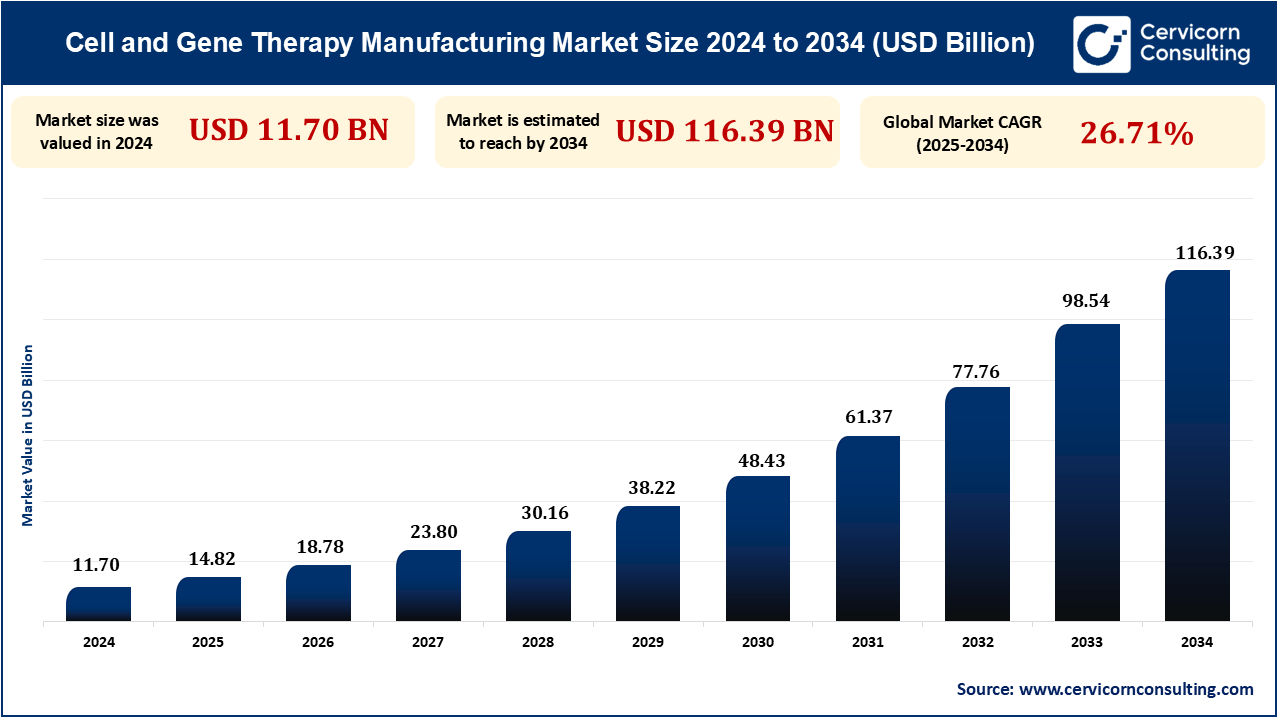

The global cell and gene therapy manufacturing market size was measured at USD 11.70 billion in 2024 and is anticipated to exceed around USD 116.39 billion by 2034, growing at a compound annual growth rate (CAGR) of 26.71% from 2025 to 2034. An increasing demand for personalized medicine, technological advancements in genetic engineering equipment, and increasing investments in regenerative medicine. Additionally, approvals by regulatory bodies and improved production processes enhance market growth. Growing cases of genetic disorders and cancer further drive demand.

The cell and gene therapy manufacturing market involves the production of biologic products utilized in gene and cell-based treatments. It involves cell line development and production, and viral vector production, as well as genetic material for therapeutic purposes. It involves the entire process from research and development to scale-up manufacture to market. It involves provision for aseptic manufacture, quality control, and regulatory affairs. Key therapeutic areas are oncology, genetic disorders, and autoimmune diseases. As demand for customized medicines grows, the evolution of manufacturing technologies is becoming more crucial to improve efficiency and scalability.

One of the foremost drivers of the cell and gene therapy manufacturing market is the expanding demand for customized medicine. The more personalized that healthcare becomes, the more the gene and cell therapies are emerging as key elements in fulfilling patient-specific needs. Progress in genomic studies and gene editing tools, such as CRISPR, allows for the creation of more efficient therapies. The increasing incidence of genetic disorders and cancers also increases the demand for customized treatments. Also, regulatory authorities are sanctioning increasing numbers of gene therapies, promoting expansion within the market. The trend implies a major need for dedicated manufacturing capabilities to drive the production of such therapies at high volumes.

U.S:

By Region:

By Scale:

By Therapy Type:

By Mode:

| Attribute | Details |

| Market Size in 2024 | USD 11.70 Billion |

| Market Size in 2033 | USD 98.54 Billion |

| Market CAGR | 26.71% from 2025 to 2034 |

| By Therapy Type |

|

| By Application |

|

| By Scale |

|

| By Mode |

|

| By Workflow |

|

| By Region |

|

| Key Players |

|

Genetic engineering technologies, such as CRISPR, are transforming the cell and gene therapy Manufacturing Market. The technologies make it possible to make precise genetic modifications to make therapies more efficient and effective. Therapies can be personalized to fit an individual's genetic signature. The process enhances the efficiency of therapy and the clinical uptake rate. Therefore, the cell and gene therapy market is growing further.

In December 2023, Editas Medicine and Vertex Pharmaceuticals entered into a non-exclusive license agreement for Cas9 gene editing technology. Vertex will apply the Cas9 technology to its ex vivo gene editing therapies, such as CASGEVY for sickle cell disease and beta thalassemia. This deal further extends Editas Medicine's cash runway through 2026. Cas9 gene editing offers an accurate method of targeting a variety of genetic mutations. The two companies seek to treat unmet medical needs in severe hematologic diseases.

The growing need for customized medicine is propelling the cell and gene therapy manufacturing market. Patients require treatments that are personalized to their genetic makeups for improved therapy efficiency. Precision medicine allows targeted therapies with fewer side effects. Through increasing awareness and penetration, there is a demand for advanced manufacturing processes. This drives market growth for targeted therapies.

In February 2022, Thermo Fisher Scientific launched combined commercial packaging and distribution services for cell and gene therapies (CGT) in Europe and the U.S. Patheon Commercial Packaging Services for CGT offers GMP storage, serialization, ultracold and cryogenic packing, and worldwide distribution. The end-to-end solution guarantees supply chain integrity from manufacturing through distribution. 10-20 new FDA CGT approvals are expected per year by 2025 according to the market. Thermo Fisher's services extend to complementing its current CGT development and manufacturing capabilities.

High production costs are a significant constraint in the cell and gene therapy manufacturing market. The manufacturing complexity demands specialized equipment, trained staff, and rigorous quality control. Sophisticated bioreactor systems and viral vector manufacturing add to the costs. These high costs restrict therapy availability and competition for smaller biotech firms. Physicians also have difficulty scaling these treatments.

For instance, in April 2024, Cell and gene therapies provide long-term efficacy but may have serious side effects. Approvals by regulators are on the rise, increasing market application, as in the case of Kymriah and Yescarta. The high prices, averaging USD 20.4 billion per year, present financial challenges, although manufacturer support programs are on the rise. Prices vary from USD 65,000 to USD 0.42 billion, affecting access and value assessment. Cost-effectiveness assessments take into account treatment longevity and patient population size.

Automation and cutting-edge manufacturing technologies are having a gigantic potential in the Cell and Gene Therapy Manufacturing Market. The combination of automation technology with artificial intelligence can best minimize production complexity, increase scalability, and eliminate human errors. Such technologies improve the quality control process and decrease the cost of labor. With increasing demand for therapies, automation increases efficiency and reduces the cost. This enhances market growth with increased efficiency and affordability.

For example, in May 2024, Cellular Origins and CGT Catapult are collaborating to automate the production of CGT at the UK factory of CGT Catapult. They will combine Cellular Origins' Constellation robotic platform with CGT Catapult's GMP operations to illustrate benefits of automation. The objective is to surmount scale-up challenges in CGT manufacturing, leveraging tube welding for process adaptation through automated processes. CGT Catapult is also introducing digital and automation testbeds with autonomous software for seamless workflows. The deal seeks to lower costs, enhance efficiency, and increase access to life-saving treatments.

The market is expected to witness the maximum growth in Europe due to increased investment in biotechnology and regenerative medicine. The EU regulatory environment supports the advancement of gene and cell therapy. Leading European biotech companies and research centers cultivate gene editing and personalized medicine. Increased agreements between governments and industries favor market expansion. Higher levels of clinical trials accelerate the growth rate in Europe.

North America dominated market in 2024 due to robust infrastructure and sophisticated healthcare systems. Market growth is supported by major pharmaceutical giants such as Pfizer, Moderna, and Gilead Sciences. Strong regulatory support speeds up therapy approval. High demand for innovative treatments also adds to the need for gene therapy manufacturing solutions that are scalable.

Contract manufacturing dominates the market because of the demand for specialized production. Outsourcing prevents expensive in-house facilities. CMOs provide expertise and scalable infrastructure for effective production. They assist biotech companies as therapies scale up.

For instance, in April 2024, Bristol Myers Squibb (BMS) and Cellares entered a USD 0.38 billion agreement for CAR-T cell therapy manufacturing. Cellares will provide global capacity reservation and availability to enhance access to cell therapy. The agreement is meant to leverage Cellares' automated production platform, decreasing cost and increasing supply of therapy. The collaboration meets BMS's vision for exploring cell therapy innovation and manufacturing. Cellares' technology will scale up and optimize CAR-T cell therapy manufacturing.

Cell therapy manufacturing produces living cells as a treatment for diseases like cancer and genetic disease. Cell therapy manufacturing involves isolating, reshaping, and expanding cells through specialized techniques and strict quality controls. The manufacturing process will expand and optimize for widespread application as the demand for customized treatments grows.

For example, in May 2024, Anito-cel, a CAR-T for relapsed/refractory multiple myeloma, had maintained activity with an acceptable safety profile. In the iMMagine-1 trial, it demonstrated a 97% overall response rate and a 62% complete response rate. Anitocel targets BCMA using a novel D-domain binder, lowering neurotoxicity risks. Kite (Gilead Sciences) and Arcellx are developing it with encouraging outcomes in high-risk patients.

Pre-commercial/R&D scale manufacturing is the leading trend in themarket with a focus on enhancing processes for clinical trials. It involves small-scale production, optimizing processes, and therapeutic cell line development. Quality, consistency, and compliance with future therapy regulatory requirements are highly dependent on this stage.

For example, in August 2023, SCG Cell Therapy unveiled a GMP-certified cell therapy production plant and R&D center in Singapore in July 2023. The plant provides cell therapy products to Asia-Pacific's, North America's, and Europe's medical institutions. It expands the abilities in advanced cell therapy manufacturing and stem cell technology. The automated system in the facility minimizes clean room space by 80% and decreases per-patient manufacturing expense up to 70%. The R&D center specializes in cell therapy product candidates, such as those that treat HBV-related liver cancer.

Empower your strategy with expert insights, purchase this premium research@ https://www.cervicornconsulting.com/buy-now/2365

Ask here for more details@ sales@cervicornconsulting.com