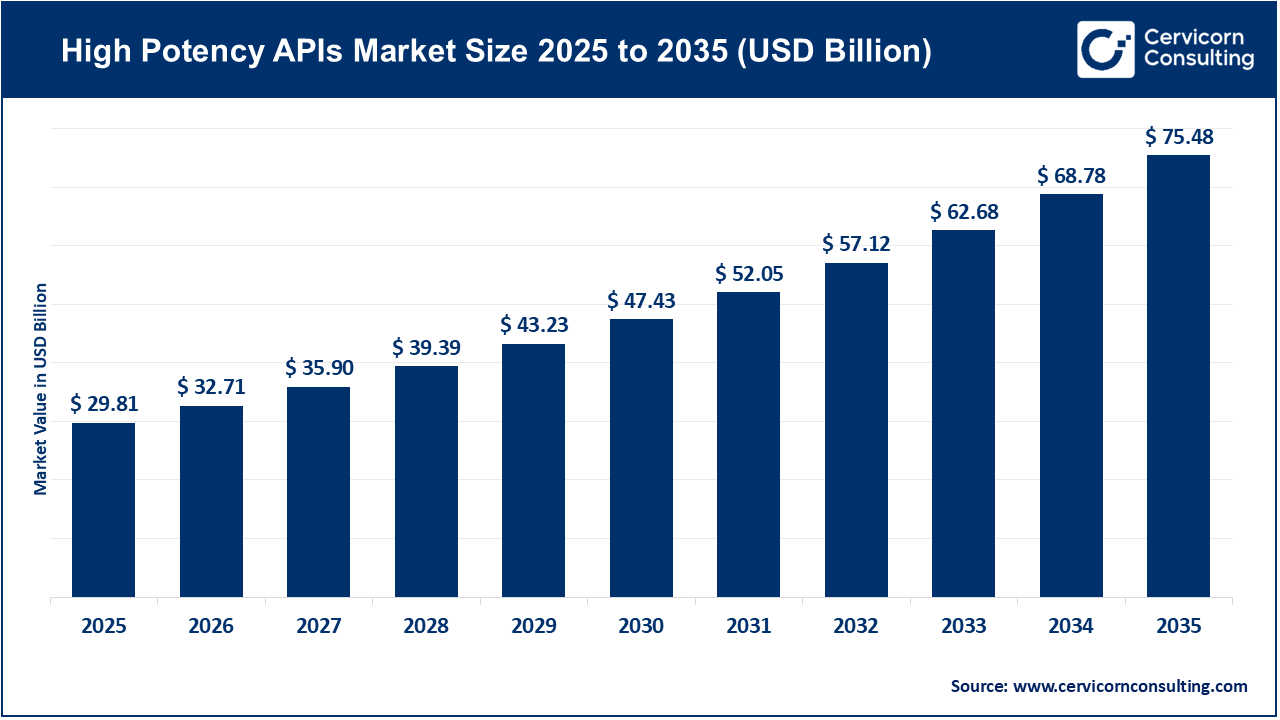

The global high potency APIs market size was valued at USD 29.81 billion in 2025 and is expected to be worth around USD 75.48 billion by 2035, exhibiting at a compound annual growth rate (CAGR) of 9.7% over the forecast period from 2026 to 2035. The high potency API market continues to expand due to increasing numbers of patients who require effective, targeted therapies for cancer and hormone-related disorders. As time passes, more pharmaceutical manufacturers are developing new medicines using high-potency active pharmaceutical ingredients (HPAPIs), leading to an increase in demand for HPAPIs. More importantly, many pharmaceutical companies continue to invest in advanced manufacturing technologies to safely manufacture HPAPIs. As such, the strict regulations regarding the safe handling of HPAPIs have led to improvements in manufacturing processes and equipment used by manufacturers of these compounds. Ultimately, these developments have contributed to an increase in both capacity and the quality of HPAPIs.

A number of other recent developments are also contributing to the growth of the HPAPI market. For example, the expansion of HPAPI manufacturing facilities by multiple pharmaceutical companies, as well as the addition of containment systems to many existing contract manufacturers in anticipation of future contract projects, should support the continued growth of the industry. Furthermore, with an increasing number of new oncolytic therapies starting clinical trials, this will greatly increase demand for HPAPI. Therefore, it appears that the HPAPI market will continue to grow steadily over time.

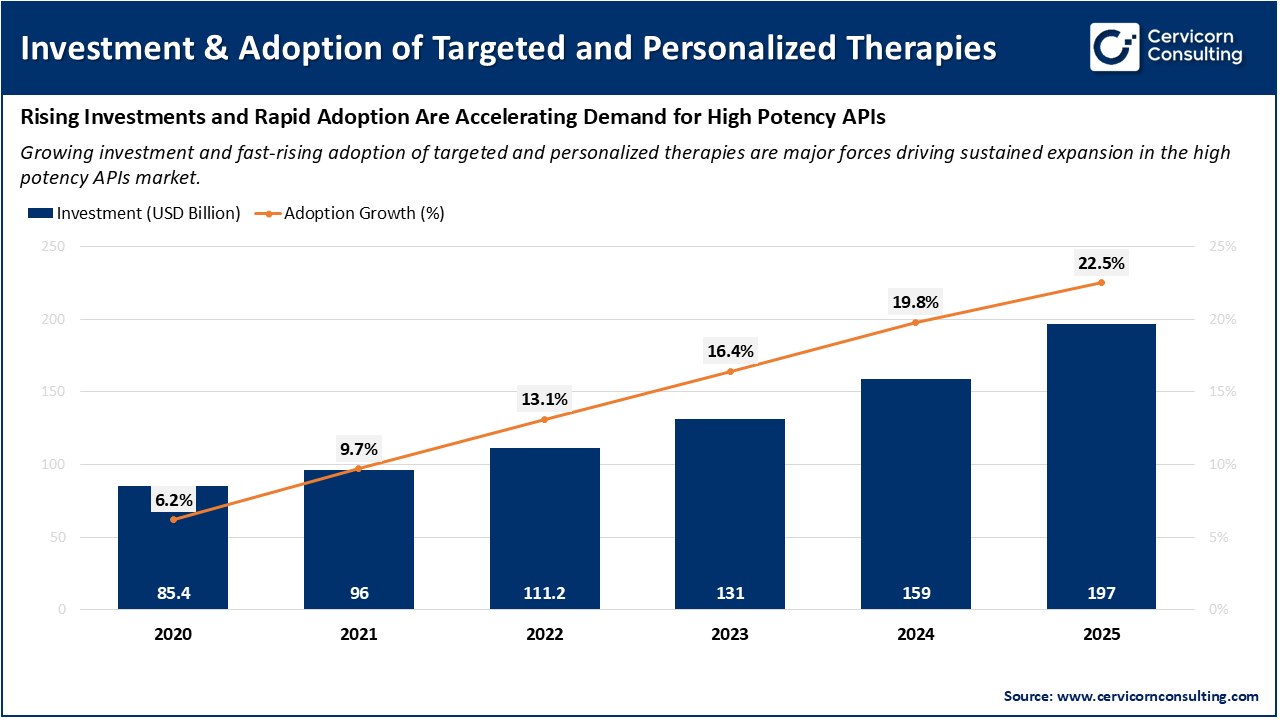

Rising Demand for Targeted and Personalized Therapies Driving the High Potency APIs Market

The increasing need for targeted therapy and personalized therapy is driving the growth of the high potency active pharmaceutical ingredient market as these cutting-edge therapies use active pharmaceutical ingredients that are effective in very low doses. Most modern cancer therapies, antibody-drug conjugates, and hormone therapy rely on highly potent active pharmaceutical ingredients to deliver the therapeutic benefits of strong medications with fewer side effects. Pharmaceutical companies continue to research and develop personalized medications that are appropriate for a patient's genetic or other profile. Therefore, these companies increasingly rely on HPAPIs to ensure the accurate delivery of medication to the target patient population, thus providing their customers with more precise and effective medications. This development in drug development forces manufacturers to increase their production capabilities, invest in enclosed GMP facilities, and increase their reliance on technology to support increased demand. As a result, targeted and personalized therapies will continue to be a major contributor to the growth of the HPAPI market.

1. AGC Pharma Chemicals Expands High-Potency API Production Capacity

The recently offered state-of-the-art manufacturing facility at AGC Pharma Chemicals in Barcelona will have a 30% increase in production capabilities, and the facility will also be able to produce very high potency APIs at OEB5 containment levels. The addition of a manufacturing facility will be a fantastic opportunity for AGC Pharma Chemicals to respond to increasing requests from drug manufacturers to provide API's that are more potent. By supplying higher volumes of high potency APIs to more drug manufacturers AGC Pharma Chemicals will help create a larger marketplace for high potency APIs which will support the growth of the high potency API market and support more sophisticated therapies in oncology and targeted therapies.

2. U.S. Strategic Active Pharmaceutical Ingredients Reserve (SAPIR) Initiative

The U.S. government plans to use its Strategic Active Pharmaceutical Ingredients Reserve (SAPIR) program to enhance access to domestic sources of high-potency APIs, while minimizing reliance on foreign suppliers. The SAPIR program requires federal agencies to establish and maintain reserves of essential pharmaceutical products, in order to support the federal government's mission of protecting and supporting public health through national health security initiatives. The SAPIR initiative helps protect manufacturers' confidence that they will have a secure source for their products, leading to increased investment in domestic production of active pharmaceutical ingredients and enhancing the infrastructure necessary for providing consistent and reliable supply of high potency APIs.

3. SK Pharmteco Launches Dedicated HPAPI Analytical Testing Laboratory

In January 2025, SK Pharmteco launched an upgraded Analytical Testing Laboratory dedicated solely to high potency APIs. This laboratory is designed to improve the accuracy of testing for high potency compounds and provide higher levels of quality control for potent products, as the strength and safety requirements for these compounds usually make them harder to analyze and test accurately. Improving the quality and accuracy of the analytical capabilities associated with high potency APIs will help create a more effective and sustainable high potency API market. Higher quality accurate analytical data will remove many of the barriers faced by those developing complex drug formulations as well as shorten the time associated with getting new products to market.

4. Major New API Manufacturing Investment by Eli Lilly

Eli Lilly invested approximately USD 6 billion to construct a large-scale API manufacturing plant in Alabama, as part of their plan to increase the production of drug ingredients within the United States. The new facility will manufacture small molecule APIs which may contain potent substances. The amount invested into this type of facility indicates the company has significant confidence in future demand for potent drug ingredients, and this investment will help expand the market for high-potency APIs. The establishment of a new domestic manufacturing capability for such drugs decreases the risk associated with global supply chains and supports the continued growth of developing targeted and complex drug therapies.

Report Scope

| Area of Focus | Details |

| Market Size in 2026 | USD 32.71 Billion |

| Estimated Market Size in 2035 | USD 75.48 Billion |

| Projected CAGR 2026 to 2035 | 9.70% |

| Dominant Region | North America |

| Fastest Growing Region | Asia-Pacific |

| Key Segments | Type, Synthesis Type, Manufacturer Type, Therapeutic Application, Region |

| Key Companies | Pfizer, Inc., F. Hoffmann-La Roche Ltd. (Roche), Sanofi S.A., Bristol-Myers Squibb Company, Bayer AG, Novartis International AG, Boehringer Ingelheim International GmbH, Teva Pharmaceutical Industries Ltd., Eli Lilly and Company, Merck & Co., Inc., AbbVie Inc., Viatris Inc. |

The high potency APIs market is segmented into type, synthesis type, manufacturer type, therapeutic application, and region.

The innovative HPAPI segment is a leading segment within the HPAPI market. This type of API is in high demand among pharmaceutical companies, as they are developing a larger share of their pipeline products including HMIs and other specific indications that use highly potent molecules compared to traditional, less potent forms. Innovative HPAPI products are typically used in the development of new oncology drugs and biologics, and they are among the most clinically demanded molecules, which results in a relatively high price point. This segment is further driven by investments from innovator companies in R&D, as well as by pharmaceutical companies in clinical trials, all of which generate substantial revenue that contributes to the overall HPAPI market.

High Potency APIs Market Share, By Type, 2025 (%)

| Product Type | Revenue Share, 2025 (%) |

| Innovative HPAPIs | 61.40% |

| Generic HPAPIs | 38.60% |

Generic HPAPIs represent the fastest-growing segment of the HPAPI market, driven by the continued growth of generic oncology drugs and the increasing need for production capacity of potent compounds by generic manufacturers. Additionally, many governments and healthcare systems continue to drive demand for affordable treatments, leading generic manufacturers to expand their capacity for producing potent compounds. The growth of the generic HPAPI segment is fueled by several factors, including recent expirations of patents on some of the highest-volume, high-potency drugs and the overall expansion of contract manufacturing. As these companies grow, they will attract more customers and generate significant growth in the HPAPI market.

Synthetic HPAPIs are the leading segment in the HPAPI market. Many small molecule oncological drugs and hormone therapies have been developed using synthetic methods. Synthetic HPAPIs use established technologies and industry-standard processes to manufacture and distribute APIs to customers. The scalability, cost-effectiveness, and ease of quality verification associated with synthetic HPAPIs make them the preferred option for manufacturing and distributing many high-potency therapeutic agents.

High Potency APIs Market Share, By Synthesis Type, 2025 (%)

| Synthesis Type | Revenue Share, 2025 (%) |

| Synthetic HPAPIs | 69.80% |

| Biotech HPAPIs | 30.20% |

Biotech-derived HPAPIs are fastest growing segment of the market. Biologics and antibody-drug conjugates (ADCs) are rapidly gaining acceptance and expanding the range of therapies available to treat various diseases, particularly in the evolving field of immuno-oncology, where biotech-derived payloads are used for targeted therapy, individualized treatment, and the development of biologics. Advances in bioprocessing, cell cultures, protein engineering, and other biopharmaceutical technologies are enabling new applications for biotech-derived HPAPIs as the market grows rapidly, creating significant growth opportunities for the future.

Captive manufacturers are the leaders in the market for HPAPIs, because many of the large pharmaceutical companies prefer to control the manufacture of HPAPIs that are sensitive in nature to ensure they maintain the quality of the drug product, the confidentiality of their intellectual property (IP), and the highest safety standards. Most captive manufacturers possess the most advanced containment technologies, have established manufacturing infrastructures globally, and can efficiently respond to global demand for high potency APIs while protecting their proprietary formulation.

High Potency APIs Market Share, By Manufacturer Type, 2025 (%)

| Manufacturer Type | Revenue Share, 2025 (%) |

| Captive Manufacturers | 64.70% |

| Merchant Manufacturers | 35.30% |

The merchant manufacturer segment is the fastest growing segment in the high potency API market. The fastest growing segment is merchant manufacturers due to the growing trend to outsource HPAPI manufacturing. Many drug developers do not have access to specialized HPAPI manufacturing facilities; as a result, they rely on contract manufacturers that can offer high containment manufacturing capabilities. As the need for developing targeted therapies and drugs for the treatment of cancer continues to increase, merchant manufacturers are expanding their physical manufacturing capabilities to meet this growing demand.

The oncology segment continues to dominate the market, as most cancer-related therapies require highly potent molecules that can effectively kill tumor cells at very low doses. As a result, with the rapid increase in the global cancer burden and the continual launch of new oncology treatment drugs, this segment's dominance will continue to increase for many years. Additionally, many new, high-value therapy classes are emerging within the oncology segment that have been developed using HPAPIs (ADCs and cytotoxics) and, as a result, there is an increase in the use of HPAPIs within oncology.

High Potency APIs Market Share, By Manufacturer Type, 2025 (%)

| Manufacturer Type | Revenue Share, 2025 (%) |

| Oncology | 71.20% |

| Hormonal Imbalance | 14.60% |

| Glaucoma | 4.80% |

| Others | 9.40% |

Hormone replacement therapy (HRT) has emerged as one of the fastest-growing high-potency API markets. The therapies for menopause, thyroid disorders, and reproductive health are all examples of hormone imbalance therapies that use potent steroidal/non-steroidal APIs, which are prescribed in very small amounts. The overall prevalence of women undergoing HRT, in addition to the rapid expansion of diagnostic rates and increased deployment of hormone replacement therapies, provides strong momentum by which to support the high growth potential of this market segment.

The high-potency APIs market is segmented into various regions, including North America, Europe, Asia-Pacific, and LAMEA. Here is a brief overview of each region:

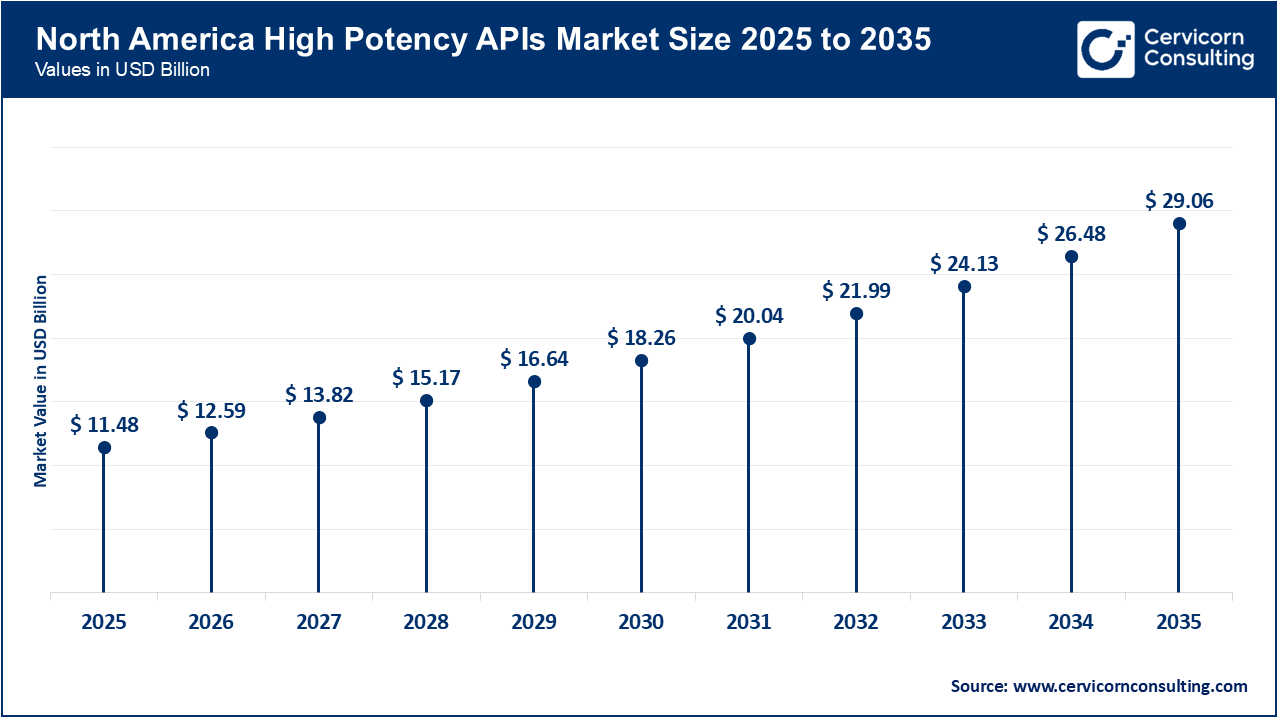

The North America high potency APIs market size was valued at USD 11.48 billion in 2025 and is expected to reach around USD 29.06 billion by 2035. The North America is primary contributor to the market, with its emphasis on oncology and targeted therapies, rapid increase in the amount spent on healthcare, and many pharmaceutical innovators. Availability of advanced manufacturing infrastructure, a high level of safety regulation, and an increase in the use of high-potency ingredients within new products are the major drivers for growth in this region, as is the increased governmental focus on strengthening the pharmaceutical supply chain and enhancing domestic production of APIs. An increase in the number of clinical studies and technical advances in containment technology have also positively impacted the growth of the high-potency API market.

Recent Developments:

The Asia-Pacific high potency APIs market size was estimated at USD 8.29 billion in 2025 and is forecasted to surpass around USD 20.98 billion by 2035. The Asia-Pacific region is the leading region, due to increasing pharmaceutical outsourcing, lower production costs, and rapid development of drug manufacturing in local markets. India and China are the world’s leading suppliers of generic high-potency APIs, while Japan leads in terms of innovative & biotech drug development. Increasing government investments in healthcare, rising incidence of cancer, and systems for supporting domestic API production are driving growth. In addition, the transitions from dependence to self-reliance for APIs in Asian countries are boosting the growth of the market.

Recent Developments:

The Europe high potency APIs market size was accounted for USD 7.51 billion in 2025 and is predicted to hit around USD 19.02 billion by 2035. Europe is a key player in the production of high-potency API due to its regulatory framework, the presence of a high number of contract development manufacturing organizations (CDMOs), and continuing investments into advanced pharmaceutical manufacturing techniques. Europe is witnessing significant growth in the production of specialty medications, particularly cytotoxic medications and the acceptance of innovative manufacturing technologies. European CDMOs provide world-class containment facilities that have led to the availability of HPAPIs being produced through global outsourcing. The high potency APIs market is experiencing additional growth through sustainability initiatives and the level of support from European governments for pharmaceutical manufacturing.

Recent Developments:

High Potency APIs Market Share, By Region, 2025 (%)

| Region | Revenue Share, 2025 (%) |

| North America | 38.50% |

| Europe | 25.20% |

| Asia-Pacific | 27.80% |

| LAMEA | 8.50% |

The LAMEA high potency APIs market was valued at USD 2.53 billion in 2025 and is projected to reach around USD 6.42 billion by 2035. The LAMEA market is rising due to factors like the increasing level of investment in healthcare, increasing number of pharmaceutical brand manufacturers, and the increased demand for oncology and specialty medicines. The Middle Eastern nations are investing in developing their local capabilities as a way to be less dependent on imports while the Latin Nations are enhancing regulatory processes and improving manufacturing capacities gradually. The overall size of the market is less than that of other areas, however, the changing health systems in place and the increasing number of health care professionals who have knowledge of targeted therapies are allowing for continued growth and improvement of the market in this area.

Recent Developments:

Pfizer, Inc.

F. Hoffmann-La Roche Ltd. (Roche)

Sanofi S.A.

By Type

By Synthesis Type

By Manufacturer Type

By Therapeutic Application

By Region