Automotive IoT is revolutionizing modern vehicles with real-time connectivity, enhanced safety, and smart services—from telematics and predictive maintenance to V2X communication and over-the-air software updates. The rise of 5G networks, ADAS, and telematics data privacy concerns are reshaping industry dynamics.

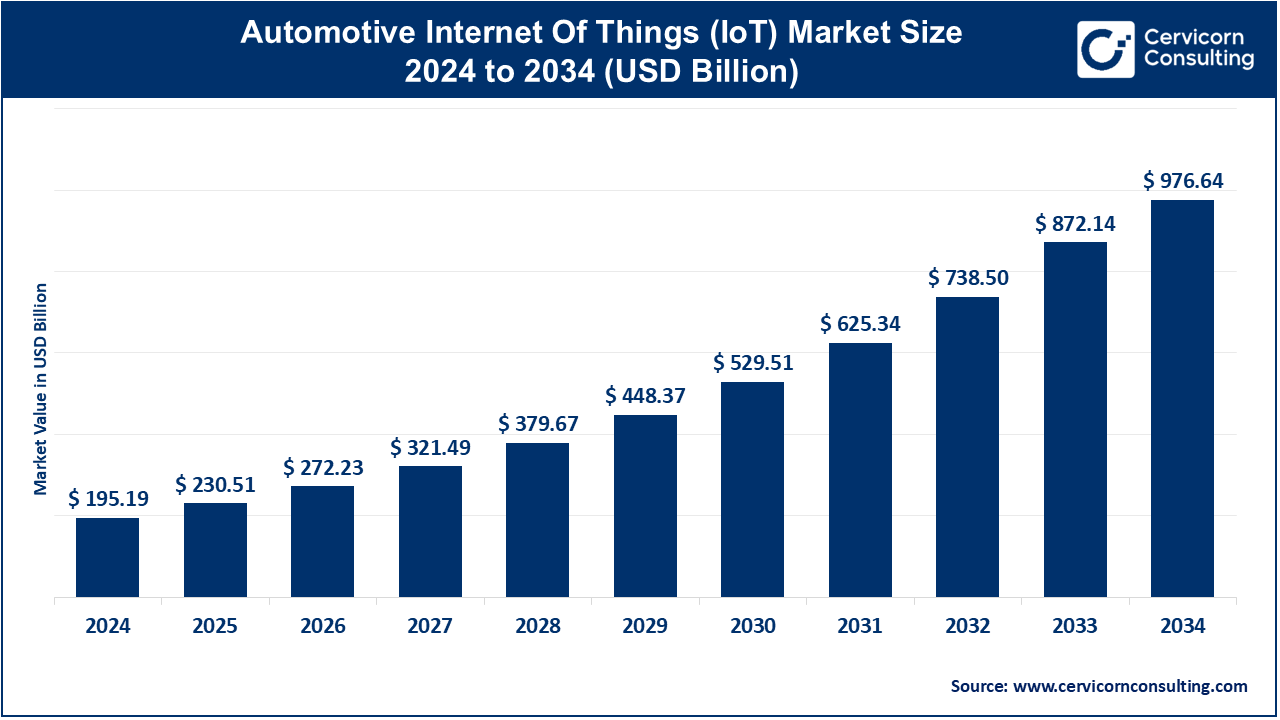

The global automotive internet of things (IoT) market size was reached at USD 230.51 billion in 2025 and is expected to be worth around USD 1,121.22 billion by 2035, growing at a compound annual growth rate (CAGR) of 17.14% over the forecast period from 2026 to 2035.

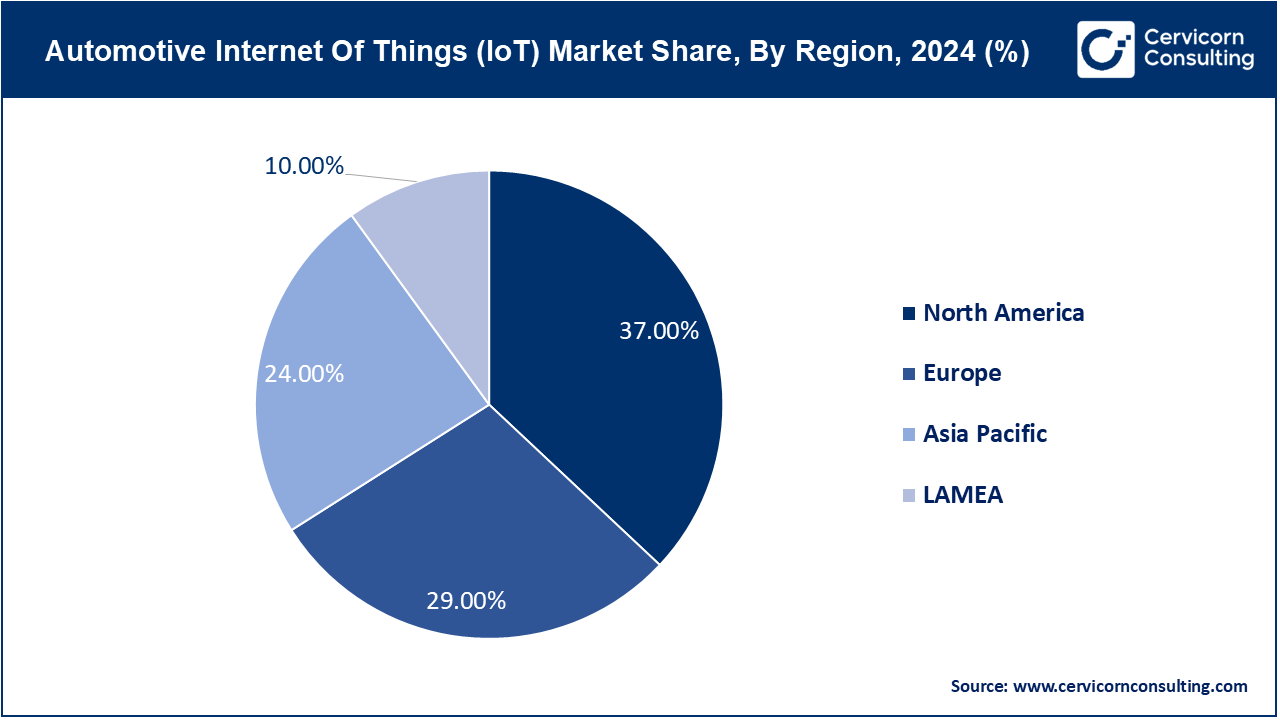

The automotive IoT market is poised for significant expansion as technology continues to evolve, creating opportunities for connected and intelligent transportation systems. The increasing demand for connected vehicles equipped with advanced safety, navigation, and entertainment features is driving growth. Governments across the globe are implementing policies to enhance road safety and reduce emissions, which has led to higher adoption of IoT technologies in vehicles. Additionally, the rise of electric vehicle and autonomous vehicles is further accelerating market momentum, as these technologies rely heavily on IoT for efficient operation and management. Regions like North America and Europe dominate the automotive IoT market due to their well-established automotive industries, extensive 5G infrastructure, and strong focus on research and development. In 2023, China exported a total of 447,200 electric cars to Germany, while only 11,400 moved in the other direction, highlighting China's significant role in the automotive IoT export market.

The automotive internet of things (IoT) is an integration of advanced sensors, connectivity technologies, and data processing systems into vehicles and their supporting infrastructure. This technology enables vehicles to communicate with each other (V2V), with external devices like smartphones, and with broader networks (V2X) such as traffic systems and cloud platforms. Automotive IoT enhances vehicle safety, efficiency, and user experience by enabling features like real-time navigation, predictive maintenance, autonomous driving, and infotainment systems. Sensors collect data about the vehicle's surroundings and internal conditions, which are processed and analyzed to optimize performance. The adoption of IoT in the automotive sector is also driving innovations in fleet management, electric vehicle (EV) systems, and vehicle-to-grid (V2G) solutions, making transportation smarter and more sustainable.

Emerging Global Trends Shaping the Automotive IoT Ecosystem

Key Operational Insights & Technology Trends in the Automotive IoT Market (2023–2024)

| Category | Insight |

| Connected Cars in Operation | Over 250 million vehicles globally are equipped with embedded or tethered connectivity modules. |

| 5G-Ready Vehicle Models | More than 140 new vehicle models launched in 2023–24 support 5G V2X and telematics capabilities. |

| Edge Devices per Vehicle | Connected cars now have an average of 70 to 100 sensors per vehicle, with approximately 25% linked to safety or telematics. |

| Software Over-the-Air (SOTA) | 8 of the top 10 global OEMs now offer over-the-air (OTA) software updates for infotainment or ADAS. |

| Telematics Insurance Adoption | Approximately 35% of new auto insurance policies in Europe and North America now incorporate real-time vehicle data. |

| U.S. IoT Cybersecurity Measures | Over 600 Chinese-made automotive modules were restricted by the U.S. BIS due to security concerns. |

| Vehicle-to-Infrastructure (V2I) | 200+ smart city projects globally have deployed V2I infrastructure for traffic and emergency control. |

Report Scope

| Area of Focus | Details |

| Market Size in 2026 | USD 272.23 Billion |

| Market Growth Rate | CAGR of 17.14% from 2026 to 2035 |

| Market Size by 2035 | USD 1,121.22 Billion |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Segment Coverage | Application, Component, Communication, Vehicle Type, System and Regions |

Enhanced User Experience Expectations:

Integration of Blockchain Technology:

High Implementation Costs:

Data Privacy and Security Concerns:

Integration with Smart City Initiatives:

Expansion into Emerging Markets:

Interoperability Issues:

Regulatory and Compliance Hurdles:

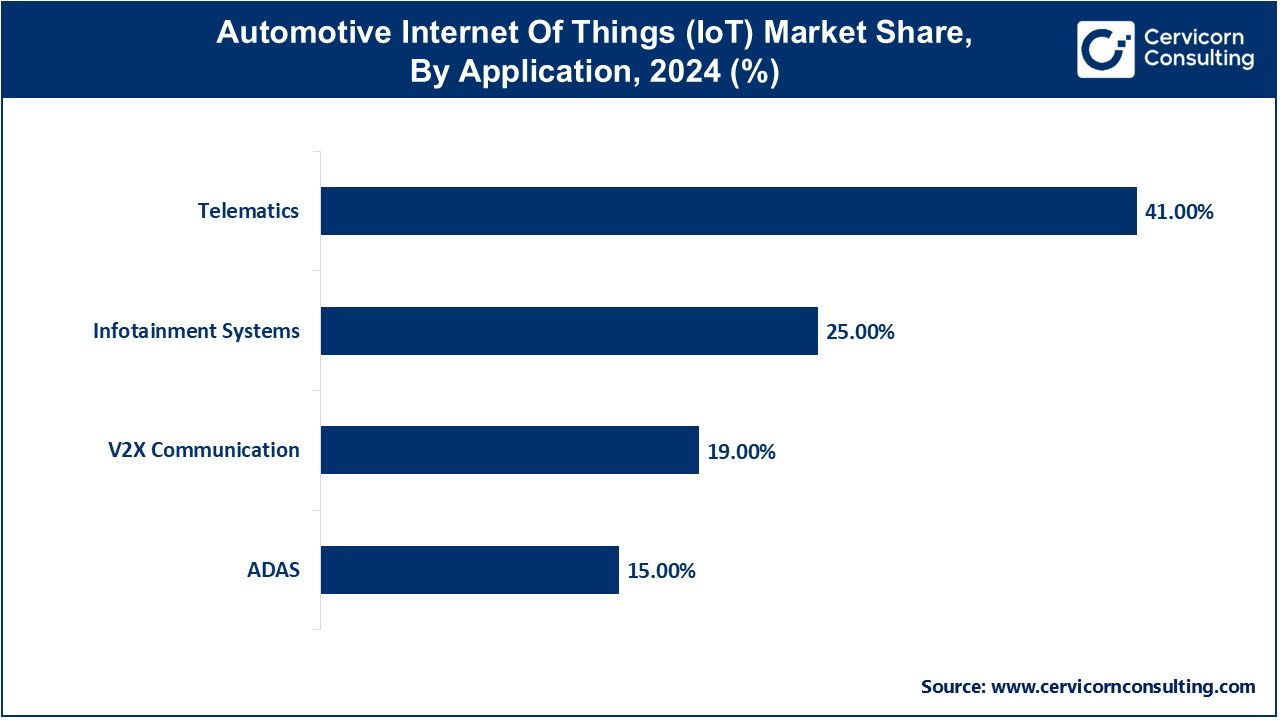

Vehicle-to-Everything (V2X) Communication: The V2X communication Segment has recorded market share of 19% in 2025. V2X communication enables vehicles to interact with each other, infrastructure, and pedestrians to enhance safety and traffic efficiency. Growth in smart cities and advanced traffic management systems is driving V2X adoption. Innovations in 5G technology are improving data transfer speeds and connectivity, enabling more reliable and real-time communication between vehicles and their environment.

Advanced Driver Assistance Systems (ADAS): ADAS segment has reported market share of 15% in the year of 2025. ADAS uses IoT technologies to assist drivers with features like adaptive cruise control, lane-keeping assistance, and automated parking. Increasing demand for vehicle safety and automation is propelling ADAS development. Integration with AI and machine learning is enhancing the capabilities of these systems, leading to more sophisticated and accurate driver assistance features.

Infotainment Systems: In 2025, the infotainment systems segment has captured second highest market share of 25%. Infotainment systems provide entertainment, navigation, and connectivity features within vehicles, integrating IoT technologies for enhanced user experiences. Growing consumer preference for seamless in-car connectivity and multimedia options is driving innovation. Advancements in voice recognition, app integration, and real-time updates are making infotainment systems more interactive and personalized.

Telematics: The telematics segment has confirmed highest market share of 41% in 2025. Telematics involves the use of IoT technology to monitor and manage vehicle performance, diagnostics, and fleet management. Rising interest in fleet optimization and vehicle health monitoring is expanding telematics applications. Enhanced data analytics and real-time diagnostics are improving maintenance, efficiency, and operational control for both individual and commercial vehicles.

Others: This category includes miscellaneous IoT applications in automotive, such as vehicle health monitoring and automated driving systems. Emerging technologies like autonomous driving and advanced sensors are driving innovation. The focus is on developing new applications that enhance vehicle performance, safety, and user convenience, with ongoing research in areas such as predictive maintenance and smart manufacturing.

Hardware: The hardware segment has dominated the market in 2025 with the share of 59%. Hardware in automotive IoT includes sensors, embedded systems, and connectivity modules such as GPS and communication devices. The trend is toward advanced sensors and robust connectivity modules to support real-time data processing and enhanced vehicle features. Innovations include more compact and cost-effective sensors and improved connectivity options like 5G, driving advancements in vehicle safety and automation.

Software: The software segement has generated market share of 25% in 2025. Software encompasses IoT platforms, data analytics, and cybersecurity solutions used in automotive applications. There is a growing focus on sophisticated software for data management, predictive maintenance, and enhanced security. Advances include AI-driven analytics for better vehicle performance insights and robust cybersecurity measures to protect against cyber threats and ensure data privacy.

Services: Services segment has calculated market share of 16% in the year of 2025. Services in automotive IoT include cloud services, consulting, and support related to IoT integration and maintenance. Increased demand for managed services and cloud-based solutions is driving growth. Companies are offering end-to-end solutions that include installation, integration, and ongoing support, as well as analytics services to optimize vehicle operations and improve user experiences.

In-Vehicle Communication: The in-vehicle communication segment has produced share of 14% in 2025. In-vehicle communication involves the exchange of data between various systems and components within a vehicle, such as infotainment systems, ADAS, and engine control units. Increasingly sophisticated in-vehicle networks enable enhanced functionalities like real-time diagnostics, seamless infotainment integration, and advanced driver assistance. The rise of high-speed data buses and centralized computing platforms is driving innovations in this space.

Vehicle-to-Vehicle Communication: The vehicle-to-vehicle (V2V) communication segment has garnered market share of 34% in 2025. Vehicle-to-vehicle (V2V) communication allows vehicles to exchange information directly with one another to enhance safety and coordination on the road. V2V communication is gaining traction due to its potential to reduce accidents and improve traffic flow. Advances in dedicated short-range communications (DSRC) and emerging 5G technologies are enhancing the reliability and range of V2V systems.

Vehicle-to-Infrastructure Communication: Vehicle-to-infrastructure (V2I) communication segment has measured highest 52% market share in 2025. Vehicle-to-infrastructure (V2I) communication enables vehicles to interact with road infrastructure, such as traffic lights and signage, to optimize traffic management and safety. V2I communication is growing with the development of smart infrastructure and intelligent transportation systems. The integration of IoT sensors and real-time data analytics is improving traffic efficiency and reducing congestion through enhanced interaction with urban infrastructure.

Passenger Cars: Vehicles designed primarily for personal transportation, including sedans, SUVs, and hatchbacks. Increasing integration of IoT for enhanced connectivity features, such as real-time navigation, infotainment systems, and advanced driver assistance systems (ADAS). There is growing demand for personalized in-car experiences and seamless smartphone integration.

Commercial Vehicles: Vehicles used for business purposes, such as trucks, buses, and delivery vans. Rising use of IoT for fleet management, telematics, and predictive maintenance. Innovations focus on optimizing logistics, improving vehicle efficiency, and enhancing safety through real-time monitoring and data analytics.

Electric Vehicles (EVs): Vehicles powered by electric motors rather than internal combustion engines, including battery electric vehicles (BEVs) and plug-in hybrids (PHEVs). Increased adoption of IoT for battery management, charging infrastructure integration, and vehicle-to-grid communication. IoT enhances the management of energy consumption and supports the growth of smart charging solutions.

Others: Includes specialized and non-traditional vehicles, such as autonomous vehicles, recreational vehicles (RVs), and two-wheelers. Growing use of IoT to support autonomous driving technologies, vehicle-to-everything (V2X) communication, and advanced safety features. This segment is expanding with innovations aimed at improving vehicle performance and enhancing user experiences.

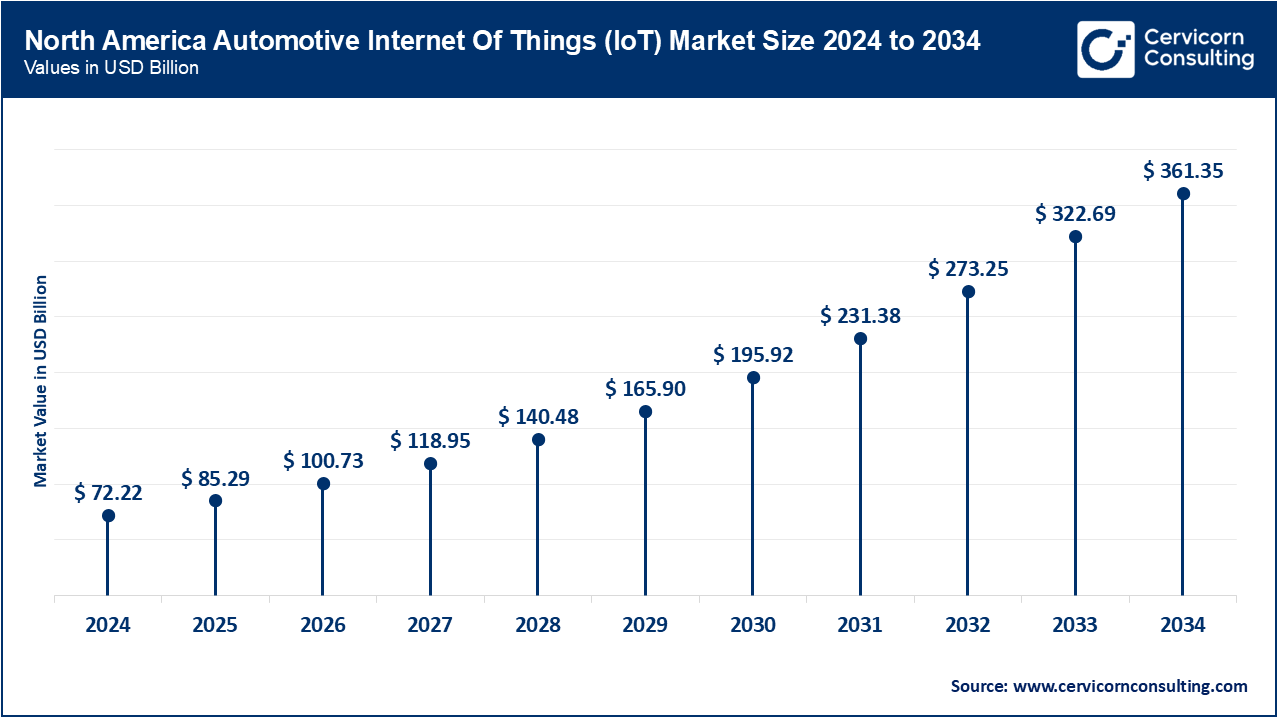

North America market size is expected to reach around USD 414.85 billion by 2035 increasing from USD 85.29 billion in 2025 with a CAGR of 19.10%. North America leads in automotive IoT adoption due to high consumer demand for advanced in-car technologies and strong investments in autonomous driving and connected vehicle solutions. The region is also a hub for innovation with extensive R&D activities and robust infrastructure supporting IoT integration.

The Asia Pacific market size is calculated at USD 55.32 billion in 2025 and is projected to grow around USD 269.09 billion by 2035 with a CAGR of 21.60%. Rapid urbanization and rising disposable incomes in Asia-Pacific are driving the adoption of IoT technologies in vehicles. The region is witnessing significant growth in connected and electric vehicles, with a strong emphasis on improving transportation efficiency and developing smart infrastructure to support IoT-enabled solutions.

The Europe market size is measured at USD 66.85 billion in 2025 and is expected to grow around USD 325.15 billion by 2035 with a CAGR of 19.80%. Europe focuses on integrating IoT with sustainable and smart mobility solutions. The region emphasizes regulatory compliance, such as stringent data privacy laws and environmental standards, driving the development of IoT technologies that align with EU regulations and support smart city initiatives.

The LAMEA market size is forecasted to reach around USD 112.12 billion by 2035 from USD 23.05 billion in 2025. In LAMEA(Latin America and Middle East & Africa), there is a growing focus on enhancing vehicle safety and efficiency through IoT. Emerging markets are increasingly adopting IoT solutions to improve fleet management and address transportation challenges, while governments are starting to invest in smart infrastructure and connectivity projects.

Aurora Innovation and Nuro Inc. are emerging in the automotive IoT market with innovations in autonomous driving and delivery solutions. Their focus on developing advanced autonomous systems and smart logistics demonstrates significant technological advancements and market entry strategies. Tesla and Qualcomm dominate the market with extensive IoT integration. Tesla leads in connected and autonomous vehicle technologies, while Qualcomm provides critical semiconductor solutions for vehicle connectivity and telematics, driving advancements in in-car infotainment and vehicle-to-everything (V2X) communication.

Market Segmentation

By Application

By Component

By Communication

By Vehicle Type

By System

By Region