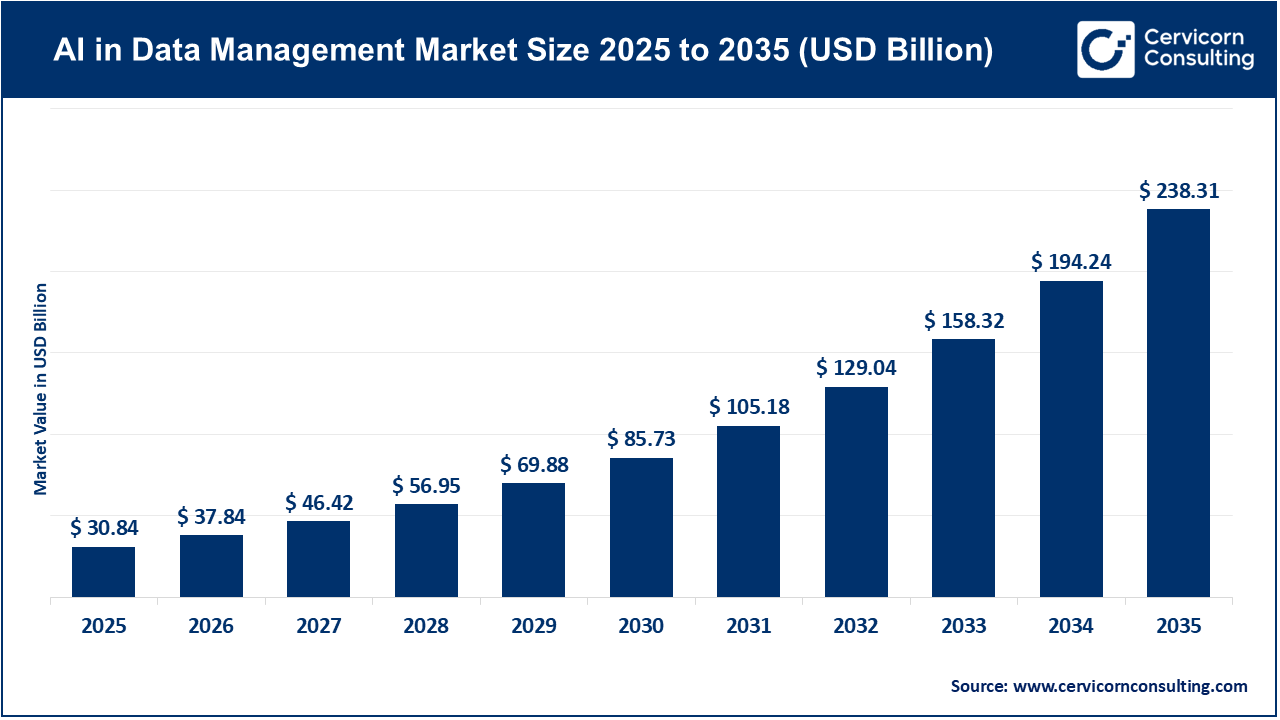

The global AI in data management market size was reached at USD 30.84 billion in 2025 and is expected to be worth around USD 238.31 billion by 2035, exhibiting at a compound annual growth rate (CAGR) of 22.69% over the forecast period 2026 to 2035. The AI in data management market is rapidly expanding in all major industries. Organizations are utilizing AI to efficiently manage extremely large, complex, and unstructured data. The growth of the IoT, social media, and digital platforms has exponentially increased the volume of data. AI tools make it possible to quickly automate data collection, integration, and cleaning with increasing accuracy. Machine learning and natural language processing technologies provide improve analytical processing time and real-time insights are driving the market further.

Moreover, the AI data management market growth is also driven by digital transformation and data-driven decision-making. Businesses are replacing manual processes and activities with AI-powered automation to improve productivity. Predictive modeling and generative AI are also providing businesses with actionable insights into big data. Industries such as healthcare, BFSI, and telecom are leading the adoption of AI for compliance and efficiency. Governments, specifically in response to rising perceived data privacy regulations, have also spawned more firms that invest in AI governance tools. Overall, AI in Data Management is shaping the data management landscape into a competitive advantage for modern enterprises.

What is AI in Data Management?

Artificial intelligence (AI) in data management leverages AI technologies (machine learning, natural language processing, and predictive analytics), integrated into the data organizing, storage, analysis, and governance processes. Specifically, AI supports automating manual domains (data cleaning, classification, integration, and monitoring) of data management, allowing organizations to consolidate and manage larger and more complex datasets much more efficiently. In turn, AI can improve data accuracy, inform better decision-making, ensure compliance requirements, and positively expedite raw data to provide insights and effectively make data a strategic asset.

Applications of AI in Data Management

Organizations Increasing Investment in AI Data Management

Organizations are increasing their investments in AI-powered data management solutions to facilitate digital transformation, optimize data workflows, and bolster analytics capability. For instance, survey results show a 74% of companies invested in AI or generative AI over the last year, which tops all other technological areas. At the same time, a global survey indicates that 61% of organizations are re-evaluating their data & analytics operating model because of AI technologies, showing that data management is not just an IT function – it is a strategic imperative. These events signify how organizations are seeing data as a strategic asset and are putting organizational resources (budgets, infrastructure, skills) behind developing an AI-enabled platform for ingestion, governance, quality, integration, and real-time insight.

Impact of AI in Data Management on Organizational Performance Improvements

| Area of Improvement | Approximate Improvement % | Details |

| Data quality & consistency | ~ 98 % consistency vs ~ 75 % manually | AIâ€driven validation frameworks improve accuracy over traditional methods. |

| Manual effort / person-hours on routine tasks | ~ 50 % reduction in person-hours | Routine data-quality tasks automated by AI freeing up human effort. |

| Time to prepare / process data | ~ 65 % reduction | AI speeds up data preparation and integration in large datasets. |

| Improved decision-making & insight speed | ~ 58 % organizations report improved decision-making | Reflects better outcomes when data management is enhanced by AI. |

| Operational cost reduction | ~ 40 % reduction | Efficiency gains from AI in managing and processing data translate into cost savings. |

How Exponential Growth in Mobile Data Traffic Is Powering AI Data Management Market?

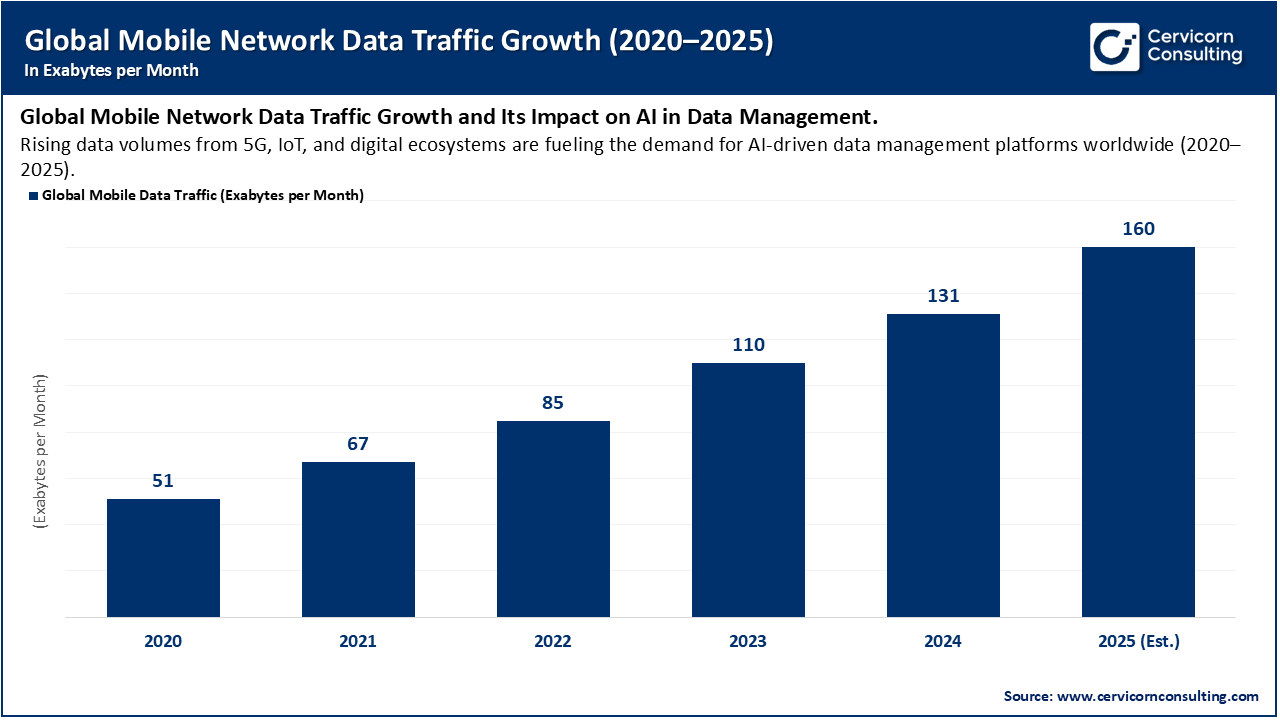

The global data traffic generated by mobile networks is expected to grow more than three times from 2020 to 2025, as 5G rollout, IoT proliferation, and trends toward higher resolution content continues to consume bandwidth. The telecom and IT industries are currently creating over one hundred and fifty exabytes a month, which is creating a huge challenge for organizations to manage, process and analyze so much information, all the time. This phenomenal growth is contributing to the growth of the AI in data management market, as enterprises will harness AI-based platforms for data integration, real-time analytics, and intelligent storage optimization. As networks evolve towards 6G and edge computing, AI-enabled data management will play a vital role in enabling scale, governance, and predictive-analytics capacity to hyper-connected digital economy.

1. Major acquisition by Salesforce of Informatica (~USD 8 billion)

2. Acquisition by Databricks of startup Neon (~USD 1 billion) to bolster AI-powered data management

3. Launch of Milestone Systems’ “Project Hafnia” with Nvidia to provide high-quality curated video data for AI-model training

4. Trend of “Edge AI + Decentralized Data Management” gaining traction

Explosive growth in data volume & complexity

As organizations produce unprecedented amounts of structured and unstructured data (from IoT, logs, social, etc.), the need for intelligent, scalable data-management tools will increase. One report states that growing data volume is a key factor driving the market. This is driving the market because legacy tooling can't keep pace, and AI-driven tools will be more capable of automating, integrating, and making sense of heterogeneous data, putting it into context.

Stricter regulatory/compliance demands and need for scalable architectures

Organizations are experiencing growing regulatory pressure (for example GDPR, CCPA) and require data-management solutions which can manage audit trails, lineage, governance and metadata at scale. The report stated that regulatory compliance was a key driver of AI in data management. Meanwhile the push to cloud, multi-cloud and hybrid architectures requires scalable data-management infrastructures, which AI tools assist in providing.

High upfront cost and infrastructure/integration complexity

The cost associated with the deployment of AI-enabled data-management systems is too high for many enterprises due to the cost of the infrastructure, legacy system integration and skills to deploy. For example, a study showed that 46% of enterprises thought the costs associated with infrastructure investment to be too high. This constraint reduces the rate of adoption, especially in smaller organizations or those with a large legacy burden.

Data quality, availability and siloed architecture issues

AI-powered data management only works well to the extent that the original data is clean, accessible and integrated. Many organizations face challenges related to data haphazardness and the quality of data while there are also issues around different formats of data. One particularly relevant market report mentions that availability and quality deficiencies are both major barriers. This is a relevant constraint because, without the proper foundational data, AI initiatives are less likely to be successful or valuable, making organization more hesitant to engage with it.

Real-time analytics and unstructured data processing use-cases

As more data is generated in real time, and the amount of unstructured data (e.g., text, video, logs) increases, AI-embedded data-management platforms have an incredible opportunity to deliver value. For example, approximately 59% of enterprises are seeking AI-driven tools to process unstructured data for real-time insights. Vendors who enable real-time ingestion, updated cleaning functionality, tagging, and analytics will open the door to new segments of the market and will be able to charge a premium.

Expanding adoption in emerging regions & underserved industry verticals

Many organizations in the Asia-Pacific, Latin America and some parts of the Middle East are relatively early in their AI/data-management journey. Market research shows significant growth opportunities in these regions. Industry verticals like manufacturing, government and healthcare also represent significant opportunities for AI in data management, particularly as regulatory, data complexity and transformation pressures rise.

Governance, privacy, trust and transparency concerns

As AI systems take over a range of data-management tasks (tagging, analysis, integration), concerns related to data privacy/algorithmic bias/explainability/compliance become much more amplified. For instance, one source stated 56% of practitioners in AI consider data privacy as their top ethical concern. As such, organizations must establish strong governance, auditability and transparency - without it, they risk delaying adoption and increasing risk.

Scaling pilots into production and talent/maturity gaps

While many organizations are piloting AI for data management, they continue to find it difficult to scale those solutions across the enterprise. In fact, research found only 28% of organizations report having reached enterprise-scale AI/ML deployments, and data management was cited as the top technical barrier (~32%). Furthermore, continued issues with skills gaps (data science, engineering, metadata management) and operational maturity (governance, processes, data pipelines) challenges have hindered widespread adoption.

The AI in data management market is segmented into various regions, including North America, Europe, Asia-Pacific, and LAMEA. Here is a brief overview of each region:

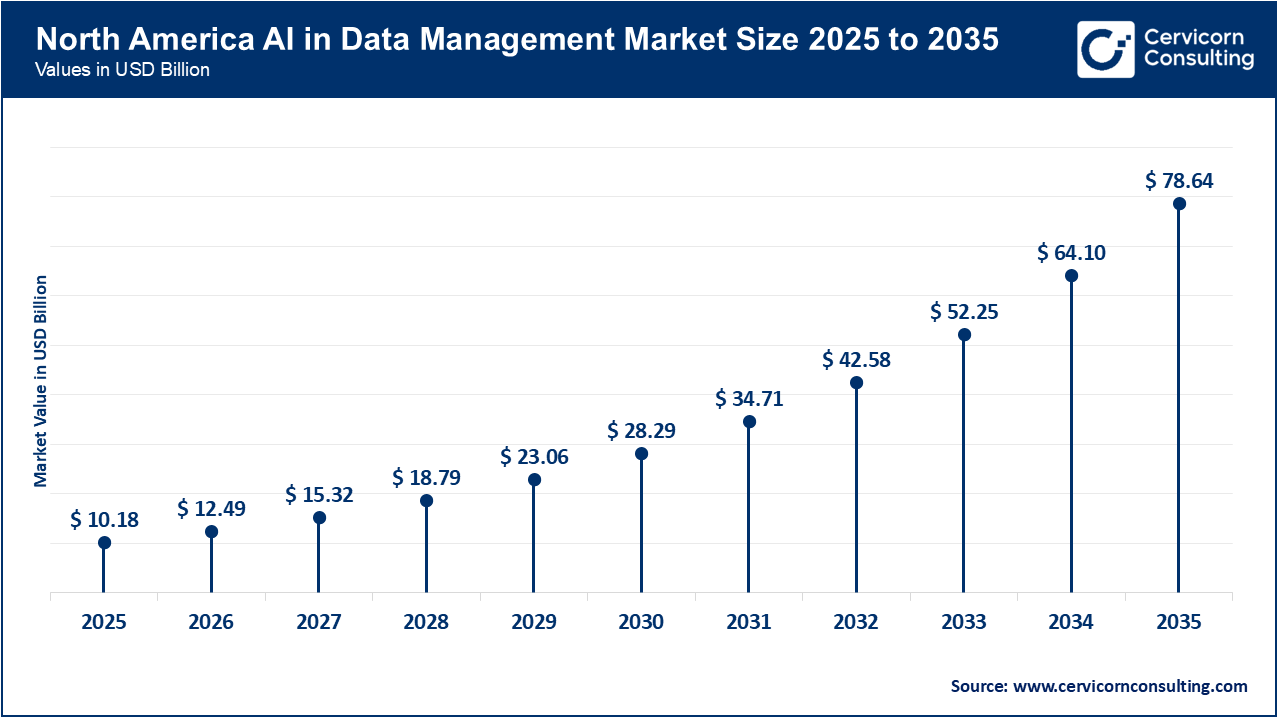

North America remains the global leader, aided by significant investments in AI infrastructure, enterprise data modernization, and advanced analytics adoption. The United States is leading this growth through robust partnerships amongst hyperscale cloud providers, data management software innovation, and semiconductor manufacturers. The region's growth will be further boosted by the CHIPS and Science Act, which supports AI chip production and the establishment of AI-ready data centers in various states. In addition, there is increasing demand for hybrid data architecture designs and automation through AI applications in industries such as BFSI, healthcare, and manufacturing that will drive large-scale adoption. The region will continue this leadership with an emphasis on responsible AI governance and data security.

Recent Development:

Asia-Pacific has the fastest adoption due to rapid digitization, government support to facilitate AI infrastructure programs, and increase in enterprise data volumes. Countries including China, India, Japan, and South Korea are launching AI-enabled data frameworks to improve operational agility and organizational decision making. As 77% of regional enterprise organizations have adopted a distributed data strategy and 65% of regional enterprises have a formalized data governance model, the Asia-Pacific region appears to be in the shift from experimentation to enterprise-wide adoption of AI. Added investments in areas such as local data centers and sovereign AI frameworks are supporting the growing demands for secure, real-time data management across multiple industries.

Recent Developments:

AI in Data Management Market Share, By Region, 2025 (%)

| Region | Revenue Share, 2025 (%) |

| North America | 33% |

| Asia-Pacific (APAC) | 29% |

| Europe | 31% |

| LAMEA | 7% |

Europe is experiencing sustained growth due to strong regulatory frameworks such as GDPR and the EU AI Act, along with expanding focus on ethical and responsible AI. Europe comprises about one-quarter of the market share and rapidly increasing the infrastructure to compete with the larger world. As part of a new initiative to increase compute capacity in Europe, the EU announced a EUR 30 billion investment to develop a network of gigawatt-scale AI data centers. With accelerating AI investments in Germany, France, and the Nordics, the continent continues to build a governance framework on sustainable AI data infrastructure

Recent Developments:

LAMEA region is an emerging yet high-potential market, spurred by national AI strategies, cloud infrastructure growth and a ramp-up of smart city projects. The UAE and Saudi Arabia are ahead in regional adoption, with Latin America and Africa not far behind with strategic government initiatives and private sector digital transformation programs. Investment in the data center ecosystem as well as AI governance frameworks are creating nurturing conditions for AI-enabled data tech platforms. While there are still infrastructural and regulatory hurdles, rising connectivity and cloud infrastructure growth suggests strong growth over the next decade.

Recent Developments:

The AI in data management market is segmented into deployment, offering, data type, application, technology, vertical, and region.

Cloud (Dominating Segment)

Cloud-based AI in data management dominates the market due to its scalability, cost-savings, and flexibility to manage enormous datasets in distributed environments. Organizations are increasingly selecting cloud platforms like AWS, Google Cloud, and Azure for AI and analytics adoption because of real-time and continuous access to data and the data as a service model. Industry reports indicate that over 65% of organizations have migrated all or some of their core data management workload to cloud-based AI-managed solutions to accelerate innovation and collaboration on enterprise data globally.

AI in Data Management Market Share, By Deployment, 2025 (%)

| Deployment | Revenue Share, 2025 (%) |

| Cloud | 69% |

| On-Premises | 31% |

On-Premises (Fastest-Growing Segment)

While cloud leads overall, on-premises deployment is growing rapidly—particularly in highly-the regulated industry sectors such as BFSI and government—where data sovereignty and compliance is the focal point. Organizations are investing in private AI infrastructures to increase the control and security of sensitive datasets. Additionally, the emergence of hybrid and edge AI frameworks has further fueled this process, demonstrating a strong level of growth of >20% year-on-year for on-premises AI-managed data management platforms.

Platform (Dominating Segment)

AI data management platforms have become the foundation of enterprise data ecosystems by integrating machine learning, governance, metadata management, and automated quality control into a single interface. These platforms are widely used for enterprise scale deployment, with vendors like Informatica, IBM, and SAP leading the market. Approximately 55% of large enterprises favor platform-centric deployments with the intent to integrate fragmented data systems to improve governance efficiency.

AI in Data Management Market Share, By Offering, 2025 (%)

| Offering | Revenue Share, 2025 (%) |

| Platform | 48% |

| Services | 29% |

| Software Tools | 23% |

Services (Fastest-Growing Segment)

Managed and professional services are experiencing fast growth as organizations are looking for expertise to implement, integrate, and maintain AI driven data management tools. The lack of internal AI talent and increasing complexity of hybrid data architectures has fueled outsourcing demand. This segment is also influenced by service providers offering custom AI integration, data quality assurance, and predictive data-ops support.

Image (Dominating Segment)

Due to the increasing adoption of computer vision and image analytics (in sectors like healthcare, manufacturing, and security), image data is the leading category of its sector. AI-powered image processing enables businesses and organizations to automate quality inspection, medical imaging analysis, and facial recognition. The widespread usage of IoT cameras and security surveillance systems has also contributed to its dominance, as image data makes up nearly 35% to 40% of AI data management workloads worldwide.

AI in Data Management Market Share, By Data Type, 2025 (%)

| Data Type | Revenue Share, 2025 (%) |

| Image | 28% |

| Text | 26% |

| Video | 20% |

| Speech & Voice | 14% |

| Audio | 12% |

Text (Fastest-Growing Segment)

Text data, however, is the fastest-growing type of data, largely due to the mainstreaming of generative AI, Natural Language Processing (NLP), and large language models (LLMs) in data management. However, enterprises are using AI to help manage, analyze, and extract insights from their vast amount of unstructured text data, such as emails, documents, and reports. The growth in the adoption of automation and compliance tools is also contributing to the CAGR for this sector to be greater than 28%, with a focus on the environments related to financial and legal data.

Process Automation (Dominating Segment)

Process automation is at the forefront of the market with AI-driven data management automating repetitive data processing, validating, and transforming tasks - lowering operational costs and increasing accuracy. Industries such as BFSI, telecom, and manufacturing are utilizing automation with AI-based data-ops to facilitate the financial and operational automation process for their data workflows. Process automation represents over 32% of the total market revenue to show the principle of automation at the heart of the enterprise data strategy.

Imputation & Predictive Modeling (Fastest-Growing Segment)

This segment is the fastest growing mainly due to the prevalence of AI for forecasting, abnormality detection, and intelligent fill-ins for data. Organizations utilize predictive AI models for data to reach higher data completeness, forecast trends, and enhance or optimize decision-making processes. Machine learning for predictive analytics runs through data pipelines for speed and scalability for upcoming growth over 27% in annual growth rate, led by finance and healthcare and supply-chain and logistics use cases.

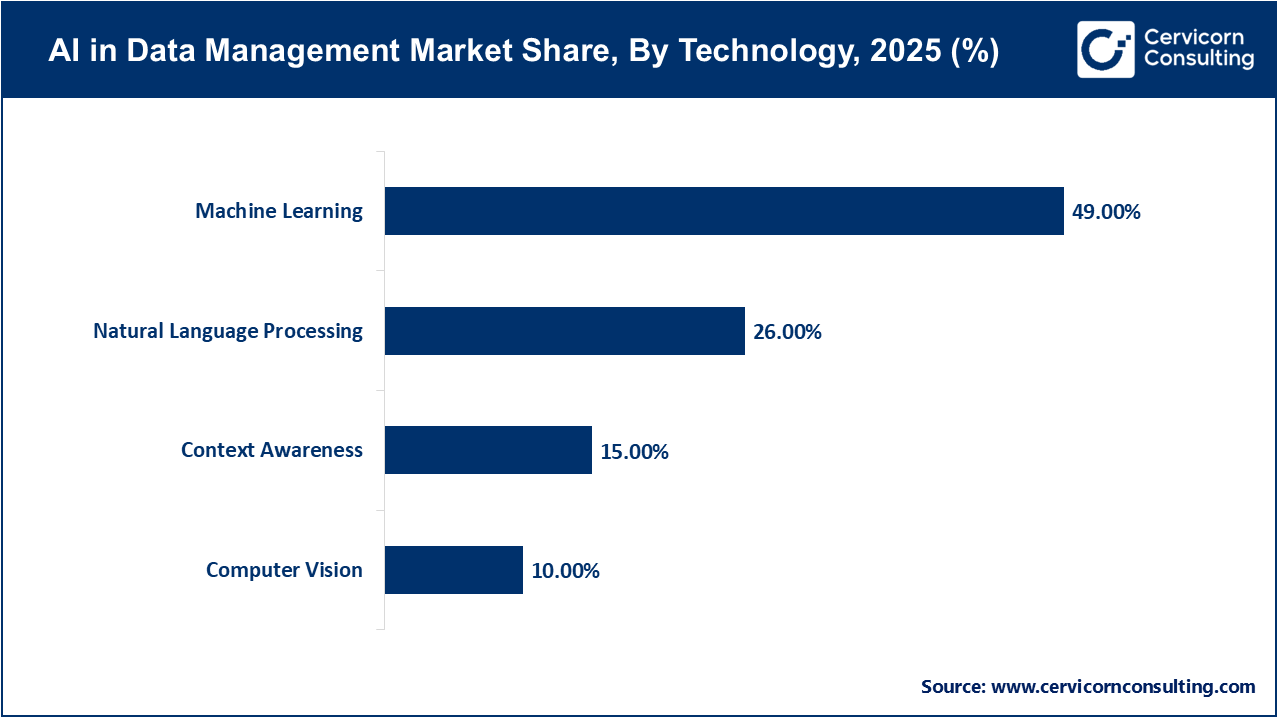

Machine Learning (Dominating Segment)

Machine Learning (ML) continues to be the foundation of improved AI in data management, driving automation, anomaly detection, and pattern recognition. ML algorithms improve data precision, increase governance, and reduce human effort across industries. Industry research suggests that over 70% of AI data management tools use ML as a core engine, making it the most mature and commonly deployed technology in the data management space.

Computer Vision (Fastest Growing Segment)

The area of computer vision is growing quickly as technology is used to manage visual data streams in healthcare, retail, and surveillance. There are more AI-powered image tagging, defect detection, and visual analytics solutions appearing. The ongoing improvements to GPU computing and vision transformers (ViTs) are contributing to the CAGR of more than 30% for computer vision, mostly linked to automation and industrial monitoring.

IT & Telecommunications (Dominating Segment)

The IT & Telecommunications sector holds the largest share, accounting for around 23% in 2025. This is fueled by the sheer volume of data traffic increases, the rollout of 5G, and the migration to the cloud. IT service providers and telecom operators, on a daily basis, produce and manage petabytes of both structured data (for example, logs of customer usage) and unstructured data (for example, logs of network performances and IoT devices). Therefore, and in order to manage data on such a scale efficiently, these organizations are using AI-backed data management solutions, primarily focused on automated data integration, cleansing and governance.

AI in Data Management Market Share, By Vertical, 2025 (%)

| Vertical | Revenue Share, 2025 (%) |

| IT & Telecommunications | 23% |

| Healthcare & Life Sciences | 18% |

| BFSI (Banking, Financial Services & Insurance) | 15% |

| Retail & E-commerce | 10% |

| Media & Entertainment | 8% |

| Manufacturing | 7% |

| Government & Defense | 6% |

| Energy & Utilities | 5% |

| Others | 8% |

Healthcare & Life Sciences (Fastest Growing Segment)

Healthcare has been the fastest growing vertical and it is attributed to greater adoption of AI for medical data processing, diagnostics, managing patient records, and drug discovery. Data management using AI-based analytics enables healthcare organizations obtain better interoperability and improved analysis of genomic data, imaging data, and electronic health record data. The adoption of AI in data management within the healthcare sector is forecasted to grow by greater than 32% CAGR, largely due to the post-pandemic attitude towards digital transformation, along with accelerating AI adoption and analytics in predictive health.

Industry Leaders’ Perspectives

1. Microsoft – Enabling Autonomous Data Systems for Scalable Enterprise AI

“Data management is the foundation of enterprise AI. Our mission is to build intelligent data systems that automate governance, improve accessibility, and unlock predictive insights at scale.”— Satya Nadella, CEO, Microsoft

Microsoft is channeling resources into AI-enhanced data management platforms — Azure Synapse and Fabric — to combine analytics, governance and automation in one environment. This is a growing push in enterprises to adopt self-healing and self-optimising data environments.

2. Google Cloud – Prioritizing Real-Time, AI-Powered Data Intelligence

“The next era of data management is not about storing more data, but understanding it in real time using AI.”— Thomas Kurian, CEO, Google Cloud

Google's recent announcements, including Data Advantage Cloud Suite (2025), illustrate a movement towards real-time AI analytics and data orchestration. The company claims that over 70% of enterprises in North America are moving towards integrated AI data management platforms to foster agility and speed in decision-making.

3. IBM – Driving Responsible AI and Governance in Data Management

“AI without trusted data is meaningless. Responsible governance and data lineage are essential for business-grade AI.”— Arvind Krishna, CEO, IBM

For IBM, the core of sustainable AI is completely data integrity and governance and its Watsonx Data platform emphasises explainability, compliance and reducing bias — all of which are paramount in industries like BFSI and healthcare, where data ethics are just as important as data accuracy.

Market Segmentation

By Deployment

By Offering

By Data Type

By Application

By Technology

By Vertical

By Region

Chapter 1. Market Introduction and Overview

1.1 Market Definition and Scope

1.1.1 Overview of AI in Data Management

1.1.2 Scope of the Study

1.1.3 Research Timeframe

1.2 Research Methodology and Approach

1.2.1 Methodology Overview

1.2.2 Data Sources and Validation

1.2.3 Key Assumptions and Limitations

Chapter 2. Executive Summary

2.1 Market Highlights and Snapshot

2.2 Key Insights by Segments

2.2.1 By Deployment Overview

2.2.2 By Offering Overview

2.2.3 By Data Type Overview

2.2.4 By Application Overview

2.2.5 By Technology Overview

2.2.6 By Vertical Overview

2.3 Competitive Overview

Chapter 3. Global Impact Analysis

3.1 Russia-Ukraine Conflict: Global Market Implications

3.2 Regulatory and Policy Changes Impacting Global Markets

Chapter 4. Market Dynamics and Trends

4.1 Market Dynamics

4.1.1 Market Drivers

4.1.1.1 Explosive growth in data volume & complexity

4.1.1.2 Stricter regulatory/compliance demands and need for scalable architectures

4.1.2 Market Restraints

4.1.2.1 High upfront cost and infrastructure/integration complexity

4.1.2.2 Data quality, availability and siloed architecture issues

4.1.3 Market Challenges

4.1.3.1 Governance, privacy, trust and transparency concerns

4.1.3.2 Scaling pilots into production and talent/maturity gaps

4.1.4 Market Opportunities

4.1.4.1 Real-time analytics and unstructured data processing use-cases

4.1.4.2 Expanding adoption in emerging regions & underserved industry verticals

4.2 Market Trends

Chapter 5. Premium Insights and Analysis

5.1 Global AI in Data Management Market Dynamics, Impact Analysis

5.2 Porter’s Five Forces Analysis

5.2.1 Bargaining Power of Suppliers

5.2.2 Bargaining Power of Buyers

5.2.3 Threat of Substitute Products

5.2.4 Rivalry among Existing Firms

5.2.5 Threat of New Entrants

5.3 PESTEL Analysis

5.4 Value Chain Analysis

5.5 Product Pricing Analysis

5.6 Vendor Landscape

5.6.1 List of Buyers

5.6.2 List of Suppliers

Chapter 6. AI in Data Management Market, By Deployment

6.1 Global AI in Data Management Market Snapshot, By Deployment

6.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

6.1.1.1 On-premises

6.1.1.2 Cloud

Chapter 7. AI in Data Management Market, By Offering

7.1 Global AI in Data Management Market Snapshot, By Offering

7.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

7.1.1.1 Platform

7.1.1.2 Services

7.1.1.3 Software Tools

Chapter 8. AI in Data Management Market, By Data Type

8.1 Global AI in Data Management Market Snapshot, By Data Type

8.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

8.1.1.1 Audio

8.1.1.2 Image

8.1.1.3 Speech & Voice

8.1.1.4 Video

8.1.1.5 Text

Chapter 9. AI in Data Management Market, By Technology

9.1 Global AI in Data Management Market Snapshot, By Technology

9.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

9.1.1.1 Machine Learning

9.1.1.2 Computer Vision

9.1.1.3 Natural Language Processing

9.1.1.4 Context Awareness

Chapter 10. AI in Data Management Market, By Application

10.1 Global AI in Data Management Market Snapshot, By Application

10.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

10.1.1.1 Data Augmentation

10.1.1.2 Exploratory Data Analysis

10.1.1.3 Data Anonymization & Compression

10.1.1.4 Imputation Predictive Modeling

10.1.1.5 Process Automation

10.1.1.6 Data validation & Noise Reduction

10.1.1.7 Others

Chapter 11. AI in Data Management Market, By Vertical

11.1 Global AI in Data Management Market Snapshot, By Vertical

11.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

11.1.1.1 BFSI

11.1.1.2 Government & Defense

11.1.1.3 Retail & e-commerce

11.1.1.4 IT & Telecommunications

11.1.1.5 Healthcare & Life Sciences

11.1.1.6 Energy & Utilities

11.1.1.7 Manufacturing

11.1.1.8 Media & Entertainment

11.1.1.9 Others

Chapter 12. AI in Data Management Market, By Region

12.1 Overview

12.2 AI in Data Management Market Revenue Share, By Region 2024 (%)

12.3 Global AI in Data Management Market, By Region

12.3.1 Market Size and Forecast

12.4 North America

12.4.1 North America AI in Data Management Market Revenue, 2022-2034 ($Billion)

12.4.2 Market Size and Forecast

12.4.3 North America AI in Data Management Market, By Country

12.4.4 U.S.

12.4.4.1 U.S. AI in Data Management Market Revenue, 2022-2034 ($Billion)

12.4.4.2 Market Size and Forecast

12.4.4.3 U.S. Market Segmental Analysis

12.4.5 Canada

12.4.5.1 Canada AI in Data Management Market Revenue, 2022-2034 ($Billion)

12.4.5.2 Market Size and Forecast

12.4.5.3 Canada Market Segmental Analysis

12.4.6 Mexico

12.4.6.1 Mexico AI in Data Management Market Revenue, 2022-2034 ($Billion)

12.4.6.2 Market Size and Forecast

12.4.6.3 Mexico Market Segmental Analysis

12.5 Europe

12.5.1 Europe AI in Data Management Market Revenue, 2022-2034 ($Billion)

12.5.2 Market Size and Forecast

12.5.3 Europe AI in Data Management Market, By Country

12.5.4 UK

12.5.4.1 UK AI in Data Management Market Revenue, 2022-2034 ($Billion)

12.5.4.2 Market Size and Forecast

12.5.4.3 UKMarket Segmental Analysis

12.5.5 France

12.5.5.1 France AI in Data Management Market Revenue, 2022-2034 ($Billion)

12.5.5.2 Market Size and Forecast

12.5.5.3 FranceMarket Segmental Analysis

12.5.6 Germany

12.5.6.1 Germany AI in Data Management Market Revenue, 2022-2034 ($Billion)

12.5.6.2 Market Size and Forecast

12.5.6.3 GermanyMarket Segmental Analysis

12.5.7 Rest of Europe

12.5.7.1 Rest of Europe AI in Data Management Market Revenue, 2022-2034 ($Billion)

12.5.7.2 Market Size and Forecast

12.5.7.3 Rest of EuropeMarket Segmental Analysis

12.6 Asia Pacific

12.6.1 Asia Pacific AI in Data Management Market Revenue, 2022-2034 ($Billion)

12.6.2 Market Size and Forecast

12.6.3 Asia Pacific AI in Data Management Market, By Country

12.6.4 China

12.6.4.1 China AI in Data Management Market Revenue, 2022-2034 ($Billion)

12.6.4.2 Market Size and Forecast

12.6.4.3 ChinaMarket Segmental Analysis

12.6.5 Japan

12.6.5.1 Japan AI in Data Management Market Revenue, 2022-2034 ($Billion)

12.6.5.2 Market Size and Forecast

12.6.5.3 JapanMarket Segmental Analysis

12.6.6 India

12.6.6.1 India AI in Data Management Market Revenue, 2022-2034 ($Billion)

12.6.6.2 Market Size and Forecast

12.6.6.3 IndiaMarket Segmental Analysis

12.6.7 Australia

12.6.7.1 Australia AI in Data Management Market Revenue, 2022-2034 ($Billion)

12.6.7.2 Market Size and Forecast

12.6.7.3 AustraliaMarket Segmental Analysis

12.6.8 Rest of Asia Pacific

12.6.8.1 Rest of Asia Pacific AI in Data Management Market Revenue, 2022-2034 ($Billion)

12.6.8.2 Market Size and Forecast

12.6.8.3 Rest of Asia PacificMarket Segmental Analysis

12.7 LAMEA

12.7.1 LAMEA AI in Data Management Market Revenue, 2022-2034 ($Billion)

12.7.2 Market Size and Forecast

12.7.3 LAMEA AI in Data Management Market, By Country

12.7.4 GCC

12.7.4.1 GCC AI in Data Management Market Revenue, 2022-2034 ($Billion)

12.7.4.2 Market Size and Forecast

12.7.4.3 GCCMarket Segmental Analysis

12.7.5 Africa

12.7.5.1 Africa AI in Data Management Market Revenue, 2022-2034 ($Billion)

12.7.5.2 Market Size and Forecast

12.7.5.3 AfricaMarket Segmental Analysis

12.7.6 Brazil

12.7.6.1 Brazil AI in Data Management Market Revenue, 2022-2034 ($Billion)

12.7.6.2 Market Size and Forecast

12.7.6.3 BrazilMarket Segmental Analysis

12.7.7 Rest of LAMEA

12.7.7.1 Rest of LAMEA AI in Data Management Market Revenue, 2022-2034 ($Billion)

12.7.7.2 Market Size and Forecast

12.7.7.3 Rest of LAMEAMarket Segmental Analysis

Chapter 13. Competitive Landscape

13.1 Competitor Strategic Analysis

13.1.1 Top Player Positioning/Market Share Analysis

13.1.2 Top Winning Strategies, By Company, 2022-2024

13.1.3 Competitive Analysis By Revenue, 2022-2024

13.2 Recent Developments by the Market Contributors (2024)

Chapter 14. Company Profiles

14.1 Amazon Web Services

14.1.1 Company Snapshot

14.1.2 Company and Business Overview

14.1.3 Financial KPIs

14.1.4 Product/Service Portfolio

14.1.5 Strategic Growth

14.1.6 Global Footprints

14.1.7 Recent Development

14.1.8 SWOT Analysis

14.2 Accenture plc

14.3 Databricks Inc.

14.4 Microsoft Corporation

14.5 Google LLC

14.6 Salesforce, Inc.

14.7 International Business Machines Corporation

14.8 SAS Institute

14.9 Teradata Corporation

14.10 Oracle Corporation

14.11 SAP SE

14.12 TIBCO Software Inc.