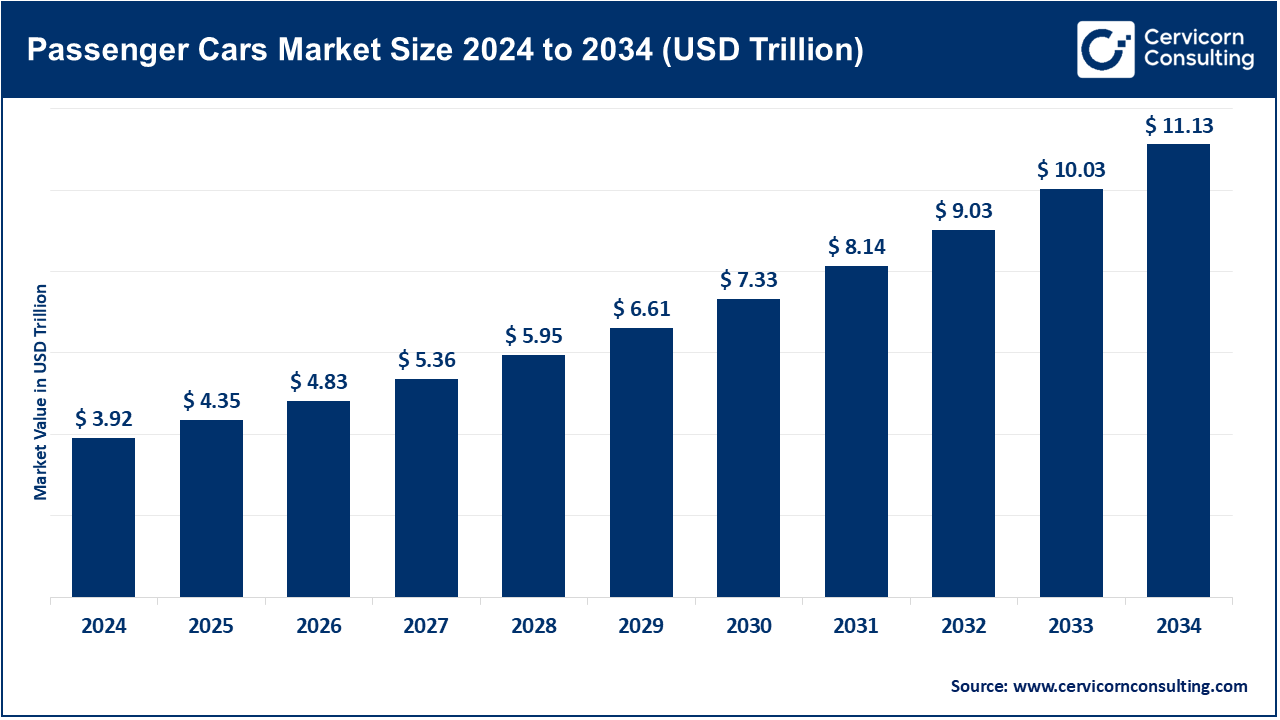

The global passenger cars market size was reached at USD 3.92 trillion in 2024 and is expected to be worth around USD 11.13 trillion by 2034, growing at a compound annual growth rate (CAGR) of 16.10% over the forecast period from 2025 to 2034. The passenger car market is expected to grow significantly due to rising disposable incomes, urbanization, improved road infrastructure, technological innovations, and increasing demand for personal mobility and electric vehicle adoption.

A passenger car is a type of privately owned motor vehicle designed to transport people rather than goods. Passenger vehicles include sedans, SUVs, hatchbacks, and even convertibles which are integrated with internal combustion engines or, more commonly now, electric powertrains. Trucks, buses and vans are more flexible and comfortable compared to other modes of transport. Modern passenger vehicles are increasingly receiving fuel-efficient engines, navigation systems, and sophisticated driver-assistance systems. This is alongside policies, urban sprawl, competitors, innovation, and higher fossil fuel and emissions regulations controls. This changes these factors focus the immediate demand or need. Expand your view economically and these factors encourage having a vehicle.

Volume of passenger cars sold across India in the financial year 2024, by original equipment Manufacturer:

| Vehicle | No. of Vehicle Sold |

| Maruti Suzuki India | 16,05,264 |

| Hundai Motor India | 5,61,371 |

| Tata Motors | 5,38,264 |

| Mahindra & Mahindra | 4,24,570 |

| Kia India | 2,25,539 |

| Toyota Kirloskar Motors | 2,12,646 |

| Skoda Auto VW Group | 88,412 |

| Renault India | 46,614 |

| Nisan Motor India | 27,317 |

| Mercedes-benz Group | 15,599 |

Report Scope

| Area of Focus | Details |

| Market Size in 2025 | USD 4.35 Trillion |

| Expected Size in 2034 | USD 11.13 Trillion |

| Projected Market CAGR form 2025 to 2034 | 16.10% |

| Superior Region | Asia-Pacific |

| Booming Region | Asia-Pacific |

| Key Segments | Vehicle Class, Propulsion Type, Engine Capacity, Type, Fuel Type, Region |

| Key Companies | Ford Motor Company, General Motors, AUDI AG, Kia Motors Corporation, Groupe Renault, Groupe PSA, SAIC Motor Corporation Limited, Tesla, Daimler AG, BMW AG, Hyundai Motor Company, BYD Company Ltd., Continental AG, TOYOTA MOTOR CORPORATION, Nissan Motor Co., LTD., Volkswagen AG, AB Volvo, Honda Motor Co., Ltd. |

Compact Cars: The compact cars segment has dominated the market in 2024. Affordable vehicles like the Maruti Suzuki Swift and Tata Tiago have remained fuel efficient and highly popular in the Indian market. However, reports indicate a shift in consumer focus towards larger vehicles and SUVs. Maruti's working equations reported a drop in sales for mini and compact models by 12.6% over the previous year due to increased vehicle prices and shifting consumer trends in May 2025. Although, compact cars still comprise a significant portion of car sales in India, especially in urban areas where space constraints make maneuverability and parking easy. In order to retain consumer interest, Manufacturers are upgrading models with new features.

Midsize Cars: Midsize SUVs categorize Midsize vehicles which include the Maruti Suzuki Grand Vitara that is showing great signs of growth in India. Grand Vitara crossed the 300,000 unit sales mark in 32 months making it the fastest selling SUV in this segment. This boom is the result of the “goldilocks” effect where consumers seeking balance between space, comfort, and fuel efficiency. Midsize segments are gaining more and more competition, hybrid technology and advanced safety features are being added to new models by manufacturers meeting changing consumer needs.

Passenger Cars Market Revenue Share, By Vehicle Class, 2024 (%)

| Vehicle Class | Revenue Share, 2024 (%) |

| Compact | 47% |

| Midsize | 32% |

| Premium | 11% |

| Luxury | 2% |

| Others | 8% |

Premium Cars: Enhanced features and comfort are fueled among the emerging Indian middle and upper-middle class. Models such as Hyundai Alcazar and Kia Carens Clavis are appealing consumers who want luxury at a relatively cheaper cost. These vehicles are equipped with panoramic sunroofs, advanced infotainment systems, turbocharged engines, and other luxurious features. The expansion of the middle class coupled with better access to premium financing suggests a heightened demand for vehicles that are aesthetically and functionally dominant. Premium cars encapsulate both of these facets into one offering.

Luxury Cars: The segment of luxury cars in India grew by 6% in 2024, reaching 51,200 units sold. Mercedes Benz and BMW have accelerated the expansion of their EV portfolios, releasing the EQS SUV and BMW iX. The positive trend towards luxurious EVs is backed with reliable charging stations and government-supported financing. There are more and more consumers willing to invest in luxury cars that are high performance and eco-friendly which is a positive indicator for the growth of the segment.

Others: This category includes subclasses such as sports cars, specialized vehicles, and even convertibles. While these categories do appeal to a smaller demographic, they do provide adequacy to the breadth of the automobile market. Special edition models limited by number are usually constructed to display engineering prowess and value symbolism. Such vehicles are often regarded as flagship models which enhance the brand image alongside car enthusiasts.

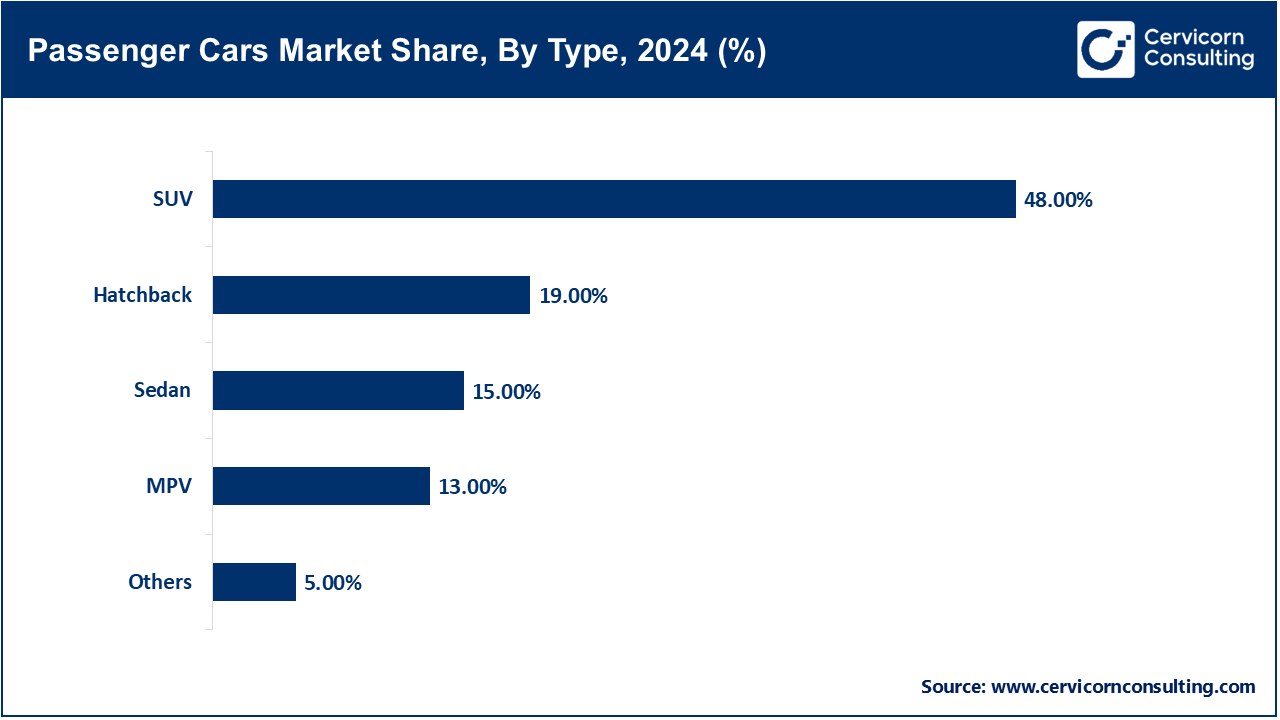

MPV (Multi-Purpose Vehicle): MPVs such as the Toyota Innova and Kia Carens are favored by large families as well as commercial operators for their roomy interiors and multifaceted uses. In 2024, the Toyota Innova recorded a 27% year on year increase in sales which confirms the continuous need for MPVs in India. Now, in order to widen their market, companies are modifying MPVs by adding ADAS and hybrid engines. This is being done to mpvs to meet changing socio-economic norms while maintaining a balance between comfort, utility, and efficiency.

SUV (Sport Utility Vehicle): The SUV segment has dominated the market in 2024. The sporty stance and higher driving position of these cars has made them the most common body type for an Indian passenger car. SUVs such as the Maruti Suzuki Fronx and Tata Nexon have showed best selling numbers, with fronx achieving a 66% year-on-year growth in 2024. The SUV sector is full of diverse consumers which includes compact to full size models, EVs, and many fuel types. The mix of functionality and safety associated with SUVs makes them appealing to a wide range of consumers.

Hatchbacks: Hatchbacks have been the most preferred car in India as they are economical. However, there is a shift in preference to larger vehicles like SUVs and this is impacting the sales of hatchbacks negatively. To counter these trends, manufacturers are retrofitting older models with modern aesthetics and improved safety features. Regardless of competition, fuel efficiency and ease of navigating through city traffic makes them a practical option for urban dwellers.

Sedan: Sedans are loved by families as well as working professionals due to the comfort and performance they offer. Their popularity is on a decline along with the rise in SUVs, but Honda City and Hyundai Verna sedans continue to sell well. To reignite interest in this segment, Renault and Nissan are equipping their vehicles with newer infotainment systems and turbocharged engines. These may be issues in some ways, but for more traditional users looking for a no-frills three-box car with a spacious boot means there’s still demand.

Others: This category includes body styles like coupes and crossovers which cater to niche markets. These models may have fewer sales than other popular vehicles, but they help deepen the diversity offered in the automotive industry. Automakers often use these vehicle models to establish new design and engineering standards to capture the attention of new customers and strengthen their position in the marketing spotlight.

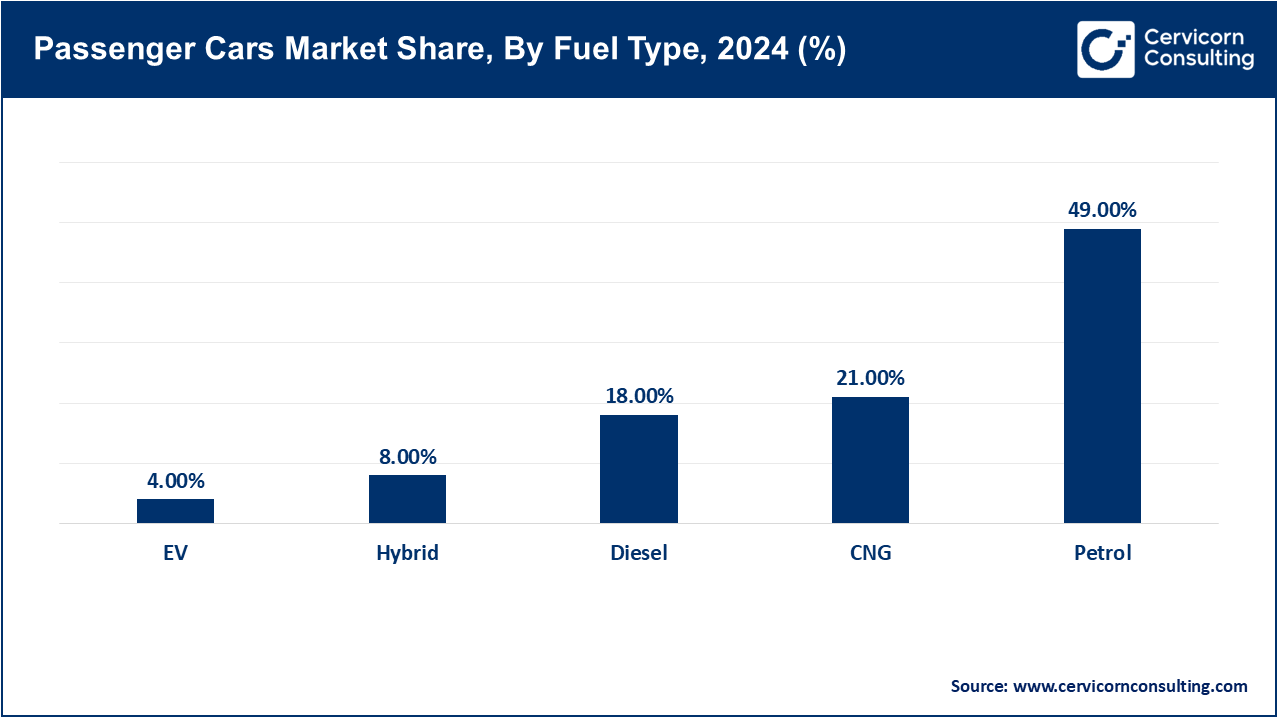

Petrol: The dominant fuel choice for Indian consumers still remains petrol, mainly because of its accessibility, lower cost, and smooth driving experience. As per data from the VAHAN portal, petrol-powered passenger vehicles accounted for almost 74% of total car sales in 2024. Both Maruthi Suzuki and Hyundai command this segment of the market with the Swift and i20 models. Furthermore, petrol engines offer lower service costs, better suited for idling or stop-and-go driving common in congested city traffic. Despite some movement towards electric vehicles, the convenience that comes with petrol keeps it in the lead as the favorite option. Increased fuel costs, along with tighter emissions control policies, will slowly change the direction of consumer choice. We can expect more petrol-hybrids to emerge during this shift.

Diesel: Some diesel cars got sold in the past because of emission regulations and the increasing difference in prices between diesel and petrol. In 2013, the sale of diesel cars exceeded 50%, by 2024 this number has dropped to below 20% (source: Ministry of Road Transport & Highways). Even so, diesel is still used in bigger cars like SUVs and MPVs where fuel economy during long drives is important. Tata Motors and Mahindra still sell diesel models to rural and commercial consumers. However, the growing restrictions on the use of diesel vehicles in NCR and other states because of pollution issues are limiting the market. After 2030, the outlook for diesel in India is fairly bleak.

Compressed Natural Gas (CNG): The adoption of CNG powered vehicles along with CNG infrastructure is increasing in metropolitan cities like Delhi, Mumbai and Pune. Due to an increase in the number of eco-friendly consumers and the rising prices of petrol/diesel, CNG passenger vehicle sales went up 28% year-over-year in FY 2023-24. Maruti Suzuki leads the industry with its Wagon R CNG and Ertiga CNG models. These vehicles are more economical to operate due to their lower emissions, making them popular with private and fleet users; however, refill stations outside urban centers are limited, which hinders wider adoption. With the government’s increasing incentives and the expansion of CNG stations (set to hit 10,000 by 2030 per MoPNG), this gap may be bridged and growth unlocked.

EV (Electric Vehicles): The passenger car segment that is growing the fastest in India is electric vehicles. According to the estimates provided by the VAHAN dashboard, India is projected to have over 15 lakh EV registrations by early 2025. Leading the industry is Tata Motors which has an EV market share of over 70% with the Nexon EV and Tiago EV. The government, together with the state’s no registration and road tax policies, encourages the adoption of EVs under the Fame II scheme. Apart from that, charging infrastructure is being enhanced with over 10,000 public charging stations anticipated by 2024 (Ministry of Power). The steep initial cost continues to be a difficulty alongside the market fuel price, but falling battery prices are starting to improve the conditions for EVs.

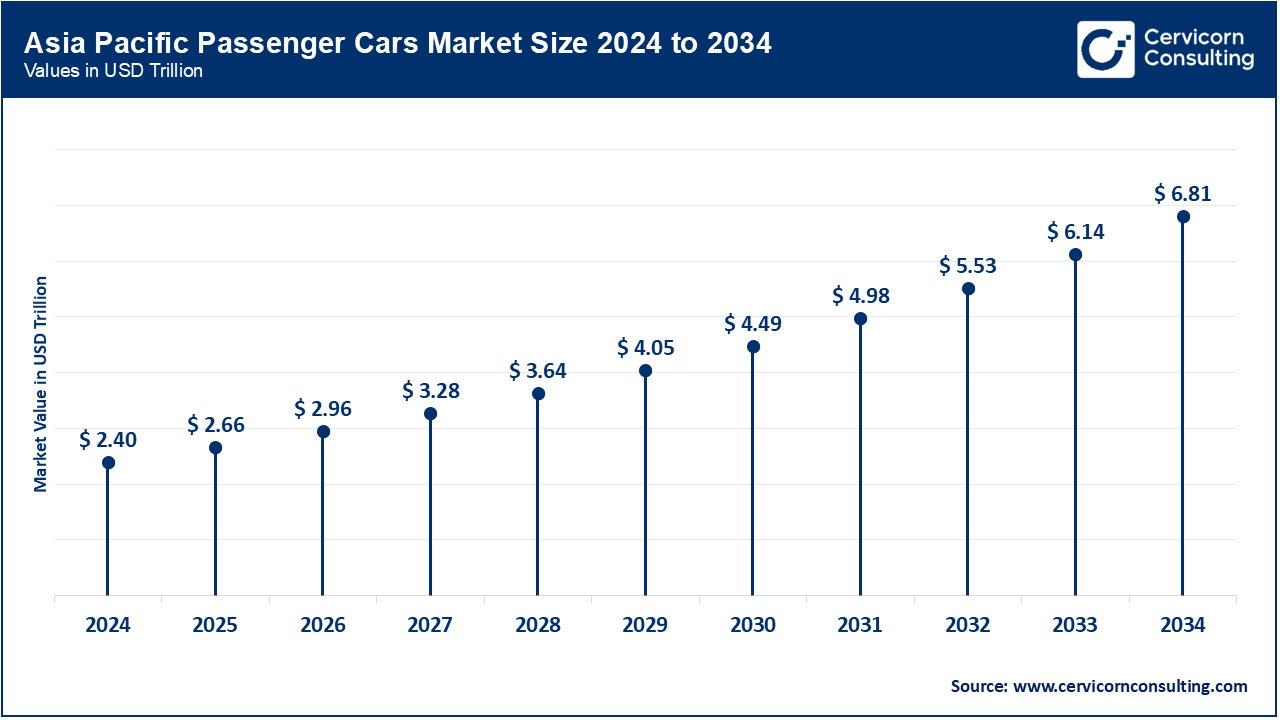

The passenger cars market is segmented into several key regions: North America, Europe, Asia-Pacific, and LAMEA (Latin America, Middle East, and Africa). Here’s an in-depth look at each region

China still remains in first place as the world's leading passenger car market, with having the strongest changes in EV sales. The new energy vehicle sales from BYD at 380,089 gave evidence in April 2025 fueling China’s claim of leading in adopting EVs. The India’s market is heaving in turmoil as it experienced an approximate decrease of 4% in passenger cars sales in May 2025 due to high stocking inventories and rare earth elements restraining supply for manufactured EVs. Japan, Australia, and South Korea are actively enhancing in the automotive industry on hybrids and electric vehicles due to government funding and consumer demands for eco-friendly transport options.

In North America, there were notable shifts in the sales of passenger cars in early 2025. In the U.S., there was a sales peak in March as car purchases surged prior to anticipated tariffs. However, by May, sales had decreased nearly 10%, reflecting the volatility of the market. Ford’s sales sales increased more than 16% in May due to a large increase in hybrid vehicle sales, although electric vehicle sales fell by 25%. In Canada, Quebec’s Tesla sales plummeted in early 2025 due to suspended government rebates and tariffs increasing the difficulty of purchasing vehicles. Mexico continues to be an important automotive manufacturing country, however, it faced challenges in 2025 due to the new U.S. tariffs, which are expected to reduce production by a million cars and damage trade relations. Overall, these developments indicate the nadir of government policies and volatile market conditions on the automotive industry in North America.

Passenger Cars Market Revenue Share, By Region, 2024 (%)

| Region | Revenue Share, 2024 (%) |

| North America | 11.10% |

| Europe | 20.60% |

| Asia-Pacific | 61.20% |

| LAMEA | 7.10% |

Economic headwinds have been affecting the European market for passenger cars. The European monetary union eased its growth constraints by lowering the main interest rate to 2% in June 2025. In the UK new car sales increased 1.6% in May due new corporate fleet requirement but Tesla’s sales dropped by 36% because of increasing competition from Chinese makers of electric vehicles like BYD. Frift and Germany have further experienced mixed results, with sales declining in Germany by 3.9% and France by 15% over the last few months, which has impacted other regions across the globe. The region’s focus on electrification is still in motion and EV’s continue to capture an increasing market share in the overall sales across the region.

Economic stability and government purchase incentives are helping to revive the production and sales of passenger vehicles in Brazil. The country is also trying to develop biofuel technologies, particularly green alternatives like ethanol powered cars. Alongside these advancements, Brazil is still struggling with inflation and inadequate infrastructure to sustain electric vehicles. The other part of the region, the Middle East, has the UAE and Saudi Arabia making remarkable investments in South Africa has the largest car market in the region but is still grappling with economic and infrastructural challenges.

Recent partnerships in the Passenger Cars Market showcase a growing push for electrification, sustainability, and smart mobility through collaboration between automakers and tech firms. Major players like General Motors and Honda are working together on affordable next-generation EV platforms, while Ford and SK On have partnered to scale battery manufacturing in North America. Toyota has joined forces with Mazda and Subaru to co-develop future EV technologies and solid-state batteries. Meanwhile, Volkswagen continues its strategic alliance with XPeng in China to accelerate EV innovation. These partnerships focus on expanding EV infrastructure, advancing autonomous driving systems, and reducing vehicle emissions. Such collaborations are key to meeting tightening global emission regulations and transforming the future of personal mobility.

Market Segmentation

By Vehicle Class

By Propulsion Type

By Engine Capacity

By Type

By Fuel Type

By Region

Chapter 1. Market Introduction and Overview

1.1 Market Definition and Scope

1.1.1 Overview of Passenger Cars

1.1.2 Scope of the Study

1.1.3 Research Timeframe

1.2 Research Methodology and Approach

1.2.1 Methodology Overview

1.2.2 Data Sources and Validation

1.2.3 Key Assumptions and Limitations

Chapter 2. Executive Summary

2.1 Market Highlights and Snapshot

2.2 Key Insights by Segments

2.2.1 By Vehicle Class Overview

2.2.2 By Propulsion Type Overview

2.2.3 By Engine Capacity Overview

2.2.4 By Type Overview

2.2.5 By Fuel Type Overview

2.3 Competitive Overview

Chapter 3. Global Impact Analysis

3.1 Russia-Ukraine Conflict: Global Market Implications

3.2 Regulatory and Policy Changes Impacting Global Markets

Chapter 4. Market Dynamics and Trends

4.1 Market Dynamics

4.1.1 Market Drivers

4.1.1.1 Rising Environmental Awareness

4.1.1.2 Technological advancement

4.1.1.3 Strong Aftersales Service Networks

4.1.2 Market Restraints

4.1.2.1 Supply Chain Disruptions

4.1.2.2 Rising Raw Material Prices

4.1.3 Market Challenges

4.1.3.1 Cybersecurity Threats in Connected Vehicles

4.1.3.2 EV Battery Disposal and Recycling

4.1.4 Market Opportunities

4.1.4.1 Expansion into Emerging Markets

4.1.4.2 Increasing Mobility Access in Rural Areas

4.1.4.3 Fleet Electrification by Commercial Operators

4.2 Market Trends

Chapter 5. Premium Insights and Analysis

5.1 Global Passenger Cars Market Dynamics, Impact Analysis

5.2 Porter’s Five Forces Analysis

5.2.1 Bargaining Power of Suppliers

5.2.2 Bargaining Power of Buyers

5.2.3 Threat of Substitute Products

5.2.4 Rivalry among Existing Firms

5.2.5 Threat of New Entrants

5.3 PESTEL Analysis

5.4 Value Chain Analysis

5.5 Product Pricing Analysis

5.6 Vendor Landscape

5.6.1 List of Buyers

5.6.2 List of Suppliers

Chapter 6. Passenger Cars Market, By Vehicle Class

6.1 Global Passenger Cars Market Snapshot, By Vehicle Class

6.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

6.1.1.1 Compact

6.1.1.2 Midsize

6.1.1.3 Premium

6.1.1.4 Luxury

6.1.1.5 Others

Chapter 7. Passenger Cars Market, By Propulsion Type

7.1 Global Passenger Cars Market Snapshot, By Propulsion Type

7.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

7.1.1.1 ICE

7.1.1.2 Electric

Chapter 8. Passenger Cars Market, By Engine Capacity

8.1 Global Passenger Cars Market Snapshot, By Engine Capacity

8.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

8.1.1.1 <1000 cc

8.1.1.2 <1000-1500 cc

8.1.1.3 <1500-2000 cc

8.1.1.4 >2000 cc

Chapter 9. Passenger Cars Market, By Type

9.1 Global Passenger Cars Market Snapshot, By Type

9.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

9.1.1.1 MPV

9.1.1.2 SUV

9.1.1.3 Hatchback

9.1.1.4 Sedan

9.1.1.5 Others

Chapter 10. Passenger Cars Market, By Fuel Type

10.1 Global Passenger Cars Market Snapshot, By Fuel Type

10.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

10.1.1.1 Petrol

10.1.1.2 Diesel

10.1.1.3 CNG

Chapter 11. Passenger Cars Market, By Region

11.1 Overview

11.2 Passenger Cars Market Revenue Share, By Region 2024 (%)

11.3 Global Passenger Cars Market, By Region

11.3.1 Market Size and Forecast

11.4 North America

11.4.1 North America Passenger Cars Market Revenue, 2022-2034 ($Billion)

11.4.2 Market Size and Forecast

11.4.3 North America Passenger Cars Market, By Country

11.4.4 U.S.

11.4.4.1 U.S. Passenger Cars Market Revenue, 2022-2034 ($Billion)

11.4.4.2 Market Size and Forecast

11.4.4.3 U.S. Market Segmental Analysis

11.4.5 Canada

11.4.5.1 Canada Passenger Cars Market Revenue, 2022-2034 ($Billion)

11.4.5.2 Market Size and Forecast

11.4.5.3 Canada Market Segmental Analysis

11.4.6 Mexico

11.4.6.1 Mexico Passenger Cars Market Revenue, 2022-2034 ($Billion)

11.4.6.2 Market Size and Forecast

11.4.6.3 Mexico Market Segmental Analysis

11.5 Europe

11.5.1 Europe Passenger Cars Market Revenue, 2022-2034 ($Billion)

11.5.2 Market Size and Forecast

11.5.3 Europe Passenger Cars Market, By Country

11.5.4 UK

11.5.4.1 UK Passenger Cars Market Revenue, 2022-2034 ($Billion)

11.5.4.2 Market Size and Forecast

11.5.4.3 UKMarket Segmental Analysis

11.5.5 France

11.5.5.1 France Passenger Cars Market Revenue, 2022-2034 ($Billion)

11.5.5.2 Market Size and Forecast

11.5.5.3 FranceMarket Segmental Analysis

11.5.6 Germany

11.5.6.1 Germany Passenger Cars Market Revenue, 2022-2034 ($Billion)

11.5.6.2 Market Size and Forecast

11.5.6.3 GermanyMarket Segmental Analysis

11.5.7 Rest of Europe

11.5.7.1 Rest of Europe Passenger Cars Market Revenue, 2022-2034 ($Billion)

11.5.7.2 Market Size and Forecast

11.5.7.3 Rest of EuropeMarket Segmental Analysis

11.6 Asia Pacific

11.6.1 Asia Pacific Passenger Cars Market Revenue, 2022-2034 ($Billion)

11.6.2 Market Size and Forecast

11.6.3 Asia Pacific Passenger Cars Market, By Country

11.6.4 China

11.6.4.1 China Passenger Cars Market Revenue, 2022-2034 ($Billion)

11.6.4.2 Market Size and Forecast

11.6.4.3 ChinaMarket Segmental Analysis

11.6.5 Japan

11.6.5.1 Japan Passenger Cars Market Revenue, 2022-2034 ($Billion)

11.6.5.2 Market Size and Forecast

11.6.5.3 JapanMarket Segmental Analysis

11.6.6 India

11.6.6.1 India Passenger Cars Market Revenue, 2022-2034 ($Billion)

11.6.6.2 Market Size and Forecast

11.6.6.3 IndiaMarket Segmental Analysis

11.6.7 Australia

11.6.7.1 Australia Passenger Cars Market Revenue, 2022-2034 ($Billion)

11.6.7.2 Market Size and Forecast

11.6.7.3 AustraliaMarket Segmental Analysis

11.6.8 Rest of Asia Pacific

11.6.8.1 Rest of Asia Pacific Passenger Cars Market Revenue, 2022-2034 ($Billion)

11.6.8.2 Market Size and Forecast

11.6.8.3 Rest of Asia PacificMarket Segmental Analysis

11.7 LAMEA

11.7.1 LAMEA Passenger Cars Market Revenue, 2022-2034 ($Billion)

11.7.2 Market Size and Forecast

11.7.3 LAMEA Passenger Cars Market, By Country

11.7.4 GCC

11.7.4.1 GCC Passenger Cars Market Revenue, 2022-2034 ($Billion)

11.7.4.2 Market Size and Forecast

11.7.4.3 GCCMarket Segmental Analysis

11.7.5 Africa

11.7.5.1 Africa Passenger Cars Market Revenue, 2022-2034 ($Billion)

11.7.5.2 Market Size and Forecast

11.7.5.3 AfricaMarket Segmental Analysis

11.7.6 Brazil

11.7.6.1 Brazil Passenger Cars Market Revenue, 2022-2034 ($Billion)

11.7.6.2 Market Size and Forecast

11.7.6.3 BrazilMarket Segmental Analysis

11.7.7 Rest of LAMEA

11.7.7.1 Rest of LAMEA Passenger Cars Market Revenue, 2022-2034 ($Billion)

11.7.7.2 Market Size and Forecast

11.7.7.3 Rest of LAMEAMarket Segmental Analysis

Chapter 12. Competitive Landscape

12.1 Competitor Strategic Analysis

12.1.1 Top Player Positioning/Market Share Analysis

12.1.2 Top Winning Strategies, By Company, 2022-2024

12.1.3 Competitive Analysis By Revenue, 2022-2024

12.2 Recent Developments by the Market Contributors (2024)

Chapter 13. Company Profiles

13.1 Ford Motor Company

13.1.1 Company Snapshot

13.1.2 Company and Business Overview

13.1.3 Financial KPIs

13.1.4 Product/Service Portfolio

13.1.5 Strategic Growth

13.1.6 Global Footprints

13.1.7 Recent Development

13.1.8 SWOT Analysis

13.2 General Motors

13.3 AUDI AG

13.4 Kia Motors Corporation

13.5 Groupe Renault

13.6 Groupe PSA

13.7 SAIC Motor Corporation Limited

13.8 Tesla Inc.

13.9 Daimler AG

13.10 BMW AG

13.11 Hyundai Motor Company

13.12 BYD Company Ltd.

13.13 Continental AG

13.14 TOYOTA MOTOR CORPORATION

13.15 Nissan Motor Co., LTD.

13.16 Volkswagen AG

13.17 AB Volvo

13.18 Honda Motor Co., Ltd.