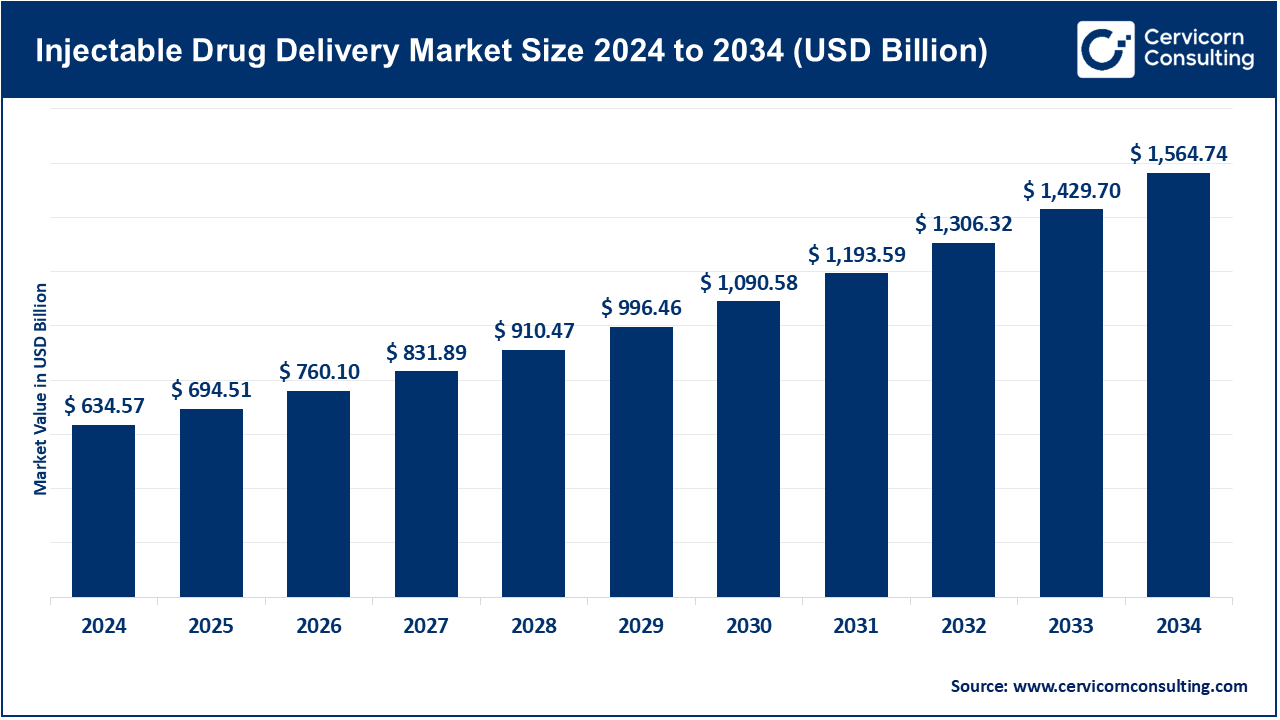

The global injectable drug delivery market size was estimated at USD 634.57 billion in 2024 and is anticipated to surpass around USD 1,564.74 billion by 2034, rising at a compound annual growth rate (CAGR) of 9.45% during the forecast period from 2025 to 2034. The injectable drug delivery market is rapidly gaining speed, owing to the increased need of accuracy, patient-based therapy, and scalable healthcare provision. Due to the increasing trend of chronic diseases, biologics, and personalized medicine, the delivery systems require high-quality precision, safety, and convenience in terms of delivery. To overcome this, manufacturers are coming up with green, minimally invasive injectors, wearables and IoT-equipped smart systems that ensure greater patient compliance and sustainability.

Injectable drug delivery is being transformed by digital transformation into intelligent, connected platforms. Cloud-based surveillance, artificial intelligence-based analytics, and real-time compliance monitoring are enabled to enable health care providers to enhance treatment outcomes and decrease risks. The combination of telehealth, home healthcare solutions and intelligent drug delivery devices is causing therapy to become more interactive, scalable, and accessible. As the world grows fast in terms of technological advancement and the increased global competition, the market is set to improve patient safety, operational efficiency, and sustainability, making injectable delivery one of the foundations of the next generation of healthcare.

Report Scope

| Area of Focus | Details |

| Market Size in 2025 | USD 694.51 Billion |

| Estimated Market Size in 2034 | USD 1,564.74 Billion |

| Projected CAGR 2025 to 2034 | 9.45% |

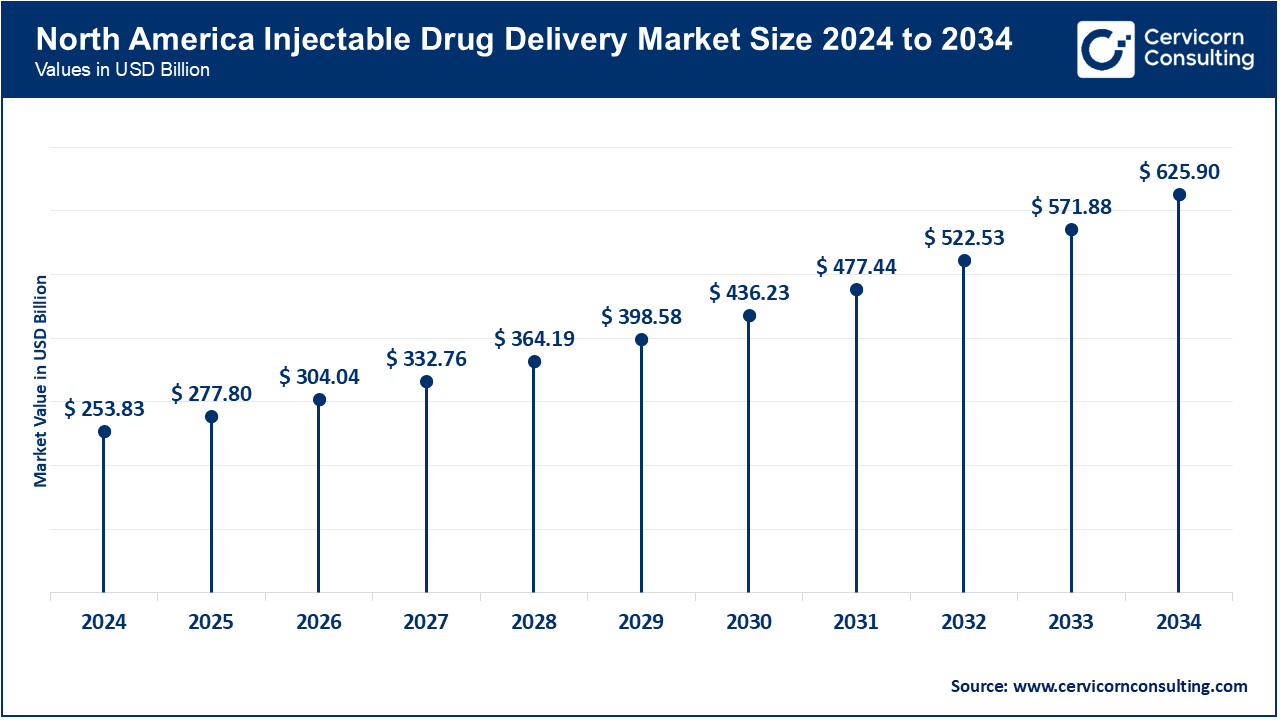

| Dominant Region | North America |

| Leading Growth Region | Asia-Pacific |

| Key Segments | Type, Formulation Packaging, Therapeutic Application, Usage Pattern, Site of Administration, Distribution Channel, Facility of Use, Region |

| Key Companies | Becton, Dickinson and Company, Pfizer Inc., Teva Pharmaceuticals Industries Ltd., Eli Lilly and Company, Baxter International, Inc., Sandoz, Terumo, Schott AG, Gerresheimer, Ypsomed, Bespak, B. Braun Melsungen |

The injectable drug delivery market is segmented into several key regions: North America, Europe, Asia-Pacific, and LAMEA (Latin America, Middle East, and Africa). Here’s an in-depth look at each region.

North America remains the largest region owing to the robust framework of healthcare system with top-tier regulations in place alongside substantial investment in Research and Development activities. The chronic disease prevalence and the shift to more user-friendly injectors further enhances the demand. For instance, the FDA Merck subcutaneous Keytruda rebate in September 2025 decreased the infusion time to 2 minutes from 30 and shows the region’s dedication to speed and convenience in cancer therapy.

Sustainability and strong compliance with Wraparound Protection Architecture for worldwide harnessing of cancerous tissue and incorporation of self injection system is a global response in which the portion of the infusion system is mainly benefitted from strong self-administered medication adoption and eco-friendly packaging. The Keytruda rebate by the EMA in September 2025, accompanied by the Pharmapack Europe in February 2025 with the recognition of replenishable self-injectors, confirms the region’s swift integration into worldwide cancerous tissue developments.

Asia-Pacific remains the fastest growing region owing to urbanization which is accompanied with a chronic disease prevalence and the government investment in healthcare. The tier II and III cities infers the cost effective and patient-friendly injectors which are widely in use. Of note is the July 2025 QuidelOrtho rapid immunoassay kit for detection of certain respiratory infections which shows the region’s desire to be proactive and accessible in the outbreak response and certain diagnostics.

Injectable Drug Delivery Market Share, By Region, 2024 (%)

| Region | Revenue Share, 2024 (%) |

| North America | 40% |

| Europe | 29% |

| Asia-Pacific | 22% |

| LAMEA | 9% |

LAMEA is a developing region today as sustained growth is underpinned with modern healthcare systems and advancing immunization programs. Adoption may still lag behind more developed regions, but it is advancing. In June 2025, scientists in South Africa demonstrated further strides in expanding injectable-based healthcare with the deployment of immunoassay kits for the simultaneous testing of HIV and hepatitis which was loaded onto a mobile diagnostic unit.

Devices: Payment precision greatly influences the efficiencies programmable syringes introduce, alongside conventional auto injectors, pen injectors, advanced syringes, as well as auto injectors worn on the body. patients are greatly apart alongside decreased reliance on outpatient medical facilities. Smart sensors connectivity, ergonomic designs are being integrated at even greater rates. For example, BD (Becton, Dickinson and Company) in July 2025 started its first pharma funded clinical trial with the BD Libertas™ Wearable Injector for biologics. This device enables the use of biologics and facilitates home-based subcutaneous volumetric injections, consequently, reducing the large volume of hospital visits.

Injectable Drug Delivery Market Share, By Type, 2024 (%)

| Type | Revenue Share, 2024 (%) |

| Device | 62.60% |

| Formulations | 37.40% |

Formulations: Adverse reactions as well as the need for specialized stabilizing techniques for the drug are presented and remains the defining characteristic of biologics, vaccines, hormonal injections, biosimilars, as well as oncology drugs. These are the injections themselves. Advances in formulations focus on the elimination of frequent injections, enhancement of shelf life, and reduction of adverse effects. Eli Lilly for instance decreased dosing complexity as well as improved patient adherence by receiving the FDA approval in March 2025 for the new once-weekly injectable formulation of its diabetes drug, Mounjaro. This greatly reduces the number of injections as well as increases patient adherence.

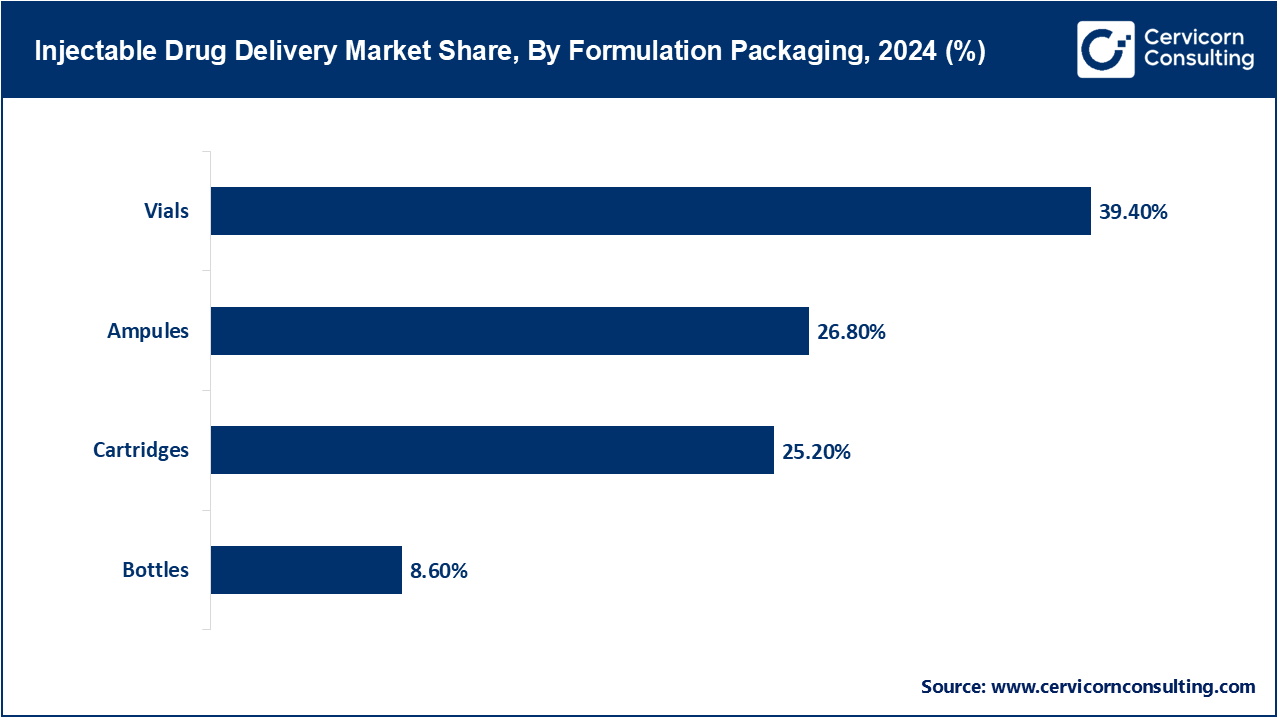

Ampules: Preserving sterile injectable solutions in small sealed glass containers called ampules entails high protection against contamination, although interruption in convenience occurs due to the need to break the seal before use. Gerresheimer’s ampules made from glass with eco-friendly and lightweight characteristics and reduced co2-emisssion for production, in stark contrast from their previous models all the way back to January 2025, defended the integrity of the crucial sterility of injectables while also wanting to accomplish sustainability goals.

Vials: Widely used in hospital and clinical settings, vials are single or multi dose glass containers. The use of vials is common due to the ease of mass scale production in immunizations and treatments for oncology. Advanced ready to use sterile vials (RTU) aimed towards the accelerated production of vaccines and biologics, inline with the decreased sterilization steps of vials and biologics, were manufactured in collaboration with SCHOTT and Gerresheimer in May 2025, advanced vials expanding Stevanato Group’s offerings.

Cartridges: Prefilled units of cartridges used for pen injectors and autoinjectors have become extremely popular due to the convenience of self-administration and accurate dose delivery. The use of cartridges has become the norm for chronic conditions. With the emergence of the ready to use polymer cartridge platform, designed specifically for sensitive biologics, SCHOTT Pharma advanced the compatibility of medical devices back in 2025 while also improving patient safety and ease of use.

Bottles: These are often large-volume containers that are typically administered through infusion and used in other hospital settings. Bottles hold multiple doses and are essential to any therapy that requires dilution or mixing. In April 2025, Baxter enriched parenteral packaging line with multi-chamber bottles aimed to sustain length unstable injectable combinations for greater flexibility in oncology and critical care treatment. This addition was intended to improve flexibility both within oncology and critical care medicine.

Auto-immune Diseases: This is the only segment where injectables dominate. The condition may include rheumatoid arthritis, psoriasis, or multiple sclerosis. This segment is growing rapidly with biologics commanding refluxing demand for pen and autoinjectors for self-treatment at home. February 2025 is the month when Amgen announced the FDA approval for the Amjevita on-body biosimilar injector for rheumatoid arthritis. This further allows self-administration beyond the clinical setting, Cassette and sheath combo eliminated for increased Amgen patient biosimilar injector portable flexibility.

Hormonal Disorders: Chronic disorders requiring therapy involving multiple injectables include hormonal therapies such as, insulin, fertility, and, as well as, growth hormones. The Integrat es emphasizes better investment compliance and enhancing the patient experience. In March 2025, Novo Nordisk released the upgraded FlexTouch® insulin pen with digital connectivity to improve real time glucose to insulin ratio management accessed from smartphone apps.

Injectable Drug Delivery Market Share, By Therapeutic Application, 2024 (%)

| Therapeutic Application | Revenue Share, 2024 (%) |

| Auto-immune Diseases | 22.60% |

| Hormonal Disorders | 18.40% |

| Orphan Diseases | 10% |

| Oncology | 41.80% |

| Others | 7.20% |

Orphan Diseases: Orphan drugs serve the purpose for such uncommon conditions the patients with enduring forlorn ailments serve the ever-growing need as the injectables segment is highly specialized and seldom to cope with such devices. Due to the high cash value, the smaller populations create more demand for the highly specialized therapies. In July 2025, Chiesi Group received CMA endorsement for injection type Lamzede® with the antidote for alpha-mannosidosis, an innovative step in the Orphan Injectables segment.

Oncology: The cancer treatment was continuously evolving to adding more than just monoclonal antibodies or chemotherapy with subcutaneous infusion and multiple check point inhibitors. As of June 2025, Sanofi showcased phase 3 trial results at ASCO for Sarclisa on-body injector, shifting from the prevalent practice of IV infusion and showing the same efficacy. The Sarclisa trial is an improvement in treatment duration and patient comfort.

Others: This relates to vaccines, anesthetics, and cardiovascular injectables. As exemplified by its other pipeline candidates, in April 2025, Moderna expanded its pipeline by adding an injectable RSV vaccine candidate currently in late-stage clinical trials, demonstrating broader therapeutic usage.

Curative Care: Active conditions like infections or metabolic disorders require the use of injectable medicine. Dosing precision and rapid response is an intricate aspect of these medicines. In May 2025 Pfizer released an antibiotic formulation containing long-acting injectables to the European market which helps avoids the need to dose multiple times daily by combatting antibiotic resistant infections.

Injectable Drug Delivery Market Share, By Usage Pattern, 2024 (%)

| Usage Pattern | Revenue Share, 2024 (%) |

| Curative Care | 53.10% |

| Immunization | 41.60% |

| Others | 5.30% |

Immunization: During the pandemic, global health dependence the mass production and efficient delivery of vaccines. Successful vaccine trials results were released by AstraZeneca in June 2025 demonstrating the use of a needle-free jet injector and a vaccine. This makes vaccine jetting more accesible in vaccine scarce and underdeveloped areas.

Other: Examples are palliative care and pain management adjunct injectable medicines. Teva in January 2025 released a prefilled syringe designed for the management of migraines that helps patients achieve relief rapidly and is accessible and easy.

Skin: Intradermal and subcutaneous injections are most common with vaccines and biologics like insulin. In March 2025, NanoPass Technologies announced FDA clearance for its microneedle intradermal system intended to enhance absorption and alleviating pain during vaccination. These microneedles are designed to tackle vaccination problems such as absorption and device-related pain.

Circulatory/Musculoskeletal: Very few drugs can reach the systemic circulation to achieve target controlled therapeutics with less side effects. Rapid systemic action drugs are delivered directly to the blood through intravenous injections and Intramuscular Injections(MI) directly to the muscles. In July 2025, Johnson & Johnson reported positive results for its long-acting antipsychotic delivered intramuscularly, showing decreased relapse rates in Schizophrenic patients.

Organs: The drug delivery system wherein the drug is directly delivered to the tissues like ocular and hepatic tissues to achieves site specific concentration are termed as organ specific injections. In July 2025, Regeneron received FDA breakthrough designation for the most innovative injuectable drug for age-related macular degeneration offering optimised expanded dosing intervals intravitreal injections.

Central Nervous System: The Drug delivery systems that include Intrathecal and other intr spinal injections as well as epidural injections for other spinal and neurological conditions. In April 2025, Biogen announced Phase 2 success of its injectable therapy for ALS, using intrathecal delivery systems, marking the advancement of the field of targeted CNS deliveries.

Hospitals & Clinics: Prime location for complex injectables, oncology treatments, and other emergency therapies. In June 2025, there was a shift in Sanofi’s on-body injector trial, where upside was identified in moving some oncology treatments for infusion on infusion chairs to SC injections, thus opening up capacity in hospitals.

Retail Pharmacy Stores: This segment enjoys prefilled syringes and vaccines for increased user friendliness. CVS Health’s in-chain injectable biologics initiative was rolled out in 200 pharmacies across the US in February 2025, thus enabling patients to access specialty therapies in a non-hospital environment.

Injectable Drug Delivery Market Share, By Distribution Channel, 2024 (%)

| Distribution Channel | Revenue Share, 2024 (%) |

| Hospitals & Clinics | 54.20% |

| Retail Pharmacy Stores | 32.50% |

| Others | 13.30% |

Others: This consists of other specialty clinics and includes government-sponsored immunization drives. In January 2025 India’s Ministry of Health launched the large-scale immunization programs for injectable vaccines of measles and rubella, thus improving the immunization coverage in rural and remote areas of the country.

Hospitals & Clinics: Hospitals and clinics are monitoring and supervising more advanced and higher risk injectables; for example, the April 2025 partnership between the Mayo Clinic and Medtronic works with AI technology to enhance the precision of infusible injectables on oncology wards to guide infusion dosing systems.

Home Care Settings: In March 2025, the Roche Company for home care invented the ‘connected self-injection device for hemophilia’, enabling patients to share vital data with healthcare professionals even from their home.

Others: This includes ambulatory care and, in July 2025, the Médecins Sans Frontières units in conflict zones, improving access to care in poorly serviced areas, provided portable auto injectors with antibiotics.

Market Segmentation

By Type

By Formulation Packaging

By Therapeutic Application

By Usage Pattern

By Site of Administration

By Distribution Channel

By Facility of Use

By Region

Chapter 1. Market Introduction and Overview

1.1 Market Definition and Scope

1.1.1 Overview of Injectable Drug Delivery

1.1.2 Scope of the Study

1.1.3 Research Timeframe

1.2 Research Methodology and Approach

1.2.1 Methodology Overview

1.2.2 Data Sources and Validation

1.2.3 Key Assumptions and Limitations

Chapter 2. Executive Summary

2.1 Market Highlights and Snapshot

2.2 Key Insights by Segments

2.2.1 By Type Overview

2.2.2 By Formulation Packaging Overview

2.2.3 By Therapeutic Application Overview

2.2.4 By Usage Pattern Overview Overview

2.2.5 By Site of Administration Overview

2.2.6 By Distribution Channel Overview

2.2.7 By Facility of Use Overview

2.3 Competitive Overview

Chapter 3. Global Impact Analysis

3.1 Russia-Ukraine Conflict: Global Market Implications

3.2 Regulatory and Policy Changes Impacting Global Markets

Chapter 4. Market Dynamics and Trends

4.1 Market Dynamics

4.1.1 Market Drivers

4.1.1.1 Rising Chronic Disease Burden

4.1.1.2 Shift Toward Home & Point-of-Care Treatment

4.1.2 Market Restraints

4.1.2.1 High Cost of Innovation & Biologics Delivery Systems

4.1.3 Market Challenges

4.1.3.1 Infrastructure and Accessibility Gaps in Emerging Regions

4.1.4 Market Opportunities

4.1.4.1 Integration of Telemedicine and Smart Healthcare

4.1.4.2 Advancement of Biologics and Wearables

4.2 Market Trends

Chapter 5. Premium Insights and Analysis

5.1 Global Injectable Drug Delivery Market Dynamics, Impact Analysis

5.2 Porter’s Five Forces Analysis

5.2.1 Bargaining Power of Suppliers

5.2.2 Bargaining Power of Buyers

5.2.3 Threat of Substitute Products

5.2.4 Rivalry among Existing Firms

5.2.5 Threat of New Entrants

5.3 PESTEL Analysis

5.4 Value Chain Analysis

5.5 Product Pricing Analysis

5.6 Vendor Landscape

5.6.1 List of Buyers

5.6.2 List of Suppliers

Chapter 6. Injectable Drug Delivery Market, By Type

6.1 Global Injectable Drug Delivery Market Snapshot, By Type

6.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

6.1.1.1 Devices

6.1.1.2 Formulations

Chapter 7. Injectable Drug Delivery Market, By Formulation Packaging

7.1 Global Injectable Drug Delivery Market Snapshot, By Formulation Packaging

7.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

7.1.1.1 Ampules

7.1.1.2 Vials

7.1.1.3 Cartridges

7.1.1.4 Bottles

Chapter 8. Injectable Drug Delivery Market, By Therapeutic Application

8.1 Global Injectable Drug Delivery Market Snapshot, By Therapeutic Application

8.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

8.1.1.1 Auto-immune Diseases

8.1.1.2 Hormonal Disorders

8.1.1.3 Orphan Diseases

8.1.1.4 Oncology

8.1.1.5 Others

Chapter 9. Injectable Drug Delivery Market, By Site of Administration

9.1 Global Injectable Drug Delivery Market Snapshot, By Site of Administration

9.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

9.1.1.1 Skin

9.1.1.2 Circulatory/Musculoskeletal

9.1.1.3 Organs

9.1.1.4 Central Nervous System

Chapter 10. Injectable Drug Delivery Market, By Distribution Channel

10.1 Global Injectable Drug Delivery Market Snapshot, By Distribution Channel

10.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

10.1.1.1 Hospitals & Clinics

10.1.1.2 Retail Pharmacy Stores

10.1.1.3 Others

Chapter 11. Injectable Drug Delivery Market, By Facility of Use

11.1 Global Injectable Drug Delivery Market Snapshot, By Facility of Use

11.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

11.1.1.1 Hospitals & Clinics

11.1.1.2 Home Care Settings

11.1.1.3 Others

Chapter 12. Injectable Drug Delivery Market, By Usage Pattern

12.1 Global Injectable Drug Delivery Market Snapshot, By Usage Pattern

12.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

12.1.1.1 Curative Care

12.1.1.2 Immunization

12.1.1.3 Others

Chapter 13. Injectable Drug Delivery Market, By Region

13.1 Overview

13.2 Injectable Drug Delivery Market Revenue Share, By Region 2024 (%)

13.3 Global Injectable Drug Delivery Market, By Region

13.3.1 Market Size and Forecast

13.4 North America

13.4.1 North America Injectable Drug Delivery Market Revenue, 2022-2034 ($Billion)

13.4.2 Market Size and Forecast

13.4.3 North America Injectable Drug Delivery Market, By Country

13.4.4 U.S.

13.4.4.1 U.S. Injectable Drug Delivery Market Revenue, 2022-2034 ($Billion)

13.4.4.2 Market Size and Forecast

13.4.4.3 U.S. Market Segmental Analysis

13.4.5 Canada

13.4.5.1 Canada Injectable Drug Delivery Market Revenue, 2022-2034 ($Billion)

13.4.5.2 Market Size and Forecast

13.4.5.3 Canada Market Segmental Analysis

13.4.6 Mexico

13.4.6.1 Mexico Injectable Drug Delivery Market Revenue, 2022-2034 ($Billion)

13.4.6.2 Market Size and Forecast

13.4.6.3 Mexico Market Segmental Analysis

13.5 Europe

13.5.1 Europe Injectable Drug Delivery Market Revenue, 2022-2034 ($Billion)

13.5.2 Market Size and Forecast

13.5.3 Europe Injectable Drug Delivery Market, By Country

13.5.4 UK

13.5.4.1 UK Injectable Drug Delivery Market Revenue, 2022-2034 ($Billion)

13.5.4.2 Market Size and Forecast

13.5.4.3 UKMarket Segmental Analysis

13.5.5 France

13.5.5.1 France Injectable Drug Delivery Market Revenue, 2022-2034 ($Billion)

13.5.5.2 Market Size and Forecast

13.5.5.3 FranceMarket Segmental Analysis

13.5.6 Germany

13.5.6.1 Germany Injectable Drug Delivery Market Revenue, 2022-2034 ($Billion)

13.5.6.2 Market Size and Forecast

13.5.6.3 GermanyMarket Segmental Analysis

13.5.7 Rest of Europe

13.5.7.1 Rest of Europe Injectable Drug Delivery Market Revenue, 2022-2034 ($Billion)

13.5.7.2 Market Size and Forecast

13.5.7.3 Rest of EuropeMarket Segmental Analysis

13.6 Asia Pacific

13.6.1 Asia Pacific Injectable Drug Delivery Market Revenue, 2022-2034 ($Billion)

13.6.2 Market Size and Forecast

13.6.3 Asia Pacific Injectable Drug Delivery Market, By Country

13.6.4 China

13.6.4.1 China Injectable Drug Delivery Market Revenue, 2022-2034 ($Billion)

13.6.4.2 Market Size and Forecast

13.6.4.3 ChinaMarket Segmental Analysis

13.6.5 Japan

13.6.5.1 Japan Injectable Drug Delivery Market Revenue, 2022-2034 ($Billion)

13.6.5.2 Market Size and Forecast

13.6.5.3 JapanMarket Segmental Analysis

13.6.6 India

13.6.6.1 India Injectable Drug Delivery Market Revenue, 2022-2034 ($Billion)

13.6.6.2 Market Size and Forecast

13.6.6.3 IndiaMarket Segmental Analysis

13.6.7 Australia

13.6.7.1 Australia Injectable Drug Delivery Market Revenue, 2022-2034 ($Billion)

13.6.7.2 Market Size and Forecast

13.6.7.3 AustraliaMarket Segmental Analysis

13.6.8 Rest of Asia Pacific

13.6.8.1 Rest of Asia Pacific Injectable Drug Delivery Market Revenue, 2022-2034 ($Billion)

13.6.8.2 Market Size and Forecast

13.6.8.3 Rest of Asia PacificMarket Segmental Analysis

13.7 LAMEA

13.7.1 LAMEA Injectable Drug Delivery Market Revenue, 2022-2034 ($Billion)

13.7.2 Market Size and Forecast

13.7.3 LAMEA Injectable Drug Delivery Market, By Country

13.7.4 GCC

13.7.4.1 GCC Injectable Drug Delivery Market Revenue, 2022-2034 ($Billion)

13.7.4.2 Market Size and Forecast

13.7.4.3 GCCMarket Segmental Analysis

13.7.5 Africa

13.7.5.1 Africa Injectable Drug Delivery Market Revenue, 2022-2034 ($Billion)

13.7.5.2 Market Size and Forecast

13.7.5.3 AfricaMarket Segmental Analysis

13.7.6 Brazil

13.7.6.1 Brazil Injectable Drug Delivery Market Revenue, 2022-2034 ($Billion)

13.7.6.2 Market Size and Forecast

13.7.6.3 BrazilMarket Segmental Analysis

13.7.7 Rest of LAMEA

13.7.7.1 Rest of LAMEA Injectable Drug Delivery Market Revenue, 2022-2034 ($Billion)

13.7.7.2 Market Size and Forecast

13.7.7.3 Rest of LAMEAMarket Segmental Analysis

Chapter 14. Competitive Landscape

14.1 Competitor Strategic Analysis

14.1.1 Top Player Positioning/Market Share Analysis

14.1.2 Top Winning Strategies, By Company, 2022-2024

14.1.3 Competitive Analysis By Revenue, 2022-2024

14.2 Recent Developments by the Market Contributors (2024)

Chapter 15. Company Profiles

15.1 Becton

15.1.1 Company Snapshot

15.1.2 Company and Business Overview

15.1.3 Financial KPIs

15.1.4 Product/Service Portfolio

15.1.5 Strategic Growth

15.1.6 Global Footprints

15.1.7 Recent Development

15.1.8 SWOT Analysis

15.2 Dickinson and Company

15.3 Pfizer Inc.

15.4 Teva Pharmaceuticals Industries Ltd.

15.5 Eli Lilly and Company

15.6 Baxter International, Inc.

15.7 Sandoz

15.8 Terumo

15.9 Schott AG

15.10 Gerresheimer

15.11 Ypsomed

15.12 Bespak

15.13 B. Braun Melsungen