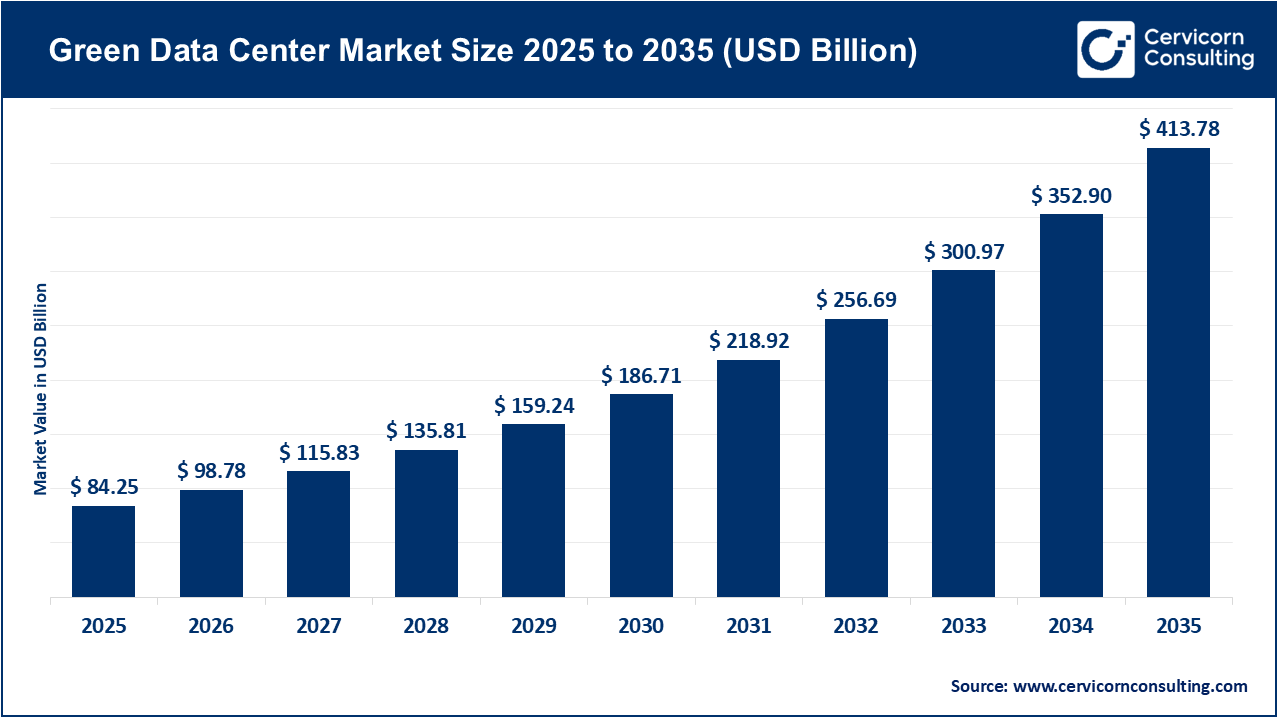

The global green data center market size reached at USD 84.25 billion in 2025 and is expected to be worth around USD 413.78 billion by 2035, exhibiting at a compound annual growth rate (CAGR) of 17.25% over the forecast period 2026 to 2035.

Green Data Center: How Does It Fuel the Sustainable Future of IT Sector?

As traditional data centers come up with concerns including energy consumption, carbon emissions, water usage and waste management; the facilities that are designed with environmental stability are known as green data centers. These facilities use energy-efficient technologies, renewable energy sources and eco-friendly building materials. Moreover, smart design to minimize the environmental effects without compromising performance is utilized in green data center.

A few major components that act as operational elements in a green data center are; renewable energy integration, efficient cooling technologies, server consolidation and modular/scalable design. As multiple authorities started turning heads to sustainable solutions and green building materials, the adoption of green data centers is expected to rise.

What is a Green Data Center Market?

Global green data center market revolves around technologies, services and infrastructure solutions that operate data centers with minimal environmental impact. The shift towards cost saving, regulatory compliances and brand differentiation creates substantial potential for the green data center market to expand globally. These offerings create an inclusive marketplace for vendors, cloud providers, equipment manufacturers and companies that are creating solutions for net-zero IT sector.

Digital transformation, rising electricity consumption, government regulations have emerged the progress of green data centers. The green data center market is driven by a diverse ecosystem of participants working collectively to reduce the environmental footprint of digital infrastructure. Leading the space are hyperscale cloud providers such as AWS, Microsoft Azure, and Google Cloud, which invest heavily in renewable energy and ultra-efficient data center designs.

Major Application Areas of Green Data Centers:

Global Push by Private Companies

Across industries, corporate sustainability has become a central strategic priority rather than a voluntary initiative. With thousands of global private companies committing to net-zero targets for 2030, 2040, or 2050, reducing operational emissions has never been more crucial. Because data centers are among the largest consumers of electricity within an organization, they significantly influence overall carbon footprints, particularly Scope 2 emissions linked to purchased power.

As a result, businesses are accelerating the shift toward green data centers by adopting renewable energy sources, investing in high-efficiency servers, deploying low-carbon cooling technologies, and purchasing renewable energy credits to offset unavoidable emissions. These initiatives not only support ESG compliance but also enhance brand credibility, attract sustainability-driven investors, and reduce long-term operating costs. Ultimately, net-zero commitments are reshaping the data infrastructure landscape, making green data centers an essential component of modern corporate responsibility.

Many of the corporates are already pledging for the sustainable future. Followings are few of them:

Capital Expenditure Barriers:

High cost of implementation acts as a major barrier for the expansion of the green data center market, which may particularly impact on the mid-scale or small-scale organizations. According to Gartners report, sustainable/green IT solution can cost 40% more upfront as compared to the traditional systems.

Energy-efficient hardware, processors and drivers often come at premium end due to the advanced materials used in manufacturing. Integrating, managing and retrofitting such systems can remain a key hurdle for many organizations considering the transition to green computing.

Cost Comparison of Conventional vs. Green Computing Infrastructure:

| Component | Conventional/Traditional | Green Computing |

| Server Hardware | $2,500/unit | $3,300/unit |

| Data Center Cooling | $7M | $9.2 M |

| Monitoring System | - | Approx.. 25% cost upfront |

Future Outlook of Technology and Policies

Emerging technologies, sustainability-driven initiatives and policies are observed to act as transformative factors for the green data center market. Looking forward to year 2035, the overall projections indicate that a potential 50% reduction of carbon emission is observed in the IT sector. Keeping research and development at center, an investment estimated at $150 billion by 2030 is expected to accelerate the innovation in energy-efficient technologies.

Moreover, efforts such as training IT staff in sustainable computing practices, prioritizing cloud providers running on renewable energy and conducting audits for IT infrastructure to identify waste are seen to offer expansion for the market. As governments and regulatory bodies focus on creating policies to establish clear standards for computing equipment, funding for research into next-gen computing and promoting digital literacy create a sustained outlook for the green data center market.

Long RoI Timeline:

Although green data centers offer significant long-term cost savings, the long return on investment timeline spans 5-6 years from the integration. This timeline extends the overall financial strain on stakeholders. SMEs with low potential of investment may find this struggle to justify. As the technology is still expanding, financial uptakes from governments remain low. Whereas, viable financial instruments such as green bonds and sustainability-linked loans can bridge the gap for investors.

Googles Case Study of Sustainable Data Centers:

Google, being one of the most prominent pioneers in green computing, has demonstrated large-scale digital infrastructure and their operations with minimal environmental impact. Google has committed to carbon-free energy by 2030 which represents one of the most ambitious sustainability targets in the technology sector. Google has implemented AI-powered cooling systems, making it the most innovative improvement.

Googles success has influenced multiple other major shareholders such as Microsoft which adopted similar AI cooling techniques and Amazon Web Services that accelerated its renewable energy timeline to 100% in 2025.

Top 10 Countries Green Data Center Initiatives: Government Support for the Industrys Growth

| Country | Government Initiatives |

| China | Launched East-to-West Computing Project to build energy-efficient hubs in cooler regions |

| United States | Federal tax incentives for energy-efficient infrastructure and started offering DOE support for liuid cooling and modular data centers. |

| Germany | Promoted Energy Efficiency Act and renewable power requirements |

| United Kingdom | Starter UK Net Zero 2050 Strategy and Climate Change Agreements for tax relief for energy-efficient sectors. |

| France | Made French Energy Code mandatory for efficient cooling and renewable sourcing |

| India | Started subsidies in multiple states for renewable power and green building certifications. |

| Canada | Started clean energy regulations and federal incentives for renewables, especially for data center operators. |

| Netherlands | Implemented strict environmental permitting and incentives for heat re-use. |

| Singapore | Started incentives for green cooling and energy-efficient technologies. |

| Japan | Started Green Transformation program and subsidies for renewable-powered digital infrastructure. |

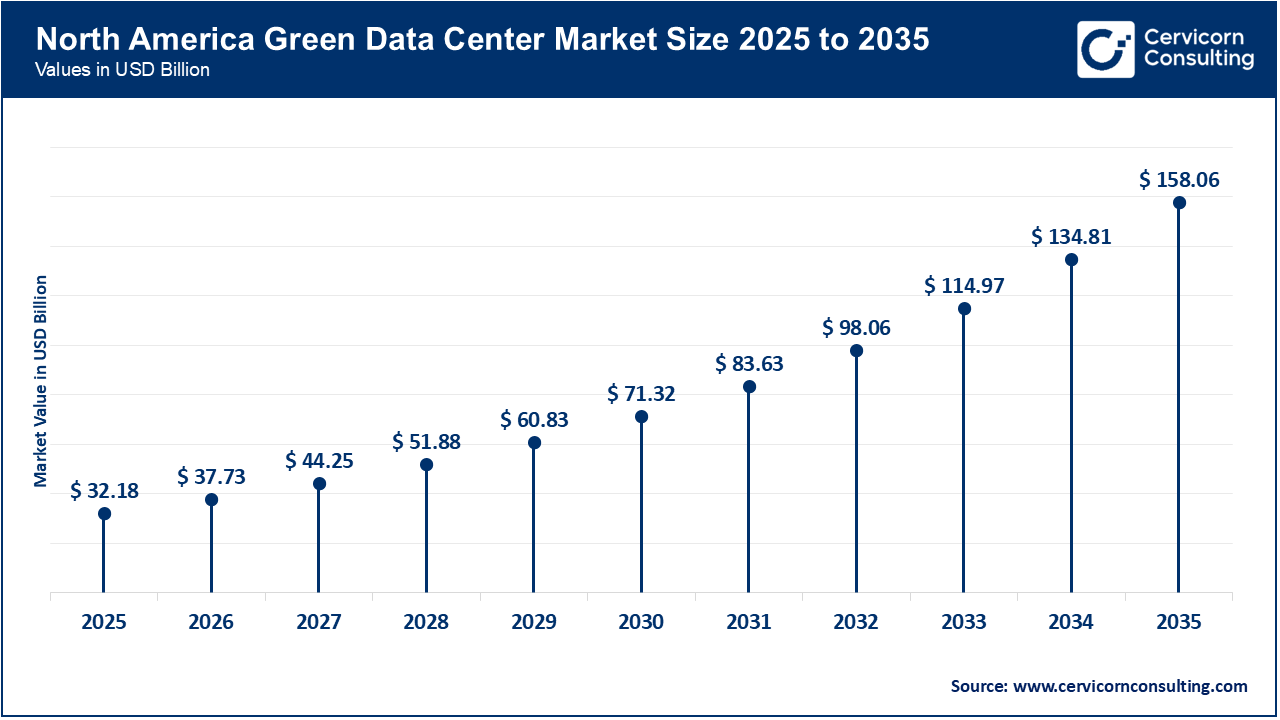

The North America green data center market size valued at USD 32.18 billion in 2025 and is expected to reach around USD 158.06 billion by 2035.

In 2025, North America dominated the market. Mixture of strong regulatory support and presence of major key players supported the market in recent years to expand rapidly in North American countries. Multiple governments have set aggressive sustainability goals for different sector, which makes the market hold potential of expansion. Both United States and Canada have implemented laws. For instance, the United States has implemented Inflation Reduction Act in 2022 which makes it mandatory for players to adopt sustainable solutions in industries.

According to McKinsey, nearly 70% of the projected data-center power demand by 2030 will be driven by hyperscalers, reflecting how rapidly their infrastructure needs are accelerating. This shift is already visible as major technology companies continue announcing multibillion-dollar partnerships with U.S. states to develop massive next-generation data-center campuses. These hyperscale operators are increasingly designing vast, integrated sites spanning hundreds of acres to maximise the efficiencies of colocated compute and support the rising workloads of AI, cloud services, and advanced analytics.

Moreover, the invention and easy adoption of advanced technologies such as advanced cooling systems, AI and machine learning, modular design and efficient hardware supported the green data center market to expand in North America smoothly.

United States Green Data Center Market Recent Developments:

The Asia-Pacific green data center market size estimated at USD 20.89 billion in 2025 and is projected to hit around USD 102.62 billion by 2035. Asia Pacific is observed to be the fastest growing region. This growth is driven by a massive demand for digital infrastructure in developing nations across the region. Government regulations and technological innovations create a combination of potential factors for the expansion of the market. Moreover, corporate commitments such as, sustainability goals, net-zero emissions, financing and power purchase agreements support industry expansion.

Data volumes and processing demands continue to expand in Asian countries. As the complexity and scale of data center operations continue to grow, professionals in the sector are focusing in strategizing on how to make green data centers more efficient.

Asia is emerging as one of the fastest-growing regions for green data centers, driven by soaring cloud adoption, rapid AI expansion, and increasing sustainability mandates. Reflecting this shift, Jeremy Deutsch, Chair of the APDCA, underscored the urgency of balanced progress, stating that Balancing energy sustainability with the surging demand for digital infrastructure is one of the Asia-Pacific region defining challenges. He added that with strong, future-focused policy frameworks, governments can ensure digital transformation evolves in step with their net-zero ambitions, allowing technology and sustainability to strengthen each other.

Indian Green Data Center Market Scope:

The Digital Personal Data Protection Act (DPDPA) 2023 has prompted Indian enterprises to prioritise investments in secure, scalable digital infrastructure, significantly reshaping the country data center landscape. Organizations that manage sensitive information are now required to upgrade to advanced, compliant systems, as the Act enforces strict standards for data handling, storage, and security. As a result, companies are accelerating their adoption of modern, highly protected data center solutions. This regulatory shift has also increased consumer confidence, with individuals reassured that businesses are using strong, cutting-edge measures to safeguard their personal data.

Rising Energy Demand: The Green Data Center Imperative in China

China now leads the Asia Pacific region with 449 data centers as of 2023, and its electricity consumption from these facilities has surged accordingly. In 2024, the International Energy Agency (IEA) reported that China accounted for 25% of global data-center electricity use, making it the second-largest consumer after the United States. While the demand is expected to increase with the rapid expansion of AI infrastructure, estimates vary widely.

Government and industry projections suggest usage could rise from 100-200 TWh in 2025 to 400-600 TWh by 2030, with emissions potentially reaching 200 million tonnes of COâ‚‚e. Despite this growth, data centers still contribute a relatively small share of Chinas total electricity consumption, currently between 0.9% and 2.7% far below the manufacturing sector, which grew by 300 TWh in 2024 alone.

To manage this rising demand and environmental impact, China central and local governments are implementing policies promoting greener, more efficient data-center designs. These include mandating improved energy efficiency standards, encouraging renewable-powered facilities, and supporting the relocation of large data centers to regions with abundant clean energy. Yet challenges persist, especially around balancing technological growth with sustainability goals and ensuring that new facilities adhere to low-carbon guidelines.

As China pushes ahead with AI development, cloud expansion, and digital transformation, the shift toward green data centers is becoming essential, not optional. The country ability to meet soaring digital needs while controlling emissions will depend on its success in scaling energy-efficient technologies and accelerating renewable integration across its data-center ecosystem.

Green Data Center Market Share, By Region, 2025 (%)

| Region | Revenue Share, 2025 (%) |

| North America | 38.20% |

| Europe | 29.40% |

| Asia-Pacific | 24.80% |

| LAMEA | 7.60% |

The Europe green data center market size reached at USD 24.77 billion in 2025 and is anticipated to reach around USD 121.65 billion by 2035. Europe green data center market is expanding rapidly as sustainability becomes a core priority across the regions digital ecosystem. Driven by stringent EU climate policies, rising energy costs, and accelerating cloud adoption, data center operators are increasingly shifting toward renewable-powered, high-efficiency facilities. Countries like Germany, the Netherlands, Sweden, and Denmark are leading the charge by offering strong regulatory frameworks, tax incentives, and access to abundant green energy. At the same time, hyperscalers and colocation providers are investing heavily in advanced cooling technologies, circular energy systems, and carbon-neutral infrastructure to meet Europe ambitious emissions targets for 2030 and beyond.

Booming Data Centers in Germany to Support the European Sustainability Goals:

Germany is investing heavily in R&D, industry partnerships, and digital-innovation clusters to accelerate eco-friendly datacentre development. Federal programmes, such as support from the Federal Ministry for Economic Affairs and Climate Action (BMWK) fund projects in liquid cooling, AI-based energy optimisation, and renewable-powered data-centre design. Germany is also promoting the use of district heating networks, where waste heat from data centres is captured to heat homes and public buildings, reducing overall emissions. Collaborations between cloud providers, universities, and energy companies further strengthen innovation. Together, these initiatives position Germany as one of Europes leaders in sustainable, energy-efficient digital infrastructure.

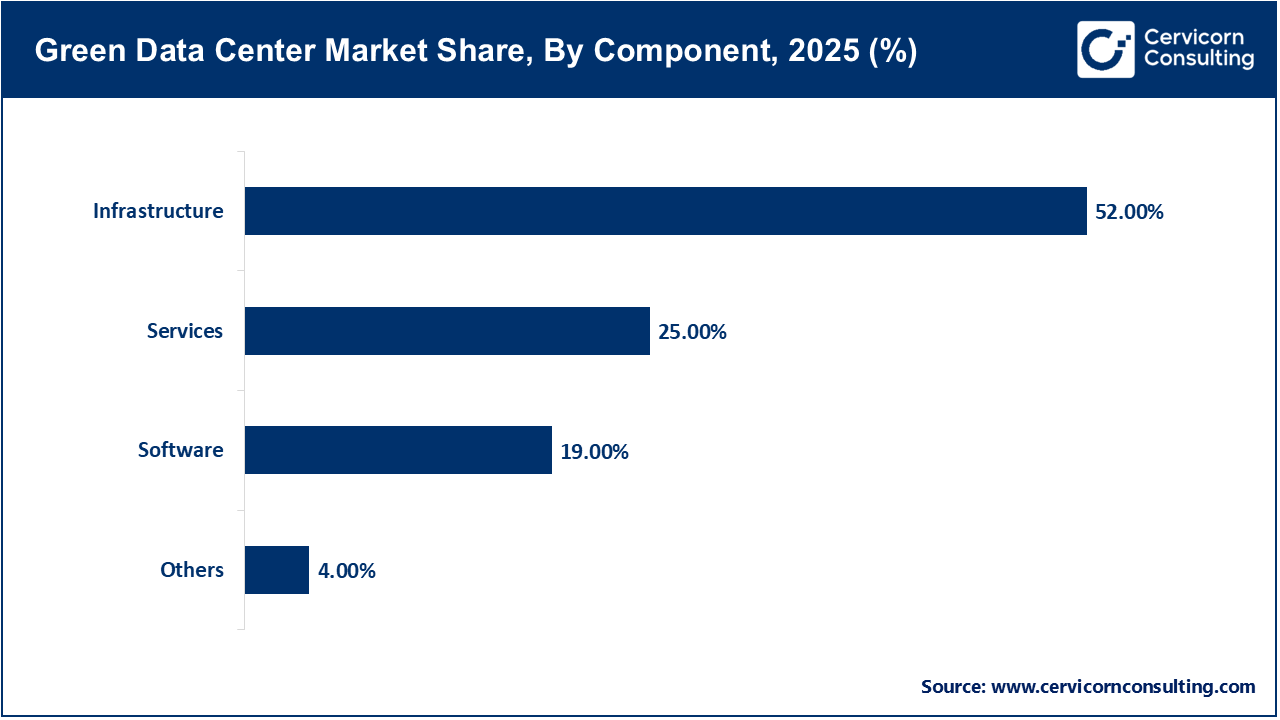

Infrastructure dominated the segment in the green data center market as it includes core elements such as renewable-powered UPS systems, liquid cooling, high-efficiency servers, and advanced HVAC technologies. Organizations prioritise infrastructure upgrades as the fastest route to reducing PUE (Power Usage Effectiveness) and meeting sustainability targets. Many hyperscalers, for example, have invested heavily in immersion cooling systems that cut energy consumption by up to 40%. This segment continues to expand as data center operators replace legacy hardware with next-generation, energy-efficient solutions.

Software is becoming the fastest-growing component due to rising adoption of AI-powered energy management tools and DCIM platforms that optimise power, cooling, and workflow automation. Modern green data centers rely on intelligent algorithms to predict workload spikes and adjust system performance in real time, reducing unnecessary energy use. A notable example is the use of digital twin software, which allows operators to simulate and enhance data center efficiency before making physical changes. As sustainability targets tighten globally, software-driven optimisation is increasingly viewed as essential rather than optional.

Large and hyperscale data centers dominated the market as global cloud providers continue to build massive, multi-acre campuses to support AI, cloud computing, and data-intensive workloads. These sites benefit from economies of scale, enabling deeper investment in renewable energy, advanced cooling, and high-density server layouts. For example, hyperscalers like AWS and Google have developed 100MW+ green campuses powered by onsite solar and wind farms. Their immense capacity positions them as the backbone of the global green data center ecosystem.

Green Data Center Market Share, By Data Center Size and Capacity, 2025 (%)

| Data Center Size and Capacity | Revenue Share, 2025 (%) |

| Edge & Micro Data Centers (1-5 MW) | 18% |

| Medium Data Centers (5-10 MW) | 28% |

| Large & Hyperscale Data Centers (50 MW & above) | 54% |

Medium data centers are emerging as the fastest-growing category because they offer an ideal balance between scalability and operational efficiency for mid-sized enterprises. These facilities are increasingly adopted by industries like retail and BFSI that require sustainable expansion without moving to hyperscale environments. A recent example is regional financial institutions shifting to 5-10 MW green facilities that operate on renewable power and advanced cooling systems. Their moderate footprint, combined with reduced energy overheads, makes them highly attractive for organisations transitioning to eco-friendly infrastructure.

Cloud and hyperscale data centers dominated the green data center market, due to surging global demand for cloud services, AI workloads, and digital transformation initiatives. These facilities are the first to adopt renewable-powered systems, liquid cooling, and automation at scale, setting industry benchmarks for sustainability. Companies like Microsoft and Meta continue to expand their green hyperscale campuses across Europe and the US, showcasing long-term commitments to carbon-neutral operations. Their leadership makes them the primary drivers of innovation in the market.

Green Data Center Market Share, By Data Center Type, 2025 (%)

| Data Center Type | Revenue Share, 2025 (%) |

| Cloud & Hyperscale Data Centers | 53% |

| Colocation Data Centers | 30% |

| Enterprise Data Centers | 17% |

Colocation data centers are growing swiftly as enterprises look for sustainable, cost-efficient alternatives to building their own green infrastructure. These facilities allow businesses to operate in energy-efficient environments without capital expenditure, making them attractive for SMEs and mid-sized corporations. An example is businesses shifting from legacy on-premise IT rooms to colocation sites with renewable power purchase agreements. As sustainability becomes a procurement requirement, demand for green colocation services is expected to surge.

BFSI dominated the market in 2025 due to strict compliance standards, data security requirements, and rapid digitalisation across banking and financial services. Financial institutions are early adopters of low-PUE, renewable-powered data centers to support high-volume transactions and secure data workflows. For instance, several major banks migrated to green hyperscale facilities to meet ESG requirements while improving operational resilience. Given the industry regulatory environment, BFSI remains a steady and influential contributor to green data center demand.

The IT & telecom sector is the fastest-growing adopter as 5G rollout, IoT expansion, and cloud-native applications massively increase data processing needs. These companies demand scalable, energy-efficient compute environments to cope with rising digital traffic and sustainability mandates. A key example is telecom operators partnering with green data center providers to support low-latency 5G edge infrastructure. As digital connectivity expands, the sectors reliance on green infrastructure will continue to intensify.

Energy & utilities segment is expected to grow rapidly as smart grids, renewable-energy monitoring systems, and digital infrastructure require sustainable data processing. These organizations increasingly depend on green data centers to analyse grid loads, monitor renewable assets, and manage distributed energy resources. A recent example includes utility providers adopting AI-driven data centers to manage real-time solar and wind generation data. As the energy transition accelerates, demand for eco-friendly data processing in this sector will soar.

November 2025-TotalEnergies Power Deal with Data4

March 2025-Areim Raises Euro 450M for Sustainable Data Centres

October 2025 - Ardian Acquires Irish Utility Energia for AI-Driven Growth

By Component

By Data Center Size and Capacity

By Data Center Type

By End User

By Region