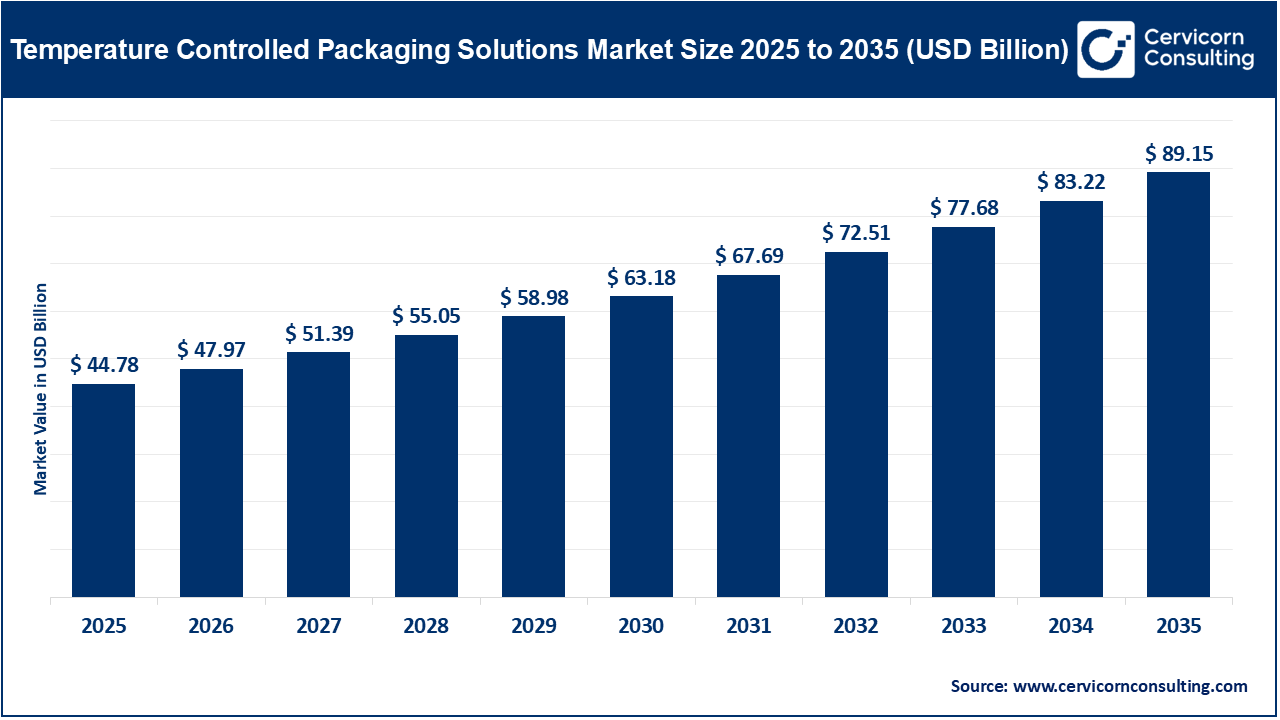

The global temperature-controlled packaging solutions market size was valued at USD 44.78 billion in 2025 and is anticipated to surpass around USD 89.15 billion by 2035, growing at a compound annual growth rate (CAGR) of 7.2% over the forecast period from 2026 to 2035. The overall growth in quick-commerce services associated to food and beverages sector promotes the expansion of temperature-controlled packaging solutions market.

What is Temperature Controlled Packaging Solutions Market and How it Works?

The temperature controlled packaging solutions market represents the ecosystem of products/technologies that allow one to maintain a defined temperature range while intransport/storage for items that require temperature control due to the fact that there are many industries where slight temperature variation can lead to product safety issues, product efficacy issues and/or product quality issues; this is particularly important in the pharmaceutical, biopharmaceutical and vaccine industries as well as clinical trial materials, including food packaging.

Companies that are considered as being some of the leading global providers of temperature controlled packaging solution for the healthcare supply chain and food supply chain include Sonoco, Cold Chain Technologies, and Pelican BioThermal.

Majorly Used Insulation Materials for Temperature Controlled Packaging:

| Insulation Material | Benefits | Key Application |

| Foam | Cost effective and lightweight | Food and beverages and quick shipments |

| Gel Packs | Long lasting consistency | Biological samples, pharmaceuticals and long shipments |

| Vacuum Insulation | Superior insulation | Pharmaceuticals |

| Reflective Insulation | Reflects heat, lightweight | Electronics, quick shipments |

How Does Recyclable Packaging Solutions Support Temperature Controlled Packaging?

By combining eco-friendly packaging design with dependable thermal capabilities, recyclable packaging solutions are helping to maintain the temperatures of items transported via the cold chain system and reduce the environmental footprint of dangerous consumables. There are many examples of new products showing how recyclable packaging materials have been successfully integrated into temperature controlled packaging solutions. One example is a product that utilizes a single-use cold chain box that can be recycled at curbside 100% (using either recycled PET or recycled paper) while providing temperature stability for up to 48 hours at chill temperatures.

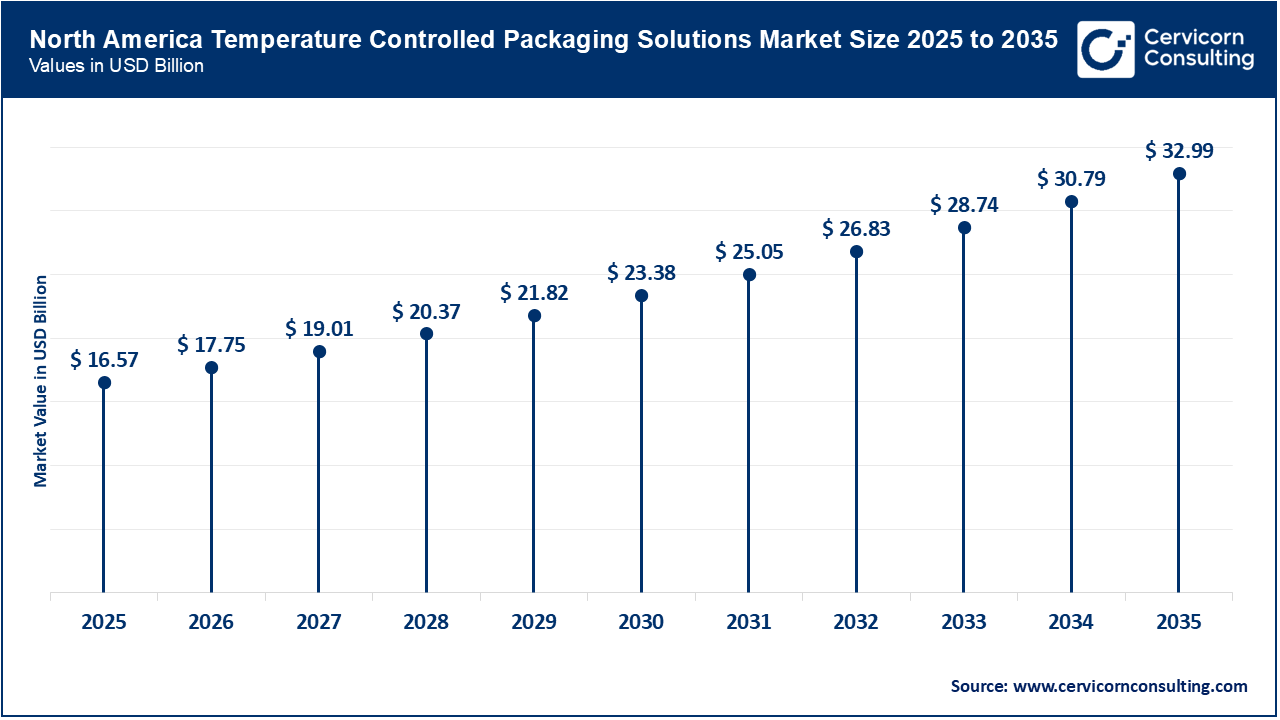

The North America temperature-controlled packaging solutions market size was valued at USD 16.57 billion in 2025 and is anticipated to surpass around USD 32.99 billion by 2035. North America in 2025, dominated the temperature controlled packaging solutions market. As the epicenter of pharmaceutical development, biologics production, vaccine formulation, and sophisticated clinical research in the world, North America has a significant need for temperature controlled packaging systems that protect the quality of products through increasingly complex supply chains during these operations.

In addition to the high volume of biologics being manufactured in North America, there are many more ways in which North America is on the cutting edge of innovation regarding therapeutic modalities. The therapeutic options created in North America include the adoption of cell and gene therapies, an increasing use of injectables, and strong enforcement of regulations requiring compliance with temperature controlled (cold chain) distribution.

Due to all this consideration, both U.S. and Canadian pharmaceutical manufacturers and logistics providers are moving towards using validated, data-enabled and reusable temperature controlled packaging solutions to support domestic distribution and international shipments of their products.

The Asia-Pacific temperature-controlled packaging solutions market size was estimated at USD 11.64 billion in 2025 and is anticipated to reach around USD 23.18 billion by 2035. Asia Pacific is observed to grow at the fastest rate during the forecast period. As rapid on-demand food service markets are significantly expanding across Asia; a major opportunity has come about for the temperature controlled packaging solutions industry. With the increased consumer reliance on food delivery applications to provide their ready-made meals, grocery items and perishable item purchases, it has become necessary for the logistics systems that provide these services to keep product quality and safety from the vendor to the consumer’s door. This expanding delivery system is driving up demand for insulated packaging, refrigerated transportation modules and real time temperature monitoring systems, which are critical components of temperature controlled packaging solutions.

A large portion of the volume of food logistics and delivery in the area can be attributed to China. Online food delivery services/companies such as Meituan, Ele.me, and GrabFood dominate the segment and account for tens of millions of daily food deliveries in urban areas. They are rapidly expanding their reach to towns and cities outside of large metropolitan centres. There is a need for sophisticated temperature-controlled packaging systems to preserve the quality and safety of perishable and prepared food during the urban/suburban last mile deliveries from the supplier to the consumer.

In China, climate controlled packaging in cold chain logistics has been impacted by the increase in cost of insulation materials and refrigerants as refrigerant prices rose (refrigerants such as R32 and related low GWP blends) have created a search by many logistics providers to find other thermal mass materials with a hybrid cooling strategy so they could become more cost effective yet still get the required performance.

Average Costing of Packaging Materials in China

According to our expert research panel at Cervicorn Consulting, following are approximate pricing of few packaging materials in China (as of January 2026):

“Passive Systems Held the Largest Share of Temperature Controlled Packaging Solutions Market in 2025”

The passive systems segment dominated the market in 2025 due to its significant market share, acceptance and low costs, as well as its ability to be used across several sectors. Passive packaging systems utilize thermal insulating material and refrigerants in their design and are commonly found in logistics providers' supply chains to manage refrigerated and frozen product shipments. These passive systems are commonly found in short distance deliveries and last mile delivery locations. According to survey results from logistics associations, over 70% of food and beverage shipments that require a temperature controlled shipment still use passive packaging systems because of their lower upfront cost and ease-of-use.

Temperature Controlled Packaging Solutions Market Share, By Type, 2025 (%)

| Type | Revenue Share, 2025 (%) |

| Passive Systems | 65% |

| Active Systems | 35% |

The active temperature controlled packaging system segment is forecasted to grow faster during this period. Active systems include mechanical refrigeration units, battery or electricity assisted cooling, and electronic control systems that provide precise temperature ranges for longer periods of time and in less than ideal environmental conditions. The growth of this segment is driven by the increased complexity of cold chain logistics for biologics, vaccines, and high value pharmaceuticals where maintaining a stable and continuous temperature is imperative to their success.

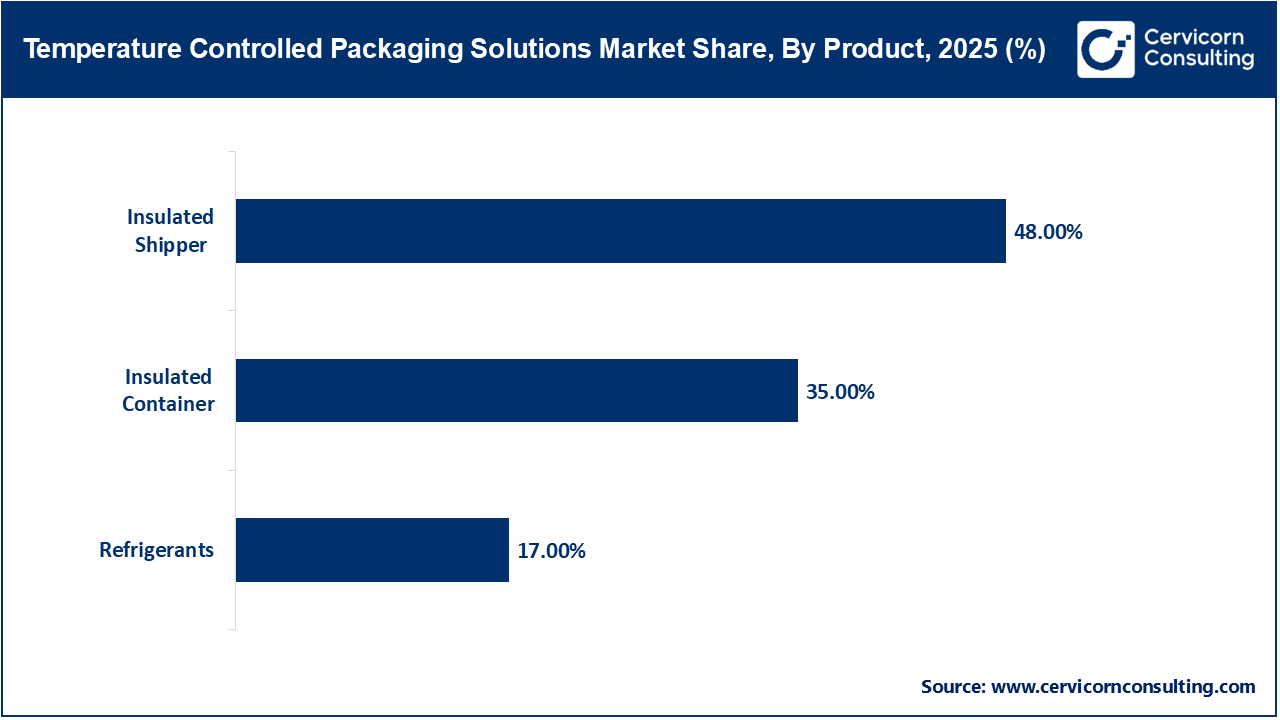

“Insulated Shippers Held the Largest Share, Insulated Containers to Grow Rapidly by 2035”

Insulated shippers segment led the temperature controlled packaging solutions in 2025, retaining the highest usage rate in medium-distance cold chain shipments. Insulated shippers are usually manufactured from expanded polystyrene, polyurethane panels, or corrugated insulative wraps. Insulated shippers are commonly used in the transportation of chilled and frozen products through regional supply chains. The leading grocery distributors have reported that insulated shippers are the preferred choice for over 50% of refrigerated grocery shipments, including chocolates, dairy products, and non-alcoholic beverages.

Insulated containers are expected to experience the fastest-growth in the market. Due to their flexibility for short and long-term temperature controlled shipping, they have also experienced a growth in popularity due to their growing use in premium e-commerce deliveries. Insulated containers have been engineered to carry multilayer insulation and offer a high degree of protection against external factors. As a result, they are a popular choice for the reusable/sustainable cold chain option.

Experts at Cervicorn Consulting confirm the increased use of insulated containers by some of the largest food delivery & online grocery companies as a means of maintaining product quality during the last mile delivery that is where the likelihood of temperature excursions are at their highest.

“The Food and Beverages Segment Dominated the Market in 2025; Healthcare to Observe Significant Growth”

The food and beverages application segment led the temperature-controlled packaging market in 2025, due to the massive volume of perishable items that need to be transported at preserved temperatures. Sub-applications like grocery items, chocolates, alcoholic and non-alcoholic beverages, fish and meat, and dairy products cumulatively contributed to the largest market share. This is attributed to the global shift in consumer patterns, such as the consumption of fresh and frozen foods, the rise of online grocery shopping, and the demand for high-quality chilled products.

Temperature Controlled Packaging Solutions Market Share, By Application, 2025 (%)

| Application | Revenue Share, 2025 (%) |

| Food and Beverages | 49% |

| Healthcare | 45% |

| Others | 6% |

Though food and drinks contributed to the overall volume, the healthcare application segment is the fastest-growing segment during the forecast period. The growth is driven by the unprecedented demand for temperature-sensitive medical shipments. These include pharmaceuticals, blood products, clinical trial shipments, drug testing samples, pathology specimens, and organ transplantation kits. The growth is attributed to the rise in biopharmaceutical manufacturing, the expansion of clinical trials globally, and the strict regulations for the controlled temperature logistics of biologics and vaccines.

“Industry experts report that the cold chain shipments of pharmaceuticals have been growing at a rate of 10 to 15 percent per annum, which is higher than the traditional food cold chain growth, as healthcare providers have been investing in more advanced packaging to ensure stability and compliance from the manufacturer to the point of care.”

Top Government Initiatives and Programs (2026) for Temperature Controlled and Cold Chain Packaging

| Country | Initiative/Program | Impact & Highlight |

| India | Integrated Cold Chain & Value Addition Infrastructure Scheme | National program under the Ministry of Food Processing Industries that provides credit-linked subsidies (up to 35–50% of project cost) to build and modernize cold storage, pre-cooling, CA storage, refrigerated vehicles, and processing infrastructure. |

| U.S. | Food Traceability and Cold Chain Compliance Rules | U.S. regulatory framework under USDA and FDA emphasizes digital traceability and rigorous temperature documentation for perishable food and healthcare shipments. |

| China | National Cold Chain Development Plan | Implementing multi-year cold chain logistics development plans focused on expanding pharma cold exports, ensuring vaccine and biologics distribution integrity, and upgrading refrigerated transportation networks. |

| European Union | EU Cold Chain Regulatory Strengthening | EU regulatory frameworks are evolving to standardize electronic traceability and thermal control requirements for temperature-sensitive shipments. |

| Brazil | Strategic Cold Chain Infrastructure Investment Support | The Brazilian government supports cold chain infrastructure through national programs aimed at improving refrigerated storage, transport, and pharma logistics, particularly for perishable goods and vaccine distribution. |

North America

Asia Pacific

Europe

By Type

By Product

By Application

By Region