Beauty and Personal Care Products Market Size and Growth 2025 to 2034

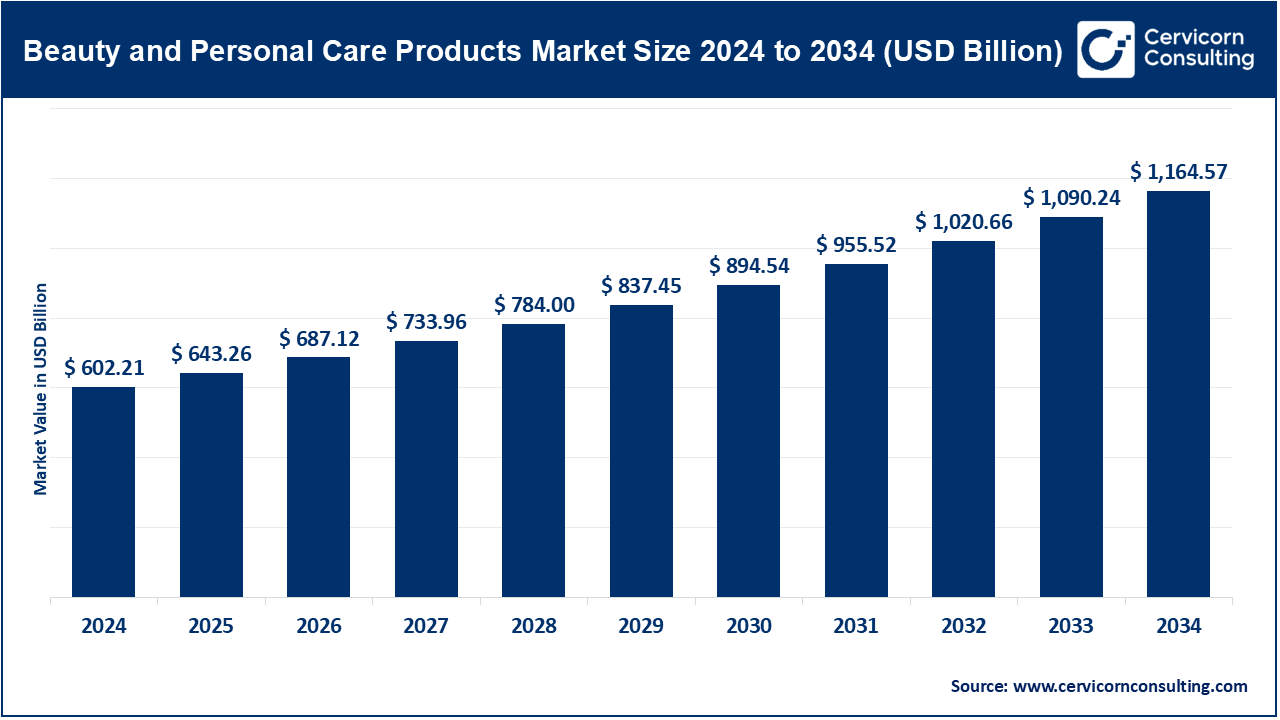

The global beauty and personal care products market size was reached at USD 602.21 billion in 2024 and is expected to be worth around USD 1,164.54 billion by 2034, growing at a compound annual growth rate (CAGR) of 7.9% over the forecast period 2025 to 2034.

The beauty and personal care products market is expected to flourish due to growing consumer awareness around personal grooming, rising demand for clean and sustainable beauty, urbanization in developing economies, and decreased cost of time in an increasing number of people. Technology advances being made in skincare innovation (you can use a person's genetics/bio-markers) and the use of artificial intelligence to recommend personal products will contribute to a more accessible and innovative market as the number of platforms expand. The development of technologies that allow products to be discovered through social media, as well as influence by beauty influencers and digital campaigns will accelerate the discovery of products for a growing number of consumers. In addition to these things, disposable income contributes to increased investment in premium, clean and sustainable products, and the desire for wellness-oriented beauty routines furthers premium product use. Many of the reasons mentioned above contribute to strong and widespread growth across all regions and segments.

The merger of biotechnology, modern sustainable technologies, and digital technology is changing the market landscape for beauty and personal care products. The active ingredients of skincare AI diagnostics and microbiome-friendly skincare products are being further developed. There is also an exponentially rising population of consumers desiring clean vegan, cruelty-free cosmetics which is leading to more sustainable subcontracting suppliers and greener packaging. Additionally, skin analysis software and AR/VR are transforming brand engagement. Such integration gives rise to multifunctional self-care cosmetics enabling holistic wellness. Self-expression, health, and wellness will be increasingly interconnected with the evolution of the BPC sector.

Beauty and Personal Care Products Market Report Highlights

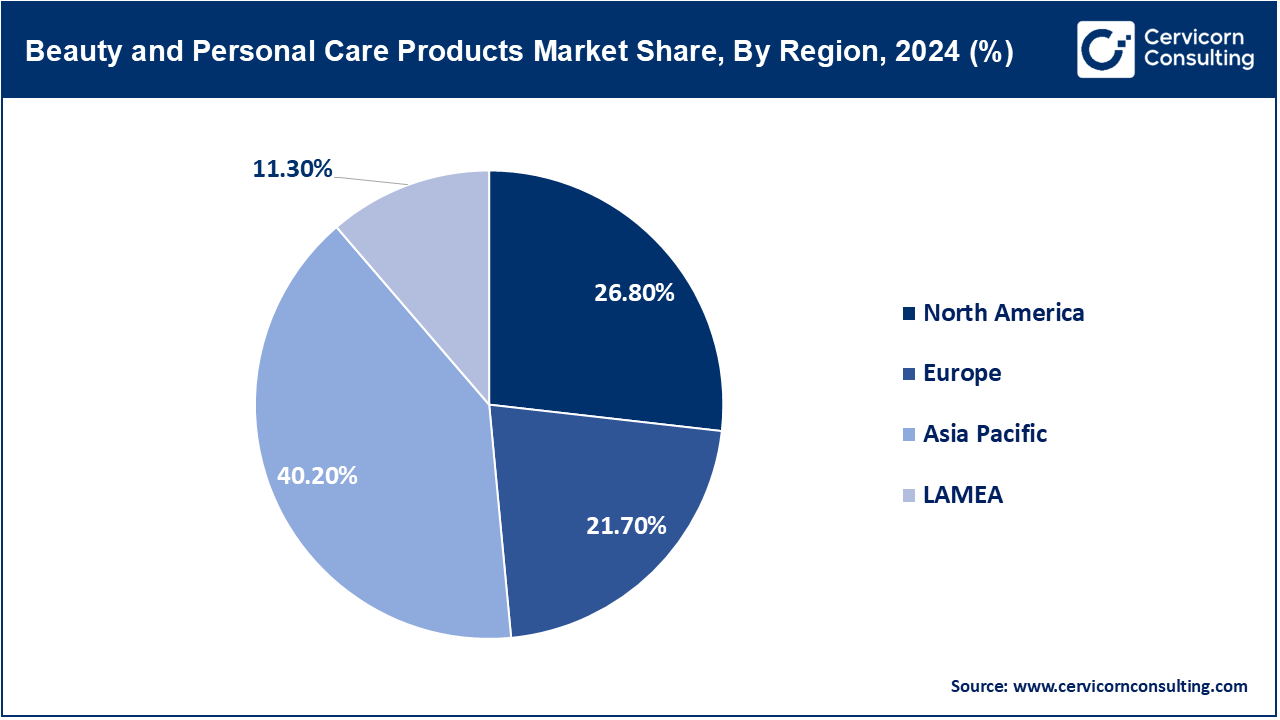

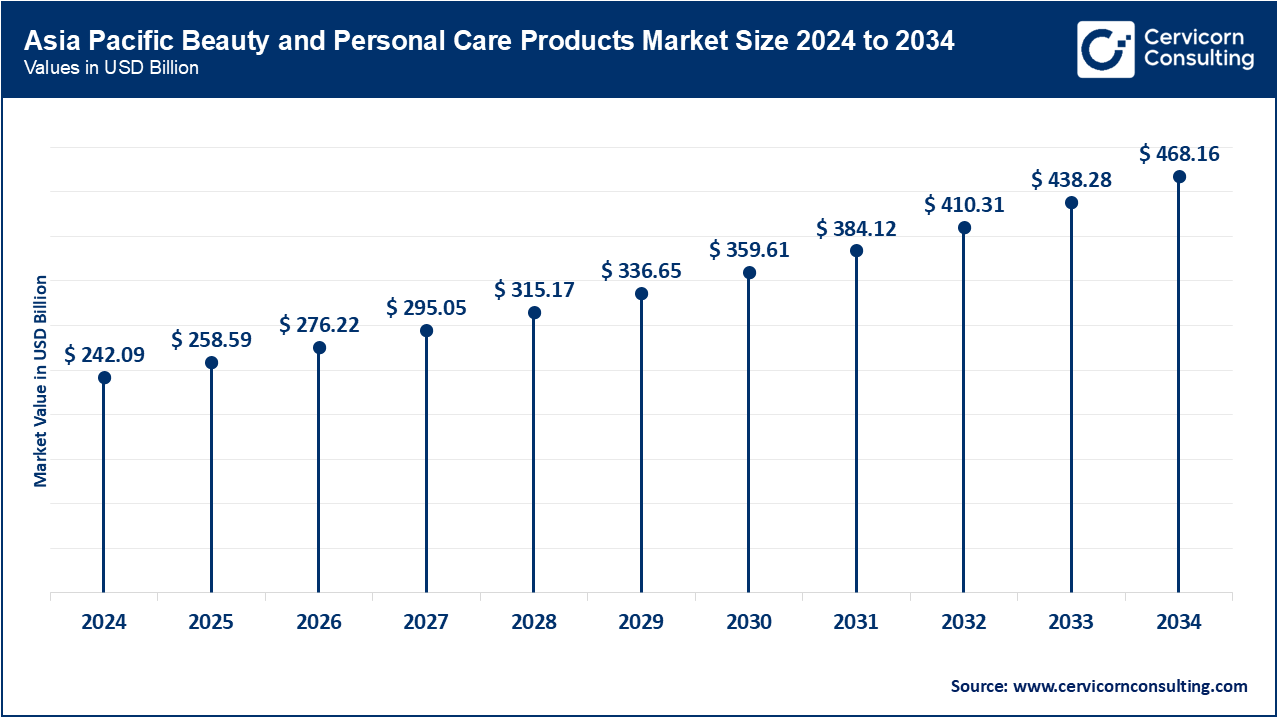

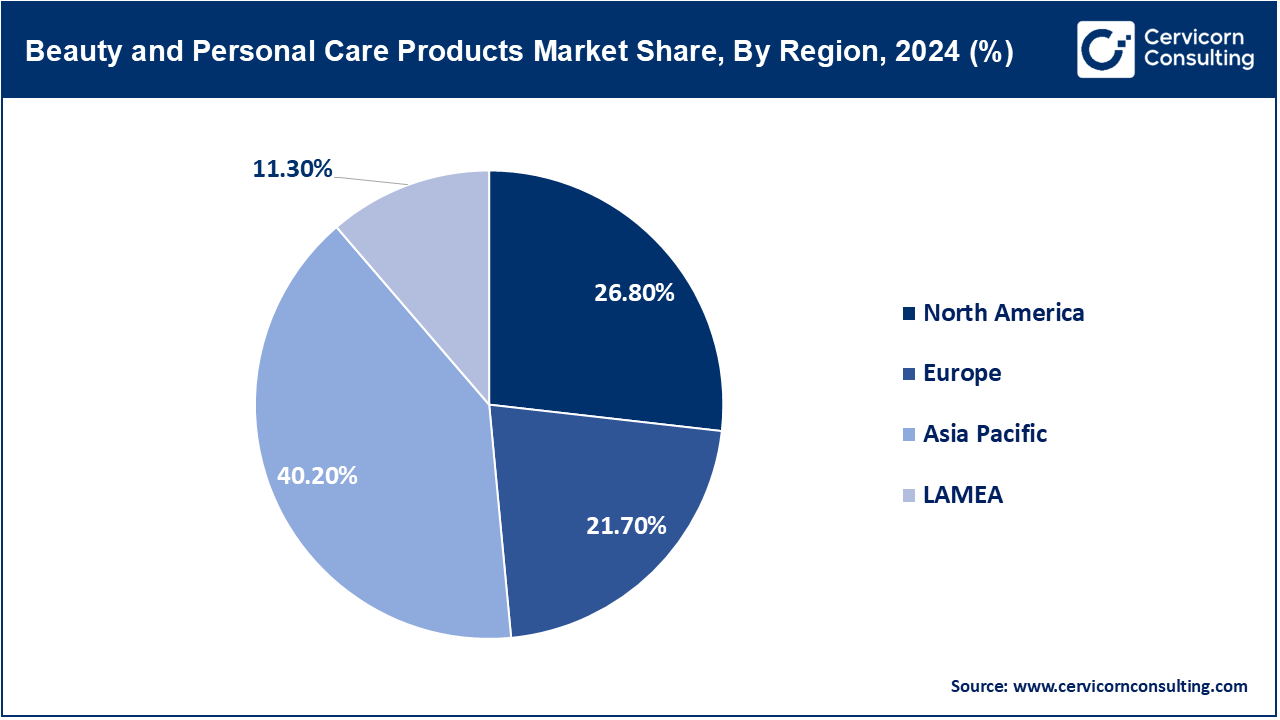

- By Region, Asia Pacific dominated the global market with a revenue highest share of 40.2% in 2024, due to the growing number of working women and young, internet-savvy consumers in China and India is boosting demand for beauty and personal care products, creating significant regional market growth opportunities in the coming years.

- By Product Type, the skin care segment has recorded a revenue share of around 45.01% in 2024. Skin care dominates owing to rising concerns over aging, pollution, and skin sensitivity. The demand for moisturizers, serums, and sun protection products is driving growth across all demographics globally.

- By End user, the women segment has recorded a revenue share of around 40.5% in 2024. Women segment lead due to increased awareness of beauty routines, growing disposable income, and higher adoption of skincare, cosmetics, and wellness products tailored specifically for women across diverse age groups.

- By Distribution Channel, the hypermarkets & supermarkets segment has recorded revenue share of around 41.01% in 2024. Hypermarkets & Supermarkets dominate the market owing to high product accessibility, competitive pricing, and consumer preference for convenient, one-stop shopping experiences, especially for daily-use and essential beauty care products.

- By Nature, the organic segment has recorded revenue share of around 47.1% in 2024. Organic segment lead owing to growing demand for natural, chemical-free formulations. Consumers increasingly seek eco-friendly, safe, and ethically produced beauty products aligned with health-conscious and sustainability-focused lifestyles.

Beauty and Personal Care Products Market Growth Factors

- E-commerce's Transformative Impact: The beauty and personal care (BPC) sector has experienced an impact due to e-commerce in terms of store convenience, product range, and overall accessibility. For consumers, retail shopping websites and brand-specific portals as well as beauty e-commerce shops like Nykaa and Sephora offer almost all products. Even brick and mortar shops have joined the e-commerce bandwagon, accepting a higher degree of transparency through ratings and reviews, ingredient disclosures, virtual try-ons, and other aspects of contemporary e-commerce shopping. Moreover, customer engagement tools like pre-recorded brand interactions and social media live streams are now popular as they engage the customers directly. DTC (Direct-to-Consumer) has also emerged as a method where brands use first-party information to craft tailored interactions. The COVID pandemic fast-tracked this trend. Currently, digital sales channels contribute to 20% of total revenues in the BPC market globally. In emerging markets, the existing online infrastructure is expected to continuously enhance, indicating promising long-term prospects in the market.

- Social media and Influencer Marketing: The BPC industry has actively used Instagram, TikTok, and YouTube to shape consumer perception and narrative control. Trust-building through reviews and endorsements is done by a range of professionals from beauty and dermatology experts to ‘trusted’ influencers. Through tutorials, influencers facilitate discovery. Platforms like YouTube and TikTok, along with social media in general, present opportunities for virality, which can turn ordinary products into staples in every home. Sponsored ads through micro and macro influencers on social media targeting specific demographic shifts also contribute to such DIY advertising forms. Given the nature of emotional engagement through visual advertisements, the BPC sector is more easily reached through social media compared to other forms of advertising. This pivot in marketing approach has democratized the market, allowing small indie brands to compete with and capture the attention of established global players.

- Positioning of BPC Products in Health and Wellness: The confluence of beauty and health offers an appealing value proposition. There is an increasing acceptance of cosmetological care whereby the skin and microbiome are treated for stress, protective barrier function, homeostasis, and holistic multitasking biotic medicinal microbiology. Natural and dermatologcally tested ingredients including probiotics, adaptogens, and vitamins are proving to be a strong growth opportunity increasingly popular among consumers and businesses alike. The interest in beauty and wellness encompasses beauty supplements, ‘sleeping’ masks, anti-pollution creams etc. Due to this increased curiosity, many brands are introducing collections that simultaneously encompass healthcare and beauty. Such innovations not only give rise to new subsectors of the economy, but also resonate with health-focused consumers, especially Millennials and Gen Z, that consider wellness an integral part of their lifestyle.

- Natural, organic, and clean beauty products are in demand: Perception of health and environmental sustainability continues to reshape the global beauty and Personal Care (BPC) market. With growing ingredient and environmental safety concerns, shoppers prefer more product label transparency. Product growth is evident for “free from”-style claims such as “ parabens, preservatives, sulfates, and synthetic fragrances”. The rapid rise of clean beauty brands such as The Ordinary, Drunk Elephant, and Herbivore illustrates the successful adoption of these formulations. Now considered major references for seeking ‘clean’ credentials, regulatory bodies and third-party certifications such as USDA Organic, COSMOS, and EWG Verified are increasingly trusted. This trend is inspiring sustainable innovation of bio-based actives and eco-conscious sourcing. Clean beauty as a concept is thoroughly nurturing development for both niche and mass-market products on a global scale, driven by heightened awareness of sensitivities toward skin and eco-friendliness.

Beauty and Personal Care Products Market Trends

- AI & AR Technology- Enhanced Personalization Diagnostics: AI and AR Technology Enhanced Personalization Diagnostics AI and AR technologies are reshaping the experience of the business process cycle with advanced systems for recommendation and virtual try-on of makeup and hair dyes. Machine learning is being embedded into skin assessment tools which evaluate a user’s skin type and tone, hydration levels, micro-pigmentation, and even acne. With the help of AR mirrors and mobile applications, consumers can virtually try on shades of makeup and hair dyes prior to purchasing them. The efficacy adds to brand trust while improving consumer confidence, reducing returns. Olay, L’oreal, and Proven Skincare have developed personalized diagnostic and real-time feedback models in combination with data collection tools streamlining constant information streams. These capabilities enhance improvement in marketing strategies and formulation based on real-time user analysis. Companies like Olay, L'Oreal and Proven Skincare have developed personalized diagnostic and skincare systems inclusive of real-time feedback mechanisms and data collection tools that provide constant information streams. These capabilities help the company improve its marketing strategies and formulations based on real-time user analysis.

- E-commerce and D2C Dominance: The introduction of e-commerce and the direct-to-consumer (D2C) model have transformed the marketing and sales of beauty products. Compared to physical stores, digital-native brands enjoy lower operational costs, improved engagement, and faster customer feedback. E-commerce provides a wide selection of beauty and personal care (BPC) products from different regions with real time reviews and comparison tools. There are also subscription models along with customized product packs that improve retention for D2C brands. Amazon Beauty, Nykaa, and Sephora Online have expanded category supply. Social media and D2C enable full ecosystem construction as shown by brands like Glossier and The Ordinary, indicating the value of a digital customer relationship.

- Sustainable Refillable, and Biodegradable: The detrimental impact of packaging on the environment has increased attention towards sustainable pedagogical approaches in the BPC sector. Brands are innovating refillable versions for lotions, perfumes, and even cleansers to combat plastic pollution. Some are looking into using mushrooms to create biologically degradable packaging or old-school paper tubes, while others are trying to make mono-materials easier to recycle. Eco-refill pouches and modular refills by Fenty Skin and L'Occitane are perfect examples of these innovations. Strongly Associated with Gen Z, consumers actively seek brands that are responsible with their packaging even if it costs more. This change in attitudes towards sustainability is also fostering competitive advantage in the landscape as ESG compliance gathers traction across global markets.

- Premium & Luxury Products Premiumization: The premiumization of BPC goods continues to accelerate as consumers increasingly view beauty as self-care and a means of indulgence. The higher-income demographics, along with the aspirational middle-class, are purchasing luxury skincare and haircare products that offer better efficacy and sensory experiences. Rising expenditure on prestige beauty products within the Asia-Pacific and Middle East regions further propels the trend. Chanel, La Mer, and Estée Lauder are extending offerings with product lines, collaborations with other designers, and spa-grade treatments. Elevation and sophisticated marketing, scientifically backed formulations also encompass premiumization. Global luxury dermatological goods are touted as the most profitable, with disproportionate spending for perceived value, rarity, branding, and associated equity.

Report Scope

| Area of Focus |

Details |

| Market Size in 2025 |

USD 643.26 Billion |

| Expected Market Size in 2034 |

USD 1164.57 Billion |

| Projected CAGR 2025 to 2034 |

7.9% |

| Key Region |

Asia-Pacific |

| Key Segments |

Product Type, End User, Distribution Channel, Nature, Region |

| Key Companies |

Unilever, Estée Lauder, Shiseido, Revlon, Procter & Gamble, L'Oréal S.A., Coty Inc., Kao Corporation, AVON PRODUCTS, INC, ORIFLAME COSMETICS S.A. |

Beauty and Personal Care Products Market Dynamics

Market Drivers

- Wellness-Cultural Influence on BPC Adoption: The Impact of Culture on BPC Adoption. Modern beauty products are now integrating purposes like emotional beauty and wellness. They indicate the modern culture self-care recuperation, mindfulness, and a more holistic approach to beauty routines. This category of BPCs also includes products which are therapeutically improved with aromatherapy oils, adaptogenic herbs, and other botanicals that foster relaxation and balance energy or sleep better. Moreover, probiotic skincare or neurocosmetics designed to improve the skin-brain connection are increasingly used. This is especially pronounced among urban youth. To meet the market needs, BPC industries are now launching comprehensive product lines that merge beauty and wellness, which combine cosmetics, nutraceuticals, and personal health care.

- Social Media and Influencers Driving Reach: Tactic for social media and influencers are indispensable for the promotion of BPC products as they effortlessly attract the interest of the consumers visually. Makeup and skincare tutorials are readily accessible on Instagram, YouTube, and TikTok. Influencers create authoritative 'honest' review content that shedding light on purported advantages, demonstrating the application steps, and establishing trust. Moreover, short video formats and livestream shopping influence participation to a notable level, making the tutorial increasingly engaging. Hashtags such as #skinfluencer and other user-generated content allow consumers to shape the brand story themselves, giving them more control. Changeable and participatory in nature, this model has shifted the BPC marketing paradigm from ad spending towards interaction through product launches, building brand recognition, and converting sales.

- The Shift Towards Sustainability & Eco-Friendly Packaging: Focus on sustainability due to rising concern over the ecological footprint of the beauty and personal care (BPC) industry has significantly transformed it. Brand owners now enjoy cosmetics and personal care products offered in recyclable, refillable, biodegradable, or zero waste packaging. While L’Oréal, Unilever, and Procter & Gamble are market leaders, they have also made attempts towards sustainability with bioplastic and paper-based tubes, as well as bioplastic and reusable containers. Along with net zero manufacturing, sustainability now also includes ethical sourcing and water conservation. These concerns are championed by Gen Z and Millennial consumers who boycott brands that go against their values. Many brands are responding to this shift in consumer behavior by setting public ESG (Environmental, Social, and Governance) goals which aim to integrate sustainability into all operations in order to win consumers’ long-term trust and loyalty.

Market Restraints

- Fierce Competition & Market Saturation: The competition in the Beauty and Personal Care (BPC) Industry stems from multinationals, local firms, and sole proprietorships. This is especially true for developed countries. Competition is pretty much a given for brands operating within the BPC industry. Companies have to outdo each other through innovations, eco-friendly initiatives, or customs branding. There is along with higher costs for marketing a product reduced loyalty amongst consumers. This results in new entrants facing barriers while the existing players face pressure on their profit margins.

- Raw Material Price Volatility: There is significant challenge leading to loss of profitability for manufacturers incurred from price fluctuations in important raw materials which include natural oils and packaging inputs. Unpredictable expenses which impact pricing further compound the challenge of maintaining profitability. For brands which rely on organic products, supply chain disruptions caused by political conflicts, climate change, and other trade policies add to the challenge of pricing.

Market Opportunity

- Growing Natural and Organic Product Uses: Increasingly, shoppers are inclined to buy products stemming from natural, non-toxic, and ethically sourced ingredients. This opens brand opportunities to expand organic lines on skincare, haircare, and cosmetics. Certification such as USDA Organic and COSMOS fosters trust, and plant-derived formulations capture health and eco-conscious consumers in the premium and mid-tier market globally.

- Emergence of Male & Unisex Grooming: The male grooming market is expanding at a robust pace because of increased awareness and change in (skincare and personal care) societal norms. Moreover, there is a growing interest among men for anti-aging, haircare, and other grooming products due to changing societal norms. In response to this segment, brands are introducing comprehensive unisex lines which focus on aesthetic appeal and functionality.

- The Premium/Luxury Branded CPC Products Growth: The bi-planning and cosmetics industry is witnessing rising demand in the Asia Pacific and Middle East regions for high-performance and luxury bi-planning and cosmetics products. Affluent consumers derive satisfaction from spending on high-quality raw materials, intricate packaging, and well-established brand names. Marketing strategies focused on limited editions, spa-grade formulations, and other premiumization tactics further enhance margins and brand equity across global beauty portfolios.

Market Challenges

- Regulatory Fragmentation and Delays in Reform: For BPC companies, crossing borders incurs navigating diverse regulatory landscapes which is challenging. Compliance with varying bans on ingredients, labeling, and safety certification requirements increases launch costs while postponing product introduction. The absence of uniform standards hampers access for emerging brands to global markets and stifles innovation, particularly for start-up brands in globalized markets.

- Counterfeit Products Undermining Brand Trust: The increasing circulation of fake cosmetic products is a verifiable phenomenon that poses serious health risks to consumers while simultaneously undermining trust in legitimate brands. This, in turn, leads to brands plunging deep into innovation-related expenditures aimed at counterfeiting prevention, in addition to incurring legal costs. This trend poses the highest threat to luxury and high-end brands, as they are constantly under the threat of counterfeiters, and their reputation is greatly damaged by the presence of substandard goods in the market.

Beauty and Personal Care Products Market Segmental Analysis

Product Type Analysis

Skin Care: The skin care segment of BPC is at the forefront, mainly due to increasing concerns regarding skin conditions, anti-aging, and protection from the sun. There is increasing consumer demand for serums and specific moisturizers as well as protective and corrective masks. This remains an age-independent concern, especially in the Asia-Pacific and North America regions, as interest in clean and active-based formulations continues to grow.

Hair Care: Included in this segment are shampoos, conditioners, hair oils, and scalp treatments. Growth is fueled by increased consumer spending on hair care, scalp health, and related styling services. There is strong demand anti-dandruff shampoos, sulfate-free shampoos as well as products that claim to control hair fall. This segment is also aided by innovation in packaging and textures, as well as an emerging male clientele.

Beauty and Personal Care Products Market Revenue Share, By Product, 2024 (%)

| Product |

Revenue Share, 2024 (%) |

| Skin Care |

45.01% |

| Hair Care |

19.25% |

| Oral Care |

14.10% |

| Color Cosmetics |

10.74% |

| Fragrances |

7.80% |

| Others |

3.10% |

Oral Care: The expanding domain of oral care includes basic hygiene along with whitening, herbal pastes, and gum health. At the same time, there is an increase in consumer spending on mouthwashes, electric toothbrushes, and probiotic toothpaste. The category is also gaining from the increasing level of dental concern in education-limited emerging markets where hygiene is on the rise and premium oral health care is gaining traction.

Color Cosmetics: Color cosmetics encompass makeup products such as foundation, eye shadow palettes, and lipsticks. While the category is emerging in some areas, it is also growing inclusively with vegan and long-wear options. Social media and influencer marketing drives purchasing behavior among Millennials and Gen Z, leading to a rapid innovation cycle due to sustained new demand and high churn rate.

Fragrances: Included in this category are perfumes, body mists, and deodorants. Shift is seen towards bespoke, eco-friendly and sustainable fragrance compositions, as well as unisex perfumes. New niche perfume brands and collaborations with celebrities is on the rise. Within the Middle East and Asia-Pacific, this region has seen traction for premium long-lasting perfumes which qualifies this segment as high-margin.

Bath & Shower: This includes body scrubs, shower gels, soaps, and bath oils. This segment is thriving alongside booming wellness trends which include aromatherapy, moisturizing, and relaxation. There is growing demand for ‘clean’ and pH-balanced formulations. Innovations in premium eco-friendly and green products focus on refillable packaging driving growth in this area.

End User Analysis

Women: In the categories of skin and color cosmetics as well as haircare, women dominate the market share of consumers for BPC products. Improved income, access to information, and evolving beauty standards drives experimentation with and a shift to premium products. Inclusivity has widened for culturally targeted product lines aimed at women within age, skin type and ethnic background.

Men: The grooming and skincare sectors are more commonplace than ever before, thus, the growth rate of the men’s segment is exceptionally high. Demand is growing for men’s face wash, anti aging creams, beard oils, and fragrances. The social acceptance of grooming combined with the rising trend of male influencers is changing men’s beauty habits far beyond basic hygiene.

Beauty and Personal Care Products Market Revenue Share, By End User, 2024 (%)

| End User |

Revenue Share, 2024 (%) |

| Women |

40.50% |

| Men |

35.20% |

| Children/Baby Care |

24.30% |

Children/Baby Care: This category incorporates sensitive moisturizers, shampoos, and sunscreens. There is a growing trend to design these products without parabens, sulfates, or artificial fragrances. There is still relatively little intellectual discourse concerning infant skin care safety and the demand for natural formulations. There is focus placed on pediatric dermatology along with organic certifications.

Nature Analysis

Organic: The organic segment has dominated the market in 2024. Organic BPC products are actively promoted in both hair care and skincare lines. They contain ingredients that are cultivated without the use of synthetic pesticides or fertilizers. This subset appeals to eco-friendly consumers looking for clean, safe, and certified skincare. Global certifications such as USDA Organic and COSMOS strengthen trust in these products. Although premium-priced most of the time, organic formulations are becoming more popular because there is growing awareness of the potential health benefits and environmental impacts.

Natural: Natural beauty products include plant oils and minerals as ingredients, as well as botanical extracts. These products do not fulfill organic certification standards, but are presumed to be safer and gentler. Consumers guided by transparency and sensitive skin typically gravitate toward these products. This area sees strong growth in the bath and skincare categories.

Conventional: Conventional BPC products have the largest market share and are the most accessible. They depend on synthetic ingredients, preservatives, and fragrances to ensure a long shelf life, consistent performance, and low price. This segment benefits from high brand awareness, market share and availability in numerous retail outlets. While they are facing pressure from clean beauty trends, there is still a large audience that identifies with these products and is looking for low-cost options.

Vegan & Cruelty-Free: These products do not contain any ingredients from animals and have not been tested on animals. This bioethical stance is popular among environmental advocates which make it appealing to Gen Z and Millenial consumers. Cruelty free certifications like Leaping Bunny and PETA add to its credibility. There is massive growth of online and offline retail for brands that use plant-based ingredients and eco-friendly packaging.

Distribution Channel Analysis

Hypermarkets & Supermarkets: The supermarkets/hypermarkets segment has captured highest revenue share in 2024. These stores are essential for everyday BPC (Beauty and Personal Care) products as they provide wide availability, ease of access, and competitive pricing. Soaps, shampoos, and toothpaste are frequently purchased in bulk through these channels. In-store promotions and sales bundling alongside significant transactional discounts accelerate the purchase of these products in large quantities. Despite emerging threats posed by digital marketplaces, hypermarkets remain steadfast in their dominance in low-cost areas and play a vital role in sustaining mass beauty brands.

Specialty Stores: Sephora, Ulta, and Nykaa fall under this category, offering specialized beauty retailing as well as an exceptional out-of-home shopping experience. Customers can receive specialist consultations alongside other premium products, which are very inviting. While some consumers may be lured by adult color cosmetics, skincare “test-out sessions” and exclusive launches are major pull factors. Specialty beauty retailing through specialized intervention thrives due to strong brand positioning and appeal focused on impact, engagement, and interaction rather than inventory on-hand. They rely primarily on impact, engagement, and brand interaction rather than stock availability.

E-commerce: Consumers enjoy comprehensive access to products, customizable shopping experiences, reviews, and recommendations; as a result, e-commerce has quickly become the most preferred shopping avenue. For clients, the ease of acquiring diverse products, AI tools guiding their shopping, virtual try-ons, and D2C models significantly popularized shopping. The COVID-19 virus sped along the digital agenda, making adaptation to e-commerce services vital; as a result, international markets have focused their strategies on beauty brands and shifted emphasis towards online shopping.

Others: This category encompasses pharmacies, department stores, and direct sales, including multi-level marketing and direct-to-consumer sales. Pharmacies serve as preferred retail outlets for dermocosmetics. Luxury fragrances and skincare products are offered at department stores. Direct selling is more common in rural regions or developing countries where personal demonstrations carry more weight. Each of these sub-channels addresses a specific need in regard to various consumer segments.

Beauty and Personal Care Products Market Regional Analysis

The beauty and personal care products market is segmented into several key regions: North America, Europe, Asia-Pacific, and LAMEA (Latin America, Middle East, and Africa). Here’s an in-depth look at each region

North America Market Trends

- The North America beauty and personal care products market size was valued at USD 161.39 billion in 2024 and is expected to reach around USD 312.10 billion by 2034.

The U.S. and Canada is characterized as mature; in addition, North America is a world leader in both consumer spending and innovation. The growth is fueled by Clean beauty innovations, wellness products, and anti-aging products. E-commerce development is quite notable for influencer-owned brands and D2C sales models. Brand endorsement enhances compliance with regulations and strengthens trust in the brand as well as the quality of the product.

Europe Market Trends

- The Europe beauty and personal care products market size was estimated at USD 130.68 billion in 2024 and is expected to hit around USD 252.71 billion by 2034.

Europe is famous for branded products which focuses on safety, sustainability and premium quality, especially in the skincare sector. France, Germany, and the UK are home to established luxury market players as well as emerging organic labels. The reputation of strict regulatory standards coupled with interest in dermo-cosmetics serves the markand as well, particularly among age-conscious consumers. There is interest in eco-packaging and cruelty-free certifications.

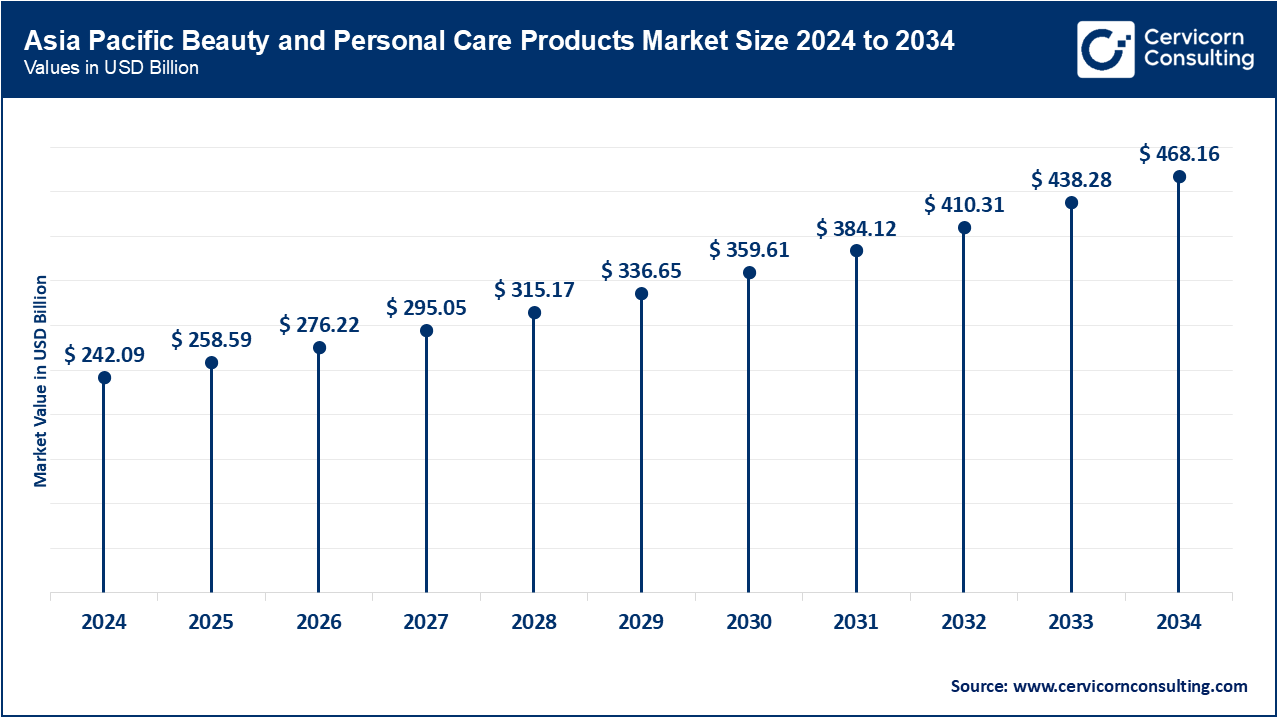

Asia Pacific leading the market

- The Asia-Pacific beauty and personal care products market size was accounted for USD 242.09 billion in 2024 and is projected to grow around USD 468.16 billion by 2034.

Asia Pacific leads the pack in growth due to high population density, rising incomes, and a culture that prioritizes skincare. China, Japan, South Korea, and India are leaders in demand. Global innovations are influenced by K-beauty and J-beauty trends. The region combines influencer marketing, a robust digital presence, and a strong demand for skin whitening and brightening products. This region celebrates technology-driven customization, alongside beauty experimentation.

LAMEA Market Trends

- The LAMEA beauty and personal care products market size was valued at USD 68.05 billion in 2024 and is anticipated to reach around USD 131.60 billion by 2034.

Growing metropolitan areas and increased awareness of beauty and skincare products are favorable for the LAMEA region’s development opportunities. Latin America’s leaders are Brazil and Mexico while the Gulf Cooperation Council countries drive the Mid East’s need for luxury goods, including upscale halal. African markets are emerging along with their region-specific skincare requirements. The hair care, sun care, and fragrance markets are all driven by low cost and local culture adaptation.

Beauty and Personal Care Products Market Top Companies

Recent Developments

Recent strategic developments in the beauty and personal care products industry highlight a strong pivot toward sustainability, digitalization, and ecosystem-driven innovation. Leading brands like Unilever, Shiseido, and L'Oréal are forming alliances with biotech firms, AI startups, and green packaging providers to co-create clean formulations, personalized skincare solutions, and refillable product systems. Collaborations with dermatological research labs and e-commerce platforms are accelerating smart diagnostics, virtual try-ons, and data-enabled product recommendations. Efforts to align with global ESG standards, reduce carbon emissions, and implement circular supply chains are reshaping industry benchmarks. These strategic moves are not only enhancing brand value but also transforming the BPC sector into a tech-integrated, ethical consumer ecosystem.

- In September 2023, L’Oréal Groupe announced a minority investment in Shinehigh Innovation, a cutting-edge biotech company based in China. The partnership is aimed at co-developing innovative and environmentally sustainable beauty solutions by leveraging Shinehigh’s biotech expertise. This strategic collaboration aligns with L’Oréal’s broader vision to scale green science initiatives and drive sustainable transformation in the global beauty industry.

- In April 2023, U.S.-based clean beauty brand Pacifica launched a new body care line called Wake Up Beautiful. The line includes a body serum and lotion formulated with retinoid and mushroom extracts to promote skin renewal and hydration. Pacifica emphasized the use of sustainable and eco-conscious ingredients, reinforcing its position in the clean and plant-based personal care segment.

- In February 2023, Japanese beauty giant Shiseido Co., Ltd., in collaboration with Shoppers Stop Ltd.’s Global SS Beauty Brands, introduced its premium makeup label NARS Cosmetics to the Indian market. The launch includes plans for 14 standalone stores across New Delhi and Mumbai during 2023, in addition to expanding its reach via Sephora India outlets.

- In February 2023, skincare startup Neon Hippie debuted in the U.S. with a new product line built around its proprietary 7 Shroom Complex, comprising mushrooms like chaga, reishi, shiitake, cordyceps, and others. The collection, which includes seven items, is available at select Neiman Marcus stores and online, offering consumers a holistic approach to skin health using mushroom-based bioactives.

- In January 2023, Shroom Skincare launched its first product, the Mycelium Glow Brightening Serum, combining vitamin C with mushroom extracts such as maitake, reishi, chaga, and cordyceps. Designed to deliver multiple skincare benefits—including protection from environmental stressors, reduced inflammation, and improved tone—the serum marks the brand’s entry into the functional and natural skincare market.

Market Segmentation

By Product Type

-

- Skin Care

- Face Skin Care

- Face Creams & Moisturizers

- Cleansers & Face Wash

- Sunscreen/Sun Care

- Others (Masks, Serum, Scrub, etc.)

- Body Skin Care

- Body Washes & Shower Gels

- Hair Removal Products

- Creams & Moisturizers

- Body Sunscreen/Sun Care

- Others (Serum, Body Scrub, Oils, etc.)

- Hair Care

- Shampoo

- Conditioner

- Oils

- Serums

- Others (Hair Masks, Peels, Etc.)

- Oral Care

- Color Cosmetics

- Fragrances

- Others

By Distribution Channel

- Online Retail

- Supermarkets/Hypermarkets

- Specialty Stores

- Pharmacies/Drugstores

- Direct Sales

- Department Stores

By Nature

- Organic

- Natural

- Conventional

- Vegan & Cruelty-Free

By End User

- Women

- Men

- Children/Baby Care

By Region

- North America

- APAC

- Europe

- LAMEA