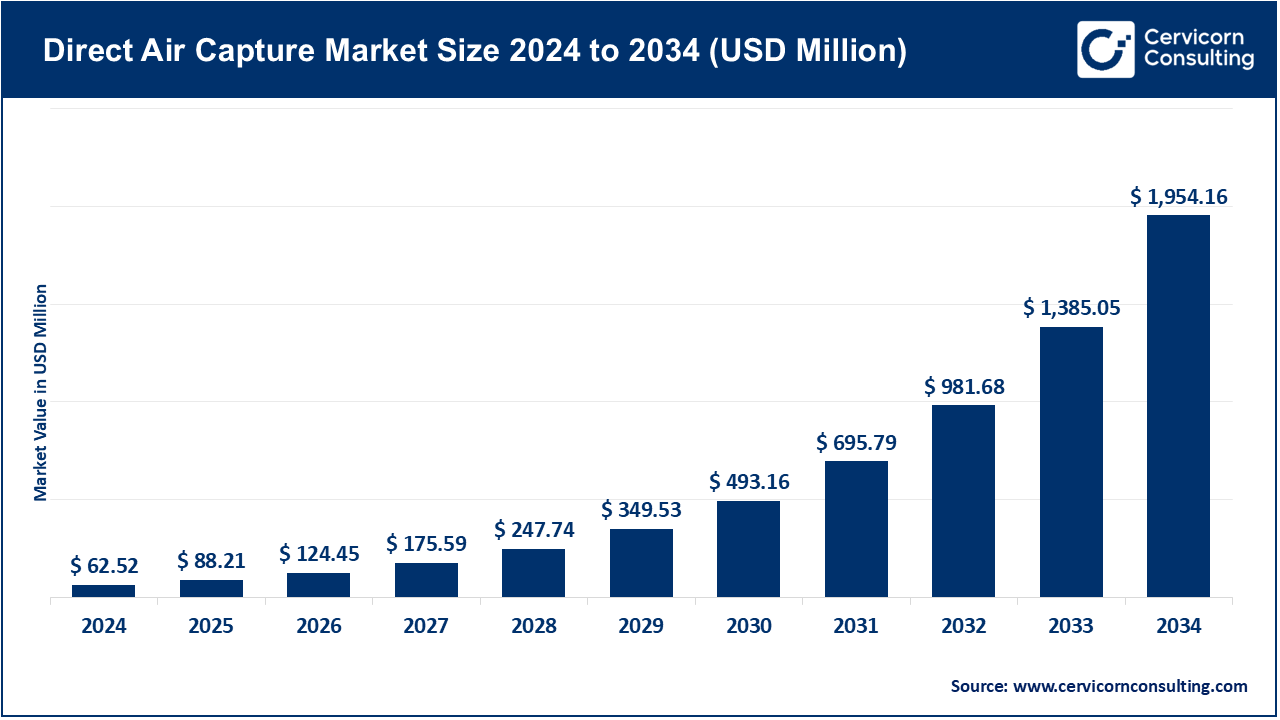

The global direct air capture market size was valued at USD 62.52 million in 2024 and is expected to be worth around USD 1,954.16 million by 2034, growing at a compound annual growth rate (CAGR) of 49.5% over the forecast period from 2025 to 2034.

The direct air capture sector is now developing as a result of increasing focus on net-zero pledges, integration of renewable energy, and sustainable growth of industries by governments and companies. DAC systems are vital for a wide array of sectors, including carbon-neutral and renewable fuel and electricity production, enhanced oil recovery (EOR), carbonated drinks, construction and healthcare industries which are looking towards sustainable systems and carbon footprint reduction as well as long-term energy resilience. Some of the most important factors are relentless rural migration, stricter global climate obligations, and increasing funding for decarbonization innovation. At the same time, improved sorbent materials, scalable chemical processes, and ongoing cost-reduction efforts are advancing the environmental and commercial value of DAC systems.

What is direct air capture?

Direct air capture (DAC) is a removal technology which extracts carbon dioxide from the atmosphere. DAC functions using chemical solvents or solid sorbents which capture CO2 from the surrounding air. The captured CO2 can be stored permanently in deep geological formations which removes the CO2 from the carbon cycle. Repurposing is also possible in industries like synthetic fuels, building materials, and beverages. DAC differs from traditional carbon capture methods and is more flexible as it does not capture emissions from a specific location but rather extracts it from the open air. The CO2 removal flexibility DAC offers makes it more versatile and effective to combat emissions.

Report Scope

| Area of Focus | Details |

| Market Size in 2025 | USD 88.21 Million |

| Estimated Market Size in 2034 | USD 1,954.16 Million |

| Projected CAGR 2025 to 2034 | 49.50% |

| Leading Region | North America |

| Key Segments | Technology, Energy Source, Number of Collectors, Application, End User, Region |

| Key Companies | Climeworks, Carbon Engineering ULC., Global thermostat, Heirloom Carbon Technologies, Soletair Power, CarbonCapture Inc, Avnos, Inc., Noya PBC, Skytree, RepAir |

The direct air capture market is segmented into several key regions: North America, Europe, Asia-Pacific, and LAMEA (Latin America, the Middle East, and Africa). Here’s an in-depth look at each region.

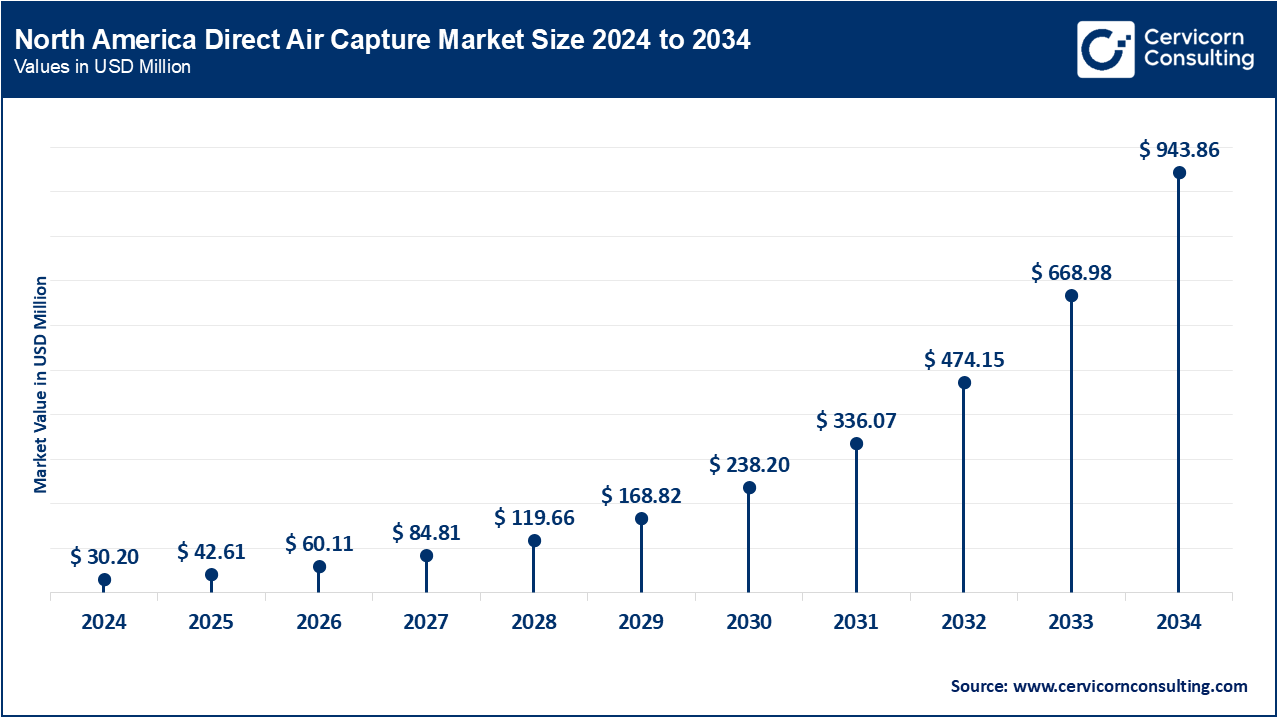

Due to robust government investments and a conducive research environment, North America is emerging as a center for Direct Air Capture development. A noteworthy instance occurred in April 2025, when the U.S. Department of Energy unveiled a pilot Direct Air Capture project in California, which was supported by over USD 1.2 billion in clean energy investments. The project aims to scale up microbial electrolysis systems using agricultural residues as feedstock. This showcases the dual emissions reduction and renewable hydrogen production goals the U.S. is pursuing at a commercial scale.

Europe is still the number one region in direct air capture development, and this is mainly due to the climate policies and green fuel incentives. In March 2025, Germany funded a €40 million program for the conversion of agricultural residues to hydrogen through dark fermentation. This is part of the Germany’s national hydrogen strategy which promotes the use of renewable hydrogen in industry and transport. In addition, the program fosters rural development by enabling farmers to earn from waste products.

Asia-Pacific is advancing direct air capture adoption with major industrial projects, especially in China. In August 2025, a Direct Air Capture industrial park in Shandong Province was launched with an investment of over USD 2 billion. The project combines algae cultivation with hybrid biological and chemical secondary hydrogen production methods. The industrial center illustrates China’s efforts to control coal consumption and dominate the global hydrogen industry.

Direct Air Capture Market Share, By Region, 2024 (%)

| Region | Revenue Share, 2024 (%) |

| North America | 48.30% |

| Europe | 29.10% |

| Asia-Pacific | 15.40% |

| LAMEA | 7.20% |

Proactive linked direct air capture adoption with renewable energy projects in the LAMEA region. In July 2025, Brazil’s state of Ceará launched a direct air capture facility at Wind Farm 3, which was financed to the tune of USD 600 million. The initiative harnesses microbial processes, seeking to combine abundant renewable electricity with hydrogen generation. It marks the first large-scale integration of direct air capture with wind energy in Latin America.

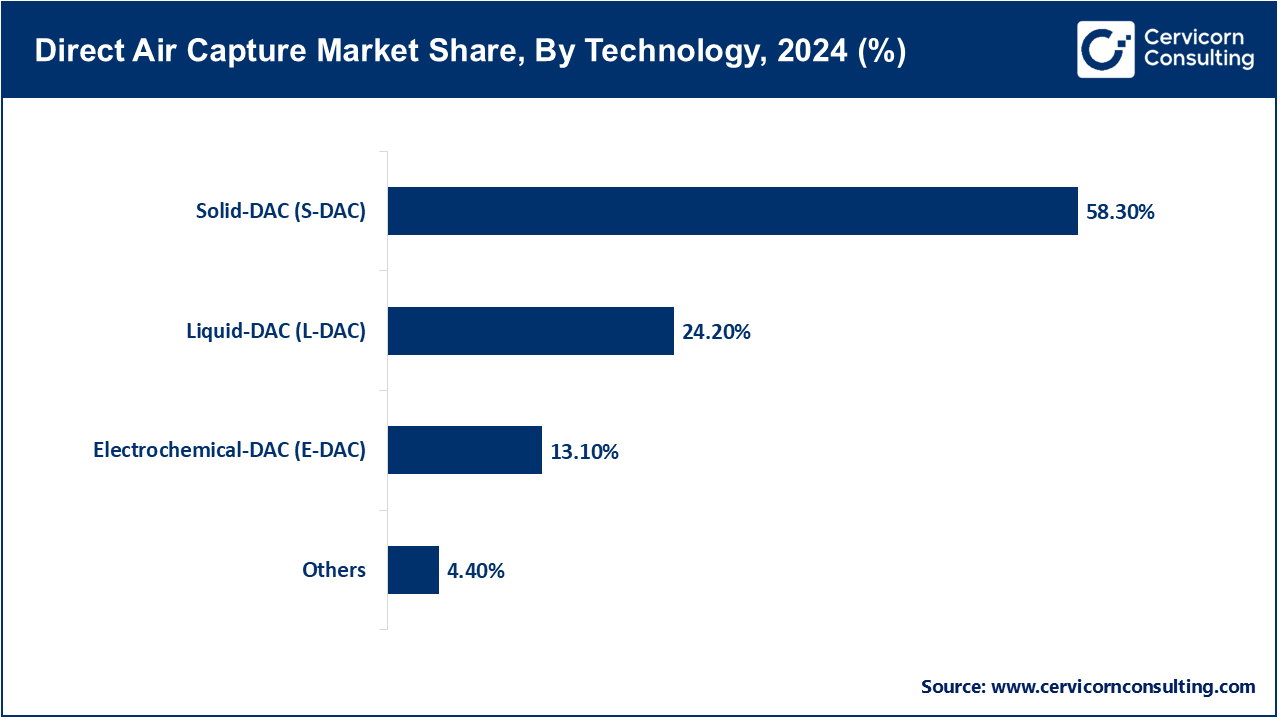

Solid-DAC (S-DAC): Solid-DAC technologies employ solid sorbents, like amine-coated filters and other porous materials, to extract CO2 from the air. CO2 can then be recovered for storage or utilization after undergoing temperature or pressure changes. In August 2025, researchers showcased the reversible CO2 capture and moisture-swing sorbent capabilities that perform better under certain humidity conditions. This development further enhances the dependable efficiency of solid-DAC technologies in real-world applications.

Liquid-DAC (L-DAC): Liquid amine and alkali solutions can also serve as chemical solvents to capture CO2 from the air, which can then be concentrated and released. In July 2025, industry articles reported that liquid absorption systems benefited from lower first-of-a-kind costs, which in turn, buoyed the overall cost. Thus, making L-DAC appealing for commercial operations that prioritize flexible and scalable systems.

Electrochemical-DAC (E-DAC): Electrochemical-DAC merges CO2 capture with its electrochemical conversion; thus, using electricity to capture the gas and transform it into fuel or chemicals. In July 2025, the Air2Chem project reported efficient results with DAC-integrated moisture electrolytic systems for platform chemical production. This enhanced the attractiveness of integrated E-DAC systems as the processes of capture and utilization could be consolidated into one integrated system.

Others: This includes new or emerging DAC methods that do not fit into solid, liquid, or electrochemical categories. In April 2025, Occidental acquired Holocene, which employs chemical looping - a hybrid method that uses cyclical reactions to capture CO2. Such methods demonstrate creativity beyond traditional DAC methods and pave new avenues for scalable CO2 removal.

Electric Power: Electricity-driven DAC utilizes various electrical energy sources to drive fans, pumps, or other electrochemical processes to capture CO2. In July 2025, Climeworks received $162 million to further refine the efficiency of electricity-operated DAC systems. This investment enables further development at their Mammoth facility in Iceland which showcases the commercial and technological maturity of electricity-driven DAC system.

Direct Air Capture Market Share, By Energy Source, 2024 (%)

| Energy Source | Revenue Share, 2024 (%) |

| Electricity | 68.30% |

| Heat | 31.70% |

Thermal energy: Heat-driven DAC uses lower-grade or waste thermal energy to regenerate the sorbents that capture CO2. In August 2025, Climeworks’ Mammoth facility utilizes Icelandic geothermal heat for DAC operations. This approach enhances energy efficiency, lowers electricity dependence, and supports continuous CO2 capture for subsequent storage or utilization.

Fewer than 10 collectors: Small-scale DAC installations tend to be less than 10 collector modules. These are usually for pilot or demonstration purposes. Heirloom’s pilot DAC plant in California with limited collector numbers was capturing 1,000 tCO2 per year in November 2023. This showcased small-scale DAC systems and refined operational data for future scaling.

Direct Air Capture Market Share, By Number of Collectors, 2024 (%)

| Number of Collectors | Revenue Share, 2024 (%) |

| Less than 10 Collectors | 56.40% |

| More than 10 Collectors | 43.60% |

More than 10 collectors: Large-scale DAC facilities employ more than 10 collectors to boost CO2 capture and throughput. Climeworks’ Mammoth facility in Iceland started capturing 36,000 tCO2 per year in May 2024. This marked the high-capacity DAC implementation and industrial-scale CO2 removal with DAC.

Carbon Capture and Storage (CCS): CCS strives to store captured carbon dioxide, CO2, permanently, typically underground and without any form of utilization or repurposing. Studies conducted in July 2025 indicated that DAC-derived CO2 was being prepared for geological storage. Industries seeking carbon neutrality without product utilization are able to achieve reliable long-term carbon sequestration.

Direct Air Capture Market Share, By Application, 2024 (%)

| Application | Revenue Share, 2024 (%) |

| Carbon Capture and Storage (CCS) | 78.21% |

| Carbon Capture Utilization and Storage (CCUS) | 21.79% |

Carbon Capture Utilization and Storage (CCUS): Combining CO2 utilization in products or fuels with storage of the remaining CO2 forms CCUS. In June 2025, Project Concho in West Texas was announced as a wind-powered DAC hub capturing CO2 for both storage and utilization, exemplifying carbon capture utilization and storage. This project blends CCS with commercial applications, demonstrating integrated approaches to maximization of value from carbon capture.

Oil & Gas: The captured CO2 can either be used in the enhanced oil recovery or stored permanently to counter the emission. In April 2025, Occidental planned to include a Stratos DAC contract plant in Texas to capture up to 500,000 tCO2 a year, part of which would be utilized in its oil and gas activities but also in corporate net zero emissions. This demonstrates the strategic position of DAC in terms of energy sector.

Food and Beverage: The CO2 captured is used as a raw material in carbonation and preservation of food and beverages. Removal credits associated with CO2 removal supplied by companies such as Climeworks would in July 2025 be used to enable carbon-neutral production by beverage producers. This illustrates the way in which DAC can assists industries in reducing their life cycle emissions in the face of consumer and government sustainability demands designed to support the global fight against climate change.

Automotive: DAC-derived CO2 can be turned into synthetic automobile fuel. In July 2025, the UK-based Carbon Neutral Fuels was funded to progress a DAC-to-fuel project generating sustainable fuels to be used in automobiles and aircraft. It indicates the decarbonization potential of DAC-derived fuels in the transport sector.

Chemicals: CO 2 that is taken captive is converted into industrial chemical production. In July 2025, the Air2Chem project was able to convert DAC-derived CO2 into platform chemicals through electrochemical conversion. This suggests that industrial opportunities involving large quantities of chemicals be made available as a potential end-use of captured CO2.

Healthcare: DAC-generated CO 2 may find application in medical or pharmaceutical manufacturing of processes where pure CO2 is needed. In July 2025, customers in Climeworks vast variety of industries, including medical applications, enjoyed access to high-quality produced CO2 to use in specialised applications. This shows a trend towards a new market segment of DAC other than energy and industrial utilization.

Others: Additional DAC end-uses are building materials, mineralization and agriculture. In August 2025, Climeworks and Carbfix were able to mineralize captured CO2 to rock in Iceland. This offers a different end-use solution in the construction and other industries, which demonstrates creative solutions to use captured carbon.

Market Segmentation

By Technology

By Energy Source

By Number of Collectors

By Application

By End-Use

By Region

Chapter 1. Market Introduction and Overview

1.1 Market Definition and Scope

1.1.1 Overview of Direct Air Capture

1.1.2 Scope of the Study

1.1.3 Research Timeframe

1.2 Research Methodology and Approach

1.2.1 Methodology Overview

1.2.2 Data Sources and Validation

1.2.3 Key Assumptions and Limitations

Chapter 2. Executive Summary

2.1 Market Highlights and Snapshot

2.2 Key Insights by Segments

2.2.1 By Technology Overview

2.2.2 By Energy Source Overview

2.2.3 By Number of Collectors Overview

2.2.4 By Application Overview

2.2.5 By End User Overview

2.3 Competitive Overview

Chapter 3. Global Impact Analysis

3.1 Russia-Ukraine Conflict: Global Market Implications

3.2 Regulatory and Policy Changes Impacting Global Markets

Chapter 4. Market Dynamics and Trends

4.1 Market Dynamics

4.1.1 Market Drivers

4.1.1.1 Government funding and policy support

4.1.1.2 Regional innovation and new entrants

4.1.2 Market Restraints

4.1.2.1 Considerable operational and economic expenditure

4.1.2.2 Insufficient CO2 demand channels for utilization

4.1.3 Market Challenges

4.1.3.1 Scaling and supply chain constraints

4.1.3.2 Feasibility of technology and reliance on models

4.1.4 Market Opportunities

4.1.4.1 Breakthroughs in Low-Energy Capture Techniques

4.1.4.2 Integration with Electrochemical CO2 Conversion

4.2 Market Trends

Chapter 5. Premium Insights and Analysis

5.1 Global Direct Air Capture Market Dynamics, Impact Analysis

5.2 Porter’s Five Forces Analysis

5.2.1 Bargaining Power of Suppliers

5.2.2 Bargaining Power of Buyers

5.2.3 Threat of Substitute Products

5.2.4 Rivalry among Existing Firms

5.2.5 Threat of New Entrants

5.3 PESTEL Analysis

5.4 Value Chain Analysis

5.5 Product Pricing Analysis

5.6 Vendor Landscape

5.6.1 List of Buyers

5.6.2 List of Suppliers

Chapter 6. Direct Air Capture Market, By Technology

6.1 Global Direct Air Capture Market Snapshot, By Technology

6.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

6.1.1.1 Solid-DAC (S-DAC)

6.1.1.2 Liquid-DAC (L-DAC)

6.1.1.3 Electrochemical-DAC (E-DAC)

6.1.1.4 Others

Chapter 7. Direct Air Capture Market, By Energy Source

7.1 Global Direct Air Capture Market Snapshot, By Energy Source

7.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

7.1.1.1 Electricity

7.1.1.2 Heat

Chapter 8. Direct Air Capture Market, By Number of Collectors

8.1 Global Direct Air Capture Market Snapshot, By Number of Collectors

8.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

8.1.1.1 Less than 10 Collectors

8.1.1.2 More than 10 Collectors

Chapter 9. Direct Air Capture Market, By Application

9.1 Global Direct Air Capture Market Snapshot, By Application

9.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

9.1.1.1 Carbon Capture and Storage (CCS)

9.1.1.2 Carbon Capture Utilization and Storage (CCUS)

Chapter 10. Direct Air Capture Market, By End-User

10.1 Global Direct Air Capture Market Snapshot, By End-User

10.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

10.1.1.1 Oil & Gas

10.1.1.2 Food and beverage

10.1.1.3 Automotive

10.1.1.4 Chemicals

10.1.1.5 Healthcare

10.1.1.6 Others

Chapter 11. Direct Air Capture Market, By Region

11.1 Overview

11.2 Direct Air Capture Market Revenue Share, By Region 2024 (%)

11.3 Global Direct Air Capture Market, By Region

11.3.1 Market Size and Forecast

11.4 North America

11.4.1 North America Direct Air Capture Market Revenue, 2022-2034 ($Billion)

11.4.2 Market Size and Forecast

11.4.3 North America Direct Air Capture Market, By Country

11.4.4 U.S.

11.4.4.1 U.S. Direct Air Capture Market Revenue, 2022-2034 ($Billion)

11.4.4.2 Market Size and Forecast

11.4.4.3 U.S. Market Segmental Analysis

11.4.5 Canada

11.4.5.1 Canada Direct Air Capture Market Revenue, 2022-2034 ($Billion)

11.4.5.2 Market Size and Forecast

11.4.5.3 Canada Market Segmental Analysis

11.4.6 Mexico

11.4.6.1 Mexico Direct Air Capture Market Revenue, 2022-2034 ($Billion)

11.4.6.2 Market Size and Forecast

11.4.6.3 Mexico Market Segmental Analysis

11.5 Europe

11.5.1 Europe Direct Air Capture Market Revenue, 2022-2034 ($Billion)

11.5.2 Market Size and Forecast

11.5.3 Europe Direct Air Capture Market, By Country

11.5.4 UK

11.5.4.1 UK Direct Air Capture Market Revenue, 2022-2034 ($Billion)

11.5.4.2 Market Size and Forecast

11.5.4.3 UKMarket Segmental Analysis

11.5.5 France

11.5.5.1 France Direct Air Capture Market Revenue, 2022-2034 ($Billion)

11.5.5.2 Market Size and Forecast

11.5.5.3 FranceMarket Segmental Analysis

11.5.6 Germany

11.5.6.1 Germany Direct Air Capture Market Revenue, 2022-2034 ($Billion)

11.5.6.2 Market Size and Forecast

11.5.6.3 GermanyMarket Segmental Analysis

11.5.7 Rest of Europe

11.5.7.1 Rest of Europe Direct Air Capture Market Revenue, 2022-2034 ($Billion)

11.5.7.2 Market Size and Forecast

11.5.7.3 Rest of EuropeMarket Segmental Analysis

11.6 Asia Pacific

11.6.1 Asia Pacific Direct Air Capture Market Revenue, 2022-2034 ($Billion)

11.6.2 Market Size and Forecast

11.6.3 Asia Pacific Direct Air Capture Market, By Country

11.6.4 China

11.6.4.1 China Direct Air Capture Market Revenue, 2022-2034 ($Billion)

11.6.4.2 Market Size and Forecast

11.6.4.3 ChinaMarket Segmental Analysis

11.6.5 Japan

11.6.5.1 Japan Direct Air Capture Market Revenue, 2022-2034 ($Billion)

11.6.5.2 Market Size and Forecast

11.6.5.3 JapanMarket Segmental Analysis

11.6.6 India

11.6.6.1 India Direct Air Capture Market Revenue, 2022-2034 ($Billion)

11.6.6.2 Market Size and Forecast

11.6.6.3 IndiaMarket Segmental Analysis

11.6.7 Australia

11.6.7.1 Australia Direct Air Capture Market Revenue, 2022-2034 ($Billion)

11.6.7.2 Market Size and Forecast

11.6.7.3 AustraliaMarket Segmental Analysis

11.6.8 Rest of Asia Pacific

11.6.8.1 Rest of Asia Pacific Direct Air Capture Market Revenue, 2022-2034 ($Billion)

11.6.8.2 Market Size and Forecast

11.6.8.3 Rest of Asia PacificMarket Segmental Analysis

11.7 LAMEA

11.7.1 LAMEA Direct Air Capture Market Revenue, 2022-2034 ($Billion)

11.7.2 Market Size and Forecast

11.7.3 LAMEA Direct Air Capture Market, By Country

11.7.4 GCC

11.7.4.1 GCC Direct Air Capture Market Revenue, 2022-2034 ($Billion)

11.7.4.2 Market Size and Forecast

11.7.4.3 GCCMarket Segmental Analysis

11.7.5 Africa

11.7.5.1 Africa Direct Air Capture Market Revenue, 2022-2034 ($Billion)

11.7.5.2 Market Size and Forecast

11.7.5.3 AfricaMarket Segmental Analysis

11.7.6 Brazil

11.7.6.1 Brazil Direct Air Capture Market Revenue, 2022-2034 ($Billion)

11.7.6.2 Market Size and Forecast

11.7.6.3 BrazilMarket Segmental Analysis

11.7.7 Rest of LAMEA

11.7.7.1 Rest of LAMEA Direct Air Capture Market Revenue, 2022-2034 ($Billion)

11.7.7.2 Market Size and Forecast

11.7.7.3 Rest of LAMEAMarket Segmental Analysis

Chapter 12. Competitive Landscape

12.1 Competitor Strategic Analysis

12.1.1 Top Player Positioning/Market Share Analysis

12.1.2 Top Winning Strategies, By Company, 2022-2024

12.1.3 Competitive Analysis By Revenue, 2022-2024

12.2 Recent Developments by the Market Contributors (2024)

Chapter 13. Company Profiles

13.1 Climeworks

13.1.1 Company Snapshot

13.1.2 Company and Business Overview

13.1.3 Financial KPIs

13.1.4 Product/Service Portfolio

13.1.5 Strategic Growth

13.1.6 Global Footprints

13.1.7 Recent Development

13.1.8 SWOT Analysis

13.2 Carbon Engineering ULC.

13.3 Global thermostat

13.4 Heirloom Carbon Technologies

13.5 Soletair Power

13.6 CarbonCapture Inc

13.7 Avnos, Inc.

13.8 Noya PBC

13.9 Skytree

13.10 RepAir