India Petrochemicals Market Size and Growth Factors 2025 to 2034

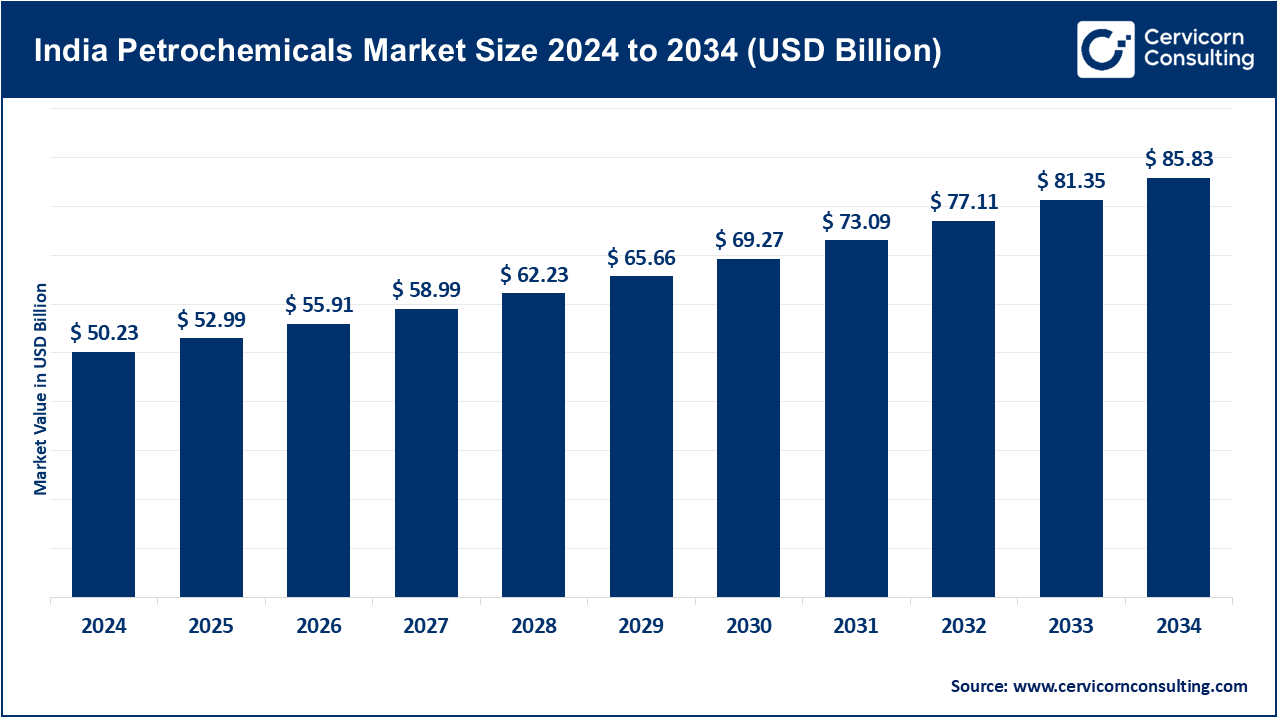

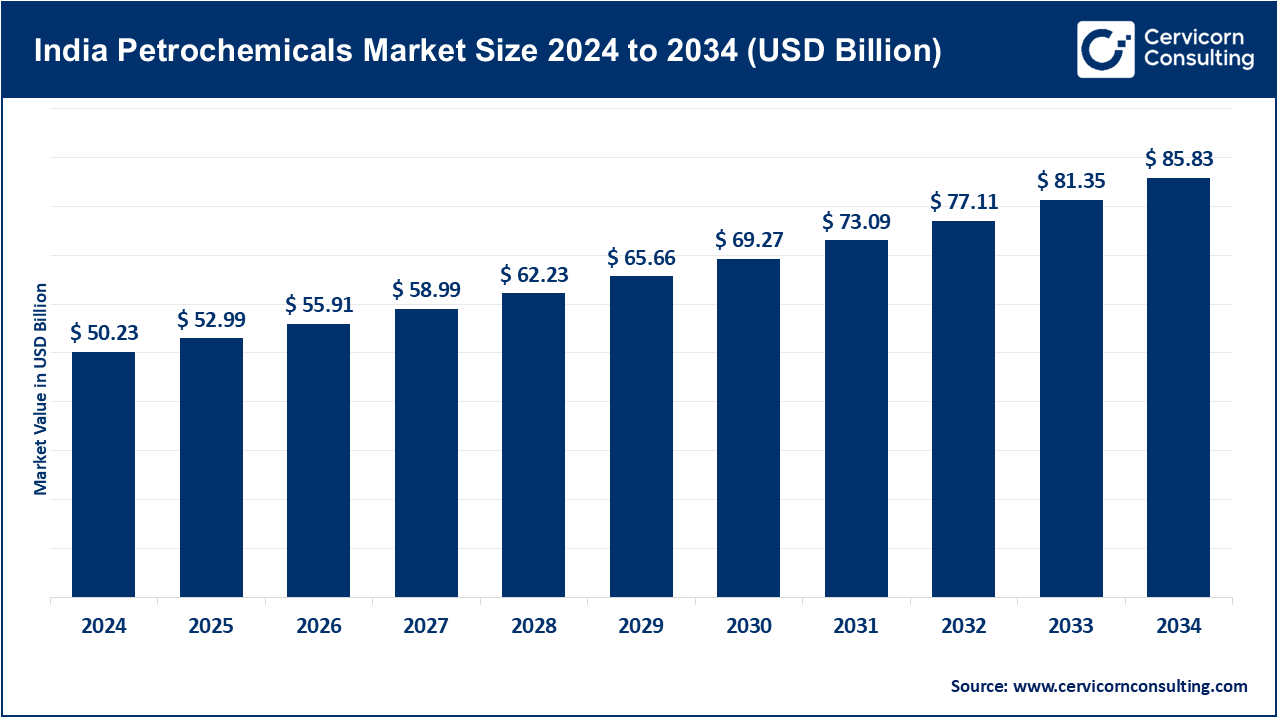

The India petrochemicals market size was valued at USD 50.23 billion in 2024 and is anticipated to reach around USD 85.83 billion by 2034, growing at a compound annual growth rate (CAGR) of 5.5% over the forecast period from 2025 to 2034. In India, the petrochemicals market is expanding at a strong pace due to both regional demand and further development of the downstream industry. Increased consumption in packaging, textiles, automotive, and construction is one of the key drivers of growth, with the packaging industry alone accounting for more than 40% of petrochemicals consumption. With initiatives like �Make in India,� the government, along with other easily accessible policies, has motivated both domestic and international businesses to enhance their production capabilities, thus increasing output growth from 6-7% per year. Moreover, urbanization and growth in the middle class are increasing the consumer goods demand, which directly impacts the consumption of petrochemicals. Adoption of new technologies is also increasing the competitive edge of the market, especially the use of bio and recycled polymers.

The India petrochemicals market refers to the sector involved in the production, processing, and distribution of chemicals derived from petroleum and natural gas. These chemicals serve as the building blocks for a wide array of products, including plastics, synthetic fibers, rubbers, fertilizers, and specialty chemicals, which are integral to industries such as automotive, packaging, textiles, and construction. Driven by rising industrialization, urbanization, and growing consumer demand, the market encompasses upstream processes like refining and cracking, midstream manufacturing of basic chemicals, and downstream production of finished products. It plays a crucial role in supporting India�s industrial growth and export potential.

India Petrochemical Export Value (USD Billion)

| Year |

Export Value (USD Billion) |

| 2020 |

22.5 |

| 2021 |

23.8 |

| 2022 |

24.3 |

| 2023 |

23.8 |

| 2024 |

20.4 |

India Petrochemicals Market Report Highlights

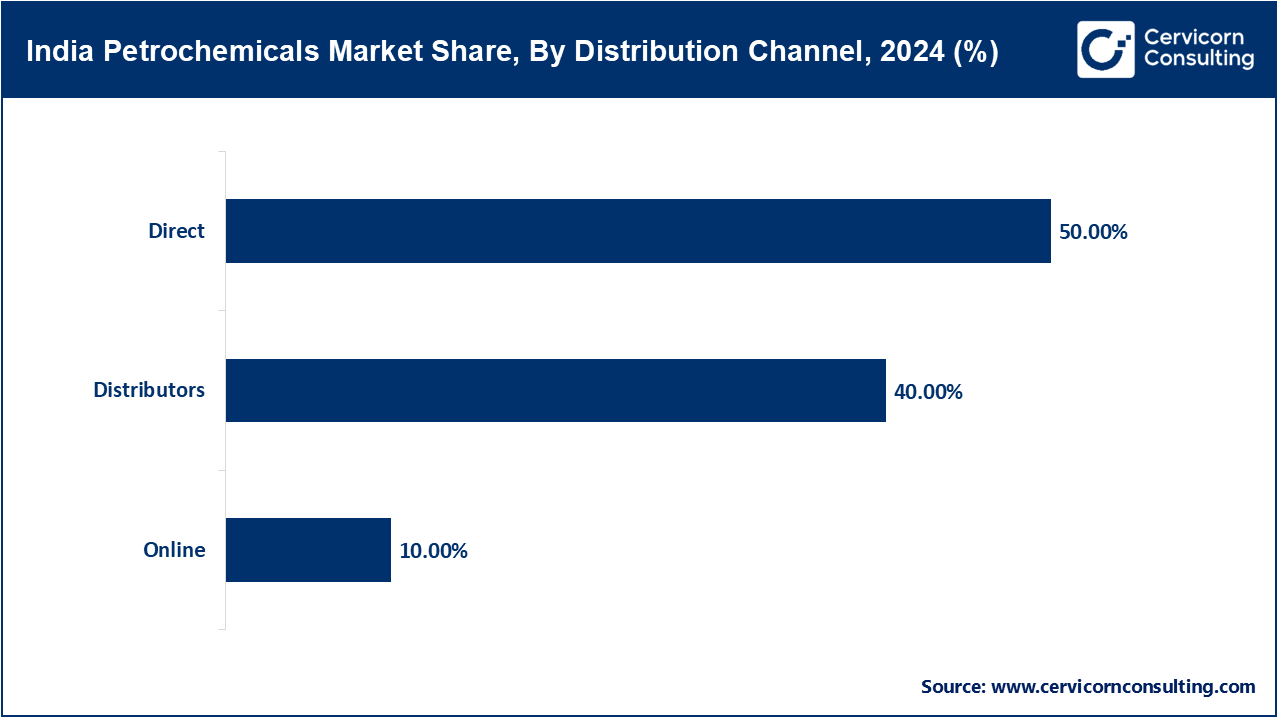

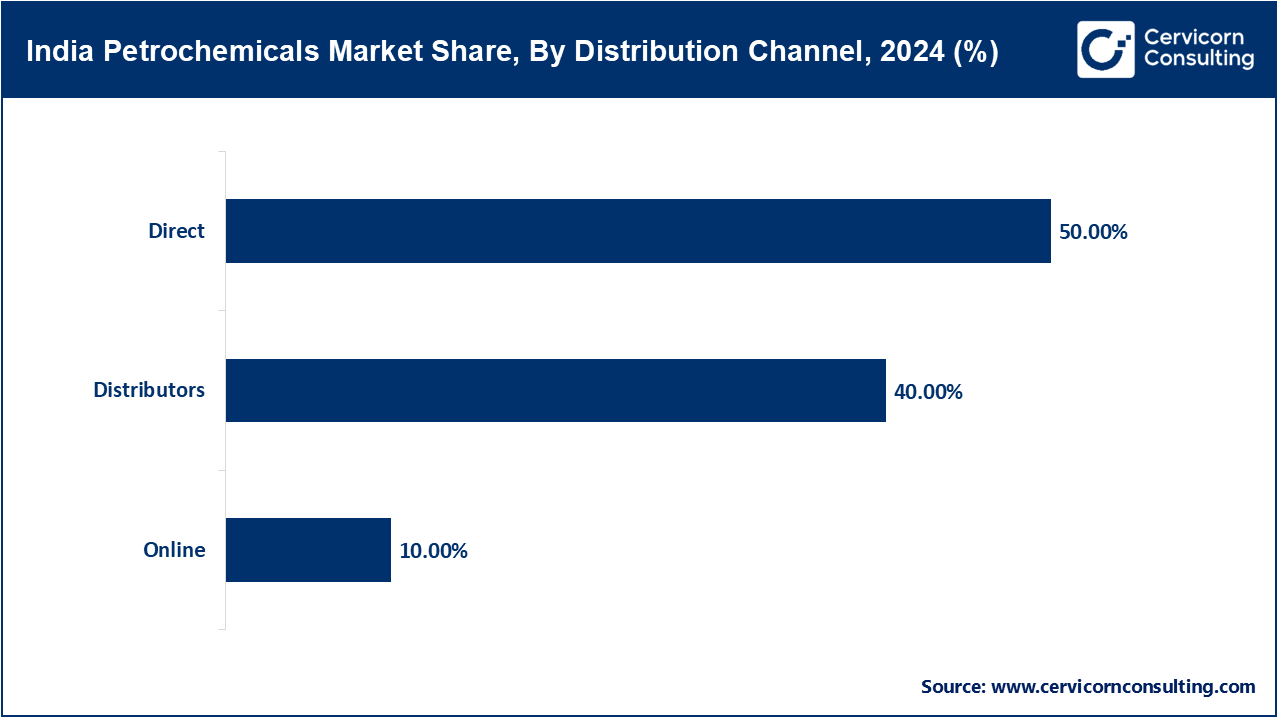

- By Distribution Channel, the direct sales segment has captured revenue share of 50% in 2024.

- By End User, the automotive segment holds around 25% of the market share, due to infrastructure and industrial development, the market is projected to increase by a Compound Annual Growth Rate (CAGR) of around 7�8% during the forecast period.

- The supply chain is being reinforced by the expansion of petrochemical plants by both public and private sectors as well as ongoing capacity addition projects.

- Government policies such as Make in India as well as initiatives for the downstream sectors are aiding growth of the industry.

- The growing focus on the production of petrochemicals R&D and sustainable petrochemical production is stimulating the invention in bio-based and greener polymers.

India Petrochemicals Market Trends

- Domestic demand and strategic global positioning: With robust growth, the country is well-positioned as a global competitor with strong domestic demand, but some remarkable trends are also shaping the industry. Manufacturers are focused more on high-value specialty chemicals, so production of polymers, elastomers, and engineered performance chemicals serving automotive, packaging, and textile industries is on the rise. For example, polypropylene and polyethylene are in high demand due to the growing packaging industry, which constitutes almost 30% of total polymer consumption in India. In addition, the country is witnessing a boom in the electric vehicles market which, along with adopting lightweight materials, is rapidly increasing the demand for high performance engineering plastics and creating scope for selling high-value specialty products.

- Sustainability and circular economy practices: To comply with international environmental mandates and eco-conscious consumer sentiment, there is a noticeable rise in bio-based and recycled feedstocks. For instance, some of the Indian market�s top names are investing in chemical recycling to solve the plastic feedstock problem, thereby supporting closed-loop systems. Additionally, energy-efficient and low-emission technologies are aiding companies to curtail nonscore operational expenditures while fulfilling stricter greenhouse gas emissions criteria. Alongside these, some companies are embarking on international partnerships for technology transfer, capacity expansion, and stronger India meets and competes for a stronger position as an exporter in the global market. In a nutshell, India�s strategic position and significance, both globally and regionally, is fortified by the production of high-value specialty chemicals and the aim to adopt sustainable practices.

India Petrochemicals Market Dynamics

Market Drivers

- The rapid expansion of downstream industries: In the case of India, the rising e-commerce sector is substantially driving the consumption of packaging materials. With the booming construction of automobiles, the automotive industry is increasingly relying on synthetic and lightweight polymers, which are derived from petrochemicals, to comply with efficiency and emission standards. This is also driving the consumption of engineering plastics in the country. In addition, the construction of smart cities and the National Highways Development Program has also aggressively stimulated the consumption of petrochemical products like PVC pipes and insulation materials. The vigorous growth of the downstream industries packaging, automotive, and construction, is accessible and rapidly expanding for petrochemical products like polyethylene, PVC and polypropylene. In recent years, the country has recorded automotive production of over 5 million vehicles.

- Government-backed investment in domestic petrochemical production: The second key driver is the government-supported initiative to foster domestic investment in the production and refining capacity of petrochemicals. India is rapidly building out its petrochemical complexes through joint ventures and expansion projects with an aim towards self-sufficiency and boosting competitiveness for exports. In addition to these policies, the Production-Linked Incentives for petrochemical sectors are helping to foster large-scale production, improve margins, and attract investment. In addition, the increased exports of polymer and specialty chemicals to Southeast Asia and the Middle East are also strengthening the market by providing a lucrative growth opportunity. All in all, these investments and structural demand patterns are driving robust, sustained growth in India's petrochemicals sector which is expected to position India as one of the key contributors to industrial and economic growth.

Market Restraints

- High volatility in crude oil prices: One persistent difficulty confronting the petrochemical sector is the pronounced volatility characterizing crude oil pricing, a factor that exerts immediate and calculable pressure on input costs. Such compressions compromise the competitiveness of final products against imported alternatives, both in domestic arenas and in international markets that, in turn, widen the price band of dependence on crude-derived feed. Of particular concern is the mid-sized and smaller manufacturing base, which exhibits comparatively fragile capitalization; rapid and sustained input shocks may exceed the digestive capacity of internal reserves. The absence of sufficient hedging instruments closes arbitraged stability gaps, compelling curtailed output, prolonged deferral of debottlenecking initiatives, or, in extremis, an abrogation of anticipated capacity enlargements.

- Increasing regulatory and environmental pressures: Petrochemical industries are also faced with intensive governmental policies focused on Green Technology and Environmental footprint. These policies are on the rise with the Indian government freshening its emissions policies. Petrochemical industries are thus mandated to comply with more stringent norms in regard to pollutant gas and water emissions, waste disposal, as well as greenhouse gas emissions. These systems are essential in states like Gujarat and Maharashtra, which are central hubs for petrochemical production, as they are required to implement more stringent regulations with the central government on emission reduction. These regulations alongside with the baseline policies on waste disposal lead to enhanced compliance costs.

Market Opportunities

- Expanding demand for specialty and high-performance polymers: The Indian petrochemicals market is projected to experience critical growth propelled by domestic consumption, exports, and technology. One such opportunity includes the increasing need for specialty and high-performance polymers in the petrochemical industry in the automotive, packaging, electronics, and construction sectors. For example, the Indian automotive market is expected to grow at more than 10% CAGR over the coming years, which increases demand for lightweight and durable plastic parts, thus increasing the consumption of engineering plastics and high-density polyethylene. Similarly, the move by the packaging industry to sustainable and recyclable materials has opened opportunities for bio-based and biodegradable polymers, which is a niche, yet fast-growing segment in the petrochemicals market.

- Expanding domestic production and reducing import dependency: "Make in India" and the growth of integrated refinery-petrochemical complexes and dedicated petrochemical hubs are major foreign investment magnets as they seek to reduce imports of ethylene, propylene, and benzene derivatives. The government�s focus on �Make in India� and integrated refinery-and petrochemical complexes are major investment magnets for foreign and domestic players. Such hubs are conducive for efficient production and profitability due to the economies of scale they generate as well as India�s geographical position that enables easy exports to Southeast Asia, the Middle East and Africa, all of which are rapidly urbanizing and industrializing, increasing their petrochemical consumption. Technologically advanced companies are able to gain a streamlined competitive advantage to their rivals using methods such as catalytic cracking, process intensification, and digital process monitoring to enhance product quality, reduce costs, and increase yielded.

Market Challenges

- High energy intensity of the industry coupled with rising energy costs: Concurrently, a significant impediment to sustained industry-wide competitiveness is the pronounced energy intensity that characterizes core petrochemical processes, coupled with persistent and increasing energy price inflation. The bulk of production value is underwritten by high temperature and high pressure processing, thus broad petrochemical value nets allocate 20�30% of overall operating expenditure to energy alone. Retail electricity tariffs for industrial power consumers have, over the last decade, moderated only intermittently, while offering cumulative increases of 5�7% per annum, a trajectory that is further compounded by episodic power interruptions in several industrially strategic states that compel process facilities to fall39 constantly on expensive and heavily priced diesel generating sets. As a converging risk, these idiosyncratic and systemic energy price increases can quickly eclipse the marginal profitability that is underwritten by scale advantages and advanced processing technologies birth. Mid-sized polymer production facilities across Gujarat and Maharashtra indicate that annual electricity costs may exceed ₹200 crore�an expenditure that compresses margins and erodes competitive advantage relative to overseas manufacturers. Tariff and availability uncertainty compounds this challenge, leaving little room for operational hedges.

- Inadequate port facilities, congested highways, and limited storage capacity: Nationwide, infrastructure drag persists within the petrochemical supply chain. Port facilities, again, contribute the most. Insufficient acreage for dedicated storage, coupled with traffic choke-points on the NH-8 and NH-16 corridors, sharply constrains rail and truck transit for hazardous and temperature-sensitive compounds that the sector regularly handles. Observational records show that Mundra and Kandla, despite recent dredging and quay enlargement, experience vessel turnaround delays that approach eleven calendar days on average, postponing both critical feedstock arrivals and scheduled export dispatch. Rail capacity shortages exacerbate the problem, as the dedicated freight corridors that would alleviate congestion remain unfinished. Overall, supply chain fluidity diminishes, with average turnaround lead-times lengthening between 5 and 10%. The cumulative economic coefficient of these delays is substantial; additional freight costs, spoiled cargo, and an inability to seize export windows exceed ₹40,000 rupees per tonne in best-case scenarios. By extension, neither high domestic power tariffs nor the constrained infrastructure permit the sector to ramp polymer output decisively for the domestic peak season nor for emergent overseas orders.

India Petrochemicals Market Segmental Analysis

Distribution Channel Analysis

Direct Sales: Direct sales dominate the Indian petrochemical distribution landscape, commanding approximately 60% of the total volume. Leading companies�Reliance Industries, Indian Oil Corporation, and Haldia Petrochemicals�favour contractual arrangements with primary offtakers, including automotive assemblers, flexible-pack producers, and chemicals-used-in-constructs, executing large-scale, multi-year deals. Such mechanism delivers consistent, specification-compliant output, avails tailored specifications, and secures quality reinforcement, particularly for bulk orders of polyolefins and synthetic elastomers. Through these long-standing arrangements, producers align output schedules, mitigate price risk, and ease working capital requirements.

Distributors and Wholesalers: Wholesalers and regional distributors is the second-largest slice, accounting for around 30% of sales. This tier services the small- and medium-enterprise bandwidth unable to transact directly with primary producers, extends supply chains into peripheral markets, and balances inventories across states. Entities like Finolex Plasson and Supreme Petrochemicals package logistical flexibility, offering disposable polyolefins, polyvinyl chloride grades, and assorted intermediate products to decentralised plastic moulders, synthetic yarnmakers, and thermoformed-packaging-makers. By leveraging these intermediaries, the majors extend the footprint across the country�s multi-channel, fragmented manufacturing fabric while anchoring pricing stability.

Online: The digital and e-commerce distribution sub-channel, while presently accounting for only 10% of sales, is expanding rapidly. Online marketplaces and direct-B2-B apps promote smaller moulders, bespoke compounders, and specialty coater to procure standard grades�polypropylene, ultraviolet-absorbing grades, and commodity polyesters�through transparent quoting, robotised forecasting prompts, and reduced administrative friction.

End User Analysis

Automotive: The domestic automotive sector emerges as the predominant consumer, representing nearly one-fourth of national petrochemical throughput. Derivatives like polypropylene, polyethylene, and synthetic elastomers are integral to interior modules, fuel delivery assemblies, and weight-optimized bodywork, collectively lowering curb weight and enhancing thermal efficiency. Notable assemblers, including Maruti Suzuki and Tata Motors, have accelerated the substitution of non-load-bearing metallic assemblies with polymeric analogues.

Packaging: The packaging trajectory presents an equally formidable market, contributing approximately one-fifth of aggregate demand, fuelled by e-commerce, food, and beverage consumption. Flexible films, containers, and labels manufactured from polyethylene and PET continue to dominate, compelling domestic producers�most prominently Uflex and Essel Propack�to expand extrusion and molding capacities for both domestic and international orders.

India Petrochemicals Market Share, By End-User Industry, 2024 (%)

| End-User Industry |

Revenue Share, 2024 (%) |

| Automotive |

25% |

| Packaging |

30% |

| Textiles |

15% |

| Construction |

20% |

| Others |

10% |

Textiles and Apparel: The textiles sector is experiencing a marked transition, as synthetic filament yarns�chiefly polyester and nylon�gather market share approaching decisiveness, representing roughly 15% of petrochemical absorption.

Construction: The construction ecosystem consumes roughly 10% of national consumption through PVC, letter-expanded polystyrene, and thermoset insulation resins, providing critical support to accelerated public housing, Polytechnic housing, and digitized or smart city missions.

Others: consumer goods, electronics, and agriculture�account for the final 30% of the petrochemical market by integrating derivatives into packaging, household appliances, irrigation architecture, and fertilizers.

India Petrochemicals Market Top Companies

Recent Developments

- June 2025: Indian Oil Corporation announced a major investment of ₹61,077 crore for expanding the Paradip Petrochemical Complex in Odisha. The project involves the setting up of a PX-PTA unit, a monoethylene glycol (MEG) plant, and a textile park in Bhadrak which aims to enhance the petrochemical value chain, generating over 15,000 jobs.

- August 2025:�Indian Oil Corporation reported the scheduled launch of Sustainable Aviation Fuel (SAF) manufacturing, with operations set to commence in December. The venture is regarded as a transformative effort toward greener aviation and testimony to the firm�s sustained dedication to energy sustainability. The facility is projected to enable the aviation market to attain national carbon-reduction targets while advancing the adoption of lower-emission fuel options.

Market Segmentation

By Distribution Channel

- Direct

- Distributors

- Online

By End-User Industry

- Automotive

- Packaging

- Textiles

- Construction

- Others