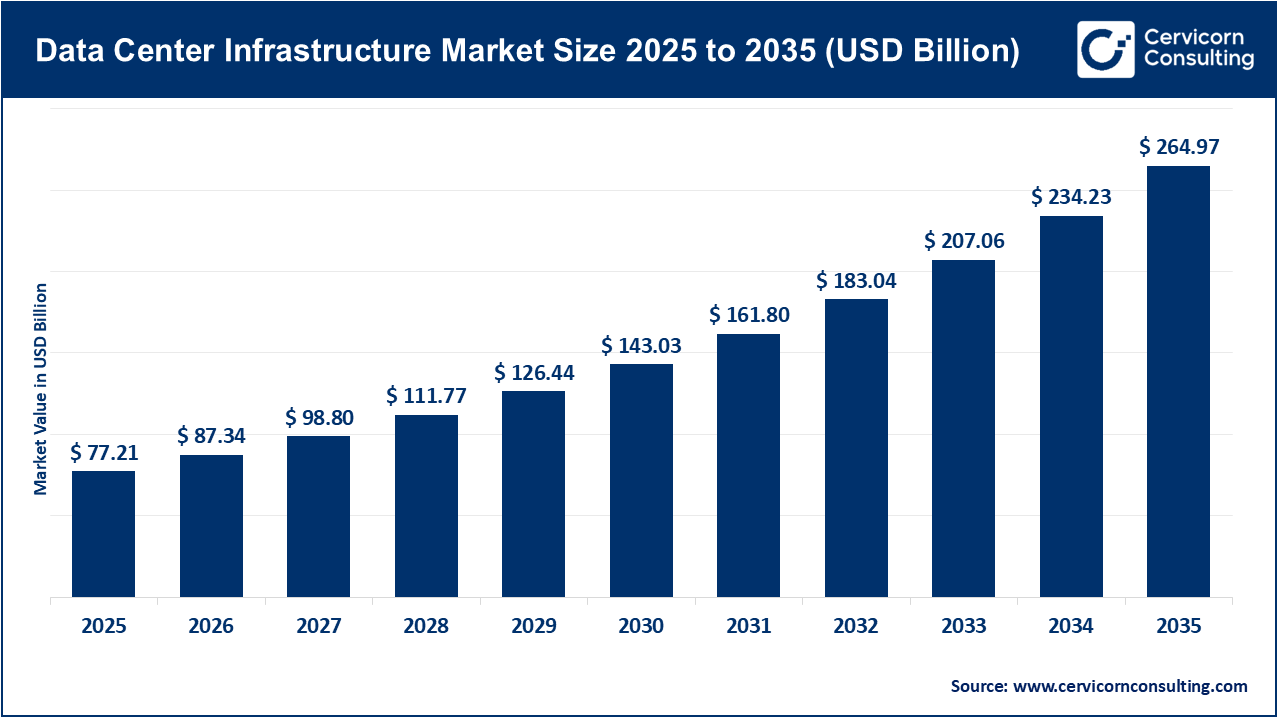

The global data center infrastructure market size was valued at USD 77.21 billion in 2025 and is expected to be worth around USD 264.97 billion by 2035, exhibiting at a compound annual growth rate (CAGR) of 13.12% over the forecast period from 2026 to 2035. The data center infrastructure market growth is largely driven by the increasing number of people and businesses using cloud computing services daily. Many businesses and organizations depend on data centers to store, manage, and process significant amounts of digital data that they generate on a daily basis. Digital services, online streaming services, and long-term remote work models all contribute to the growing need for advanced servers, storage systems, and networking equipment. Additionally, governments and large enterprises are making considerable investments in the establishment of secure data centers to protect sensitive information and comply with the rigorous regulations imposed upon them for the protection of customer privacy and data security.

One of the biggest catalysts driving the data center infrastructure market is the rapid growth of emerging technologies such as artificial intelligence (AI), big data analytics, and the Internet of Things (IoT). All of these technologies require high performance infrastructure with very fast processing speed and extremely low latency. Growing demand for energy efficiency and green data centers continues to support the continued growth of this market. Additionally, the expansion of 5G networks and edge computing continue to result in increased demand for flexible and modern data center infrastructure around the world.

AI & Hyperscale Compute Demand Driving Market Growth

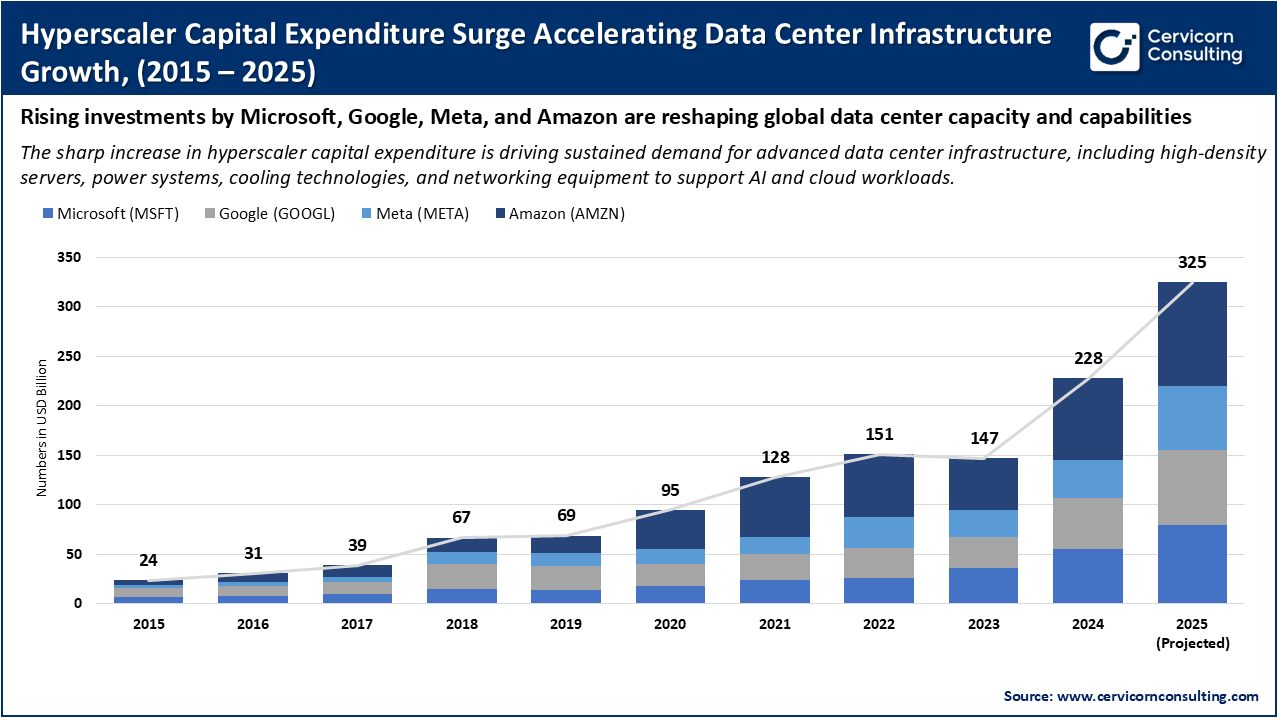

With the increasing level of demand and use of Artificial Intelligence (AI), there is a need for more hyper-scale computing (data centres) infrastructure globally. The growth of various AI-related applications has increased demand for very high-performance computing, large amounts of memory, and fast data processing. For example: Hyper-scale companies such as Amazon Web Services, Microsoft Azure and Google Cloud continue to expand existing data centre capacity in order to accommodate the increased training and inference workloads associated with AI. Hyper-scale companies are also using advanced graphics processing units (GPUs), high-density server clusters and liquid-cooling technology to address the growing demand for performance and energy. As the size and complexity of AI models grows, the continued development of hyper-scale data centres will be a major driver of long-term investment in the hyper-scale infrastructure market and will help to accelerate overall market growth.

The graphic demonstrates that the hyperscale capital expenditure has seen a consistent, sustained increase in capital expenditure from 2015 to 2025 with an increase in growth after 2020. The graphic indicates that as more capital is spent each year by major cloud service providers on increasing their data centre capacity due to increased demand for cloud services, AI workloads, and digital demand, as well as providing the necessary infrastructure to support these types of cloud services, during the years up to 2025 there will be a significant increase in the upward trend of hyperscale and AI-capable infrastructure along with an increase in the demand for servers, power systems, cooling systems, and networking systems. This trend shows that the increases in hyperscale capital expenditure will continue to stimulate and drive growth in the data center infrastructure market during the time period up to 2025.

1. Microsoft Expansion of AI-Focused Data Centers

Microsoft is accelerating the growth of AI-optimized data centers that enable larger-scale AI models and cloud services by increasing their investment in high-density server systems, advanced GPUs and the ability to provide an effective means of cooling using some type of liquid cooling. This progress will fuel demand for data center facility infrastructure as it pertains to the construction of specialized servers, power management systems and cooling technologies that are efficient in design and effective at supporting an intensive AI environment. As a result, suppliers are now being challenged to engineer new hardware configurations specifically designed for both AI and hyperscale computing.

2. Amazon Web Services Global Hyperscale Data Center Development

Amazon Web Services continues to grow the number of hyperscale data centres it builds globally to meet growing demand for cloud computing, AI and enterprise workload needs. These new facilities will include more automation, be more energy efficient and have an even greater variety of designs that can scale to meet future demand. As a result, AWS's most recent expansion of hyperscale data centre capacity will increase demand for modular data centres, advanced network hardware and fixed power distribution systems and have a significant impact on the growth of the overall data centre infrastructure market. Amazon's continued growth of AWS Hyperscale Data Centres also supports the continued growth of supporting industries to produce and create additional infrastructure reliability.

3. U.S. Government Investment in Digital and Data Infrastructure

The government of the United States has implemented programs that enhance the national digital infrastructure. Among these initiatives are financial incentives to promote local data centre development and domestic semiconductor production. The purpose of these initiatives is to enhance the security of data, increase the adoption rate of cloud computing services, strengthen the readiness of artificial intelligence capabilities and foster innovation through the expansion of digital infrastructure. The financial support to establish these types of data centres creates a market for the development and utilization of technology that is compliant and secure, increases investment from the public sector and decreases the time it takes to develop data centre facilities while increasing the overall demand for technology solutions.

4. European Union Green Data Center Policy Initiatives

In order to promote the use of energy-efficient and sustainable practices, the European Union introduced a set of policies aimed at establishing carbon reduction targets and establishing minimum guidelines regarding the use of renewable sources of energy to power data centres. These policies create incentives for data centre operators to install energy-efficient cooling technologies, utilise optimised electrical power usage, and implement smart energy management systems on their premises. The development of these policies has created a way for operators to invest in green technology, upgrade their facilities, and develop environmentally friendly infrastructure solutions throughout Europe.

Report Scope

| Area of Focus | Details |

| Market Size in 2026 | USD 87.34 Billion |

| Estimated Market Size in 2035 | USD 264.97 Billion |

| Projected CAGR 2026 to 2035 | 13.12% |

| Dominant Region | North America |

| Fastest Growing Region | Asia-Pacific |

| Key Segments | Product, Component, Data Center Type, Deployment, Application, Region |

| Key Companies | Dell Technologies, Cisco Systems, Inc., IBM Corporation, Schneider Electric SE, Oracle Corporation, Siemens AG, Eaton Corporation, Lenovo Group Limited, Nutanix, Inc., NetApp, Inc., Vertiv Co., Fujitsu Limited, CyrusOne Inc., Hewlett Packard Enterprise, Equinix, Inc. |

The data center infrastructure market is segmented into various regions, including North America, Europe, Asia-Pacific, and LAMEA. Here is a brief overview of each region:

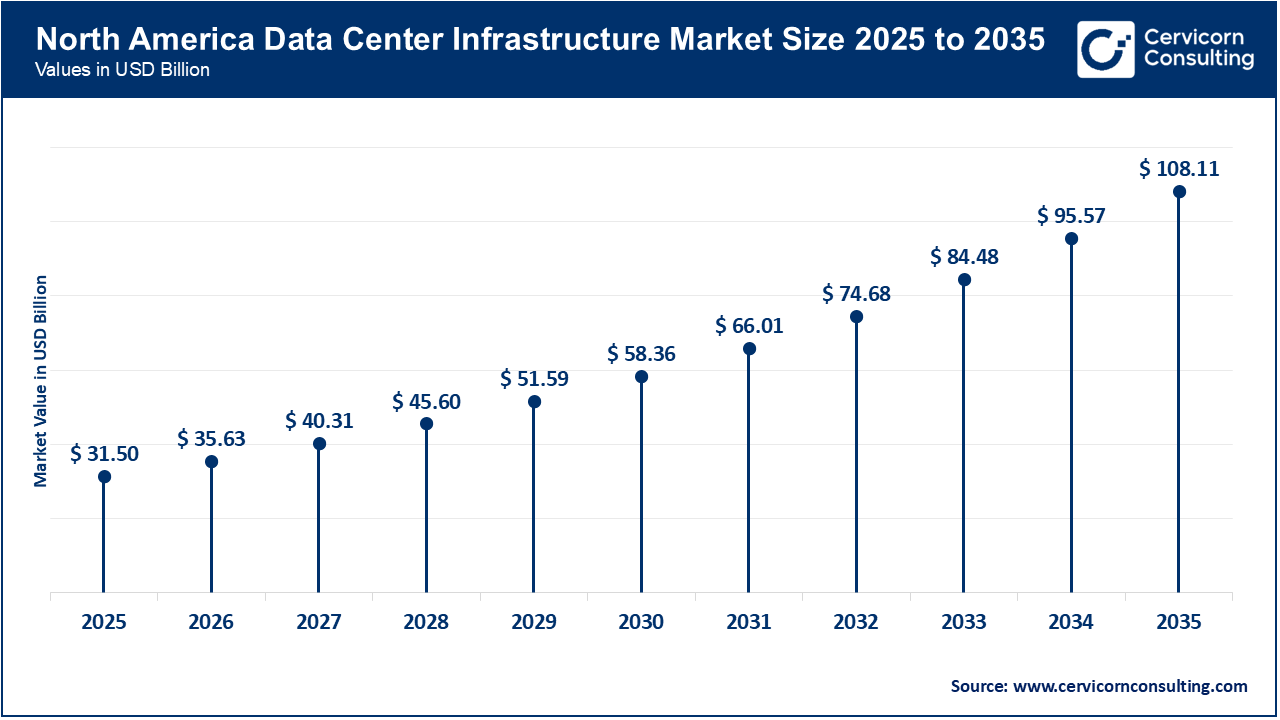

The North America data center infrastructure market size was valued at USD 31.50 billion in 2025 and is projected to hit around USD 108.11 billion by 2035. North America is the largest region, primarily due to significant amounts of funding from hyperscale cloud vendors and increases in demand for AI, Cloud, and high-performance computing. The combined presence of numerous enterprise-level data centers and hyperscale campus facilities in the United States has created a well-formed infrastructure ecosystem that provides the industry with much needed power, cooling, network, and rack capabilities. As organizations continue to migrate on-premise workload solutions to cloud or AI-supported platforms, North America will continue to benefit from its established digital infrastructure, reliable electrical distribution networks, and established vendor supply chain systems. Thus, North America will remain a center of gravity for investment into the data center infrastructure market.

Recent Developments

The Asia-Pacific data center infrastructure market size was estimated at USD 17.45 billion in 2025 and is estimated to surpass around USD 59.88 billion by 2035. A major contributor to the current growth of the Asia-Pacific market is the rapid developments in digital technology as well as an increasingly digital economy. As more people use the internet and access cloud services, demand for data centres continues to grow. Countries like Australia and India have begun to construct new data centres or increase the size, or capacity, of already existing data centres in order to fulfil domestic and regional demand; this rapid growth is being driven in part by an increase in demand for power and other associated infrastructure and services within those countries, as a result of increasing investment into the development of cloud ecosystems and data centre energy and cooling infrastructures.

Recent Developments:

The Europe data center infrastructure market size was accounted for USD 20.92 billion in 2025 and is forecasted to grow around USD 71.81 billion by 2035. In Europe, the expansion of the data center infrastructure is primarily due to the rapidly growing digital landscape created by the increased use of digital services as well as the need for compliance and regulation in relation to Data Sovereignty and Data Efficiency. As more businesses and government agencies choose to use digital services and make the transition to cloud or hybrid environments, there are increased demands for energy-efficient modernized data center infrastructure in the areas of power, cooling and networking. Therefore, this creates a substantial and growing opportunity for development and improvement of existing and new data centers throughout Europe.

Recent Developments

Data Center Infrastructure Market Share, By Region, 2025 (%)

| Region | Revenue Share, 2025 (%) |

| North America | 40.80% |

| Europe | 27.10% |

| Asia-Pacific | 22.60% |

| LAMEA | 9.50% |

The LAMEA data center infrastructure market was valued at USD 7.33 billion in 2025 and is anticipated to reach around USD 25.17 billion by 2035. The LAMEA region has been steadily gaining traction, and with an increase in digital adoption across the globe, also an increase in enterprise and cloud service providers investing in new data centre infrastructure outside of their traditional markets. The region offers lower overall density of legacy infrastructure, a growing rate of Internet connectivity and increasing demand for more localized data storage and processing, thus offering this region an abundance of growth opportunities. In addition to the aforementioned factors, as established market providers begin to expand their footprint into new, developing markets, the LAMEA region is a frontier for infrastructure development.

Recent Developments:

The data center infrastructure market is segmented into product, component, data centers, deployment, application, and region.

The power segment of the market continues to be the leading segment due to the importance of consistent and stable electricity supply in supporting all data center functions. Data centers make significant expenditures on UPS systems, backup generators, power distribution units, and storage solutions to prevent downtime and maintain company operations. With the growth of data centers' size and increased rack density, dependable electrical systems continue to provide the basis for all data centers and therefore keep the power segment as the leading segment.

Data Center Infrastructure Market Share, By Product, 2025 (%)

| Product | Revenue Share, 2025 (%) |

| Power | 29.40% |

| Cooling | 24.80% |

| Networking Equipment | 18.20% |

| IT Racks & Enclosures | 12.50% |

| LV/MV Distribution | 9.10% |

| DCIM | 6.0% |

In contrast, cooling has become the fastest growing segment of the market due to the increasing heat generation from ultra-high-density servers, artificial intelligence workloads, and hyperscale environments, which is causing inefficient traditional air-cooling methods to accelerate the adoption of liquid cooling, immersion cooling, and more advanced thermal management methodologies. Interest in energy efficiency and sustainability continues to increase and therefore supports the increasing demand for the latest innovations in cooling technology.

The hardware section of the data center infrastructure industry is the largest because physical elements, including servers, racks, power supplies, cooling systems and networks, make up the bulk of a data center's infrastructure. New builds as well as the ongoing construction of larger data center facilities maintains strong global hardware demand for enterprise, hyperscale, and colocation uses.

Data Center Infrastructure Market Share, By Component, 2025 (%)

| Component | Revenue Share, 2025 (%) |

| Hardware | 62.70% |

| Services | 23.50% |

| Software | 13.80% |

The software segment is expected to be the fastest-growing sector of the market as businesses adopt automated, monitored, and intelligent methods to manage their data center operations. Technologies such as data center infrastructure management software, artificial intelligence-based analytic tools, and data center infrastructure management software solutions provide operators with tools to manage the amount of energy consumed in order to optimize uptime while minimizing ongoing operations in an increasingly complex data center environment.

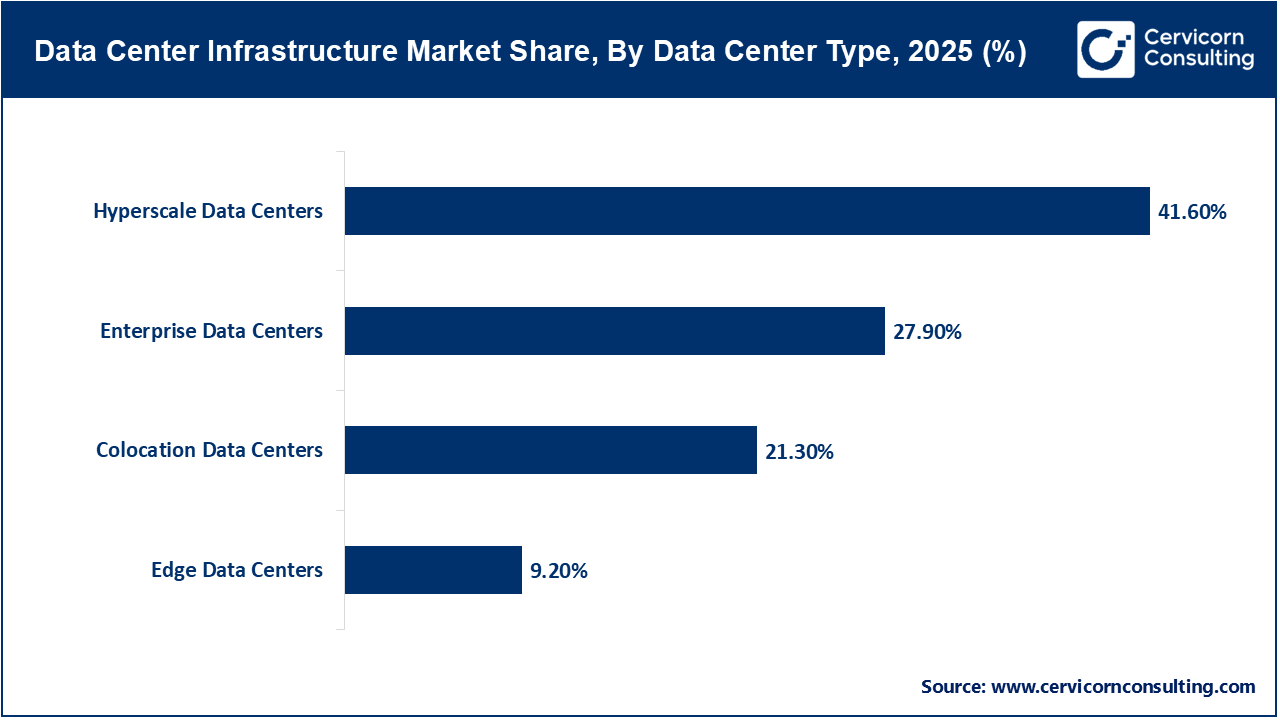

Hyperscale data centers are the leading type of data center among the market players because of the large-scale investment of large cloud service providers (like Google and Amazon) for cloud computing, AI and big data services. To support these applications, hyperscale data centers require a tremendous amount of servers, networking, power, and cooling equipment, which is why they account for the greatest share of data center market demand.

The edge data center segment is the fastest-growing segment of the overall market. The growth of edge data centers has been driven by the increasing need for low-latency processing of data for 5G networks, Internet of Things (IoT) devices, and real-time applications. As a result of these demands, businesses are constructing smaller, more localized data centers closer to their end-users to allow for increased performance and to help alleviate network congestion caused by centralized processing. This trend continues to fuel investments in network-edge infrastructure.

The IT and telecom segment continues to have a significant impact on growing the market due to the constant increase in data transmission, advancement in digital communications and expansion of networks. Due to these requirements for robust and scalable data centre support of cloud services, mobile networks and high-speed connectivity, the IT service providers, as well as telecom operators, are in need of these infrastructures.

Data Center Infrastructure Market Share, By Application, 2025 (%)

| Application Segment | Revenue Share, 2025 (%) |

| IT & Telecom | 34.20% |

| BFSI | 16.80% |

| Colocation | 15.10% |

| Government | 11.40% |

| Healthcare | 8.60% |

| Manufacturing | 7.30% |

| Energy | 4.10% |

| Others | 2.50% |

The healthcare sector is fastest growing segment in market. Healthcare providers are moving more toward the digitization of their medical records and the use of telemedicine and imaging. Healthcare providers require secure data storage and therefore invest heavily in the establishment of compliant and reliable data centre infrastructure to support the increasing use of technology that requires data-intensive applications.

By Product

By Component

By Data Center

By Deployment

By Application

By Region