Home Medical Equipment Market Size and Growth 2026 to 2035

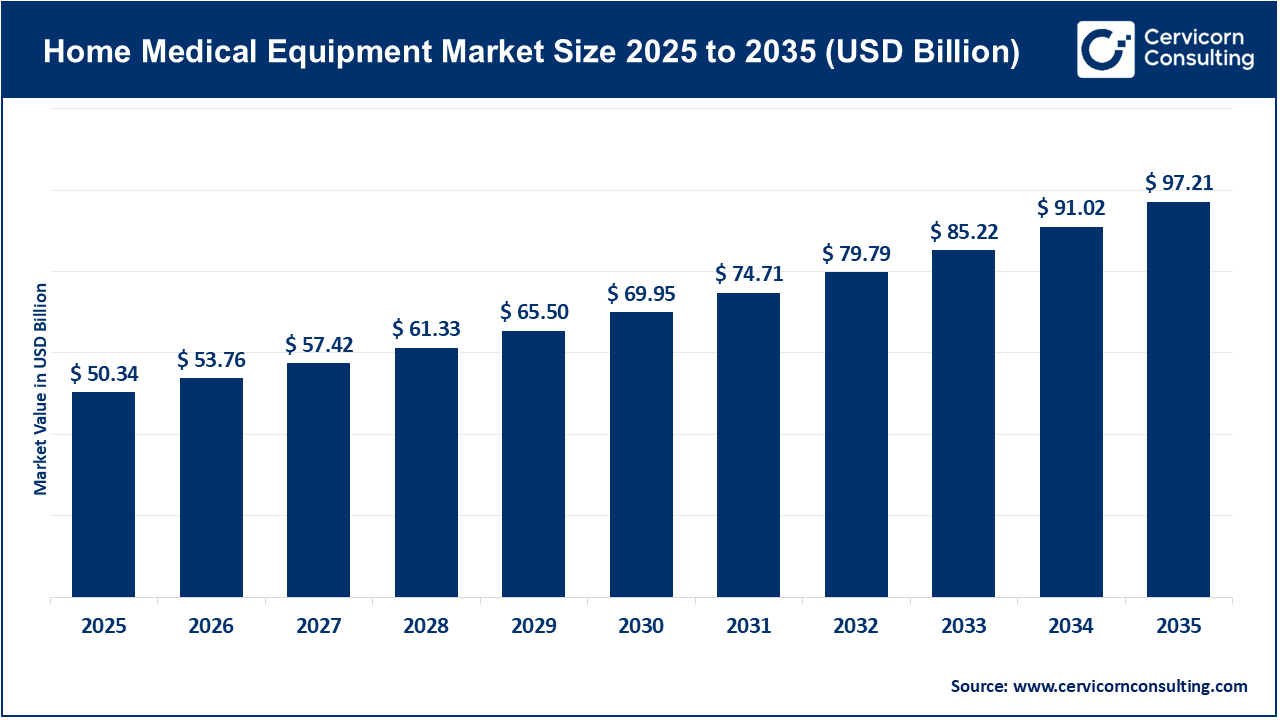

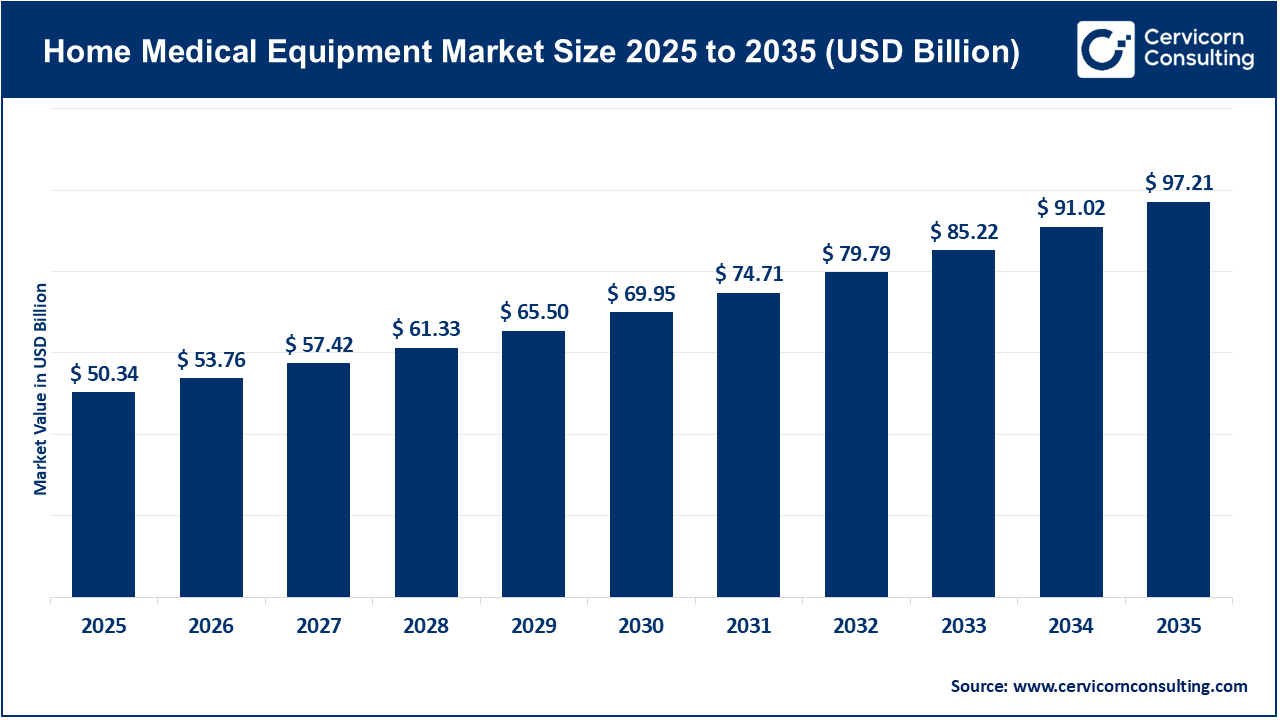

The global home medical equipment market size reached at USD 50.34 billion in 2025 and is expected to be worth around USD 97.21 billion by 2035, exhibiting at a compound annual growth rate (CAGR) of 6.8% over the forecast period 2026 to 2035. The home medical equipment market is growing steadily, driven by chronic diseases, aging populations, and the shift toward home-based healthcare. The home medical equipment market is establishing growth as individuals are increasingly seeking to receive healthcare services outside of a medical facility, in a home environment. The increasing incidence of chronic diseases, such as diabetes, respiratory disorders, and cardiovascular conditions, has led to an increase in the number of home monitoring and therapy devices. The increasing elderly population across the globe will also drive growth, as older patients prefer home medical care, because it is convenient, typically lower cost, and non-hospital care. New technology devices, such as portable oxygen concentrators, smart technology, monitoring systems, and user-friendly means of mobility assist patients in living at home and managing their care individually.

Furthermore, the home medical equipment market is being informed by the trend of increasing awareness of home medical care, supported by governmental initiatives advocating for home-based treatments. The production and increasing accessibility of the devices can improve availability and is now widely through both retail and online capabilities. The social acceptance, cost-effectiveness, and the fact that home care is not usually hospital-based are additional contributing factors to the increased use of home medical equipment. Usage of remote monitoring and telehealth practices, which allow doctors to monitor their patients from afar, support the use of home medical equipment. Overall, these factors contribute to a steady increase in the market for home medical equipment on a global level.

Report Highlights

- By Region, North America (38.4%): Dominates the market due to strong healthcare infrastructure and high chronic disease burden.

- By Region, Asia-Pacific (22.0%): Fastest-growing region supported by expanding healthcare access and rising middle-class income.

- By Product, Therapeutic Equipment (46.3%): Largest share, includes respiratory, dialysis, and infusion devices widely used for chronic conditions.

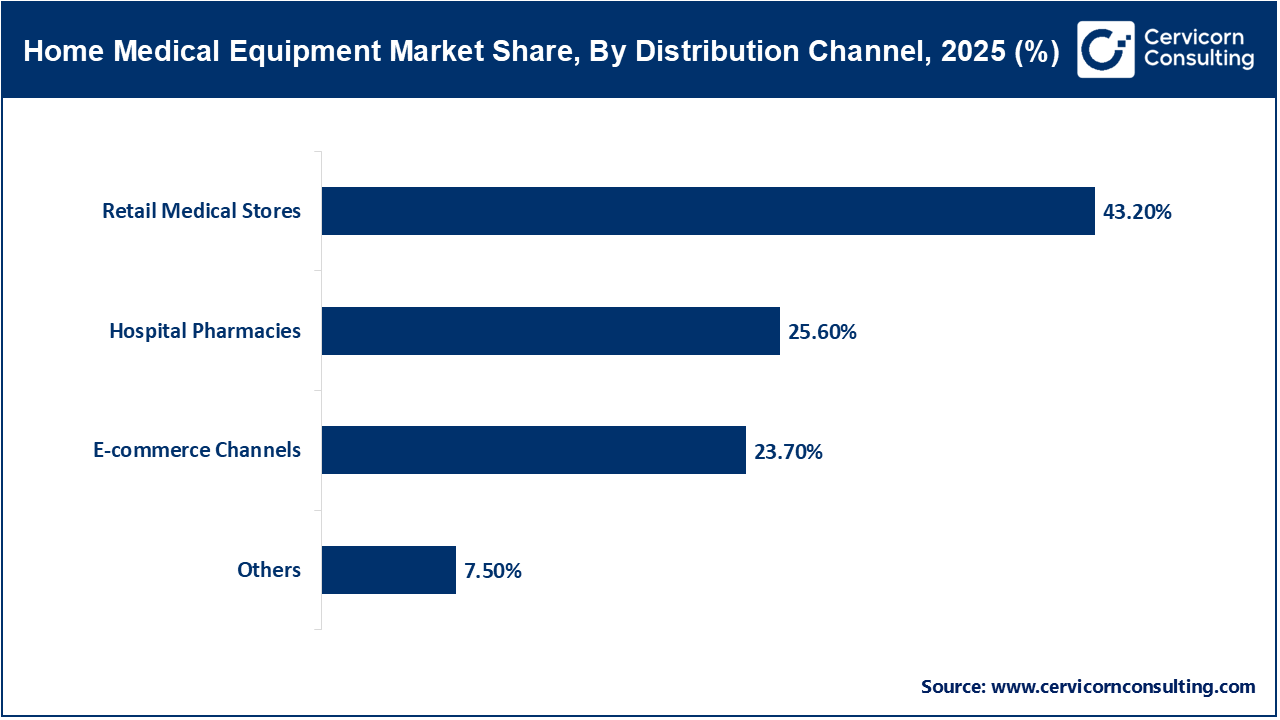

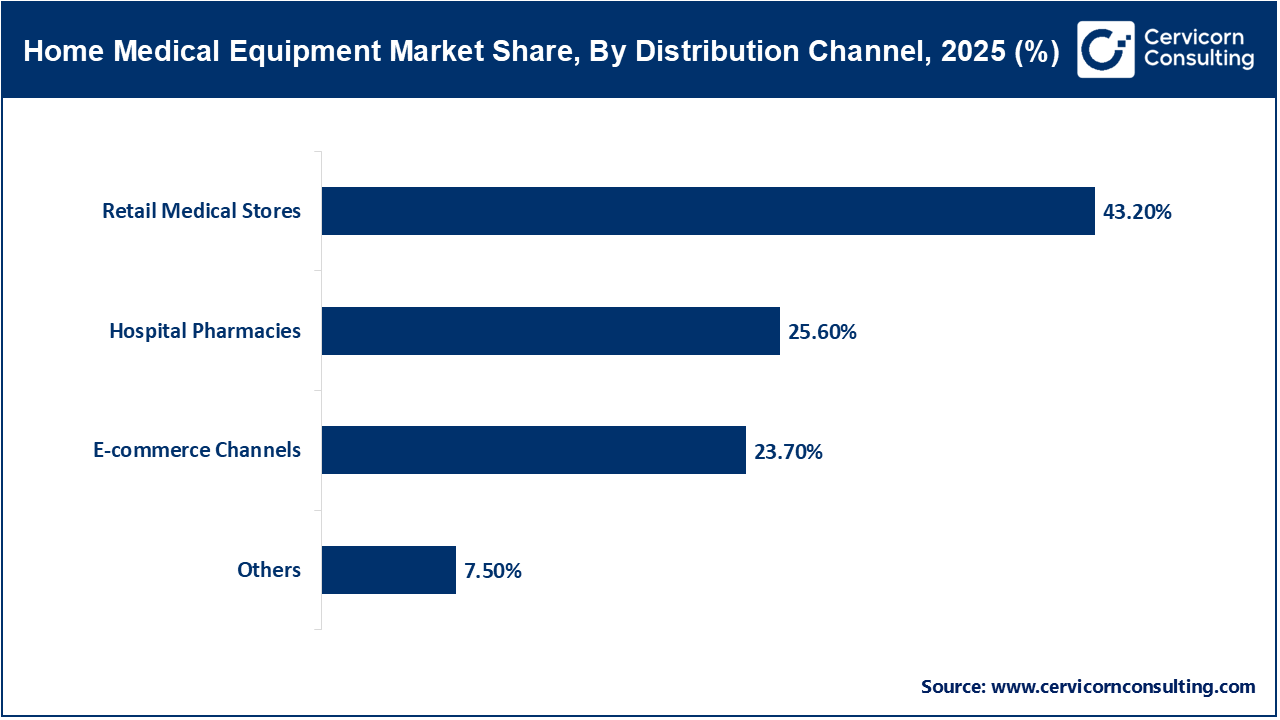

- By Distribution Channel, Retail Medical Stores (43.2%): Remains the leading channel due to convenience and immediate availability.

What is Home Medical Equipment?

Home medical equipment includes all the numerous types of medical equipment and supplies that are intended for use in the home for purposes of receiving healthcare, support recovery and the management of ongoing medical needs. Home medical equipment allows patients to effectively manage their chronic, acute, or post-acute needs at home, therefore encouraging mobility, monitoring vital signs, or providing therapeutic treatment to keep them home and avoid the need for frequent visits to the emergency room or clinic. Home medical equipment aids in improving comfort, independence, and overall quality of life of patients receiving episodic or long-term medical care at home.

Types of Home Medical Equipment:

- Therapeutic equipment: CPAP machines, oxygen concentrators, nebulizers, ventilators, and dialysis machines.

- Patient monitoring equipment: blood pressure monitors, glucose meters, heart rate monitors, and apnea monitors.

- Mobility assist and patient support equipment: wheelchairs, walkers, canes, crutches, and mobility scooters.

- Home safety equipment: bathroom safety aids, bed rails, and fall-prevention tools.

- Medical furniture and accessories: hospital beds, over-bed tables, and adjustable chairs.

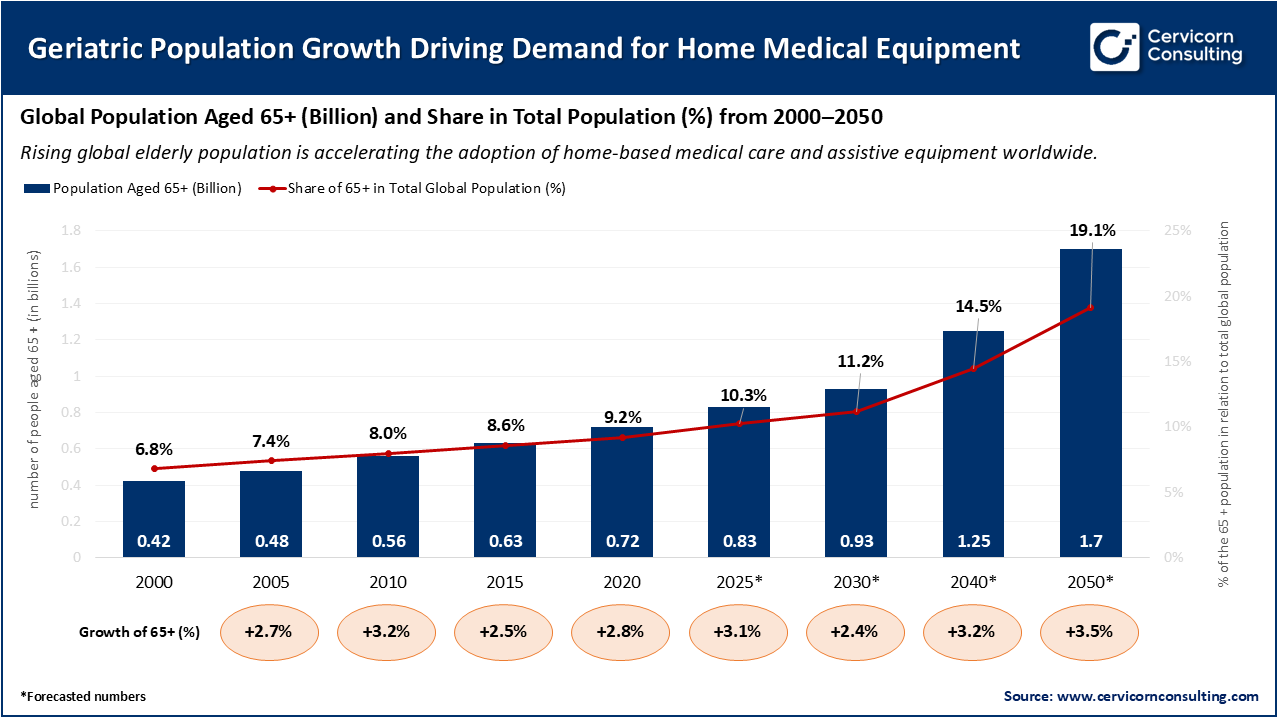

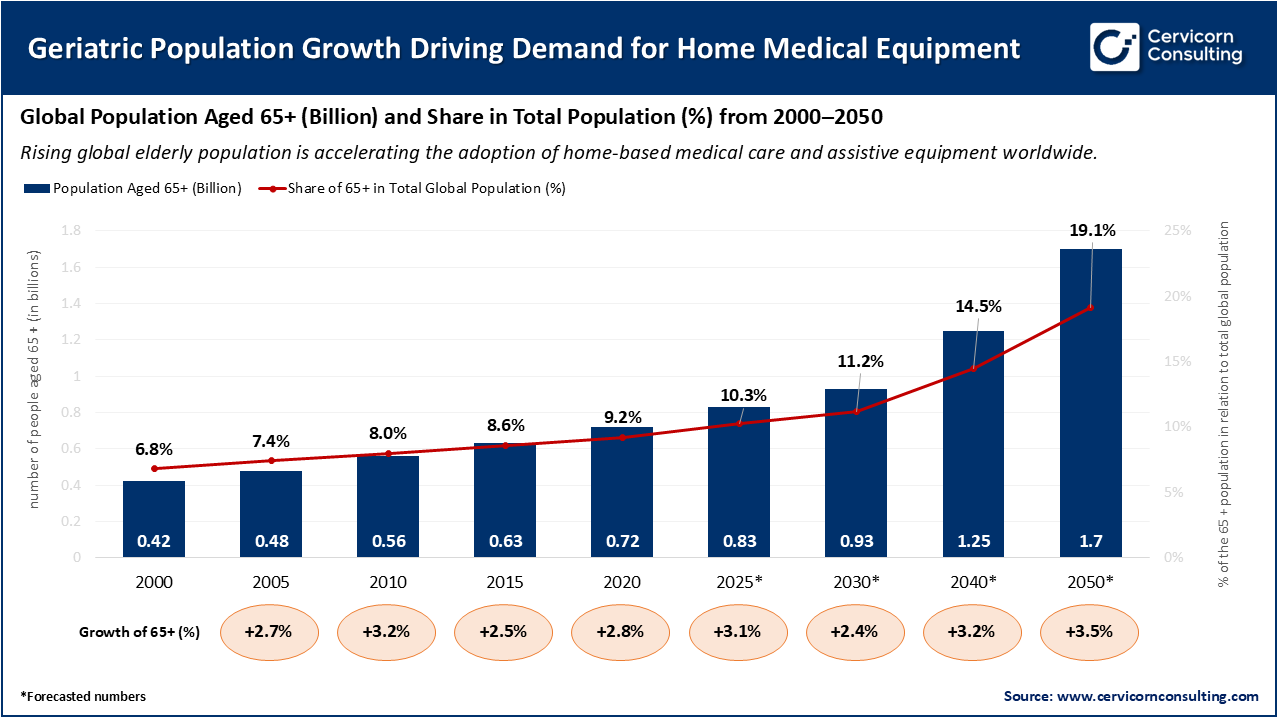

Growing Geriatric Population Boosting Demand for Home Medical Equipment

The rise in the elderly population will cause significant growth in the home medical equipment market since older adults are likelier to experience chronic diseases that require ongoing monitoring and care relative to younger adults. Chronic diseases that are commonly observed in older adults include diabetes, respiratory conditions, arthritis, and cardiovascular disease. Many older adults are interested in receiving treatments in their homes rather in the hospital. This has resulted in an increase for home medical devices to aide them. This is especially true for mobility aids, oxygen therapy products, and home monitoring systems which can support seniors in their independence in the home and improve their quality of life. This influx of in-home care in lieu of hospital care identifies older adults as an impetuous for the developing home medical equipment market.

The chart provides a clear representation of the rise experienced in the global elderly population (aged 65 and older) from 2000 to a potential 2050 snapshot, expressed in terms of total numbers and global population percentage. The population of individuals aged 65 and older is expected to increase from approximately 0.42 billion in 2000 to 1.7 billion in 2050, while the proportion in the total global population will increase from around 6.8 % to almost 20%. Moreover, the year-over-year percentage growth rates will remain steady, ranging from a low of +2.4% to +3.5% annually, representing significant demographic trends associated with the movement toward societies that are aging globally. As this population continues to grow, the prevalence of age-related chronic conditions, mobility impairment, and long-term care needs will dramatically increase. Hence, the demand for home medical devices, such as respiratory assist devices, patient monitoring devices, and mobility assist devices also continues to increase as older adults expressed a high preference for in – home care delivery that is more efficient, less expensive, and comfortable, compared to institutional service delivery.

Impact of Recent Tariff Policies

- The United States has enacted higher import tariffs on medical devices and components, which includes a base tariff rate of approximately 10% as well as existing country-specific tariffs on certain medical technology imports from China of as high as ~54%.

- Higher tariffs result in increased production costs for manufacturers in the home medical equipment sector, owing to the fact that manufacturing often times involves global supply chains and imported components.

- The tariff structure can result in interruptions to supply chains as well as delays in the availability of equipment that is intended for home use (e.g., respiratory, mobility and monitoring equipment) due to delays in obtaining components and loss of approvals following the re-qualification process.

- For exporters of home medical equipment (e.g., Indian and European) the tariff landscape has diminished competitiveness in large markets (e.g., U.S.) while impacting margins for growth.

- Tariff pressure may result in incremental costs to end-users or patients of home medical equipment, which could limit adoption of rental home medical equipment, especially in price-sensitive markets.

- Some emerging mitigation strategies include manufacturers diversifying supply chains, continuing to explore domestic manufacturers, and sourcing from non-tariff countries, which may usher in structural changes to the home medical equipment market.

Market Trends

FDA’s “Home as a Healthcare Hub” Initiative (2024)

- In 2024, the Center for Devices and Radiological Health (CDRH) with the United States Food and Drug Administration (FDA) created the "Home as a Healthcare Hub" initiative which marked a significant leap forward in promoting innovation around home-use devices. This was a major and historical declaration recognizing the home as an appropriate setting for healthcare and encouraging device manufacturers to focus on producing devices that are safer, more usable, and effective for patients receiving care outside the healthcare setting. It was anticipated that enabling these changes with less regulatory burden would stimulate partnerships and collaboration among regulators, practitioners, and device manufacturers to accelerate growth in the home medical equipment sector and enable patients to receive high-quality care in the home setting.

Owens & Minor’s Acquisition of Rotech Healthcare (2024)

- Owens & Minor's acquisition of Rotech Healthcare in July 2024 signifies a significant merger within the home medical equipment industry. Rotech Healthcare is well known for its home-use respiratory equipment such as CPAP, and ventilators, and this acquisition greatly extended the capacity of Owens & Minor. It furthers not only the efficiency of the supply chain, but also product access, and affordability for those needing home-based care. This acquisition points to a bona-fide trend of investing substantial dollars by leading healthcare systems into the home medical equipment industry which promotes innovation, and access to healthcare on a global scale.

Rise of Smart and Connected Home Medical Devices

- The entry of IoT-enabled and smart medical devices is quickly transforming the home medical equipment market. Connected devices such as glucose monitors, smart oxygen concentrators, and remote cardiac trackers allow patients to send data to their providers on a real-time basis. On-site data improves patient monitoring, treatment accuracy and preventative care. As patients and caregivers continue to seek convenience in care and ongoing oversight, the options for smart technology are incentivizing market growth and motivating manufacturers to develop more complex, user-friendly and enhanced medical devices for home use.

Expansion of Telemedicine and Remote Care Models

- The international emergence of telemedicine and remote care services have vastly accelerated demand for medical equipment to be used in the home. As healthcare organizations move toward virtual appointments and integrated remote monitoring, patients need reliable equipment at home to monitor vital signs or to manage an existing chronic condition. This development allows patients to receive continuous care and monitoring between hospital visits, thus reducing adverse outcomes and lowering overall costs of care. As a result, the demand for telehealth and remote care are a significant driver in the home medical equipment market.

Report Scope

| Area of Focus |

Details |

| Market Size in 2026 |

USD 53.76 Billion |

| Expected Market Size in 2035 |

USD 97.21 Billion |

| Estimated CAGR 2026 to 2035 |

6.8% |

| Prime Region |

North America |

| High-growth Region |

Asia-Pacific |

| Key Segments |

Product, Distribution Channel, Region |

| Key Companies |

Abbott Laboratories, 3B Medical, Inc., Becton Dickinson (BD), Drive DeVilbiss Healthcare, Boston Scientific Corporation, Teva Pharmaceutical Industries Ltd., Fisher & Paykel Healthcare, Hill-Rom Holdings, Inc., GE Healthcare, Smiths Medical, Invacare Corporation, Philips Healthcare, Medline Industries, Inc., ResMed Inc., Stanley Healthcare/Stanley Black & Decker |

Market Dynamics

Market Drivers

Increasing Prevalence of Chronic Diseases

- The rising prevalence of chronic diseases, including diabetes, asthma, sleep apnoea, and cardiovascular diseases, is driving growth of the home medical equipment market. Chronic diseases typically require ongoing monitoring and long-term management, which is increasingly being done by patients in their own homes. Glucose monitors and insulin delivery devices, oxygen concentrators, and blood pressure monitors allow for improved and ongoing management of one's health, without the need to see a physician in person. The rising need for at-home chronic disease management worldwide subsequently stimulates demand and market growth for home medical equipment globally.

Aging Population and Preference for Home Care

- The demographics of an increasing aging population is yet another substantial contributor to growth in the market. Older adults tend to have mobility challenges and comorbidities, so home care is more feasible and comfortable. As recent family and healthcare systems attempt to cut costs and limit hospitalization, home care is becoming the preferential modality and is a required trajectory within health. This demographic phenomenon is a support for growing the home medical equipment market.

Market Restraints

High Equipment Costs and Limited Reimbursement Policies

- One of the prominent restraints on market growth is the high upfront cost of advanced home medical equipment (e.g., ventilators, portable dialysis machines). Several patients in developing regions cannot afford these devices, and insurance reimbursement for home healthcare products can sometimes be limited and or difficult to navigate. The financial barrier of purchasing this equipment limits its overall penetration rate, particularly in low- and middle-income countries, which has contributed to the slower growth of the home medical equipment market.

Technical and Maintenance Challenges

- Home medical devices commonly need regular maintenance, service, calibration, and technical assistance in order to operate reliably and safely. Generally, most patients and caregivers do not have the technical understanding to safely use the various types of home medical devices. This will generally lead to misuse of the device or malfunction of the device when no one can service the device. In some regions, after-sale support is not available further compromising the reliability of the device. Together, these operational issues all contribute to losing consumer confidence and slowed overall growth in the home medical device market.

Market Opportunities

Integration of Smart Technology and IoT

- The integration of intelligent sensing, cloud connectivity, and artificial intelligence presents a distinct opportunity for innovation within the home medical devices market. Smart home medical device technology creates the potential of interactive tracking and communication of patient data in real time between patients and healthcare professionals, thus fostering timely and equitable treatments that improve accuracy and preventative care. This technological transformation is generating not only new business opportunities for manufacturers, but is also increasing effective and efficient use of remote healthcare.

Expansion in Emerging Economies

- The Asia-Pacific, Latin America, and Middle East regions have high growth potential. The drivers of growing demand for home healthcare products in these markets are awareness of healthcare, improved infrastructure, and government policies providing support for home healthcare. Better affordability and access will allow manufacturers to expand their footprint and build distribution networks. In addition, increases in adoption in developing countries will support overall growth in the global home medical equipment market over the next several years.

Market Challenges

Regulatory and Compliance Barriers

- Stringent regulatory requirements for product safety, quality, and approval, create delays to the introduction of new home medical devices. Manufacturers must contend with intricate certification processes that differ around the world this affects time-to-market and compliance costs, and especially proves challenging for smaller companies to be active participants. This situation is a significant challenge for the home medical equipment sector.

Data Privacy and Security Concerns

- As connected and smart home medical devices continue to become more prevalent, the data security is a growing concern. Many devices are capable of collecting and transmitting patient information which is a target for cyberattacks or a data breach. Achieving compliance with patient's privacy rules like HIPAA and GDPR requires a comprehensive set of cybersecurity protection measures that can be very expensive. These concerns must be addressed to have public trust and to promote adoption of the home medical equipment industry.

Regional Analysis

The home medical equipment market is segmented into various regions, including North America, Europe, Asia-Pacific, and LAMEA. Here is a brief overview of each region:

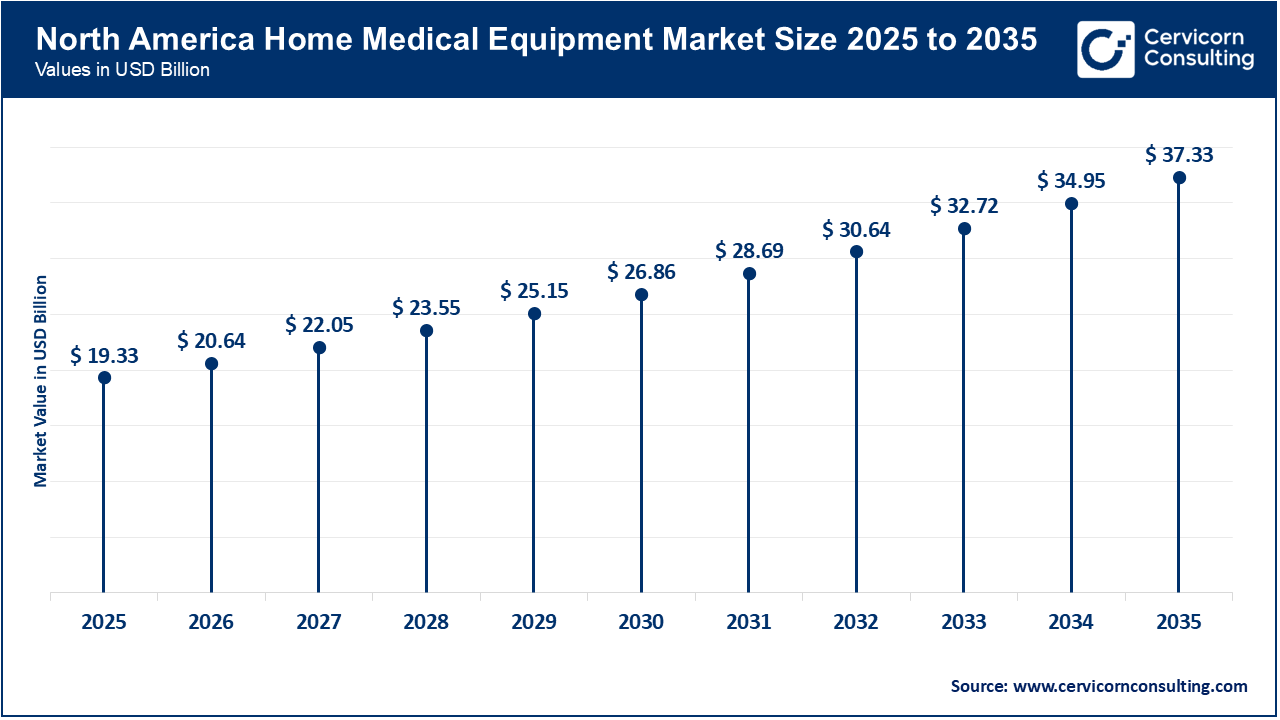

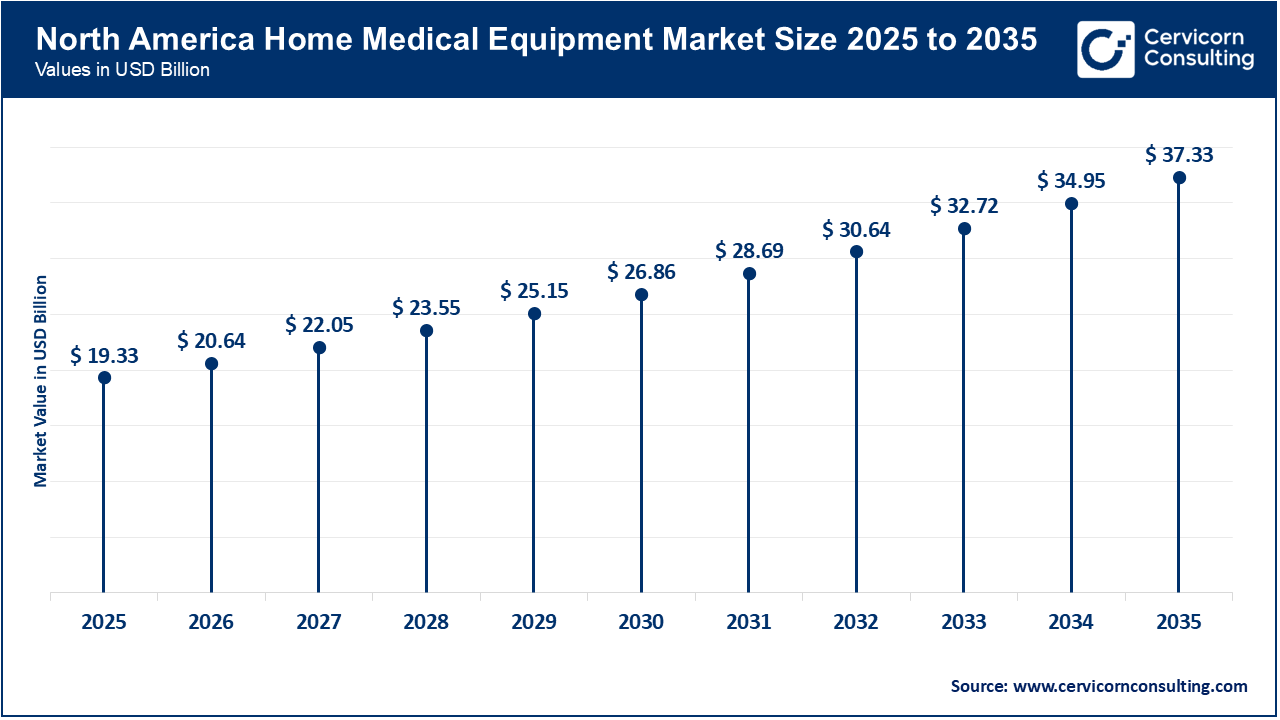

North America Home Medical Equipment Market: Strong Infrastructure & Aging Population Fuel Demand

The North America home medical equipment market stood at USD 19.33 billion in 2025 and is forecast to rise to approximately USD 37.33 billion by 2035. In North America is supported by its mature healthcare infrastructure, wide-ranging reimbursement regimes, and a rapidly increasing elderly population that prefers care at home. The high prevalence of chronic disease combined with conducive payer settings makes home-use devices (mobility aids, respiratory, monitoring devices, etc.) more prevalent and acceptable. The region benefits from a developed regulatory landscape and a strong uptake of telehealth and remote-monitoring solutions, which supports demand.

Recent Developments:

- Owens & Minor's acquisition of Rotech Healthcare, for USD 1.36 billion, in order to build home-oxygen and CPAP device distribution in the U.S.

- The U.S. Food & Drug Administration´s (FDA) announcement about framing the home as a ‘healthcare hub’, as a way of reinforcing the role of home-use medical equipment.

Asia-Pacific (APAC) Home Medical Equipment Market: Rapid Healthcare Expansion & Rising Middle-Class Drive Fastest Growth

The Asia-Pacific home medical equipment market reached USD 12.64 billion in 2025 and is anticipated to almost double, hitting about USD 24.40 billion by 2035. The Asia-Pacific region is poised to be the fastest-growing market, driven by rapid urbanization, increases in disposable incomes, growing awareness of home healthcare options, and a relatively massive population of underserved patients. The incidence of chronic diseases and an expanding elder population necessitate home care options, particularly in countries like India and China driving the regional growth. The scarcity of professional home-care alternatives in many regions will also contribute to the spread of home-based equipment.

Recent Developments:

- Increasing investment in home-care infrastructure in India and China, combined with some incentives for local medical-device manufacturing to provide domestic equipment production.

- The Hong Kong International Medical & Healthcare Fair 2025 featured elder care technologies, an exhibit of home-health technologies, and a general interest in regional development and innovation in home medical equipment.

Europe Home Medical Equipment Market: Elderly Population & Cost Pressure Encourage Market

The Europe home medical equipment market size reached at USD 13.94 billion in 2025 and is projected to reach approximately USD 26.93 billion by 2035. Europe is driven by an aging population, an elevated incidence of chronic disease, and mounting pressure on health systems to cut down on inpatient costs. As hospitalization becomes increasingly expensive and less desirable, there is a demonstrable shift of care to the home medical environment that in turn, raises demand for monitoring and assistive devices and home-therapy systems. Furthermore, as noted, the European market remains a tight regulatory environment that fosters innovation, although it can be a bit slower to launch devices into the market than some other faster growing regions.

Recent Developments:

- European Commission has been banning most Chinese companies from bidding for most public-tender medical-device contracts above EUR 5 million, which represents an increasing level of protectionism for sourcing medical devices from China and it may affect supply chains as well.

- Medical device makers in Europe such as Siemens Healthineers have revealed a stronger revenue pickup in the United States while orders from China slowed, demonstrating regional demand shifts and supply-chain considerations.

Home Medical Equipment Market Share, By Region, 2025 (%)

| Region |

Revenue Share, 2025 (%) |

| North America |

38.40% |

| Europe |

27.70% |

| Asia-Pacific |

25.10% |

| LAMEA |

8.80% |

LAMEA Home Medical Equipment Market: Emerging-economy Expansion & Home-care Shift Fuel Growth

The LAMEA home medical equipment market reached USD 4.43 billion in 2025 and is forecast to expand to around USD 8.55 billion by 2035. The LAMEA market is experiencing positive momentum in the face of governments and the private sector investing to improve healthcare systems and expand access to home care for patients. Growing burdens of chronic disease and aging populations in countries like Brazil, South Africa and the Gulf States are shifting patients' needs towards devices that facilitate treatment and monitoring at home rather than through hospital stays. The increasing awareness of home care options as well as remote monitoring solutions are also helping grow the regions' use of home medical equipment solutions.

Recent Developments:

- In Latin America, healthcare reform and increased public investment are helping to provide better access and affordability of home care devices.

- In certain parts of the Middle East (countries within the GCC) and Africa, home care service provides are creating partnerships with device manufacturers to supply portable respiratory and monitoring equipment for home use.

Segmental Analysis

The home medical equipment market is segmented into product, distribution channel, and region.

Product Analysis

Therapeutic equipment represents the majority of the home medical equipment market due to their widespread use for the management of chronic diseases associated with respiratory illness, sleep apnoea, and renal failure. For patients requiring long-term care, CPAP machines (Continuous Positive Airway Pressure), oxygen concentrators, nebulizers, and home dialysis are critical for home treatment. The dual impact of the increasing prevalence of respiratory and cardiovascular disease as well as the growing elderly population, continues to reinforce the preeminence of the therapeutic segment. Innovations in technology and the emergence of small and easy-to-use therapeutic devices for home treatment have, furthermore, improved the efficacy of home-based treatment.

Home Medical Equipment Market Share, By Product, 2025 (%)

| Product |

Revenue Share, 2025 (%) |

| Therapeutic Equipment |

46.30% |

| Patient Monitoring Equipment |

29.70% |

| Mobility Assist & Patient Support Equipment |

15.20% |

| Bathroom Safety Equipment |

4.80% |

| Medical Furniture & Accessories |

3.10% |

| Others |

0.90% |

Patient monitoring equipment is the most rapidly growing product segment in the home medical equipment market due to the expanding telehealth market and remote patient monitoring. Technologies like glucose monitors, blood pressure monitors, and cardiac monitoring systems are appealing more and more to patients that prefer the ability to capture their respective health metrics in real-time from their home. The increasing presence of smart technology and wireless connectivity aims to augment patient convenience and allow health care professionals to access and analyze data remotely. This trend is projected to continue as engagement with digital health accelerates worldwide.

Distribution Channel Analysis

Retail medical stores currently lead the home medical equipment market due to their ease of access, personalised service and readily available products. Patients often like to purchase from a local retail store where they can view the device and receive assistance in its use. The established relationships between manufacturers and retail stores also encourages product variety as well as reliability for product availability. While the medical device marketplace shifts toward more digital and potent method of purchasing products, retail stores will likely remain the preferred and most convenient purchasing channel for elderly patients and chronic-care patients going forward.

E-commerce is rapidly becoming the fastest growing distribution channel for home medical equipment. Increasing numbers of people are using the internet, feeling comfortable purchasing items online, and digital healthcare channels are becoming more robust to support this change. Online stores exhibit an amazing variety of equipment with transparent pricing and home delivery, which are all huge advantages for people who are not mobile. The pandemic only pushed this even more. Manufacturers are now looking for greater reach through partnerships with e-commerce juggernauts and specialized medical platforms.

Home Medical Equipment Market Top Companies

Market Segmentation

By Product

- Therapeutic Equipment

- Home Respiratory Therapeutics Equipment

- CPAP Accessories

- CPAP Machines

- Oxygen Delivery Equipment

- Ventilators

- Nebulizers

- Humidifiers

- Home IV Equipment

- IV Administration

- IV Pumps

- IV Accessories

- Home Dialysis Equipment

- Home Hemodialysis Products

- Home Peritoneal Dialysis Products

- Patient Monitoring Equipment

- Blood Glucose Monitoring Equipment

- Cardiac Monitoring Equipment

- Apnea Monitoring Equipment

- Temperature Monitoring Equipment

- Others

- Mobility Assist & Patient Support Equipment

- Wheelchairs

- Walking Assist Devices

- Walkers & Rollers

- Canes & Walking Sticks

- Crutches

- Mobility Scooters

- Bathroom Safety Equipment

- Medical Furniture & Accessories

- Others

By Distribution Channel

- Retail Medical Stores

- Hospital Pharmacies

- E-commerce Channels

- Others

By Region

- North America

- APAC

- Europe

- LAMEA