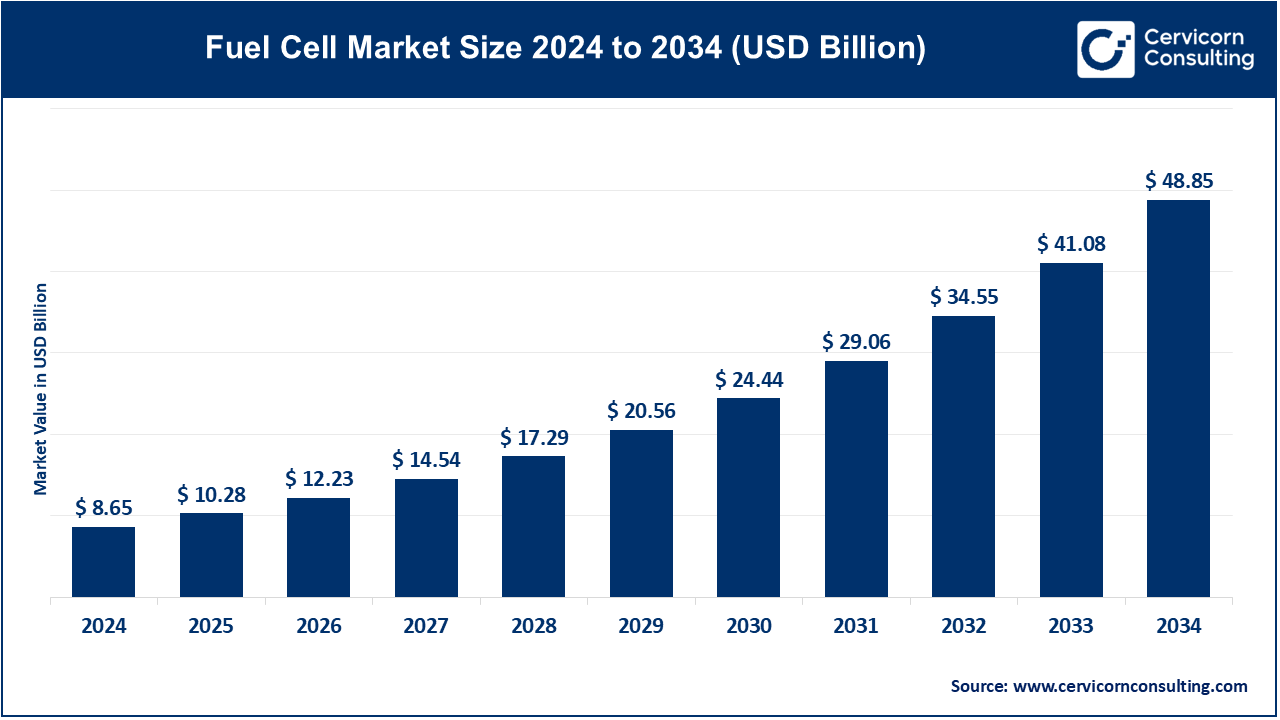

The global fuel cell market size was reached at USD 8.65 billion in 2024 and is expected to be worth around USD 48.85 billion by 2034, growing at a compound annual growth rate (CAGR) of 18.90% over the forecast period from 2025 to 2034.

The fuel cell market is expected to grow significantly due to rising demand for clean energy, government support for hydrogen technologies, decarbonization goals, and advancements in fuel cell efficiency and infrastructure. The adoption of fuel cells is accelerated by the advancements in their technology, reduction in costs, and inter-industrial collaborations. Environmental regulations, integration of renewable energy and the global pivot towards sustainable energy systems are the key driving aspects for the future of the fuel cell market.

The center of the fuel cell market is the creation and shifting into commerce of appliances which transubstantiate the chemical energy of fuels, almost always hydrogen, to electricity via an electrochemical process. Fuel cells find their uses in diverse fields like, transport, stationary power generation, and portable power devices. As compared to traditional combustion engines, fuel cells have an astonishing level of efficiency, low emission output, and operate quietly. It is evident that the market growth is rapid because both clean energy solutions and hydrogen infrastructure initiatives by the government are increasing.

Proportion of fuel cell power generation facility capacity in South Korea in 2023, by region

| City | Capacity (%) |

| Gyeonggi | 25% |

| Incheon | 22% |

| Gangwon | 9% |

| Seoul | 8% |

| Chungnam | 8% |

| Jeonnam | 7% |

| Busan | 4% |

| Others | 17% |

Report Scope

| Area of Focus | Details |

| Market Size in 2025 | USD 10.28 Billion |

| Expected Market Size in 2033 | USD 41.08 Billion |

| Projected CAGR 2025 to 2034 | 18.9% |

| Key Region | Asia-Pacific |

| Key Segments | Type, Components, Fuel, Size, Application, End-Use, Region |

| Key Companies | Ballard Power Systems, Bosch, Horizon Fuel Cell Technologies, ElringKlinger, Hydrogenics, SOLIDpower Italia, Ceres Power, AVL, Pragma Industries, Mitsubishi Hitachi Power Systems, W.L. Gore & Associates, Nedstack Fuel Cell Technology, Proton Motor Fuel Cell GmbH, Bloom Energy, AISIN |

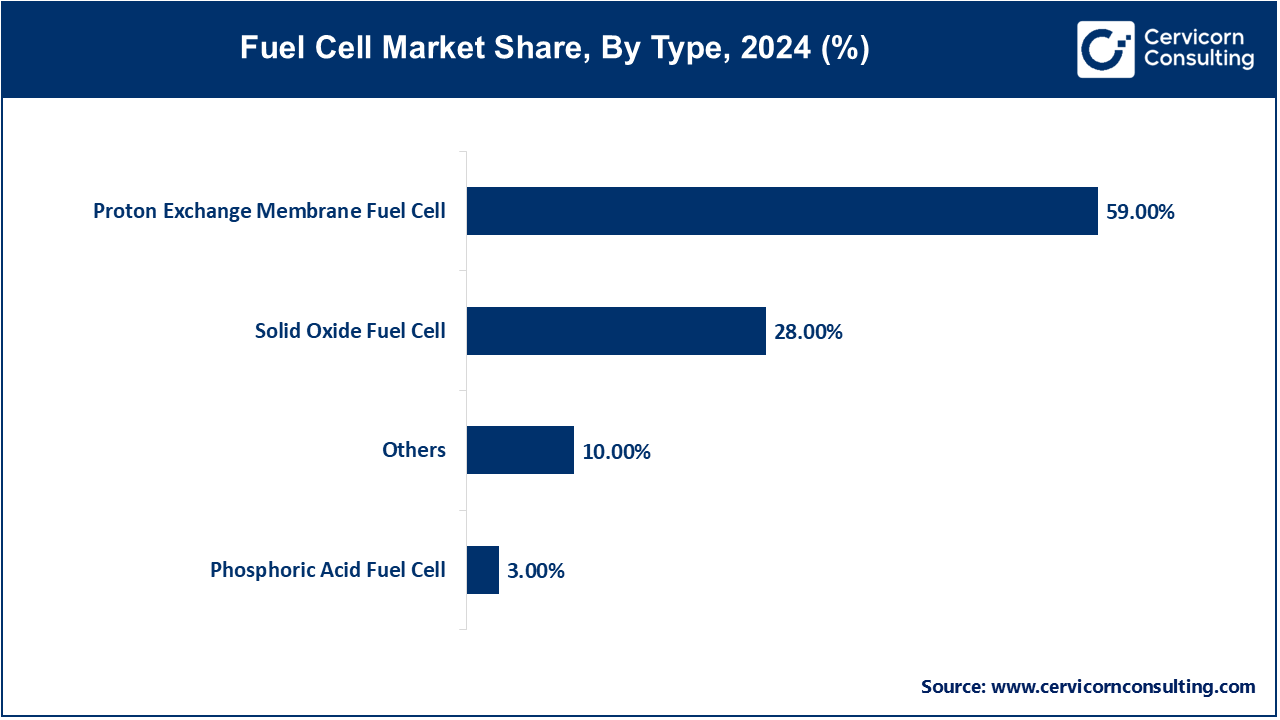

Proton Exchange Membrane Fuel Cell (PEMFC): A Proton Exchange Membrane Fuel Cell (PEMFC) runs an electrochemical reaction with hydrogen and oxygen to generate electricity, emitting water vapor as a byproduct. This system operates optimally at lower temperatures (50 - 100 įC) due to its compact nature and quick start up requirements. Recent research has been focused on increasing catalyst activity and decreasing the use of precious metals such as platinum. Shift of focus from hydrogen powered passenger vehicles to trucks and buses is under Toyotaís new strategy where the Hydrogen-electric van prototype is set to unveil in November 2024. This change of direction demonstrates the heightened attention paid to commercial PEMFC systems in public transport.

Solid Oxide Fuel Cell (SOFC): SOFCs have high operational temperatures (600-1000į C). They are known to be flexible with what fuel is used as well as have varying operational efficency. Especially for stationary power generation, they are geared towards. In 2023, Bloom Energy signed an agreement for deployment of 2.5 MW SOFC tecnology with Perenco in England. Also, emission free power generating systems that produce green hydrogen were developed by Elcogen AS in partnership with Korea Shipbuilding and Offshore Engineering. This partnership further demonstrates the increasing importance of SOFCs on the working projects in sustainable energy systems.

Phosphoric Acid Fuel Cell (PAFC): Phosphoric Acid Fuel Cells (PAFCs) stand out due to their CO and CO‚āā tolerance along with capable of using various fuel types. More commonly referred to as Phosphoric Acid Fuel Cells (PAFC), they have a working temperature of 150Ė210 įC and use liquid phosphoric acid as an electrolyte. The PAFC market was estimated to be USD 475 million in 2023 and is expected to grow significantly by 2030. Recently, there has been progress in the PAFC hybrid systems which incorporate sustainability-focused solar and biomass renewable energy sources that improve PAFC efficiency.

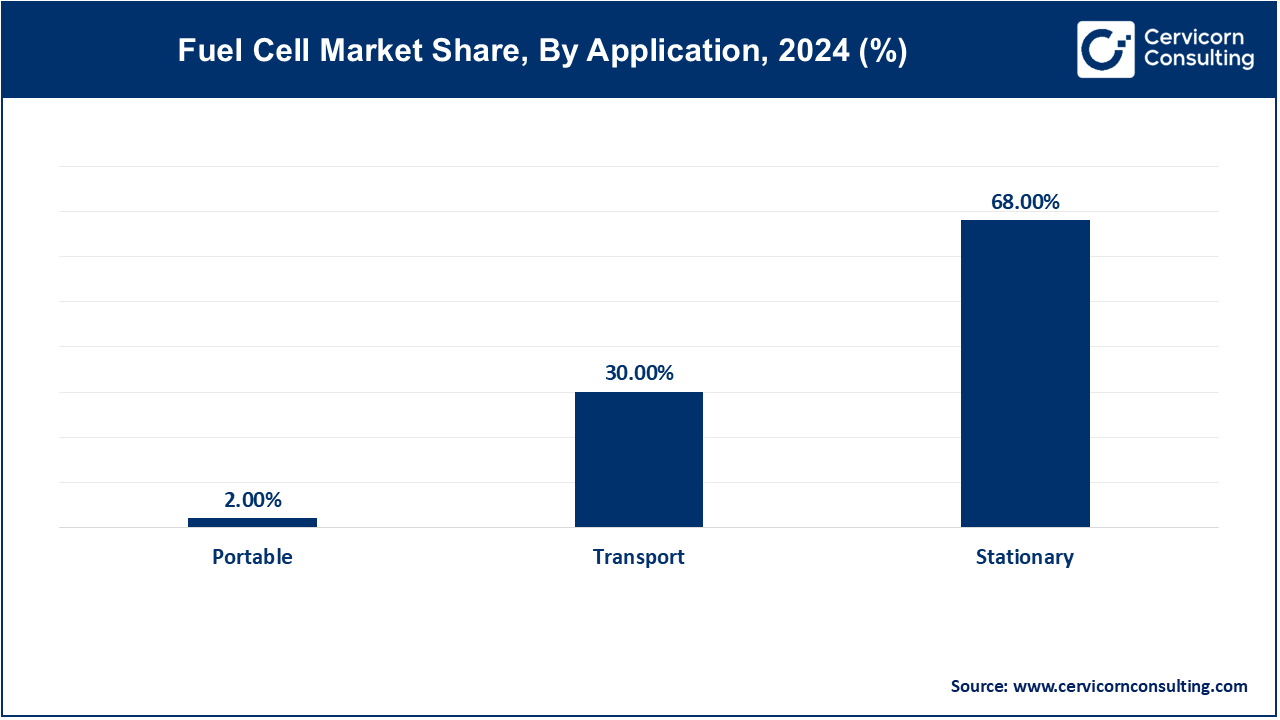

Transportation: The use of fuel cells is growing in the transportation industry, especially for heavy-duty and public transit vehicles. The Alstom manufactured hydrogen-powered passenger trains that travel on a 62 mile-route and only emit steam and condensed water were first introduced in Hamburg Germany in 2022. In the same manner, Solaris will also deliver 38 hydrogen fuel cell buses to Barcelona in 2024. This reinforces their commitment to green public transport using local green hydrogen.

Stationary: More recent innovations in fuel cells stationary applications focus on plants that demand reliable and highly efficient energy as the primary fuel source. In 2023, Bloom Energy implemented a 2.5 MW SOFC system in England as a part of the countryís clean energy initiatives. These systems are effective in energy-stressed areas and have commercial buildings, data centers and industrial facilities as clients due to their high electric efficiency and heat.

Portable: Applications for portable fuel cells are growing, especially for backup power and in energy supply to remote locations. Advances in technology have made it possible to develop portable systems that require less space and are more efficient. These systems benefit numerous activities from emergency response missions to leisure activities outdoors in places that lack electricity due to their remote nature.

Based on components, the market is classified into stack and balance of plant. The stack segment has accounted for a maximum revenue share in 2024.

Fuel Cell Market Share, By Components, 2024 (%)

| Components | Revenue Share, 2024 (%) |

| Stack | 61% |

| Balance of Plant | 39% |

Based on size, the market is classified into small-scale and large-scale. The large-scale segment has dominated the market in 2024.

Fuel Cell Market Share, By Size, 2024 (%)

| Size | Revenue Share, 2024 (%) |

| Small-scale | 29% |

| Large-scale | 71% |

The fuel cell market is segmented into several key regions: North America, Europe, Asia-Pacific, and LAMEA (Latin America, Middle East, and Africa). Hereís an in-depth look at each region

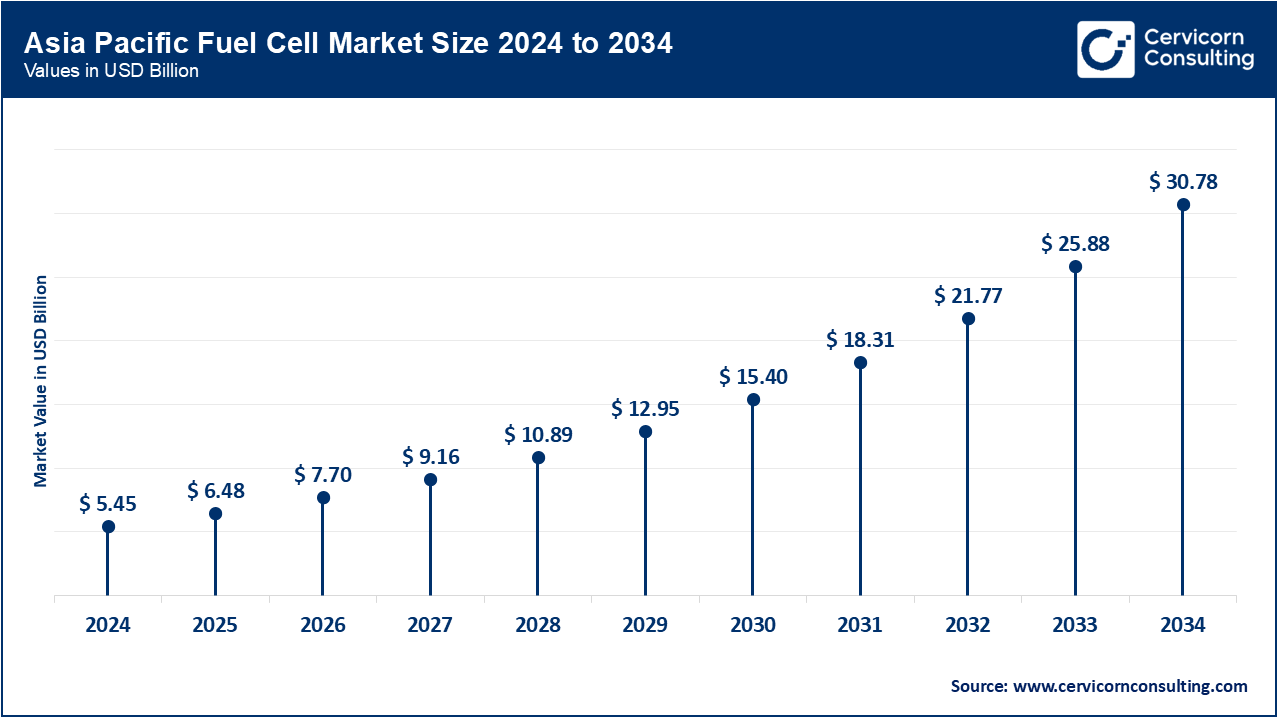

The Asia-Pacific fuel cell market size was valued at USD 5.45 billion in 2024 and is expected to reach around USD 30.78 billion by 2034. The Asia-Pacific region is leading growth with China planning to spend $20 billion on hydrogen and fuel cell development in the country's 14th-five year plan. The implementation Japan PEM Fuel Cell roadmap called "Hydrogen Society" intends fuel cell proliferation. India inaugurated the National Hydrogen Energy Mission in 2024 for greater production of green hydrogen. South Korea promotes fuel cell automobiles and power generation systems with government subsidies. The region's governmental incentive-based policies enable swift technological uptake and infrastructure development.

The North America fuel cell market size was estimated at USD 2.08 billion in 2024 and is projected to surpass around USD 11.72 billion by 2034.†North America has led in fuel cell innovation. For example, the U.S. government has spent more than $250 million allocated for hydrogen and fuel cell research development in 2024. Canada has a Hydrogen Strategy that allocates funds close to $1.5 Billion in 2023 for hydrogen-related infrastructure. Mexico has been interested in hydrogen-powered vehicles, and it is working with select firms in the U.S. due to its energy policies. The current strong policy support in this region, along with investment in expanded hydrogen and fuel cell infrastructure, is encouraging adoption of fuel cells in the transport and stationary places. Public-private collaborations will also help drive commercialization of technology. This ecosystem of support consistently positions North America to advance the global progress for clean hydrogen solutions.

The Europe fuel cell market size was accounted for USD 0.95 billion in 2024 and is forecasted to hit around USD 5.37 billion by 2034.†Europe is more aggressive than other regions in promoting the use of fuel cells. The UKís 2023 Hydrogen Strategy aims to deliver 10 GW of low-carbon hydrogen by 2030. Germany set aside 10.2 billion USD for hydrogen technology expansion on transport and power sectors in 2024. France is including fuel cells in its Multiannual Energy Plan with an emphasis on buses and power systems dual use. EU has aligned its funding priorities towards building a competitive hydrogen ecosystem and accelerate innovation and adoption more widely across regions and sectors. The region expects to dominate sustainable fuel cell technology by the middle of the decade. Support from regulations will continue to drive market development.

Fuel Cell Market Revenue Share, By Region, 2024 (%)

| Region | Revenue Share, 2024 (%) |

| North America | 24% |

| Europe | 11% |

| Asia-Pacific | 63% |

| LAMEA | 2% |

The LAMEA fuel cell market size was reached at USD 8.65 billion in 2024 and is expected to be worth around USD 48.85 billion by 2034.†Brazil is emerging as the Latin American champion for green hydrogen with the 2023 National Hydrogen Program. The country is also planning green hydrogen plants and fuel cell buses in S„o Paulo and Rio de Janeiro. Petrobras is sponsoring clean energy initiatives aligned with Brazilís Paris Agreement commitments. International collaboration accelerates technology and import infrastructures. Furthermore, Brazil has plentiful cheap renewable energy sources such as hydropower which makes producing green hydrogen more economical. This builds a competitive advantage for Brazil within the zone on clean energies. The priorities include decarbonization of heavy transport and industrial activities.

The fuel cell industry is dominated by major players like Ballard Power Systems, Bosch, Horizon Fuel Cell Technologies, and Hydrogenics. These companies focus on improving fuel cell efficiency and reducing costs to expand applications in transport, stationary, and portable sectors. Collaborations with renewable energy firms help scale green hydrogen production, vital for clean fuel cells. Many integrate fuel cells with electric vehicles to enable zero-emission mobility. Ongoing R&D and partnerships drive innovations in PEM and SOFC technologies. Expanding manufacturing and supply chains supports rising demand. Their efforts accelerate the shift toward sustainable and clean energy solutions globally.

Recent partnerships in the fuel cell industry emphasize clean energy and innovation. Ballard Power Systems collaborates with Toyota to develop advanced fuel cells for heavy-duty vehicles. Bosch teams up with Hyundai to integrate fuel cell tech in commercial vehicles. Horizon Fuel Cell Technologies works with Cummins to scale fuel cell stack production. ElringKlinger partners with Nikola to supply fuel cell components for trucks. These collaborations focus on expanding hydrogen infrastructure, cutting emissions, and lowering costs. Together, they drive the global transition to sustainable fuel cell transportation.

Market Segmentation

By Type

By Components

By Fuel

By Size

By Application

By End-Use

By Region

Chapter 1. Market Introduction and Overview

1.1 Market Definition and Scope

1.1.1 Overview of Fuel Cell

1.1.2 Scope of the Study

1.1.3 Research Timeframe

1.2 Research Methodology and Approach

1.2.1 Methodology Overview

1.2.2 Data Sources and Validation

1.2.3 Key Assumptions and Limitations

Chapter 2. Executive Summary

2.1 Market Highlights and Snapshot

2.2 Key Insights by Segments

2.2.1 By Type Overview

2.2.2 By Components Overview

2.2.3 By Fuel Overview

2.2.4 By Size Overview

2.2.5 By Application Overview

2.2.6 By End User Overview

2.3 Competitive Overview

Chapter 3. Global Impact Analysis

3.1 Russia-Ukraine Conflict: Global Market Implications

3.2 Regulatory and Policy Changes Impacting Global Markets

Chapter 4. Market Dynamics and Trends

4.1 Market Dynamics

4.1.1 Market Drivers

4.1.1.1 Supportive International Agreements on Climate Change

4.1.1.2 Increasing Consumer Awareness of Sustainable Energy

4.1.1.3 Scope of Fuel Cell Applications Apart from Automotive Sector

4.1.2 Market Restraints

4.1.2.1 High Initial Cost of Fuel Cell Systems

4.1.2.2 Limited Hydrogen Refueling Infrastructure Globally

4.1.2.3 Safety Concerns Related to Hydrogen Handling and Transport

4.1.3 Market Challenges

4.1.3.1 Increasing Hydrogen Production Without Increasing Emissions

4.1.3.2 Comprehensive Development of Hydrogen Filling Stations

4.1.4 Market Opportunities

4.1.4.1 Increasing Application in Heavy-Duty and Commercial Vehicles

4.1.4.2 Adoption in Marine and Rail Transport

4.1.4.3 Potential for Cost Reduction Through Mass Production and Scale-Up

4.2 Market Trends

Chapter 5. Premium Insights and Analysis

5.1 Global Fuel Cell Market Dynamics, Impact Analysis

5.2 Porter’s Five Forces Analysis

5.2.1 Bargaining Power of Suppliers

5.2.2 Bargaining Power of Buyers

5.2.3 Threat of Substitute Products

5.2.4 Rivalry among Existing Firms

5.2.5 Threat of New Entrants

5.3 PESTEL Analysis

5.4 Value Chain Analysis

5.5 Product Pricing Analysis

5.6 Vendor Landscape

5.6.1 List of Buyers

5.6.2 List of Suppliers

Chapter 6. Fuel Cell Market, By Type

6.1 Global Fuel Cell Market Snapshot, By Type

6.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

6.1.1.1 Proton Exchange Membrane Fuel Cell

6.1.1.2 Solid Oxide Fuel Cell

6.1.1.3 Phosphoric Acid Fuel Cell

6.1.1.4 Others

Chapter 7. Fuel Cell Market, By Components

7.1 Global Fuel Cell Market Snapshot, By Components

7.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

7.1.1.1 Stack

7.1.1.2 Balance of Plant

Chapter 8. Fuel Cell Market, By Fuel

8.1 Global Fuel Cell Market Snapshot, By Fuel

8.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

8.1.1.1 Hydrogen

8.1.1.2 Ammonia

8.1.1.3 Methanol

8.1.1.4 Ethanol

8.1.1.5 Hydrocarbon

Chapter 9. Fuel Cell Market, By Size

9.1 Global Fuel Cell Market Snapshot, By Size

9.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

9.1.1.1 Small-scale

9.1.1.2 Large-scale

Chapter 10. Fuel Cell Market, By Application

10.1 Global Fuel Cell Market Snapshot, By Application

10.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

10.1.1.1 Transport

10.1.1.2 Stationary

10.1.1.3 Portable

Chapter 11. Fuel Cell Market, By End-Use

11.1 Global Fuel Cell Market Snapshot, By End-Use

11.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

11.1.1.1 Residential

11.1.1.2 Commercial & Industrial

11.1.1.3 Transportation

11.1.1.4 Data Centers

11.1.1.5 Military & Defense

11.1.1.6 Utilities & Government

Chapter 12. Fuel Cell Market, By Region

12.1 Overview

12.2 Fuel Cell Market Revenue Share, By Region 2024 (%)

12.3 Global Fuel Cell Market, By Region

12.3.1 Market Size and Forecast

12.4 North America

12.4.1 North America Fuel Cell Market Revenue, 2022-2034 ($Billion)

12.4.2 Market Size and Forecast

12.4.3 North America Fuel Cell Market, By Country

12.4.4 U.S.

12.4.4.1 U.S. Fuel Cell Market Revenue, 2022-2034 ($Billion)

12.4.4.2 Market Size and Forecast

12.4.4.3 U.S. Market Segmental Analysis

12.4.5 Canada

12.4.5.1 Canada Fuel Cell Market Revenue, 2022-2034 ($Billion)

12.4.5.2 Market Size and Forecast

12.4.5.3 Canada Market Segmental Analysis

12.4.6 Mexico

12.4.6.1 Mexico Fuel Cell Market Revenue, 2022-2034 ($Billion)

12.4.6.2 Market Size and Forecast

12.4.6.3 Mexico Market Segmental Analysis

12.5 Europe

12.5.1 Europe Fuel Cell Market Revenue, 2022-2034 ($Billion)

12.5.2 Market Size and Forecast

12.5.3 Europe Fuel Cell Market, By Country

12.5.4 UK

12.5.4.1 UK Fuel Cell Market Revenue, 2022-2034 ($Billion)

12.5.4.2 Market Size and Forecast

12.5.4.3 UKMarket Segmental Analysis

12.5.5 France

12.5.5.1 France Fuel Cell Market Revenue, 2022-2034 ($Billion)

12.5.5.2 Market Size and Forecast

12.5.5.3 FranceMarket Segmental Analysis

12.5.6 Germany

12.5.6.1 Germany Fuel Cell Market Revenue, 2022-2034 ($Billion)

12.5.6.2 Market Size and Forecast

12.5.6.3 GermanyMarket Segmental Analysis

12.5.7 Rest of Europe

12.5.7.1 Rest of Europe Fuel Cell Market Revenue, 2022-2034 ($Billion)

12.5.7.2 Market Size and Forecast

12.5.7.3 Rest of EuropeMarket Segmental Analysis

12.6 Asia Pacific

12.6.1 Asia Pacific Fuel Cell Market Revenue, 2022-2034 ($Billion)

12.6.2 Market Size and Forecast

12.6.3 Asia Pacific Fuel Cell Market, By Country

12.6.4 China

12.6.4.1 China Fuel Cell Market Revenue, 2022-2034 ($Billion)

12.6.4.2 Market Size and Forecast

12.6.4.3 ChinaMarket Segmental Analysis

12.6.5 Japan

12.6.5.1 Japan Fuel Cell Market Revenue, 2022-2034 ($Billion)

12.6.5.2 Market Size and Forecast

12.6.5.3 JapanMarket Segmental Analysis

12.6.6 India

12.6.6.1 India Fuel Cell Market Revenue, 2022-2034 ($Billion)

12.6.6.2 Market Size and Forecast

12.6.6.3 IndiaMarket Segmental Analysis

12.6.7 Australia

12.6.7.1 Australia Fuel Cell Market Revenue, 2022-2034 ($Billion)

12.6.7.2 Market Size and Forecast

12.6.7.3 AustraliaMarket Segmental Analysis

12.6.8 Rest of Asia Pacific

12.6.8.1 Rest of Asia Pacific Fuel Cell Market Revenue, 2022-2034 ($Billion)

12.6.8.2 Market Size and Forecast

12.6.8.3 Rest of Asia PacificMarket Segmental Analysis

12.7 LAMEA

12.7.1 LAMEA Fuel Cell Market Revenue, 2022-2034 ($Billion)

12.7.2 Market Size and Forecast

12.7.3 LAMEA Fuel Cell Market, By Country

12.7.4 GCC

12.7.4.1 GCC Fuel Cell Market Revenue, 2022-2034 ($Billion)

12.7.4.2 Market Size and Forecast

12.7.4.3 GCCMarket Segmental Analysis

12.7.5 Africa

12.7.5.1 Africa Fuel Cell Market Revenue, 2022-2034 ($Billion)

12.7.5.2 Market Size and Forecast

12.7.5.3 AfricaMarket Segmental Analysis

12.7.6 Brazil

12.7.6.1 Brazil Fuel Cell Market Revenue, 2022-2034 ($Billion)

12.7.6.2 Market Size and Forecast

12.7.6.3 BrazilMarket Segmental Analysis

12.7.7 Rest of LAMEA

12.7.7.1 Rest of LAMEA Fuel Cell Market Revenue, 2022-2034 ($Billion)

12.7.7.2 Market Size and Forecast

12.7.7.3 Rest of LAMEAMarket Segmental Analysis

Chapter 13. Competitive Landscape

13.1 Competitor Strategic Analysis

13.1.1 Top Player Positioning/Market Share Analysis

13.1.2 Top Winning Strategies, By Company, 2022-2024

13.1.3 Competitive Analysis By Revenue, 2022-2024

13.2 Recent Developments by the Market Contributors (2024)

Chapter 14. Company Profiles

14.1 Ballard Power Systems

14.1.1 Company Snapshot

14.1.2 Company and Business Overview

14.1.3 Financial KPIs

14.1.4 Product/Service Portfolio

14.1.5 Strategic Growth

14.1.6 Global Footprints

14.1.7 Recent Development

14.1.8 SWOT Analysis

14.2 Bosch

14.3 Horizon Fuel Cell Technologies

14.4 ElringKlinger

14.5 Hydrogenics

14.6 SOLIDpower Italia

14.7 Ceres Power

14.8 AVL

14.9 Pragma Industries

14.10 Mitsubishi Hitachi Power Systems

14.11 W.L. Gore & Associates

14.12 Nedstack Fuel Cell Technology

14.13 Proton Motor Fuel Cell GmbH

14.14 Bloom Energy

14.15 AISIN