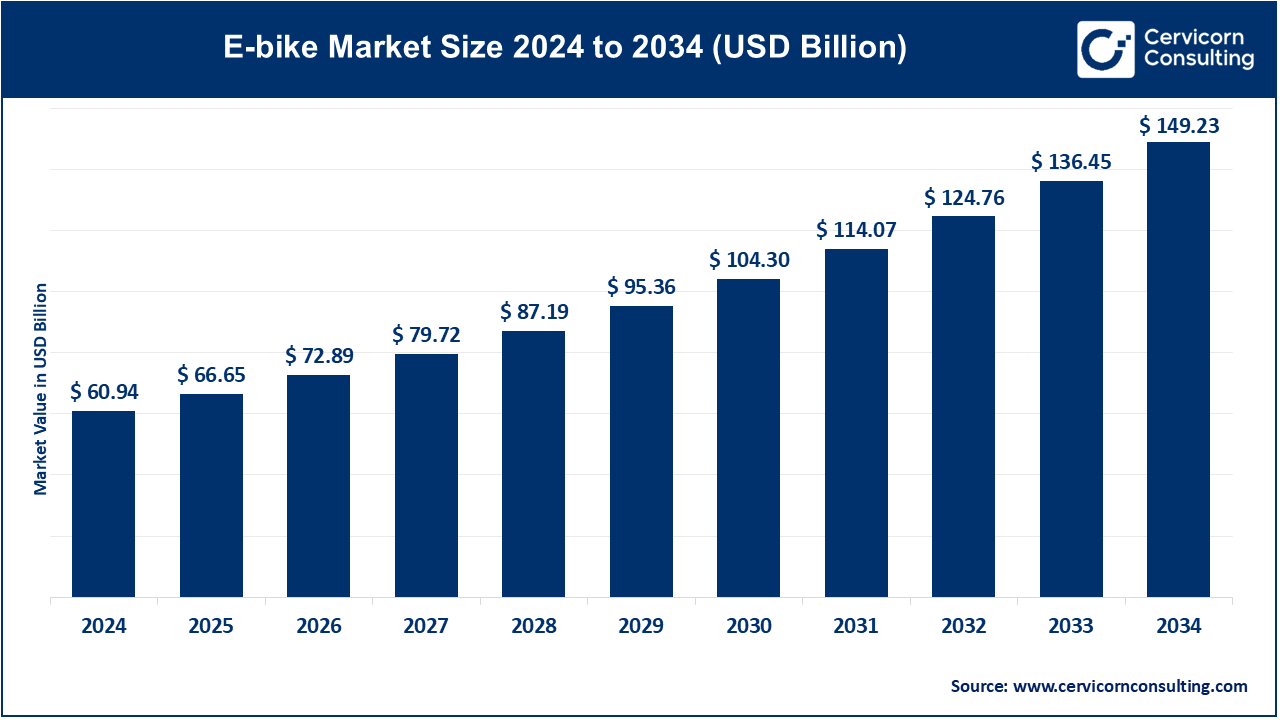

The global E-bike market size was reached at USD 60.94 billion in 2024 and is expected to be worth around USD 149.23 billion by 2034, growing at a compound annual growth rate (CAGR) of 9.36% over the forecast period from 2025 to 2034. The e-bike market is expected to grow significantly due to rising fuel costs, increased environmental awareness, urban congestion, and government incentives promoting sustainable and affordable personal mobility solutions.

Electric bikes, or e-bikes, are a modern redesign of traditional bicycles. They have an electric motor and battery which assists with pedaling, making it easier to travel further and faster. Riders can utilize less effort due to having pedals that amplify the motion. Pedal-assist e-bikes and throttle-operated e-bikes are two classifications of e-bikes, with varying functions. E-bikes are great alternatives for commuting, transportation of goods, relaxing or exercising, and do not emit harmful substances unto the environment. Unlike cars, e-bikes help diminish traffic congestion and reduce carbon footprints. There are regulations for e-bikes where they are only allowed to go 25–28 km/h (15–20 mph). The increasing adoption rates of e-bikes are due to new advances in technology and the search for more environmentally friendly transportation methods.

Report Scope

| Area of Focus | Details |

| Market Size in 2025 | USD 66.65 Billion |

| Expected Market Size in 2033 | USD 136.45 Billion |

| Projected Market CAGR 2025 to 2034 | 9.36% |

| High-impact Region | Asia-Pacific |

| Key Segments | Product, Drive Mechanism, Class, Battery, Speed, Mode of Operation, Component, Battery Capacity, Motor Weight, Motor Power, Region |

| Key Companies | Giant Manufacturing Co. Ltd., Yadea Group Holdings Ltd., Pedego Electric Bikes, Merida Industry Co. Ltd, Trek Bicycle Corporation, Accell Group N.V., Brompton Bicycle Ltd., Yamaha Motor Company, Pon.Bike, Aima Technology Group Co. Ltd. |

Pedelecs: Specifically, participants are supported in pedaling with a Pedelec or pedal electric cycle which provides motor assistance up to a speed of 25 km/h. These Pedelecs became famous in Europe and Asia because of their accessibility and simple operation and compliance with the law. Casual cyclists, as well as urban commuters, are the primary drivers of adoption as they attempt to blend exercise and leisure.

Speed Pedelecs: Designed for long-distance and performance commuting, speed pedelecs offer motor assistance up to 45 km/h. Because of their capability, such e-bikes are often subject to insurance, registration, and even helmet requirements. These are favored in markets where infrastructure supports high speed cycling, and appeal to professionals seeking an alternative to motor vehicles for daily travel.

Throttle on Demand: Scooters and mopeds are to cars as throttle-controlled e-bikes are to bicycles, no paddling is required for operation, only a twist or push to the throttle. This type of pedelec is common in Asia and North America, catering to consumers motivated by ease of use and low physical demand. For some countries, this classification prohibits broader circulation due to regulations on motorized vehicles making it problematic in Europe.

Scooter or Motorcycle: E-scooters and e-motorcycles resemble traditional two-wheelers in design but are powered electrically. These are used for longer urban trips and in shared mobility fleets. With rising interest in personal electric vehicles, these models serve as car replacements in crowded cities, but often fall outside standard e-bike regulations and require licensing and insurance.

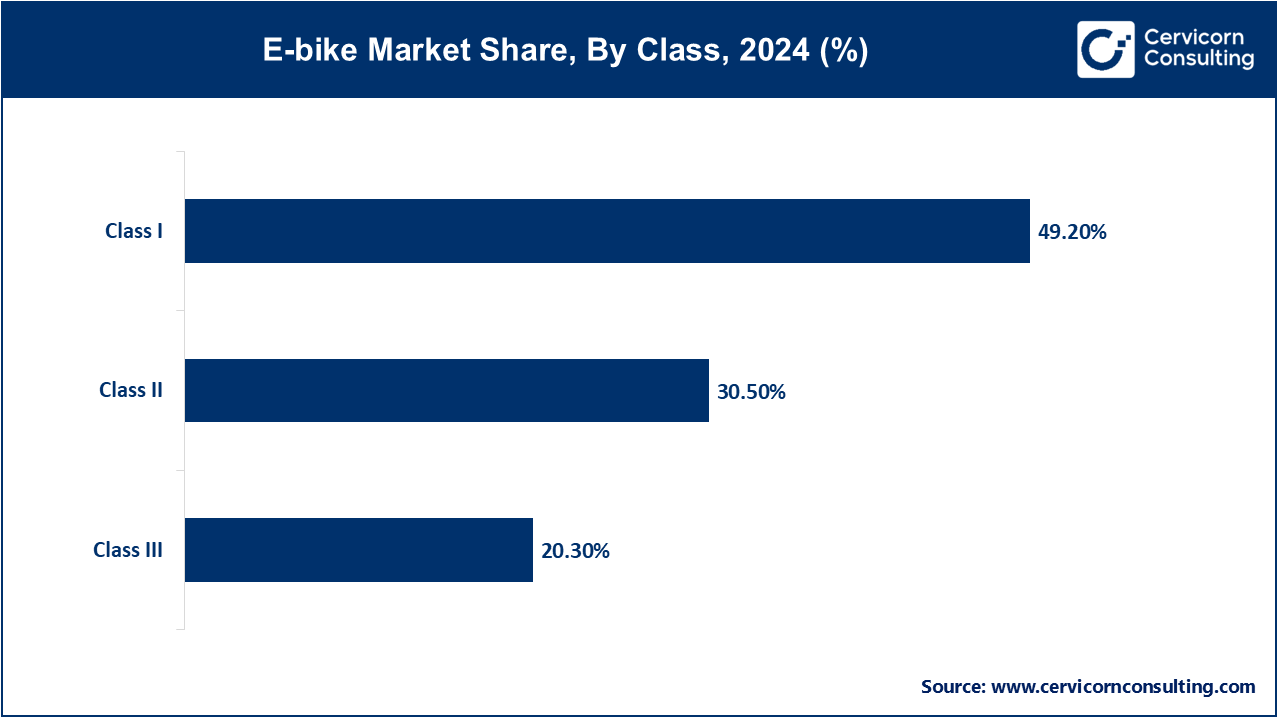

Based on class, the market is classified into class I, class II, and class III. The class I segment dominated the e-bike market in 2024.

Hub Motor: In hub motor e-bikes, the motor is integrated into the hub of the front or rear wheel. They can be found in entry level models, are inexpensive, and have low maintenance. They assist in propulsion, but their lack of torque management makes them ineffective in more challenging off-road environments. Most suitably for regions with lower altitudes, infrequent short walks tends to erratic jogs, and frequent simple drives in suburban areas. Best inhabited sparsely populated flat regions provides the best scope.

Mid-Drive: A mid-drive e-bike motor mounted at the crankset provides optimal balance, efficiency, functional torque control, and augments primary performance. These systems perform effectively on steep terrain making them suitable for mountain biking and heavy-duty use. Although pricier, they provide improved natural ride feel and battery efficiency during rigorous biking. Dominating the premium segment in Europe, mid-drive motors are popular because dual e-bikes/mountain bikes are expensive.

Others: Shaft-drive and friction drives are categorized as outliers, they deviate from the customary hub or mid-drive configurations. Because of these systems’ low efficiency and complex maintenance requirements, they tend to be less common. However, their application in specialty or custom-designed e-bikes can be beneficial. Their market adoption is limited and mostly for research purposes.

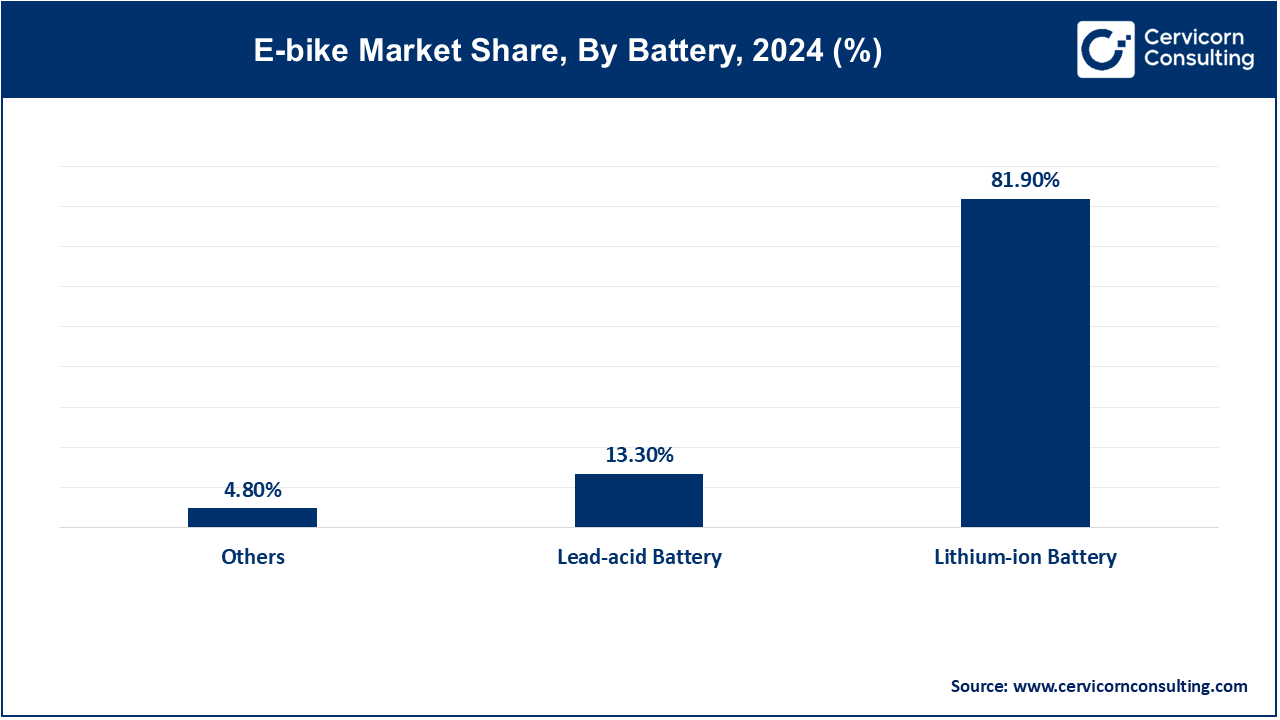

Based on battery, the market is classified into lead-acid battery, lithium-ion battery, and others. The lithium-ion battery segment dominated the market in 2024.

The E-bikes market is segmented into several key regions: North America, Europe, Asia-Pacific, and LAMEA (Latin America, Middle East, and Africa). Here’s an in-depth look at each region

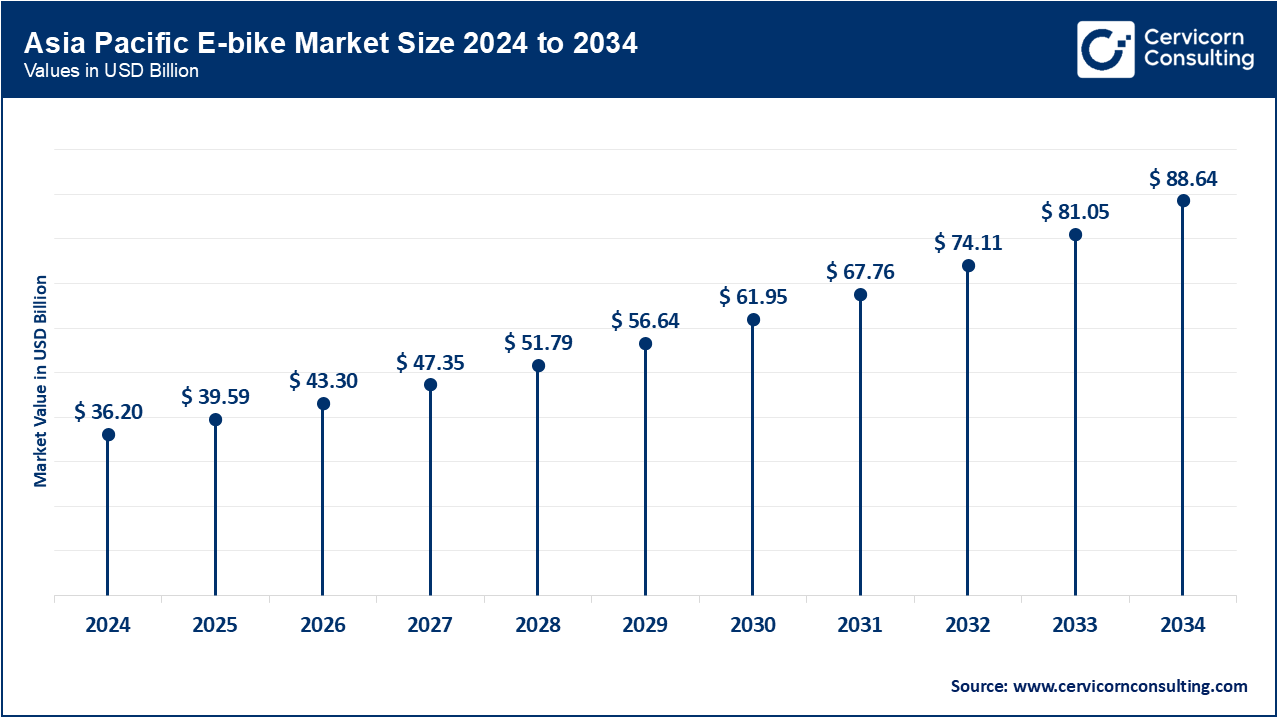

The Asia-Pacific E-bike market size was exceeded at USD 36.20 billion in 2024 and is forecasted to grow around USD 88.64 billion by 2034. The leading players by volume in the Asia-Pacific region are China, India, and Japan. China's steep infrastructure investment enables it to dominate the global supply chain. Economically, urban policies restricting gas two-wheelers and subsidizing electric-enabled vehicles assures continued demand. India is increasingly emerging faster owing to fuel price pressures and environmental concerns. However, challenge remains with infrastructure and price sensitivity in rural areas. Southeast Asia's exports are diversifying the region’s markets.

The North America E-bike market size was valued at USD 6.64 billion in 2024 and is expected to reach around USD 16.27 billion by 2034. The North America is steadily growing with upcoming opportunities due to increasing fuel costs, environmental consciousness, and traffic congestion in metropolitan areas. In Canada and the US, e-bikes are increasingly being used for urban commuting as well as recreation. Demand is also increasing due to government incentives such as California’s e-bike rebate program as well as new bike lane construction. However, the limited cycling culture in some states and high e-bike costs remains a challenge. Shared micromobility programs and corporate wellness programs are expected to further aid market growth in this region.

The Europe E-bike market size was estimated at USD 18.10 billion in 2024 and is projected to hit around USD 44.32 billion by 2034. Europe is still the global leader, with e-bike adoption being led by Germany, Netherlands, and France. The market is more mature in Western Europe, and this can be attributed to a well-established cycling culture and spending by the government in the regions. The region greatly benefits from environmental policies that encourage using low-emission transportation. EU policies toward climate neutrality as well as domestic subsidies still create demand. Increasing use of speed pedelecs and cargo e-bikes for commercial purposes is also noted. However, saturation of the market in Western Europe drives manufacturers to explore opportunities in Eastern Europe.

E-bike Market Revenue Share, By Region, 2024 (%)

| Region | Revenue Share, 2024 (%) |

| North America | 10.90% |

| Asia-Pacific | 59.40% |

| Europe | 29.70% |

E-bike adoption is slower than average growth in the LAMEA region which provides with challenges and opportunities. Increasing fuel prices and traffic congestions in Latin America, especially in Brazil, Mexico and Colombia is supporting the growth of e-bikes as economical solutions to urban mobility woes. But poor cycling infrastructure alongside high costs of imports will slow these benefits down. UAE and Saudi Arabias’s forward-looking vision policies are integrating e-bikes into smart city frameworks, spearheading e-bike usage in the region, although extreme heat and low awareness are two hindering factors. Africa suffers from stunted development but interest due to low-cost transportation keeps rising. The region still has long-term potential, as government and private stakeholders look more into cleaner mobility solutions.

Recent collaborations in the e-bike industry reflect a strategic push toward technological advancement, sustainability, and mobility-as-a-service integration. Leading players such as Giant Manufacturing Co. Ltd., Yadea Group Holdings Ltd., Pedego Electric Bikes, and Merida Industry Co. Ltd are forming alliances with software firms and mobility platforms to integrate IoT, AI-based diagnostics, and connected features. These partnerships aim to enhance user experience, streamline fleet management, and improve energy efficiency. Additionally, joint ventures are enabling localized manufacturing and distribution, reducing supply chain dependency and promoting faster adoption in emerging urban markets. Some notable examples of key developments in the E-bikes Market include:

Market Segmentation

By Product

By Drive Mechanism

By Class

By Battery

By Speed

By Mode of Operation

By Component

By Battery Capacity

By Motor Weight

By Motor Power

By End Use

By Region

Chapter 1. Market Introduction and Overview

1.1 Market Definition and Scope

1.1.1 Overview of E-bike

1.1.2 Scope of the Study

1.1.3 Research Timeframe

1.2 Research Methodology and Approach

1.2.1 Methodology Overview

1.2.2 Data Sources and Validation

1.2.3 Key Assumptions and Limitations

Chapter 2. Executive Summary

2.1 Market Highlights and Snapshot

2.2 Key Insights by Segments

2.2.1 By Product Overview

2.2.2 By Drive Mechanism Overview

2.2.3 By Class Overview

2.2.4 By Battery Overview

2.2.5 By Speed Overview

2.2.6 By Mode of Operation Overview

2.2.7 By Component Overview

2.2.8 By Battery Capacity Overview

2.2.9 By Motor Weight Overview

2.2.10 By Motor Power Overview

2.2.11 By End Use Overview

2.3 Competitive Overview

Chapter 3. Global Impact Analysis

3.1 Russia-Ukraine Conflict: Global Market Implications

3.2 Regulatory and Policy Changes Impacting Global Markets

Chapter 4. Market Dynamics and Trends

4.1 Market Dynamics

4.1.1 Market Drivers

4.1.1.1 Urbanization and Traffic Congestion

4.1.1.2 Rising Fuel Prices

4.1.1.3 Integration with Smart City Initiatives

4.1.1.4 Environmental Issues

4.1.2 Market Restraints

4.1.2.1 High Initial Costs

4.1.2.2 Limited Charging Infrastructure

4.1.2.3 Market Saturation in Developed Regions

4.1.3 Market Challenges

4.1.3.1 Issues Relating to Battery Life and Efficiency

4.1.3.2 Lack of Charging Facilities

4.1.3.3 Supply Chain Disruptions

4.1.4 Market Opportunities

4.1.4.1 Expansion in Emerging Markets

4.1.4.2 Corporate Adoption for Employee Commutes

4.1.4.3 Integration with Renewable Energy

4.2 Market Trends

Chapter 5. Premium Insights and Analysis

5.1 Global E-bike Market Dynamics, Impact Analysis

5.2 Porter’s Five Forces Analysis

5.2.1 Bargaining Power of Suppliers

5.2.2 Bargaining Power of Buyers

5.2.3 Threat of Substitute Products

5.2.4 Rivalry among Existing Firms

5.2.5 Threat of New Entrants

5.3 PESTEL Analysis

5.4 Value Chain Analysis

5.5 Product Pricing Analysis

5.6 Vendor Landscape

5.6.1 List of Buyers

5.6.2 List of Suppliers

Chapter 6. E-bike Market, By Product

6.1 Global E-bike Market Snapshot, By Product

6.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

6.1.1.1 Pedelecs

6.1.1.2 Speed Pedelecs

6.1.1.3 Throttle on Demand

6.1.1.4 Scooter or motorcycle

Chapter 7. E-bike Market, By Drive Mechanism

7.1 Global E-bike Market Snapshot, By Drive Mechanism

7.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

7.1.1.1 Hub motor

7.1.1.2 Mid-drive

7.1.1.3 Others

Chapter 8. E-bike Market, By Class

8.1 Global E-bike Market Snapshot, By Class

8.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

8.1.1.1 Class I

8.1.1.2 Class II

8.1.1.3 Class III

Chapter 9. E-bike Market, By Battery

9.1 Global E-bike Market Snapshot, By Battery

9.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

9.1.1.1 Lead-acid Battery

9.1.1.2 Lithium-ion Battery

9.1.1.3 Others

Chapter 10. E-bike Market, By Speed

10.1 Global E-bike Market Snapshot, By Speed

10.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

10.1.1.1 Up to 25 KM/H

10.1.1.2 25-45 KM/H

Chapter 11. E-bike Market, By Mode of Operation

11.1 Global E-bike Market Snapshot, By Mode of Operation

11.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

11.1.1.1 City/Urban E-bikes

11.1.1.2 Mountain E-bikes

11.1.1.3 Trekking/Touring E-bikes

11.1.1.4 Cargo E-bikes

11.1.1.5 Others (Cruiser)

Chapter 12. E-bike Market, By Component

12.1 Global E-bike Market Snapshot, By Component

12.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

12.1.1.1 Battery

12.1.1.2 Electric Motors

12.1.1.3 Motor Controller

12.1.1.4 Frame with Forks

12.1.1.5 Others (Brake Systems, Wheels & Gears)

Chapter 13. E-bike Market, By Battery Capacity

13.1 Global E-bike Market Snapshot, By Battery Capacity

13.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

13.1.1.1 Below 250W

13.1.1.2 251W to 450W

13.1.1.3 451W to 650 W

13.1.1.4 Above 650W

Chapter 14. E-bike Market, By Motor Weight

14.1 Global E-bike Market Snapshot, By Motor Weight

14.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

14.1.1.1 <2 kg

14.1.1.2 >2 kg -<2.4 kg

14.1.1.3 >2.4 kg

Chapter 15. E-bike Market, By Motor Power

15.1 Global E-bike Market Snapshot, By Motor Power

15.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

15.1.1.1 <40nm

15.1.1.2 >40nm-<70nm

15.1.1.3 >70nm

Chapter 16. E-bike Market, By End Use

16.1 Global E-bike Market Snapshot, By End Use

16.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

16.1.1.1 Personal

16.1.1.2 Commercial

Chapter 17. E-bike Market, By Region

17.1 Overview

17.2 E-bike Market Revenue Share, By Region 2024 (%)

17.3 Global E-bike Market, By Region

17.3.1 Market Size and Forecast

17.4 North America

17.4.1 North America E-bike Market Revenue, 2022-2034 ($Billion)

17.4.2 Market Size and Forecast

17.4.3 North America E-bike Market, By Country

17.4.4 U.S.

17.4.4.1 U.S. E-bike Market Revenue, 2022-2034 ($Billion)

17.4.4.2 Market Size and Forecast

17.4.4.3 U.S. Market Segmental Analysis

17.4.5 Canada

17.4.5.1 Canada E-bike Market Revenue, 2022-2034 ($Billion)

17.4.5.2 Market Size and Forecast

17.4.5.3 Canada Market Segmental Analysis

17.4.6 Mexico

17.4.6.1 Mexico E-bike Market Revenue, 2022-2034 ($Billion)

17.4.6.2 Market Size and Forecast

17.4.6.3 Mexico Market Segmental Analysis

17.5 Europe

17.5.1 Europe E-bike Market Revenue, 2022-2034 ($Billion)

17.5.2 Market Size and Forecast

17.5.3 Europe E-bike Market, By Country

17.5.4 UK

17.5.4.1 UK E-bike Market Revenue, 2022-2034 ($Billion)

17.5.4.2 Market Size and Forecast

17.5.4.3 UKMarket Segmental Analysis

17.5.5 France

17.5.5.1 France E-bike Market Revenue, 2022-2034 ($Billion)

17.5.5.2 Market Size and Forecast

17.5.5.3 FranceMarket Segmental Analysis

17.5.6 Germany

17.5.6.1 Germany E-bike Market Revenue, 2022-2034 ($Billion)

17.5.6.2 Market Size and Forecast

17.5.6.3 GermanyMarket Segmental Analysis

17.5.7 Rest of Europe

17.5.7.1 Rest of Europe E-bike Market Revenue, 2022-2034 ($Billion)

17.5.7.2 Market Size and Forecast

17.5.7.3 Rest of EuropeMarket Segmental Analysis

17.6 Asia Pacific

17.6.1 Asia Pacific E-bike Market Revenue, 2022-2034 ($Billion)

17.6.2 Market Size and Forecast

17.6.3 Asia Pacific E-bike Market, By Country

17.6.4 China

17.6.4.1 China E-bike Market Revenue, 2022-2034 ($Billion)

17.6.4.2 Market Size and Forecast

17.6.4.3 ChinaMarket Segmental Analysis

17.6.5 Japan

17.6.5.1 Japan E-bike Market Revenue, 2022-2034 ($Billion)

17.6.5.2 Market Size and Forecast

17.6.5.3 JapanMarket Segmental Analysis

17.6.6 India

17.6.6.1 India E-bike Market Revenue, 2022-2034 ($Billion)

17.6.6.2 Market Size and Forecast

17.6.6.3 IndiaMarket Segmental Analysis

17.6.7 Australia

17.6.7.1 Australia E-bike Market Revenue, 2022-2034 ($Billion)

17.6.7.2 Market Size and Forecast

17.6.7.3 AustraliaMarket Segmental Analysis

17.6.8 Rest of Asia Pacific

17.6.8.1 Rest of Asia Pacific E-bike Market Revenue, 2022-2034 ($Billion)

17.6.8.2 Market Size and Forecast

17.6.8.3 Rest of Asia PacificMarket Segmental Analysis

17.7 LAMEA

17.7.1 LAMEA E-bike Market Revenue, 2022-2034 ($Billion)

17.7.2 Market Size and Forecast

17.7.3 LAMEA E-bike Market, By Country

17.7.4 GCC

17.7.4.1 GCC E-bike Market Revenue, 2022-2034 ($Billion)

17.7.4.2 Market Size and Forecast

17.7.4.3 GCCMarket Segmental Analysis

17.7.5 Africa

17.7.5.1 Africa E-bike Market Revenue, 2022-2034 ($Billion)

17.7.5.2 Market Size and Forecast

17.7.5.3 AfricaMarket Segmental Analysis

17.7.6 Brazil

17.7.6.1 Brazil E-bike Market Revenue, 2022-2034 ($Billion)

17.7.6.2 Market Size and Forecast

17.7.6.3 BrazilMarket Segmental Analysis

17.7.7 Rest of LAMEA

17.7.7.1 Rest of LAMEA E-bike Market Revenue, 2022-2034 ($Billion)

17.7.7.2 Market Size and Forecast

17.7.7.3 Rest of LAMEAMarket Segmental Analysis

Chapter 18. Competitive Landscape

18.1 Competitor Strategic Analysis

18.1.1 Top Player Positioning/Market Share Analysis

18.1.2 Top Winning Strategies, By Company, 2022-2024

18.1.3 Competitive Analysis By Revenue, 2022-2024

18.2 Recent Developments by the Market Contributors (2024)

Chapter 19. Company Profiles

19.1 Giant Manufacturing Co. Ltd.

19.1.1 Company Snapshot

19.1.2 Company and Business Overview

19.1.3 Financial KPIs

19.1.4 Product/Service Portfolio

19.1.5 Strategic Growth

19.1.6 Global Footprints

19.1.7 Recent Development

19.1.8 SWOT Analysis

19.2 Yadea Group Holdings Ltd.

19.3 Pedego Electric Bikes

19.4 Merida Industry Co. Ltd

19.5 Trek Bicycle Corporation

19.6 Accell Group N.V.

19.7 Brompton Bicycle Ltd.

19.8 Yamaha Motor Company

19.9 Pon.Bike

19.10 Aima Technology Group Co. Ltd.