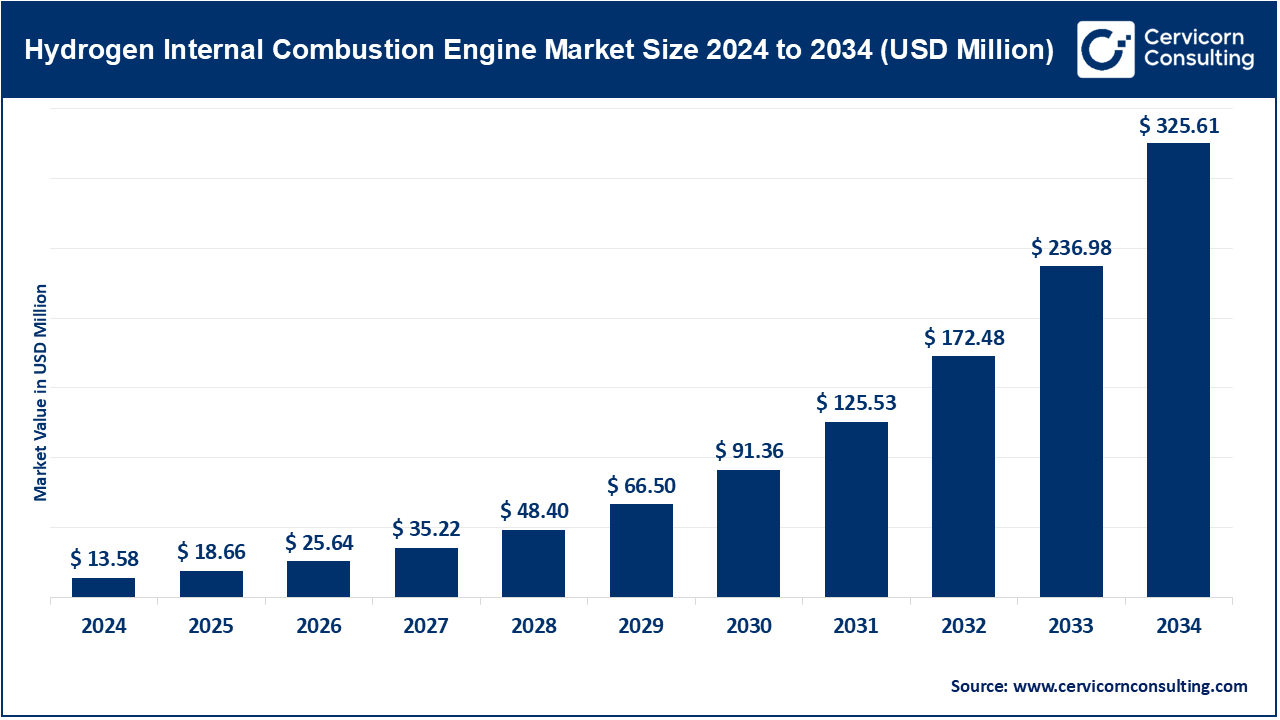

The global hydrogen internal combustion engine market size was valued at USD 13.58 million in 2024 and is expected to hit around USD 325.61 million by 2034, growing at a compound annual growth rate (CAGR) of 37.40% over the forecast period from 2025 to 2034. The hydrogen IC engine market is growing as more countries focus on sustainable energy. The need to lower greenhouse gas (GHG) emissions from the transportation sector is more urgent than ever. Hydrogen-based combustion engines are positioned to become the low to zero-emission bridge to battery operated electric vehicles. They give �low carbon mobility� without the challenges of battery disposal or charging stations. Hydrogen engines are safer than before with the integration of IoT, AI, and advanced thermal management technologies, as well as more responsive to varied uses in the transportation sector such as commercial vehicles, heavy trucks, and marine vessels. Real time performance monitoring, predictive maintenance, and emissions control enhancements lower operational costs and improve overall operational efficiency.

The incorporation of hydrogen refueling stations, intelligent engine tuning technology, and hybrid hydrogen and electric powertrains reconfigured market perceptions of performance-oriented sustainability. Government promotion of hydrogen adoption through clean energy policies and tax breaks incentivizes greater manufacturer investment and research efforts into next-generation combustion technology. Likewise, AI-powered combustion tuning, digital twin modeling, and sensor-based fuel management systems optimize engines for a specific condition, achieving peak energy output and minimal emissions. Empirical evidence correlates decarbonization with growing technological adoption and innovation, which paints a positive future for the hydrogen internal combustion engine market in the next ten years.

Report Scope

| Area of Focus | Details |

| Market Size in 2025 | USD 18.66 Million |

| Estimated Market Size in 2034 | USD 325.61 Million |

| Projected CAGR 2025 to 2034 | 37.40% |

| Dominant Region | Asia-Pacific |

| Key Segments | Engine Type, Vehicle Type, Application, Fuel Type, Region |

| Key Companies | Cummins Inc., Rolls-Royce plc (MTU Engines), Toyota Motor Corporation, MAN Truck & Bus (Volkswagen Group), Deutz AG, Yamaha Motor Co., Ltd., Caterpillar Inc., JCB, Hyundai Motor Company, Punch Hydrocells (Belgium) |

The hydrogen IC engine market is segmented into several key regions: North America, Europe, Asia-Pacific, and LAMEA (Latin America, Middle East, and Africa). Here�s an in-depth look at each region.

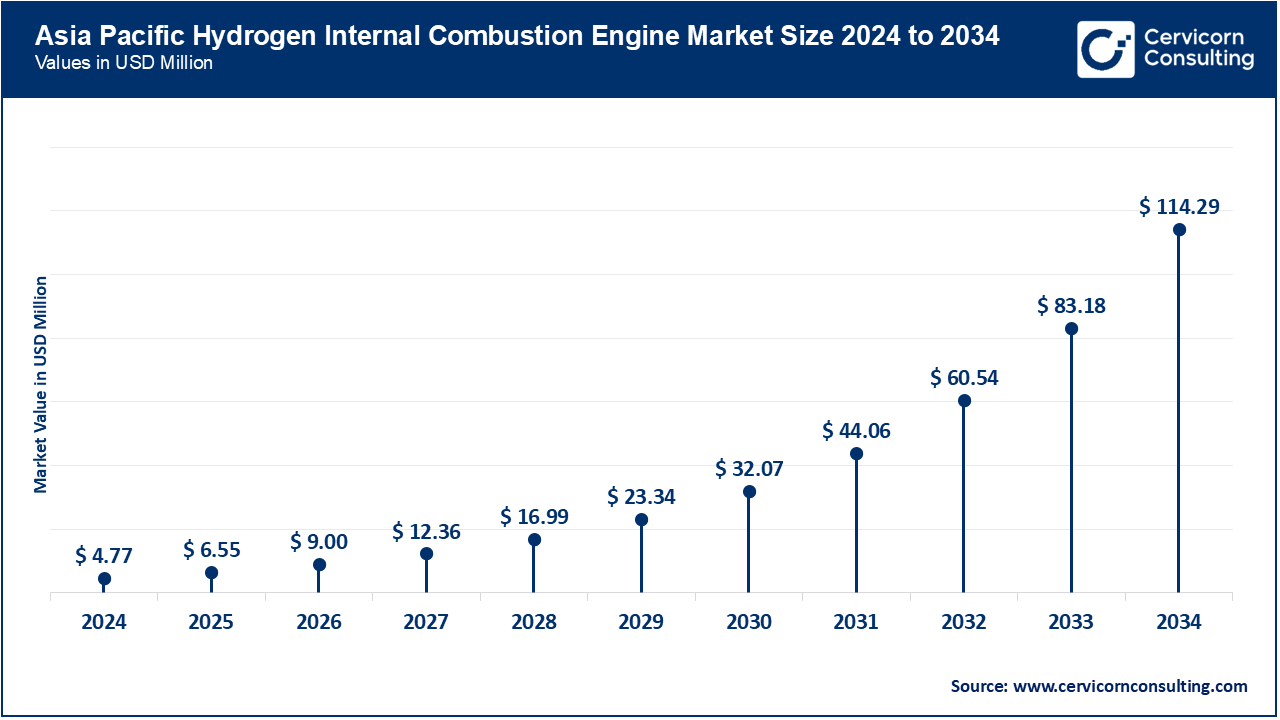

Asia-Pacific is leading the hydrogen ICE market. This is attributed to the rapid urbanization and industrialization of the region along with government support for low-emission mobility. By June 2025, production facility upgrades focusing on digital monitoring, high-strength alloy production, and advanced rolling of alloys will have been incorporated into more than 70% of the manufacturing facilities of China, Japan, India, and South Korea. By mid-2025, China had deployed almost 2,000 hydrogen fuel commercial vehicles into urban logistics fleets with fuel efficiencies reaching 80 km per kg of hydrogen. The region is growing in excess of 10% per year on the back of policy support and partnerships with sustainable transport infrastructure global technology providers.

North America region is expanding due to its early acquisition of the hydrogen combustion technologies and the developed base of the automotive and heavy industries. By automation of over 60% of hydrogen engine production with AI control systems, digital twins, and the precision alloying techniques during the period between 2023 and 2025, efficiency optimization and waste reduction became a reality. Adoption of Hydrogen ICE technology in heavy-duty trucks and buses showed a monthly deployment rate of 500 units with reports stating a decrease of 70% of NOx emissions when compared to diesel. Industry-driven expansion on both transportation and industrial sectors continues due to targeted tax credits and the production of hydrogen.

Europe is the second biggest market, and for good reason. Market demand, the achievements in the decarbonization of transport, and the adoption of hybrid hydrogen-electric platforms fuel early adoption of hydrogen technologies. In Germany, France, and the U.K., hydrogen ICE production facilities were the first in Europe to implement electric arc furnaces and automated production quality control systems by April 2025, achieving an annual growth of production volume by 15-20%. European OEMs focus on hybrid hydrogen ICEs. This, alongside the adoption of integrated renewables, market growth is ensured with the European Union's carbon-neutrality and low-emission automobile mandates. In the first quarter of 2025, the commercial application in trucks, buses, and light passenger fuel vehicles resulted in the deployment of over 1200 hydrogen-powered vehicles.

Hydrogen ICE Market Share, By Region, 2024 (%)

| Region | Revenue Share, 2024 (%) |

| North America | 27.60% |

| Europe | 29.80% |

| Asia-Pacific | 35.10% |

| LAMEA | 7.50% |

The LAMAE region has potential as a developing market fueled by new energy initiatives, urbanization, and infrastructure growth. The hydrogen ICE production facilities and steel production plants located in Brazil, Mexico, Saudi Arabia, and the UAE expect the advanced automated production rolling lines to improve nearly 40% of the production capacity by May 2025, as they integrate production of medium to high strength components for hydrogen engines. More than 150 integrated hydrogen ICE modular trucks designed for the logistics and industrial machinery sectors have been deployed as pilot vehicles in each of the countries, and are expected to grow with the government spending on infrastructure. The use of high strength hydrogen engines on a wide range of industrial and urban uses will increase steadily in the 2026-2027 timeframe, improving the uptake of these engines.

Single Cylinder Hydrogen ICE: Single-cylinder hydrogen internal combustion engines are small, lightweight, and specially designed for use in smaller vehicles, as well as light industrial machinery. For applications that are low in power, they become fuel-efficient and produce lower emissions. Due to demand for use in small machinery and urban delivery vehicles, Asian manufacturers were able to increase production of single-cylinder hydrogen internal combustion engines by 10% by March 2025. Testing showed an impressive 65% reduction in nitrogen oxide emissions compared to gasoline engines, proving their worth for use in light industry and city transport.

Hydrogen ICE Market Share, By Engine Type, 2024 (%)

| Engine Type | Revenue Share, 2024 (%) |

| Single Cylinder Hydrogen ICE | 34.50% |

| Multi Cylinder Hydrogen ICE | 65.50% |

Multi Cylinder Hydrogen ICE: Hydrogen internal combustion engines that are multi-cylinder allow for heavy-duty trucks, industrial machinery, and buses to function with the needed high torque and power output. They improve the combustion engine with hydrogen fuel combustion to lower the emissions of carbon while still maintaining high power. By April 2025, European Original Equipment Manufacturers were able to launch multi-cylinder hydrogen engines which improved hydrogen ICE effectiveness for long-haul operations, heavy-duty transport, and commercial trucks and buses. This was a game-changer as they improved fuel efficiency by 20% and decreased diesel engine nitrogen oxide emissions by 70%.

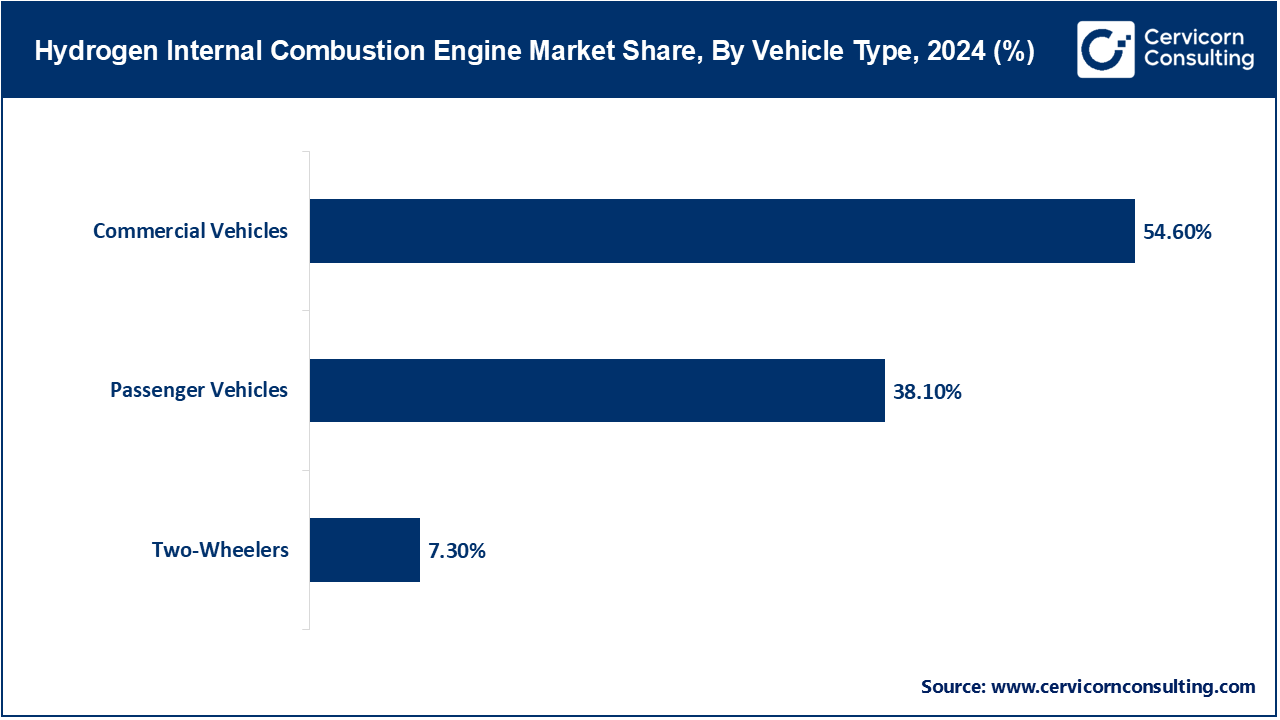

Passenger Vehicles: Hydrogen combustion engines as substitutes for usual internal combustion engines in cars provide a low-emission option. Travel ranges are longer compared to electric-only cars. They also keep CO2 and NOx emissions in check. As of May 2025, Toyota and Hyundai have completed tests on hydrogen ICE passenger vehicles that can travel 600 km on a single refuel. This proves viability for long-distance travel and city use while staying compliant to global emission standards.

Commercial Vehicles: Hydrogen ICE technology in buses, trucks and vans allows logistics and public transport to leverage hydrogen technology for high torque, long operating zones and range for hydrogen ICE vehicles. As of June 2025, Cummins and Volvo hydrogen-powered trucks in Europe achieved 500 km range for hydrogen fuel and reduced fleet CO2 emissions by 40% compared to diesel trucks. This is a big step for sustainable freight transport in Europe.

Two-wheelers: Hydrogen ICE for motorcycles and scooters provides an eco-friendly option for city transport. Their small size and fuel efficiency are ideal for short-distance and high-frequency travel in urban centers. Starting in February 2025, Indian startups will be offering powered scooters that use 1kg of hydrogen to travel 80km. This cuts urban vehicle emissions by 30% and is a solution for city center congestion.

Automotive: Hydrogen ICEs integrated into vehicles, trucks, and hybrid fleets acts as a stepping-stone solution for low-carbon transport. It helps in achieving performance while also addressing emission target. By April 2025, European EV manufacturers had integrated high-strength hydrogen ICEs into hybrid cars and 10% chassis weight reduction was achieved as well as increased efficiency of battery enclosures, thus overall production cost was lowered.

Marine: Marine hydrogen ICEs are being deployed in ferries, cargo ships, and small vessels in order to reduce emissions, and to meet the new more demanding environmental policies in coastal as well as global including international and open waters. By March 2025, Norwegian shipyards introduced hydrogen-powered ferries with a 200 km per refuel range, reducing NOx emissions by 60%, demonstrating their practical application in regional marine transport.

Hydrogen ICE Market Share, By Application, 2024 (%)

| Application | Revenue Share, 2024 (%) |

| Automotive | 46.10% |

| Marine | 23.30% |

| Industrial Machinery | 16.40% |

| Power Generation | 14.20% |

Industrial Machinery: Industrial and construction machinery rely on hydrogen ICEs for their high torque output and continuous operation where battery-electric systems are limited. By January 2025, North American construction firms adopted hydrogen ICE excavators and forklifts, reducing fuel costs by 15% and CO₂ emissions by 35%, improving efficiency and sustainability on work sites.

Power Generation: Hydrogen ICEs are used in distributed power systems, backup generators, and renewable energy support infrastructure, providing low-emission alternatives for energy production. By June 2025, Japan and Germany deployed hydrogen ICE generators at renewable energy farms, providing 10 MW auxiliary power for backup, and supporting fossil fuel free, grid-stable, clean energy goals.

Compressed Hydrogen: Compressed hydrogen fuel is utilized on land transport because of its ease of storage, lower price compared to liquid hydrogen, and volume. At higher pressures, hydrogen fuel also has a great energy density. By February 2025, Asia-Pacific compressed hydrogen fuel logistics operators adopted it on trucks and hydrogen fuel regional freight transport was possible. Trucks could travel 500 km on a single fill up and refueling time was reduced by 25%.

Liquid Hydrogen: For long-range, heavy-duty vehicles, liquid hydrogen is preferable as it contains a higher energy density per unit mass. This is also true for aviation and marine transport access. By May 2025, liquid hydrogen was being tested by European aerospace OEMs for ICEs on prototype long-haul aircraft engines. This new advancement of a ranges of 1,000 km per refuel advances the feasibility of hydrogen in aviation.

Hydrogen ICE Market Share, By Fuel Type, 2024 (%)

| Fuel Type | Revenue Share, 2024 (%) |

| Compressed Hydrogen | 55.60% |

| Liquid Hydrogen | 29.10% |

| Hydrogen Blends | 15.30% |

Hydrogen Blends: Hydrogen blending with natural gas or other conventional fuels can transition without full infrastructure changes because of hydrogen blending. This market integration is possible because hydrogen blend emissions and greenhouse gases are reduced significantly. By March 2025, US utility companies had installed 20% hydrogen blend gas turbines. This also proved the feasibility of transitioning gas-powered turbines for power generation, as it had a 15% reduction in CO2 emissions while output energy was the same as the previous 20% gas blend.

Market Segmentation

By Engine Type

By Vehicle Type

By Application

By Fuel Type

By Region