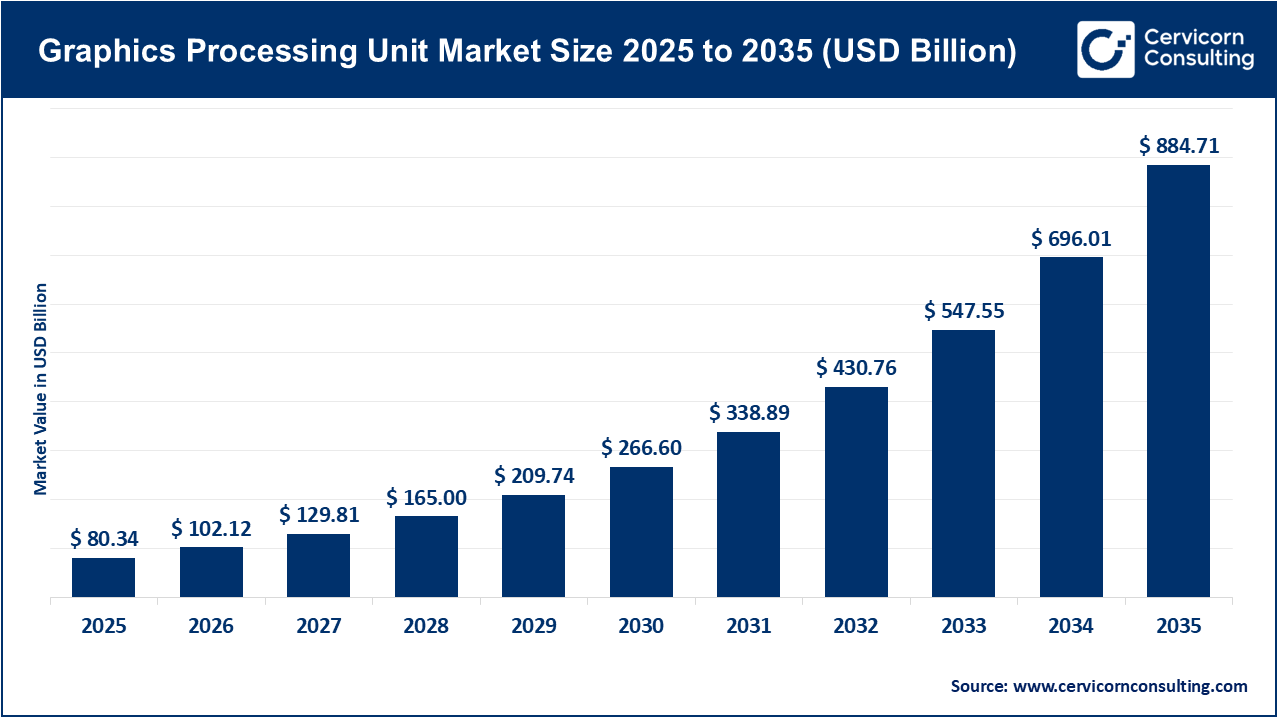

The global graphics processing unit market size reached at USD 80.34 billion in 2025 and is expected to be worth around USD 884.71 billion by 2035, exhibiting at a compound annual growth rate (CAGR) of 27.12% over the forecast period 2026 to 2035. The graphics processing unit (GPU) market is growing rapidly, mainly due to the increasing demand for high performance computing for much more than traditional gaming. For example, GPUs are being used by companies to speed-up workloads in artificial intelligence, machine learning and scientific research jobs that require massive parallelism and high memory bandwidth. The infrastructure server and data-center accelerators are exhibiting the fastest growth rates, indicating this change. Regions such as Asia-Pacific are showing increased uptake as government investments towards defence, intelligence, IoT and cloud computing systems continue to rise.

Moreover, several technology advances are helping drive the graphics processing unit market forward. Next-generation GPU architectures and memory technologies (for aspect GDDR7, improved cache, real-time ray tracing and tensor cores optimized for AI-powered workloads) are allowing GPUs to be more than just rendering they are now at the center of data-rich workloads. On the operational front, recent developments in supply chain, manufacturing nodes, demand surges have also impacted pricing and availability: a good example is shipment surges of GPUs (+27% in Q2 2025) due, in part, to buyers anticipating tariff increases. These dynamics higher demand, increased end-use cases and more complex hardware lead to a virtuous cycle of investment and advancement in the graphics processing unit market.

What is a graphics processing unit?

A graphics processing unit (GPU) is a specialized electronic circuit designed to expedite image and video processing as well as intricate mathematical computations. A GPU is optimized for parallel processing and can thus perform thousands of smaller processes at the same time. Because of these characteristics, GPUs are valuable in high-quality graphics rendering for gaming and multimedia but are also valuable in heavy computations in artificial intelligence, data analytics, and scientific simulations.

Applications of GPUs:

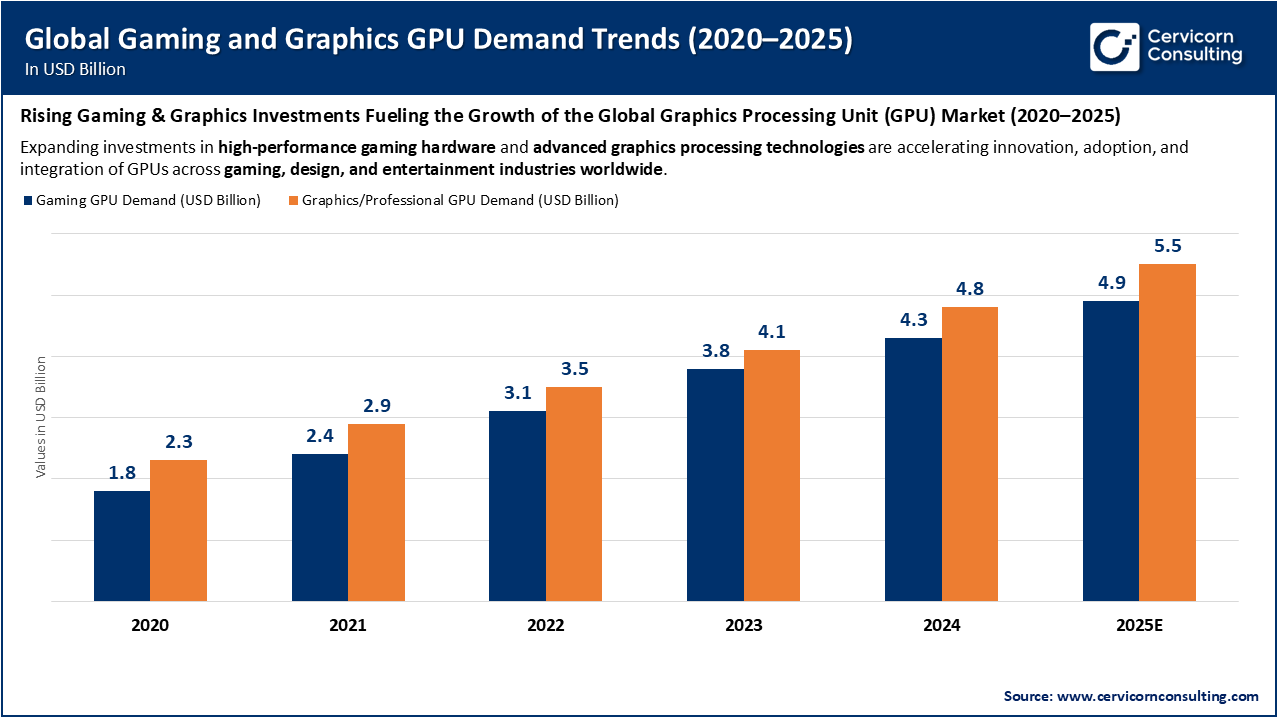

The growing demand for high-end rendering and high-quality content in immersive gaming experiences across consoles, PCs, mobile devices, and VR/AR is driving growth in the graphics processing unit market. According to reports, 78% of active gaming consoles are powered by a single vendor, which demonstrates the significance of the GPU technology to the gaming community. Consequently, esports, a growing interest in 4k/8k games, VR and AR implementations, and streaming gameplay has created demand with expectations beyond standard GPU capabilities. More specifically, gamers are wanting ray tracing in real time, AI-based upscaling, and ultra-low latency. This establishes a virtuous cycle wherein game developers launch increasingly demanding titles, prompting hardware manufacturers to produce advanced GPUs to enhance the experience.

Increasing investment in cutting-edge gaming hardware and advanced graphics processing technology is accelerating innovations, and adoption and integration of graphics processing units (GPUs) across the gaming, design, and entertainment industries globally. Increased pressure for immersive experiences, AI-assisted rendering, and real-time ray tracing is leading GPU manufacturers to deliver more efficient and faster architectures. This is reshaping the computing ecosystem and driving GPU adoption in all areas, including gaming PCs and consoles, cloud gaming, digital content creation and metaverse applications.

| Year | Development | Significance for Gaming GPUs |

| Jan 2025 (CES) | NVIDIA announced its GeForce RTX 50-series based on the Blackwell architecture, GDDR7 memory, 4th-gen RT cores and DLSS 4. | Gaming GPUs have taken a leap forward, with higher resolutions & better frame rates, making use of AI acceleration and ray tracing features targeted at gamers. |

| Mid 2025 | AMD announced that its RDNA 4 GPUs are based on a modular SoC architecture to allow scalable and cost-efficient GPU designs. | This indicates even a wider availability of high-performance GPUs at a variety of price points, bringing advanced graphics to the mainstream gamer. |

| 2025 Q3 | Expantion of features such as its NVIDIA Project G Assist for an AI-driven gaming assistant that will support more RTX hardware. | Show that GPU makers are not just focused on raw hardware, but are planning intelligent feature integration to maximize gaming performance, latency & user experience. |

1. Launch of Blackwell Architecture by NVIDIA

In March 2024, NVIDIA announced its Blackwell microarchitecture in both consumer and data-centre GPUs. Blackwell GPUs provide a massive leap in performance, accomplishing 2.2× the performance on the Llama 3.1 405B benchmark from the previous generation at the same scale. This is a significant point in the GPU market because it expands the performance performance ceiling for what GPUs can achieve which increases the relative attractiveness of GPUs for hosting high-value applications (AI, HPC, advanced graphics), encouraging investment in new architecture, and generating demand across the ecosystem.

2. Entry of the GeForce RTX 50 Series (consumer-gaming GPUs) based on Blackwell

In January 2025, NVIDIA introduced the RTX 50 series consumer GPUs, constructed on Blackwell architecture, with GDDR7 memory and advanced RT/Tensor cores, along with AI advancements like DLSS 4. For instance, the RTX 5090 was announced as having 3,352 AI TOPS. This latest product is a sign of progress for the GPU market by reinforcing the consumer-gaming segment of the market, raising the value and performance expectations of gamers and creators alike, driving upgrades, and expanding the total addressable GPU market by merging gaming and AI-capable GPUs.

3. Upcoming launch of RDNA 5 architecture from AMD

AMD has officially stated that its RDNA 5 GPU architecture is targeted to be released in late 2026 with major upgrades, including enhanced ray tracing performance and possibly GDDR7 memory. This is driving the GPU market because it raises the competitive stakes and having a major vendor innovating its architecture to increase pricing, adoption and diversity matters. Overall, it will be beneficial for the overall growth of the market by reducing reliance on a single vendors roadmap.

4. Supply chain and ecosystem readiness for AI and advanced GPU workloads

The broader ecosystem, including server makers such as Dell Technologies, HPE and Lenovo, continues to ramp up GPU infrastructure to support advanced workloads. For example, NVIDIA formally announced RTX PRO/Blackwell server editions for major 2U systems with leading system OEMs. This milestone will contribute to GPU market growth by continuing to escalate usage away from the desktop and gaming markets, into enterprise and AI/ML, simulation, and data centres. This enlarging the demand base beyond traditional gaming, and making GPUs central to many more workloads.

Rising Demand for High-Performance Gaming and Realistic Graphics

Expanding Use of GPUs in Artificial Intelligence and Data-Centric Applications

High Production Costs and Pricing Volatility

High Power Consumption and Thermal Management Issues

Growth of Cloud Gaming and GPU-as-a-Service (GaaS)

Integration of GPUs into Autonomous Vehicles and Edge AI Systems

Intense Competition and Rapid Technological Obsolescence

Global Supply Chain Disruptions and Semiconductor Dependencies

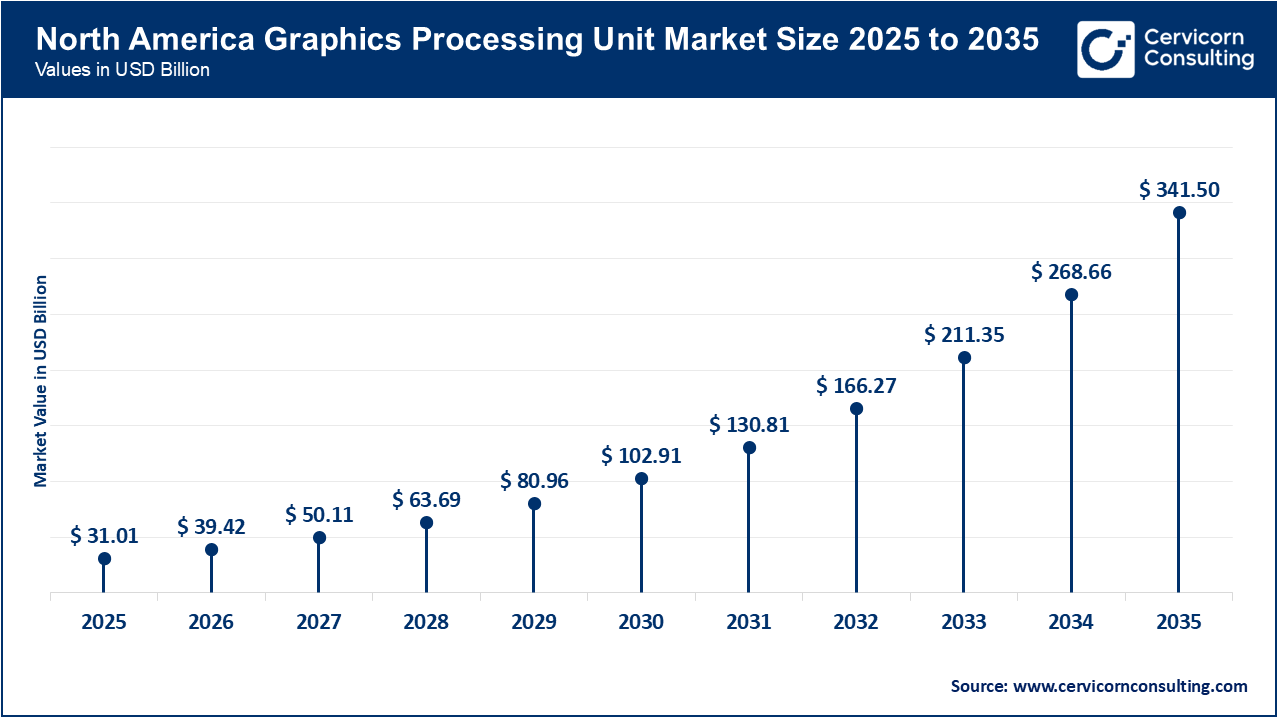

The graphics processing unit market is segmented into various regions, including North America, Europe, Asia-Pacific, and LAMEA. Here is a brief overview of each region:

North America's GPU market is underpinned by a strong ecosystem of cloud service providers, leading GPU vendors, its gaming culture, and large investment insides. The cloud segment saw the greatest amount of revenue generated in the data-centre GPU segment in North America. The region also had the earliest prevalence of high-end GPUs used for generative AI and scientific computing and gaming. This pushed the market forward in volume and capability.

Recent Developments:

The Asia-Pacific is growing market for GPUs because of various factors such as rapid digitalisation, large gaming markets, substantial semiconductor manufacturing capabilities, and government support for AI and cloud infrastructure. For example, China's "New Infrastructure" program and other targeted expansions of AI/data-centre capacity are evident examples of major public sector projects. The Asia-Pacific is becoming both a demand centre for GPUs and related hardware and a manufacturing centre.

Recent Developments:

The European GPU market is bolstered by solid demand from industrial automation, automotive applications (most notably electrified vehicles and autonomous driving) and the professional graphics and gaming segments. The region also sees a gradual adoption of GPUs for VR/AR, design and manufacturing workflows, and data-centre expansion.

Recent Developments:

GPU Market Share, By Region, 2025 (%)

| Region | Revenue Share, 2025 (%) |

| North America | 38.60% |

| Asia-Pacific (APAC) | 29.40% |

| Europe | 21.30% |

| LAMEA | 10.70% |

The GPU market in the LAMEA region is driven by increasing disposable income, rising gaming penetration, growing cloud services and infrastructure build-out in emerging economies. While now smaller than other regions, LAMEA has much potential for future growth as both enterprises and consumers increasingly adopt GPU-related technology.

Recent Developments:

The graphics processing unit market is segmented into type, deployment model, end-user, application, and region.

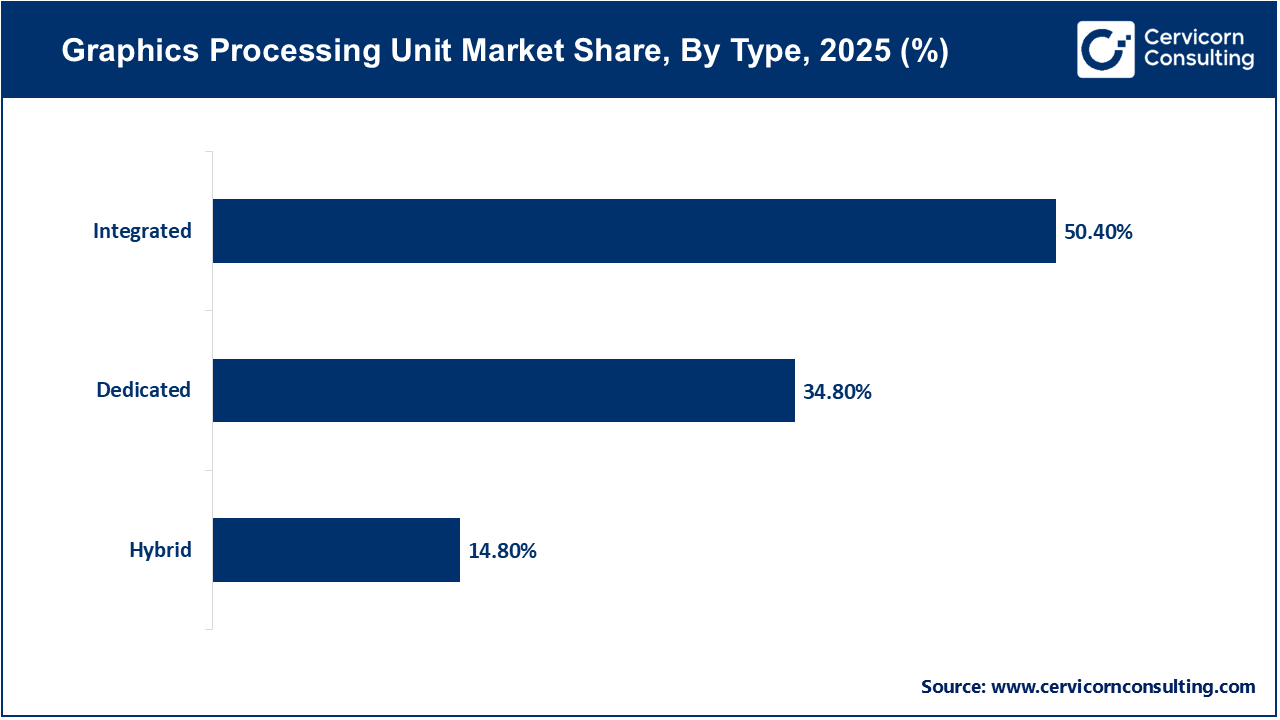

Integrated GPUs account for the largest share of graphics processing unit market, due to their extensive use in laptops, desktops, and mobile devices. Integrated GPUs are built right into the chip along with the CPU and primarily serve as an economical and energy-efficient answer for computing, multimedia and casual gaming purposes. For example, leading CPU manufacturers like Intel (Iris Xe, Arc integrated) and AMD (Ryzen with Radeon Graphics) are significantly improving integrated GPU performance, narrowing the gap between its performance and a discrete GPU. The trend toward thin, portable devices with energy-efficient computing needs will keep integrated GPUs to be the most common kind, whether used directly by consumers or in commercial applications.

The hybrid GPU segment is the fastest-growing segment as it has combined both integrated and dedicated GPU capabilities to balance performance and efficiency. Hybrid GPU Systems offer a smart way to switch between the two graphics engines, integrated GPU and discrete graphics, based on workload — optimizing battery life and computational power. Technologies like NVIDIA Optimus, AMD SmartShift, and Apple’s Unified Memory Architecture (UMA) have led to new hybrid products for high-performance laptops and workstations to support creative professionals. The ongoing trend of mobile gaming, on-the-go content production, and AI computing generally requires hybrid solutions for a substantial growth opportunity in this hybrid GPU segment in the coming years.

On-premises deployment dominates the GPU market, especially in gaming, local rendering farms, and enterprise solutions that require full hardware control and low latency. On-premises GPU systems are favored by businesses, research institutions, and professional studios that want data privacy, customization and real-time performance. Furthermore, high-performance GPUs such as NVIDIA RTX 6000 Ada and AMD Radeon PRO series strengthen the on-premises segment, as organizations must establish dedicated infrastructure for critical workloads, including the production of creative content.

GPU Market Share, By Deployment Model, 2025 (%)

| Deployment Model | Revenue Share, 2025 (%) |

| On-premises | 55.60% |

| Cloud | 44.40% |

Cloud deployment is the fastest-growing market segment as it is fueled by the rapid surge of cloud gaming, AI-as-a-service, and GPU virtualization. Major cloud providers are rolling out or have expanded GPU instances for customers who want to rent computational power rather than buying physical hardware. This business model has also brought the possibility of scaling workloads in applications such as AI, data analysis, and machine learning, while lowering the cost to businesses. Cloud GPUs have enabled flexibility and accessibility and are expected to be a leading growth driver for this segment of the market going forward.

The gaming segment leads the GPU market, holding a large share due to the global popularity of high-fidelity and competitive gaming. GPUs are essential for the experience of 4K resolution, real-time ray tracing, and AI-driven upscaling for gaming consoles and PCs. The gaming market density continues to increase within esports, virtual reality, and live-streaming. Brands like NVIDIA GeForce RTX and AMD Radeon RX maintain large shares of this market, generating revenue and enthusiasm for annual releases.

GPU Market Share, By End-User, 2025 (%)

| End-User | Revenue Share, 2025 (%) |

| Gaming | 37.20% |

| Automotive | 16.80% |

| Design & Manufacturing | 20.50% |

| Healthcare | 9.60% |

| Real Estate | 8.90% |

| Others | 70% |

The healthcare sector is the fastest-growing in the GPU market, driven by more AI-driven diagnostics, medical imaging, and predictive analytics. GPUs help to speed up advanced computations required in CT scans, MRI analysis, and genomic sequencing. Companies are using GPU-enabled platforms like NVIDIA Clara to render images faster and have improved diagnostic capabilities. The extent of GPU usage in robotic surgery systems and telemedicine systems has also increased, making healthcare one of the most attractive verticals for the future adoption of GPUs.

The gaming consoles segment holds the highest share of the market due to the success of next-generation consoles like the Sony PlayStation 5, Microsoft Xbox Series X, and the Nintendo Switch 2. These gaming consoles are heavily reliant upon GPU technology to deliver cinema-quality graphics, faster frame rates, and immersive experiences. Additionally, the upgrade cycle of gaming hardware and strong consumer demand keeps the gaming segment at the top of GPU usage on a global scale

GPU Market Share, By Application, 2025 (%)

| Application | Revenue Share, 2025 (%) |

| Gaming Consoles | 21.70% |

| AI & ML | 17.30% |

| Data Centers | 15.40% |

| Healthcare & Medical Imaging | 6.80% |

| Cryptocurrency Mining | 5.10% |

| Rendering & Visualization | 8.20% |

| High-performance Computing (HPC) | 9.60% |

| Edge Computing & IoT | 8.90% |

| Autonomous Systems | 4.20% |

The AI and machine learning segment represents the fastest-growing application area. GPUs are essential for accelerating deep learning model training, neural network inference, and natural language processing. Corporations such as Google, Amazon, and Tesla rely on GPU clusters for their artificial intelligence models and autonomous systems. NVIDIA's Tensor Cores and AMD's ROCm platform are establishing GPUs as the cornerstone of AI workloads across cloud, enterprise, and edge environments. This will ensure long-term growth of AI applications as AI becomes integrated into almost every industry.

Industry Leaders’ Perspectives: Voices Shaping the Future of Graphics Processing Unit (2025):

Jensen Huang (CEO, NVIDIA Corporation)

Huang has said in multiple settings that GPUs are no longer just "graphics chips" but are part of a new computing infrastructure comparable to electricity or the Internet. For example, at COMPUTEX 2025 he said: "AI is now infrastructure, and this infrastructure ... needs factories." He also suggested that compute, particularly for agentic AI and reasoning models, will grow "100×" over recent predictions. Huang's view is pushing the GPU market in the sense that it is stimulating investment in GPU capacity (data centres, cloud, HPC) and it establishes GPUs as central to not just gaming or graphics, but AI, autonomous systems, robotics and generative computing. The implication is that vendors have to scale GPU capacity, as well as its software/algorithm ecosystems, supply chains and new cooling/power paradigms.

Lisa Su (CEO, Advanced Micro Devices (AMD))

Lisa Su frames the future of computing as a “super-cycle” with AI and high-performance computing driving a significant change in the way industries operate. Su has remarked, “I really believe that this is the beginning of a 10-year kind of supercycle.” Su also reiterates that GPUs will facilitate augmenting human work rather than replacing human work in its totality, stating, "AI won’t take your job… it will transform the way you work." For the GPU market, this translates to AMD betting on wide adoption in all markets (data centres, cloud, edge) and planning their GPU/accelerator product roadmap accordingly. It creates renewed competition, diversification of end use beyond the gaming space, and centres around sustainability and partner ecosystems, not just product launches.

Market Segmentation

By Type

By Deployment Model

By End-user

By Application

By Region