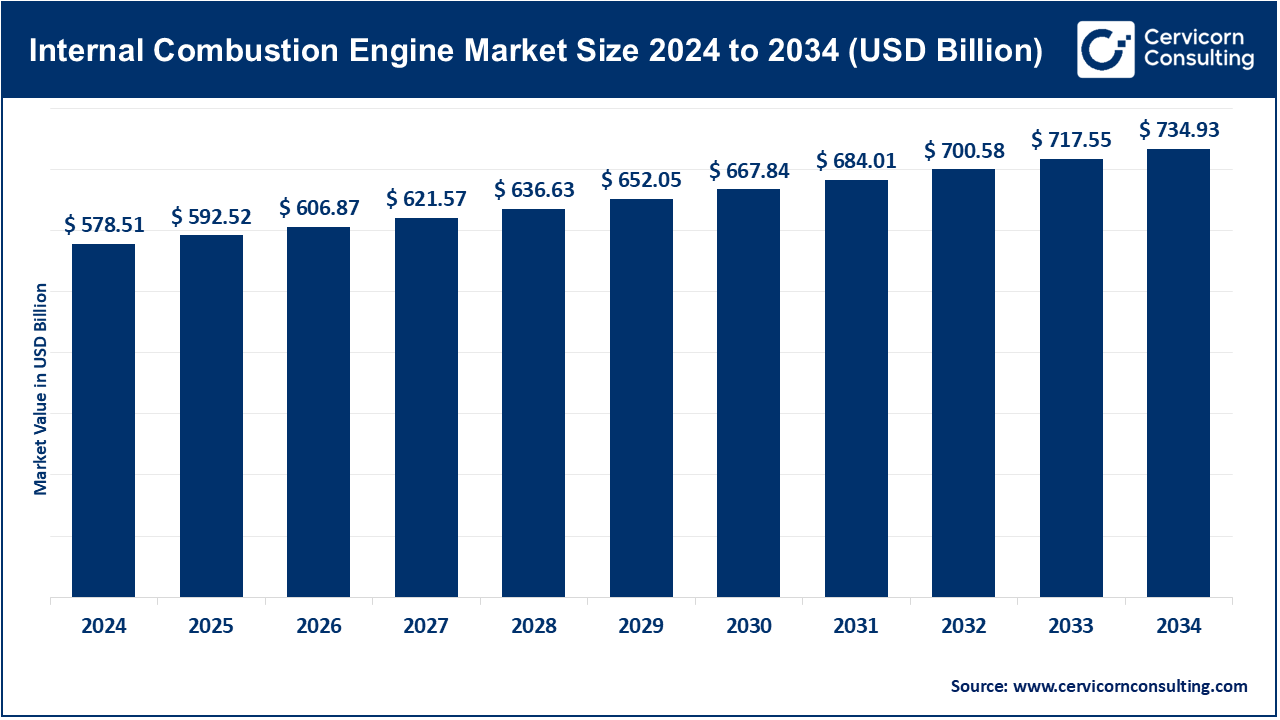

The global internal combustion engine market size was valued at USD 578.51 billion in 2024 and is expected to be worth around USD 734.93 billion by 2034, growing at a compound annual growth rate (CAGR) of 2.42% over the forecast period from 2025 to 2034. The internal combustion engine (ICE) market is steadily increasing as industries depend on reliable and efficient power systems for transport, agriculture, manufacturing and energy production. With innovations running in fuel efficiency, emission control and hybrid integration, ices are developing to meet modern performance and stability demands. While electrification receives traction, ICE is essential in limited EV infrastructure areas, providing cost -effective and proven solutions. Since businesses want reliable technology to support industrial development and dynamics, ICE market plays an important role in enabling operational efficiency and long-term development in global regions.

An internal combustion engine (ICE) is a type of heat engine that produces power by burning fuel. Within a small area known as a combustion chamber, a fuel-air mixture is burned in this kind of engine. This combustion produces hot, high-pressure gases that expand quickly, applying force to a moving part—usually a piston. This force pushes the piston, which turns its linear motion into rotational motion by driving a crankshaft. A car, generator, or other piece of equipment is then powered by this rotational energy. Directly converting fuel's chemical energy into mechanical work is the basic idea.

Report Scope

| Area of Focus | Details |

| Market Size in 2025 | USD 592.52 Billion |

| Expected Market Size in 2034 | USD 734.93 Billion |

| Projected CAGR 2025 to 2034 | 2.42% |

| Leading Region | Asia-Pacific |

| Key Segments | Fuel Type, Engine Type, Power Output, End-Use, Application, Region |

| Key Companies | AB Volvo, TOYOTA MOTOR CORPORATION, Volkswagen Group, Rolls-Royce plc, Mahindra & Mahindra Ltd., Renault Group, MITSUBISHI HEAVY INDUSTRIES, LTD., MAN, General Motors, Ford Motor Company, FCA US LLC, Robert Bosch GmbH, AGCO Corporation, Caterpillar, Shanghai Diesel Engine Co., Ltd. |

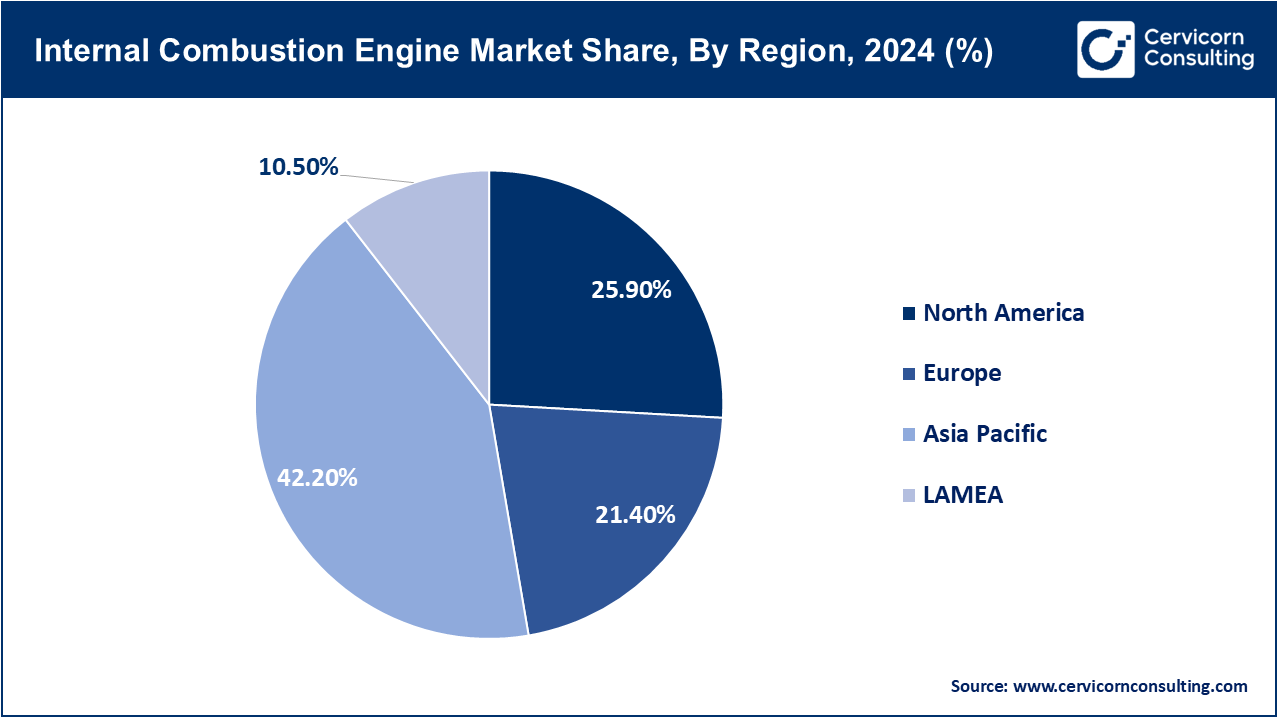

The internal combustion engine market is segmented into several key regions: North America, Europe, Asia-Pacific, and LAMEA (Latin America, Middle East, and Africa). Here’s an in-depth look at each region.

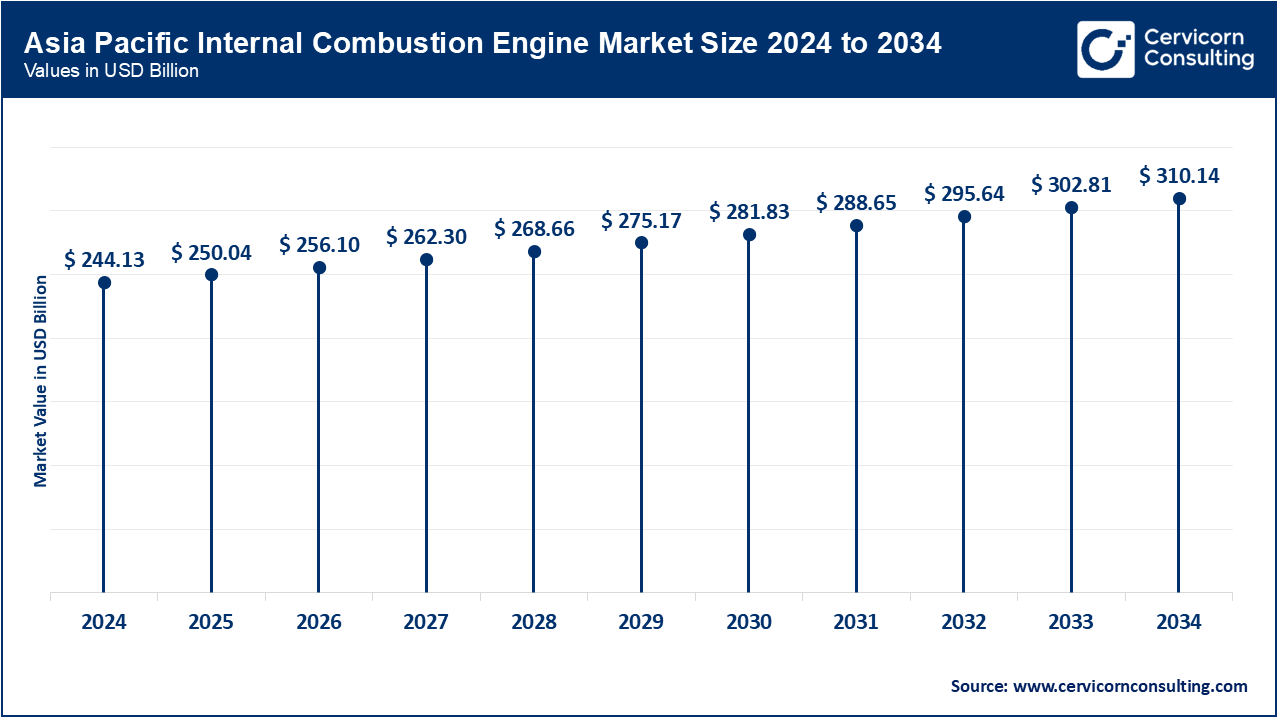

Countries like China, Japan, South Korea, India, and Australia make up the Asia-Pacific region, and it still continues to lead the world in the market for ICE due to the heavy demand for diesel-powered vehicles, commercial fleets, and even off-highway machinery. While electric vehicles (EVs) are on the rise, ICE, especially diesel engines, continue to be used in the infrastructure and agriculture sectors. The unveiling of FAW Group’s new 1.5L turbo-diesel engine for light trucks and commercial vehicles in August 2022 indicates that innovation aimed at improving efficiency and emissions is still persistent in this ICE region.

The North American market for ICE encompasses the US, Canada, Mexico, and smaller markets, all of which are driven by demand for heavy vehicles, commercial transportation, and legacy vehicle fleets. The ICE is still dominant in the industrial and agricultural sectors, even with the increase in EV adoption. In March 2024, General Motors announced its expansion of its engine plant in Canada for the V8 and inline engines to be used in North American trucks and SUVs. The investment of $1 billion further reinforces the region’s reliance on ICE technology, amid the prevailing trends towards electrification.

The ICE market for Europe comprises both the Western and Eastern EU countries. There are still persistent regulations on emissions, yet there remains persistent ICE usage in commercial and rural industries. There is an ongoing transitioning towards cleaner fuels balanced with ICE retention. In June 2023, Volkswagen Engine Division took the first step towards sustainable ICE production with the opening of its first europe-wide Plug-in Hybrid engine plant in Germany. It will produce ICEs with electrified components for compliance with Euro 7 norms. This marks a strategic shift towards coexistence between hybrid systems and ICE.

LAMEA is made up of countries such as Brazil, Middle Eastern countries and African countries. These countries still heavily rely on ICE due to weak EV infrastructure and the high price of electrification. LTEV (Low-Temperature Electronic Valve) engines are still widely used in agriculture, mining and heavy transport. In October 2024, Embraer made a positive change for the environment by becoming the first to reduce regional emissions with unleashing a biofuel-compatible diesel engine for agricultural aircraft. This shows how countries in this region are trying to modernize ICE with sustainable alternatives.

Gasoline: The spark ignition engines operate using gasoline as fuel and are ubiquitous in passenger vehicles because they are smoother and quieter. They offer rapid acceleration, but torque is lower than in diesel engines. In 2025, General Motors spent over $0.88 billion in a New York plant for the development of the next generation V8 gasoline engines. That investment further validated the usage of gasoline engines in full-size trucks and the SUVs, even as the inclination towards the electric vehicles continues worldwide.

ICE Market Share, By Fuel Type, 2024 (%)

| Fuel Type | Revenue Share, (%) |

| Gasoline | 60.38% |

| Diesel | 39.62% |

Diesel: The diesel engines utilize compression ignition, which provides better fuel efficiency and higher torque compared to gasoline engines. This impacts the commercial category of the automobile sector, and is especially robust with respect to the marine and commercial vehicles. At the Bharat Mobility Expo in 2025, Škoda rekindled diesel in India with the introduction of the diesel 2.0-litre TDI Superb which had marked uses for specific market needs. Continued advancements in diesel technology are focused on achieving lower emissions and enhanced efficiency in fuel consumption in line with the new industry standards.

Inline Engine: An inline engine has all cylinders arranged in a straight line, providing a simpler overall structure and less complicated maintenance. These engines are used for compact cars and smaller SUVs. Mazda reaffirmed inline configurations are still relevant with the rest of diesel systems in need of cleaner operational performance by modernizing the CX-60 SUV’s Skyactiv-D diesel engines emphasizing torque and low emissions with an inline 6-cylinder diesel engine.

ICE Market Share, By Engine Type, 2024 (%)

| Engine Type | Revenue Share, (%) |

| Inline Engine | 44.67% |

| V-type Engine | 55.33% |

V-type Engine: As opposed to the cylinders being arranged in a “V” shape which allows for compact design and increased power density for performance and luxury vehicles, V-type engines tend to be fitted on high-end sedans, sport cars and trucks. GM put out an additional USD 0.88 billion directed towards the production of a new-model V8 V-type engine intended for their Tonawanda plant which will cater to Full Size vehicles requiring more power in 2025. V-type engines remain essential to premium combustion platforms.

Below 100 HP: The small vehicles, two-wheeled units, and light machinery make use of engines under 100 horsepower. Such engines usually have low emissions and are fuel-efficient. The Kia introduced a diesel Carens MPV engine in 2023, aiming to meet the needs of value-driven customers while staying emission-compliant. Though low in power, these diesel engines are suitable for cost-sensitive and developing markets where they are often used in hybrid setups to increase their performance.

ICE Market Share, By Power Output, 2024 (%)

| Power Output | Revenue Share, (%) |

| Below 100 HP | 55.42% |

| 100–300 HP | 44.58% |

100–300 HP: It also includes mid-range SUVs, sedans, and light trucks, which are equipped with 100 to 300 horsepower engines. The fuel versatility is one of the advantages of the segments since these engines offer a good blend of performance and fuel economy. As an example, in 2024, Isuzu launched a 2.2L engine in D-MAX and MU-X models in Thailand. The rest of Southeast Asia was experiencing a spike in demand for mid-range diesel powertrains, so the new engine offered better drivability and enhanced transmission technology.

Automotive: This segment encompasses both the commercial vehicles and passenger vehicles, ranging from light-duty automobiles to heavy-duty trucks. ICEs are still the primary type of energy used, but there is a change to EVs. In 2023, Stellantis spent over 1 billion dollars modernizing the combustion engine plants in Italy for ICE and hybrid production. This investment has benefited the Jeep and Fiat models, proving that ICE vehicles are still a keystone of the automotive strategy worldwide.

ICE Market Share, By End User, 2024 (%)

| End User | Revenue Share, (%) |

| Automotive | 69.81% |

| Marine | 19.09% |

| Aircraft | 11.10% |

Marine: The application of ICEs in marine includes small boats, ships, and yachts which need reliable propulsion systems. Diesel engines dominate this sector due to their reliability and efficiency over long distances. In 2024, Wärtsilä expanded its marine engine portfolio by mid-range engines with low-emission dual fuel systems, adding to its mid-size vessel offerings. While hybrid systems are beginning to emerge, marine ICE engines are still advancing towards lowered emissions and greater digital controls for more environmentally friendly marine operations.

Passenger Cars: The last decade has seen changes to passenger cars. Their internal combustion engines (ICE) now operate within the range of 80-200 hp for both city and highway driving. While gasoline engines still sit at the top of the popularity list, diesel engines maintain dominance in some regions. Moreover, in 2023, Toyota announced the release of hybrid ICEs for both Camry and Corolla models which enhanced their fuel economy. This shift highlighted OEMs priorities on the improvement of thermal efficiency and hybridization to prolong the lifecycles of passenger cars.

ICE Market Share, By Application, 2024 (%)

| Application | Revenue Share, (%) |

| Passenger Cars | 65.74% |

| Commercial Vehicles | 34.26% |

Commercial Vehicles: The commercial vehicles include the buses, vans and trucks, which require high torque and durability. This category mainly consists of heavy-duty vehicles like trucks, buses and vans. These vehicles still rely on the diesel ICE because of its unrivalled efficiency in transporting heavy loads. To these ends, Cummins has made strides in alternate hybrids for commercial vehicles. In 2022, the company declared an investment of $2 billion in a new line of fuel-agnostic engines that can support blends of diesel, natural gas, and hydrogen. This ICE-agnostic approach underscores compliance with ever changing global regulations on commercial usage.

Market Segmentation

By Fuel Type

By Engine Type

By Power Output

By End-Use

By Application

By Region

Chapter 1. Market Introduction and Overview

1.1 Market Definition and Scope

1.1.1 Overview of Internal Combustion Engine

1.1.2 Scope of the Study

1.1.3 Research Timeframe

1.2 Research Methodology and Approach

1.2.1 Methodology Overview

1.2.2 Data Sources and Validation

1.2.3 Key Assumptions and Limitations

Chapter 2. Executive Summary

2.1 Market Highlights and Snapshot

2.2 Key Insights by Segments

2.2.1 By Fuel Type Overview

2.2.2 By Engine Type Overview

2.2.3 By Power Output Overview

2.2.4 By Application Overview

2.2.5 By End User Overview

2.3 Competitive Overview

Chapter 3. Global Impact Analysis

3.1 Russia-Ukraine Conflict: Global Market Implications

3.2 Regulatory and Policy Changes Impacting Global Markets

Chapter 4. Market Dynamics and Trends

4.1 Market Dynamics

4.1.1 Market Drivers

4.1.1.1 The emission regulations for driving innovation

4.1.1.2 Strategic diversification by OEM and oil giants

4.1.2 Market Restraints

4.1.2.1 Growing in the EV Adoption

4.1.2.2 Fuel price volatility and the environmental cost

4.1.3 Market Challenges

4.1.3.1 Hydrogen ICE Rollout for Fleet

4.1.3.2 ICE outsourcing model

4.1.4 Market Opportunities

4.1.4.1 The clean ICE technology is costly

4.1.4.2 Competition with falling EV cost

4.2 Market Trends

Chapter 5. Premium Insights and Analysis

5.1 Global Internal Combustion Engine Market Dynamics, Impact Analysis

5.2 Porter’s Five Forces Analysis

5.2.1 Bargaining Power of Suppliers

5.2.2 Bargaining Power of Buyers

5.2.3 Threat of Substitute Products

5.2.4 Rivalry among Existing Firms

5.2.5 Threat of New Entrants

5.3 PESTEL Analysis

5.4 Value Chain Analysis

5.5 Product Pricing Analysis

5.6 Vendor Landscape

5.6.1 List of Buyers

5.6.2 List of Suppliers

Chapter 6. Internal Combustion Engine Market, By Fuel Type

6.1 Global Internal Combustion Engine Market Snapshot, By Fuel Type

6.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

6.1.1.1 Gasoline

6.1.1.2 Diesel

Chapter 7. Internal Combustion Engine Market, By Engine Type

7.1 Global Internal Combustion Engine Market Snapshot, By Engine Type

7.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

7.1.1.1 Inline Engine

7.1.1.2 V-type Engine

Chapter 8. Internal Combustion Engine Market, By Power Output

8.1 Global Internal Combustion Engine Market Snapshot, By Power Output

8.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

8.1.1.1 Below 100 HP

8.1.1.2 100–300 HP

Chapter 9. Internal Combustion Engine Market, By Application

9.1 Global Internal Combustion Engine Market Snapshot, By Application

9.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

9.1.1.1 Passenger Cars

9.1.1.2 Commercial Vehicles

Chapter 10. Internal Combustion Engine Market, By End-User

10.1 Global Internal Combustion Engine Market Snapshot, By End-User

10.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

10.1.1.1 Automotive

10.1.1.2 Marine

10.1.1.3 Aircraft

Chapter 11. Internal Combustion Engine Market, By Region

11.1 Overview

11.2 Internal Combustion Engine Market Revenue Share, By Region 2024 (%)

11.3 Global Internal Combustion Engine Market, By Region

11.3.1 Market Size and Forecast

11.4 North America

11.4.1 North America Internal Combustion Engine Market Revenue, 2022-2034 ($Billion)

11.4.2 Market Size and Forecast

11.4.3 North America Internal Combustion Engine Market, By Country

11.4.4 U.S.

11.4.4.1 U.S. Internal Combustion Engine Market Revenue, 2022-2034 ($Billion)

11.4.4.2 Market Size and Forecast

11.4.4.3 U.S. Market Segmental Analysis

11.4.5 Canada

11.4.5.1 Canada Internal Combustion Engine Market Revenue, 2022-2034 ($Billion)

11.4.5.2 Market Size and Forecast

11.4.5.3 Canada Market Segmental Analysis

11.4.6 Mexico

11.4.6.1 Mexico Internal Combustion Engine Market Revenue, 2022-2034 ($Billion)

11.4.6.2 Market Size and Forecast

11.4.6.3 Mexico Market Segmental Analysis

11.5 Europe

11.5.1 Europe Internal Combustion Engine Market Revenue, 2022-2034 ($Billion)

11.5.2 Market Size and Forecast

11.5.3 Europe Internal Combustion Engine Market, By Country

11.5.4 UK

11.5.4.1 UK Internal Combustion Engine Market Revenue, 2022-2034 ($Billion)

11.5.4.2 Market Size and Forecast

11.5.4.3 UKMarket Segmental Analysis

11.5.5 France

11.5.5.1 France Internal Combustion Engine Market Revenue, 2022-2034 ($Billion)

11.5.5.2 Market Size and Forecast

11.5.5.3 FranceMarket Segmental Analysis

11.5.6 Germany

11.5.6.1 Germany Internal Combustion Engine Market Revenue, 2022-2034 ($Billion)

11.5.6.2 Market Size and Forecast

11.5.6.3 GermanyMarket Segmental Analysis

11.5.7 Rest of Europe

11.5.7.1 Rest of Europe Internal Combustion Engine Market Revenue, 2022-2034 ($Billion)

11.5.7.2 Market Size and Forecast

11.5.7.3 Rest of EuropeMarket Segmental Analysis

11.6 Asia Pacific

11.6.1 Asia Pacific Internal Combustion Engine Market Revenue, 2022-2034 ($Billion)

11.6.2 Market Size and Forecast

11.6.3 Asia Pacific Internal Combustion Engine Market, By Country

11.6.4 China

11.6.4.1 China Internal Combustion Engine Market Revenue, 2022-2034 ($Billion)

11.6.4.2 Market Size and Forecast

11.6.4.3 ChinaMarket Segmental Analysis

11.6.5 Japan

11.6.5.1 Japan Internal Combustion Engine Market Revenue, 2022-2034 ($Billion)

11.6.5.2 Market Size and Forecast

11.6.5.3 JapanMarket Segmental Analysis

11.6.6 India

11.6.6.1 India Internal Combustion Engine Market Revenue, 2022-2034 ($Billion)

11.6.6.2 Market Size and Forecast

11.6.6.3 IndiaMarket Segmental Analysis

11.6.7 Australia

11.6.7.1 Australia Internal Combustion Engine Market Revenue, 2022-2034 ($Billion)

11.6.7.2 Market Size and Forecast

11.6.7.3 AustraliaMarket Segmental Analysis

11.6.8 Rest of Asia Pacific

11.6.8.1 Rest of Asia Pacific Internal Combustion Engine Market Revenue, 2022-2034 ($Billion)

11.6.8.2 Market Size and Forecast

11.6.8.3 Rest of Asia PacificMarket Segmental Analysis

11.7 LAMEA

11.7.1 LAMEA Internal Combustion Engine Market Revenue, 2022-2034 ($Billion)

11.7.2 Market Size and Forecast

11.7.3 LAMEA Internal Combustion Engine Market, By Country

11.7.4 GCC

11.7.4.1 GCC Internal Combustion Engine Market Revenue, 2022-2034 ($Billion)

11.7.4.2 Market Size and Forecast

11.7.4.3 GCCMarket Segmental Analysis

11.7.5 Africa

11.7.5.1 Africa Internal Combustion Engine Market Revenue, 2022-2034 ($Billion)

11.7.5.2 Market Size and Forecast

11.7.5.3 AfricaMarket Segmental Analysis

11.7.6 Brazil

11.7.6.1 Brazil Internal Combustion Engine Market Revenue, 2022-2034 ($Billion)

11.7.6.2 Market Size and Forecast

11.7.6.3 BrazilMarket Segmental Analysis

11.7.7 Rest of LAMEA

11.7.7.1 Rest of LAMEA Internal Combustion Engine Market Revenue, 2022-2034 ($Billion)

11.7.7.2 Market Size and Forecast

11.7.7.3 Rest of LAMEAMarket Segmental Analysis

Chapter 12. Competitive Landscape

12.1 Competitor Strategic Analysis

12.1.1 Top Player Positioning/Market Share Analysis

12.1.2 Top Winning Strategies, By Company, 2022-2024

12.1.3 Competitive Analysis By Revenue, 2022-2024

12.2 Recent Developments by the Market Contributors (2024)

Chapter 13. Company Profiles

13.1 AB Volvo

13.1.1 Company Snapshot

13.1.2 Company and Business Overview

13.1.3 Financial KPIs

13.1.4 Product/Service Portfolio

13.1.5 Strategic Growth

13.1.6 Global Footprints

13.1.7 Recent Development

13.1.8 SWOT Analysis

13.2 TOYOTA MOTOR CORPORATION

13.3 Volkswagen Group

13.4 General Electric

13.5 Rolls-Royce plc

13.6 Mahindra & Mahindra Ltd.

13.7 Renault Group

13.8 MITSUBISHI HEAVY INDUSTRIES, LTD.

13.9 MAN

13.10 Ford Motor Company

13.11 FCA US LLC

13.12 Robert Bosch GmbH

13.13 AGCO Corporation

13.14 Caterpillar

13.15 Shanghai Diesel Engine Co., Ltd.