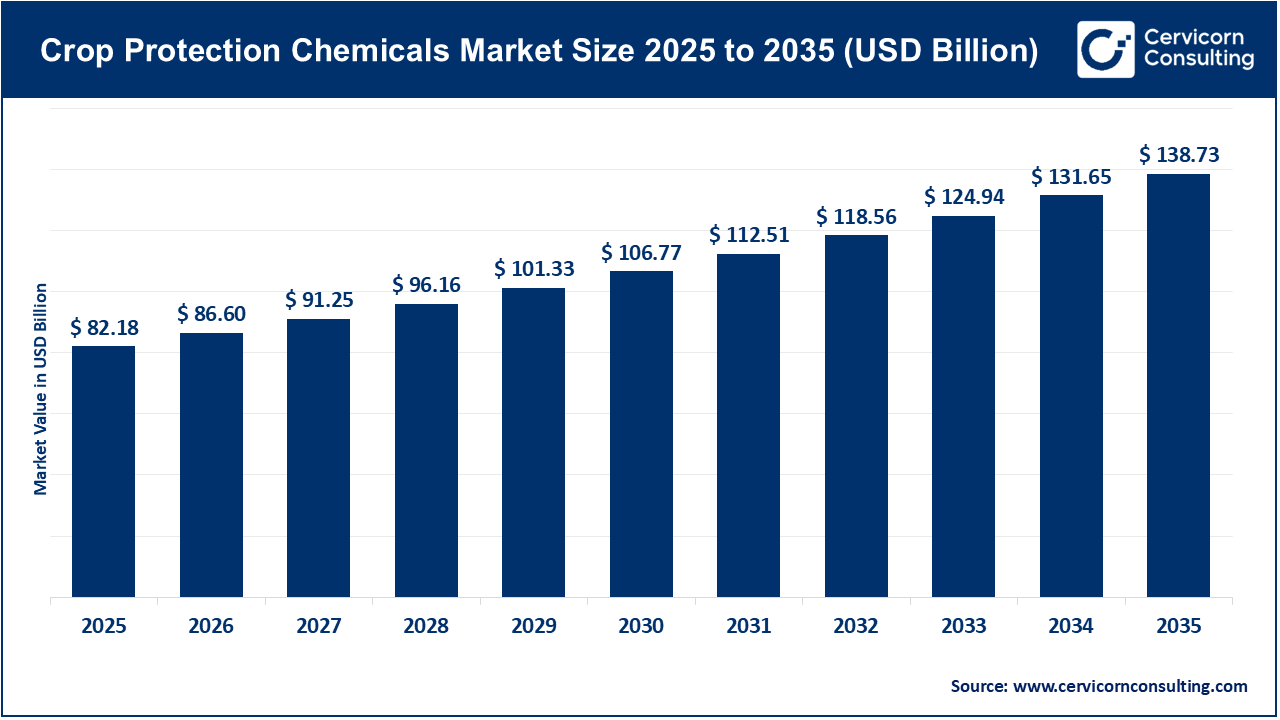

The global crop protection chemicals market size was valued at USD 82.18 billion in 2025 and is expected to be worth around USD 138.73 billion by 2035, exhibiting at a compound annual growth rate (CAGR) of 5.4% over the forecast period from 2026 to 2035. The crop protection chemicals market is experiencing strong growth, driven by rising global food demand and increasing pressure on the agricultural system to improve productivity. This market encompasses a wide range of solutions such as herbicides, insecticides, fungicides, and biological agents to provide efficiency and reliable food production systems. These products play a critical role in protecting crops from pests, diseases, and weeds that threaten to reduce global harvests by 20% to 40% each year. Climate change and declining per-capita arable land availability are shifting the role of advanced chemical and biological protection products, which are evolving from yield enhancement to essential components of global economic security. The market is ongoing in transforming broad-spectrum synthetic chemicals into more targeted "bio-rational" solutions integrated with digital technology. The increase in resistant pest populations and regulatory restrictions on traditional active ingredients is reshaping the crop protection industry.

Economic factors are major drivers of growth in the crop protection market. In many developing regions, rising costs and limited availability of agricultural labor are increasingly shifting reliance toward chemical-based solutions. Specifically, in parts of Southeast Asia and Africa, farmers are increasingly replacing manual efforts with herbicides to remove weeds more efficiently. The agricultural sector has also integrated into the global trade network to export many products and protect them from pest damage. In addition, technological innovation strongly supports market growth. The emergence of artificial intelligence and precision agriculture enables targeted applications of crop protection chemicals. These technologies help reduce chemical waste and runoff while maximizing effectiveness and improving overall crop health.

Precision Agriculture and Digital Monitoring Adoption Drive the Market Growth

The adoption of precision agriculture and advanced monitoring technologies is a significant driver of growth in the crop protection chemicals market. This shift moves away from broad applications across the field, such as "spot spraying" and variable-rate applications. These options support farmers in achieving their production goals through the use of AI-powered sensors, satellite images, and drones to perform field assessments quickly. In short, farmers can adopt precision agriculture to identify specific areas of their fields that require treatment and accomplish their goals by applying targeted treatments, such as reducing total chemical volume and improving application performance and efficiency. This trend is changing the value proposition for chemical manufacturers.

1. Major Corporate Developments and Mergers

The crop protection industry has experienced significant consolidation, leading to the rise of the "big four" global players such as Syngenta (ChemChina), Bayer (Monsanto), Corteva Agriscience, and BASF. These mergers, completed between 2017 and 2020, aimed to reshape the competitive landscape by centralizing R&D resources and global distribution networks. This consolidation was primarily driven by the need for substantial capital investments to develop new active ingredients like seeds and chemicals, providing integrated advanced platforms for farmers. Recent corporate milestones have focused on integrating the newly merged companies and managing their portfolios. Additionally, companies sold off non-core assets to satisfy anti-trust regulators, while simultaneously acquiring biological start-ups and other specialized digital firms to bolster their innovation pipelines.

2. Government Policy and Regulatory Frameworks.

Government policies, such as the European Union’s Green Deal and Farm to Fork, have become the major drivers of the market. Under these initiatives, the European Union has set a target to reduce the overall use and risk of chemical pesticides by 50% by 2030. The implications of this legislation have strongly affected the market and agricultural sector, leading to the promotion of substantial regulatory and product stewardship teams that strategically and tactically introduce their entire product portfolios. Similar regulatory trends are emerging globally, as China continues to strengthen environmental regulations related to chemical manufacturing, and the USA is increasingly evaluating the long-term cumulative societal implications of certain active ingredients.

3. Innovations in Chemical Synthesis and Distribution

Another significant milestone shaping the market is technological innovations in chemical synthesis and formulation segments. Recent advances in chemistry have introduced new "novel modes of action" to effectively address issues of pest and weed resistance. For example, recently, the introduction of new insecticide classes with highly exclusive mechanisms is designed to control pests while remaining safe for beneficial insects such as bees, which represents an extraordinary technical achievement. Additionally, improvements in distribution and packaging are making chemical handling safer and more efficient.

4. Wide Commitment to Large-Scale Sustainability

The industry-wide commitment to large-scale sustainability initiatives and carbon farming practices plays a significant role in driving market growth. Leading crop protection companies are increasingly collaborating with food processors and retailers to implement regenerative agriculture across millions of hectares. These programs focus on using cover crops, reducing tillage, and applying chemicals more precisely and responsibly to improve soil health and boost carbon sequestration. Notably, initiatives that link certain crop protection products to verified carbon credits are creating new revenue streams for farmers and helping the agrochemical industry align with global climate goals.

Report Scope

| Area of Focus | Details |

| Market Size in 2026 | USD 86.60 Billion |

| Market Size in 2035 | USD 138.73 Billion |

| CAGR 2026 to 2035 | 5.40% |

| Key Segments | Type, Crop Type, Formulation, Source, Mode of Application, Region |

| Key Companies | BASF SE, Bayer CropScience, Syngenta Group, Corteva Agriscience, FMC Corporation, UPL Limited, Nufarm Limited, Sumitomo Chemical Co., Ltd., ADAMA Agricultural Solutions, American Vanguard Corporation, Koppert Biological Systems, Gowan Company, PI Industries, Valent U.S.A. LLC, Verdesian Life Sciences |

The crop protection chemicals market is segmented into various regions, including North America, Europe, Asia-Pacific, and LAMEA. Here is a brief overview of each region:

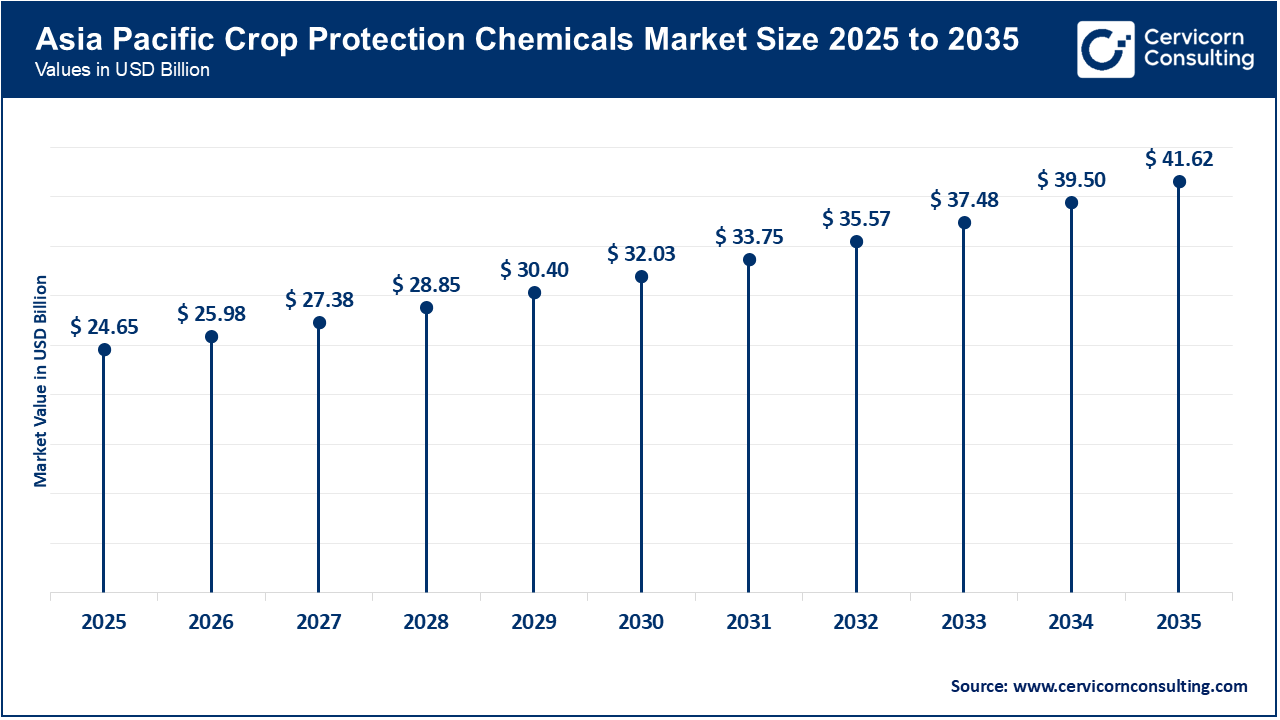

The Asia-Pacific crop protection chemicals market size was valued at USD 24.65 billion in 2025 and is expected to record around USD 41.62 billion by 2035. The Asia Pacific region has the largest share of the global market, mainly due to the region need to ensure food security for nearly 60% of the world's population. Rapid urbanization is reducing the amount of arable land available per capita, and the increased use of chemicals to maximize yield on land that is planted. In countries such as India and China, government subsidies are supporting agricultural inputs, while modernization efforts are helping smallholder farmers to adopt more effective herbicides and insecticides. Additionally, increasing rural labor costs are forcing changes from manual weeding to chemical weed control, which indicating the region will remain a primary volume driver for the global market.

Recent Developments:

The North America crop protection chemicals market size was estimated at USD 18.08 billion in 2025 and is forecasted to surpass around USD 30.52 billion by 2035. The North American market is characterized by the integration of high degree of technology and large amount of cultivaton of genetically modified (GM) crops. The combination of herbicide-tolerant seeds with particular chemical pairings has established a specialized segment of the market to focus on commodity crops such as corn, soybeans, and cotton. Countries such as the U.S. and Canada have professional growers who have adopted precision agriculture tools, such as GPS sprayers and drone-based applications. These tools help to apply chemical usages more efficient and minimize environmental runoff.

Recent Developments:

The Europe crop protection chemicals market size was reached at USD 13.97 billion in 2025 and is predicted to hit around USD 23.58 billion by 2035. Europe represent the most mature market, currently undergoing a significantly shift from"Farm to Fork" strategy and the European Green Deal. Government regulatory frameworks, such as REACH and CLP, have promoted reduction in conventional active ingredients, creating an opportunities in the market, which is occupied by new generation compliant, and eco-friendly formulations, at a higher price point. The EU is a recognized global leader in adopting biopesticide and integrated pest management (IPM) solutions as farmers work to meet legislation demanding a reduction of 50% in chemical pesticide usage by 2030.

Recent Developments:

Crop Protection Chemicals Market Share, By Region, 2025 (%)

| Region | Revenue Share, 2025 (%) |

| Asia Pacific | 30% |

| North America | 22% |

| Europe | 17% |

| LAMEA | 31% |

The LAMEA crop protection chemicals market size was valued at USD 25.48 billion in 2025 and is anticipated to reach around USD 43.01 billion by 2035. The LAMEA region is early stages of development but has strong market potential. Countries such as Brazil and Argentina represent the largest growth frontier for the global crop protection industry, primarily driven by the continued expansion of arable land. Agriculture in LAMEA is heavily export-driven, focused on commodity crops like Soybeans, sugarcane, and coffee which require intensive protection from tropical pests and diseases.

Recent Developments:

The crop protection chemicals market is segmented into type, crop type, formulation, source, mode of application, and region.

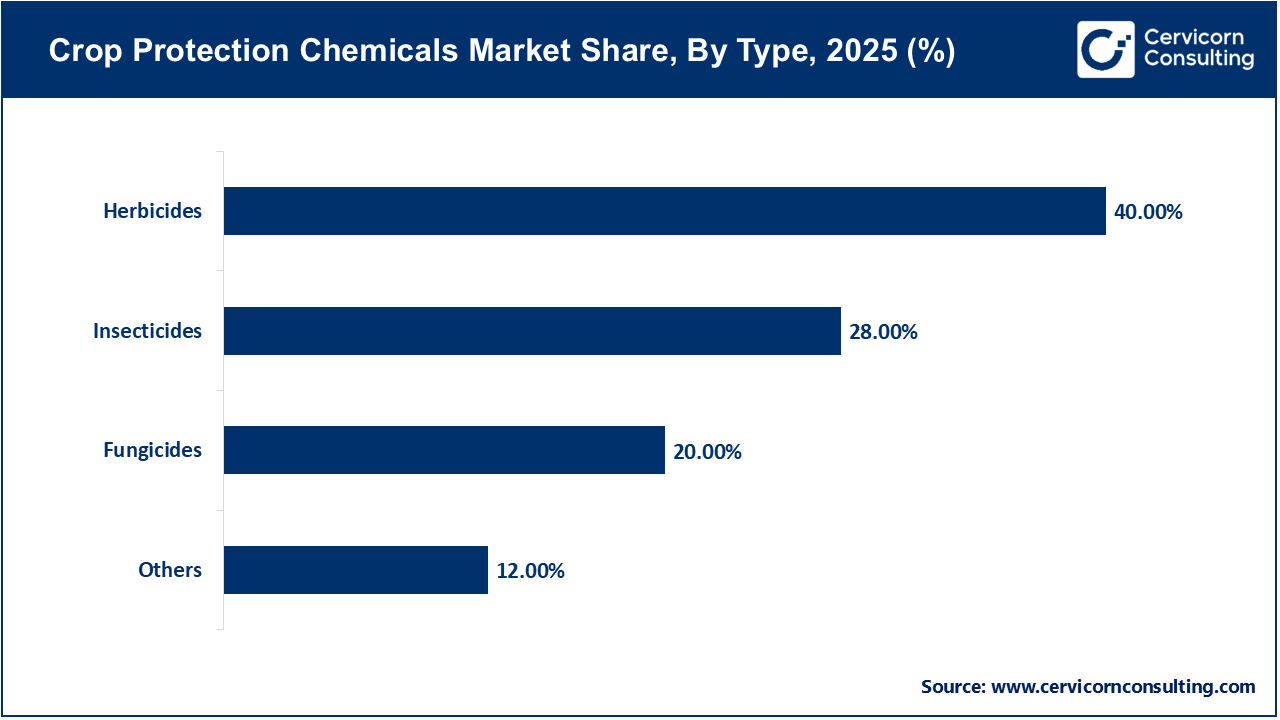

Herbicides continue to be the largest segment of the global crop protection chemical market, primarily because of their critical role in large-scale cultivation of row crops like corn, soybeans, and wheat. As labor costs continue to rise and farmers increasingly adopt conservation farming practices such as "no-till" or "minimum-till" systems, reliance on chemical weed control helps maintain soil structure. Herbicides offer a cost-effective solution that helps suppress weed growth while preserving soil structure, improving operational efficiency, and supporting higher crop yields.

Insecticides represent the fastest-growing segment of the market due to expanding pest ranges caused by climate change and increasing insect resistance to conventional chemical formulations. Insecticides are especially important for high-value horticultural crops, where even minor pest infestations can damage crop quality in retail markets due to high aesthetic and quality standards. Additionally, export agriculture markets in regions such as Latin America and Asia are driving strong growth in insecticide use, as fruit and vegetable production expands significantly.

The cereals segment, encompassing crops such as wheat, rice, corn, and barley, holds the largest position in the market, primarily due to its central role in global food and animal feed systems. These massive scales of cereal cultivation, on the order of hundreds of millions of hectares, create consistent and substantial baseline demand for crop protection solutions, making this segment the most sizeable and core element of the crop protection chemicals market. The predominance of cereals is further supported by government subsidies and food security programs from major producing countries like China, India, and the U.S.

Crop Protection Chemicals Market Share, By Crop Type, 2025 (%)

| Crop Type | Revenue Share, 2025 (%) |

| Cereals | 42% |

| Fruits and Vegetables | 22% |

| Oilseeds and Pulses | 20% |

| Others | 16% |

Fruits and vegetables are currently the fastest-growing segment of the market because of a “nutritional shift" in developing economies. Rising disposable incomes and expanding middle class populations across Asia-Pacific and Latin America are accelerating consumer demand for fresh, diverse, and high-quality products. Fruits and vegetables are particularly prone to a wide range of pests and diseases; as a result, crop protection products are applied multiple times and often involve various types of chemicals throughout the growing season to maintain product quality.

Liquid formulations are the leading segment in the market mainly because of the widespread availability of advanced formulations such as emulsifiable concentrates (EC), suspension concentrates (SC), and soluble liquids (SL). These formulations continue to be extensively used across the global agricultural system, where the vast majority of spraying equipment, ranging from tractor-mounted booms to aerial crop applications, is specifically designed to apply liquids. In addition, liquid products also offer ease of use in handling, mixing, and acceptance, making them highly suitable for both small farmers and large industrial users.

Crop Protection Chemicals Market Share, By Formulation, 2025 (%)

| Formulation | Revenue Share, 2025 (%) |

| Liquid | 68% |

| Solid | 32% |

Solid Formulations are the fastest-growing segment in the crop protection chemicals market during the forecast period, primarily due to various technologies such as water-dispersible granules (WG), wettable powders (WP), and dusts, which provide stability and better shelf life for the product. In rugged regions with limited cold-chain infrastructure or extreme climate elements, especially near 0°C, solid formulations are often preferred because they offer stability and less degradation compared to liquids. Advances in "granulation" technology have also improved the handling of solid products and minimised hazards by reducing dust exposure.

Synthetic chemicals are the leading segment of the market, having formed the foundation of modern agriculture in the mid-20th century. They continue to be the dominant segment in terms of raw sales and application volumes. These products are developed through advanced chemical synthesis, which offers the highest levels of efficiency, consistency, and cost-effectiveness. The entire global agrochemical industry, from R&D and development pipelines to manufacturing plants, is primarily designed to produce synthetic active ingredients. For large crops, this segment remains the most economically viable solution for managing large-area pest and weed pressures. However, this segment is under increasing pressure from regulatory agencies and environmental groups.

Crop Protection Chemicals Market Share, By Source, 2025 (%)

| Source | Revenue Share, 2025 (%) |

| Synthetic Chemicals | 80% |

| Biologicals | 20% |

Biopesticides are the fastest-growing segment of the crop protection market, driven by a significant shift toward sustainable agriculture. This category includes microbial pesticides, naturally-derived biochemicals, and semiochemicals such as pheromones. The expansion of biologicals is supported by growing consumer demand for "organic" or "pesticide-free" produce and requires new innovative technologies to manage chemical resistance. In 2024, biologicals, while still a small portion of total crop protection sales, are rapidly increasing and are expected to significantly surpass those of traditional synthetics. The rise of advanced biologicals also reflects a more favourable regulatory environment, with the registration process for biopesticides often faster and less expensive than for synthetic chemicals.

Foliar spray is the leading application segment of the market because of they are most conventional and widely use method over global crop protection market. In this approach, liquid chemical is applied directly to the leaves and stems of the plant, typically usually from ground-based spray units or aircraft. Foliar spray is technology it’s versatile, it can be used for various stages of crop growth such as herbicides, fungicides, and insecticides. Foliar spray is particularly effective for "curative" treatments and issues with pests and diseases that need to be addressed immediately to prevent yield loss.

Crop Protection Chemicals Market Share, By Mode of Application, 2025 (%)

| Mode of Application | Revenue Share, 2025 (%) |

| Foliar Spray | 47% |

| Soil Treatment | 22% |

| Seed Treatment | 18% |

| Others | 13% |

Seed treatment is the fastest growing mode of application in the market, primarily driven by shift towards a more "surgical" and "preventative" approach to protecting crop. This method involves applying chemical or biological agents directly onto the seed before planting, protecting the plant from soil-borne pests and diseases during earliest stages of crop growth. Seed treatments are highly efficient, requiring little active ingredient volume, especially compared to foliar sprays.

By Type

By Crop Type

By Formulation

By Source

By Mode of Application

By Region