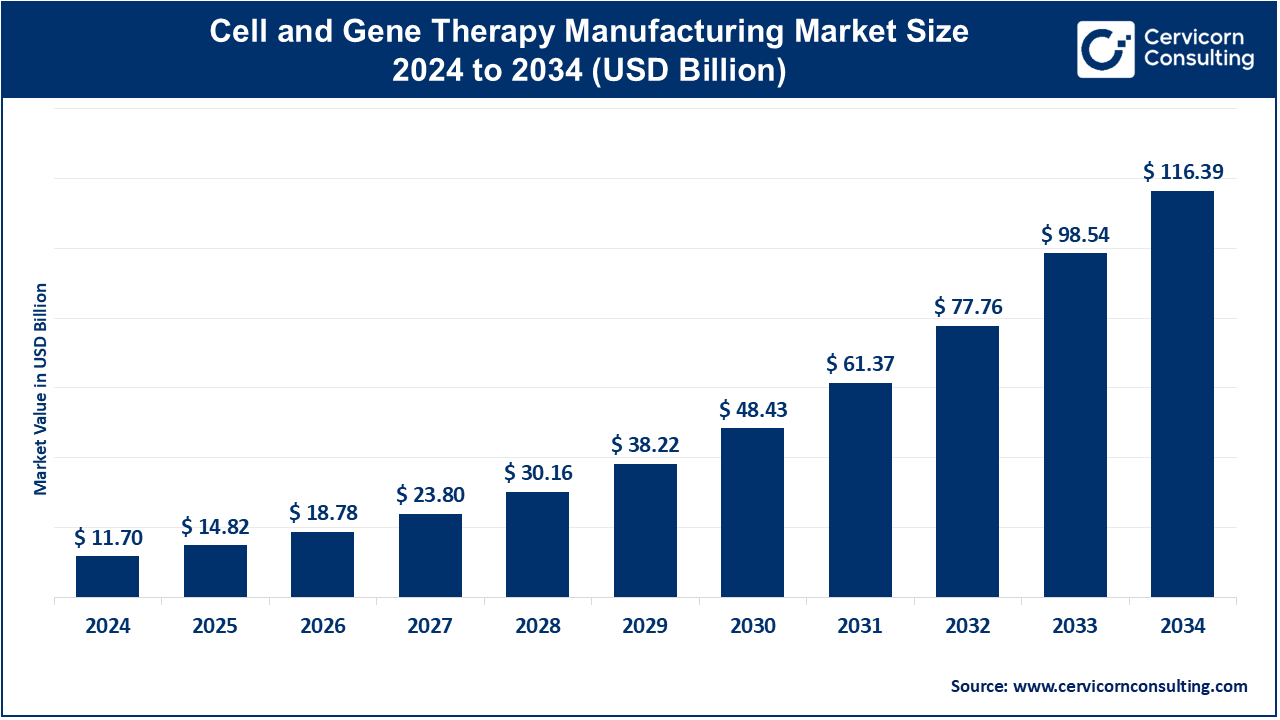

The global cell and gene therapy manufacturing market size was valued at USD 11.70 billion in 2024 and is forecasted to reach around USD 116.39 billion by 2034, growing at a compound annual growth rate (CAGR) of 26.71% over the forecast period 2025 to 2034. The U.S cell and gene therapy manufacturing market size is estimated to reach around USD 44.60 billion by 2034 with a CAGR of 24.68%.

The cell and gene therapy manufacturing market is experiencing rapid growth due to increasing advancements in biotechnologies and a surge in demand for personalized medicine. As the understanding of genetic diseases improves, more therapies are being developed, leading to a rise in investments in this field. Additionally, the growing success of clinical trials for gene therapies and cell-based treatments is driving market expansion. The global market is expected to grow exponentially in the coming years, with both established pharmaceutical companies and biotech startups investing heavily in the research and development of cell and gene therapies. According to a report by the Alliance for Regenerative Medicine, as of 2023, there are over 1,200 gene therapy products in the clinical trial pipeline worldwide, targeting various conditions including cancer, inherited genetic disorders, and cardiovascular diseases. The market is also benefiting from improved manufacturing techniques and regulatory frameworks that streamline production processes. Innovations like automation and advanced bioprocessing technologies are making it easier to scale up production while maintaining quality and safety.

Cell and gene therapy manufacturing involves creating treatments that use cells or genes to repair, replace, or alter defective cells within the body to treat diseases. These therapies work by either modifying the patient's own cells or using donor cells. Cell therapy includes procedures like stem cell therapies, where healthy cells are used to repair damaged tissues, while gene therapy involves inserting or modifying genes to treat genetic disorders. The manufacturing process for both involves complex steps, such as isolating and growing cells in controlled environments, modifying the genes, and ensuring the treatments are safe and effective. This process requires high precision and compliance with strict regulations to ensure the quality and safety of the therapies before they reach patients.

Report Scope

| Area of Focus | Details |

| Market Size in 2025 | USD 14.82 Billion |

| Market Size by 2034 | USD 116.39 Billion |

| Market Growth Rate | CAGR of 26.71% from 2025 to 2034 |

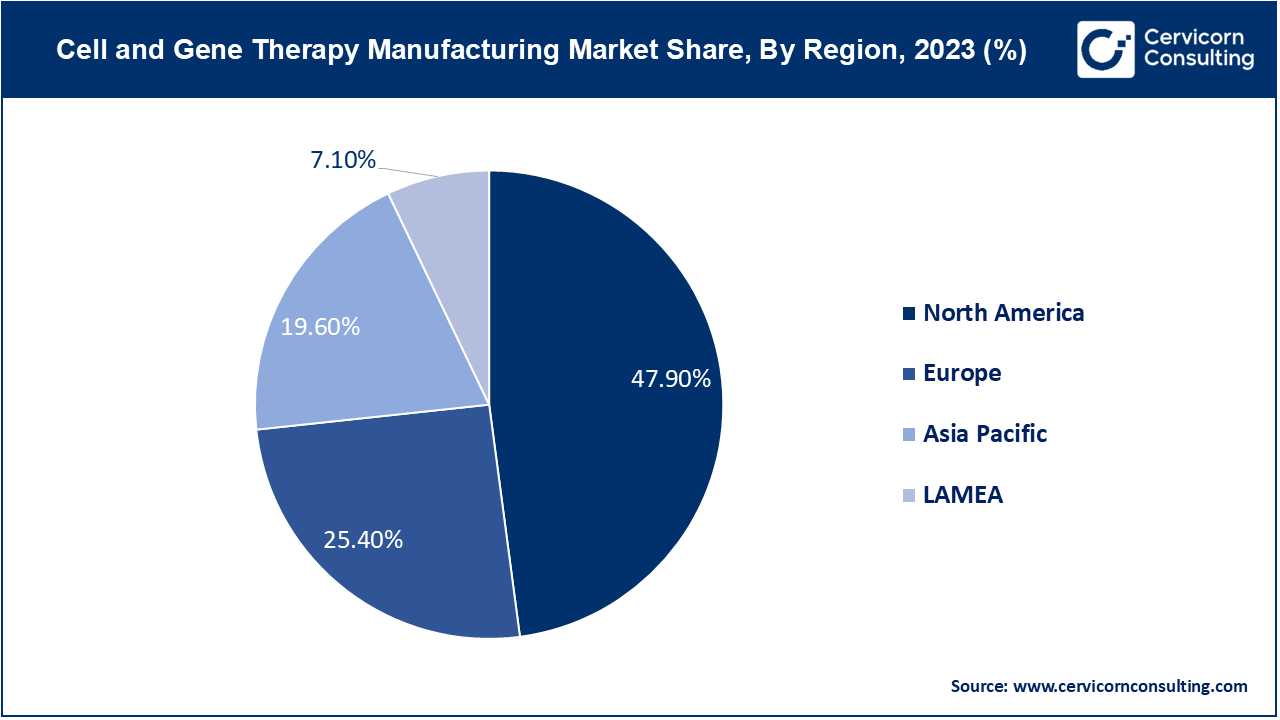

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Segment Coverage | Therapy Type, Application, Scale, Mode, Workflow and Regions |

Shift Toward Automation and Digitalization:

Adoption of Allogeneic Therapies:

High Production Costs:

Complex Regulatory Landscape:

Emerging Markets:

Collaboration and Partnerships:

Supply Chain Management:

Scalability of Manufacturing Processes:

The cell and gene therapy manufacturing market is segmented into therapy type, scale, workflow, application, region. Based on therapy type, the market is classified into cell therapy and gene therapy. Based on application, the market is classified into oncology, neurological disorders, ophthalmic disorders, and others. Based on scale, the market is classified into pre-commercial/R&D scale manufacturing, and commercial scale manufacturing. Based on workflow, the market is classified into cell processing, cell banking, process development, and others.

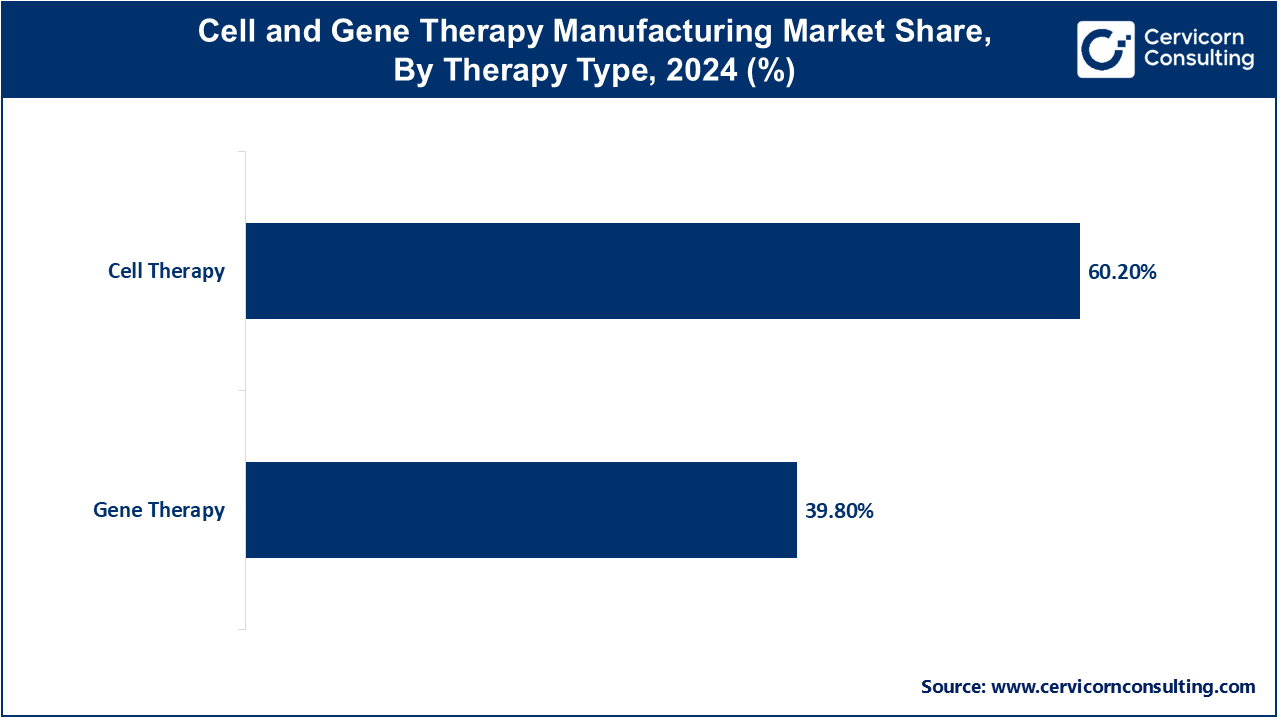

Cell Therapy: The cell therapy segment has generated highest market share of 60.2% in 2024. Cell therapy involves the administration of living cells to treat or cure diseases. These cells can be derived from the patient (autologous) or a donor (allogeneic). In the manufacturing market, the trend is toward improving scalability and automation to meet growing demand. Innovations in cell expansion, cryopreservation, and quality control are driving market growth, alongside the development of off-the-shelf allogeneic therapies, which offer broader patient accessibility.

Gene Therapy: Gene therapy segment has acquired market share of 39.8% in 2024. Gene therapy focuses on modifying or replacing defective genes to treat genetic disorders and diseases. This segment is witnessing advancements in viral vector production, which is crucial for delivering therapeutic genes. Trends include the shift towards more efficient and safer vectors, such as adeno-associated viruses (AAVs), and the rise of ex vivo gene editing techniques. Regulatory support and increasing clinical success are also boosting the market for gene therapy manufacturing.

Oncology: Oncology in cell and gene therapy targets cancers through therapies like CAR-T, modifying patient cells or introducing therapeutic genes to target cancer. Growth is driven by CAR-T cell therapy approvals and personalized treatments, with ongoing research to overcome tumor resistance.

Cardiovascular Diseases: Therapies for cardiovascular diseases focus on regenerating heart tissue or enhancing function through cell and gene modification. Innovations in stem cells and gene editing are advancing treatments, with emphasis on improving delivery methods and outcomes.

Neurological Disorders: This segment involves therapies for neurological conditions like Parkinson’s and Alzheimer’s, aiming to restore or replace damaged neurons. Increased focus on gene therapy and overcoming blood-brain barrier challenges, with promising clinical trial results.

Ophthalmic Disorders: Cell and gene therapies for eye conditions aim to repair or replace retinal cells to restore vision. Growth driven by successful gene therapy approvals and advancements in gene delivery techniques for various eye disorders.

Rare Diseases: Targeting genetic disorders with therapies that address the underlying genetic causes of rare diseases. Expanding due to orphan drug designations and targeted therapies, with a focus on long-term efficacy and safety.

Infectious Diseases: Developing therapies to combat infections by enhancing immune responses or targeting pathogens’ genetic material. Accelerated by the COVID-19 pandemic, with innovative approaches like CRISPR-based antivirals gaining attention.

Others: Includes therapies for conditions like autoimmune diseases and metabolic disorders, focusing on immune modulation or tissue repair. Expanding as researchers explore diverse applications, driven by advances in gene editing and stem cell technology.

Pre-commercial/ R&D Scale Manufacturing: Pre-commercial or R&D scale manufacturing segment has reported dominating market share of 73.24% in the year of 2024. Pre-commercial or R&D scale manufacturing involves small-scale production focused on developing and validating cell and gene therapies. Trends in this segment include increased investment in early-stage research, advancements in cell culture technologies, and the use of automated systems to streamline R&D processes. This phase is crucial for proving feasibility and optimizing manufacturing processes before transitioning to larger-scale production.

Commercial Scale Manufacturing: The commercial scale manufacturing segment has confirmed market share of 26.76% in 2024. Commercial scale manufacturing refers to large-scale production intended for widespread distribution and commercial use of cell and gene therapies. Trends include the expansion of manufacturing facilities, adoption of advanced technologies for increased efficiency, and implementation of robust quality control measures. As therapies move from clinical trials to market, scaling up processes while maintaining consistency and regulatory compliance is a key focus.

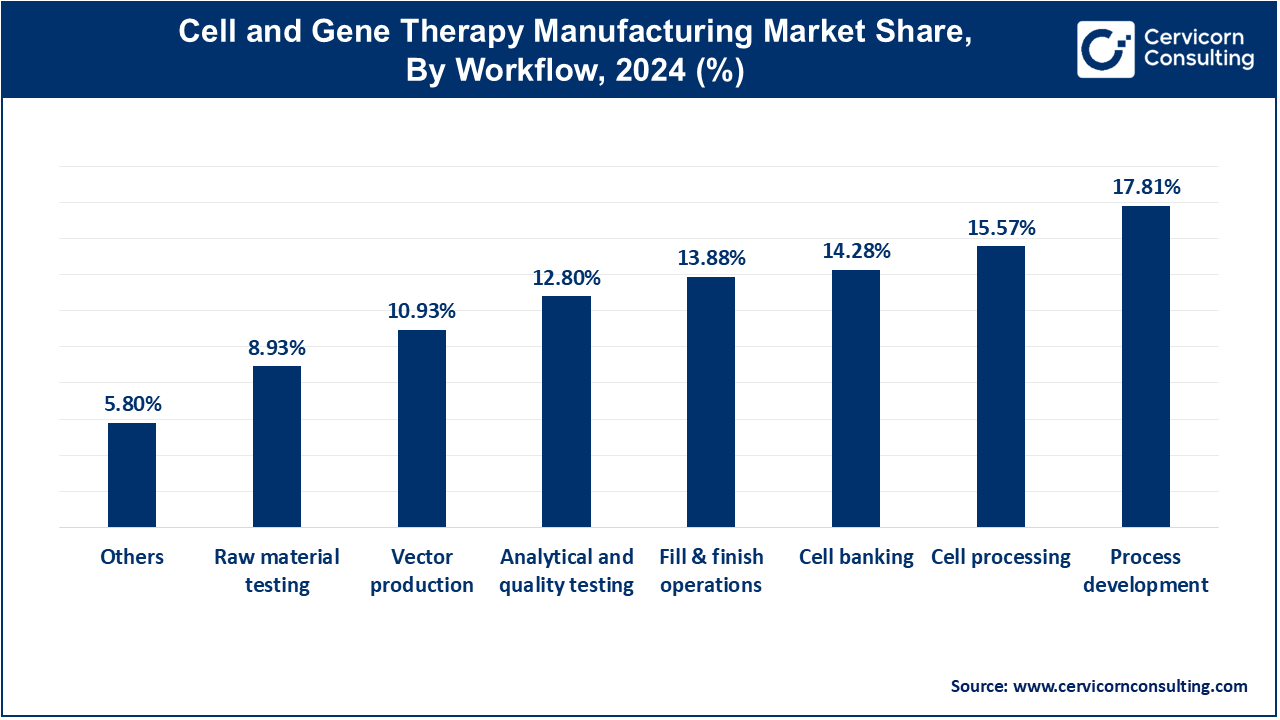

Cell Processing: The cell processing semgment has accounted market share of 15.57% in 2024. Cell processing involves the isolation, activation, and expansion of cells for therapy. Trends include advancements in automated cell processing technologies that enhance efficiency and reduce variability. The shift towards personalized medicine is driving the need for scalable, high-throughput cell processing solutions to meet growing demand.

Cell Banking: Cell banking segment has captured market share of 14.28% in 2024. Cell banking refers to the long-term storage of cells for future use, ensuring their viability and integrity. Trends include the use of advanced cryopreservation techniques and automated systems to improve cell quality and reduce contamination risks. Increasing regulatory requirements are also driving improvements in cell banking practices.

Process Development: The process development segment has registered market share of 17.81% in the year of 2024. Process development encompasses designing and optimizing manufacturing processes for cell and gene therapies. Current trends focus on enhancing process efficiency and scalability through innovations in bioprocessing and automation. There is also a growing emphasis on developing robust, reproducible processes to meet regulatory standards and reduce production costs.

Fill & Finish Operations: Fill & finish operations segment has covered market share of 13.88% in 2024. Fill & finish operations involve the final steps of product formulation, including filling, capping, and packaging. Trends include the adoption of advanced aseptic filling technologies and automated systems to ensure high-quality, contamination-free products. There is a growing demand for flexible, scalable solutions to accommodate varying production volumes.

Analytical and Quality Testing: The analytical and quality testing segment has achieved market share of 12.8% in 2024. There is a growing focus on ensuring compliance with stringent regulatory standards. Analytical and quality testing ensures the safety, efficacy, and consistency of cell and gene therapies. Trends include the integration of advanced analytical technologies, such as high-throughput sequencing and real-time PCR, to enhance testing accuracy and efficiency.

Raw Material Testing: The raw material testing segment has calculated 8.93% market share in 2024. Raw material testing involves evaluating the quality and safety of materials used in therapy production. Trends include increased use of rigorous testing methods and traceability systems to ensure material consistency and reduce risks. Enhanced regulatory scrutiny is driving improvements in raw material testing protocols.

Vector Production: Vector production segment has recorded market share of 10.93% in 2024. Vector production involves creating viral vectors used to deliver therapeutic genes into cells. Trends include the development of more efficient and scalable vector production methods, such as cell-based and cell-free systems. Advances in vector engineering are improving delivery efficiency and reducing production costs.

Others: "Others" includes additional processes and technologies that support cell and gene therapy manufacturing, such as logistics, supply chain management, and data management. The others segment has captured market share of 5.8% in 2024. Trends in this segment focus on improving overall operational efficiency and integrating digital solutions to streamline manufacturing workflows and enhance data integration.

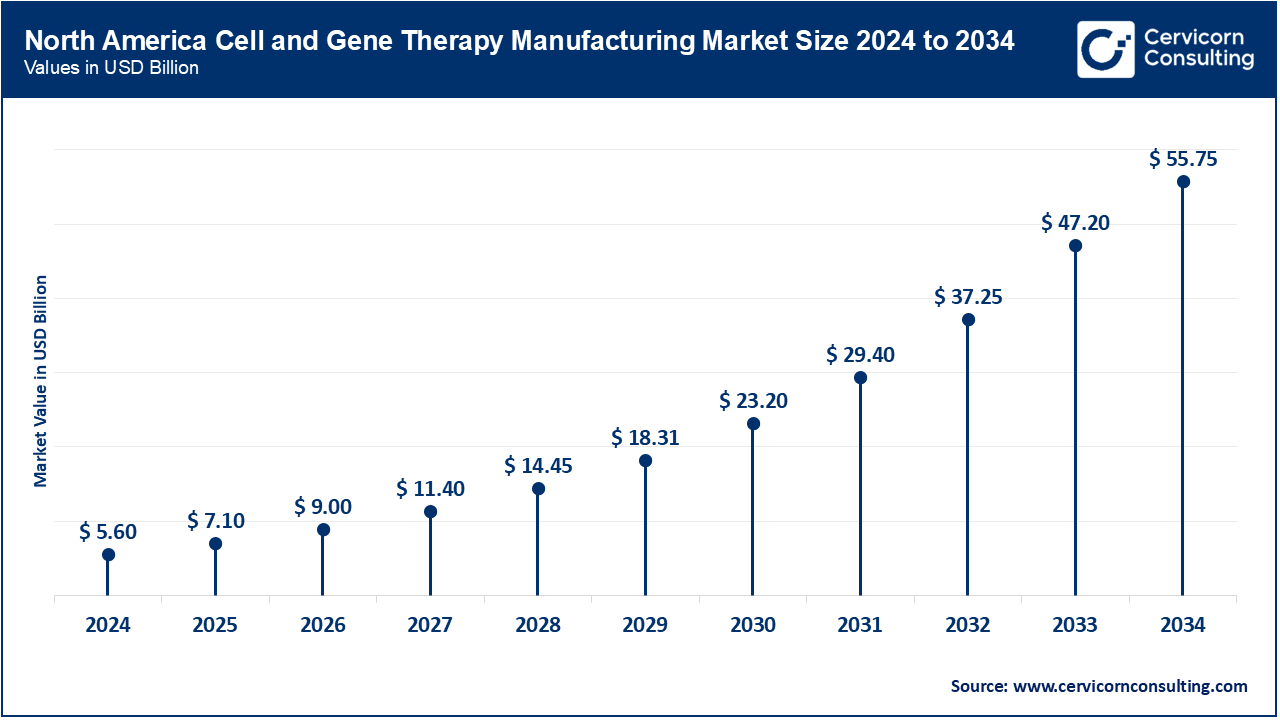

The North America market size is expected to reach around USD 55.75 billion by 2034 increasing from USD 5.60 billion in 2024 with a CAGR of 26.94%. North America leads in the cell and gene therapy manufacturing market due to advanced technological infrastructure and significant investments in R&D. The U.S. and Canada are at the forefront of clinical trials and regulatory approvals, with a growing emphasis on personalized medicine and innovative manufacturing techniques. Increased collaboration between biotech firms and contract manufacturing organizations (CMOs) is also driving growth.

The Asia Pacific market size is calculated at USD 2.30 billion in 2024 and is projected to grow around USD 19.34 billion by 2033 with a CAGR of 30.17%. The Asia-Pacific region is witnessing rapid expansion in cell and gene therapy manufacturing due to increasing investments, a growing patient population, and advancements in biotechnology. Countries like China and Japan are focusing on scaling up production capabilities and improving access to cutting-edge therapies. Regulatory advancements and government support for biotech industries are also key growth drivers.

The Europe market size is measured at USD 2.97 billion in 2024 and is expected to grow around USD 29.56 billion by 2034 with a CAGR of 25.45%. Europe is experiencing growth in cell and gene therapy manufacturing driven by supportive regulatory frameworks and funding initiatives from the European Union. The region is focusing on expanding manufacturing capabilities and enhancing cross-border collaborations to streamline production and access to therapies. Additionally, Europe is a hub for innovative research in gene editing and cell therapies.

In the LAMEA(Latin America, Middle East, and Africa) region, cell and gene therapy manufacturing is expanding slowly due to emerging market dynamics and improving healthcare infrastructure. Growth is driven by increasing healthcare investments and rising awareness of advanced therapies. There is a growing emphasis on building local manufacturing capabilities and partnerships to meet regional healthcare needs and regulatory requirements.

Companies like Orgenesis Inc. and Poseida Therapeutics, Inc. are emerging in the cell and gene therapy market, focusing on innovative technologies such as advanced gene editing and scalable manufacturing processes. These firms are leveraging novel approaches to address specific therapy challenges and enhance production efficiency. Novartis AG and Gilead Sciences, Inc. lead the market through their extensive portfolios and robust R&D investments. Novartis excels with its Kymriah product, while Gilead dominates with Yescarta, benefiting from established manufacturing capabilities and regulatory expertise.

Market Segmentation

By Therapy Type

By Application

By Scale

By Mode

By Workflow

By Region