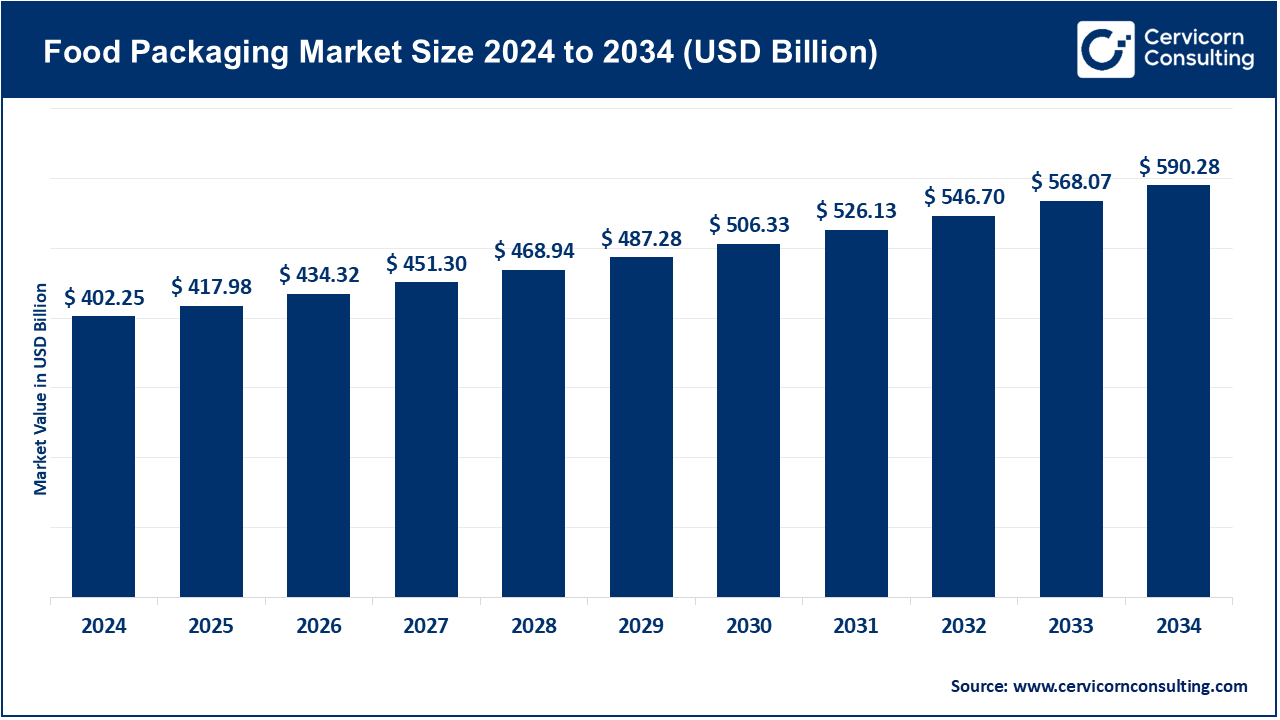

The global food packaging market size is calculated at USD 417.98 billion in 2025 and is expected to surpass around USD 590.28 billion by 2034, growing at a compound annual growth rate (CAGR) of 5.9% over the forecast period 2025 to 2034.

Like most other sectors, the food packaging sub-sector is growing rapidly, with manufacturers increasingly implementing novel sustainable, consumer-centric solutions to keep pace with the rising demand. Unlike the other types of stored foods, ready-to-eat meals and foods that are on-the-go require even more safety assurances and even more convenience to be ensured. Packaging should not only keep the food fresh is stored and during transportation, the convenience of the consumer is of the utmost importance too. Offer consumers more options and a traditional wasteful product with inline twists and turns become complaints from the consumers. New materials with rigid polymers, more bioplastics, compostable films, and paperboard solve the problem.

To enhance consumer touchpoints like real time info and traceability, and to allow consumers to engage more with the food, we are using smart packaging materials which integrate augmented reality, QR codes, and RFID tags. The simultaneous growth and ease of access to emerging markets, food delivery services, and e-commerce has resulted in even more demand for smartly packaged food. In an era of fierce competition, smartly sustaining technological convenience and packaging improves efficiency, brand differentiation, and restores the balance in the conscious global food industry.

Report Scope

| Area of Focus | Details |

| Market Size in 2025 | USD 417.98 Billion |

| Estimated Market Size in 2034 | USD 590.28 Billion |

| Projected CAGR 2025 to 2034 | 5.9% |

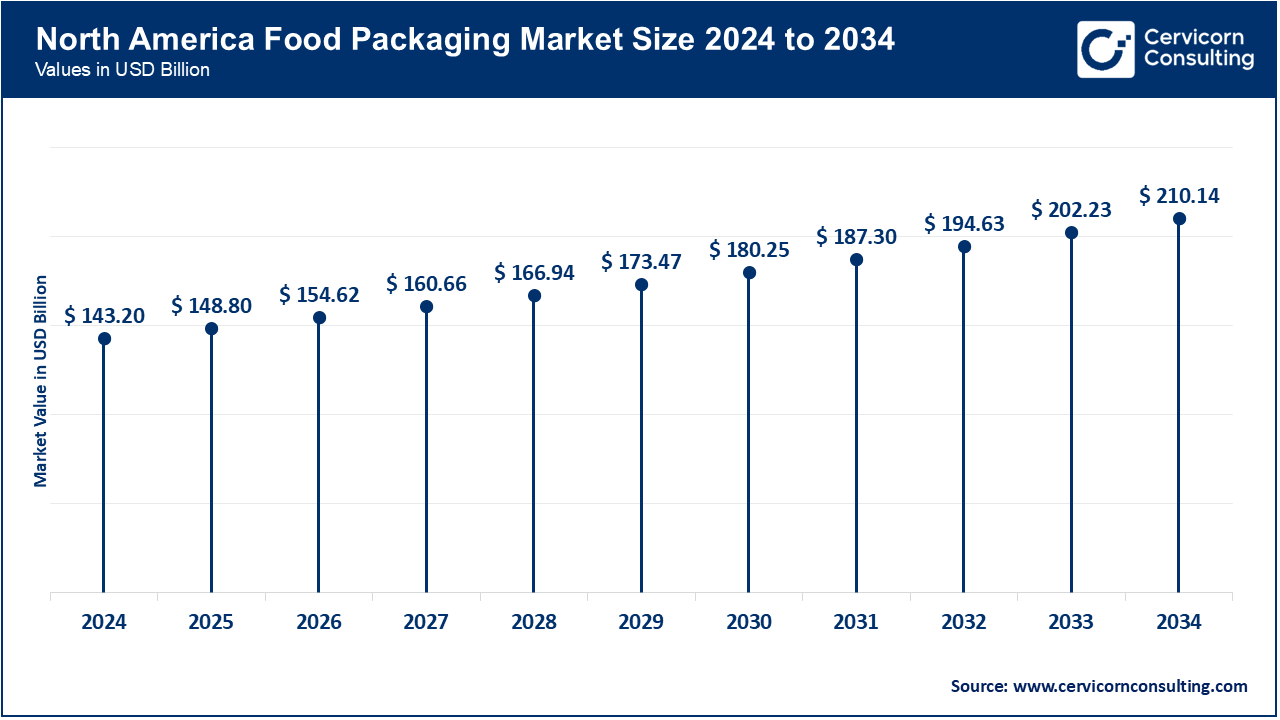

| Leading Region | North America |

| Fastest Growing Region | Asia-Pacific |

| Key Segments | Type, Material, Packaging Type, Application, Food Type, Region |

| Key Companies | International Paper Company, Mondi, Smurfit Kappa Group, Graphic Packaging International, LLC, DS Smith, Eastern Pak Limited, WestRock Company, Packaging Corporation of America, Nippon Paper Industries Co., Ltd., Sonoco Products Company, Amcor plc, Clearwater Paper Corporation |

The food packaging market is segmented into several key regions: North America, Europe, Asia-Pacific, and LAMEA (Latin America, Middle East, and Africa). Here’s an in-depth look at each region.

North America is the pioneer in terms of implementing sustainable and smart food packaging solutions, as the situation is characterized by strict requirements regarding plastic consumption and the increased level of consumer awareness of the environmental impact. Firms are gradually incorporating recyclable, compostable and biodegradable packaging in various food divisions. Ocado and Deliveroo tested fully recyclable and temperature-safe meal kit and ready-to-eat packaging in September 2025, which is part of the sustainability of the region in terms of packaging used in e-commerce and delivery. Retailers and food manufacturers exploring alternative products to single-use plastics that are environmentally friendly also contribute to the trend, especially frozen and chilled food products.

Sustainable packaging has originated in Europe, with a focus on regulations and the principles of a circular economy. The regulations of the European Union to curb plastic waste and increase recycling have increased the switch towards paper-based, compostable and plant-based packaging materials. In September, 2025, Hinojosa Packaging Group presented its FSC certified Halopack and Sumbox solutions at Interpack 2025 showcasing recyclable and compostable solutions to the bakery, confectionery and frozen seafood segments. These solutions are being rolled out on a large scale in Germany and the Netherlands, specifically, to increase sustainability ambitions in retail and food service industries.

The Asia-Pacific region is witnessing the rapid growth due to the growing urbanization, growing e-commerce and the growing demand of food products that are handy and easy to carry. The economies such as India and China are increasing the potential of producing sustainable packaging materials. In September 2025, Xampla presented biodegradable, plant-protein-based films on ready-to-eat meals in Asia, which indicated an increased attention of the region to environmentally-friendly packaging options. This trend is also enabled by increased purchasing power among consumers towards packaged foods that have long shelf life and better traceability.

Food Packaging Market Share, By Region, 2024 (%)

| Region | Revenue Share, 2024 (%) |

| North America | 35.60% |

| Europe | 24.80% |

| Asia-Pacific | 30.40% |

| LAMEA | 9.20% |

The use of sustainable food packaging is an emerging trend in the LAMEA region, as pilot projects and others lead to awareness. The recyclable and compostable packaging is being incorporated in the retail and food delivery sectors in Brazil, South Africa, and the UAE. In September 2025, a number of local businesses tested sustainable packaging solutions of bakery and frozen foods that would meet the requirements of the local environmental policy. LAMEA has a high growth potential, although the growth rate is slower than the growth rate of North America and Europe, with sustainability efforts and consumer demand rising.

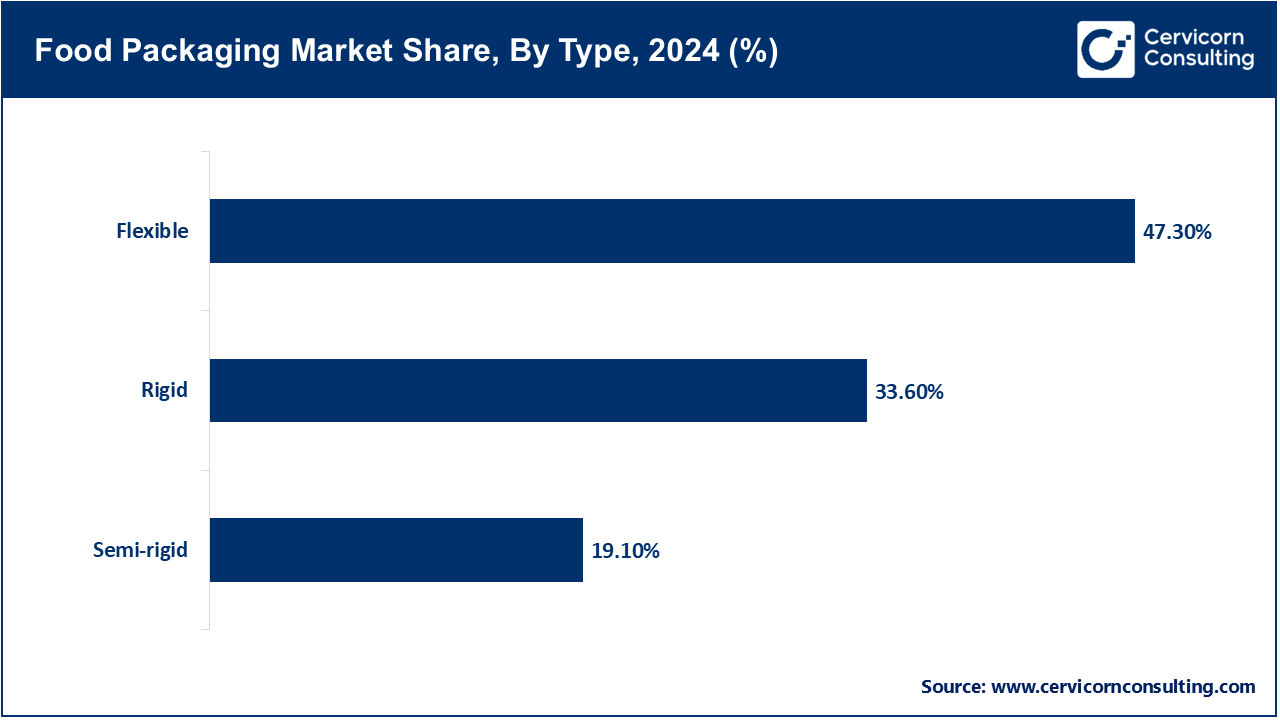

Flexible Packaging: Snacks, ready-to-eat meals, and frozen foods can benefit more from flexible packaging innovation due to their light weight and space-saving qualities. Moreover, flexible packaging is protective. In September 2025, Hinojosa Packaging Group introduced Sumbox, a waterproof and fully recyclable flexible tray fashioned to cut down plastic waste from frozen seafood. This also demonstrates the performance of flexible packaging in cold-chain logistics.

Rigid Packaging: Rigid packaging is still preferred for dairy, sauces and beverages because of its ease of use and sturdy barrier protective properties. Nestlé’s August 2025 launch of fully recyclable rigid cartons for plant-based beverages in Europe is an example of unmatched consumer convenience. This illustrates the growing demand for sturdy packaging.

Semi-rigid Packaging: Semi-rigid packaging is the the lower cost alternative to thermoformed and clamshell trays. As such, they still provide ample protection as well as light weight features. In September 2025, a number of collaborative European firms demonstrated semi-rigid packaging at Interpack 2025 which highlight the use of biocompostable and biorecyclable materials suitable for bakery and confectionery. This shows the focus of product protection alongside sustainability.

Plastics: Conventional plastics are used predominantly, however the industry is walking towards bioplastics and polymers. In the month of September of 2025, Xampla obtained 14 million dollars which was funded by investors interested in sustainable practices to advance their biodegradable plant-based packaging which encompasses linings and dissolvable films. This is evidence of the growing focus toward the removal of single use plastics for more sustainable options.

Paper and Paper Based Materials: Cardboard and paper are on the rise because of their recyclability and sustainable attributes. Hinojosa’s Halopack which is a certified modular cardboard tray which eliminates plastic for frozen seafood and perishables by 80 percent proves the ability of companies to embrace sustainable practices without sacrificing product performance.

Food Packaging Market Share, By Material, 2024 (%)

| Material | Revenue Share, 2024 (%) |

| Plastics | 44.10% |

| Paper & Paper-Based Materials | 25.80% |

| Glass | 10.70% |

| Metals | 12.90% |

| Others | 6.50% |

Glass: In the month of August of 2025, O-I Glass Europe launched fully lightweight fully recyclable glass bottles for gourmet sauces, which decreased carbon footprints without sacrificing product quality. This product is evidence of how glass is still used for high-grade beverages, sauces, and condiments because of being inert and easily recyclable.

Metals: Ball Corporation is a leading producer of aluminum cans used for drinks and tin products due to their strength and the ability to easily be recycled, which was the focus of the expansion of production to Europe in September 2025. This expansion was made in line with the growing need for eco friendly metal packaging.

Others: New emerging materials, like seaweed films and starch composites, are being researched to tackle issues of sustainability. At a European trade show in of September 2025, Xampla brought to showcase edible coatings and compostable films for grab-and-go meals, thus advancing in innovation for alternative materials.

Bakery & Confectionery: The bakery & confectionery segment leading the market. In terms of this segment, the packaging needs to be made from sustainable materials, visually appealing, and protective. During Interpack 2025 in September 2025, Hinojosa offered sustainable bakery trays which included semi-rigid and paper substrates with a focus on sustainable presentation for the tray.

Dairy Products: In order to enhance shelf-life of the product and become more sustainable, many brands have turned to using recyclable cartons and bioplastic lids. This sustainability effort is exemplified in Aug 2025, with Nestlé’s introduction of fully recyclable rigid cartons.

Fruits & Vegetables: This segment requires the more sustainable, low-waste packaging solutions. In the UK, the government introduced a ban on certain plastic-wrapped fruits and vegetables in August 2025, forcing companies to find and use recyclable and compostable options that align with circular economy objectives.

Meat & Seafood: Packaged frozen meat and seafood benefit from the use of moisture resistant and durable packaging. Hinojosa’s Sumbox introduced in September 2025, shows how waterproof recyclable trays can provide sustainability, yet ensure food and safety for cold chain operations.

Sauces & Dressings: Standard for dressings and sauces continues to be glass and metal premium containers. One Horizon Group (O-I) Glass Europe’s lightweight recyclable bottles which were released in August 2025 illustrates an example of environmentally-friendly packaging executed without compromising the quality of the product.

Others: There is a rapid expansion of meal kits and food delivery which requires packaging that is insulated, recyclable, and temperature resistant. In September 2025, retailers like Ocado and Deliveroo tested new delivery packaging to improve food quality and lessen eco damage.

Frozen Food: The frozen food segment leading the market. The packaging has to withstand moisture and temperature, which is very important for the integrity of the food. The Sumbox by Hinojosa (September 2025) embodies the different trends in packaging such as the functional and sustainable. The Sumbox focuses on ready-to-eat meals and frozen seafood.

Chilled Food: Freshness is maintained through the use of rigid trays and flexible films. At Interpack 2025, European companies showcased new ideas in packaging for the chilled food segment.

Canned Food: The major players in this segment, Ball Corporation, is also renowned for sustainable canned food wrapping as well as expanding recycled aluminum production in September 2025. In this segment, metal cans are the primary type used.

Shelf Stable Food: Widely adopted sections of the semi rigid and paper based packaging for snacks, cereals and dry goods, are hamstrung by the other food groups. Hinojosa has spurred the industry’s eco-friendly focus by showcasing compostable bakery trays that are multi food type friendly at Interpack 2025.

Market Segmentation

By Type

By Material

By Packaging Type

By Application

By Food Type

By Region