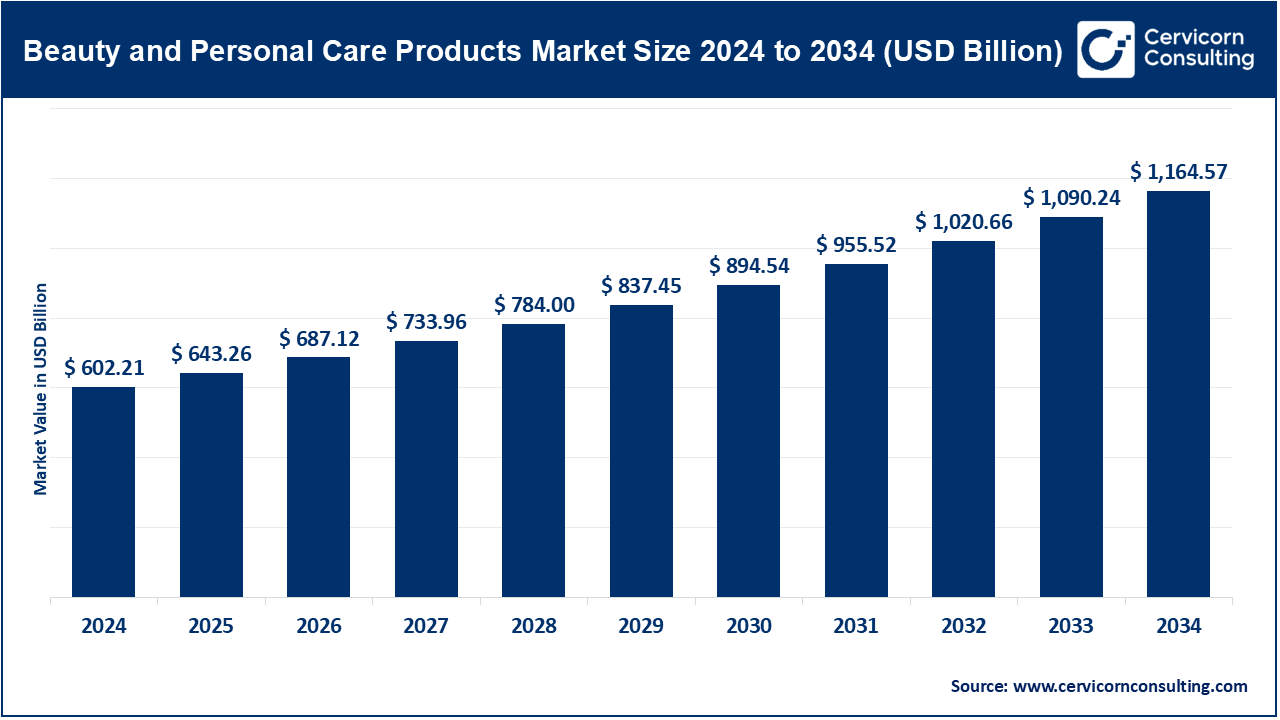

The global beauty and personal care products market size was reached at USD 602.21 billion in 2024 and is expected to be worth around USD 1,164.54 billion by 2034, growing at a compound annual growth rate (CAGR) of 7.9% over the forecast period 2025 to 2034.

The beauty and personal care products market is expected to flourish due to growing consumer awareness around personal grooming, rising demand for clean and sustainable beauty, urbanization in developing economies, and decreased cost of time in an increasing number of people. Technology advances being made in skincare innovation (you can use a person's genetics/bio-markers) and the use of artificial intelligence to recommend personal products will contribute to a more accessible and innovative market as the number of platforms expand. The development of technologies that allow products to be discovered through social media, as well as influence by beauty influencers and digital campaigns will accelerate the discovery of products for a growing number of consumers. In addition to these things, disposable income contributes to increased investment in premium, clean and sustainable products, and the desire for wellness-oriented beauty routines furthers premium product use. Many of the reasons mentioned above contribute to strong and widespread growth across all regions and segments.

The merger of biotechnology, modern sustainable technologies, and digital technology is changing the market landscape for beauty and personal care products. The active ingredients of skincare AI diagnostics and microbiome-friendly skincare products are being further developed. There is also an exponentially rising population of consumers desiring clean vegan, cruelty-free cosmetics which is leading to more sustainable subcontracting suppliers and greener packaging. Additionally, skin analysis software and AR/VR are transforming brand engagement. Such integration gives rise to multifunctional self-care cosmetics enabling holistic wellness. Self-expression, health, and wellness will be increasingly interconnected with the evolution of the BPC sector.

Report Scope

| Area of Focus | Details |

| Market Size in 2025 | USD 643.26 Billion |

| Expected Market Size in 2034 | USD 1164.57 Billion |

| Projected CAGR 2025 to 2034 | 7.9% |

| Key Region | Asia-Pacific |

| Key Segments | Product Type, End User, Distribution Channel, Nature, Region |

| Key Companies | Unilever, Estée Lauder, Shiseido, Revlon, Procter & Gamble, L'Oréal S.A., Coty Inc., Kao Corporation, AVON PRODUCTS, INC, ORIFLAME COSMETICS S.A. |

Skin Care: The skin care segment of BPC is at the forefront, mainly due to increasing concerns regarding skin conditions, anti-aging, and protection from the sun. There is increasing consumer demand for serums and specific moisturizers as well as protective and corrective masks. This remains an age-independent concern, especially in the Asia-Pacific and North America regions, as interest in clean and active-based formulations continues to grow.

Hair Care: Included in this segment are shampoos, conditioners, hair oils, and scalp treatments. Growth is fueled by increased consumer spending on hair care, scalp health, and related styling services. There is strong demand anti-dandruff shampoos, sulfate-free shampoos as well as products that claim to control hair fall. This segment is also aided by innovation in packaging and textures, as well as an emerging male clientele.

Beauty and Personal Care Products Market Revenue Share, By Product, 2024 (%)

| Product | Revenue Share, 2024 (%) |

| Skin Care | 45.01% |

| Hair Care | 19.25% |

| Oral Care | 14.10% |

| Color Cosmetics | 10.74% |

| Fragrances | 7.80% |

| Others | 3.10% |

Oral Care: The expanding domain of oral care includes basic hygiene along with whitening, herbal pastes, and gum health. At the same time, there is an increase in consumer spending on mouthwashes, electric toothbrushes, and probiotic toothpaste. The category is also gaining from the increasing level of dental concern in education-limited emerging markets where hygiene is on the rise and premium oral health care is gaining traction.

Color Cosmetics: Color cosmetics encompass makeup products such as foundation, eye shadow palettes, and lipsticks. While the category is emerging in some areas, it is also growing inclusively with vegan and long-wear options. Social media and influencer marketing drives purchasing behavior among Millennials and Gen Z, leading to a rapid innovation cycle due to sustained new demand and high churn rate.

Fragrances: Included in this category are perfumes, body mists, and deodorants. Shift is seen towards bespoke, eco-friendly and sustainable fragrance compositions, as well as unisex perfumes. New niche perfume brands and collaborations with celebrities is on the rise. Within the Middle East and Asia-Pacific, this region has seen traction for premium long-lasting perfumes which qualifies this segment as high-margin.

Bath & Shower: This includes body scrubs, shower gels, soaps, and bath oils. This segment is thriving alongside booming wellness trends which include aromatherapy, moisturizing, and relaxation. There is growing demand for ‘clean’ and pH-balanced formulations. Innovations in premium eco-friendly and green products focus on refillable packaging driving growth in this area.

Women: In the categories of skin and color cosmetics as well as haircare, women dominate the market share of consumers for BPC products. Improved income, access to information, and evolving beauty standards drives experimentation with and a shift to premium products. Inclusivity has widened for culturally targeted product lines aimed at women within age, skin type and ethnic background.

Men: The grooming and skincare sectors are more commonplace than ever before, thus, the growth rate of the men’s segment is exceptionally high. Demand is growing for men’s face wash, anti aging creams, beard oils, and fragrances. The social acceptance of grooming combined with the rising trend of male influencers is changing men’s beauty habits far beyond basic hygiene.

Beauty and Personal Care Products Market Revenue Share, By End User, 2024 (%)

| End User | Revenue Share, 2024 (%) |

| Women | 40.50% |

| Men | 35.20% |

| Children/Baby Care | 24.30% |

Children/Baby Care: This category incorporates sensitive moisturizers, shampoos, and sunscreens. There is a growing trend to design these products without parabens, sulfates, or artificial fragrances. There is still relatively little intellectual discourse concerning infant skin care safety and the demand for natural formulations. There is focus placed on pediatric dermatology along with organic certifications.

Organic: The organic segment has dominated the market in 2024. Organic BPC products are actively promoted in both hair care and skincare lines. They contain ingredients that are cultivated without the use of synthetic pesticides or fertilizers. This subset appeals to eco-friendly consumers looking for clean, safe, and certified skincare. Global certifications such as USDA Organic and COSMOS strengthen trust in these products. Although premium-priced most of the time, organic formulations are becoming more popular because there is growing awareness of the potential health benefits and environmental impacts.

Natural: Natural beauty products include plant oils and minerals as ingredients, as well as botanical extracts. These products do not fulfill organic certification standards, but are presumed to be safer and gentler. Consumers guided by transparency and sensitive skin typically gravitate toward these products. This area sees strong growth in the bath and skincare categories.

Conventional: Conventional BPC products have the largest market share and are the most accessible. They depend on synthetic ingredients, preservatives, and fragrances to ensure a long shelf life, consistent performance, and low price. This segment benefits from high brand awareness, market share and availability in numerous retail outlets. While they are facing pressure from clean beauty trends, there is still a large audience that identifies with these products and is looking for low-cost options.

Vegan & Cruelty-Free: These products do not contain any ingredients from animals and have not been tested on animals. This bioethical stance is popular among environmental advocates which make it appealing to Gen Z and Millenial consumers. Cruelty free certifications like Leaping Bunny and PETA add to its credibility. There is massive growth of online and offline retail for brands that use plant-based ingredients and eco-friendly packaging.

Hypermarkets & Supermarkets: The supermarkets/hypermarkets segment has captured highest revenue share in 2024. These stores are essential for everyday BPC (Beauty and Personal Care) products as they provide wide availability, ease of access, and competitive pricing. Soaps, shampoos, and toothpaste are frequently purchased in bulk through these channels. In-store promotions and sales bundling alongside significant transactional discounts accelerate the purchase of these products in large quantities. Despite emerging threats posed by digital marketplaces, hypermarkets remain steadfast in their dominance in low-cost areas and play a vital role in sustaining mass beauty brands.

Specialty Stores: Sephora, Ulta, and Nykaa fall under this category, offering specialized beauty retailing as well as an exceptional out-of-home shopping experience. Customers can receive specialist consultations alongside other premium products, which are very inviting. While some consumers may be lured by adult color cosmetics, skincare “test-out sessions” and exclusive launches are major pull factors. Specialty beauty retailing through specialized intervention thrives due to strong brand positioning and appeal focused on impact, engagement, and interaction rather than inventory on-hand. They rely primarily on impact, engagement, and brand interaction rather than stock availability.

E-commerce: Consumers enjoy comprehensive access to products, customizable shopping experiences, reviews, and recommendations; as a result, e-commerce has quickly become the most preferred shopping avenue. For clients, the ease of acquiring diverse products, AI tools guiding their shopping, virtual try-ons, and D2C models significantly popularized shopping. The COVID-19 virus sped along the digital agenda, making adaptation to e-commerce services vital; as a result, international markets have focused their strategies on beauty brands and shifted emphasis towards online shopping.

Others: This category encompasses pharmacies, department stores, and direct sales, including multi-level marketing and direct-to-consumer sales. Pharmacies serve as preferred retail outlets for dermocosmetics. Luxury fragrances and skincare products are offered at department stores. Direct selling is more common in rural regions or developing countries where personal demonstrations carry more weight. Each of these sub-channels addresses a specific need in regard to various consumer segments.

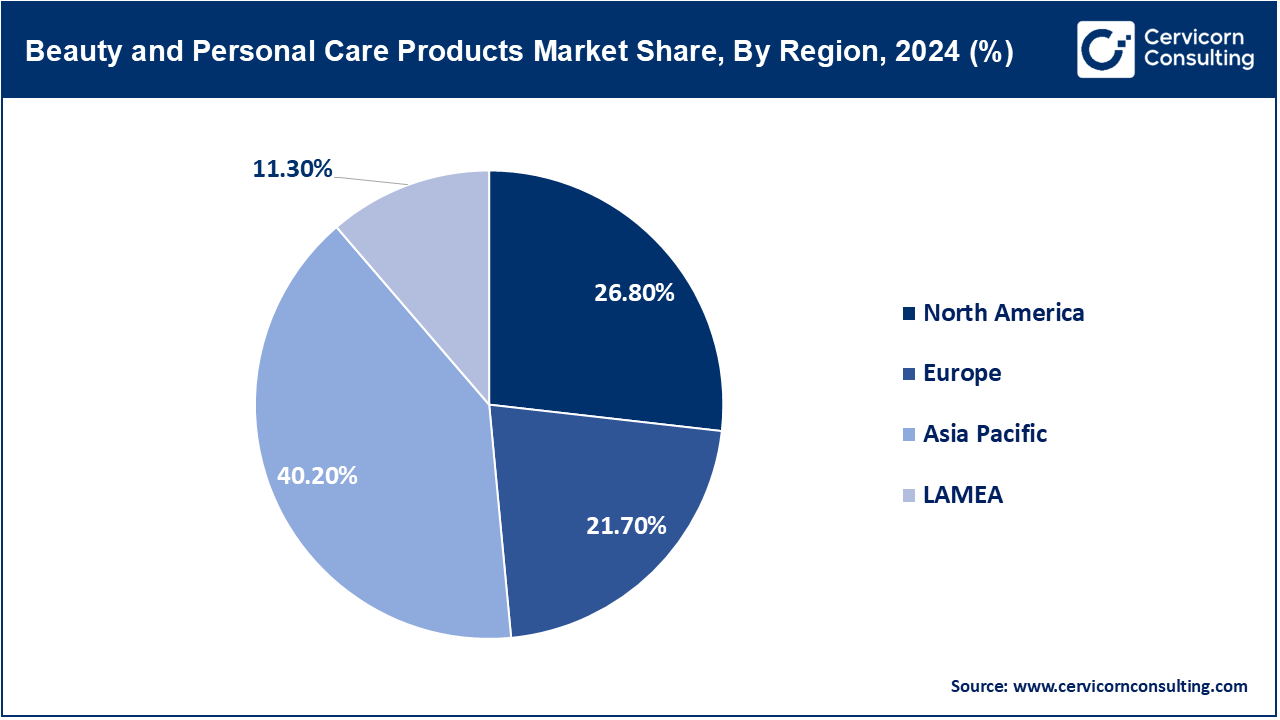

The beauty and personal care products market is segmented into several key regions: North America, Europe, Asia-Pacific, and LAMEA (Latin America, Middle East, and Africa). Here’s an in-depth look at each region

The U.S. and Canada is characterized as mature; in addition, North America is a world leader in both consumer spending and innovation. The growth is fueled by Clean beauty innovations, wellness products, and anti-aging products. E-commerce development is quite notable for influencer-owned brands and D2C sales models. Brand endorsement enhances compliance with regulations and strengthens trust in the brand as well as the quality of the product.

Europe is famous for branded products which focuses on safety, sustainability and premium quality, especially in the skincare sector. France, Germany, and the UK are home to established luxury market players as well as emerging organic labels. The reputation of strict regulatory standards coupled with interest in dermo-cosmetics serves the markand as well, particularly among age-conscious consumers. There is interest in eco-packaging and cruelty-free certifications.

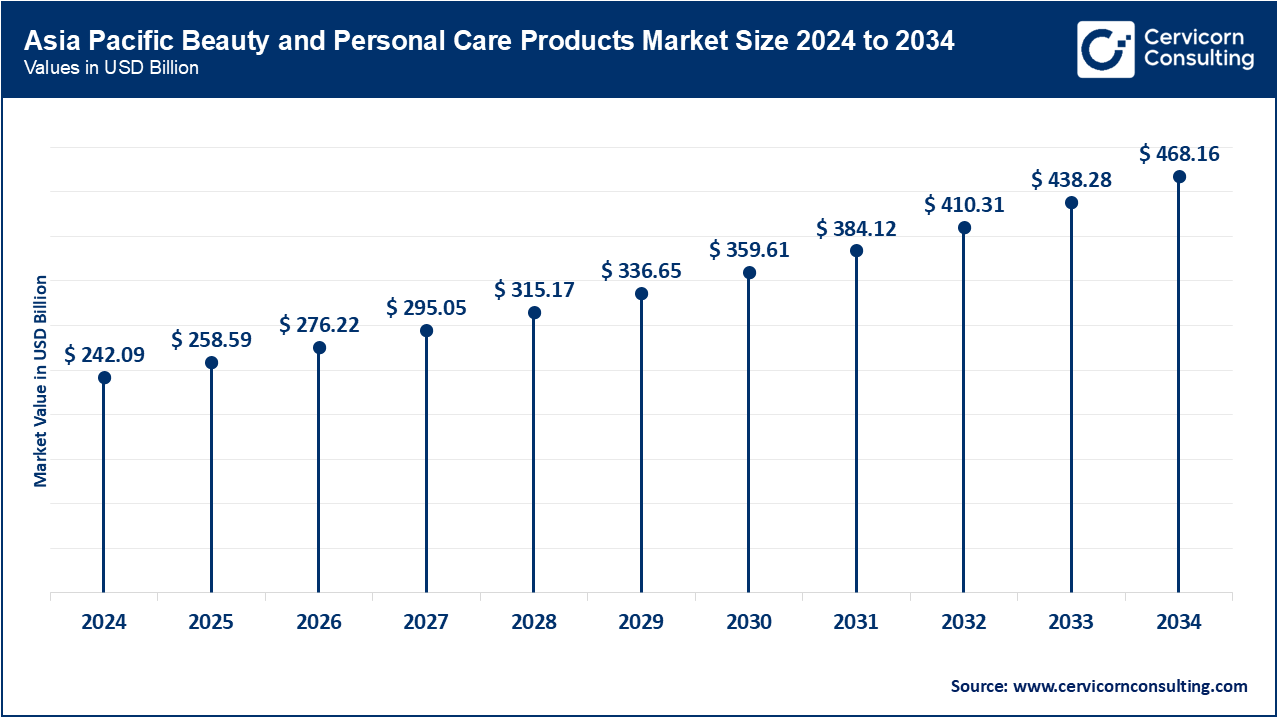

Asia Pacific leads the pack in growth due to high population density, rising incomes, and a culture that prioritizes skincare. China, Japan, South Korea, and India are leaders in demand. Global innovations are influenced by K-beauty and J-beauty trends. The region combines influencer marketing, a robust digital presence, and a strong demand for skin whitening and brightening products. This region celebrates technology-driven customization, alongside beauty experimentation.

Growing metropolitan areas and increased awareness of beauty and skincare products are favorable for the LAMEA region’s development opportunities. Latin America’s leaders are Brazil and Mexico while the Gulf Cooperation Council countries drive the Mid East’s need for luxury goods, including upscale halal. African markets are emerging along with their region-specific skincare requirements. The hair care, sun care, and fragrance markets are all driven by low cost and local culture adaptation.

Recent strategic developments in the beauty and personal care products industry highlight a strong pivot toward sustainability, digitalization, and ecosystem-driven innovation. Leading brands like Unilever, Shiseido, and L'Oréal are forming alliances with biotech firms, AI startups, and green packaging providers to co-create clean formulations, personalized skincare solutions, and refillable product systems. Collaborations with dermatological research labs and e-commerce platforms are accelerating smart diagnostics, virtual try-ons, and data-enabled product recommendations. Efforts to align with global ESG standards, reduce carbon emissions, and implement circular supply chains are reshaping industry benchmarks. These strategic moves are not only enhancing brand value but also transforming the BPC sector into a tech-integrated, ethical consumer ecosystem.

Market Segmentation

By Product Type

By Distribution Channel

By Nature

By End User

By Region

Chapter 1. Market Introduction and Overview

1.1 Market Definition and Scope

1.1.1 Overview of Beauty and Personal Care Products

1.1.2 Scope of the Study

1.1.3 Research Timeframe

1.2 Research Methodology and Approach

1.2.1 Methodology Overview

1.2.2 Data Sources and Validation

1.2.3 Key Assumptions and Limitations

Chapter 2. Executive Summary

2.1 Market Highlights and Snapshot

2.2 Key Insights by Segments

2.2.1 By Product Overview

2.2.2 By Distribution Channel Overview

2.2.3 By Nature Overview

2.2.4 By End User Overview

2.3 Competitive Overview

Chapter 3. Global Impact Analysis

3.1 Russia-Ukraine Conflict: Global Market Implications

3.2 Regulatory and Policy Changes Impacting Global Markets

Chapter 4. Market Dynamics and Trends

4.1 Market Dynamics

4.1.1 Market Drivers

4.1.1.1 Wellness-Cultural Influence on BPC Adoption

4.1.1.2 Social Media and Influencers Driving Reach

4.1.1.3 The Shift Towards Sustainability & Eco-Friendly Packaging

4.1.2 Market Restraints

4.1.2.1 Fierce Competition & Market Saturation

4.1.2.2 Raw Material Price Volatility

4.1.3 Market Challenges

4.1.3.1 Regulatory Fragmentation and Delays in Reform

4.1.3.2 Counterfeit Products Undermining Brand Trust

4.1.4 Market Opportunities

4.1.4.1 Growing Natural and Organic Product Uses

4.1.4.2 Emergence of Male & Unisex Grooming

4.1.4.3 The Premium/Luxury Branded CPC Products Growth

4.2 Market Trends

Chapter 5. Premium Insights and Analysis

5.1 Global Beauty and Personal Care Products Market Dynamics, Impact Analysis

5.2 Porter’s Five Forces Analysis

5.2.1 Bargaining Power of Suppliers

5.2.2 Bargaining Power of Buyers

5.2.3 Threat of Substitute Products

5.2.4 Rivalry among Existing Firms

5.2.5 Threat of New Entrants

5.3 PESTEL Analysis

5.4 Value Chain Analysis

5.5 Product Pricing Analysis

5.6 Vendor Landscape

5.6.1 List of Buyers

5.6.2 List of Suppliers

Chapter 6. Beauty and Personal Care Products Market, By Product

6.1 Global Beauty and Personal Care Products Market Snapshot, By Product

6.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

6.1.1.1 Body Skin Care

6.1.1.2 Skin Care

6.1.1.3 Hair Care

6.1.1.4 Oral Care

6.1.1.5 Color Cosmetics

6.1.1.6 Fragrances

6.1.1.7 Others

Chapter 7. Beauty and Personal Care Products Market, By Distribution Channel

7.1 Global Beauty and Personal Care Products Market Snapshot, By Distribution Channel

7.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

7.1.1.1 Online Retail

7.1.1.2 Supermarkets/Hypermarkets

7.1.1.3 Specialty Stores

7.1.1.4 Pharmacies/Drugstores

7.1.1.5 Direct Sales

7.1.1.6 Department Stores

Chapter 8. Beauty and Personal Care Products Market, By Nature

8.1 Global Beauty and Personal Care Products Market Snapshot, By Nature

8.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

8.1.1.1 Organic

8.1.1.2 Natural

8.1.1.3 Conventional

8.1.1.4 Vegan & Cruelty-Free

Chapter 9. Beauty and Personal Care Products Market, By End-User

9.1 Global Beauty and Personal Care Products Market Snapshot, By End-User

9.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

9.1.1.1 Women

9.1.1.2 Men

9.1.1.3 Children/Baby Care

Chapter 10. Beauty and Personal Care Products Market, By Region

10.1 Overview

10.2 Beauty and Personal Care Products Market Revenue Share, By Region 2024 (%)

10.3 Global Beauty and Personal Care Products Market, By Region

10.3.1 Market Size and Forecast

10.4 North America

10.4.1 North America Beauty and Personal Care Products Market Revenue, 2022-2034 ($Billion)

10.4.2 Market Size and Forecast

10.4.3 North America Beauty and Personal Care Products Market, By Country

10.4.4 U.S.

10.4.4.1 U.S. Beauty and Personal Care Products Market Revenue, 2022-2034 ($Billion)

10.4.4.2 Market Size and Forecast

10.4.4.3 U.S. Market Segmental Analysis

10.4.5 Canada

10.4.5.1 Canada Beauty and Personal Care Products Market Revenue, 2022-2034 ($Billion)

10.4.5.2 Market Size and Forecast

10.4.5.3 Canada Market Segmental Analysis

10.4.6 Mexico

10.4.6.1 Mexico Beauty and Personal Care Products Market Revenue, 2022-2034 ($Billion)

10.4.6.2 Market Size and Forecast

10.4.6.3 Mexico Market Segmental Analysis

10.5 Europe

10.5.1 Europe Beauty and Personal Care Products Market Revenue, 2022-2034 ($Billion)

10.5.2 Market Size and Forecast

10.5.3 Europe Beauty and Personal Care Products Market, By Country

10.5.4 UK

10.5.4.1 UK Beauty and Personal Care Products Market Revenue, 2022-2034 ($Billion)

10.5.4.2 Market Size and Forecast

10.5.4.3 UKMarket Segmental Analysis

10.5.5 France

10.5.5.1 France Beauty and Personal Care Products Market Revenue, 2022-2034 ($Billion)

10.5.5.2 Market Size and Forecast

10.5.5.3 FranceMarket Segmental Analysis

10.5.6 Germany

10.5.6.1 Germany Beauty and Personal Care Products Market Revenue, 2022-2034 ($Billion)

10.5.6.2 Market Size and Forecast

10.5.6.3 GermanyMarket Segmental Analysis

10.5.7 Rest of Europe

10.5.7.1 Rest of Europe Beauty and Personal Care Products Market Revenue, 2022-2034 ($Billion)

10.5.7.2 Market Size and Forecast

10.5.7.3 Rest of EuropeMarket Segmental Analysis

10.6 Asia Pacific

10.6.1 Asia Pacific Beauty and Personal Care Products Market Revenue, 2022-2034 ($Billion)

10.6.2 Market Size and Forecast

10.6.3 Asia Pacific Beauty and Personal Care Products Market, By Country

10.6.4 China

10.6.4.1 China Beauty and Personal Care Products Market Revenue, 2022-2034 ($Billion)

10.6.4.2 Market Size and Forecast

10.6.4.3 ChinaMarket Segmental Analysis

10.6.5 Japan

10.6.5.1 Japan Beauty and Personal Care Products Market Revenue, 2022-2034 ($Billion)

10.6.5.2 Market Size and Forecast

10.6.5.3 JapanMarket Segmental Analysis

10.6.6 India

10.6.6.1 India Beauty and Personal Care Products Market Revenue, 2022-2034 ($Billion)

10.6.6.2 Market Size and Forecast

10.6.6.3 IndiaMarket Segmental Analysis

10.6.7 Australia

10.6.7.1 Australia Beauty and Personal Care Products Market Revenue, 2022-2034 ($Billion)

10.6.7.2 Market Size and Forecast

10.6.7.3 AustraliaMarket Segmental Analysis

10.6.8 Rest of Asia Pacific

10.6.8.1 Rest of Asia Pacific Beauty and Personal Care Products Market Revenue, 2022-2034 ($Billion)

10.6.8.2 Market Size and Forecast

10.6.8.3 Rest of Asia PacificMarket Segmental Analysis

10.7 LAMEA

10.7.1 LAMEA Beauty and Personal Care Products Market Revenue, 2022-2034 ($Billion)

10.7.2 Market Size and Forecast

10.7.3 LAMEA Beauty and Personal Care Products Market, By Country

10.7.4 GCC

10.7.4.1 GCC Beauty and Personal Care Products Market Revenue, 2022-2034 ($Billion)

10.7.4.2 Market Size and Forecast

10.7.4.3 GCCMarket Segmental Analysis

10.7.5 Africa

10.7.5.1 Africa Beauty and Personal Care Products Market Revenue, 2022-2034 ($Billion)

10.7.5.2 Market Size and Forecast

10.7.5.3 AfricaMarket Segmental Analysis

10.7.6 Brazil

10.7.6.1 Brazil Beauty and Personal Care Products Market Revenue, 2022-2034 ($Billion)

10.7.6.2 Market Size and Forecast

10.7.6.3 BrazilMarket Segmental Analysis

10.7.7 Rest of LAMEA

10.7.7.1 Rest of LAMEA Beauty and Personal Care Products Market Revenue, 2022-2034 ($Billion)

10.7.7.2 Market Size and Forecast

10.7.7.3 Rest of LAMEAMarket Segmental Analysis

Chapter 11. Competitive Landscape

11.1 Competitor Strategic Analysis

11.1.1 Top Player Positioning/Market Share Analysis

11.1.2 Top Winning Strategies, By Company, 2022-2024

11.1.3 Competitive Analysis By Revenue, 2022-2024

11.2 Recent Developments by the Market Contributors (2024)

Chapter 12. Company Profiles

12.1 Unilever

12.1.1 Company Snapshot

12.1.2 Company and Business Overview

12.1.3 Financial KPIs

12.1.4 Product/Service Portfolio

12.1.5 Strategic Growth

12.1.6 Global Footprints

12.1.7 Recent Development

12.1.8 SWOT Analysis

12.2 Estée Lauder

12.3 Shiseido

12.4 Revlon

12.5 Procter & Gamble

12.6 L'Oréal S.A.

12.7 Coty Inc.

12.8 Kao Corporation

12.9 AVON PRODUCTS, INC

12.10 ORIFLAME COSMETICS S.A.