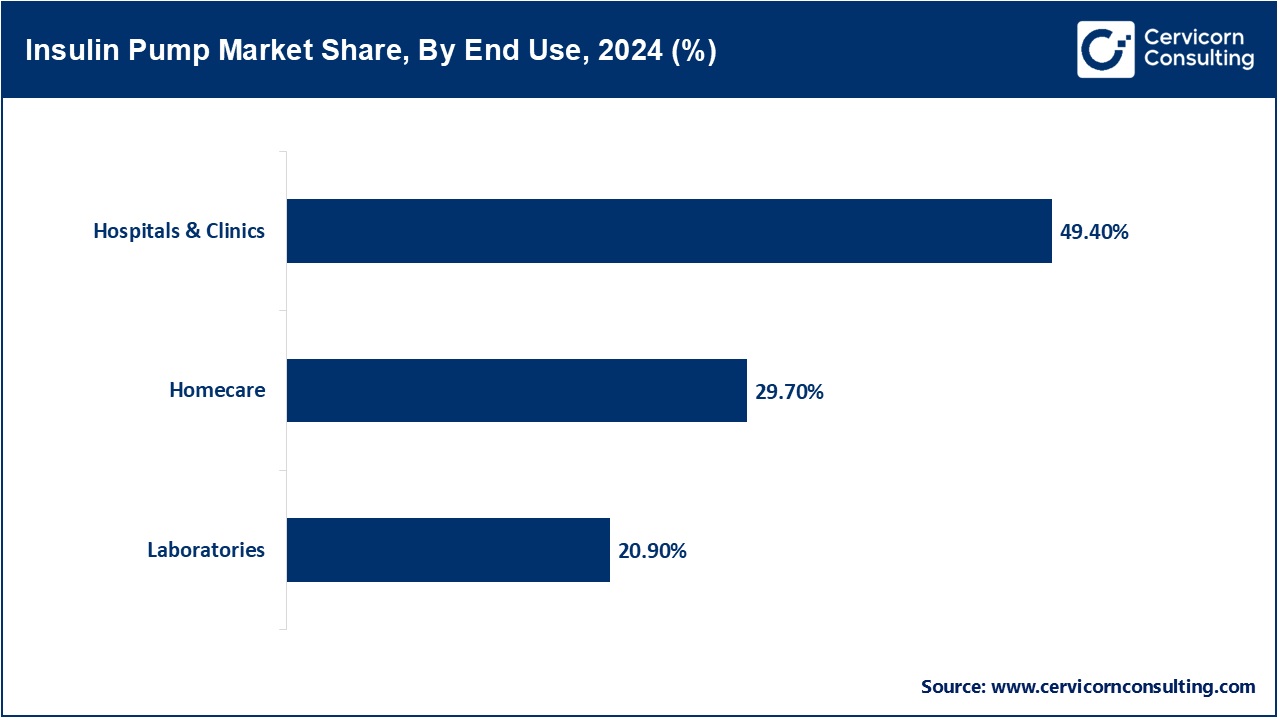

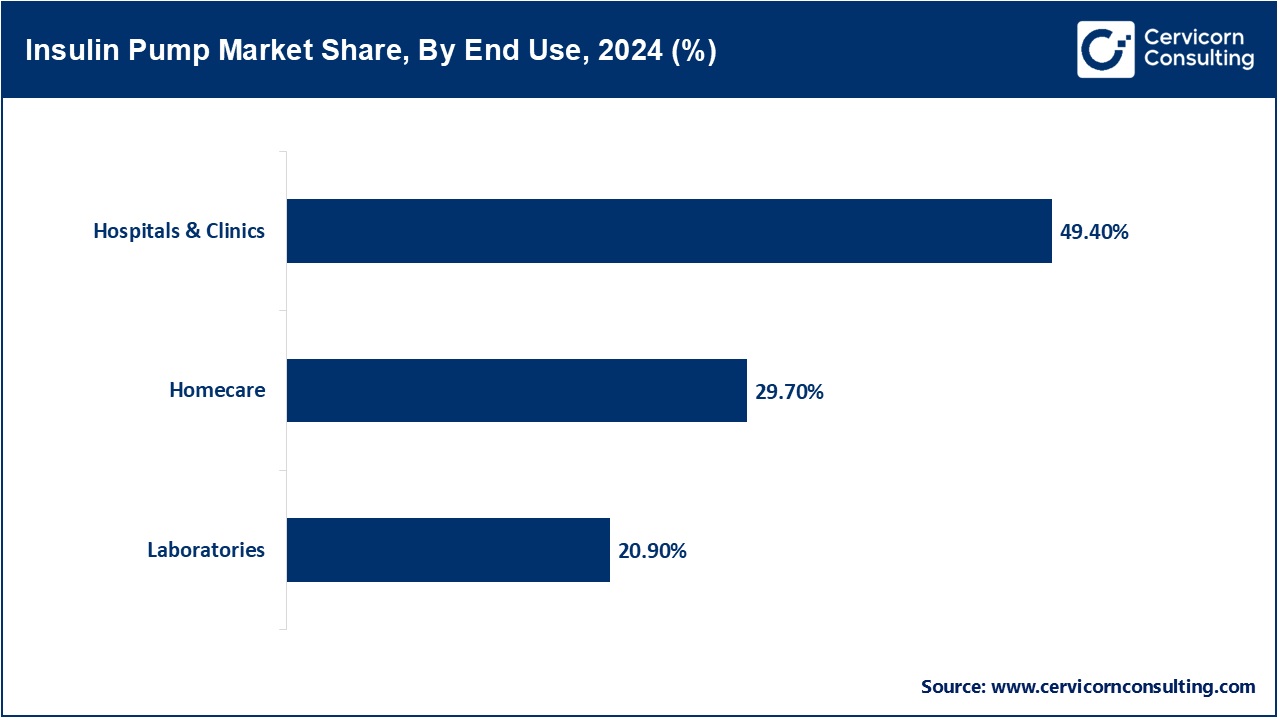

- By end user, the hospital and clinics segment has recorded a revenue share of around 49.4% in 2024, owing to the increased prevalence of diabetes-related hospital admissions, preference for professional device initiation under medical supervision, and improved reimbursement frameworks for inpatient insulin therapy management.

- By accessories, the insulin set insertion devices segment accounted for a revenue share of 41.7% in 2024, due to advancements in user-friendly designs and enhanced comfort.

Insulin Pump Market Growth Factors

- Rising Global Diabetes Prevalence: The International Diabetes Federation's data shows a staggering 537 million people diagnosed with diabetes in 2021, with projections estimating over 640 million by 2030. This has led to a greater need for effective diabetes management solutions such as insulin pumps. The Asia-Pacific region continues to experience rapid urbanization which, along with changing lifestyle habits, is increasing the burden of diabetes and healthcare expenditures. Furthermore, the increasing awareness of diabetes fuels its prevalence, further driving the demand for insulin pumps as patients become more proactive in optimizing their blood glucose control. These initiatives from the government and public health campaigns globally increase the need for faster adoption of insulin pumps.

- Technological Advancements in Insulin Pumps: The Medtronic MiniMed 780G system with hybrid closed-loop technology and advanced meal detection is one of the insulin pumps innovations that augments automation in insulin delivery. Recent advancements in insulin pump technology have greatly improved precision and diabetes management ease through hardware miniaturization and advanced algorithms. Furthermore, real-time integration with wearable continuous glucose monitors (CGMs) allows graded assessment of glucose levels, enhancing diabetes control and minimizing hypoglycemic episodes. The insulin pumps are more appealing to patients and healthcare professionals due to their augmented ease of use. Adoption rates are thus heightened. The pace at which sophisticated systems are entering the market is accelerating due to FDA and other regulatory approvals.

- Integration with Continuous Glucose Monitoring (CGM): The integration of CGM systems with insulin pumps is changing the management of diabetes as it provides real-time glucose information for insulin administration. This integration improves device-dependent regulation of glucose complications. Recent interoperability approvals of CGM and pump systems empowers flexible diabetes management with closed-loop systems, thereby improving safety. Regulatory data demonstrates strengthened patient engagement and outcomes with pump-CGM integration, driving market expansion. In addition, global telemedicine programs support enhanced clinical remote decision-making and patient oversight through the sharing of cloud-based data.

Insulin Pump Market Trends

- Move Towards Artificial Pancreas Systems: The market trend of artificial pancreas systems is driven by the integration of continuous glucose monitors (CGM), insulin pumps, and advanced algorithms for automated insulin delivery. The FDA's approval of tandem hybrid closed loop systems, like Control-IQ pump, signals a movement toward less manual intervention in diabetes management. While reducing the need for patient-driven actions, these systems improve diabetes control and the patient’s quality of life. Investment for R&D aimed at fully closed-loop systems is increasing due to the need for smarter devices. Cross-industry collaboration is also advancing the development of AI-driven insulin delivery systems. Adoption is being accelerated everywhere as regulatory authorities are harmonizing rules to allow these complex systems.

- Smartphone Integration for Remote Monitoring: The trend of integrating insulin pumps with smartphones allows users to remotely check glucose levels, adjust insulin dosages, and share necessary data with healthcare professionals. The insulin X2 pump with Bluetooth and compatible mobile applications increases user engagement and convenience. This shift is supported by the increasing investments in digital health technologies as well as greater smartphone ownership. Policies related to reimbursement and telehealth also shifted after the pandemic to support remote diabetes care. During the connected health landscape, legal frameworks focus mostly on data privacy and security, which builds patient trust. Such connectivity can improve care and clinical outcomes.

- Miniaturization of Devices: The growing need for portable insulin pumps motivates the marketing of lightweight devices that deliver insulin with a minimal insulin delivery system. Recently, the Mobi Tandem pump was launched, addressing the needs of younger and more active users. Furthermore, the miniaturization aids in the user’s compliance with treatment regimens as such devices are more user-friendly. Such improvements in microelectronics and battery technology result to the possibility of using advanced features in smaller devices, thus increasing their life span. These innovations are also easily available in developing countries where such features are important. Miniaturization improves device efficiency and user comfort.

Report Scope

| Area of Focus |

Details |

| Market Size in 2025 |

USD 6.27 Billion |

| Expected Market Size in 2034 |

USD 11.28 Billion |

| Projected Market CAGR 2025 to 2034 |

8.70% |

| Dominant Region |

North America |

| Rapidly Expanding Region |

Asia-Pacific |

| Key Segments |

Type, Product, Disease Indication, Accessories, End Use, Region |

| Key Companies |

Medtronic, Hoffmann-La Roche AG, Tandem Diabetes Care, Inc., Insulet Corporation, Ypsomed, Sanofi S.A., Sooil development, Jiangsu Delfu Co., Ltd., Cellnovo Ltd, Valeritas, Inc |

Insulin Pump Market Dynamics

Market Drivers

- Favorable Reimbursement Policies: Improvements in reimbursement policy, particularly in the United States, have made insulin pumps far more accessible. The Inflation Reduction Act of 2022 capped insulin pricing for Medicare beneficiaries at $35 a month which alleviated costs for patients. Some states also enacted additional reimbursement policies mandating coverage for diabetes devices which expanded public and private payer coverage. This financial backing increases provider recommendation of pumps and patient acceptance. Also, reimbursement for telehealth diabetes management, including remote insulin pump monitoring, has expanded. Such changes eliminate financial obstacles and drive market expansion.

- Increased Spending on Healthcare: Diabetes is a globally prevalent disease, and healthcare spending on diabetes treatment is estimated to reach approximately $966 billion in 2021, with expenditures increasing continuously with the expectation of larger disease burden. Both public and private sectors are directing funds into diabetes care development in order to reduce long-term complications and prevent unnecessary hospitalizations. Greater investment aids the creation and implementation of sophisticated insulin pump systems. Countries like China, India, and Brazil are adding diabetes management devices into their national health programs demonstrating an increase in spending. These spending subsidize the costs and improve the healthcare infrastructure which drives wider adoption of insulin pumps.

- Advancements in Technology in AI and Machine Learning: The adoption of an artificial intelligence (AI) framework alongside pumping mechanization technologies enables pumps to operate on a fully automated basis. AI algorithms enhance the effectiveness of controlling blood sugar levels, as well as mitigate the likelihood of hypoglycemic episodes. Medical AI technologies and devices are receiving approvals from authorities since their health and wellness implications are likely to be beneficial. Significant investments are being made in the integration of AI technology as healthcare companies collaborate with technology firms to improve algorithm accuracy and device interfaces. The use of AI also enables predictive analytics for diabetes management. Regulatory policies are being developed around AI safety, transparency, and medical devices.

Market Restraints

- High Device Costs: Insulin pumps remain expensive, with initial device costs averaging $6,500 in the U.S., and annual consumables adding another $2,000 to $3,000. Such high expenditures pose access barriers especially in low- and middle-income countries. Many patients are still facing affordability issues due to reimbursement gaps and out-of-pocket costs, exacerbated by a lack of insurance support. In addition, the device upgrade and maintenance cycle compounds the financial devices over time which is burdensome in the long term. Regions with limited healthcare funding face greater economic disparities, hindering the adoption of these devices. In turn, these financial barriers slow growth in the market and highlight the need for alternatives with lower-cost.

- Limited Insurance Coverage: There are still gaps within the policy framework for insuring the use of insulin pumps, which remains unaddressed. Many patients are discouraged from seeking pump therapy due to lack of coverage and appeal rejections by providers. Primary insurers often cover these services only for priority patients, disregarding other patients suffering from the same condition. There is a clear need for legislative action to provide access to treatments for all patients, irrespective of public or private-funded healthcare systems. Restorative legislative action is needed for patients who are not offered coverage deemed essential.

- Device Errors and User Errors: Although the use of pumps for administering insulin is an important technological advancement, there are still some occasional device malfunctions or programming errors that pose a risk to the safety of the patient. Mistakes made by the user, including insertion, management, and removal, can also lead to negative events. These risks continue to motivate safety communications and recalls by regulatory bodies. While focused education and training sessions help, they are not universally practiced. Moreover, robust post-market surveillance coupled with better design requirements needs to be implemented to increase the safety and reliability of the devices. All the factors aforementioned may discourage users and healthcare practitioners alike.

Market Opportunities

- Expansion in Emerging Markets: In India, China, and Latin America, the adoption of urban lifestyles is markedly increasing the prevalence of diabetes. Insulin pump manufacturers have considerable expansion potential in these regions. A country’s infrastructure, including government healthcare systems and reimbursement programs are strengthening diabetes management. Greater education within the field, coupled with subsidized spending, is increasing market penetration. Locally based partnership contracts, market-specific launches featuring cost-effective designs, and tailored advertising also aid within the region. Adoption of advanced diabetes solutions is becoming more accessible because of improved healthcare availability and a rising middle class in the region.

- Advancement in Developing Low-Cost Devices: Focus is shifting to low-end insulin pumps targeted towards poorer, neglected areas. The limitations created by 3D printing and other simplified device designs, along with stringent production rules, lower the cost of manufacturing devices and provide more economical overall production costs. Subsidized device programs are made possible through collaborations between NGOs, governments, and device manufacturers. Regulatory bodies are easing barriers to low-cost devices by fast-tracking their reviews. The successful introduction of low-cost pumps in India illustrates the potential for expansion. This initiative is in line with global health priorities aimed at reducing the complications of diabetes through improved access to care.

- Incorporation of Telehealth Services: The surge in telehealth services during the pandemic signals enhanced opportunities for diabetes care, such as remote supervision of insulin pumps. The telemedicine policies offer reimbursement systems and other complementary regulations that support remote virtual consults, thereby aiding patients with specialized care access. Telehealth and insulin pump companies are developing real-time data transfer systems which will allow for proactive healthcare. With these systems, patients experience improved adherence and satisfaction, while clinics incur reduced visit volumes and the costs associated with those visits. Legal frameworks concerning telehealth data security and privacy have been shifting positively. This partnership expands the availability of healthcare while simultaneously streamlining the quality of care provided.

Market Challenges

- Cybersecurity Risks: The rising adoption of smartphones, as well as cloud technologies, for connecting to and controlling insulin pumps, opens doors to numerous hacking and data breach opportunities. These threats compromise patient safety, privacy, and trust. Agencies such as the FDA and the European Medicines Agency have published recommendations requiring significant investments into cybersecurity for medical devices. Preventive measures for blocking attacks include encryption, secure logins, frequent updates to software, and prevention of breaches. Responding to the Manufacturer and Collaborator’s cybersecurity device requirements calls for continuous and dynamic engagement with cybersecurity specialists. Protecting the trust and assurance of the patients relies on device security.

- Regulatory Challenges: The cross-border scope of the medical devices regulation framework creates an obstacle for entry into the new insulin pumps market. Adherence to these criteria is problematic in terms of generating the clinical evidence file and a complete dossier. The constantly changing legislation on artificial intelligence and digital health technologies adds to the already intensive focus of the law. Lengthy timeframes inflate the costs of devices and obscure their availability to patients, however, there is growing acceptance of faster pathways for innovative breakthrough devices. Innovation is appreciated as long as safety, compliance with regulations, and international considerations are integrated.

Insulin Pump Market Segmental Analysis

Type Analysis

Tethered Pumps: The tethered insulin pumps remain important due to their large reservoir and reliable insulin delivery. We have reported in previous years the FDA’s changes to post-market surveillance for insulin pumps, and screening of materials used for pump tubing and their fittings from a safety and infection control perspective. These are still preferred in some clinical situations where subcutaneous insulin has to be continuously infused. The oversight review of legal frameworks has noted gaps in device governance, oversight concerning adverse event reporting and documentation which would protect the patient's rights. There have been some strides made in the initiatives toward the design of tubeless pumps, however, tethered pumps are still critical to the effective management of diabetes.

Insulin Pump Market Revenue Share, By Type, 2024 (%)

| Type |

Revenue Share, 2024 (%) |

| Tethered Pumps |

64.80% |

| Patch Pumps |

35.20% |

Patch Pumps: The growing interest in patch pumps among the youth has been attributed to their direct skin attachment, making them more easily concealable. The 2023 approval of Omnipod 5 by the FDA has integrated CGM and furthered innovation in patch pumps. There is now a legal allowance for interlinked diabetes devices, which enhances user and safety friendliness. As reported by CDC, patch pump users have increased health and well-being alongside better treatment adherence. Regulators appear to drive with strong ambitions toward the patch pumps.

Product Analysis

MiniMed: Medtronic's MiniMed 780G, which received FDA approval in 2023 for its hybrid closed-loop insulin delivery system, continues to lead the market with best-selling MiniMed pumps. This device enhances glycemic control while simultaneously mitigating risks of hypoglycemia. Medtronic complies with FDA safety and quality regulations, including rigorous adverse event reporting. Medtronic and other corporations ensure compliance in the advancement of diabetes care technologies. This order integrates compliance with other organizational frameworks illustrating interdisciplinary collaboration.

Accu-Chek: In 2024, Roche received FDA clearance for advanced Accu-Chek insulin pumps, which are now equipped with sophisticated CGM systems and include GDRP compliant data management systems for the US market. The company aligns with the strict use of public health programs in Europe and the US. The use of data privacy greatly influences the software design of Accu-Chek. Roche is active in the promotion of educational materials on the safe use of insulin pumps.

Tandem: As of 2023 Tandem Diabetes’s X2 pump, enhanced AI-driven insulin delivery and stringent cybersecurity compliance received FDA clearance. The corporation complies with federal interoperability mandates and post-market surveillance obligations as well. Tandem’s telehealth compliant remote software updates promote both user engagement and regulatory compliance. Regulatory policies enhance safety and facilitate connectivity between devices. Their compliance requirements within the homecare market stimulate creativity and advancement within the sector.

Omnipod: In 2023, Omnipod's patch pump was granted FDA’s designation of Breakthrough Device, which allowed quicker review due to the innovation of a tubeless design. Insulet Corporation complied with HHS regulations on Health and Information Systems Telehealth Care regarding Remote Monitoring. Compliance with the reporting obligations on medical device safety guarantees Insulet ongoing surveillance for safety oversight, which telehealth alignment provides compliance. Its popularity arises from the omnipod’s ease of use in the clinical and homecare settings.

Disease Indication Analysis

Type 1 Diabetes: Individuals diagnosed with Type 1 Diabetes are exclusive users of insulin pumps because of their continuous physiological insulin deficiency. According to the CDC, approximately 1.6 million Americans are suffering from Type 1 Diabetes, a considerable portion of this population benefits from state-sponsored reimbursement programs for pump supplies. Regulatory authorities impose stringent safety regulations for devices used in this population due to their high vulnerability. Pumps designed specifically for Type 1 diabetics and integrated with artificial intelligence have received priority regulatory approvals because of their benefits on glycemic control and reduced hospitalization risks. These legal frameworks improve access to patients while ensuring device safety.

Insulin Pump Market Revenue Share, By Disease Indication, 2024 (%)

| Disease Indication |

Revenue Share, 2024 (%) |

| Type 1 Diabetes |

69.40% |

| Type 2 Diabetes |

30620% |

Type 2 Diabetes: There is an increase in pump use among patients with more advanced stages of Type 2 diabetes requiring more intensive insulin therapy. An estimate by WHO indicates over 422 million people worldwide have diabetes, which is also accepted as a growing diabetes epidemic. With increasing acceptance of pumps for advanced management of Type 2 diabetes, regulators are revising policies to widen the scope of their use. Government policies now promote the use of pumps to minimize complications. Clinical trials that have been submitted for regulatory review since 2023 confirm the safety and effectiveness of pumps in this population.

End Use Analysis

Hospitals & Clinics: In 2024, hospitals and clinics lead the market, owing to their role in the diagnosis and treatment strategy development as well as in-device training supervision for diabetic patients. These multidisciplinary care systems also include an endocrinologist, a diabetes educator, and nursing staff, all of whom guarantee effective patient onboarding and insulin titration. In addition, hospital-grade monitoring systems offer safe insulin therapy management for patients at elevated risk. Improved reimbursement policies and coverage by insurance plans for inpatient pump therapy enhances the adoption of insulin pumps in clinical practice.

Homecare: This segment is fast growing in the market, owing to advancements in the ease of interface, wireless data transfer, and remote monitoring. There is a growing preference among patients, especially those with Type 1 diabetes, to control their insulin management from the comfort of their home which offers autonomy and minimizes hospital visits. Real-time glucose monitoring and pump adjustments facilitated by telehealth, mobile and computer apps, and virtual consultations make homecare an efficient and economical option for chronic disease management needing limited clinical supervision.

Laboratories: Clinics and diagnostic laboratories perform a distinctive but critical role concerning insulin pumps. Their roles encompass clinical trials and research and development activities. They also assist in the verification and validation processes pertaining to the device's performance. Through safety and efficacy testing and usability evaluation, they provide assistive evaluation technology in controlled environments. Additionally, diagnostic laboratories assist in analyzing glycemic trends and identifying biomarkers for pump algorithm optimization to inform insulin delivery systems. Even though clinics and diagnostic laboratories are not direct points of care, their work helps ensure that insulin pumps are safe from clinical risk, technological failure, and regulatory non-compliance as well as pre-emptively tested for all risks before the devices reach the hospitals or homecare.

Insulin Pump Market Regional Analysis

The insulin pump market is segmented into several key regions: North America, Europe, Asia-Pacific, and LAMEA (Latin America, Middle East, and Africa). Here’s an in-depth look at each region.

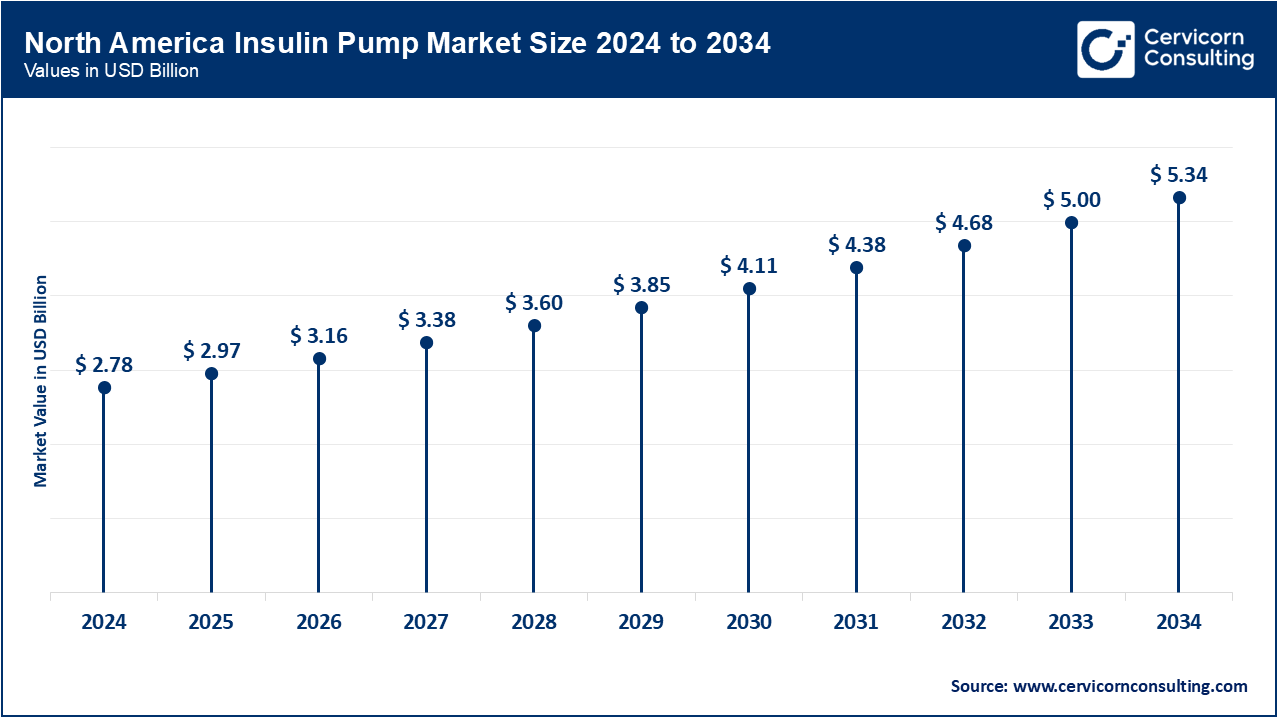

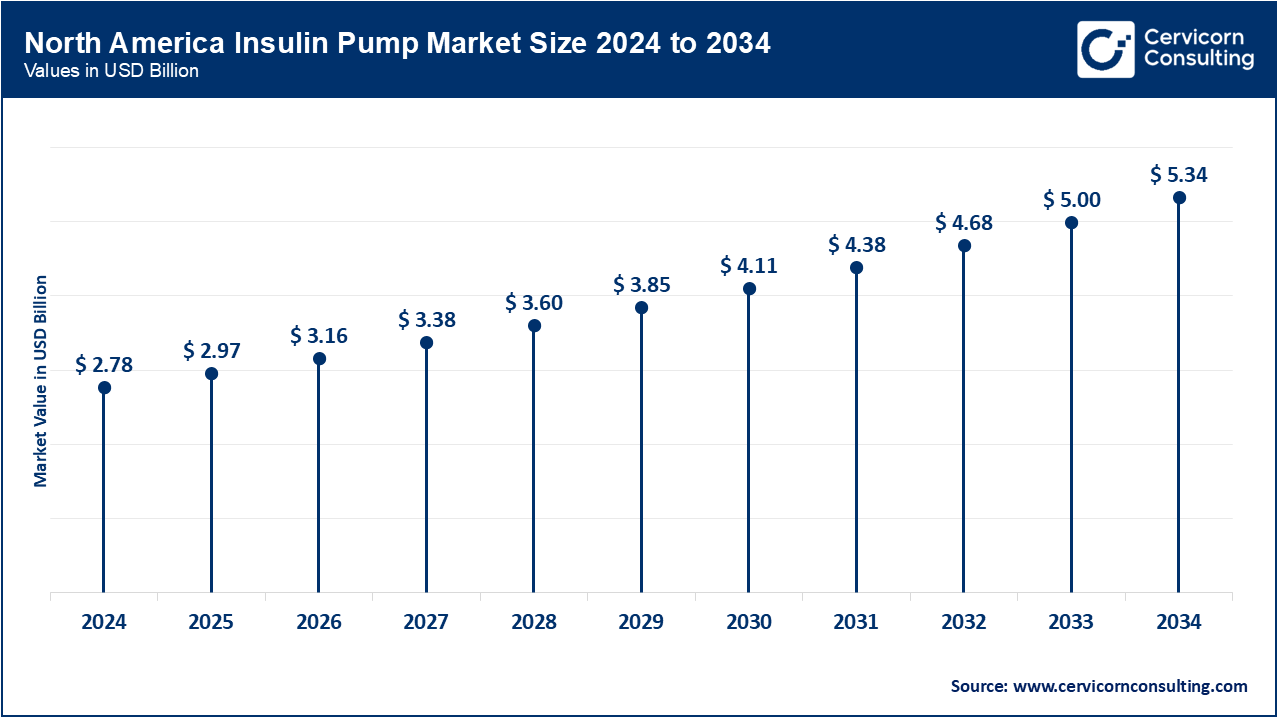

Why is North America leading the insulin pump market?

- North America Market Size in 2024: USD 2.78 Billion

- North America Market Size in 2034 (Projected): USD 5.34 Billion

The insulin pump sector within North America is spearheaded by the US, Canada, and Mexico. It is under strict control of the FDA and Health Canada which guarantees safety and innovation of the devices. The US FDA’s 2023 pumps interoperability and cybersecurity guidance boosts the reception of new devices with AI features. Canada’s Health Canada has strengthened post-market surveillance protocols thus increasing patient safety. Mexico is expanding access with government healthcare programs on diabetes management and the recently passed law liberalizing the approval of medical devices. The region benefits from Medicare and Medicaid strong reimbursement policies which encourage the use of homecare insulin pumps. Cross-border regulatory harmonization efforts focus on the reduction of approval processes which would increase innovation.

Europe Insulin Pump Market Trends

- Europe Market Size in 2024: USD 1.04 Billion

- Europe Market Size in 2034 (Projected): USD 2 Billion

The insulin pump industry in Europe encompasses the UK, Germany, and France, all of whom fall under the EMA as well as GDPR data protection legislation which impacts the device's functionality. UK's MHRA amends the regulatory scope for device approvals in 2024 to accelerate innovation in diabetes care, including CGM-integrated pumps. Germany requires strict safety and clinical evaluation compliance with the EU MDR for France’s Promoting diabetes care initiatives with enhanced reimbursement for pump therapies is france’s latest. The safety surveillance of devices still remains a focus of the EMA across member states. The legal aspects supporting telemedicine have eased pump adoption in remote regions. The focus of collaboration among European agencies centers on the need for coherent and integrative safety policies that foster innovation while maintaining the safety and security of the patient.

What factors are contributing fastest growth os Asia-Pacific region in the insulin pump market?

- Asia-Pacific Market Size in 2024: USD 1.64 Billion

- Asia-Pacific Market Size in 2034 (Projected): USD 3.15 Billion

The region is made up of China, India, Japan, Australia and South Korea, which are becoming quick adopters of insulin pumps under new policies. China’s NMPA streamlined the approval processes in 2023 for devices with multi-interface connectivity and interoperability. The CDSCO of India expanded access to the market by adopting regulatory policies for reimbursable diabetes control devices in 2024. In Japan, the PMDA grants comprehensive fast-track approvals and performs post-marketing evaluation for sophisticated pump systems, whereas Australia’s TGA has recently enhanced safety through stricter quality regulations on medical devices. South Korea adheres to KFDA regulations which align with other countries' best practices. Government telehealth and health promotion initiatives facilitate the growing use of insulin pumps in hospitals and homecare services.

LAMEA Insulin Pump Market Trends

- North America Market Size in 2024: USD 0.42 Billion

- North America Market Size in 2034 (Projected): USD 0.80 Billion

Latin America and the Middle East & Africa (MEA) are improving the adoption of insulin pumps with new regulatory changes and investments in healthcare. In Brazil, ANVISA revised device regulations to enhance safegaurds whilst increase in government reimbursement for diabetes technology. Telemedicine for remote patient monitoring is also expanding in adjacent countries. In MEA, the UAE revised medical device regulations in 2024, Saudi SFDA strengthened post-market surveillance in 2023, and SAHPRA is globally aligning approval processes with South African legislation. Both regions focus on telehealth expansion and governmental strategies for diabetes care, fostered by supranational regulatory partnerships to strengthen patient safety and innovation.

Insulin Pump Market Top Companies

Recent Developments

Recent partnerships in the insulin pump industry underscore innovation in diabetes care and integration of connected health technologies. Tandem Diabetes Care partnered with Dexcom to integrate the Dexcom G7 continuous glucose monitor with its X2 insulin pump, enhancing real-time glucose control. Medtronic collaborates with the Mayo Clinic to advance closed-loop insulin delivery research and AI-based diabetes management. Insulet Corporation joined forces with Abbott to integrate the Omnipod insulin delivery system with Abbott’s FreeStyle Libre sensor, aiming for a seamless user experience. Roche partnered with Senseonics to explore implantable glucose monitoring and data-sharing ecosystems. These alliances aim to improve interoperability, user convenience, and personalized insulin therapy. Collectively, they push the market toward smarter, more connected, and user-centric diabetes solutions.

- In April 2025, Medtronic has advanced its partnership with Abbott by submitting an interoperable insulin pump to the FDA, aiming to integrate seamlessly with Abbott’s continuous glucose monitoring (CGM) technology. This submission marks a significant step toward offering people with diabetes more flexible and personalized treatment options. The interoperable system is designed to improve glucose control and simplify diabetes management. If approved, it will allow patients to choose compatible devices that best fit their needs. The collaboration reflects both companies’ commitment to innovation and patient-centric care. This move could set a new standard in diabetes technology by enabling greater device connectivity and choice.

- In August 2024, Glytec has expanded its global collaboration with Roche to transform hospital diabetes management by integrating Glytec’s Glucommander insulin dosing software with Roche’s cobas® pulse smart blood glucose system. This partnership aims to improve inpatient diabetes care through advanced analytics and decision support, helping healthcare providers optimize glycemic management and patient outcomes. The collaboration addresses new regulatory requirements, such as CMS mandates for reporting severe hypoglycemia and hyperglycemia. By combining Roche’s global reach with Glytec’s trusted software, the initiative seeks to boost patient safety and cost-effectiveness worldwide. Glytec’s platform is already used in over 350 hospitals, streamlining workflows and delivering strong ROI. The partnership highlights both companies’ commitment to tackling critical healthcare challenges. Ultimately, it aims to advance global standards in diabetes care.

Market Segmentation

By Type

- Tethered Pumps

- Patch Pumps

By Product

- MiniMed

- Accu-Chek

- Tandem

- Omnipod

- Others

By Disease Indication

- Type 1 Diabetes

- Type 2 Diabetes

By Accessories

- Insulin reservoir or cartridges

- Insulin set insertion devices

- Battery

By End Use

- Hospitals & clinics

- Homecare

- Laboratories

By Region

- North America

- APAC

- Europe

- LAMEA