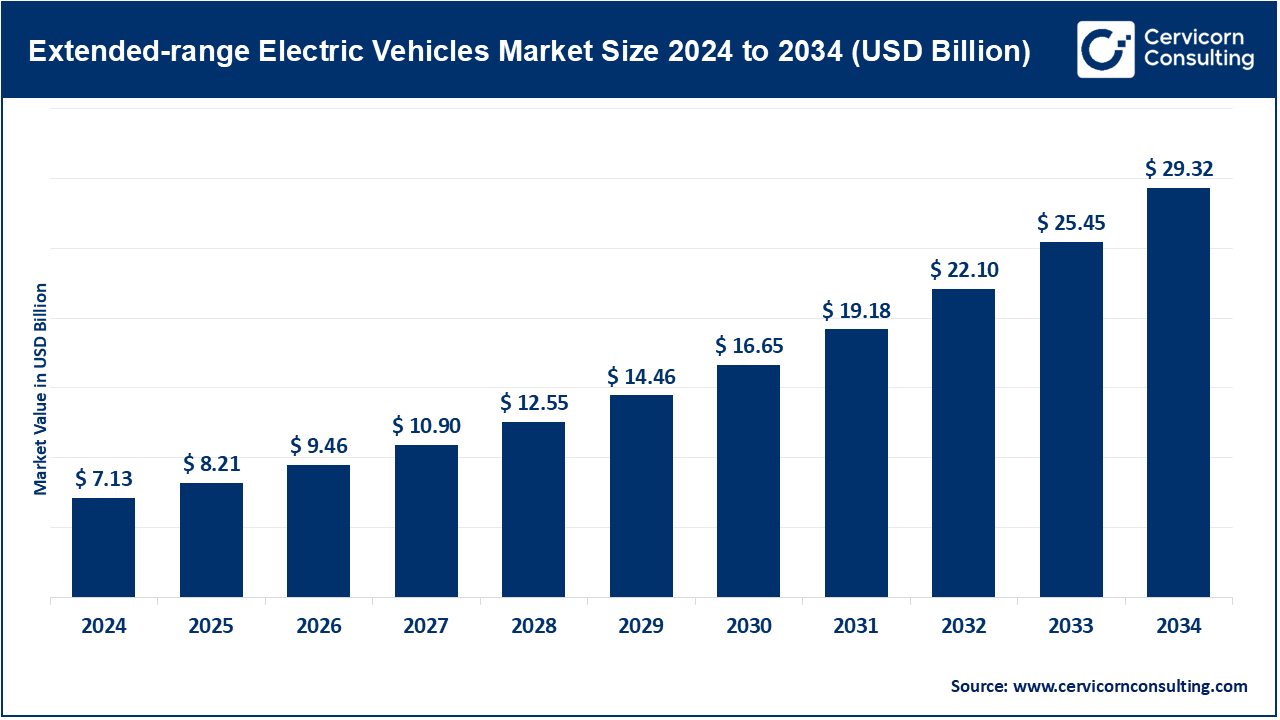

The global extended-range electric vehicles market size was valued at USD 7.13 billion in 2024 and is anticipated to reach around USD 29.32 billion by 2034, growing at a compound annual growth rate (CAGR) of 15.2% over the forecast period from 2025 to 2034. The extended-range electric vehicles (EREV) market is growing rapidly as demand rises for vehicles that offer both longer driving ranges and greater energy efficiency. Acting as a bridge between traditional hybrids and fully electric vehicles, EREVs are benefiting from advancements in battery technology particularly in cathodes, anodes, and electrolytes which enhance performance, charging speed, and safety. This innovation not only boosts the appeal of EREVs but also strengthens their role in driving the global shift toward cleaner, electrified transportation.

Extended-range electric vehicles or EREVs is a type of hybridized vehicles that mainly has the qualities of being an electric vehicle with a backup generator, an internal combustion engine (or ICE). The wheels are powered by the electric motor (operating on energy stored in a battery) that allows zero-emission driving with a degree of limited range (usually 40-80 miles). The ICE turns off when the battery runs out, but then will still turn back on when it cannot power the wheels directly but instead to make electricity and provide longer distances. It also removes range anxiety but retains the advantages of electric propulsion in commuters. The increased fuel efficiency and reduced emissions compared to standard cars and higher flexibility to travel long distances makes EREVs a successor to fully electric cars and traditional cars with internal combustion engine.

Report Scope

| Area of Focus | Details |

| Market Size in 2025 | USD 8.21 Billion |

| Expected Market Size in 2034 | USD 29.32 Billion |

| Projected CAGR 2025 to 2034 | 15.20% |

| Dominant Region | Asia-Pacific |

| Key Segments | Vehicle Type, Range, Battery Type, Propulsion Type, End-User, Region |

| Key Companies | Li Auto Inc., BMW AG, Toyota Motor Corporation, General Motors (GM), BYD Auto Co., Ltd., Ford Motor Company, Stellantis N.V., Hyundai Motor Company, Honda Motor Co., Ltd., Mercedes-Benz Group AG, Nissan Motor Corporation, Volvo Cars |

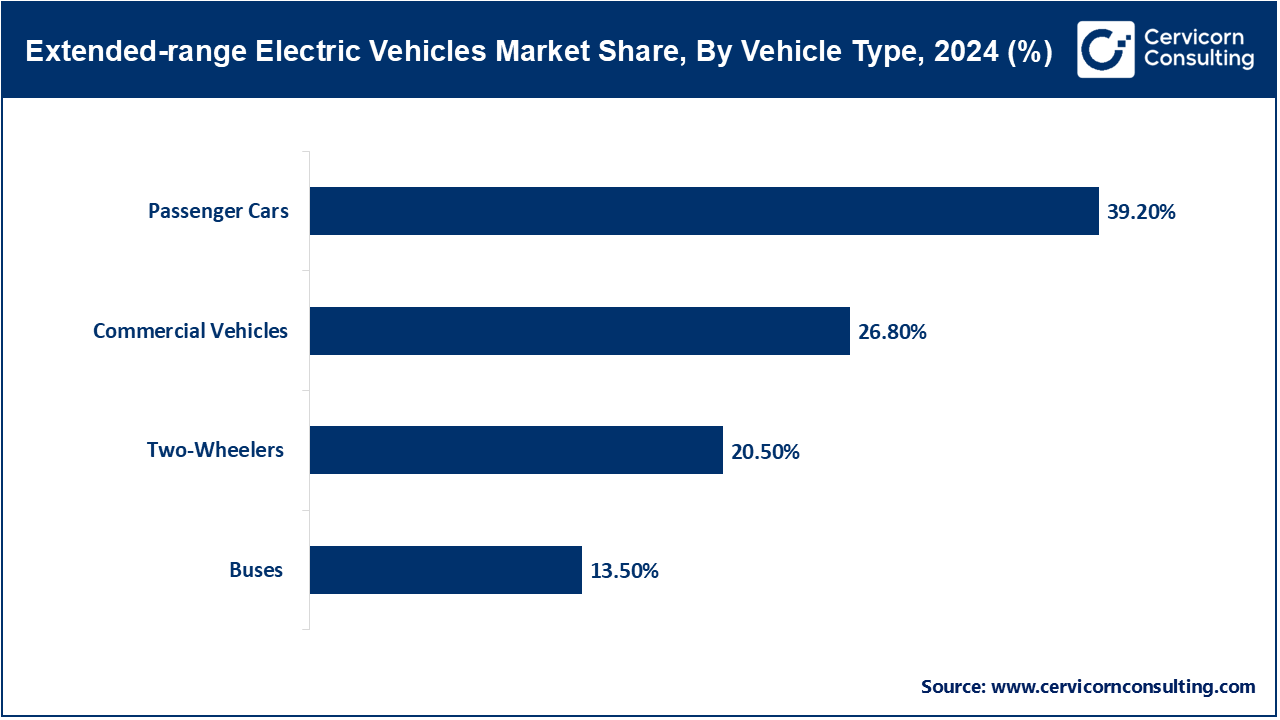

Passenger Cars: The passenger cars segment has generated highest revenue share. Passenger cars are those vehicles that are light on duty and are mainly meant to be used by individuals and on their day-to-day commutation. Rides in this segment contain long-range electric powered with backup fuels options. In November 2024, Li Auto announced its latest extended SUV developed to accommodate small families called Li L9 with monthly sales hitting 47,000 units. The model is also a combination of smart technology with over 300-mile electric range, which is regarded as a microcosm of the increasing demands of family-friendly EREVs that are luxurious in China and even in other states.

Commercial vehicles: Commercial vehicles may also refer to the use of trucks or vans in carrying out logistics, transportation of goods, or to offer services. There are REVs that will minimise fuel consumption in urban distribution and provide range flexibility. In March 2023, Ford Pro introduced an extended-range version of E-Transit Custom to serve the fleet customers in Europe. This autonomous van will be useful on a longer city delivery runs, and helps ensure that by 2025, two-thirds of Ford commercial fleet sales will be electrified.

Two-Wheelers: These two systems include the electric scooters and motorcycles that are gaining popularity in terms of mobility in urban and semi-urban areas. EREVs of this segment have small combustion engines as backup. In August 2023, Ultraviolette, an Indian startup, introduced the battery-powered variant of its F77 Recon (high-performance long-range electric bike with 307 km (191 mi) of range per charge). It is not hybridized, but it still indicates the development of a higher-range electric bikes, and dual-battery set-ups are now under discussion of hybridization.

Buses: EREV buses are used in the public transportation systems and are a hybrid use of electric motors and combustion engines over the extended operational routes. The same year in January, Yutong Bus supplied Latin American cities with 500 extended-range electric buses; this stepped in to help reduce the reliance on fossil-fuel basis. These buses had been designed with a superior battery-swapping, hybrid technologies that could fit longer routes within the cities intercity.

Up to 150 Miles: This category of range is aimed at the city commuters that have a short daily commute and frequent access to charging. In April 2023, the Note Aura E-Power of Nissan became popular in Japan, featuring less than 150 miles of mixed gas-electric range with the help of a hybrid system. By the end of 2023, the model had sold more than 100,000 units, demonstrating that even limited-range EREVs could gain urban consumers, unless they are also accompanied with fuel range backup and reliability.

151-300 Miles: The 151-300 miles segment has recorded highest revenue share. These category of vehicles are used in mixed roads, both the city and highway roads and give a balanced ability of traveling using electricity and some few times fuel. Toyota started the sale of another upgrade of its Prius Prime in July 2024, having 220-mile electric range and enhanced battery chemistry. The car is targeting the drivers, who want to be efficient but do not necessarily want to charge publically.

More than 300 Miles: EREVs with a range in excess of 300 miles will be attractive to intercity customers as well as commercial customers who require a high level of autonomy. In October 2024, CATL presented a new generation of EV batteries to be used in long-range hybrids with more than 400 miles. Li Auto and NIO test vehicles have the battery on trial. In the face of growing pressure to replace EVs at long distances, this segment is catching the attention of automakers.

Lithium-ion: The lithium-ion battery segment accounted for a largest revenue share. Lithium-ion is a very common energy density employed in the EREVs. It is also efficient in recharge. Following the Ultium lithium-ion cells joint venture with GM and LG, the joint venture entered commercial production of the cells optimized to hybrid applications in December 2024. The cells are used in several EREV platforms Cadillac and Chevrolet brands. The strategy of their modular construction serves to balance cost satisfaction and performance in mid- and high-end EREVs, allowing transition to the production of more lithium batteries.

Nickel-Metal Hydride (NiMH): NiMH batteries are thermally more stable and their lifespan is long, although their energy density is lower than lithium-ion. Toyota still incorporates NiMH into other derivative or EREV varieties because they are reliable. In the middle of 2023, Toyota also announced an improved NiMH packs treating more fleet-oriented hybrid vehicles models, increasing regenerative braking capability. NiMH technology is not as popular in range-intensive applications, but remains in use in lower cost EREV products where dollar and energy longevity are paramount over energy density.

Solid-State Batteries: Solid-state batteries are being developed with increased energy storage and safety offered by removing the liquid electrolyte in place of solid materials. Quantum Scape made more progress towards commercializing, recording successful solid-state pilot tests in the longer-range hybrid modules in February 2025. Such cells were denser by 30 percent and could charge quicker. Car companies such as VW and BMW intend to integrate in the high-end EREV after 2026, to jump the thermal boundaries and increase the range to greater than 350 miles with further stability.

Others: This consists of new battery chemistries such as sodium-ion, lithium-ferrous phosphate, and hybrid composite, which are applicable in niche EREV models. By June 2024, BYD had adopted LFP based hybrid packs for its Qin Plus DM-i extended-range sedan. The battery has low cost, fire resistance, and an electric range of 120+ miles, which is suitable in the Asian markets. Technology advances in alternative chemistries are increasing affordability and safety throughout the lower priced EREV market to world markets.

Hybrid Series: The series hybrid segment accounted for the highest portion of the market's revenue. Series hybrid EREVs use a combustion engine only to charge battery, not drive the wheel. In September 2023, BMW unveiled the XM SUV with a series hybrid set up that provides more than 50 miles of pure electric operation as well as a performance-focused fuel generator. The setting enhances efficiency of fuel in the city cycles. This is a very powerful powertrain that is finding new popularity among luxurious automakers aimed at meeting the emission standards and performance harmony.

Extended-range Electric Vehicles Market Revenue Share, By Propulsion Type, 2024 (%)

| Propulsion Type | Revenue Share, 2024 (%) |

| Series Hybrid | 40.60% |

| Parallel Hybrid | 32.90% |

| Series-Parallel Hybrid | 26.50% |

Parallel Hybrid: In parallel hybrids, engine and the motor can drive the wheels independently allowing the car to optimize the usage of fuel or electric power depending on the condition. In May 2023, Honda also introduced its i-MMD platform to CR-V EREVs in the U.S., this time a two-motor parallel hybrid. This enabled it to have more than 42 mpg combined fuel consumption and a wider change of gears. The configuration is ideal to people who require flexibility on different terrains and longer journeys.

Series-Parallel Hybrid: Series-parallel hybrid also combines the two modes but it presents flexibility in converting them from one method to the other depending on efficiency or demand. In July 2024, Toyota upgraded its Hybrid Synergy Drive to extended-range applications in Europe so that it can fully control power sources more wisely. The updates are meant to save energy in high population urban areas and motorways. In most mid-range EREVs, the series-parallel hybrids are default simply because of the balance between complexity and adaptive power control.

The extended-range EV market is segmented into several key regions: North America, Europe, Asia-Pacific, and LAMEA (Latin America, Middle East, and Africa). Here’s an in-depth look at each region.

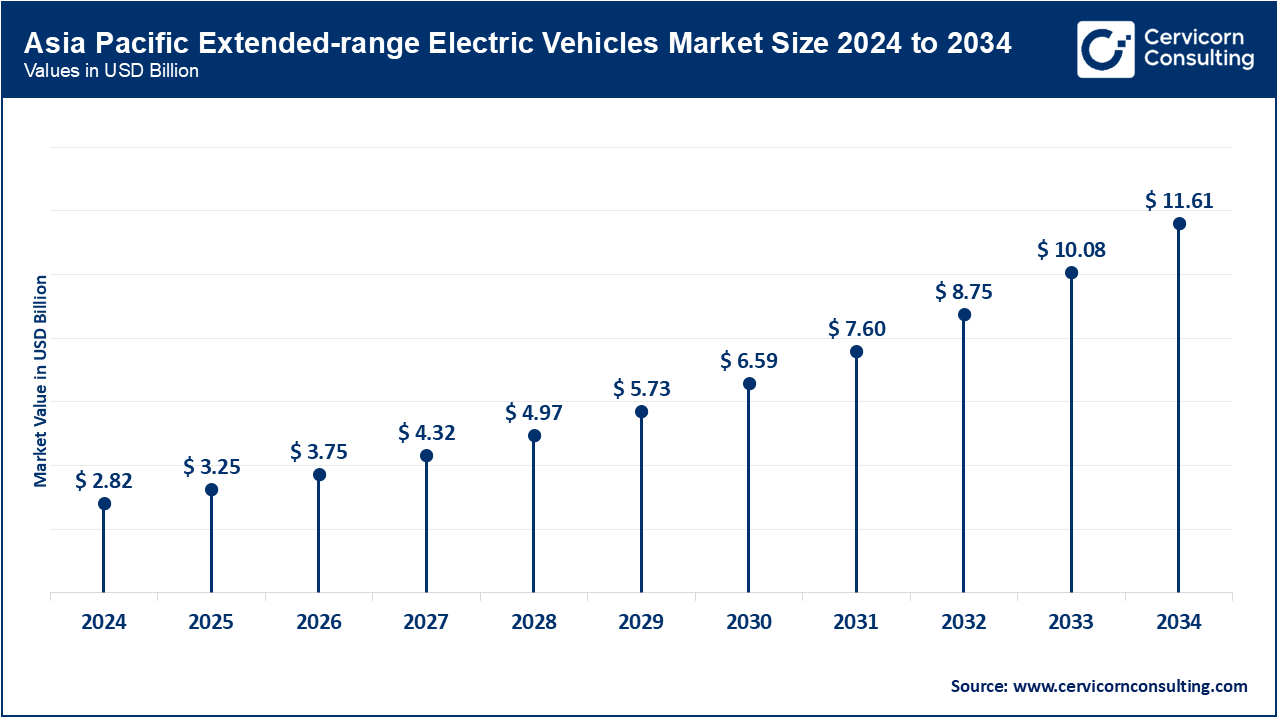

Asia-Pacific dominates the EREV market with high production, and government support, and demand in the big cities. In 2024, Li Auto sold more than 400 thousand EREVs in China. In 2023 Hybrid production was increased in Japan by Toyota and a new EREV SUV was launched in Korea by Hyundai. In 2024, India will host VinFast USD 2 billion hybrid plant. In 2023, Australia and New Zealand introduced hybrid incentives and in 2025, Taiwan increased the EREV elements.

North America is an enormously significant marketplace in the EREVs due to the increase in environmental awareness along with the government subsidies as well as presence of good R&D infrastructure. The territory spans the U.S., Canada, Mexico and more into commercial and personal vehicle electrification. In March 2023, General Motors reported the introduction of long-range variation of Chevrolet Blazer EV in the U.S. that features more than 320 miles of all-electric range. In the meantime, the Lion Electric of Canada also increased its manufacturing of hybrid school buses in April 2024. The development of EV assembly-lines (including hybrid platforms) in Mexico was strengthened in May 2023 when Ford expanded its operation in Hermosillo.

Extended-range Electric Vehicles Market Revenue Share, By Region, 2024 (%)

| Region | Revenue Share, 2024 (%) |

| North America | 28.20% |

| Europe | 25.40% |

| Asia-Pacific | 39.60% |

| LAMEA | 6.80% |

Europe has a large market, which is boosted by low emission zones, strict emission requirements and increased use of hybrids. In July 2022, BMW introduced the BMW XM SUV to Germany with 50-mile pure electric range. In November 2023, France set aside 200 million Euros to be spent on hybrid buses. The Vauxhall brand of the United Kingdom announced an extended-range Astra in May 2024. In 2023, Italy and Spain opened up EREV incentives. With the help of hybrid imports and mobility programs, Russia and the Netherlands increased their imports in 2024.

LAMEA has increased potential of EREV with the increase in fuel expenses and local regulations. CAOA of Brazil collaborated with Chery in 2022 in the assembly of local hybrids. In April 2023, the UAE started the Green Mobility Program to sustain EREV taxis and fleets. In February 2025, South Africa invested 1.5 billion dollars in the upgrade of hybrid manufacturing. Infrastructure deficiencies remain, but EREVs are useful in between steps in the mobility ecosystem of the region undergoing transformation.

Extended-range EV—Li Auto Inc., BMW AG, Toyota, and GM are shaping the market through platform innovation, hybrid efficiency, and performance upgrades. In January 2024, Li Auto crossed 400,000 EREV sales with its L series. BMW AG launched the XM in July 2022, blending electric range with luxury. Toyota scaled TNGA-based EREV output in early 2023. In March 2023, GM debuted an extended-range Blazer EV using Ultium architecture for higher range.

Market Segmentation

By Vehicle Type

By Range

By Battery Type

By Propulsion Type

By End-User

By Region