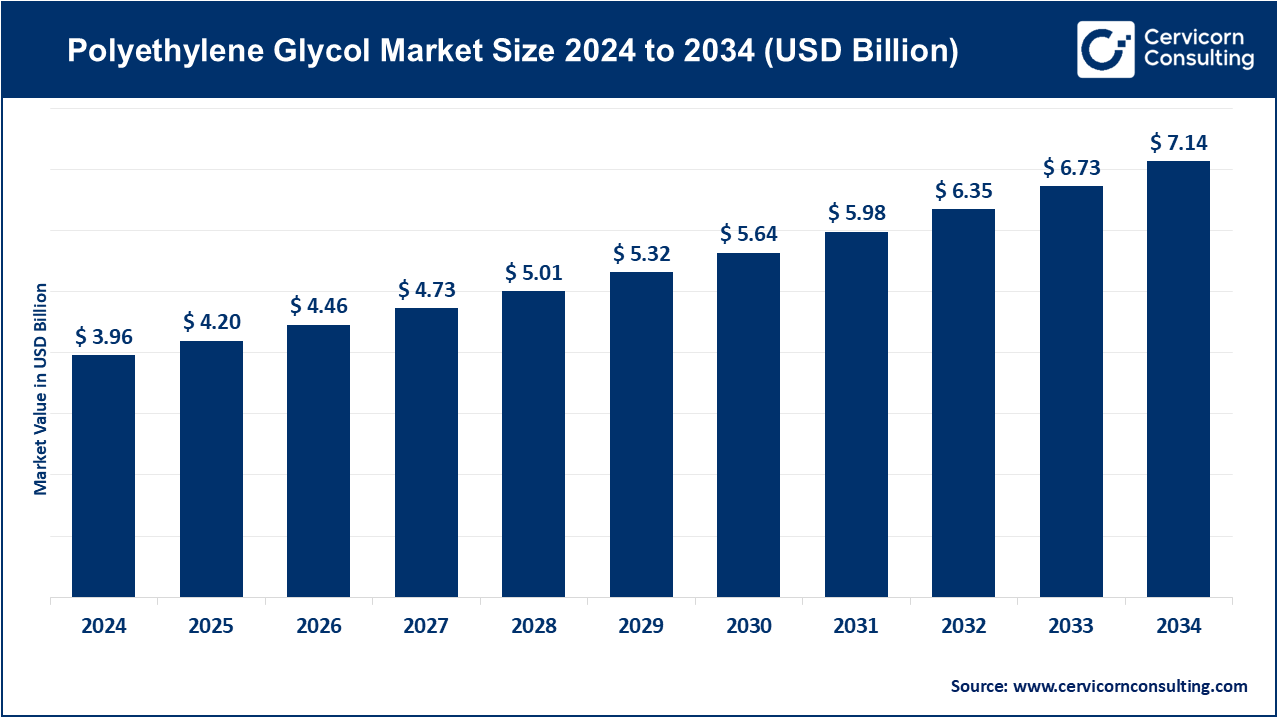

The global polyethylene glycol (PEG) market size is estimated at USD 4.20 billion in 2025 and is expected to be worth around USD 7.14 billion by 2034, growing at a compound annual growth rate (CAGR) of 6.1% over the forecast period 2025 to 2034. The polyethylene glycol (PEG) market is rising on a sustained growth curve due to the varied uses of the product in pharmaceutical and personal care to agriculture and industry driven manufacturing industries, with industries, research organizations and technology developers examining its extensive applications. PEG, which is known to be versatile due to the property of a solvent, binder, dispersant, and lubricant, is being used in sustainable formulations increasingly in place of dangerous chemicals. Increased regulatory scrutiny, as well as increased ESG commitments and consumer pressure to source more eco-friendly products, are pushing manufacturers to bio-based PEG production and biological processing systems. Its contribution both in improving the performance of products, and minimizing impact on the environment is leading to it becoming a critical part of a range of value chains.

What is Polyethylene Glycol?

Polyethylene glycol (PEG) is a polyether, which is produced by polymerizing ethylene oxide, and which can be supplied with widely varying molecular weight that affect its physical and chemical characteristics. It can be dissolved in water and is inert and non-hazardous, and therefore can be used in a very wide range of applications: as a base in drugs and cosmetics, a processing aid in industrial products or as a moisture retention agent in agriculture. These factors have made it a favourite material in both established and new industries due to its adaptability, stability and good profile in safety.

Top five brands linked to plastic pollution (Percentage of the number of items of all branded waste)

| Brand | Share of branded waste items (%) |

| Coca-Cola Company | 11% |

| PepsiCo | 5% |

| Nestle | 3% |

| Dan One | 3% |

| Altria | 2% |

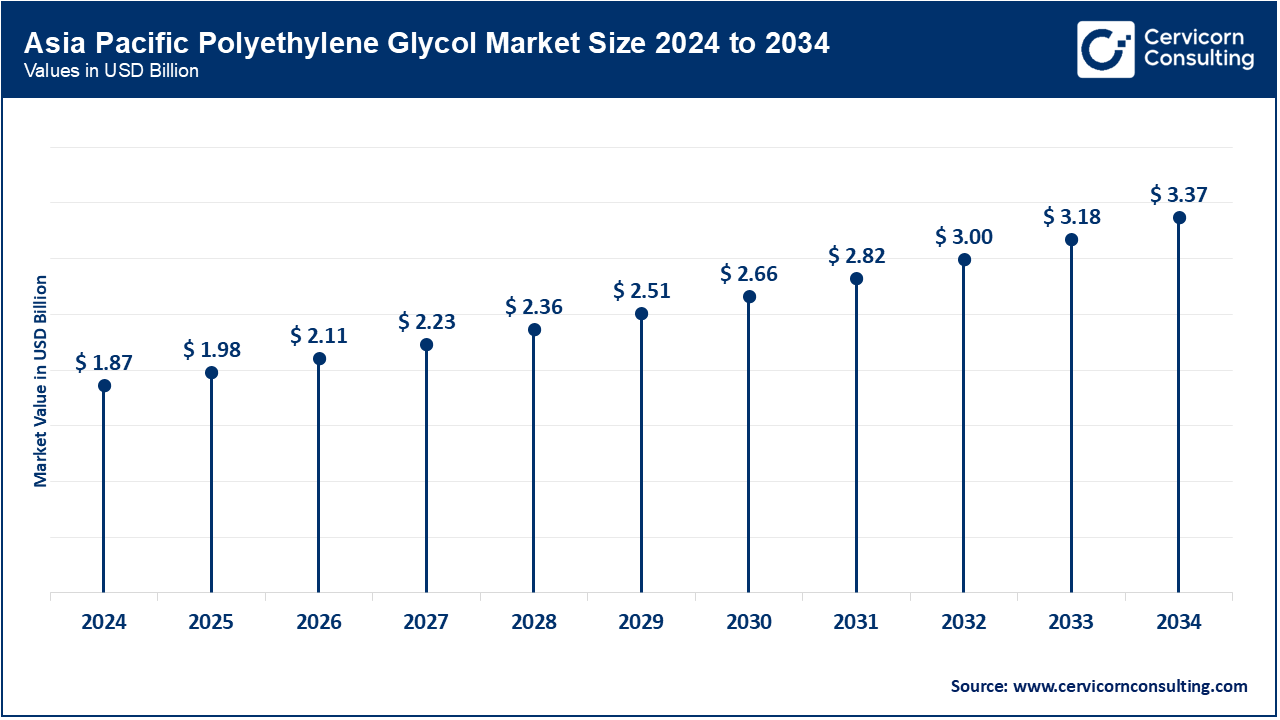

The polyethylene glycol market is segmented into several key regions: North America, Europe, Asia-Pacific, and LAMEA (Latin America, Middle East, and Africa). Here’s an in-depth look at each region.

A huge surge in the demand of PEG is being experienced in the Asia-Pacific region ostensibly because of the growing healthcare facilities, industrial application, and the cosmetics industry in that region. New PEG-based extended-release pharmaceutical formulations were approved in May 2024 in Japan and promoted greater production within the country. China, India and South Korea are ramping up PEG production used both domestically and as an export. Alternatives to bio-based and industrial-grade PEG are being promoted using demonstration projects. The mobility of advisory and training programs is boosting adoptions at a small and medium manufacturer.

The North America is strengthened by the robust pharmaceuticals, personal care and industrial applications as well as investor interest in a green chemical production. In June 2024, a number of U.S. producers increased PEG output to deal with the emerging demand of pharmaceutical-grade and cosmetic-grade PEG. California and Texas are giving incentives towards domestic production and environment friendly manufacturing process. Greater use of ESG-aligned sourcing and corporate sustainability commitments are leading to the usage of greener PEG. The partnerships among biotech firms and chemical companies are raising accuracy of manufacture and product development.

The European market is rapidly growing due to tough regulations on REACH and the Green Deal, and an increasing interest by consumers in more environmentally friendly goods. In March of 2024, BASF renovated its PEG manufacturing facility in Germany in order to make the plant energy efficient and environmentally compliant. Bio-based PEG derivatives are being promoted as cosmetics and pharmaceutical ingredients in France, Italy and the Netherlands. Increasing prices of classical purely chemical intermediates are driving producers to sustainable intermediates. Quality and environmental indicators are being harmonized by national cross-border research projects in the EU.

Polyethylene Glycol Market Share, By Region, 2024 (%)

| Region | Revenue Share, 2024 (%) |

| North America | 26.40% |

| Europe | 18.10% |

| Asia-Pacific | 47.20% |

| LAMEA | 8.30% |

The LAMEA is slowly expanding because of investments in pharmaceutical, cosmetic and industrial sectors. The company is the largest pharmaceutical company in Brazil, in April 2024, they started sourcing PEG locally to lower the level of dependence on imports. South Africa and Kenya are also using PEG in cosmetics and lubricant compound because of industrial applications. This has seen the Gulf countries further investigating the use of PEG in oilfield chemicals and polymers processing. The joint ventures between local manufacturers and global brands are create access to the market. Training programs financed by the government are ensuring that the companies can produce and maintain quality products.

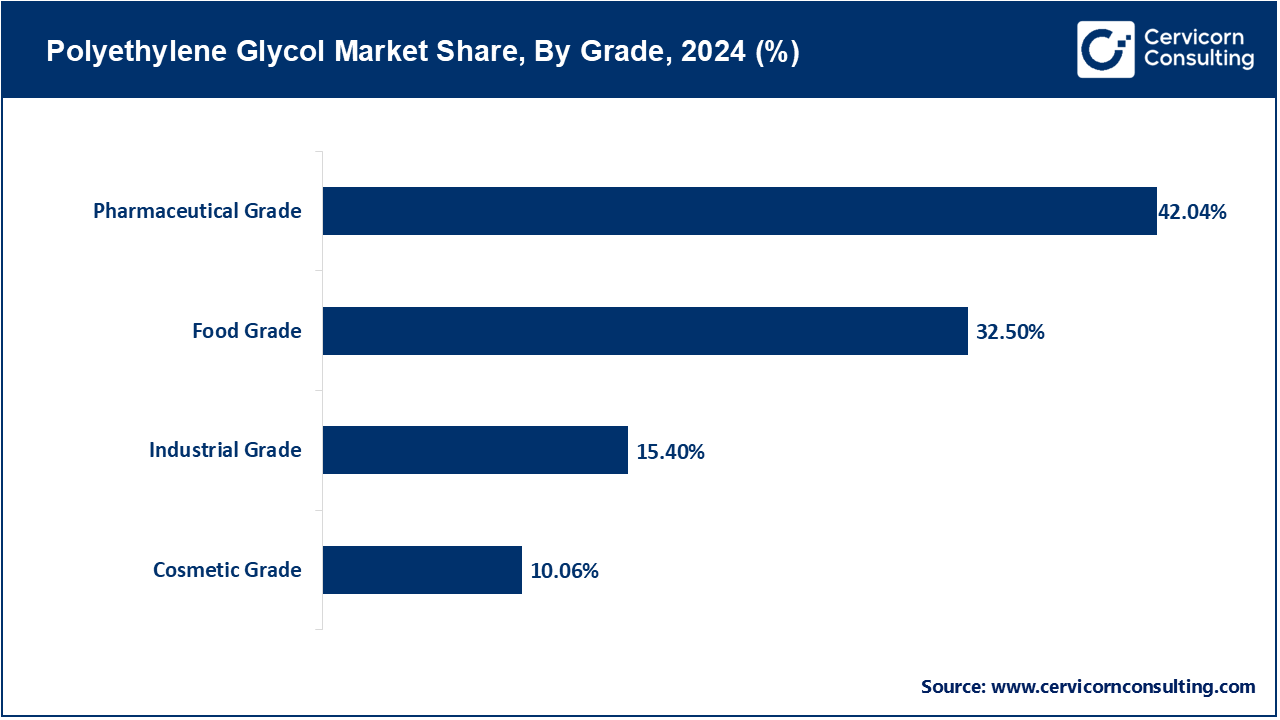

Pharmaceutical Grade: This means that pharmaceutical-grade PEG is very pure and often necessary to meet the medical and drug applications needed to be safe and also biocompatible. It is applied to excipients, ointments and laxative in addition to drug delivery systems. In December 2023, BioNTech confirmed that its mRNA COVID-19 vaccines rely on pharmaceutical grade PEG used to stabilize lipid nanoparticles so that they can safely be transported under diverse conditions. This adoption brought out its importance in immunization programs around the world. Its purity and stability cannot be overestimated in tightly regulated uses in healthcare.

Industrial Grade: Industrial grade PEG is produced on an industrial manufacturing and technical level where ultra-high purity is unnecessary. It finds application in lubricants, surface coatings and adhesives. In April 2024, the BASF company provided high-performance, industrial-grade PEG which was used in automotive manufacturing rates of the components, and in the lubricants additives in Germany. This was an enhanced viscosity management and minimization of friction in mechanical systems. It is also flexible in large-scale industrial processing which leads to a stable demand.

Cosmetic: PEG used to make cosmetic products are refined and are safe when used on the surface of a person. It is used as an emulsifier, a humectant and a texture enhancer. L'OR Launched a high end skincare line in Europe in January 2024 with cosmetic grade PEG to help in better spread as well as moisturize the skin. The formulation had an augmented moisturizing and long lasting consumer experience. It is very popular among governments at international levels.

Food Grade: Food safety grade PEG meets the requirements of contact with foodstuffs, frequently assuming the roles of foodstuff additive, as an anti-foaming agent or processing aid. In June 2023, one of the chocolate coater producers in the U.S. switched to food grade PEG in order to create a smoother chocolate coating and avoid particle crystallization. This made sure of a standardized quality of products in large seasonal production batches. Its non-toxic nature is in favor of its being mixed with food manufacturing line.

Pharmaceuticals: PEG is also prevalent in input in drugs formulation, controlled-release Tablets, topical ointments, and PEGylation which enhance solubility of drugs. In September 2023, Pfizer grew the use of PEG in its cancer-related medication to extend their half-life so fewer doses were required by patients. It led to the enhancement of therapeutic effects and increased rates of patient compliance. It has flexibility in its dosage form design and this makes it a desirable excipient in contemporary drug development.

Cosmetics and Personal Care: PEG is used as a moisturizer, thickener and emulsifier in this industry and it plays a role in the stability of products and the texture. In January 2024, The Body Shop added PEG to a new range of body creams that increases moisture retention in the skin up to 24-hours. This was a plus to the consumer satisfaction level and increased brand loyalty. The skin friendly nature of PEG ensures that it is continuously used in personal care products.

Polyethylene Glycol Market Share, By Application, 2024 (%)

| Application | Revenue Share, 2024 (%) |

| Pharmaceuticals | 44.12% |

| Cosmetics and Personal Care | 26.10% |

| Food and Beverages | 14.60% |

| Industrial Solvents | 9.80% |

| Textile Finishing | 5.38% |

Food and Beverages: PEG is used to stabilize any type of food texture as it acts as an anti-foaming agent, carrier, or processing aid during food manufacturing. In August 2023, an Indian dairy producer applied PEG to the making process of ice cream, in order to avoid the challenge of ice crystal formation during cold storage. This assisted in creaminess of products and prolonged shelf life. It has good profiles of safe consumption, which conforms to the international food safety standards.

Industrial Solvents: The cleaning agents, chemical processing and polymer manufacturing are valuable properties of PEG as a lubricant and a solvent. In April 2024, BASF supplied industrial solvent-grade PEG to produce resins in Italy to enhance process efficiency and product consistency. The use of the application cut on waste and reduced processing time. By being chemically stable it can be used in several heavy industries.

Textile Finishing: PEG is applied in textile processing to make fibers soft, get rid of static and penetrate dyes. A garment exporter in Bangladesh started using PEG-based finishing chemistry in May 2023 to get a smoother fabric handle in cotton garments. This enhanced the quality of exports and customer review. It is widely used in textile process because of its compatibility with various kinds of fibers.

200-400 g/mol: This category of molecular weight is low viscous delivering it as an ideal cosmetics and pharmaceuticals solvent or softening agent. It is appreciated extensively because it has light texture and facilitate formulation in fluids. Unilever in July 2023 also introduced PEG 300 in lotions to achieve skin absorption at a quicker rate and without a greasy deposit. This advancement increased the desire of consumers to light moisturizing creams.

400-600 g/mol: It is a common range used in ointments, liquid soaps, and industrial lubricants as it is a medium viscosity match between rheostat and flow. It provides the good solubility and stability in different temperatures. In January 2024, Procter & Gamble has added PEG 400 to a new line of liquid handwashes to enhance fragrance duration and to give the skin a soft touch. This accommodative change saw the product work better in conducive environments which were characterized by high humidity but maintained the user comfortability.

600 1000 g/mol: The corresponding molecular weight provides a denser texture, thus it can be used in ointments, creams and some versions of plastic processing operations. It has a semi-solid nature that gives it very good moisture-retentive qualities. In October 2023, Johnson & Johnson applied PEG 800 to medical ointments so as to increase occlusive effects on wound healing. This enhanced the moisturizing barrier on facial skin that has been treated to further shorten the healing process.

1000 2000 g/mol: The range is waxy solids applied in industry coatings as well as tablets and suppositories. They give controlled release and solidity to finished products. In March 2024, Novartis introduced PEG 1500 in the formulation of tablets to enhance the compression properties and manipulation of the dissolution rates. This assured uniformity in the follow-up supply as well as in quality of mass production batches.

Greater than 2000 g/mol: This grade is solid and dense and thus a powerful lubricant, mold release agent, and thickener in heavy industrial application. It is sturdy and applicable to harsh conditions of processing. One Japanese company which is an automotive supplier implemented PEG 4000 in the tire mold release agents to simplify the production in May 2023. To a large extent, this minimized defective rates, as well as the enhanced manufacturing competence.

Ethylene Oxide: Ethylene oxide is mostly used to make PEG and may be polymerized under control conditions to make many different grades and applications. It is also preferred because it is scalable and reliable. In April 2024, Dow Chemical installed new capacity of ethylene oxide at Texas to serve increasing demand of PEG in the pharmaceutical and cosmetics industries. This decision enhanced the security of the supply chains among the international clients. It has also been dominant due to its regular output of quality.

Ethylene Dichloride: This is a less-used source, however, it is a good choice when the special PEG grade needs special properties. It facilitates specific usage of lubricants and high-technology fabrication. During the month of February 2023, a South Korean specialty chemical company utilized ethylene dichloride to make PEG that would be used to manufacture niche lubricant formulations. This method satisfied viscosity and stability needs on industrial machineries. Its part-selective usage provides the specific chemical performance.

Polyethylene Glycol Market Share, By Source, 2024 (%)

| Source | Revenue Share, 2024 (%) |

| Ethylene Oxide | 45.07% |

| Ethylene Dichloride | 34.16% |

| Ethylene Glycol | 20.77% |

Ethylene Glycol: Ethylene is used as the starting material to manufacture PEG and is cheap in high-volume industries. It can be applied to different processing requirements. In August 2023, an Indian chemical plant came online to produce PEG of ethyl glycol which should be used as textile softening agent. This was less import dependence, and home industry made a more competitive deal. It has the benefit of being supple, which facilitates local supply chain progression.

Medical Device: Because PEG is biocompatible, it can make a great application to medical devices in the form of coatings and lubricants (catheters, stents, surgical instruments, etc.). It makes the insertion easy and comfortable to patients. In June 2024, U.S. medical technology firm dried PEG coatings on vascular catheters to decrease friction experienced in their use. This proved successful in raising the adoption rates by hospitals and enhanced patient care outcomes. It cannot be matched up when it comes to medical safety.

Pharmaceutical Packaging: PEG can be used in packaging in the form of moisture barrier in capsules coating and the blister pack films to maintain the stability of the product. It is essential in safeguarding sensitive drugs. In September 2023, one of the European packaging brands incorporated PEG-based coatings in capsule packing that prolonged the shelf life of pharmaceutical products. This gave drug strength and lowered wastage due to lost inventory. It is also essential to its use in controlled storage.

Polyethylene Glycol Market Share, By End User, 2024 (%)

| End User | Revenue Share, 2024 (%) |

| Medical Device | 42.10% |

| Pharmaceutical Packaging | 25.70% |

| Lubricant Additive | 20.20% |

| Paper Coating | 12% |

Lubricant Additive: The lubricating and dispersing qualities of PEG can be an asset to industrial and automotive oils sites. It increases the resistance of wear at high pressure. Shell introduced a PEG-based additive into hydraulic oils in April 2024 to increase its performance in heavy machines. This minimized maintenance periods and extended lives of the equipment in both construction and mining activities. It has a high stress tolerance, which has made it a valuable industry in terms of reliability.

Paper Coating: PEG enhances the smoothness of paper products, stains and print qualities, thus increasing the usefulness of paper products particularly in the high end of printing. In May 2023 a Japanese paper mill used PEG based coatings to improve the finish of high-quality stationery. This made the product more desirable in export markets and it enhanced brand reputation. It has functional advantages that are crucial to the specialty paper production.

Market Segmentation

By Grade

By Application

By Molecular Weight

By Source

By Form

By Package Size

By End-Use Industry

By Region