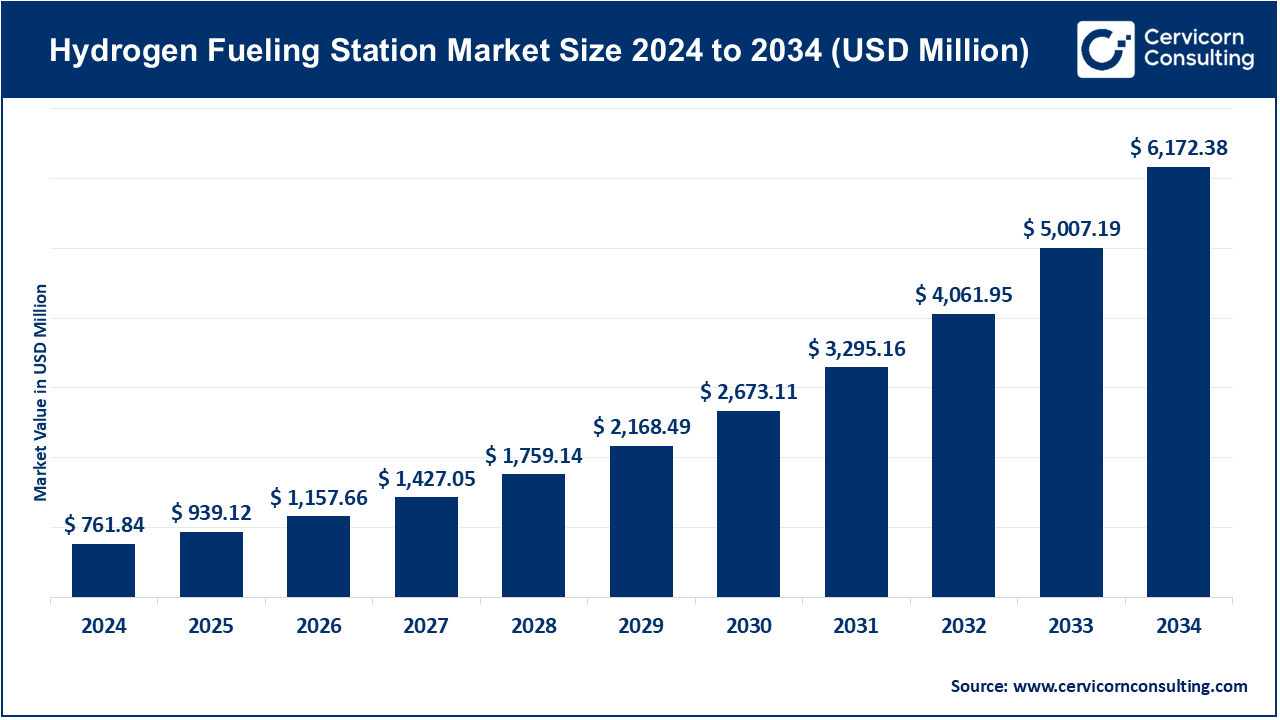

The global hydrogen fueling station market size was reached USD 761.84 million in 2024 and is expected to be worth around USD 6,172.38 million by 2034, exhibiting a compound annual growth rate (CAGR) of 23.27% over the forecast period from 2025 to 2034.

The hydrogen fueling station market is driven by a combination of government support, technological advancements, and rising demand for zero-emission vehicles. Across the globe, governments are setting tough emission standards and offering incentives for clean energy technology. The European Union, for instance, has committed to becoming carbon neutral by 2050 and has already made substantial investments in hydrogen technology. The U.S. government has also invested significantly in hydrogen infrastructure as part of its energy policy. All these efforts reduce cost barriers and stimulate private sector investment in constructing hydrogen fueling stations.

Technological advancements are also playing a crucial role in market expansion. Improvements in hydrogen production, storage, and dispensing technologies are making it more cost-effective and affordable, thus enhancing the competitiveness of hydrogen fuel. The increased adoption of fuel cell electric vehicles (FCEVs) by major automakers such as Toyota, Hyundai, and Honda is also driving demand for hydrogen fueling infrastructure. As more people become aware of hydrogen's sustainability and cleanliness, consumer demand for FCEVs will grow, necessitating the expansion of hydrogen fueling stations to meet this new demand.

What is a Hydrogen Fueling Station?

Hydrogen fueling stations are set up to provide hydrogen gas for fuel cell electric vehicles (FCEVs) and promote the use of clean energy in transportation. There are three types of hydrogen fueling stations: on-site production stations, where hydrogen is generated on-site at the station through processes such as electrolysis; off-site delivery stations, which are refilled with hydrogen produced elsewhere via pipelines or delivery trucks; and mobile stations, which are portable units that can be transported to various regions in need. In practical applications, hydrogen fueling stations provide fuel for a wide range of vehicles, including passenger cars, buses, trucks, forklifts, and even ships, serving industries such as public transportation, logistics, and industrial processes.

Key Insights and Developments in the Hydrogen Fueling Station Market

| Aspect | Insight |

| Station Types |

|

| Applications |

|

| Regional Developments |

|

| Technological Advancements |

|

| Challenges |

|

Shift Toward Heavy-Duty and Industrial Applications

While hydrogen-powered passenger vehicles have struggled due to limited infrastructure and high costs, there is a noticeable shift toward heavy-duty and industrial applications. Hydrogen fuel cells are increasingly utilized in trucks, ocean vessels, and heavy machinery, where centralized refueling infrastructure is more practical. For example, General Motors is investing in hydrogen fuel cells for heavy-duty trucks, and the Energy Observer, a hydrogen-powered ship, showcases renewable hydrogen power in decarbonizing shipping.

Development of Regional Hydrogen Hubs

Governments are investing in regional hydrogen hubs that consolidate production, storage, and distribution to support local economies and reduce emissions. In January 2025, the Port of Houston Authority received a USD 25 million grant from the U.S. Department of Transportation to create a hydrogen fueling station at Bayport, Texas. The project will introduce pipeline-based truck fueling and facilitate supply chain development in Texas and the Gulf Coast.

Technological Advancements in Hydrogen Infrastructure

Technological advancements in hydrogen production, storage, and dispensing technologies are enhancing efficiency and lowering costs. For instance, Air Liquide launched the SmartFuel® H70 hydrogen dispenser in 2024, capable of dispensing hydrogen at 700 bar pressure, which reduces refueling time for fuel cell electric vehicles (FCEVs). Additionally, Nel Hydrogen introduced the Nel Proton PEM electrolyzer series in 2023, achieving efficiencies above 80%, significantly decreasing the energy required for hydrogen production from renewable sources.

Collaborations Between Automakers to Advance Hydrogen Technology

Automakers are forming partnerships to tackle challenges in hydrogen technology. In September 2024, Toyota and BMW strengthened their collaboration on hydrogen fuel cell vehicles with a new memorandum of understanding to expedite the development of next-generation, zero-emission cars. BMW plans to introduce its first hydrogen-powered model in 2028. Their partnership aims to standardize components, reduce costs, and develop shared powertrains, along with establishing hydrogen fueling infrastructure.

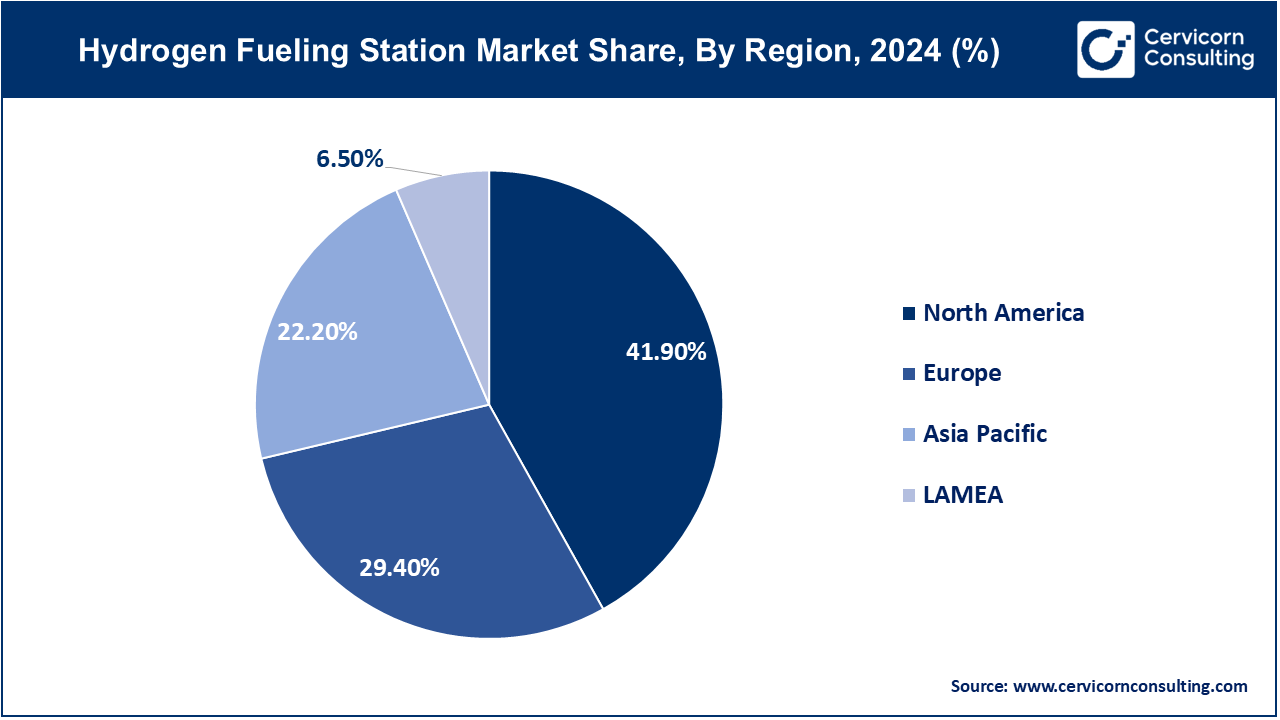

The hydrogen fueling station market is segmented into various regions, including North America, Europe, Asia-Pacific, and LAMEA.

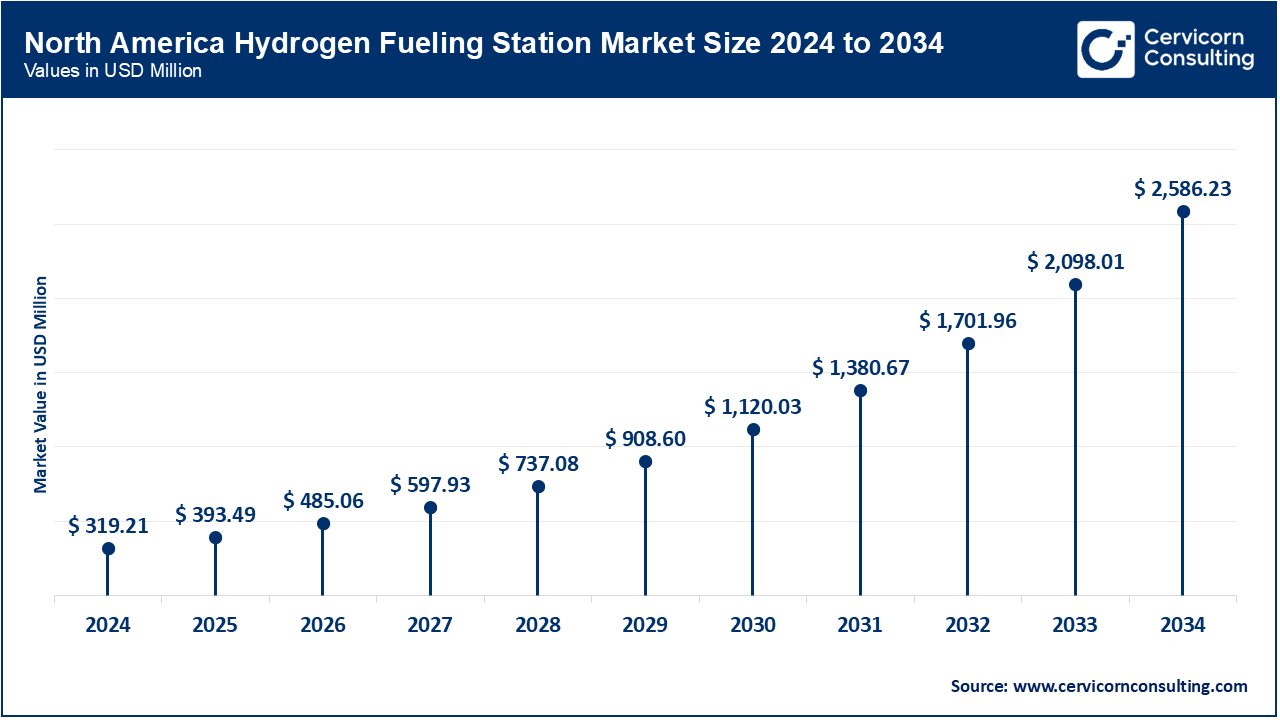

The North America hydrogen fueling station market size reached USD 319.21 million in 2024 and is expected to be worth around USD 2,586.23 million by 2034. North America is the leading region in the market, driven by strong government initiatives and increasing investments in clean energy infrastructure. The United States and Canada are focusing on hydrogen infrastructure development, with California leading the charge through a highly dense network of hydrogen stations for fuel cell electric vehicles (FCEVs). The region benefits from robust funding programs and public-private partnerships aimed at decarbonizing transportation, particularly for heavy-duty trucks and public transit fleets. Technological innovation and collaboration between automakers and energy companies are also propelling market growth.

The Asia-Pacific hydrogen fueling station market size reached USD 169.13 million in 2024 and is expected to be worth around USD 1,370.27 million by 2034. APAC is experiencing steady growth, mainly driven by the aggressive policies and substantial investments f countries like Japan, South Korea, China, and Australia. Japan's shift to hydrogen fuel cell cars and government-backed infrastructure plans have established a global benchmark. China is rapidly expanding its hydrogen fueling infrastructure to meet its ambitious carbon neutrality goals and the electrification of transportation, including buses and commercial vehicles. The region's strong government policies, combined with industrial and technological advancements, continue to solidify APAC's position as the world's fastest-growing market.

The Europe lobal hydrogen fueling station market size reached USD 223.98 million in 2024 and is expected to be worth around USD 1,814.68 million by 2034. Europe is witnessing significant momentum in hydrogen fueling infrastructure, driven by stringent emissions regulations and a strong commitment to green hydrogen production. Germany, France, and the Netherlands are making substantial investments in fixed hydrogen stations and hydrogen mobility to reduce carbon footprints in industry and transportation. The European Union's hydrogen strategy, based on renewable energy derived hydrogen, promotes the integration of electrolysis and refueling networks among member states. Cross-border collaboration is envisioned to develop a pan-European hydrogen corridor, facilitating cross-border transport and market development.

The LAMEA hydrogen fueling station market size reached USD 49.52 million in 2024 and is expected to be worth around USD 401.20 million by 2034. The Latin America, Middle East, and Africa (LAMEA) region is an emerging market, characterized by gradual adoption and pilot projects targeting public transport and industrial applications. Although infrastructure is in its infancy, countries such as Brazil, UAE, and South Africa are looking to hydrogen as a key element in their transition to clean energy strategies. The abundance of renewable energy resources, such as solar and wind, in the region presents a tremendous opportunity for the production of green hydrogen. Growing global investments and strategic partnerships are expected to foster growth in LAMEA over the next several years.

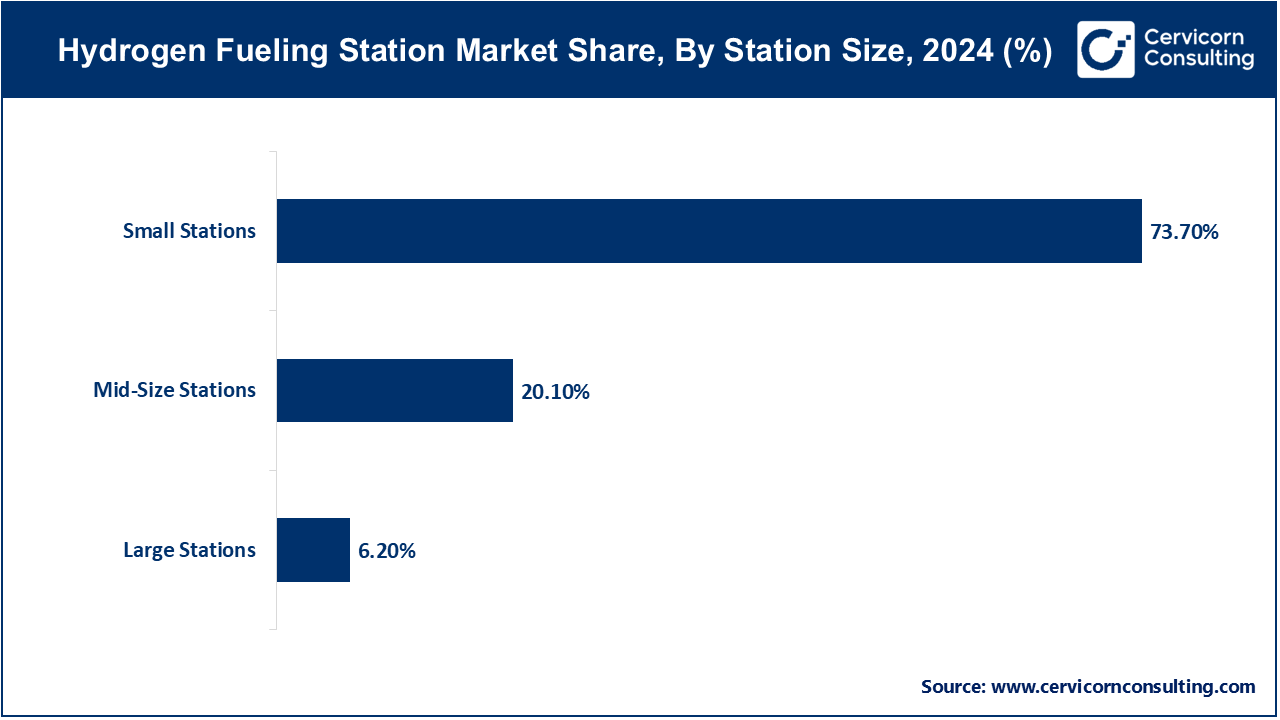

The hydrogen fueling station market is segmented into station size, supply type, pressure, station type, solution, and regions. Based on station size, the market is classified into large stations, mid-size stations, and small stations. Based on the supply type, the market is categorised into off-site (gas, and liquid) and on-site (electrolysis, and steam methane reforming (SMR)). Based on pressure, the market is categorised into high pressure and low pressure. Based on station type, the market is classified into mobile hydrogen stations and fixed hydrogen stations. Based on solution, the market is categorised into engineering procurement and construction (EPC) and components (dispensers, compressors, storage units, dispensing chiller systems, hydrogen inlets, hydraulic power units and controls, and others.

Small stations continue to dominate the market, largely due to cost efficiency, compact size, and suitability for early-phase deployment in urban and suburban areas. They are ideally suited for medium-traffic locations or where hydrogen infrastructure is being developed. Their lower installation and operation costs make them a preferred choice for governments and private investors experimenting with hydrogen refueling infrastructure. They also serve as proving grounds for new technology and are typically used to supply fleets of passenger fuel cell vehicles.

Large stations represent the fastest-growing segment, driven by increasing investment in heavy-duty transport and industrial applications. As hydrogen is increasingly utilized as a decarbonization solution for buses, trucks, and commercial fleets, the demand for high-capacity refueling stations has grown exponentially. Large stations are typically located in highway corridors and logistics hubs, where they refuel substantial quantities of fuel cell electric vehicles (FCEVs) daily. Their capability to support rapid, high-throughput fueling makes them essential enablers of scaling hydrogen mobility solutions.

On-site supply methods currently dominate the market, particularly electrolysis and steam methane reforming (SMR), as these allow for in-place hydrogen production, eliminating the need for external supply chains. This arrangement is particularly attractive in regions with abundant renewable electricity or natural gas. In-situ stations also enable real-time hydrogen production, which is more flexible to operate and results in reduced transport emissions.

Off-site supply is emerging as the fastest-growing supply type, especially with the establishment of centralized hydrogen production plants and distribution networks. Gas and liquid hydrogen supplied from off-site facilities fuel filling stations in densely populated urban areas or intercity routes, where space limitations make on-site production challenging. These supply contracts rely on economies of scale and are particularly significant for rapidly expanding hydrogen supply in broader regions.

High-pressure stations remain the dominant standard in the industry due to their compatibility with 700-bar systems used in most commercial hydrogen vehicles. High-pressure stations facilitate the same speedy refueling as gasoline, which is critical for fleet management and customer convenience. High-pressure system technology and infrastructure are advanced and represent the best solution for both new and existing hydrogen vehicles.

Low-pressure stations are experiencing steady growth, particularly in specialized industrial or material handling applications where lower pressure is sufficient. These stations are easier and more cost-effective to install and are gaining interest in niche applications such as forklifts, stationary backup power, and warehouse operations. Their development is also supported by companies wishing to explore hydrogen's potential at a lower operational level.

Fixed hydrogen stations dominate the market as they provide permanent, scalable infrastructure essential for the long-term deployment of hydrogen vehicles. These stations are typically included in national and regional plans to establish a reliable refueling network. Their consistent presence and reliability are critical for building public confidence in hydrogen transportation.

Mobile hydrogen stations are expanding rapidly, offering flexible, temporary solutions for hydrogen refueling in remote or underserved locations. They are particularly useful during pilot programs or when assessing hydrogen vehicle viability in new regions. Their relocatable nature also makes them valuable during special events or for fleet operators that operate across different locations.

Hydrogen Fueling Station Market Revenue Share, By Station Type, 2024 (%)

| Station Type | Revenue Share, 2024 (%) |

| Fixed Hydrogen Stations | 60.2% |

| Mobile Hydrogen Stations | 39.8% |

Engineering, procurement, and construction (EPC) services form the backbone of the hydrogen station market by providing turnkey solutions from design to execution. EPCs ensure that stations meet strict regulatory, safety, and performance standards, making them the most utilized service model, especially for public-private partnerships and major energy providers.

Component solutions, particularly dispensers, compressors, and storage units, are witnessing the fastest growth within the market. As more stations are constructed and older ones upgraded, the demand for high-quality, efficient components is on the rise. Continuous innovation in component technology—such as advanced cooling systems and smart control units—is driving this segment’s development and enhancing overall station performance.

The hydrogen fuel station market is characterized by the presence of global players, strategic partnerships, and increasing investments in research, development, and infrastructure. Industry leaders such as Air Liquide, Linde plc, Nel ASA, Plug Power Inc., and Toyota Tsusho are expanding aggressively through strategic partnerships, joint ventures, and government-sponsored projects. All participants are focusing on the development of turnkey hydrogen refueling solutions, station component upgrades, and the integration of renewable hydrogen production technologies. Competition is also intensifying with growing interest from energy companies, automakers, and new entrants looking to benefit from the global shift towards zero-emission mobility and clean fuel solutions.

Chart Industries

Air Liquide

Linde Engineering

FuelCell Energy, Inc.

Air Products and Chemicals, Inc.

Market Segmentation

By Station Size

By Supply Type

By Pressure

By Station Type

By Solution

By Region

Chapter 1. Market Introduction and Overview

1.1 Market Definition and Scope

1.1.1 Overview of Hydrogen Fueling Station

1.1.2 Scope of the Study

1.1.3 Research Timeframe

1.2 Research Methodology and Approach

1.2.1 Methodology Overview

1.2.2 Data Sources and Validation

1.2.3 Key Assumptions and Limitations

Chapter 2. Executive Summary

2.1 Market Highlights and Snapshot

2.2 Key Insights by Segments

2.2.1 By Station Size Overview

2.2.2 By Supply Type Overview

2.2.3 By Pressure Overview

2.2.4 By Station Type Overview

2.2.5 By Solution Overview

2.3 Competitive Overview

Chapter 3. Global Impact Analysis

3.1 Russia-Ukraine Conflict: Global Market Implications

3.2 Regulatory and Policy Changes Impacting Global Markets

Chapter 4. Market Dynamics and Trends

4.1 Market Dynamics

4.1.1 Market Drivers

4.1.1.1 Government Policies and Emission Regulations

4.1.1.2 Rise in Fuel Cell Electric Vehicle (FCEV) Adoption

4.1.2 Market Restraints

4.1.2.1 High Infrastructure and Installation Costs

4.1.2.2 Limited Hydrogen Production and Distribution Network

4.1.3 Market Challenges

4.1.3.1 Standardization and Interoperability Issues

4.1.3.2 Public Awareness and Safety Concerns

4.1.4 Market Opportunities

4.1.4.1 Integration with Renewable Energy for Green Hydrogen

4.1.4.2 Expansion into Heavy-Duty and Commercial Transport

4.2 Market Trends

Chapter 5. Premium Insights and Analysis

5.1 Global Hydrogen Fueling Station Market Dynamics, Impact Analysis

5.2 Porter’s Five Forces Analysis

5.2.1 Bargaining Power of Suppliers

5.2.2 Bargaining Power of Buyers

5.2.3 Threat of Substitute Products

5.2.4 Rivalry among Existing Firms

5.2.5 Threat of New Entrants

5.3 PESTEL Analysis

5.4 Value Chain Analysis

5.5 Product Pricing Analysis

5.6 Vendor Landscape

5.6.1 List of Buyers

5.6.2 List of Suppliers

Chapter 6. Hydrogen Fueling Station Market, By Station Size

6.1 Global Hydrogen Fueling Station Market Snapshot, By Station Size

6.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

6.1.1.1 Large Stations

6.1.1.2 Mid-Size Stations

6.1.1.3 Small Stations

Chapter 7. Hydrogen Fueling Station Market, By Supply Type

7.1 Global Hydrogen Fueling Station Market Snapshot, By Supply Type

7.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

7.1.1.1 Off-Site

7.1.1.2 On-Site

Chapter 8. Hydrogen Fueling Station Market, By Pressure

8.1 Global Hydrogen Fueling Station Market Snapshot, By Pressure

8.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

8.1.1.1 High Pressure

8.1.1.2 Low Pressure

Chapter 9. Hydrogen Fueling Station Market, By Station Type

9.1 Global Hydrogen Fueling Station Market Snapshot, By Station Type

9.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

9.1.1.1 Mobile Hydrogen Stations

9.1.1.2 Fixed Hydrogen Stations

Chapter 10. Hydrogen Fueling Station Market, By Solution

10.1 Global Hydrogen Fueling Station Market Snapshot, By Solution

10.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

10.1.1.1 Components

10.1.1.2 Engineering Procurement and Construction (EPC)

Chapter 11. Hydrogen Fueling Station Market, By Region

11.1 Overview

11.2 Hydrogen Fueling Station Market Revenue Share, By Region 2024 (%)

11.3 Global Hydrogen Fueling Station Market, By Region

11.3.1 Market Size and Forecast

11.4 North America

11.4.1 North America Hydrogen Fueling Station Market Revenue, 2022-2034 ($Billion)

11.4.2 Market Size and Forecast

11.4.3 North America Hydrogen Fueling Station Market, By Country

11.4.4 U.S.

11.4.4.1 U.S. Hydrogen Fueling Station Market Revenue, 2022-2034 ($Billion)

11.4.4.2 Market Size and Forecast

11.4.4.3 U.S. Market Segmental Analysis

11.4.5 Canada

11.4.5.1 Canada Hydrogen Fueling Station Market Revenue, 2022-2034 ($Billion)

11.4.5.2 Market Size and Forecast

11.4.5.3 Canada Market Segmental Analysis

11.4.6 Mexico

11.4.6.1 Mexico Hydrogen Fueling Station Market Revenue, 2022-2034 ($Billion)

11.4.6.2 Market Size and Forecast

11.4.6.3 Mexico Market Segmental Analysis

11.5 Europe

11.5.1 Europe Hydrogen Fueling Station Market Revenue, 2022-2034 ($Billion)

11.5.2 Market Size and Forecast

11.5.3 Europe Hydrogen Fueling Station Market, By Country

11.5.4 UK

11.5.4.1 UK Hydrogen Fueling Station Market Revenue, 2022-2034 ($Billion)

11.5.4.2 Market Size and Forecast

11.5.4.3 UKMarket Segmental Analysis

11.5.5 France

11.5.5.1 France Hydrogen Fueling Station Market Revenue, 2022-2034 ($Billion)

11.5.5.2 Market Size and Forecast

11.5.5.3 FranceMarket Segmental Analysis

11.5.6 Germany

11.5.6.1 Germany Hydrogen Fueling Station Market Revenue, 2022-2034 ($Billion)

11.5.6.2 Market Size and Forecast

11.5.6.3 GermanyMarket Segmental Analysis

11.5.7 Rest of Europe

11.5.7.1 Rest of Europe Hydrogen Fueling Station Market Revenue, 2022-2034 ($Billion)

11.5.7.2 Market Size and Forecast

11.5.7.3 Rest of EuropeMarket Segmental Analysis

11.6 Asia Pacific

11.6.1 Asia Pacific Hydrogen Fueling Station Market Revenue, 2022-2034 ($Billion)

11.6.2 Market Size and Forecast

11.6.3 Asia Pacific Hydrogen Fueling Station Market, By Country

11.6.4 China

11.6.4.1 China Hydrogen Fueling Station Market Revenue, 2022-2034 ($Billion)

11.6.4.2 Market Size and Forecast

11.6.4.3 ChinaMarket Segmental Analysis

11.6.5 Japan

11.6.5.1 Japan Hydrogen Fueling Station Market Revenue, 2022-2034 ($Billion)

11.6.5.2 Market Size and Forecast

11.6.5.3 JapanMarket Segmental Analysis

11.6.6 India

11.6.6.1 India Hydrogen Fueling Station Market Revenue, 2022-2034 ($Billion)

11.6.6.2 Market Size and Forecast

11.6.6.3 IndiaMarket Segmental Analysis

11.6.7 Australia

11.6.7.1 Australia Hydrogen Fueling Station Market Revenue, 2022-2034 ($Billion)

11.6.7.2 Market Size and Forecast

11.6.7.3 AustraliaMarket Segmental Analysis

11.6.8 Rest of Asia Pacific

11.6.8.1 Rest of Asia Pacific Hydrogen Fueling Station Market Revenue, 2022-2034 ($Billion)

11.6.8.2 Market Size and Forecast

11.6.8.3 Rest of Asia PacificMarket Segmental Analysis

11.7 LAMEA

11.7.1 LAMEA Hydrogen Fueling Station Market Revenue, 2022-2034 ($Billion)

11.7.2 Market Size and Forecast

11.7.3 LAMEA Hydrogen Fueling Station Market, By Country

11.7.4 GCC

11.7.4.1 GCC Hydrogen Fueling Station Market Revenue, 2022-2034 ($Billion)

11.7.4.2 Market Size and Forecast

11.7.4.3 GCCMarket Segmental Analysis

11.7.5 Africa

11.7.5.1 Africa Hydrogen Fueling Station Market Revenue, 2022-2034 ($Billion)

11.7.5.2 Market Size and Forecast

11.7.5.3 AfricaMarket Segmental Analysis

11.7.6 Brazil

11.7.6.1 Brazil Hydrogen Fueling Station Market Revenue, 2022-2034 ($Billion)

11.7.6.2 Market Size and Forecast

11.7.6.3 BrazilMarket Segmental Analysis

11.7.7 Rest of LAMEA

11.7.7.1 Rest of LAMEA Hydrogen Fueling Station Market Revenue, 2022-2034 ($Billion)

11.7.7.2 Market Size and Forecast

11.7.7.3 Rest of LAMEAMarket Segmental Analysis

Chapter 12. Competitive Landscape

12.1 Competitor Strategic Analysis

12.1.1 Top Player Positioning/Market Share Analysis

12.1.2 Top Winning Strategies, By Company, 2022-2024

12.1.3 Competitive Analysis By Revenue, 2022-2024

12.2 Recent Developments by the Market Contributors (2024)

Chapter 13. Company Profiles

13.1 Chart Industries

13.1.1 Company Snapshot

13.1.2 Company and Business Overview

13.1.3 Financial KPIs

13.1.4 Product/Service Portfolio

13.1.5 Strategic Growth

13.1.6 Global Footprints

13.1.7 Recent Development

13.1.8 SWOT Analysis

13.2 AIR LIQUIDE

13.3 Linde Engineering

13.4 FuelCell Energy, Inc.

13.5 Air Products and Chemicals, Inc.

13.6 Powertech Labs Inc.

13.7 Beijing PERIC Hydrogen Technologies Co.

13.8 Praxair, Inc.

13.9 Hydrogen Refueling Solutions

13.10 Nel Hydrogen

13.11 McPhy Energy S.A.

13.12 TotalEnergies