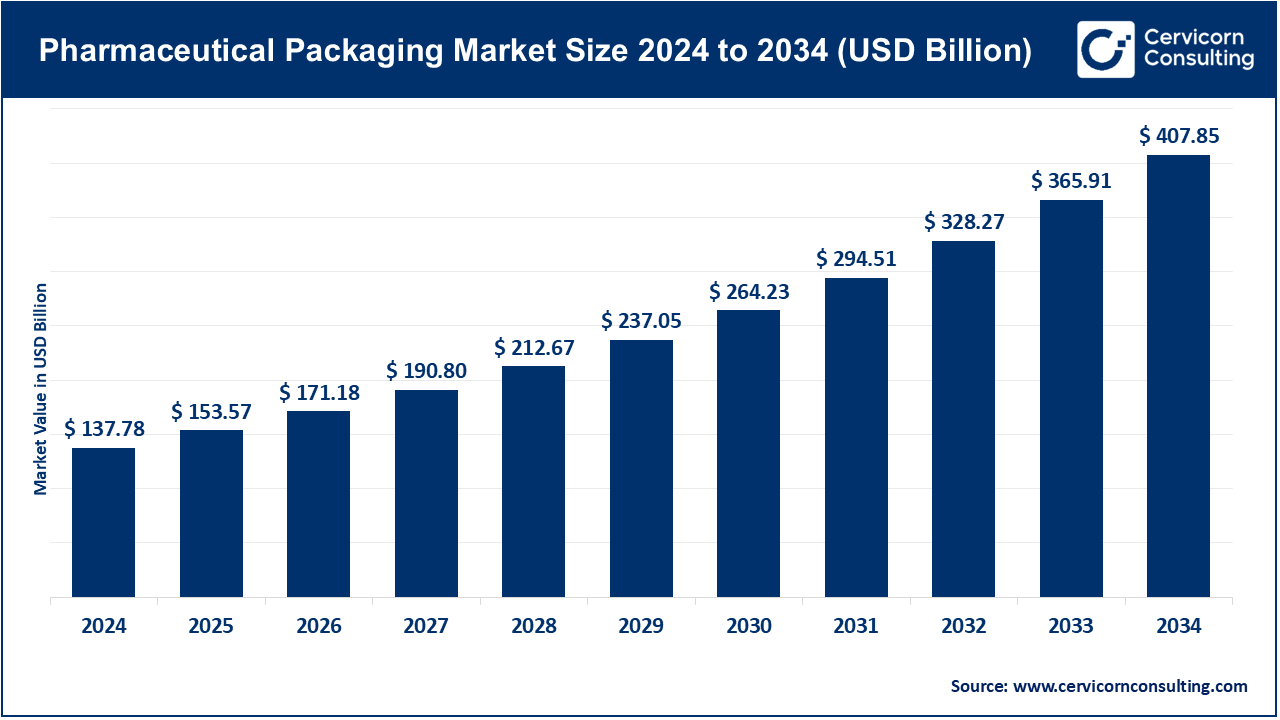

The global pharmaceutical packaging market size is calculated at USD 153.57 billion in 2025 and is expected to be worth around USD 407.85 billion by 2034, growing at a compound annual growth rate (CAGR) of 11.46% over the forecast period 2025 to 2034. The pharmaceutical packaging sector is undergoing significant growth. The steady increase in chronic conditions—currently impacting more than 1.3 billion individuals worldwide—underscores the need for packaging that is both secure and sterile. Sales of global biologics, which rose 12% in 2023, have led to heightened orders for pre-filled syringes and sterile vials. Concurrently, the expanding e-commerce pharmaceutical channel recorded a 17% year-on-year increase in 2023 and is raising the bar for tamper-proof and temperature-sensitive packaging suited for direct-to-patient distribution. Nations such as India—where pharmaceuticals exports climbed 9.4% in 2023—and Brazil are also moving quickly to incorporate advanced blister technologies and eco-friendly substrates. As the industry prioritizes sustainability, patient protection, and user convenience, these dynamics will continue to drive steady growth.

Why pharmaceutical packaging?

Pharmaceutical packaging encompasses the systematic isolation and safeguarding of pharmaceutical goods—including drugs, biologics, and diagnostic devices—throughout all logistical and handling stages. This multilevel enclosure protects the active pharmaceutical ingredients and provides a hermetic barrier against microbial ingress, mechanical impact, and variances in temperature, humidity, and electromagnetic radiation. Levels of packaging are delineated as primary, interfacing directly with the formulation (e.g., ampoules, blister films, and syringes); secondary, consolidating these primary containers into retail units (e.g., printed cartons and multipacks); and tertiary, designed for bulk logistical handling (e.g., shrink-wrapped pallets and bulk containers). In addition to physical protection, packaging delineates dosage forms, facilitates traceability through barcoding, and conveys mandated product information, all while adhering to the rigorous stipulations imposed by regulatory agencies such as the FDA and EMA.

Report Scope

| Area of Focus | Details |

| Market Size in 2025 | USD 153.57 Billion |

| Estimated Market Size in 2034 | USD 407.85 Billion |

| Projected CAGR 2025 to 2034 | 11.46% |

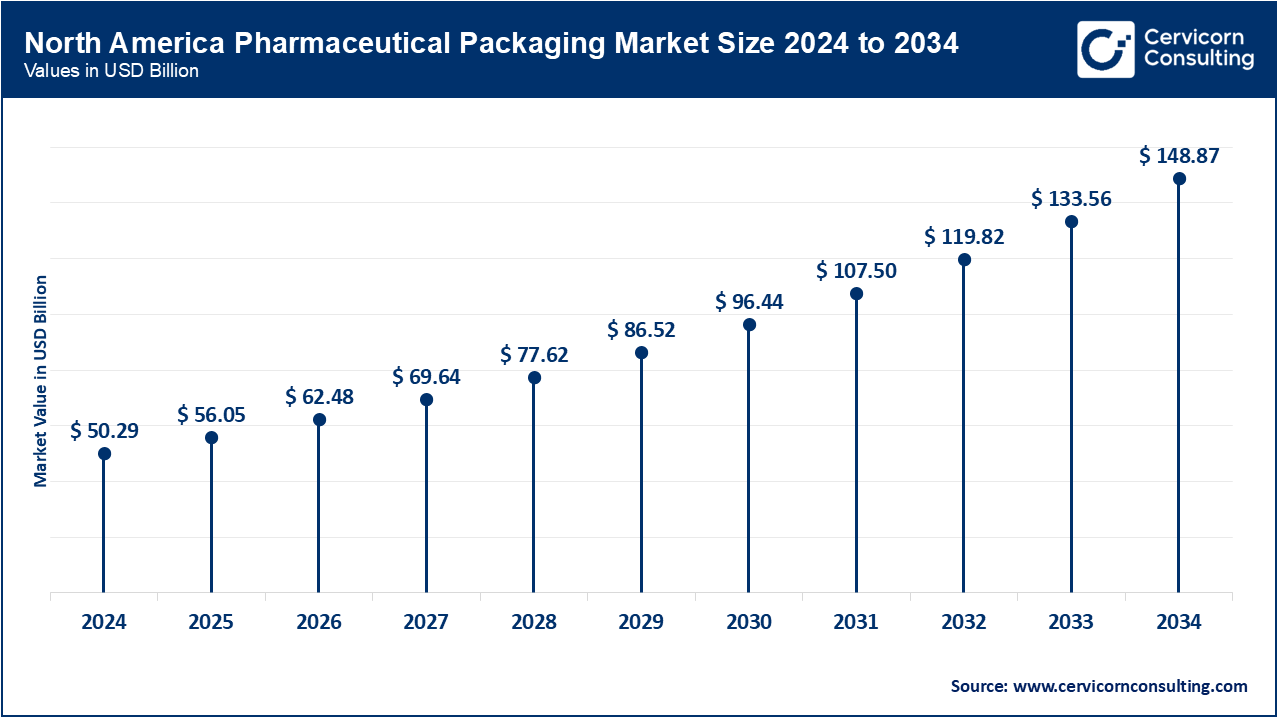

| Leading Region | North America |

| Fastest Growing Region | Asia-Pacific |

| Key Segments | Product Type, Material, Application, End User, Region |

| Key Companies | Amcor plc, Berry Global, Inc., Gerresheimer AG, SCHOTT AG, AptarGroup, Inc., West Pharmaceutical Services, Inc., WestRock Company, CCL Industries Inc., Constantia Flexibles Group GmbH, Huhtamaki Oyj, Sonoco Products Company, Albea S.A. |

The North American region had over 36.5% of the global market in 2024. This was driven by a well-established pharmaceutical industry, high spending on healthcare, and stringent regulatory policies like the DSCSA. The U.S. is also leading the industry in sustainable packaging and advanced serialization. Demand for low-cost blister and bottle packs from Canada’s generics market is also supportive. Avery Dennison’s RFID-enabled pharma labels also help transparency in the supply chain. Biologics production, specifically in the US, is also increasing the demand for vials and syringes in a controlled temperature setting. The region is also characterized by the use of smart packaging tailored for patient adherence tracking, which is supported by government-subsidized healthcare initiatives.

Europe is set to become the second largest market within the region, having over 28.4% share by 2024. It is marked by strong sustainability initiatives as well as rigorous adherence to the EU FMD. Germany, France, and the UK are frontrunners in the adoption of greener materials, including blister films and cartons made of paper. Schreiner MediPharm is an example of an EU compliance driven innovation, having created EU authentication compliant tamper-proof labels. Packaging for biologics and specialty drugs is particularly driven by innovation, especially for prefilled syringes and temperature-controlled transport packaging. The EMA has also influenced. Huhtamaki and Amcor towards expanding the offering of recyclable pharma packaging, particularly for over-the-counter and chronic care medicines aimed at waste reduction.

The region of Asia-Pacific is predicted to grow at a CAGR of more than 7% up until 2030. This is driven by increased pharmaceutical manufacture in China and India, increased exports of generics, and improved healthcare access. India’s pharmaceutical export value reached USD 25.4 billion in 2024, creating significant demand for both bulk and retail packaging. Uflex and Gerresheimer have also started to invest in Indian manufacturing for high-barrier blister films and vials respectively. Korea and Japan lead in developing smart and user-friendly packaging for the elderly. Domestic drug manufacturing policies like “Make in India,” and China’s healthcare reforms, also boost demand for packaging.

Pharmaceutical Packaging Market Share, By Region, 2024 (%)

| Region | Revenue Share, 2024 (%) |

| North America | 36.50% |

| Europe | 28.40% |

| Asia-Pacific | 24.60% |

| LAMEA | 10.50% |

The Latin America is expanding, propelled by an upgrade in healthcare and an evolving regulatory framework. The region is dominated by Mexico and Brazil, with Brazil's serialization mandate greatly impacting packaging design. The market is supported by the rising purchases of generics and over-the-counter medicines as well as domestic production. Brazil's Pharma sales are expected to surpass 30 billion dollars in 2024, leading to the adoption of more compliance driven blister packs and bottles, as per IQVIA.

Bottles: The bottles hold a 20% share of the global pharmaceutical packaging market in 2024, valued for durability and compatibility with tablets, capsules, liquids etc. Most bottles are made of HDPE, PET, and glass. For instance, Gerresheimer glass works provides high quality glass bottles while Berry Global makes child resistant plastic bottles for OTC medicines. There is growth in these items due to increased sales of OTC drugs in the US and other developing countries that do not prefer blister packs. The growth of e-pharmacy channels is also increasing the need for secure and tamper-evident bottles.

Blister Pack: Brilliant branding and advertising led to 25% market share for blister packs. Amcor and TekniPlex are the market leaders and between them produce and sell most of the high-barrier blister packs for moisture sensitive drugs. Expanding older populations in need of chronic disease medications in Europe and Asia are the major drivers.

Vials and ampoules: This segment of the market encompasses biologics used in injectable drugs, vaccines, and other biologics and represents 18% of the market. Global demand greatly increased from 2020 to 2022 as a result of the COVID-19 vaccine rollout.

Others: These are made up of manufacturing and selling tubes, jars, and stick packs, which account for a total of less than 10% market share. For example, Aptar Pharma manufactures nasal spray tubes, while Neopac produces pharma-grade barrier tubes used in dermatological creams. Demand in the industry is fueled by the topical and niche therapeutic products.

Plastics & Polymers (PE, PET, PVC, PP, etc.): Dominating the market with over 45% share in 2024, plastics and polymers continue to lead the market owing to their light weight, ease of manufacturing, and low cost. PE and PET bottoles are common containers for tablets and liquids. PVC is critical for blister pack films. Berry Global and Amcor are the primary pharma grade plastic manufacturers with moisture and oxygen barriers. Child-resistant closures and replenishable packaging raise their need, fueling greater innovation. For example, Huhtamaki designed PE bio-based syrup bottles, and TekniPlex developed PVC-free blister films to meet EU sustainability objectives. Growth is also propelled by the increased generic drug production in India and China.

Glass: Representing 30% of the market share glass is also valued in the industry because it has low chemial reactivity, it’s clear, and is also resistant to high temperature which makes it good for injectables and biologics. For stability sensitive drugs the industry standard for biopharmaceutical vials is borosilicate glass vials. Schott AG supplies high-strength glass vials for the mRNA covid-19 vaccine, and Gerresheimer has pre-sterilized glass syringes for sale to biotech companies. With the expansion of vaccine manufacturing in the Asia-Pacific region, and a shift to biologic therapies, demand is rising. Current innovations include anti-delamination coatings and lightweight glasses to reduce the risk of breakage in the logistics.

Others: For liquid medicine containers, plant-based biopolymer closures were introduced by Aptar Pharma, and Sealed Air offers flexible medical grade laminates for diagnostics packaging use. This growth stems from efforts to meet sustainability targets as well as to high-value niche packaging such as cold pouches for temperature-sensitive medicines.

Oral Drugs: Over 55% of the market stems from the usage of tablets, capsules, and syrups. This segment is served by packaging styles such as blister packs, bottles, and sachets. Amcor and TekniPlex are market leaders for high barrier blister films, and Gerresheimer supplies PET bottles for liquid formulations. Increased demand from the treatment of chronic diseases and merit from diabetes and cardiovascular drugs are enhancing supply. Increased production of blister packs has been observed as a result of India’s growing generics market. Regulatory changes like child-resistant closures in North America also drive oral drug packaging innovation.

Injectable Drugs: The market share for injectables is approximately 30% and is driven by biologics, vaccines, and oncology treatments. Primary formats include sterile vials, ampoules, prefilled syringes, and cartridges. Schott AG supplies borosilicate vials for the distribution of COVID-19 vaccines, while West Pharmaceutical Services designs coated plungers to improve stability for the drug. The surge in biologics approved in the U.S. and EU and the expansion of cold chain logistics has increased the demand for high-strength glass and polymer containers. Due to the ease of use in chronic diseases, prefilled syringes are becoming increasingly popular.

Pharmaceutical Companies: Albea's dermatology product tubes are hinged. For asthma and COPD, and for nasal sprays. Example: Cipla's metered dose inhalers with moisture protection. Nicotine, hormone, pain patches. Different multilayer barrier films are needed for each. Example of multilayer barrier: 3M's transdermal patch pouches. Pharmaceutical manufacturers are the largest end-users, holding over 50% market share in 2024 because of inhouse packaging operations for branded and patented drugs. Considerable resources are allocated to install sophisticated lines for blistering, bottle filling, labeling, and serial number marking which are in demand and essential for regulation and brand protection. Companies like Pfizer and Novartis maintain dedicated packaging units for sensitive biologics and complex oral dosage forms. For instance, Pfizer implemented a global 2D barcode serialization program across all markets to meet regulatory requirements under the U.S. DSCSA and EU FMD. Packaging inhouse allows pharma firms to safeguard product quality, controlled security and design, and reduces counterfeit infiltration risks in the supply chain

Contract Packaging Organizations (CPOs): CPOs are contract packaging organizations. They provide packaging services which allows pharma companies to redirect capital investments and concentrate on primary drug development. This segment is growing quickly which is attributed to flexibility, accelerated timelines, and specialized format knowledge. In developed regions, outsourcing constitutes more than 30 percent of total pharma packaging volumes, as reported by Pharmapack. Companies like Catalent and PCI Pharma Services provide blister packing, vial and syringe filling, labeling, and kitting for commercial and clinical trial products. PCI Pharma, for instance, managed global cold-chain packaging for the distribution of COVID-19 vaccines.

Others: Retail pharmacies are a new growing end-user segment of OTC and repackaged prescription medicines. With the global retail pharmacy market surpassing USD 1.2 trillion in 2024 (IQVIA), there is a need for more POS packaging. Clinical trial packaging is tailored for small volumes with special features needed for blinded and multi-arm study designs. They provide accurate labeling, randomization, and tracking for the studies. Almac Group and Sharp Clinical Services provide temperature-controlled blistering, multi-language labeling, and patient kits for global trials. Almac supported more than 5000 active studies with custom kits in 2023.

Market Segmentation

By Product Type

By Material

By Application

By End User

By Region