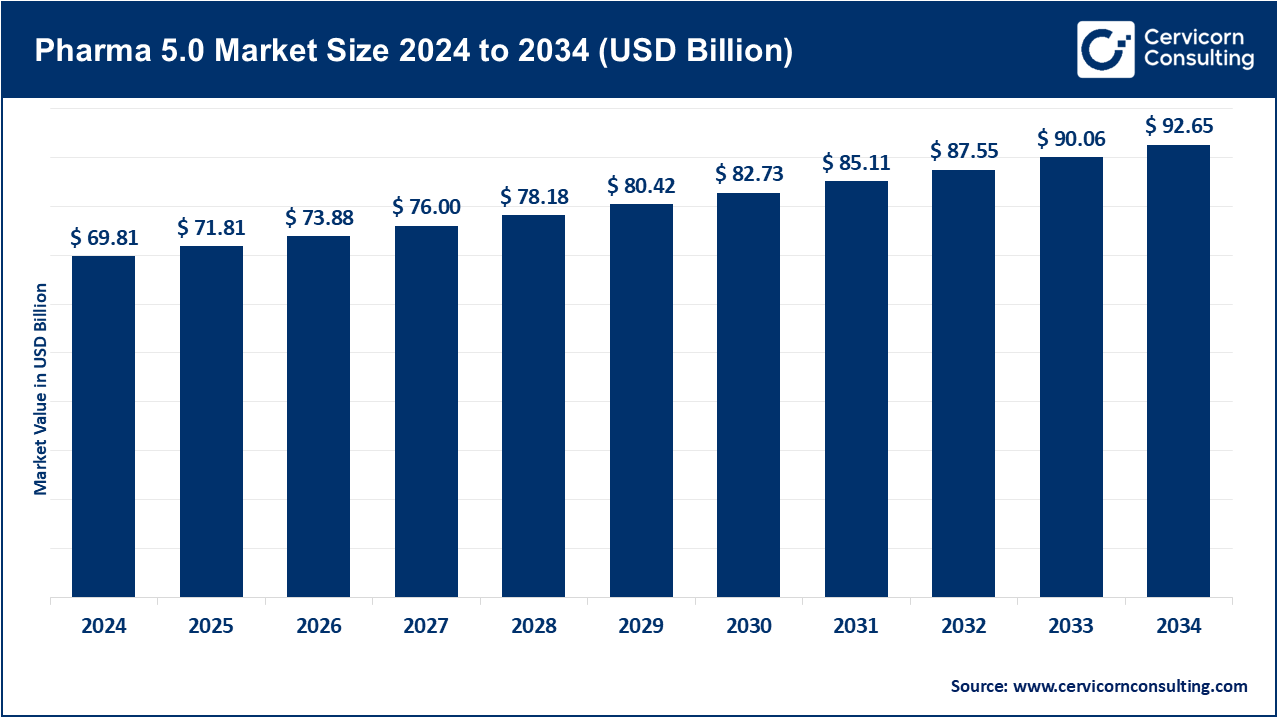

The global pharma 5.0 market size was reached at USD 69.81 billion in 2024 and is expected to be worth around USD 92.65 billion by 2034, growing at a compound annual growth rate (CAGR) of 29.68% over the forecast period from 2025 to 2034.

The integration of AI-based customization, intelligent automation, and innovation tailored to the needs of patients is anticipated to greatly increase value across the pharma 5.0 market greatly. This change is in accordance with the principles of Industry 5.0, which focuses on the collaboration of human skills with sophisticated systems to optimize the efficiency of research and development activities, facilitate the discovery of new medicines, and enhance treatment results. Further growth stems from digital twins, quantum computing in molecular modeling, and the connected health ecosystems which make real-time decision making, adherence, and precision medicine execution more efficient.

The pharma 5.0 represents the next wave of pharmaceutical innovation, where intelligent, patient-centric systems powered by AI, IoMT, robotics, digital twins, and secure blockchain-enabled supply chains transform drug discovery, manufacturing, and personalized care; these autonomous agents assist in predictive diagnostics, real‑time clinical trial analytics, and precision therapeutics, driven by growing demand for digital transformation, regulatory open‑mindedness toward digital health, enterprise investment in automation, and partnerships between pharma and tech/cloud providers positioning pharma 5.0 to accelerate time-to-market, enhance healthcare outcomes, and support value-based, empathetic automation across the industry.

Market Share of Leading 10 National Pharmaceutical market Globally 2024

| Country | Market Share, 2024 (%) |

| Canada | 1.9% |

| Brazil | 2% |

| Spain | 2% |

| UK | 2.4% |

| Italy | 2.6% |

| France | 2.9% |

| Germany | 4% |

| Japan | 4% |

| China | 7% |

| U.S. | 44% |

Report Scope

| Area of Focus | Details |

| Market Size in 2025 | USD 71.81 Billion |

| Expected Market Size in 2034 | USD 92.65 Billion |

| Projected CAGR 2025 to 2034 | 29.68% |

| Dominant Region | North America |

| Fastest Growing Region | Asia-Pacific |

| Key Segments | Technology, Type, End-User, Therapeutic Area, Deployment Mode, Region |

| Ket Companies | Pfizer, Novarti, Roche, AstraZeneca, Sanofi, Bristol Myers Squibb, GS, Eli Lilly, Johnson & Johnson, BioNTech, Moderna, Insilico Medicine, Exscienti, XtalPi, Owkin |

Artificial Intelligence (AI): The FDA issued a guidance on the application of AI in the development of drugs and biologic products in January 2025 which adopted a risk-based regulatory approach to ensure model trustworthiness. It did, however, observe an unprecedented growth in the AI-integrated submissions AI submissions crossing the 500 mark from 2016 integrated across discovery, trials, manufacturing, and post-market surveillance. AI is being applied to outcome prediction, safety signal detection, and dosage optimization. This type of regulatory endorsement is helpful in fostering trust and accelerating AI adoption at the enterprise-level across the pharma value chain. The FDA’s CDER AI Council (established 2024) continues to strengthen and support cohesive oversight over the application of AI within the therapeutic development. These developments are strengthening the infrastructure of Pharma 5.0 with advanced model governance.

Machine Learning (ML): M-CERSI workshop in February 2023 centered on ML methodologies and best practices like bias mitigation and ensuring generalizability. As of 2023, over 300 applications to the FDA containing reference to ML have been submitted, which suggests a widespread usage of ML into endpoint selection and trial optimization. In parallel, the FDA focused discussion papers on ML contained proposed precision medicine alongside adaptive clinical trial design scoped in March 2023. ML applications have now become accepted components of regulatory assessment schemes, including- but not limited to safety, efficacy, and equity of a model. Additionally, the Agency's initiatives for AI/ML lifecycle and FRAME further emphasize support from the institution. As part of Pharma 5.0, ML bolsters the culture of evidence-based decision making and agile trial designs.

Robotic Process Automation (RPA): While the FDA does not provide specific guidance on robotic process automation, its attention towards automation within AI for manufacturing (2023 FRAME papers) includes automating monotonous laboratory and production workflows. During the COVID-19 response, Pfizer's IMEx program utilized robotics for real-time anomaly detection and root cause analysis on the manufacturing lines. These steps demonstrate that RPA improves consistency, throughput, and compliance. The previously stated documents highlight the FDA’s increased focus on qualitative aspects of manufacturing (2024 QSR & ISO updates) indirectly support the use of automation for safeguard features. RPA enhances production resilience while minimizing human intervention, error, and augmenting audit trail accessibility. In Pharma 5.0, RPA is the basic layer for safe and autonomous development pipeline operation.

Internet of Things (IoT): The FDA supports the use of remote monitoring devices in decentralized trials through their guidance published in December 2023, thus validating IoT data for endpoints and pharmacovigilance. In late 2023, academic reviews cite that IoMT was widely adopted with notable security issues like replay and insider attacks. However, regulators are supportive of patient-provided real-time data which broadens the scope of participation in trials. Manufacturing equipment and patient vitals are now monitored by IoT-enabled sensors which aid in model training and safety surveillance. This blend of ongoing real-world data input changes the paradigm in clinical and postmarket oversight. As part of Pharma 5.0, IoT powers intelligent systems with actionable data regarding patients and processes.

Virtual Servers: The FDA's guidance from 2025 suggests the acceptance of cloud-based data pipelines for cloud computing scalability and secure analytics AI-assisted submissions. The Digital Health Center of Excellence and CDER AI Council maintain oversight of the cloud-drug application model infrastructure. The FDA’s public workshops, alongside funding programs for 2024, highlight the use of cloud infrastructure for remote trial data capture and collaborative research and development initiatives. The cloud's ability to harness EHR, IoMT, and real world data streams allows for centralized governance, standardized analytics, and enhanced computational power Pharma 5.0 proposes. It is no longer left to interpretation; pipelines using cloud technologies for AI validation and lifecycle tracking are granted by regulators as compliant frameworks.

AI Accelerated Drug Design: The FDA's update in January 2025 acknowledged an AI application for target engagement, exposure-response modeling, and virtual safety evaluation. Since 2016, there have been over 500 submissions AI-enabled submissions that included discovery use cases. In 2023, the first phase trials AI-designed molecule by Insilico Medicine were initiated after being granted breakthrough designation and the FDA approved their oncology candidate at the end of 2024. A workshop held by the FDA in collaboration with CTTI in August 2024 was focused on the responsible application of AI technology within drug development and manufacturing. AI tools have now progressed the candidate optimization and lead generation while maintaining regulatory oversight. Within Pharma 5.0, AI-driven technologies verify legally compliant pathways to enable discovery.

Smart Manufacturing (Digital Twins & Automation): The FDA's FRAME initiative in 2023 designated digital twins as new apparatus intended for real-time monitoring of quality and validation procedures. The IMEx platform developed by Pfizer CentreOne incorporates IoT sensors with AI-digital twins to diagnose production anomalies and optimize yields. This will be supported with updates in 2024 by the FDA on quality system regulations and cybersecurity policies. Virtual models using digital twins assist in planning and confirming manufacturing and trial processes, minimizing risk and waste. Partnerships such as the Pfizer-Flagship AI supply chain collaborative project also focus on the same transversal concern. This is also characterized within Pharma 5.0 where advanced industry automation merges with regulatory grade digitally validated workflows.

Digital Therapeutics: Regulatory momentum is growing, Q3 2023 saw 9 FDA approvals of mobile app-based digital therapeutics, mostly in mental health and addiction, per ISPOR trial analysis. In March 2024, Outlook Therapeutics received CHMP plus EU marketing authorization for bevacizumab gamma ophthalmic therapy, a milestone in pharma-digital integration. The FDA approved its first prescription digital therapeutic app in early 2024. While DTx-specific regulatory frameworks remain nascent, FDA guidance on misinformation and software lifecycle (2024) supports patient-centric applications. The pharma 5.0 embraces DTx as a complementary modality, meeting evolving regulatory and therapeutic paradigms.

Personalized Medicine Platforms: AI/ML for precision medicine, as well as bias, equity, and transparency of methods, were covered in FDA workshops in February 2023. The expansion of Moderna-BioNTech therapies now includes real-world and genomic dataset integration with PCA efforts for precision medicine. Tailored surgery diagnostics using AI-optimised comparitive analysis received increased approvals in 2024, with supplementary draft guidance increasing control of algorithmic bias toward validated patient selection. Personalised models for the development of par pharmas set by CDER’s AI Council (2024) are advanced components in prescribing pharmaceutical customisation. These steps enable Pharma 5.0 to shift towards integrated digital treatment platforms and stratified stratification systems clinically validated for individualized planning and dosing.

AI-Based Diagnostics: Since late 2024, the FDA expedited change-control paths for AI-powered diagnostic devices, acknowledging iterative software updates. Over 100 FDA applications referencing AI/ML in diagnostics were reported by early 2024. Clinical trials for AI diagnostics—spanning ophthalmology to oncology—have increased, with generative AI chatbots assisting in adverse event classification. The 2023 FDA discussion papers on AI in drug and device development affirm the role of AI diagnostics in regulatory consideration. These developments pave the way for FDA-approved, AI-driven diagnostic tools in the pharma 5.0 that satisfy clinical needs and regulatory safety standards.

Pharmaceutical & Biotech Companies: FDA’s 2025 AI guidance is intended for sponsors, reflecting alignment with biotech and pharma developers. Over 500 submissions with AI components underscore sector-wide integration. Public funding from FDA and NIH in 2024 supported corporate trials implementing AI endpoints. Collaborations like Pfizer–Tempus (2023) for oncology AI and Pfizer–Flagship (2024) AI supply-chain partnership underscore industry adoption. Regulatory frameworks such as FRAME and AI/ML lifecycle support corporate modernization. The pharma 5.0 companies are thus directly regulated, funded, and partnered within an ecosystem where regulatory clarity drives innovation.

CROs or Contract Research Organizations: The 2024 Workshop sponsored by the FDA and CTTI highlighted the importance of Single CROs in regard to AI and machine learning in augmenting and enabling trial and manufacturing processes. CROs are following the FDA 2023 remote data access instruction and peripherally supporting trial IoT frameworks by using AI and IoT analytics tools. Recent collaborations between the CROs and the FDA have concentrated on submission processing through cloud-embedded analytics AI frameworks advised through pre-advisory frameworks. The primary service providers of CROs perform the capture of real-world data and provide segments of validated digital endpoints alongside the services of data capture conforming to FDA regulations. With the increase in acceptance from regulations, it is likely that the CROs will have the capacity to offer services associated with compliance and custom innovation needed under services deemed Pharma 5.0.

Healthcare providers: Supervision of care givers using IoT and AI under FDA supervision permits patient monitoring for trial purposes making the 2023 FDA decentralized trial instruction the first emitter-allowing home IoT-based patient monitoring. AI subsumed diagnostics as chatbots commandeered patient reporting of post-enrollment for safety reporting, which, per FDA 2024 approval policies, classifies their use under trial report aides. They are being trained using workshops organized by the FDA and CDER, with NIH funding programs in 2024, focused on deploying AI in medical tools.

Research Institutes: Federal support for AI in drug development (e.g., FDA–M‑CERSI workshops in 2023) positions research institutions as partners in early-stage technology validation. NIH grants and FDA funding (2024) have backed university labs developing AI models and digital twins under regulatory framework compliance. FDA advisory committee meetings include academic experts alongside industry and regulators, reflecting broad inclusion. Collaborations between institutions and regulators on guidance papers support evidence-based model deployment. Within the pharma 5.0, academic research is recognized not only scientifically but also as structurally essential to legally verified innovation.

Oncology: Oncology is spearheading adoption in the Pharma 5.0 era because it is the most complex, data-rich, and requires personalized attention. Genomic analysis, biomarker discovery, and treatment optimization are processes supported by AI platforms. Pharma companies are using digital twins and predictive analytics to model expected patient responses to cancer interventions. Other outcomes of digital innovation include real-time development and implementation of personalized oncology pipelines, adaptive clinical trials, and improved survival rates for cancer patients.

Neurology: Pharma 5.0 technologies respond to the high unmet need and intricate treatment paths of Alzheimer’s, Parkinson’s, and epilepsy. The processes of drug development related to neurodegenerative disorders are being accelerated through advanced neuroimaging analytics integrated with brain-computer interface frameworks and AI molecular simulations. Remote neurological assessments and digital phenotyping are being facilitated through cloud-based cognitive systems. Neurology is concentrating on patient stratification and real world evidence which alongside Pharma 5.0 technologies enables more precise and stronger targeting in CNS therapies.

Cardiovascular Diseases: With regard to cardiovascular diseases, predictive analytics and risk assessment, identification of digital biomarkers, and optimizing therapeutics are enhanced through data science in Pharma 5.0. Patient remote monitoring coupled with AI/ML technologies enhances safety surveillance and post-marketing studies. Cardiovascular Pharma companies expedite time-to-market through smart clinical frameworks and virtual trials, which increases population-level impact.

Infectious Diseases: Vaccine development, outbreak forecasting, and surveillance of infectious disease antimicrobial resistance are being advanced by Pharma 5.0. AI and ML models are aiding in target selection for viral immune responses and formulation optimization, as well as during public health emergencies such as COVID-19 and emerging zoonoses via real-time cloud data integration. Improved epidemiological modeling and the design of tailored anti-infective medications using genomic and environmental factors also stem from Pharma 5.0.

Others: This category encompasses metabolic disorders, autoimmune diseases, rare diseases, and respiratory diseases, which are beginning to be treated under Pharma 5.0 paradigms. Rare diseases are aided by AI in molecule screening and patient registry analytics, while chronic diseases like diabetes benefit from diabetes digital therapeutics and connected devices. For autoimmune diseases, Pharma 5.0 aids in immunological modeling and customized selection of biologic therapies for individual patients. Such innovations provide meticulously customized and effective therapies in regions that are low R&D focus or sparse in patient population.

On-premise: Large pharmaceutical companies with sensitive data, intellectual property, and strict adherence to legal regulations prefer on-premise deployments. Such systems provide complete control over the infrastructure with specialized integration to legacy systems like LIMS, ERP, and MES. Though expensive to maintain in terms of capital and operational expenditures, on-premise models are best suited for proprietary AI models, sensitive clinical trial data, and high-performance computing requirements for drug simulations and bioinformatics.

Pharma 5.0 Market Share, By Deployment Mode, 2024 (%)

| Deployment Mode | Revenue Share, 2024 (%) |

| On-premise | 78.19% |

| Cloud-based | 21.81% |

Cloud-based: The deployment is gaining popularity in Pharma 5.0 because of its scalability, cost, and collaboration in real-time. It allows global R&D teams to share information seamlessly, facilitates AI and big data analytics on multi-omics datasets, and collaborates with other stakeholders, including CROs and regulatory bodies. Cloud platforms enable decentralized trials, digital twin modeling, and continuous learning systems, which are beneficial for agile start-ups as well as multinational pharma companies operating in multiple regions.

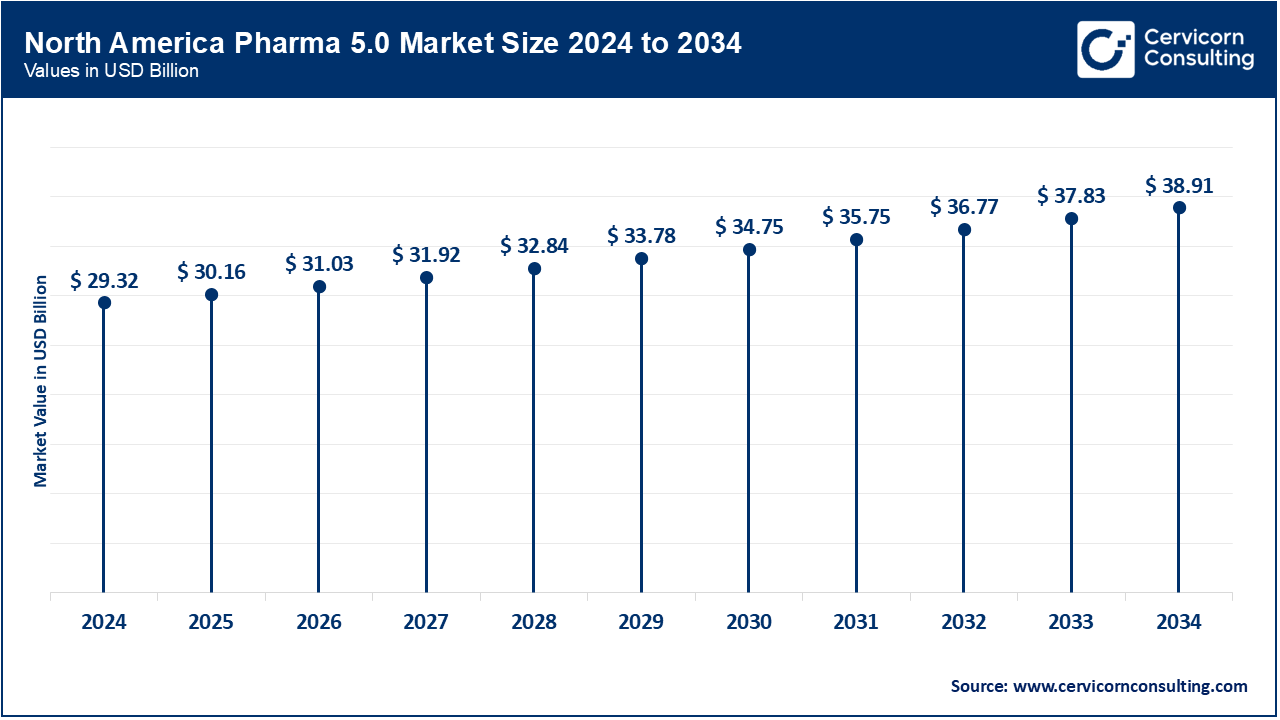

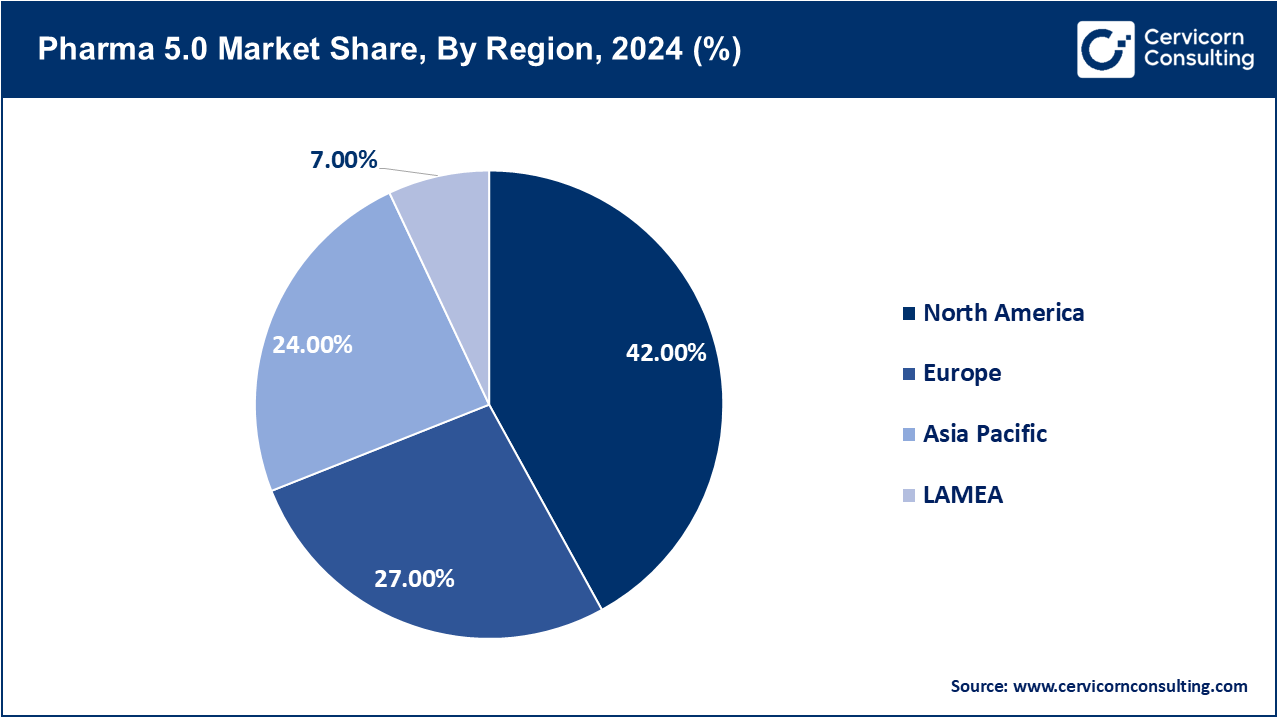

The pharma 5.0 market is segmented into several key regions: North America, Europe, Asia-Pacific, and LAMEA (Latin America, Middle East, and Africa). Here’s an in-depth look at each region.

In December 2023, the U.S. FDA published guidance on remote data acquisition for clinical trials which utilizes decentralized digital endpoints and enhances the Pharma 5.0 data ecosystem. In January 2025, Canada’s Health Canada and the U.S. FDA jointly issued transparency guidelines in GMLP and Good Machine Learning Practices (GLP) Trusting AI for Medical Devices in June 2024. The FDA also issued AI supported guidance for submission of drugs and biologist in the US in January 2025, added Canadian submission of AI linked documentation which accounted to 500 submissions since 2016. In 2024, the Canadian health administration will reduce regulatory barriers for the use AI in medical imaging and align with machine learning medical diagnostic standards. COFEPRIS in Mexico started piloting surveillance cloud systems for quality assurance in pharmaceutical manufacturing AI control in early 2025. In general, North America leads the regulatory integration of AI, digital endpoints, Cloud computing, and Pharma 5.0.

The EMA and European national regulators adopted a joint Big Data & AI workplan for 2028 in December 2023. This plan defines the use of AI throughout the lifecycle of a medicine. The EMA launched ‘Scientific Explorer’ in March 2024, an AI-powered search tool for evidence-based regulation. In June 2024, the UK’s MHRA, in conjunction with the FDA and Health Canada, endorsed GMLP principles of transparency for ML-enabled medical devices (GMLP). Germany and France have adopted interoperable EHR and AI researchworks under EU ACT-EU initiatives and AI reflection papers aligned to GDPR. In 2023, Germany started AI-in-healthcare pilot zones and France increased the deployment of AI triage tools to more regional hospitals. Europe establishes legal boundaries for the adoption of AI in Pharma 5.0 using regulations, frameworks, and interoperability.

Australia integrates AI and genomics for Pharma 5.0 in the 2023-2028 Digital Health Strategy and supporting documents. Japan’s PMDA AI/ML subcommittee for SaMD and bias mitigation has been meeting since 2022, increasing regulatory focus. The aim of the India Ayushman Bharat Digital Mission is to achieve 730 million unique Health ID assignments by January 2025 which is coupled with the AI enabled federated learning MoU for drug safety signed in September 2024. The Chinese counterpart in AI powered diagnostics and manufacturing cloud accepted its scope of work deeming it’s AI NMPA bound in mid-2024. South Korean NSTRI has conducted AI-powered secure international healthcare data sharing by SNUH in late 2024. This region cooperates to develop Pharma 5.0 via legal frameworks, federated AI, diagnostic regulation, and data sharing.

In 2024, Brazil’s ANVISA gave a go-ahead for hosting regulatory frameworks related to digital surveillance of vaccines and artificial intelligence compliance for batch testing. The UAE AI Strategy has a 2024 plan to build the largest cluster of AI data centers for healthcare in the world, propelling digital Pharma 5.0 research across the Gulf. Saudi Arabia’s Seha Virtual Hospital won awards in early November 2023 for the most innovative achievements in digital health and a Guinness World Record in October 2024 for incorporating AI telemedicine for remote patient care and monitoring, showcasing paradigm-shifting advancements in telemedicine. In June 2024, South Africa hosted a conference that dealt with the application of AI as diagnostic tools for TB and silicosis, demonstrating multidisciplinary regulatory and clinical collaboration for public health surveillance with AI. In the entire LAMEA region, some governments are attempting to formulate some laws while experimenting with AI-based clinical and manufacturing systems for Pharma 5.0.

Recent partnerships in the pharma 5.0 industry emphasize innovation and cross-industry integration. Microsoft collaborates with OpenAI to enhance AI agent capabilities in productivity and cloud services. Google teams up with Salesforce to embed advanced conversational agents in CRM platforms. IBM partners with SAP to deploy Pharma 5.0 for enterprise automation and compliance. Salesforce joins forces with AWS to scale AI-driven customer service solutions. These collaborations focus on improving automation, enhancing user experience, and accelerating AI adoption across sectors. Together, they drive the global shift toward intelligent, scalable AI agent technologies.

Market Segmentation

By Technology

By Type

By End-User

By Therapeutic Area

By Deployment Mode

By Region

Chapter 1. Market Introduction and Overview

1.1 Market Definition and Scope

1.1.1 Overview of Pharma 5.0

1.1.2 Scope of the Study

1.1.3 Research Timeframe

1.2 Research Methodology and Approach

1.2.1 Methodology Overview

1.2.2 Data Sources and Validation

1.2.3 Key Assumptions and Limitations

Chapter 2. Executive Summary

2.1 Market Highlights and Snapshot

2.2 Key Insights by Segments

2.2.1 By Technology Overview

2.2.2 By Type Overview

2.2.3 By End-User Overview

2.2.4 By Therapeutic Area Overview

2.2.5 By Deployment Mode Overview

2.3 Competitive Overview

Chapter 3. Global Impact Analysis

3.1 Russia-Ukraine Conflict: Global Market Implications

3.2 Regulatory and Policy Changes Impacting Global Markets

Chapter 4. Market Dynamics and Trends

4.1 Market Dynamics

4.1.1 Market Drivers

4.1.1.1 Surge of Health Information Sparked by the Integration of IoT and EHRs

4.1.1.2 Consumer Demand for Transparency and Access

4.1.1.3 Public and Private Funding in AI/HealthTech

4.1.2 Market Restraints

4.1.2.1 Regulatory Uncertainty for Digital Therapeutics

4.1.2.2 Resistance to Change in Traditional Pharma Culture

4.1.2.3 Limited Interoperability Among Systems

4.1.3 Market Challenges

4.1.3.1 AI Black Box Problem

4.1.3.2 Talent Gap in AI Pharma Convergence

4.1.3.3 Interdisciplinary Collaboration Barriers

4.1.4 Market Opportunities

4.1.4.1 Automation Enabled Pharmacovigilance and Precision Medicine

4.1.4.2 Smart Manufacturing with Predictive Maintenance

4.1.4.3 Companion Diagnostics with AI Technologies

4.2 Market Trends

Chapter 5. Premium Insights and Analysis

5.1 Global Pharma 5.0 Market Dynamics, Impact Analysis

5.2 Porter’s Five Forces Analysis

5.2.1 Bargaining Power of Suppliers

5.2.2 Bargaining Power of Buyers

5.2.3 Threat of Substitute Products

5.2.4 Rivalry among Existing Firms

5.2.5 Threat of New Entrants

5.3 PESTEL Analysis

5.4 Value Chain Analysis

5.5 Product Pricing Analysis

5.6 Vendor Landscape

5.6.1 List of Buyers

5.6.2 List of Suppliers

Chapter 6. Pharma 5.0 Market, By Technology

6.1 Global Pharma 5.0 Market Snapshot, By Technology

6.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

6.1.1.1 Artificial Intelligence (AI)

6.1.1.2 Machine Learning (ML)

6.1.1.3 Robotic Process Automation (RPA)

6.1.1.4 Internet of Things (IoT)

6.1.1.5 Cloud Computing

Chapter 7. Pharma 5.0 Market, By Type

7.1 Global Pharma 5.0 Market Snapshot, By Type

7.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

7.1.1.1 AI-Driven Drug Discovery

7.1.1.2 Smart Manufacturing (Digital Twins & Automation)

7.1.1.3 Digital Therapeutics

7.1.1.4 Personalized Medicine Platforms

7.1.1.5 AI-Based Diagnostics

Chapter 8. Pharma 5.0 Market, By End-User

8.1 Global Pharma 5.0 Market Snapshot, By End-User

8.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

8.1.1.1 Pharmaceutical & Biotech Companies

8.1.1.2 Contract Research Organizations (CROs)

8.1.1.3 Healthcare Providers

8.1.1.4 Research Institutes

Chapter 9. Pharma 5.0 Market, By Therapeutic Area

9.1 Global Pharma 5.0 Market Snapshot, By Therapeutic Area

9.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

9.1.1.1 Oncology

9.1.1.2 Neurology

9.1.1.3 Cardiovascular Diseases

9.1.1.4 Infectious Diseases

9.1.1.5 Others

Chapter 10. Pharma 5.0 Market, By Deployment Mode

10.1 Global Pharma 5.0 Market Snapshot, By Deployment Mode

10.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

10.1.1.1 On-premise

10.1.1.2 Cloud-based

Chapter 11. Pharma 5.0 Market, By Region

11.1 Overview

11.2 Pharma 5.0 Market Revenue Share, By Region 2024 (%)

11.3 Global Pharma 5.0 Market, By Region

11.3.1 Market Size and Forecast

11.4 North America

11.4.1 North America Pharma 5.0 Market Revenue, 2022-2034 ($Billion)

11.4.2 Market Size and Forecast

11.4.3 North America Pharma 5.0 Market, By Country

11.4.4 U.S.

11.4.4.1 U.S. Pharma 5.0 Market Revenue, 2022-2034 ($Billion)

11.4.4.2 Market Size and Forecast

11.4.4.3 U.S. Market Segmental Analysis

11.4.5 Canada

11.4.5.1 Canada Pharma 5.0 Market Revenue, 2022-2034 ($Billion)

11.4.5.2 Market Size and Forecast

11.4.5.3 Canada Market Segmental Analysis

11.4.6 Mexico

11.4.6.1 Mexico Pharma 5.0 Market Revenue, 2022-2034 ($Billion)

11.4.6.2 Market Size and Forecast

11.4.6.3 Mexico Market Segmental Analysis

11.5 Europe

11.5.1 Europe Pharma 5.0 Market Revenue, 2022-2034 ($Billion)

11.5.2 Market Size and Forecast

11.5.3 Europe Pharma 5.0 Market, By Country

11.5.4 UK

11.5.4.1 UK Pharma 5.0 Market Revenue, 2022-2034 ($Billion)

11.5.4.2 Market Size and Forecast

11.5.4.3 UKMarket Segmental Analysis

11.5.5 France

11.5.5.1 France Pharma 5.0 Market Revenue, 2022-2034 ($Billion)

11.5.5.2 Market Size and Forecast

11.5.5.3 FranceMarket Segmental Analysis

11.5.6 Germany

11.5.6.1 Germany Pharma 5.0 Market Revenue, 2022-2034 ($Billion)

11.5.6.2 Market Size and Forecast

11.5.6.3 GermanyMarket Segmental Analysis

11.5.7 Rest of Europe

11.5.7.1 Rest of Europe Pharma 5.0 Market Revenue, 2022-2034 ($Billion)

11.5.7.2 Market Size and Forecast

11.5.7.3 Rest of EuropeMarket Segmental Analysis

11.6 Asia Pacific

11.6.1 Asia Pacific Pharma 5.0 Market Revenue, 2022-2034 ($Billion)

11.6.2 Market Size and Forecast

11.6.3 Asia Pacific Pharma 5.0 Market, By Country

11.6.4 China

11.6.4.1 China Pharma 5.0 Market Revenue, 2022-2034 ($Billion)

11.6.4.2 Market Size and Forecast

11.6.4.3 ChinaMarket Segmental Analysis

11.6.5 Japan

11.6.5.1 Japan Pharma 5.0 Market Revenue, 2022-2034 ($Billion)

11.6.5.2 Market Size and Forecast

11.6.5.3 JapanMarket Segmental Analysis

11.6.6 India

11.6.6.1 India Pharma 5.0 Market Revenue, 2022-2034 ($Billion)

11.6.6.2 Market Size and Forecast

11.6.6.3 IndiaMarket Segmental Analysis

11.6.7 Australia

11.6.7.1 Australia Pharma 5.0 Market Revenue, 2022-2034 ($Billion)

11.6.7.2 Market Size and Forecast

11.6.7.3 AustraliaMarket Segmental Analysis

11.6.8 Rest of Asia Pacific

11.6.8.1 Rest of Asia Pacific Pharma 5.0 Market Revenue, 2022-2034 ($Billion)

11.6.8.2 Market Size and Forecast

11.6.8.3 Rest of Asia PacificMarket Segmental Analysis

11.7 LAMEA

11.7.1 LAMEA Pharma 5.0 Market Revenue, 2022-2034 ($Billion)

11.7.2 Market Size and Forecast

11.7.3 LAMEA Pharma 5.0 Market, By Country

11.7.4 GCC

11.7.4.1 GCC Pharma 5.0 Market Revenue, 2022-2034 ($Billion)

11.7.4.2 Market Size and Forecast

11.7.4.3 GCCMarket Segmental Analysis

11.7.5 Africa

11.7.5.1 Africa Pharma 5.0 Market Revenue, 2022-2034 ($Billion)

11.7.5.2 Market Size and Forecast

11.7.5.3 AfricaMarket Segmental Analysis

11.7.6 Brazil

11.7.6.1 Brazil Pharma 5.0 Market Revenue, 2022-2034 ($Billion)

11.7.6.2 Market Size and Forecast

11.7.6.3 BrazilMarket Segmental Analysis

11.7.7 Rest of LAMEA

11.7.7.1 Rest of LAMEA Pharma 5.0 Market Revenue, 2022-2034 ($Billion)

11.7.7.2 Market Size and Forecast

11.7.7.3 Rest of LAMEAMarket Segmental Analysis

Chapter 12. Competitive Landscape

12.1 Competitor Strategic Analysis

12.1.1 Top Player Positioning/Market Share Analysis

12.1.2 Top Winning Strategies, By Company, 2022-2024

12.1.3 Competitive Analysis By Revenue, 2022-2024

12.2 Recent Developments by the Market Contributors (2024)

Chapter 13. Company Profiles

13.1 Pfizer

13.1.1 Company Snapshot

13.1.2 Company and Business Overview

13.1.3 Financial KPIs

13.1.4 Product/Service Portfolio

13.1.5 Strategic Growth

13.1.6 Global Footprints

13.1.7 Recent Development

13.1.8 SWOT Analysis

13.2 Novarti

13.3 Roche

13.4 AstraZeneca

13.5 Sanofi

13.6 Bristol Myers Squibb

13.7 GS

13.8 Eli Lilly

13.9 Johnson & Johnson

13.10 BioNTech