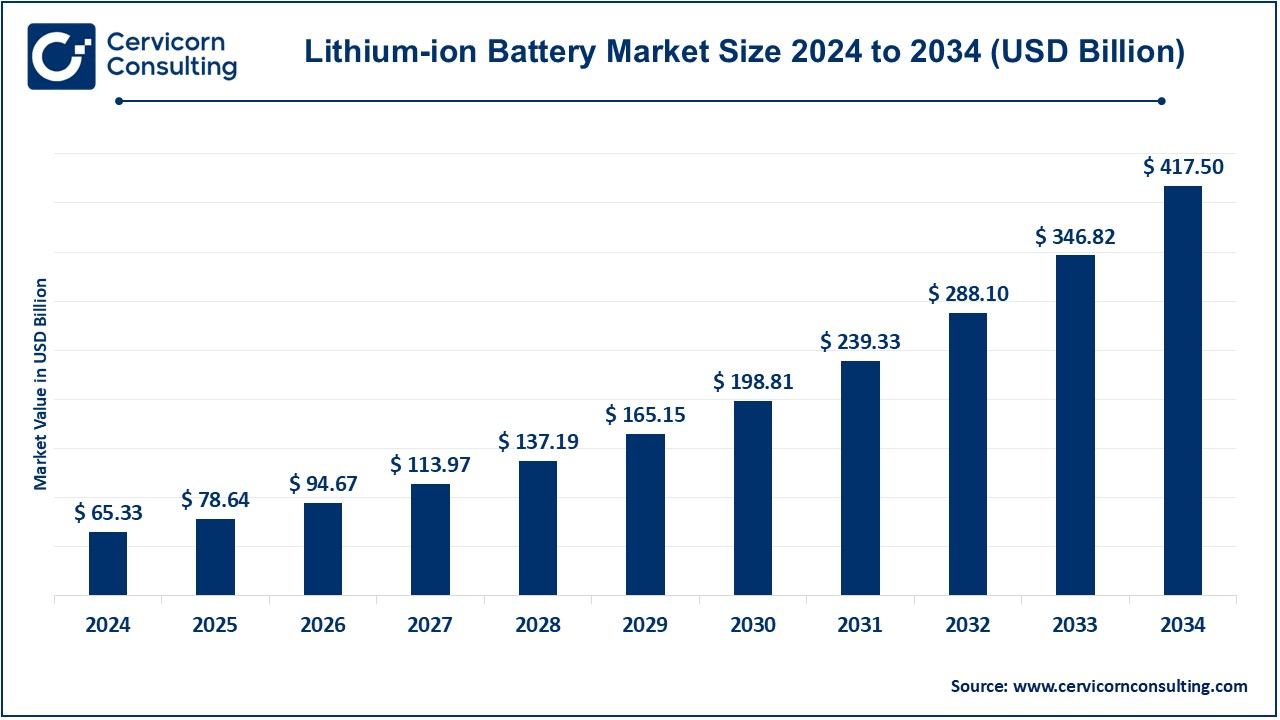

The global lithium-ion battery market size was valued at USD 65.33 billion in 2024 and is estimated to hit around USD 417.50 billion by 2034, growing at a compound annual growth rate (CAGR) of 20.38% during the forecast period 2025 to 2034. The lithium-ion battery market is expected to witness the significant growth during the forecast period owing to increasing demand from various industries especially from automotive and manufacturing industries.

The lithium-ion battery market is expected to grow owing to rising demand for electric vehicles (EVs), energy storage, and consumer electronics. The technological advancements being done by the players are resulting in the improvements in the energy density along with charging speed and service life of a battery which makes the lithium-ion batteries favorable for a wide range of applications. The process of economic growth and its interconnected positive and negative sides under the current mechanism of production is exacerbated by the reasons a heightened concern for the need to curb pollution to carry on with the process. However, issues such as non-availability of raw materials, supply chain bottlenecks, and concerns about the negative environmental impact of lithium mining are obstructing the market. It is also expected that the market will see a large amount of recycling, innovations in the green sector, and research in solid-state battery technology to solve the sustainability issue. The Asia-Pacific region remains the key market being led by China's production and supply chain capabilities. The increase in demand leads to the growth of the lithium-ion battery market, which is expected to play a major role in the continuing development of global energy storage and electrification.

Report Scope

| Area of Focus | Details |

| Market Size in 2025 | USD 78.64 Billion |

| Projected Market Size in 2034 | USD 417.50 Billion |

| Expected CAGR 2025 to 2034 | 20.38% |

| Dominant Region | Asia-Pacific |

| High Growth Region | North America |

| Key Segments | Product, Capacity, Voltage, Component, Application, Region |

| Key Companies | Toshiba Corp., Samsung SDI Co., Ltd., Saft, Panasonic Corp., LG Chem, Johnson Controls, Hitachi, Ltd., GS Yuasa International Ltd., BYD Co., Ltd., A123 Systems LLC |

Emergence of 5G & IoT

Expansion in Developing Markets

Raw Material Shortages & Price Volatility

Environmental & Ethical Concerns

Advancements in Solid-State Battery Technology

Growth in Battery Recycling & Second-Life Applications

Supply Chain Disruptions

Safety Issues & Thermal Runaway Risks

The lithium-ion battery market is segmented into product, capacity, voltage, component, application and region. Based on product type, the market is classified into lithium cobalt oxide (LCO), lithium iron phosphate (LFP), lithium nickel cobalt aluminum oxide (NCA), lithium nickel manganese cobalt (LMC), lithium titanate, and lithium manganese oxide (LMO). Based on capacity, the market is classified into BELOW 3,000 MAH, 3,001 MAH - 10,000 MAH, 10,001 MAH - 60,000 MAH and ABOVE 60,000 MAH. Based on voltage, the market is classified into LOW (BELOW 12V), MEDIUM (12V - 36V) and HIGH (ABOVE 36V). Based on component, the market is classified into cathode, anode, electrolytic solution and others. Based on application, the market is classified into automotive, medical devices, consumer electronics, energy storage systems and industrial.

Lithium Cobalt Oxide (LCO): The Lithium Cobalt Oxide segment has dominated the market in 2024. Lithium Cobalt Oxide (LCO) has become very popular for consumer electronics, thanks to its relatively high energy density, and reproducible performance. Due to their outstanding capacity retention and efficiency properties, LCO batteries are very suitable for use in smartphones, laptops, tablets, and cameras. Nevertheless, they have a small lifetime and poor thermal stability, which leads to safety issues at high loads. [Further] LCO batteries also use cobalt, which is both cost prohibitive and raises ethical sourcing concerns.

Lithium Iron Phosphate (LFP): Lithium Iron Phosphate (LFP) batteries are characterized by their excellent safety, high cycle life and thermal stability. In contrast to cobalt-based chemistries, LFP batteries are less environmentally unfriendly, less expensive, and hence are attractive for electric cars, renewable energy storage, and industrial applications. Their energy density is lower than that of NMC and NCA batteries, however they have better thermal stability and chemical resistance to overcharging and aging.

Lithium Nickel Cobalt Aluminum Oxide (NCA): Lithium Nickel Cobalt Aluminum Oxide (NCA) batteries offer a high energy density and long lifespan, making them a preferred choice for electric vehicles, particularly those produced by Tesla. NCA chemistry provides excellent performance in terms of range and efficiency, allowing EVs to achieve longer driving distances on a single charge. Nevertheless, these batteries are inferior in thermal stability and need sophisticated battery management system (BMS) to achieve safety.

Lithium Manganese Oxide (LMO): Lithium Manganese Oxide (LMO) batteries are sought after because of their high thermal stability, capability for fast charging, and low cost. LMO batteries are mainly used in power tools, medical devices, and hybrid electric vehicles (HEVs) and has good safety and performance balance. Nevertheless, their energy densities are lower than those of NMC and NCA batteries, which restricts their operation range of EV applications.

Lithium Titanate (LTO): Lithium Titanate (LTO) batteries are well-represented with ultra-fast-charging, high cycle-life and excellent safety. In contrast to the typical lithium-ion batteries, LTO replaces the graphite with lithium titanate as the anode and allows high-rate charging and discharging. These batteries are deployed in the transportation of electric vehicles in the form of electric buses, grid storages, and military technology for which robustness and reliability matter. Nevertheless, LTO batteries have a lower energy density, so they are not applicable when energy storage needs to be high and space is limited.

Lithium Nickel Manganese Cobalt (NMC): Lithium Nickel Manganese Cobalt (NMC) batteries are one of the most general of the lithium-ion chemistries available offering a combination of high energy density, cycle life, and affordability. NMC batteries power electric vehicles, energy storage systems, and consumer electronics due to their high performance and efficiency. Various NMC compositions, e.g., NMC 811 (high nickel content), increase energy density and decrease cobalt dependence. Nickel, manganese, and cobalt combination permits the manufacturers to best suit battery properties to application requirements.

Automotive: The automotive industry is the primary user of lithium-ion batteries, primarily due to the large-scale deployment of electric vehicles (EVs), hybrid electric vehicles (HEVs), and Plug-in hybrid vehicles (PHEVs). Lithium-ion batteries offer high energy density, high rate of charging and nonlinearity of cycle life, and are therefore of maximum importance for modern electric vehicles. Vehicle manufacturers are investing in battery technologies (solid-state and high-nickel chemistries) in an attempt to increase range and reduce the cost of batteries.

Consumer Electronics: The consumer electronics segment has dominated the market in 2024. Lithium-ion batteries are powering a wide range of consumer electronic devices, including smartphones, laptops, tablets, wearables and portable gaming devices. Due to their high energy density, and low weight as well as their rechargeable nature, they represent a potentially compelling power option to modern electronics that are built around compact and long-lasting power solutions. Despite the continued demand for the upcoming wireless/high performance devices, and the battery power savings potential, the market is still expanding.

Industrial: Lithium-ion batteries are applied to industrial use such as forklifts, automated guided vehicles (AGVs), robots, power tools, and standby power systems. In contrast to conventional lead acid batteries, lithium-ion technology can carry higher energy conversion efficiency, long life and require lower maintenance, which allows it to be an attractive option for industrial automation and logistics. The boom of smart manufacturing, warehouse automation and Industry 4.0 is generating a need for reliable and robust battery offerings.

Energy Storage Systems (ESS): Energy storage systems (ESS) has been employed extensively in power grid stabilization, renewable energy power generation, and energy support. Li-ion batteries are widely used for energy storage systems (ESS) at residential, commercial and utility levels due to high efficiency, scalability and decreasing cost. They allow for utilization of energy storage beyond base load, thus supporting a continuous even production during low production periods.

Medical Devices: Lithium-ion batteries are crucial for medical application owing to the benefits of their small size, high energy density, and long duration of work. The power portable medical equipment such as pacemakers, hearing aids, insulin pumps, defibrillators, and diagnostic devices, ensuring reliable performance for critical healthcare applications. Wearable health monitors, telemedicine, and remote patient monitoring technology all play a role in the continuing popularity of batteries. Li-ion technology permits miniaturisation, eras ability and volumetric power for applications that can enhance patient care and mobility.

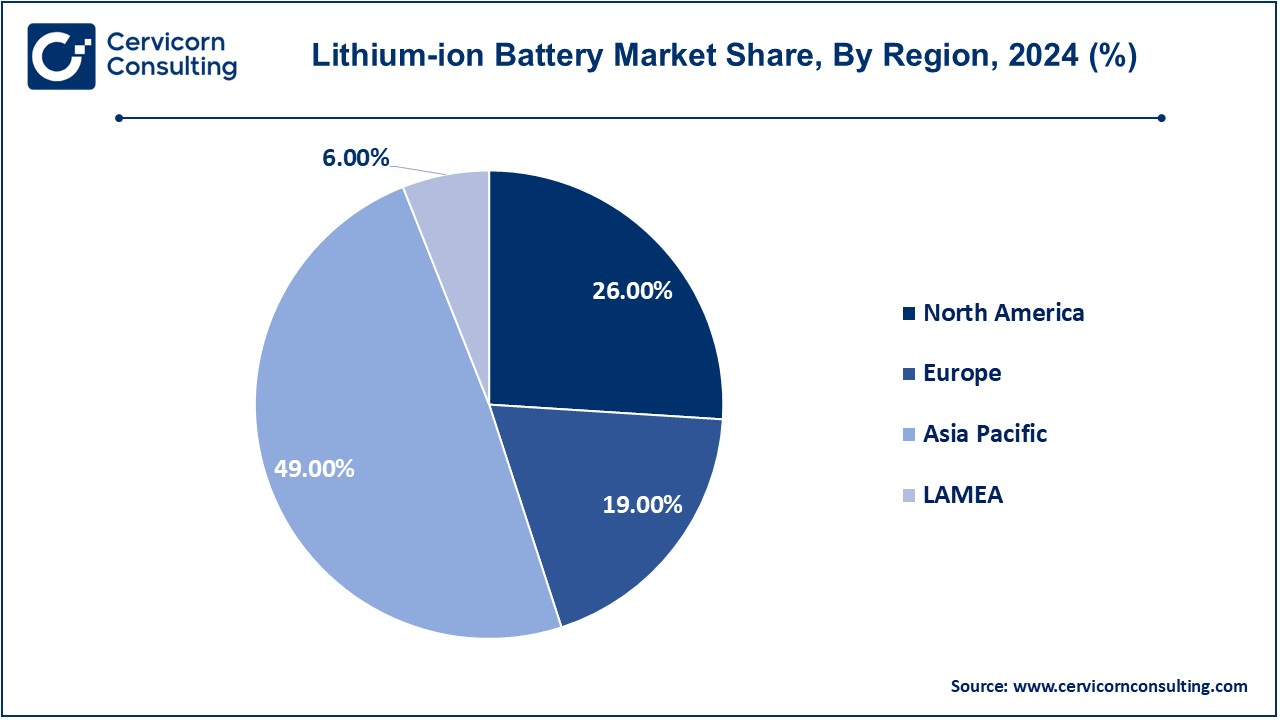

The lithium-ion battery market is segmented into various regions, including North America, Europe, Asia-Pacific, and LAMEA. Here is a brief overview of each region:

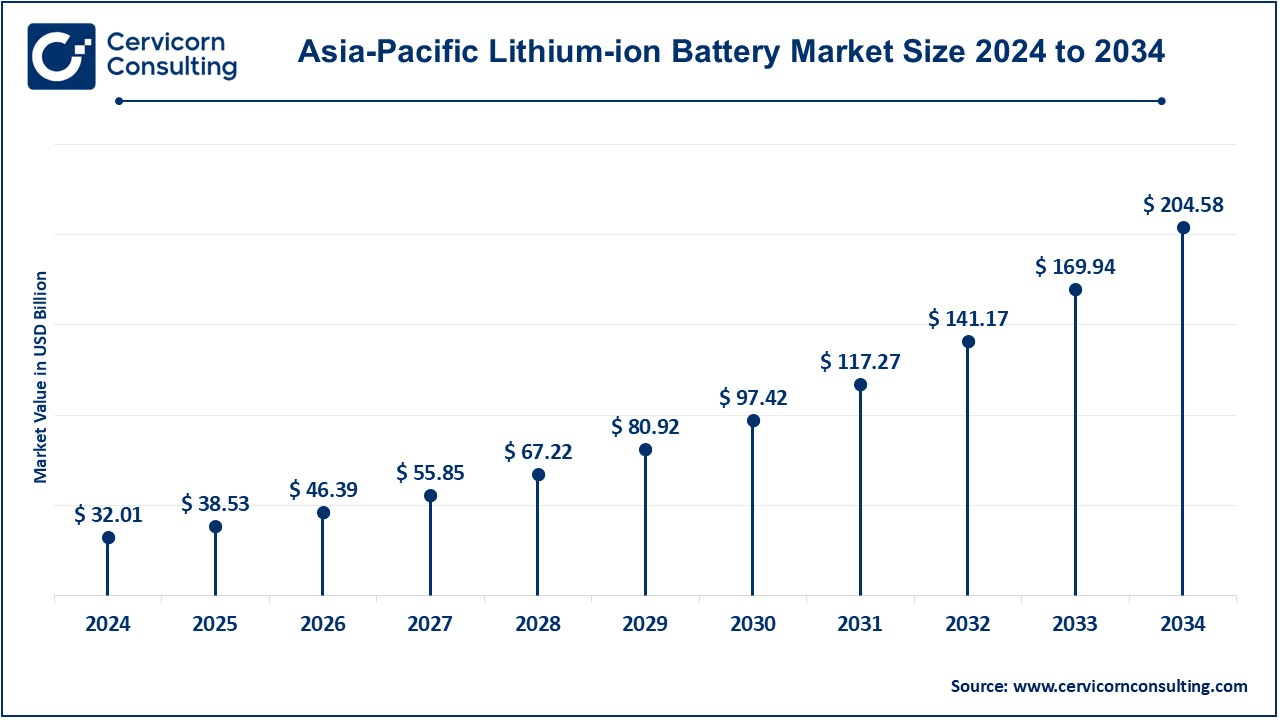

The Asia-Pacific lithium-ion battery market size was accounted for USD 32.01 billion in 2024 and is forecasted to surpass around USD 204.58 billion by 2034. Asia-Pacific is the front runner of global Li-ion battery market in China, Japan, and South Korea. China is the greatest producer and consumer, and is supported by the capacity within companies such as CATL, BYD and Panasonic to achieving mass production and technological innovation. The region benefits from a strong supply chain, an abundance of raw materials, and government initiatives that support electric vehicles and energy storage. Japan and South Korea are important battery pioneers, both putting significantly money in performance- and solid-state battery research.

The North America lithium-ion battery market size was reached at USD 16.99 billion in 2024 and is expanding to USD 108.55 billion by 2034. The North America has dominated by a growing market for electric vehicle (EV) applications, energy storage systems (ESS) and consumer devices. The United States is a leader in the region due to robust government rebates, strict emission controls, and major investment in domestic battery cell production. Companies, such as Tesla, Panasonic, and LG Energy Solution, are increasing their battery manufacturing capabilities in order to decrease dependence on Asian import. Amplifying deployment of renewable energy projects and smart grid infrastructure further stimulate demand for lithium-ion batteries.

The Europe lithium-ion battery market size was estimated at USD 12.41 billion in 2024 and is projected to hit around USD 79.33 billion by 2034. Europe market is expanding rapidly due to ambitious deep decarbonisation requirements, strict emission controls, and increasing adoption of electric vehicles. In Germany, France and the UK, among others, there are certain investments in battery production and giga factories, in order to cope with local production. The EU's need for reduced dependence on imported batteries has supported initiatives such as the European Battery Alliance. Besides, the increasing need for energy storage solutions to accommodate the penetration of renewables is a significant contributor to market growth.

The LAMEA lithium-ion battery market was valued at USD 3.92 billion in 2024 and is anticipated to reach around USD 25.05 billion by 2034. The LAMEA-based Li-ion battery market is growing as a result of the growth of electric vehicles, as well as in the growth of installations of renewable energy and industrial applications. Latin America, and in particular Chile and Argentina, are key key producers of lithium, backing global production of batteries. The Middle East is putting money into energy storage applications to enhance grid strength and allow solar and wind power deployments. The growing demand for consumer electronics and electrification in Africa is another impetus to market growth.

Recent strategic partnerships and investments in the EV charging infrastructure reflect a strong commitment to advancing sustainable transportation. Key collaborations across Europe and South America are set to enhance charging networks, integrate innovative technologies, and expand the availability of renewable energy-powered charging solutions.

Market Segmentation

By Product Type

By Capacity

By Voltage

By Component

By Application

By Region

Chapter 1. Market Introduction and Overview

1.1 Market Definition and Scope

1.1.1 Overview of Lithium-ion Battery

1.1.2 Scope of the Study

1.1.3 Research Timeframe

1.2 Research Methodology and Approach

1.2.1 Methodology Overview

1.2.2 Data Sources and Validation

1.2.3 Key Assumptions and Limitations

Chapter 2. Executive Summary

2.1 Market Highlights and Snapshot

2.2 Key Insights by Segments

2.2.1 By Product Type Overview

2.2.2 By Capacity Overview

2.2.3 By Voltage Overview

2.2.4 By Application Overview

2.2.5 By Component Overview

2.3 Competitive Overview

Chapter 3. Global Impact Analysis

3.1 Russia-Ukraine Conflict: Global Market Implications

3.2 Regulatory and Policy Changes Impacting Global Markets

Chapter 4. Market Dynamics and Trends

4.1 Market Dynamics

4.1.1 Market Drivers

4.1.1.1 Emergence of 5G & IoT

4.1.1.2 Expansion in Developing Markets

4.1.2 Market Restraints

4.1.2.1 Raw Material Shortages & Price Volatility

4.1.2.2 Environmental & Ethical Concerns

4.1.3 Market Challenges

4.1.3.1 Supply Chain Disruptions

4.1.3.2 Safety Issues & Thermal Runaway Risks

4.1.4 Market Opportunities

4.1.4.1 Advancements in Solid-State Battery Technology

4.1.4.2 Growth in Battery Recycling & Second-Life Applications

4.2 Market Trends

Chapter 5. Premium Insights and Analysis

5.1 Global Lithium-ion Battery Market Dynamics, Impact Analysis

5.2 Porter’s Five Forces Analysis

5.2.1 Bargaining Power of Suppliers

5.2.2 Bargaining Power of Buyers

5.2.3 Threat of Substitute Products

5.2.4 Rivalry among Existing Firms

5.2.5 Threat of New Entrants

5.3 PESTEL Analysis

5.4 Value Chain Analysis

5.5 Product Pricing Analysis

5.6 Vendor Landscape

5.6.1 List of Buyers

5.6.2 List of Suppliers

Chapter 6. Lithium-ion Battery Market, By Product Type

6.1 Global Lithium-ion Battery Market Snapshot, By Product Type

6.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

6.1.1.1 Lithium Cobalt Oxide (LCO)

6.1.1.2 Lithium Iron Phosphate (LFP)

6.1.1.3 Lithium Nickel Cobalt Aluminum Oxide (NCA)

6.1.1.4 Lithium Nickel Manganese Cobalt (LMC)

6.1.1.5 Lithium Titanate

6.1.1.6 Lithium Manganese Oxide (LMO)

Chapter 7. Lithium-ion Battery Market, By Capacity

7.1 Global Lithium-ion Battery Market Snapshot, By Capacity

7.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

7.1.1.1 BELOW 3,000 MAH

7.1.1.2 3,001 MAH - 10,000 MAH

7.1.1.3 10,001 MAH - 60,000 MAH

7.1.1.4 ABOVE 60,000 MAH

Chapter 8. Lithium-ion Battery Market, By Voltage

8.1 Global Lithium-ion Battery Market Snapshot, By Voltage

8.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

8.1.1.1 LOW (BELOW 12V)

8.1.1.2 MEDIUM (12V - 36V)

8.1.1.3 HIGH (ABOVE 36V)

Chapter 9. Lithium-ion Battery Market, By Application

9.1 Global Lithium-ion Battery Market Snapshot, By Application

9.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

9.1.1.1 Automotive

9.1.1.2 Medical Devices

9.1.1.3 Consumer Electronics

9.1.1.4 Energy Storage Systems

9.1.1.5 Industrial

Chapter 10. Lithium-ion Battery Market, By Component

10.1 Global Lithium-ion Battery Market Snapshot, By Component

10.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

10.1.1.1 Cathode

10.1.1.2 Anode

10.1.1.3 Electrolytic Solution

10.1.1.4 Others

Chapter 11. Lithium-ion Battery Market, By Region

11.1 Overview

11.2 Lithium-ion Battery Market Revenue Share, By Region 2024 (%)

11.3 Global Lithium-ion Battery Market, By Region

11.3.1 Market Size and Forecast

11.4 North America

11.4.1 North America Lithium-ion Battery Market Revenue, 2022-2034 ($Billion)

11.4.2 Market Size and Forecast

11.4.3 North America Lithium-ion Battery Market, By Country

11.4.4 U.S.

11.4.4.1 U.S. Lithium-ion Battery Market Revenue, 2022-2034 ($Billion)

11.4.4.2 Market Size and Forecast

11.4.4.3 U.S. Market Segmental Analysis

11.4.5 Canada

11.4.5.1 Canada Lithium-ion Battery Market Revenue, 2022-2034 ($Billion)

11.4.5.2 Market Size and Forecast

11.4.5.3 Canada Market Segmental Analysis

11.4.6 Mexico

11.4.6.1 Mexico Lithium-ion Battery Market Revenue, 2022-2034 ($Billion)

11.4.6.2 Market Size and Forecast

11.4.6.3 Mexico Market Segmental Analysis

11.5 Europe

11.5.1 Europe Lithium-ion Battery Market Revenue, 2022-2034 ($Billion)

11.5.2 Market Size and Forecast

11.5.3 Europe Lithium-ion Battery Market, By Country

11.5.4 UK

11.5.4.1 UK Lithium-ion Battery Market Revenue, 2022-2034 ($Billion)

11.5.4.2 Market Size and Forecast

11.5.4.3 UKMarket Segmental Analysis

11.5.5 France

11.5.5.1 France Lithium-ion Battery Market Revenue, 2022-2034 ($Billion)

11.5.5.2 Market Size and Forecast

11.5.5.3 FranceMarket Segmental Analysis

11.5.6 Germany

11.5.6.1 Germany Lithium-ion Battery Market Revenue, 2022-2034 ($Billion)

11.5.6.2 Market Size and Forecast

11.5.6.3 GermanyMarket Segmental Analysis

11.5.7 Rest of Europe

11.5.7.1 Rest of Europe Lithium-ion Battery Market Revenue, 2022-2034 ($Billion)

11.5.7.2 Market Size and Forecast

11.5.7.3 Rest of EuropeMarket Segmental Analysis

11.6 Asia Pacific

11.6.1 Asia Pacific Lithium-ion Battery Market Revenue, 2022-2034 ($Billion)

11.6.2 Market Size and Forecast

11.6.3 Asia Pacific Lithium-ion Battery Market, By Country

11.6.4 China

11.6.4.1 China Lithium-ion Battery Market Revenue, 2022-2034 ($Billion)

11.6.4.2 Market Size and Forecast

11.6.4.3 ChinaMarket Segmental Analysis

11.6.5 Japan

11.6.5.1 Japan Lithium-ion Battery Market Revenue, 2022-2034 ($Billion)

11.6.5.2 Market Size and Forecast

11.6.5.3 JapanMarket Segmental Analysis

11.6.6 India

11.6.6.1 India Lithium-ion Battery Market Revenue, 2022-2034 ($Billion)

11.6.6.2 Market Size and Forecast

11.6.6.3 IndiaMarket Segmental Analysis

11.6.7 Australia

11.6.7.1 Australia Lithium-ion Battery Market Revenue, 2022-2034 ($Billion)

11.6.7.2 Market Size and Forecast

11.6.7.3 AustraliaMarket Segmental Analysis

11.6.8 Rest of Asia Pacific

11.6.8.1 Rest of Asia Pacific Lithium-ion Battery Market Revenue, 2022-2034 ($Billion)

11.6.8.2 Market Size and Forecast

11.6.8.3 Rest of Asia PacificMarket Segmental Analysis

11.7 LAMEA

11.7.1 LAMEA Lithium-ion Battery Market Revenue, 2022-2034 ($Billion)

11.7.2 Market Size and Forecast

11.7.3 LAMEA Lithium-ion Battery Market, By Country

11.7.4 GCC

11.7.4.1 GCC Lithium-ion Battery Market Revenue, 2022-2034 ($Billion)

11.7.4.2 Market Size and Forecast

11.7.4.3 GCCMarket Segmental Analysis

11.7.5 Africa

11.7.5.1 Africa Lithium-ion Battery Market Revenue, 2022-2034 ($Billion)

11.7.5.2 Market Size and Forecast

11.7.5.3 AfricaMarket Segmental Analysis

11.7.6 Brazil

11.7.6.1 Brazil Lithium-ion Battery Market Revenue, 2022-2034 ($Billion)

11.7.6.2 Market Size and Forecast

11.7.6.3 BrazilMarket Segmental Analysis

11.7.7 Rest of LAMEA

11.7.7.1 Rest of LAMEA Lithium-ion Battery Market Revenue, 2022-2034 ($Billion)

11.7.7.2 Market Size and Forecast

11.7.7.3 Rest of LAMEAMarket Segmental Analysis

Chapter 12. Competitive Landscape

12.1 Competitor Strategic Analysis

12.1.1 Top Player Positioning/Market Share Analysis

12.1.2 Top Winning Strategies, By Company, 2022-2024

12.1.3 Competitive Analysis By Revenue, 2022-2024

12.2 Recent Developments by the Market Contributors (2024)

Chapter 13. Company Profiles

13.1 Toshiba Corp.

13.1.1 Company Snapshot

13.1.2 Company and Business Overview

13.1.3 Financial KPIs

13.1.4 Product/Service Portfolio

13.1.5 Strategic Growth

13.1.6 Global Footprints

13.1.7 Recent Development

13.1.8 SWOT Analysis

13.2 Samsung SDI Co., Ltd.

13.3 Saft

13.4 Panasonic Corp.

13.5 LG Chem

13.6 Johnson Controls

13.7 Hitachi, Ltd.

13.8 GS Yuasa International Ltd.

13.9 BYD Co., Ltd.

13.10 A123 Systems LLC