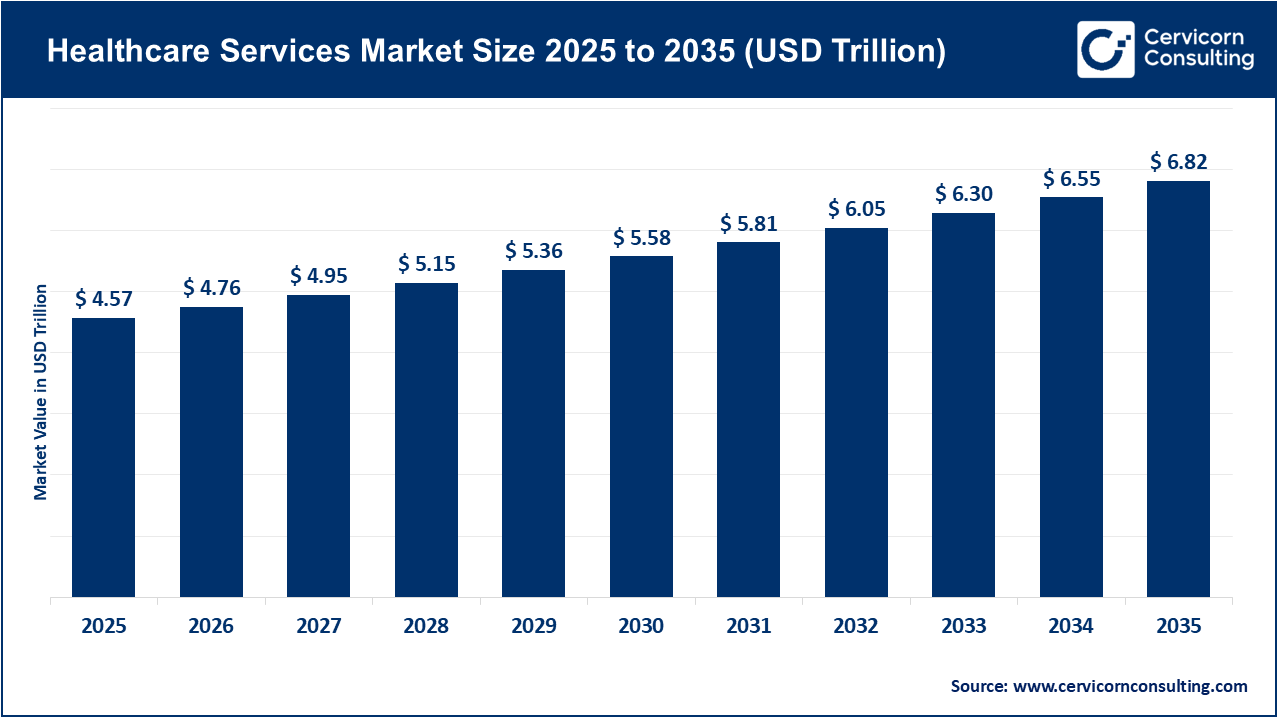

The global healthcare services market size reached at USD 4.57 trillion in 2025 and is expected to be worth around USD 6.82 trillion by 2035, exhibiting at a compound annual growth rate (CAGR) of 4.1% over the forecast period from 2026 to 2035. The expansion of healthcare services market is owing to the addition of value-based services such as, home sample collection, telehealth and integration of artificial intelligence in diagnostics.

The healthcare services market is a vast spread sector that revolves around medical, diagnostics, home healthcare and other care providers and their offerings. This market involves services taking from direct patient care, specialized services to diagnostic and support services. The market’s expansion is supported by various demographics with aging populations and rising prevalence of chronic diseases.

Moreover, awareness and access of health and wellness policies by governments and private sectors’ coverage creates strong potential for the market to boom. Players within the healthcare services market range from medical equipment manufacturers to drug manufacturers. Industry majors such as the U.S., Germany, Japan, India, Singapore, Canada and UAE are observed to sustain their shares in the market owing to high capital power, government support and regulatory support.

Public Spending and Policy Support for Healthcare Services:

| Country | Public Spending on Healthcare | Key Highlights |

| India | 1.9% spend of total GDP | Ministry of Health & Family Welfare allocated budget with 13% increase. |

| United States | 17.6% spend of the total GDP | National Health Expenditure grew to $4.9 Trillion since 2023 |

| United Kingdom | Government healthcare spending in 2023 remained £252bn | Between 2023-2024, Dept. of Health & Social Care spending remained £188.5bn |

| Japan | 11.5% spend of total GDP | Long-term care integration remained major concern in 2023 while public insurance finances dominated |

Digitization of Patient Data Management

Digitization of patient data has come up as a major driver for growth in the global healthcare services market. As healthcare providers transition from paper-based files to integrated electronic health records, they gain instant access to patient histories, diagnostics, prescriptions, and imaging results. This improves accuracy, reduces clinical errors, speeds up diagnosis, and enhances care coordination across departments. Digitized workflows also improve billing accuracy, strengthen compliance, and boost operational efficiency, allowing hospitals and diagnostic centres to serve more patients with better quality and lower administrative burden.

The global digital transformation in healthcare market is projected to reach USD 1,404.35 billion by 2034, highlighting how essential data-driven systems have become for modern healthcare delivery.

Countries such as the United States, the United Kingdom, Germany, South Korea, and Singapore are at the forefront of this transition, supported by advanced health IT infrastructure and national-level digital health policies. The shift to digital patient data also enables growth in telemedicine, remote monitoring, AI-supported diagnostics, and personalized care, creating new demand for connected healthcare services globally.

High Cost of Healthcare Services

In many areas, especially developing and underdeveloped regions, high cost of services have resulted in reduced access and delayed care. More worsened outcomes are followed by; high number of underinsured people, erosion of solidarity and reliability and quality concerns. Thereby, high cost of healthcare services acts as a major hindering factor for the market. When services become unaffordable, the gap between insured and uninsured populations widens.

Rural, elderly, and low-income groups defer treatment, resulting in poorer health outcomes and a smaller addressable market for providers. Moreover, the increased inequality caused medical debt which may hinder the number of preventive screening and early diagnosis processes. Whereas, focus on greater healthcare insurance coverage and boosting service utilization can significantly improve the business model for offering end and patients simultaneously.

Detection of Diseases with Machine Learning

AI algorithms and its models such as machine learning and NLP can analyse vast amounts of medical data and images such as pathology reports; that too with utmost accuracy, assisting doctors in early detection. A recent deep learning model, convolutional neural network has proven to carry the ability to analyse medical images like MRIs and CT scans to detect abnormalities that might be missed by humans.

This analysis and early detection with ML can lead to better treatment outcomes and increased survival rates. Considering the aftermath of COVID-19 pandemic that turned out in rising number of depressed population; Tingting Zhao, a professor at University of Rhode Island’s, in November 2025 conveyed that by applying machine learning in textual datasets it is possible to predict the early signs of depression with notable precision.

Regulatory Barriers

Regulatory barriers slow market expansion by increasing compliance costs, delaying approvals for new services, and limiting the entry of innovative care models such as telehealth or digital diagnostics. They also create operational uncertainty for providers, making it harder to scale services, attract investment, or introduce advanced technologies in a timely manner.

In 2023, India’s government issued multiple notices to major e-pharmacy platforms such as PharmEasy, Tata 1mg, and Amazon Pharmacy, warning them against selling medicines online without a clear regulatory framework. This regulatory ambiguity forced several companies to halt certain operations, delay investments, and scale back expansion. Because approvals and licensing rules were unclear, the entire digital pharmacy segment, which was growing rapidly faced operational uncertainty, reduced investor confidence, and slowed market growth.

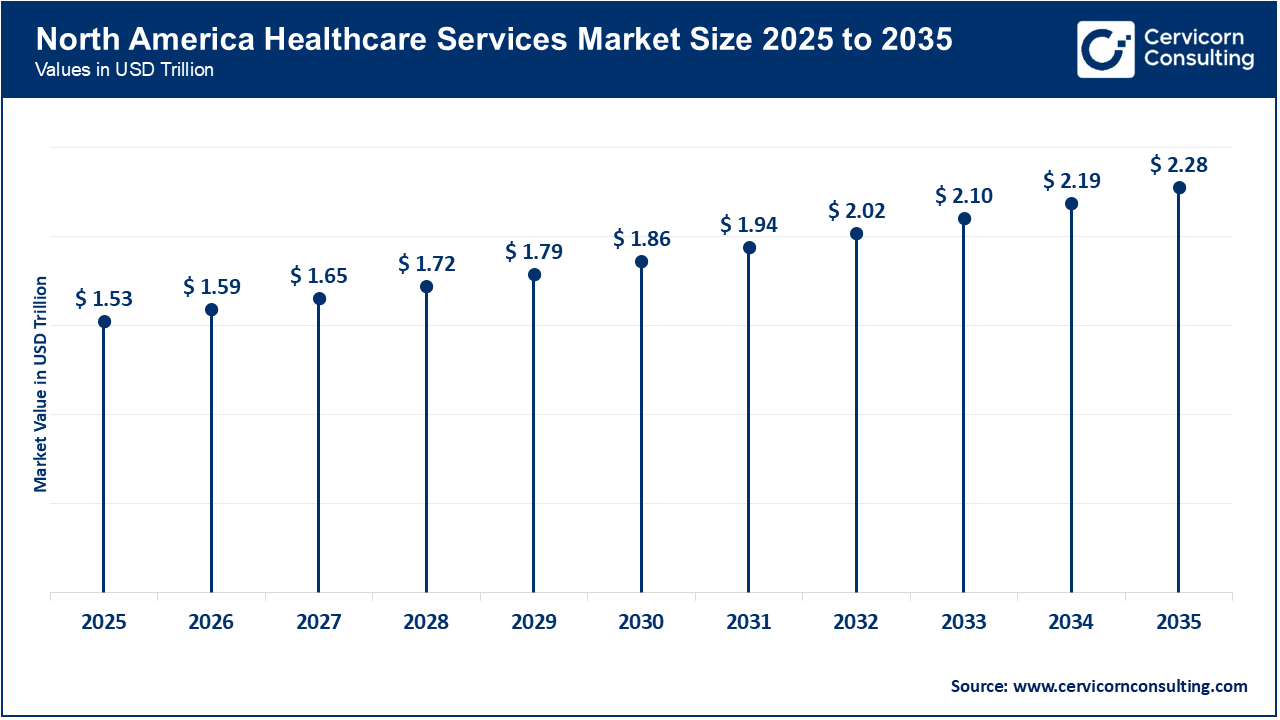

The North America healthcare services market size valued at USD 1.53 trillion in 2025 and is anticipated to reach around USD 2.28 trillion by 2035.

North America held the largest share of healthcare services market in 2025. Heavy investments in research and development activities, especially in the biopharma sector is a catalyst for the market’s major share in the market. Regulatory support and initiatives in the rehgion such as U.S. Affordable Care Act creates a sustainable factor for the market to grow.

The rising focus on value-based care in U.S. and Canada encourages investments in innovative solutions as well as operational efficiency. In last decade, the public spending in North American countries has boosted immensely, offering rapid adoption of advanced solutions, expansion of end-users and service offerings.

Key Dynamics of the U.S. Healthcare Services Market:

Holding the largest capita in the region, U.S. becomes the major shareholder of the North American healthcare services market. The market is supported by strong R&D, technological upfront and aging population in the country. According to the expert’s outlook, the growth of managed care providers, booming dental sector, M&A and revenue diversification by the rise of services will continue to rebound the opportunities in the U.S. till 2030.

On the other hand, the market in the United States is also compromised due to regulatory barriers, high upfront cost of healthcare services and lack of skilled nursing staff. According to Cervicorn Consulting’s reports, in 2024, 47.8% of hospitals in the U.S. reported a vacancy rate for nurses higher than 10%. However, medtech innovation and AI’s integration plays a clear role in tackling with such challenges.

The Asia-Pacific healthcare services market size estimated at USD 1.10 trillion in 2025 and is projected to surpass around USD 1.64 trillion by 2035.

India's hospital and diagnostics landscape is evolving rapidly, marked by aggressive expansion among private healthcare providers, particularly across Tier 2 and Tier 3 regions. The healthcare sector is a major employer as per budgetary data, over 7.5 million people are employed in Indian healthcare (including hospitals, clinics, ancillary services). Major hospital chains continue to report strong occupancy levels, even as the average patient stay has shortened, reflecting improved efficiency and sustained demand.

Key performance indicators such as ARPOB and EBITDA per bed have strengthened due to healthier patient volumes and tighter cost controls. Notably, brownfield projects where existing facilities are upgraded are delivering stronger returns than entirely new greenfield developments.

On the diagnostics side, the sector has grown more than twofold since FY17, yet India still trails global standards in per-capita testing and radiology access. The industry is steadily moving away from fragmented standalone labs toward larger, organized chains, with deeper reach across Tier 2–4 cities and rising interest in preventive and wellness testing.

Key Indian Initiatives for Healthcare Services:

Healthcare Services Market Share, By Region, 2025 (%)

| Region | Revenue Share, 2025 (%) |

| North America | 33.40% |

| Europe | 26.20% |

| Asia-Pacific | 24.10% |

| LAMEA | 16.30% |

The europe healthcare services market size accounted for USD 1.20 trillion in 2025 and is forecasted to reach USD 1.79 trillion by 2035.

Europe is observed to grow at a notable rate in the healthcare services market. Along with the technological adoption and rise in chronic diseases, the market in European countries is seen to expand with the government’s spending and rising number of healthcare coverage insurance. However, roughly 30% of current healthcare expenditure in the EU is covered by government schemes, while compulsory health insurance accounts for over 51%. On the other hand, a large share of public health budgets is channeled into hospital-based care. For example, in some EU countries like Denmark, hospital services account for more than 5% of GDP.

Considering the rising number of healthcare coverage insurance, Spain planned to have 99.5% of its population covered by the public health system in 2025. Whereas in France, 96% of people carry some form of complementary private insurance.

In addition, the integration of digital health solutions is a major factor for the growth of healthcare services market in Europe. Healthcare systems are transitioning to value-based care in order to offer efficiency in the cluster. Collaborations among researchers, companies, and patient groups are also fostering innovation, especially in rare disease research.

The cardiology accounted for the largest share in 2025, driven by the worldwide surge in cardiovascular diseases. Rapid urbanization, sedentary lifestyles, and rising obesity rates have intensified the global cardiac burden, boosting demand for advanced diagnostic imaging, cardiac interventions, and specialized hospital units. As countries continue prioritizing cardiac care infrastructure, the cardiology segment remains a major revenue contributor across both developed and emerging markets.

Psychiatry and mental health services are projected to expand at the fastest pace globally, supported by growing awareness, workplace stress, and government-led mental health policies. Digital therapy apps, tele-counselling platforms, and AI-powered behavioral health tools are enabling wider access, bridging gaps in regions with limited mental health resources. With mental health disorders now recognized as a leading global disease burden, this segment is expected to witness sustained, high-velocity growth through the forecast period.

Diagnostic services held the largest share by patient need in the global market in 2025, underscoring the universal shift toward preventive and early-stage detection. Growth in molecular testing, imaging advancements, and point-of-care diagnostics strengthened patient volumes worldwide. As healthcare providers strive for faster, more accurate decision-making, diagnostics remain a critical foundation of clinical workflows and one of the most heavily invested areas across regions.

Chronic disease management is poised for notable growth globally, fueled by the rising prevalence of long-term conditions such as diabetes, COPD, cancer, and hypertension. The expansion of remote monitoring solutions, personalized care pathways, and integrated care models is helping providers deliver ongoing support across geographies. As health systems worldwide transition from reactive treatment to proactive disease control, chronic disease management is emerging as a core growth engine.

Public hospitals continued to lead the global healthcare services market in 2025 due to large patient volumes, government-backed funding, and widespread accessibility. Many countries, especially in Asia, Latin America, and the Middle East are expanding public hospital capacity to meet rising healthcare needs. This heavy investment in infrastructure, workforce development, and specialty units reinforced the segment’s dominant position.

Telehealth platforms are set to register the fastest growth globally, as virtual consultations, remote diagnostics, and AI-driven monitoring become essential components of healthcare delivery. Accelerated by pandemic-driven behavioral shifts and strengthened by improving digital infrastructure, telehealth is gaining momentum across both mature and emerging markets. With its ability to reduce healthcare costs and expand reach to underserved populations, telehealth is becoming a major catalyst for global market expansion.

Hospital Chains

Diagnostics & Laboratory Service Providers

Integrated Healthcare Networks & Managed Care

Digital Health & Technology-Driven Service Providers

By Disease Area

By Patient Need

By Healthcare Provider Type

By Region