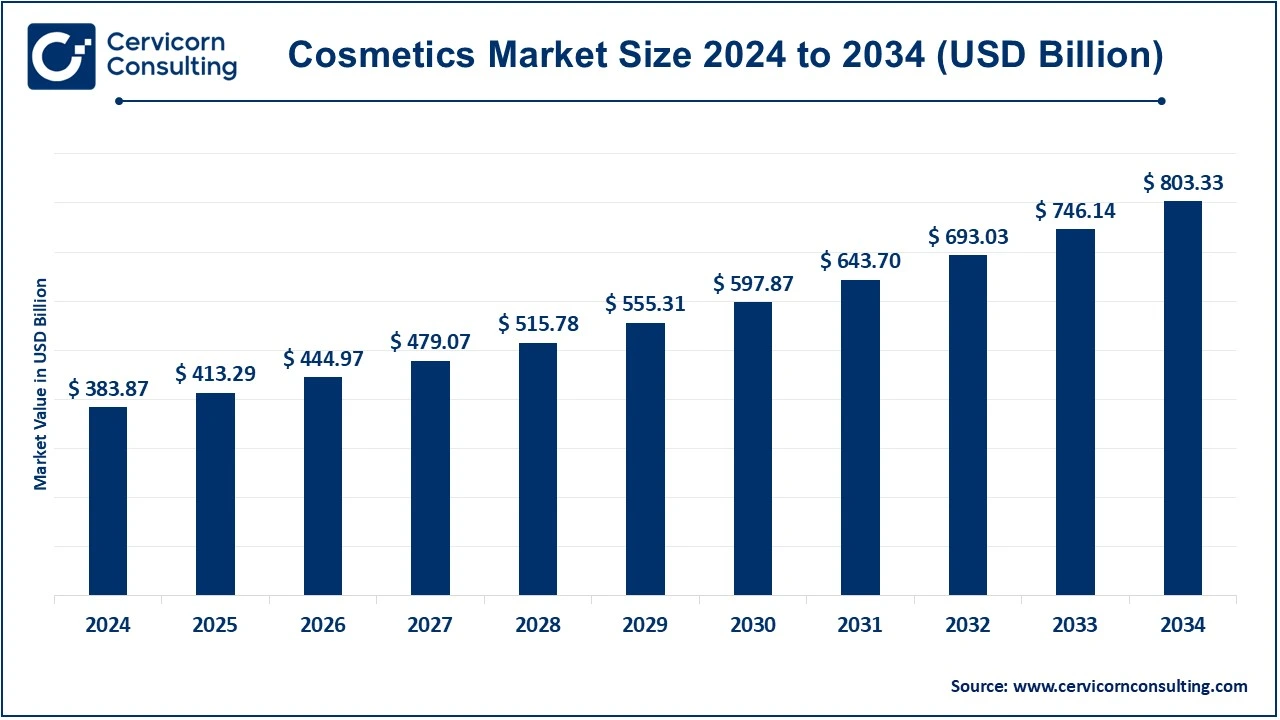

The global cosmetics market size was reached at USD 383.87 billion in 2024 and is expected to be worth around USD 803.33 billion by 2034, growing at a compound annual growth rate (CAGR) of 7.66% over the forecast period 2025 to 2034.

The cosmetics industry has seen substantial growth due to rising beauty awareness, increasing disposable income, and changing consumer preferences. The demand for skincare, organic, and sustainable beauty products has surged, especially among millennials and Gen Z. Additionally, advancements in e-commerce have boosted online sales, making beauty products more convenient to purchase. The shift toward personalized and high-performance skincare, coupled with technological advancements in beauty formulations, has further fueled market expansion. Brands are investing in AI-driven skincare solutions, virtual try-ons, and product customization. Additionally, the male grooming segment has grown significantly, contributing to the broader cosmetics market expansion. Significant R&D investments continue to fuel innovation in formulations and packaging to meet evolving consumer preferences. These factors make cosmetics a vital and dynamic solution for beauty and wellness needs worldwide. As sustainability, innovation, and personalization shape the industry, the cosmetics market is poised for steady growth, catering to diverse consumer demands while addressing environmental and ethical concerns.

What is cosmetics?

Cosmetics are products used to enhance or alter a person's appearance, including skincare, makeup, hair care, and personal hygiene items. These products range from foundations, lipsticks, and mascaras to moisturizers, shampoos, and deodorants. The primary purpose of cosmetics is to improve skin health, enhance beauty, and maintain hygiene. They are made from a combination of natural and synthetic ingredients, including essential oils, plant extracts, vitamins, and chemical compounds. Cosmetics have been used for centuries, with evidence tracing back to ancient civilizations like Egypt and Greece. Over time, advancements in science and technology have led to the development of safer and more effective cosmetic products. Today, the industry is highly regulated to ensure product safety and quality. The demand for organic and cruelty-free cosmetics has also increased as consumers become more aware of health and ethical concerns.

Key Insights Beneficial to the Cosmetics Market

Report Scope

| Area of Focus | Details |

| Market Size in 2024 | USD 383.87 Billion |

| Expected Market Size in 2034 | USD 803.33 Billion |

| Projected CAGR 2025 to 2034 | 7.66% |

| Dominant Region | Asia-Pacific |

| Key Segments | Category, Gender, Distribution Channel, Region |

| Key Companies | L'Oreal SA, Unilever plc., Procter & Gamble Co., The Est�e Lauder Companies Inc., Beiersdorf AG, Shiseido Co., Ltd., Coty Inc., Natura & Co., Kao Corporation, Johnson & Johnson Services, Inc. |

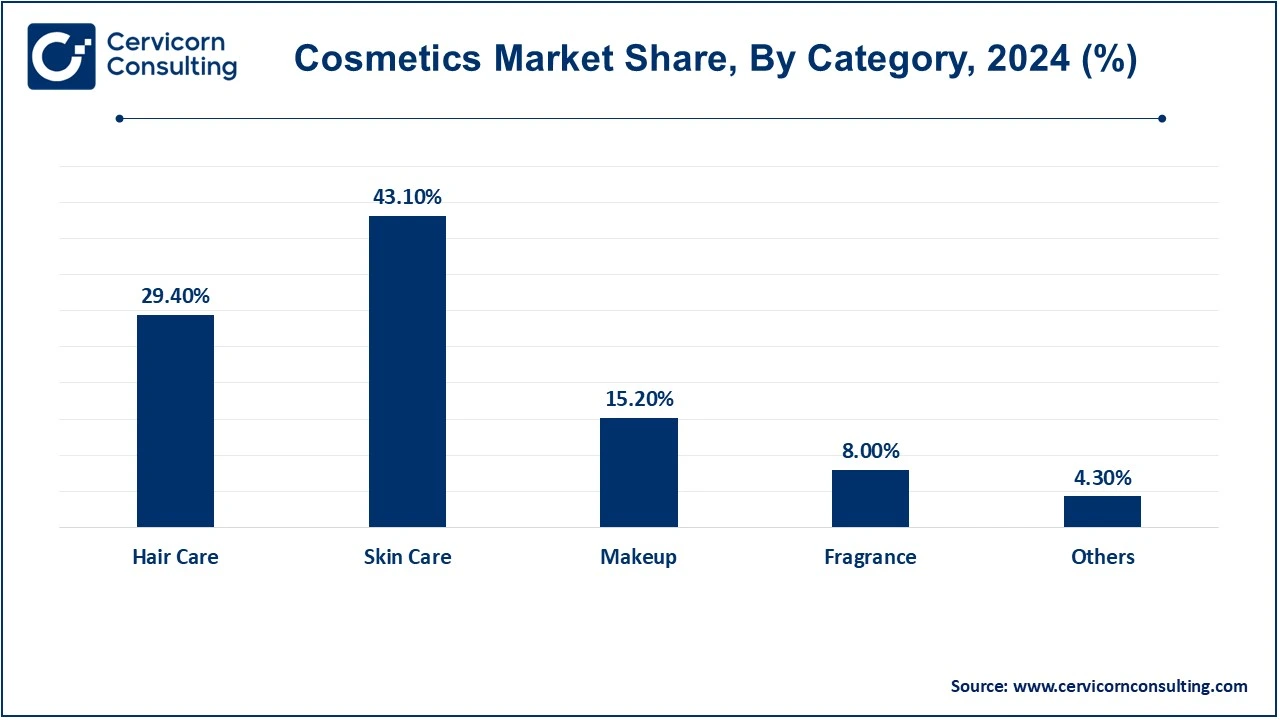

The cosmetics market is segmented into category, gender, distribution channel and region. Based on category, the market is classified into hair care, skin care, makeup, fragrance and others. Based on gender, the market is classified into men and women. Based on distribution channel, the market is classified into online and offline.

Hair Care: Hair-care products can include shampoos, conditioners, hair oils, and styling products that treat hair for improved appearance. The segment gains drive from increasing consumer awareness to hair damage and into the realm of organic alternatives. Examples include brands such as Pantene and Dove that offer specialized lines focused on hair repair, designed to address various hair care needs around the world.

Skin Care: Skin care products include moisturizers, cleansers, serums, and sunscreens, concentrating on skin health and specific concerns such as acne, aging, and pigmentation. Increased self-care trends and innovative formulations are fuelling this segment, one of the examples being the anti-aging products by Neutrogena that are widely accepted because of their proven efficacy, not to mention that they attract attention due to being the go-to choices for effective remedies.

Makeup: This is about products like foundations or lipsticks or mascaras applied by the user for beautification. The trend in this area is dictated by fashion, influencer endorsements and demand for custom made products. MAC Cosmetics is one example as it has numerous ranks of products for diverse skin colors and preferences.

Others: This includes other niche products such as perfumes, deodorants in addition to perfumes which have more demand. Growth comes from shift in lifestyles together with rise in luxury cosmetics items cashing in on the width of global market. For Examples, perfumes from Chanel, which maintain their position of reverberations as the high-end side of the cosmetics market.

Men: The male cosmetics market is on the rise with grooming products such as shaving kits, beard oil, and skincare. Men are increasingly willing to try out new propositions with respect to their grooming regimen. For example, Gillette directs its grooming range toward men who seek both efficiency and novelty in personal care routines.

Cosmetics Market Revenue Share, By Gender, 2024 (%)

| Gender | Revenue Share, 2024 (%) |

| Men | 36.90% |

| Women | 63.10% |

Women: Women�s dominance in the cosmetics market rendering their demands in skincare, hair care, and makeup relatively fast growing. The sector thrives on beauty tides and inclusivity. For example, the wide diversity of Fenty Beauty's products empowers women around the world with riches for each one of their skin shades.

Online: Due to convenience, a wide choice, and custom-tailored recommendations, sales of cosmetics are procured through online channels. The digital platforms are essential for market growth. For example, Sephora has increased customer engagement through their online store, providing virtual try-ons and exclusive discounts.

Cosmetics Market Revenue Share, By Distribution Channel, 2024 (%)

| Distribution Channel | Revenue Share, 2024 (%) |

| Online | 72.30% |

| Offline | 27.70% |

Offline: Offline channels include specialty stores, supermarkets, and brand-exclusive stores. They enrich the experience of the physical purchase and instant purchase satisfaction. For example, a user may find Ulta Beauty stores appealing due to in-store expert consultations along with a large selection of brands under one roof.

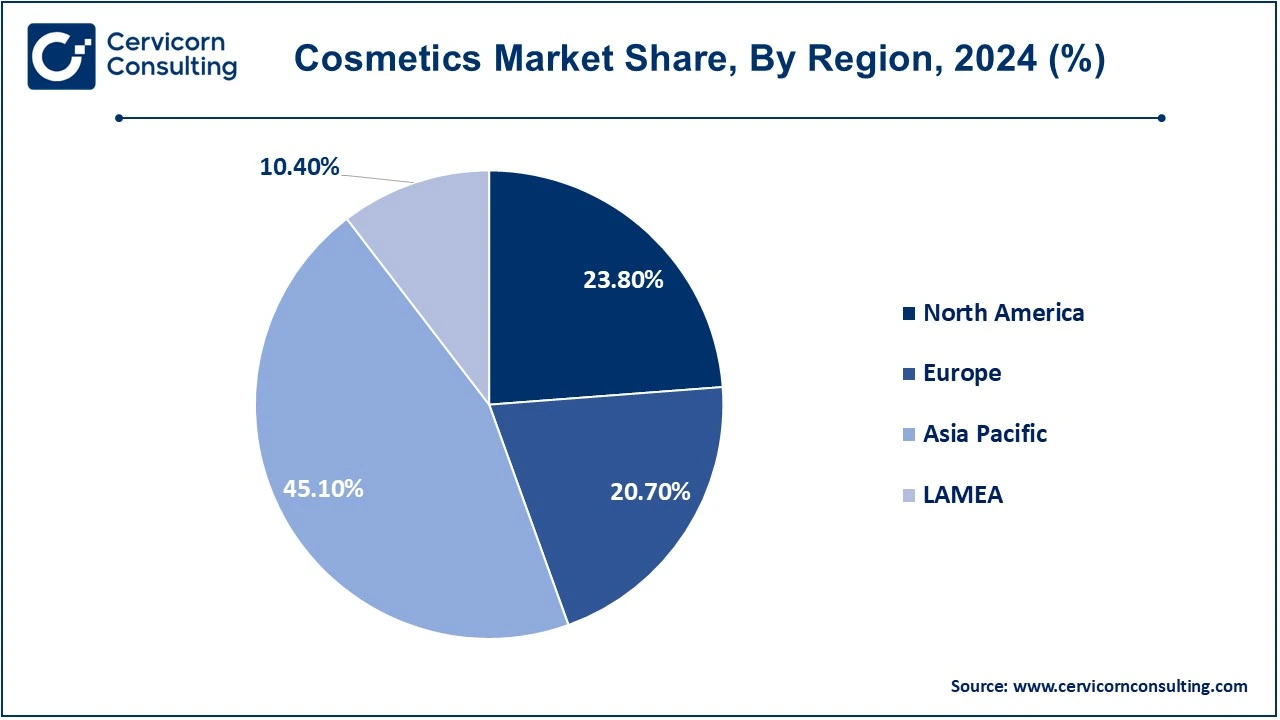

The cosmetics market is segmented into various regions, including North America, Europe, Asia-Pacific, and LAMEA. Here is a brief overview of each region:

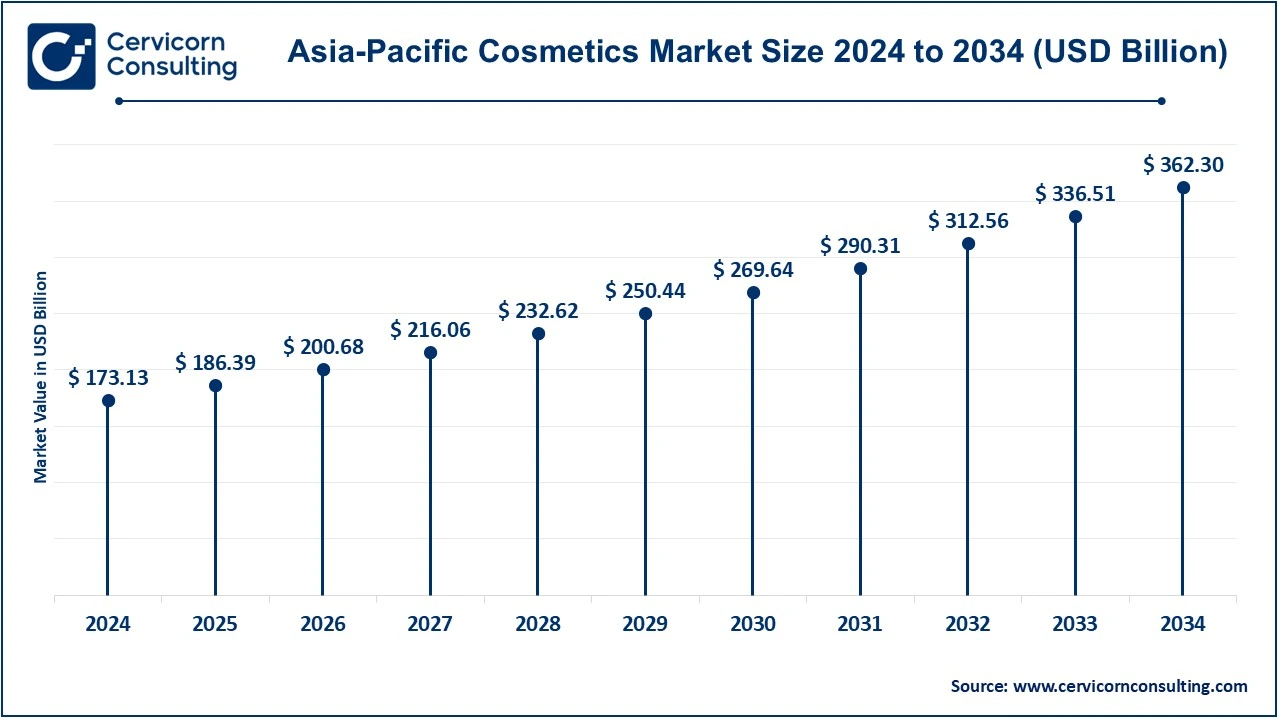

The Asia-Pacific cosmetics market size was accounted for USD 173.13 billion in 2024 and is predicted to surpass around USD 362.30 billion by 2034. The Asia-Pacific is currently the biggest and also the most fast-paced market because of the factors such as urbanization, increasing disposable income and beauty awareness in countries like China, Japan, South Korea etc. K-beauty and J-beauty constructs dominate the beauty industry, innovation is also rapid, for example, the consumption of South Korean brands like Laneige and Chinese MMM.In 2023, Japan's major cosmetics company Shiseido announced that it has expanded its line of skincare products to appeal to younger consumers in the region.

The North America cosmetics market size was valued at USD 91.36 billion in 2024 and is expected to reach around USD 191.19 billion by 2034. North America region is fueled by increasing expenditure by consumers on luxury beauty products and natural and organic formulations. It benefits from strong research and development initiatives and product launches by key players in Europe. U.S. spearheads the cosmetic sector in the country, with brands like Est�e Lauder and Maybelline using cutting-edge technologies. Also, there is an opportunity for North America to grow in cruelty-free and vegan cosmetics. Est�e Lauder sees good growth in skincare, spurred by performance posted in North America during 2023.

The Europe cosmetics market size was estimated at USD 79.46 billion in 2024 and is projected to hit around USD 166.29 billion by 2034. Europe is on a continuous growth path in the number of consumers looking for premium-priced products that cross the subsistence line up to premium ones. Though eco contour is considered lacking in Europe, the need for the continued involvement of the European Union composer in this regard is determined. For instance, France and Germany stand the chance. In France, the L'Oreal Company is the market leader and has the most brands and objectives in connection to sustainability and is making heavy investments this year in bio-based cosmetic manufacturing in Germany in response to the strong growth in the market.

The LAMEA cosmetics market size was valued at USD 39.92 billion in 2024 and is anticipated to reach around USD 83.55 billion by 2034. The LAMEA region is experiencing growth across different segments, fueled by an increasing awareness of beauty and personal care, higher disposable incomes, and a demand for affordable products. For example, Latin America is recognized for lively makeup trends while the Middle East tends to favor products that are premium and halal-certified. Brazil has been at the forefront of Latin America following Natura's directives of natural cosmetics. In 2023, in Dubai, Mikyajy ventured to launch a halal-approved makeup line in light of the rising consumer demand in the Middle East.

The new entrants in the cosmetics industry are leveraging advanced technologies and sustainable practices to innovate and meet changing consumer demands. These players focus on natural, organic, and cruelty-free products, targeting eco-conscious consumers. They also emphasize personalization through AI and data-driven solutions, offering tailored skincare and beauty regimens. Many entrants use digital platforms and direct-to-consumer models to disrupt traditional retail. For instance, brands like Glossier have revolutionized the market with minimalist, high-quality products, while others like The Ordinary focus on affordable, science-backed formulations. These strategies enable new players to compete effectively, catering to modern beauty trends and ethical consumer preferences.

CEO Statements

Jean-Paul Agon, Chairman and CEO of L�Or�al, stated,

Masahiko Uotani, President and CEO of Shiseido, mentioned,

Stefan De Loecker, CEO of Beiersdorf, highlighted,

Recent strategic launches and acquisitions in the cosmetics market reflect a strong commitment to innovation, expanding product portfolios, and meeting evolving consumer demands. Companies are increasingly focusing on sustainability, with acquisitions like L'Or�al's purchase of Aēsop and Beiersdorf's stake in S-Biomedic, reinforcing their positions in luxury skincare and dermatological treatments. Additionally, the launch of new product lines like Shiseido's SIDEKICK for men�s skincare shows a clear intent to cater to underserved demographics. These strategies underline the industry's drive to stay competitive and future-proof in an ever-changing market.

Market Segmentation

By Category

By Gender

By Distribution channel

By Region