E-bike Market Size and Growth 2025 to 2034

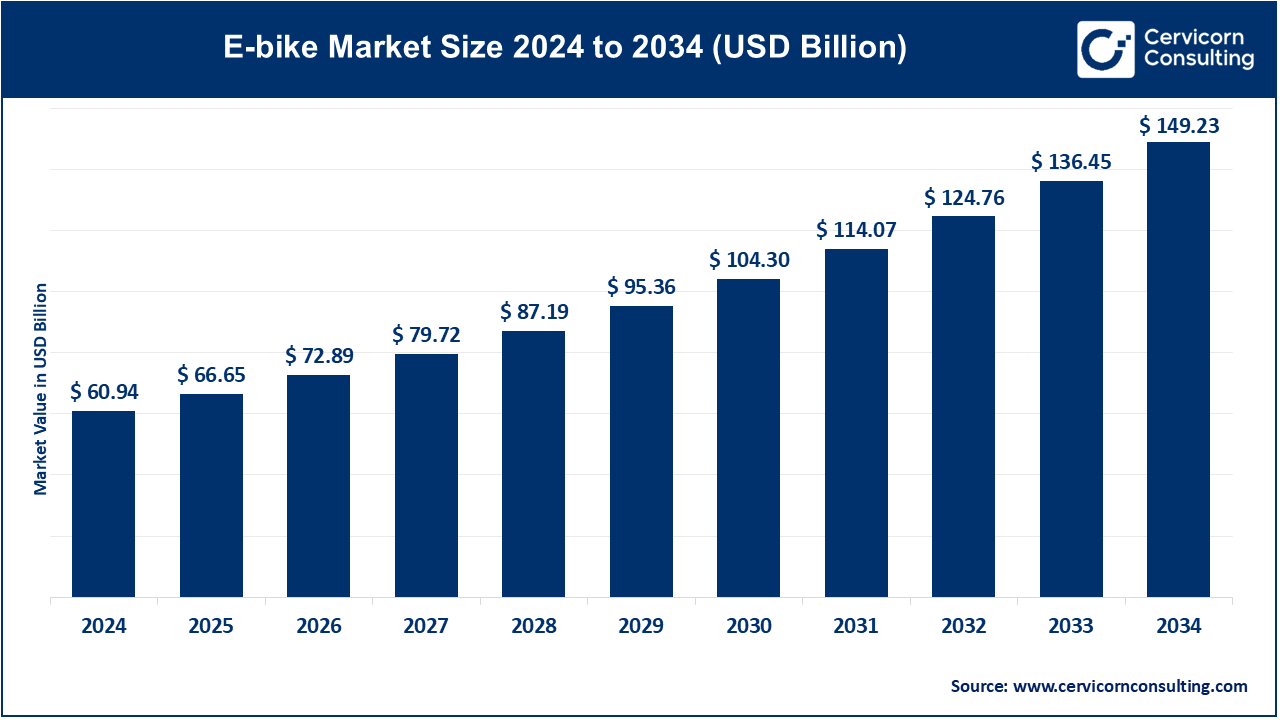

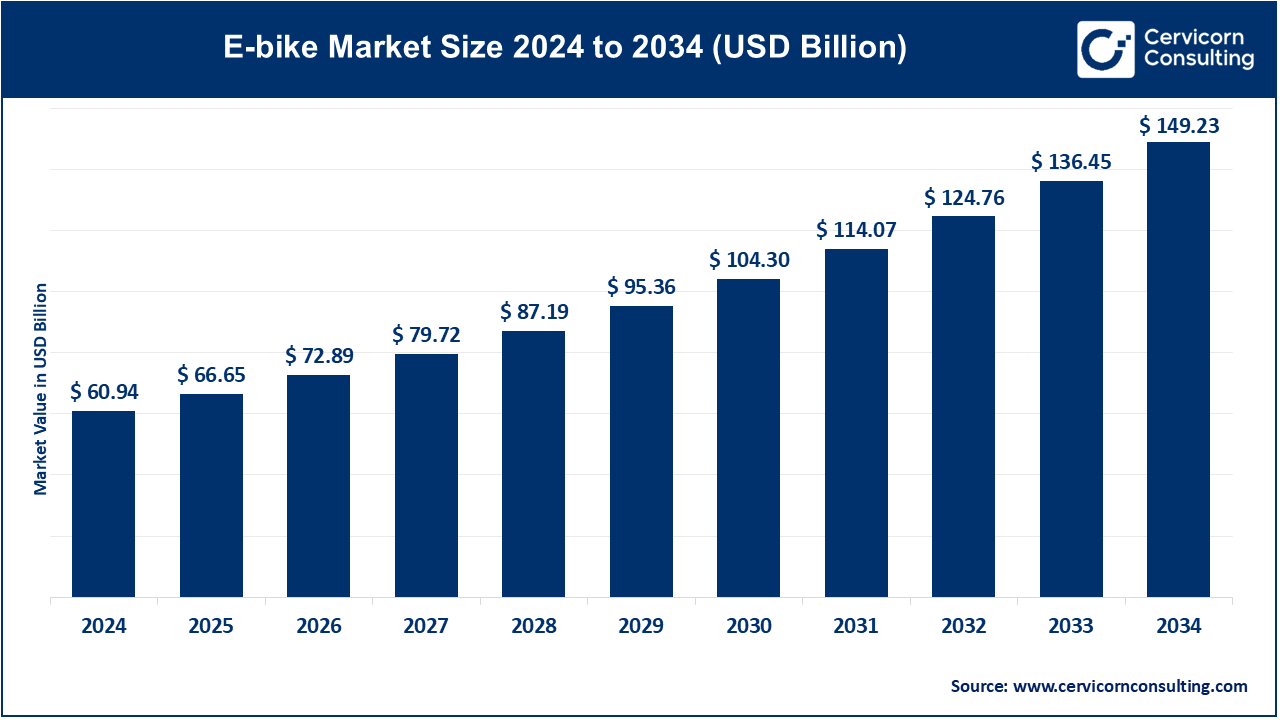

The global E-bike market size was reached at USD 60.94 billion in 2024 and is expected to be worth around USD 149.23 billion by 2034, growing at a compound annual growth rate (CAGR) of 9.36% over the forecast period from 2025 to 2034. The e-bike market is expected to grow significantly due to rising fuel costs, increased environmental awareness, urban congestion, and government incentives promoting sustainable and affordable personal mobility solutions.

Electric bikes, or e-bikes, are a modern redesign of traditional bicycles. They have an electric motor and battery which assists with pedaling, making it easier to travel further and faster. Riders can utilize less effort due to having pedals that amplify the motion. Pedal-assist e-bikes and throttle-operated e-bikes are two classifications of e-bikes, with varying functions. E-bikes are great alternatives for commuting, transportation of goods, relaxing or exercising, and do not emit harmful substances unto the environment. Unlike cars, e-bikes help diminish traffic congestion and reduce carbon footprints. There are regulations for e-bikes where they are only allowed to go 25–28 km/h (15–20 mph). The increasing adoption rates of e-bikes are due to new advances in technology and the search for more environmentally friendly transportation methods.

Report Highlights

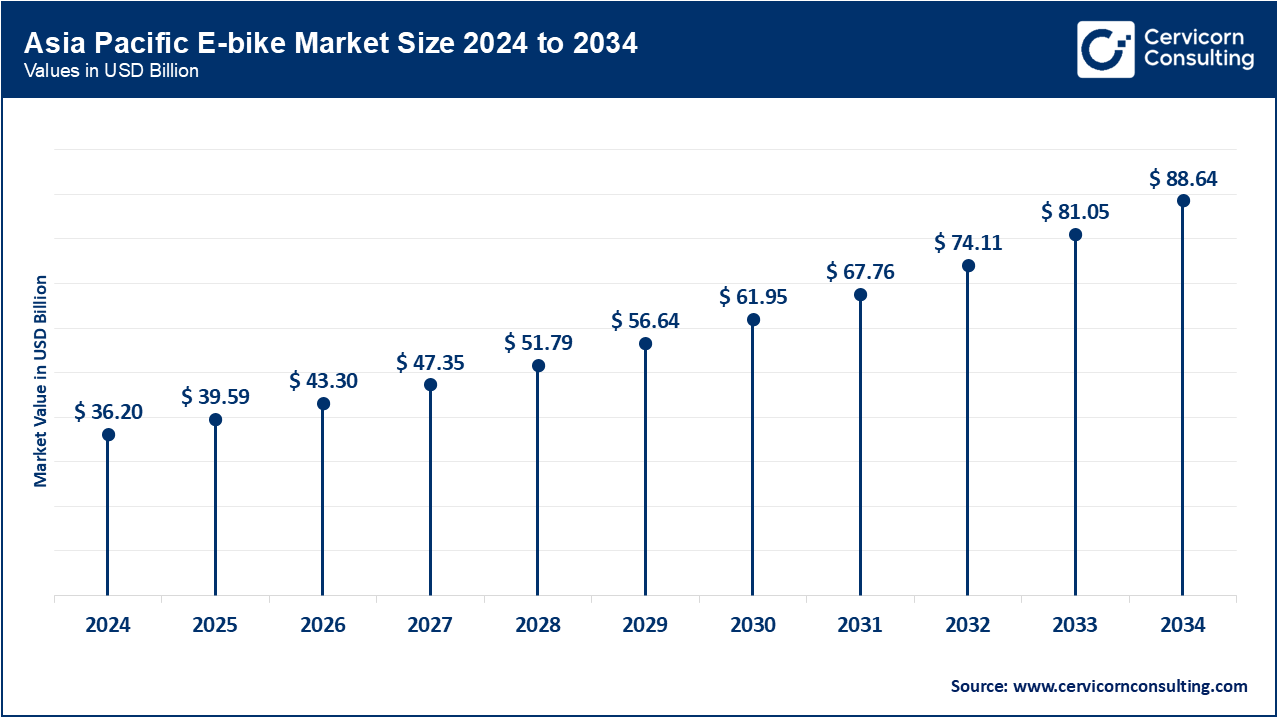

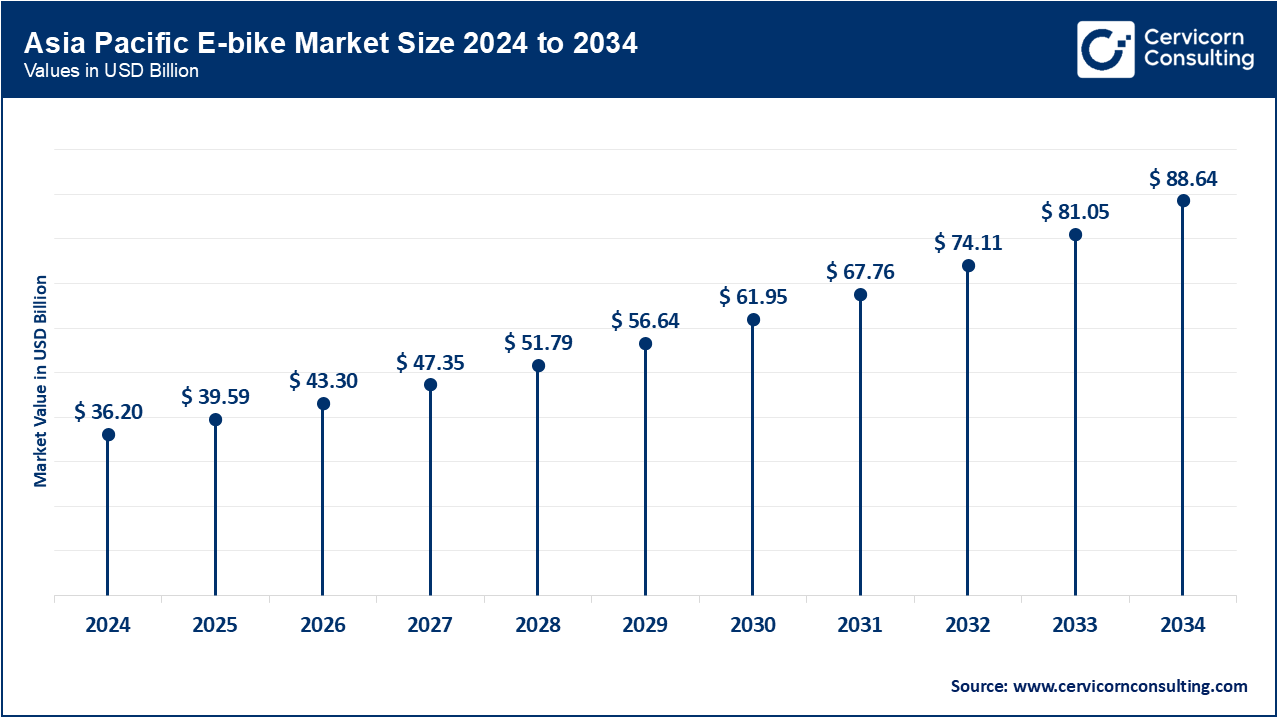

- Regional Insights: The Asia Pacific region led the market in 2024, accounting for the highest revenue share of 59.40%.

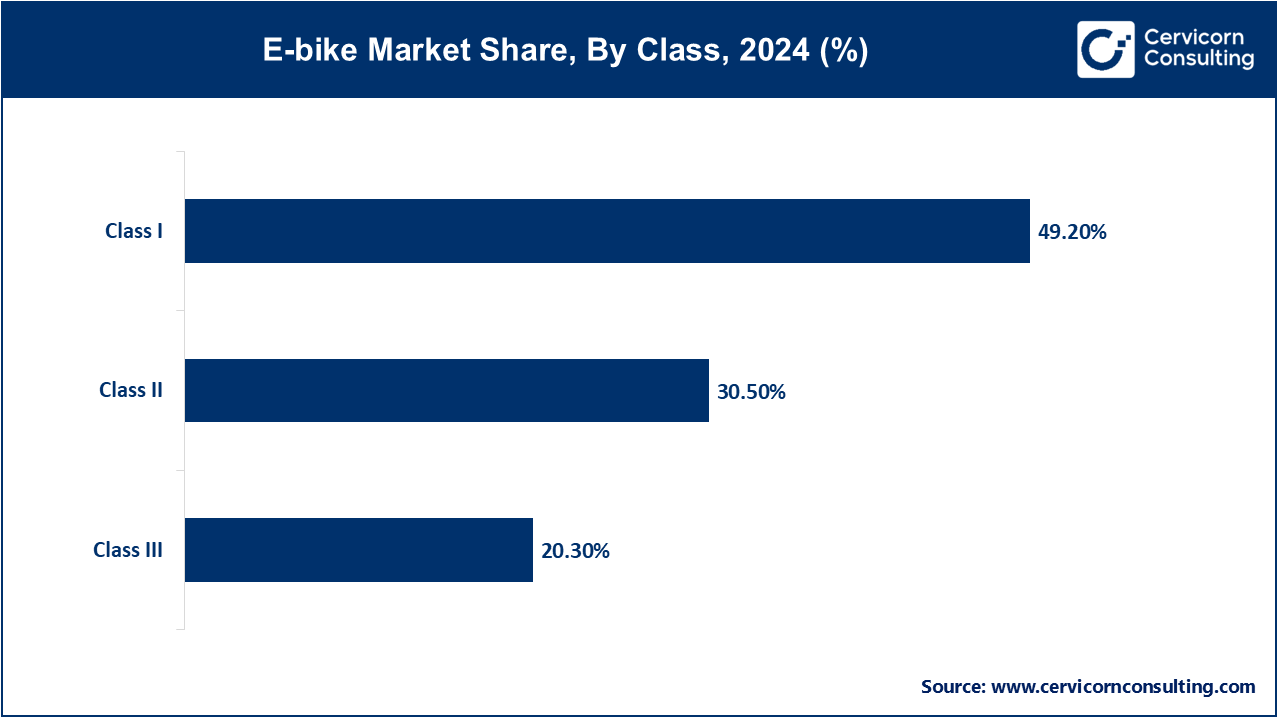

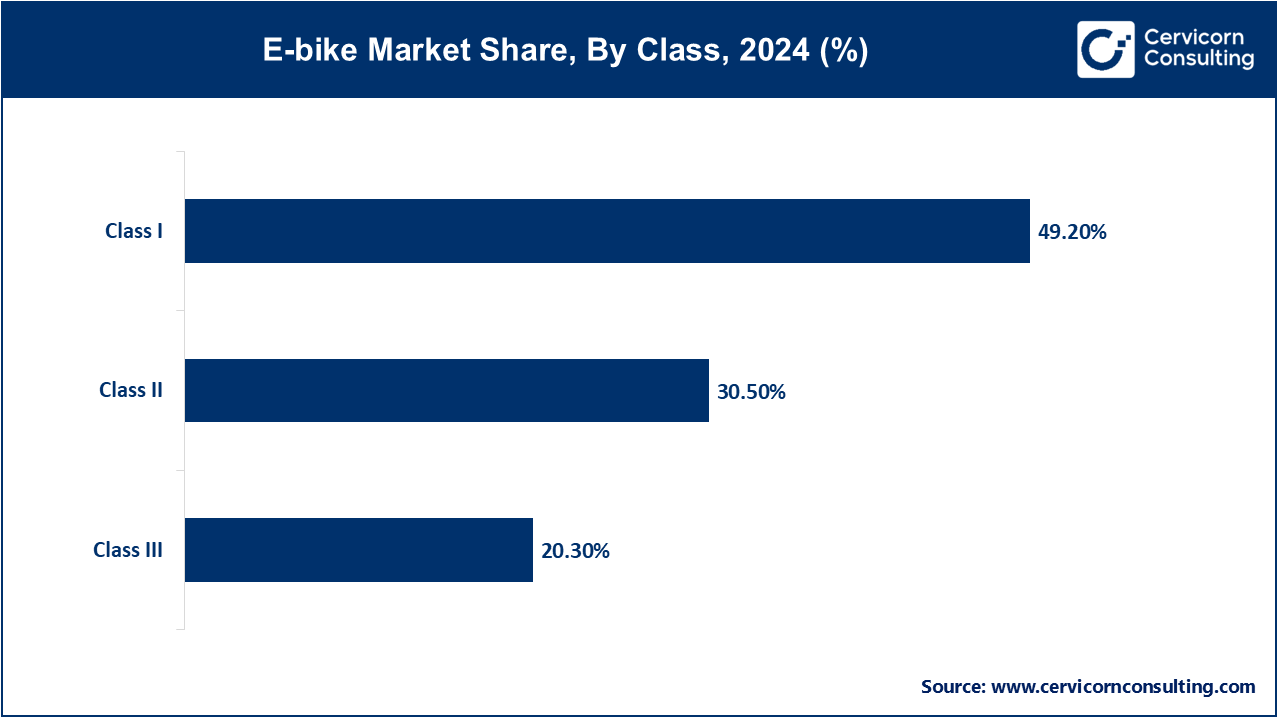

- By Class: The Class I segment contributed 49.20% of the total revenue in 2024.

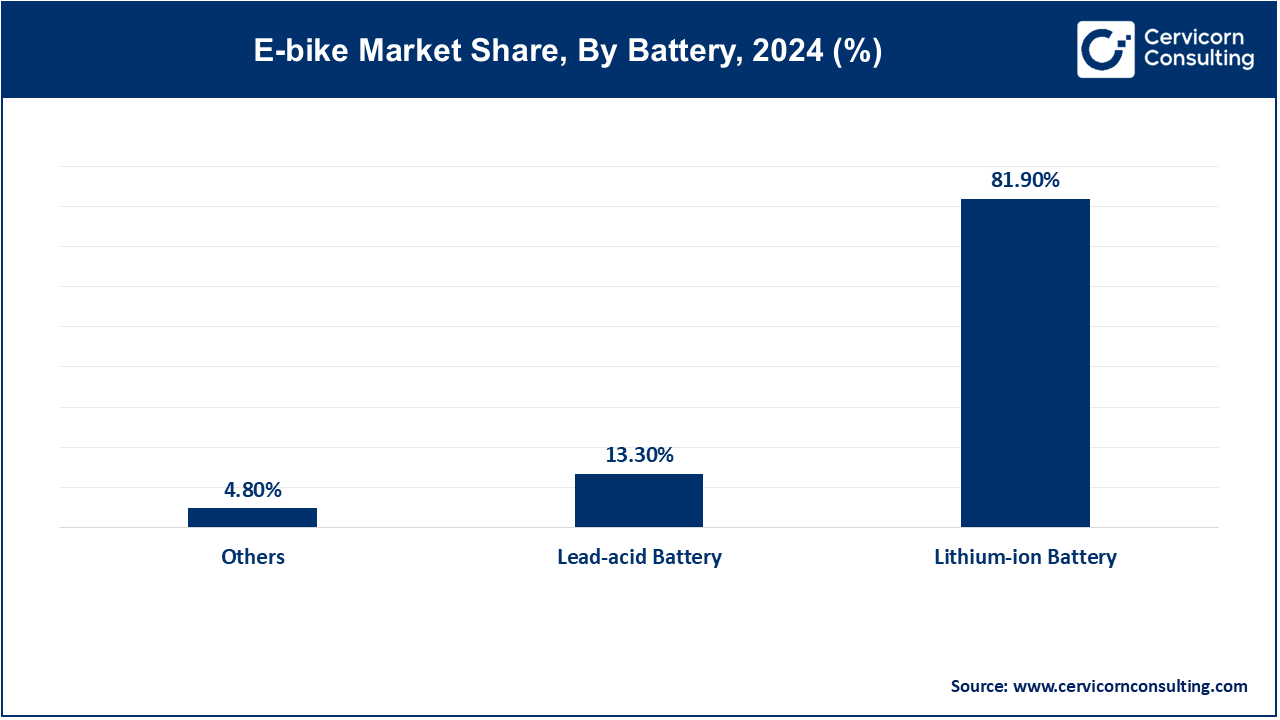

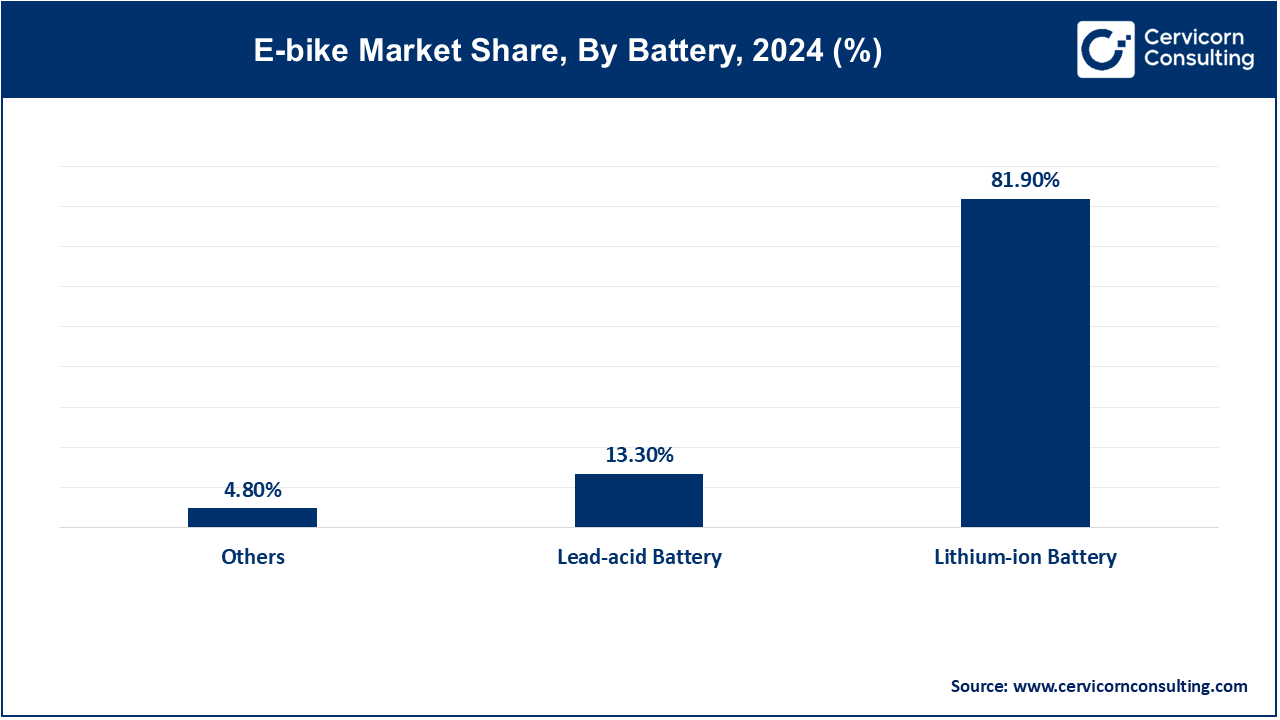

- By Battery Type: Lithium-ion batteries dominated the market with a substantial 81.90% revenue share in 2024.

- By End Use: The Personal use segment held the largest share at 86% in 2024.

- By Mode of Operation: City/urban e-bikes emerged as the leading mode in 2024.

- By Drive Mechanism: The market was primarily driven by hub motor systems in 2024.

- By Component: The battery component maintained the top position in terms of market share in 2024.

- By Battery Capacity: The 451W to 650W capacity range held the maximum share in 2024.

Market Growth Factors

- Increase in Integration of Advanced Technology: The introduction of smart sensors, IoT connectivity, AI diagnostics, and advanced battery management systems are transforming e-bikes. These technologies improve e-bike safety, performance, and enhance user experience. As a result, e-bikes appeal to consumers who are packaged as early adopters. Furthermore, the technological ecosystem incorporates mobile apps for navigation, tracking, and diagnostic purposes, which is increasing demand in metropolitan and smart city frameworks seeking sophisticated transport systems solutions.

- Adoption of Government Policy Subsidies for E-Bike Promotion: Many countries across the globe have implemented legal frameworks, subsidy structures and supportive policies aimed at lowering carbon emission levels and encouraging sustainable modes of mobility. Additional tax exemptions, lowered fees for vehicle registration, and tax dollars earmarked for cycling infrastructure enhance the use of e-bikes. Some of the strongest initiatives are in Europe and the Asia Pacific region where cities work towards net-zero goals and congestion reduction targets. Collectively, the UK government policy aims that by 2030, 50% of all short journeys in towns and cities will be made on foot, wheeled, or cycled, and will also support enabling legislation and infrastructure development for e-bikes.

- Consumer Preference Towards Sustainability and Eco-Friendly Transportation: Consumers are more inclined towards using transport that is eco-friendly because of the growing concern towards the environment. Compared to other motor vehicles, E-bikes are unique in being emission-free and energy-efficient. For short to medium distance travel, eBikes serve as a healthier and more eco-friendly compared to conventional commuting methods, resulting in reduced carbon emissions and decreased traffic congestion. Changes in the consumer's purchasing behavior is greatly contributing towards the development of the e-bike market.

- Surge in Fuel Prices: The incremental movement up of fuel prices at different regions of the globe is making consumers desperately look for cheaper transport alternatives. E-bikes, for example, require less maintenance and are cheaper to power compared to fuel-powered vehicles. These e-bikes are being adopted for personal or commercial use due to their affordability in comparison to traditional fuel-powered cars and the ever-changing fuel prices. An example can be given in the case of e-bikes which cost roughly 0.04 per mile compared to 0.04 per mile compared to 0.36 per mile for gas-powered cars. The substantial disparity that exists during times of high fuel prices makes e-bikes the most favourable means of transportation.

- Increased Popularity of Cycling as a Fitness Activity: The pandemic raised people’s health consciousness which has driven cycling as both a leisure pursuit and a fitness activity. Unlike ordinary bicycles, e-bikes have captured the attention of older and less-health conscious individuals, as they make long-distance riding easier and more enjoyable. Mountain, hybrid, and trekking e-bikes are growing in sales around the world, particularly due to fitness-motivated consumers. For instance, Le Monde reported a 5% rise annually in cycling tourism for France in July 2024. This was driven by the development of electrically assisted bicycles. These innovations are expanding the demographic scope of people who cycle for leisure and exercise, thereby increasing the construction cyclist-friendly infrastructure and services.

Market Trends

- Rising Urbanization & Traffic Congestion: The increase in populations in urban areas has worsened the problem of traffic congestion, making e-bikes a more attractive option for commutes of short distances. Cities are spending money on cycling lanes and bike friendly infrastructure which will encourage their use. E-bikes save time and lower emissions as well as costs when compared to cars. With urban planners focusing on sustainable mobility solutions, e-bikes are becoming crucial to smart city projects which further accelerates market growth.

- Technological Advancements: E-bikes are now having features such as lithium-ion batteries, IoT integration, regenerative braking and many more added to them. The user experience and satisfaction is being improved with the addition of smart displays, GPS tracking along with app integration. The e-bike market is positioned well for the future with the rise of AI powered adaptive pedal assist and anti-theft systems which makes the product a better futuristic mobility solution.

- Growing Health & Fitness Awareness: The concept of using pedal power alongside electric propulsion to cycle creates a more active lifestyle, which promotes broader demographic outreach including older people and people with low fitness levels. From the perspective of healthcare, consumers are adopting e-bikes for commuting and recreation due to the low impact joint strain and outdoor activity which helps in driving demand. The added benefit from fitness applications that monitor rides and the calories burned further serves to promote e-bikes as tools for wellness.

- Shift towards Sustainable Mobility: The accelerating impacts of climate change is making both consumers and government to focus on environmentally friendly means of transport. E-bikes has zero emission which helps in mitigating air pollution in cities. A number of countries are starting to promote the use of e-bikes by giving subsidies and tax incentives. With these policies, e-bikes are increasingly accessible and favorable in comparison to gas powered vehicles as purchasing decisions are greatly influenced by sustainability.

- Expansion of Bike-Sharing Programs: Many cities now have e-bike sharing systems which is an affordable and flexible way to enhance last-mile connectivity and they are becoming popular around the world. Such programs do not only encouraged shared mobility, but also reduce dependability on cars and do away with traffic jams. Companies such Lime and Bird are growing their fleets and including e-bikes into public transit apps. The increasing availability of dockless e-bike rentals expand urban adoption and market growth.

- Rise in the Popularity of Cargo E-Bikes: These cargo e-bikes are economical and environmentally-friendly cargo e-bikes that are becoming popular among families, small businesses, and delivery services. Their heavy lifting capability makes them a better alternative to light trucks for use in urban logistics. Demand is rising as governments adopt cargo e-bikes as part of their green logistic strategies. Their flexibility makes them suitable for urban deliveries which lowers emissions and cost.

Report Scope

| Area of Focus |

Details |

| Market Size in 2025 |

USD 66.65 Billion |

| Expected Market Size in 2033 |

USD 136.45 Billion |

| Projected Market CAGR 2025 to 2034 |

9.36% |

| High-impact Region |

Asia-Pacific |

| Key Segments |

Product, Drive Mechanism, Class, Battery, Speed, Mode of Operation, Component, Battery Capacity, Motor Weight, Motor Power, Region |

| Key Companies |

Giant Manufacturing Co. Ltd., Yadea Group Holdings Ltd., Pedego Electric Bikes, Merida Industry Co. Ltd, Trek Bicycle Corporation, Accell Group N.V., Brompton Bicycle Ltd., Yamaha Motor Company, Pon.Bike, Aima Technology Group Co. Ltd. |

Market Dynamics

Market Drivers

- Urbanization and Traffic Congestion: The worsening congestion experienced with e-scooters and e-bikes presents an opportunity for time saving for commuters. Unlike cars, bikes, e-scooters, and e-bikes can be operated freely in most streets during business hours and can be left almost anywhere without needing designated parking spaces. As infrastructural spending increases, e-scooters and e-bikes are being viewed as a means of mitigating traffic congestion.

- Rising Fuel Prices: The rising cost of gasoline and diesel has become an economic concern for most commuters, especially in less developed countries. Products like e-bikes, with rechargeable batteries scooters, electric scooters and self-balancing scooters offer low operational and maintenance expenses. This surge in e-bike purchasing stems from surges in fuel prices along with promises of better savings down the line, contributing to their growing prominence in rural areas.

- Integration with Smart City Initiatives: E-bikes are fitted to smart city frameworks with deep mobility ecosystems. These cities are building new infrastructural assets including e-docks, ogen mobility hubs, smart docking bays, and fleet tracking systems which further optimize e-dock utilization. Such systems allow for the collection of data in real-time, which increases the effectiveness of transport in urban centers. E-bike use mitigates emissions and traffic congestion and, when coupled with the public transport network, enables cities to embrace clean, multifunctional, and technology-driven congestion mitigation solutions.

- Environmental Issues: Air and global warming is a major concern for people and government authorities. As a result personal mobility e-bikes are increasingly regarded as a solution. These bikes provide no tailpipe emission during operation which is helpful for cities in the fight against pollution and the reduction of carbon footprints. They assist in achieving the international decarbonization targets as well as individual attempts for eco-friendly lifestyles. In e-bikes, cities grappling with regulations around climate change responses and a public desire for cleaner options are finding an answer to sustaining urban transport and enhancing climate resilience.

Market Restraints

- High Initial Costs: E-bikes are considered the most economical and environmentally friendly means of transport, yet their purchase cost limits widespread adoption. Enhanced battery innovations, smart technology, and top-grade materials in premium models erect a barrier to e-bike adoption for many cost-conscious consumers. In the absence of substantial subsidies or financing schemes, the initial capital requirement limits market accessibility, particularly in developing economies and among lower-income demographic segments.

- Limited Charging Infrastructure: The lack of adequate charging infrastructure poses a considerable challenge to the mainstream adoption of e-bikes. Widespread use of e-bikes in daily commuting or long-distance travel is hampered in underdeveloped areas due to a lack of public charging stations with no standardization framework. The absence of government support for mobility infrastructure e-bike infrastructures further stagnates user confidence and convenience whilst restricting operational potential.

- Market Saturation in Developed Regions: In mature markets such as Western Europe and North America, the e-bike industry is experiencing signs of saturation due to high ownership rates and early adoption. With limited untapped customer segments and escalating competition, growth momentum is slowing. This saturation compels manufacturers and distributors to shift strategic focus toward emerging markets, where rising urbanization, improving infrastructure, and supportive government policies present more substantial opportunities for market expansion and revenue diversification.

Market Opportunity

- Expansion in Emerging Markets: Emerging economies such as Saudi Arabia and India have become areas of focus for further development for the global e-bike market, as proprietary government policies and urbanization emerge. These regions are beginning to pay more attention to electric mobility and with shifting attitudes towards the environment and a boost in purchasing power, these markets appear to be brand new, untapped prospects for exporters, especially for those selling lower-cost, durable products that are meant to last and locally modified e-bikes.

- Corporate Adoption for Employee Commutes: Businesses are now including e-bikes in the scope of corporate social responsibility (CSR) policies within the Environmental Social Governance (ESG) framework of the firm. Employers are supporting health-focused climate e-bike fleets and incentivized low commuting emission e-bike use which promotes health and emission reduction. Such measures mitigate the issues associated with traffic congestion and high demand for parking spaces. As employee wellness and sustainability move up the corporate agenda, e-bikes are being used not only by employees, but also brought directly to the workplace, which makes the idea appealing to a range of manufacturers and providers to services such as leasing or managing vehicle fleets.

- Integration with Renewable Energy: The use of e-bikes and their solar-powered charging stations promises to increase sustainability as well as operational efficacy. Such systems reduce the consumption of grid electricity and fossil fuels, supporting the objectives of emission-free transport. Proprietors of solar-charging facilities, both public and private, elevate the e-bike e-sustainability cycle. This integration enhances the proposition of e-bikes not only as an eco-friendly option but also in achieving heightened energy transition objectives alongside the march towards cost-effective transport infrastructure development.

Market Challenges

- Issues Relating to Battery Life and Efficiency: The most pressing concern with e-bikes is the battery's runtime. Lithium-ion batteries age with continuous cycles of charging and discharging, thereby diminishing efficiency, range, and accessible power. Additionally, extreme temperatures and frequent charging cycles further reduce battery life. Moreover, long charging periods coupled with the expensive cost of replacement makes it difficult for those on a budget. The absence of interchangeability and negligible standardization between battery of other types further compounds these issues. Aside from these, they also incur additional operational costs, resulting in decreased reliability and adoption in the long run.

- Lack of Charging Facilities: The lack of comprehensive accessible charging facilities continues to limit the usage of e-bikes. Developing areas of many cities still do not have charging or battery swapping stations. Users are forced to rely on residential charging which is unreasonable for those sharing accommodation, apartments or similar housing units. Those kinds of infrastructure damages make remote commuting less efficient and useful, and even reduces the effectiveness and advantages of e-bikes. Improving infrastructure, both physically and in regards to public relations, can greatly increase trust while also resulting in accelerated public growth.

- Supply Chain Disruptions: E-bike manufacturing and distribution still suffers from ongoing global supply chain disruptions. In addition to the pandemic, pending geopolitical disputes alongside the crises of crucial resources such as lithium, cobalt, and semiconductors, have been adding to the cost of creation whilst straining the timelines for fabrication. Furthermore, delays in the procurement of essential components such as motors, battery cells, and controllers have adversely affected inventory levels due to the increased lead times. These constraints not only stifle the growth of the market but also increase the volatility of prices, adversely affecting the margins of the manufacturers and the affordability of the end-users.

Segmental Analysis

Product Analysis

Pedelecs: Specifically, participants are supported in pedaling with a Pedelec or pedal electric cycle which provides motor assistance up to a speed of 25 km/h. These Pedelecs became famous in Europe and Asia because of their accessibility and simple operation and compliance with the law. Casual cyclists, as well as urban commuters, are the primary drivers of adoption as they attempt to blend exercise and leisure.

Speed Pedelecs: Designed for long-distance and performance commuting, speed pedelecs offer motor assistance up to 45 km/h. Because of their capability, such e-bikes are often subject to insurance, registration, and even helmet requirements. These are favored in markets where infrastructure supports high speed cycling, and appeal to professionals seeking an alternative to motor vehicles for daily travel.

Throttle on Demand: Scooters and mopeds are to cars as throttle-controlled e-bikes are to bicycles, no paddling is required for operation, only a twist or push to the throttle. This type of pedelec is common in Asia and North America, catering to consumers motivated by ease of use and low physical demand. For some countries, this classification prohibits broader circulation due to regulations on motorized vehicles making it problematic in Europe.

Scooter or Motorcycle: E-scooters and e-motorcycles resemble traditional two-wheelers in design but are powered electrically. These are used for longer urban trips and in shared mobility fleets. With rising interest in personal electric vehicles, these models serve as car replacements in crowded cities, but often fall outside standard e-bike regulations and require licensing and insurance.

Class Analysis

Based on class, the market is classified into class I, class II, and class III. The class I segment dominated the e-bike market in 2024.

Drive Mechanism Analysis

Hub Motor: In hub motor e-bikes, the motor is integrated into the hub of the front or rear wheel. They can be found in entry level models, are inexpensive, and have low maintenance. They assist in propulsion, but their lack of torque management makes them ineffective in more challenging off-road environments. Most suitably for regions with lower altitudes, infrequent short walks tends to erratic jogs, and frequent simple drives in suburban areas. Best inhabited sparsely populated flat regions provides the best scope.

Mid-Drive: A mid-drive e-bike motor mounted at the crankset provides optimal balance, efficiency, functional torque control, and augments primary performance. These systems perform effectively on steep terrain making them suitable for mountain biking and heavy-duty use. Although pricier, they provide improved natural ride feel and battery efficiency during rigorous biking. Dominating the premium segment in Europe, mid-drive motors are popular because dual e-bikes/mountain bikes are expensive.

Others: Shaft-drive and friction drives are categorized as outliers, they deviate from the customary hub or mid-drive configurations. Because of these systems’ low efficiency and complex maintenance requirements, they tend to be less common. However, their application in specialty or custom-designed e-bikes can be beneficial. Their market adoption is limited and mostly for research purposes.

Battery Analysis

Based on battery, the market is classified into lead-acid battery, lithium-ion battery, and others. The lithium-ion battery segment dominated the market in 2024.

Regional Analysis

The E-bikes market is segmented into several key regions: North America, Europe, Asia-Pacific, and LAMEA (Latin America, Middle East, and Africa). Here’s an in-depth look at each region

Why is Asia Pacific leading the E-bike market?

The Asia-Pacific E-bike market size was exceeded at USD 36.20 billion in 2024 and is forecasted to grow around USD 88.64 billion by 2034. The leading players by volume in the Asia-Pacific region are China, India, and Japan. China's steep infrastructure investment enables it to dominate the global supply chain. Economically, urban policies restricting gas two-wheelers and subsidizing electric-enabled vehicles assures continued demand. India is increasingly emerging faster owing to fuel price pressures and environmental concerns. However, challenge remains with infrastructure and price sensitivity in rural areas. Southeast Asia's exports are diversifying the region’s markets.

North America E-bike market is steadily growing

The North America E-bike market size was valued at USD 6.64 billion in 2024 and is expected to reach around USD 16.27 billion by 2034. The North America is steadily growing with upcoming opportunities due to increasing fuel costs, environmental consciousness, and traffic congestion in metropolitan areas. In Canada and the US, e-bikes are increasingly being used for urban commuting as well as recreation. Demand is also increasing due to government incentives such as California’s e-bike rebate program as well as new bike lane construction. However, the limited cycling culture in some states and high e-bike costs remains a challenge. Shared micromobility programs and corporate wellness programs are expected to further aid market growth in this region.

Europe E-bike Market Trends

The Europe E-bike market size was estimated at USD 18.10 billion in 2024 and is projected to hit around USD 44.32 billion by 2034. Europe is still the global leader, with e-bike adoption being led by Germany, Netherlands, and France. The market is more mature in Western Europe, and this can be attributed to a well-established cycling culture and spending by the government in the regions. The region greatly benefits from environmental policies that encourage using low-emission transportation. EU policies toward climate neutrality as well as domestic subsidies still create demand. Increasing use of speed pedelecs and cargo e-bikes for commercial purposes is also noted. However, saturation of the market in Western Europe drives manufacturers to explore opportunities in Eastern Europe.

E-bike Market Revenue Share, By Region, 2024 (%)

| Region |

Revenue Share, 2024 (%) |

| North America |

10.90% |

| Asia-Pacific |

59.40% |

| Europe |

29.70% |

LAMEA E-bike Market Trends

E-bike adoption is slower than average growth in the LAMEA region which provides with challenges and opportunities. Increasing fuel prices and traffic congestions in Latin America, especially in Brazil, Mexico and Colombia is supporting the growth of e-bikes as economical solutions to urban mobility woes. But poor cycling infrastructure alongside high costs of imports will slow these benefits down. UAE and Saudi Arabias’s forward-looking vision policies are integrating e-bikes into smart city frameworks, spearheading e-bike usage in the region, although extreme heat and low awareness are two hindering factors. Africa suffers from stunted development but interest due to low-cost transportation keeps rising. The region still has long-term potential, as government and private stakeholders look more into cleaner mobility solutions.

E-bike Market Top Companies

Recent Developments

Recent collaborations in the e-bike industry reflect a strategic push toward technological advancement, sustainability, and mobility-as-a-service integration. Leading players such as Giant Manufacturing Co. Ltd., Yadea Group Holdings Ltd., Pedego Electric Bikes, and Merida Industry Co. Ltd are forming alliances with software firms and mobility platforms to integrate IoT, AI-based diagnostics, and connected features. These partnerships aim to enhance user experience, streamline fleet management, and improve energy efficiency. Additionally, joint ventures are enabling localized manufacturing and distribution, reducing supply chain dependency and promoting faster adoption in emerging urban markets. Some notable examples of key developments in the E-bikes Market include:

- In December 2024, Segway unveiled two new e-bike models the Xafari and Xyber featuring advanced smart technology, full suspension systems, and extended range capabilities. The Xafari is tailored for cyclists, equipped with a rear rack for utility, while the Xyber adopts a mini-moto aesthetic for a more rugged appeal. As part of its U.S. market expansion, Segway is developing a dedicated dealer network to support sales and service. Both models are slated for commercial launch in Q1 2025.

Market Segmentation

By Product

- Pedelecs

- Speed Pedelecs

- Throttle on Demand

- Scooter or motorcycle

By Drive Mechanism

- Hub motor

- Mid-drive

- Others

By Class

- Class I

- Class II

- Class III

By Battery

- Lead-acid Battery

- Lithium-ion Battery

- Others

By Speed

By Mode of Operation

- City/Urban E-bikes

- Mountain E-bikes

- Trekking/Touring E-bikes

- Cargo E-bikes

- Others (Cruiser)

By Component

- Battery

- Electric Motors

- Motor Controller

- Frame with Forks

- Others (Brake Systems, Wheels & Gears)

By Battery Capacity

- Below 250W

- 251W to 450W

- 451W to 650 W

- Above 650W

By Motor Weight

- <2 kg

- >2 kg -<2.4 kg

- >2.4 kg

By Motor Power

By End Use

By Region

- North America

- APAC

- Europe

- LAMEA