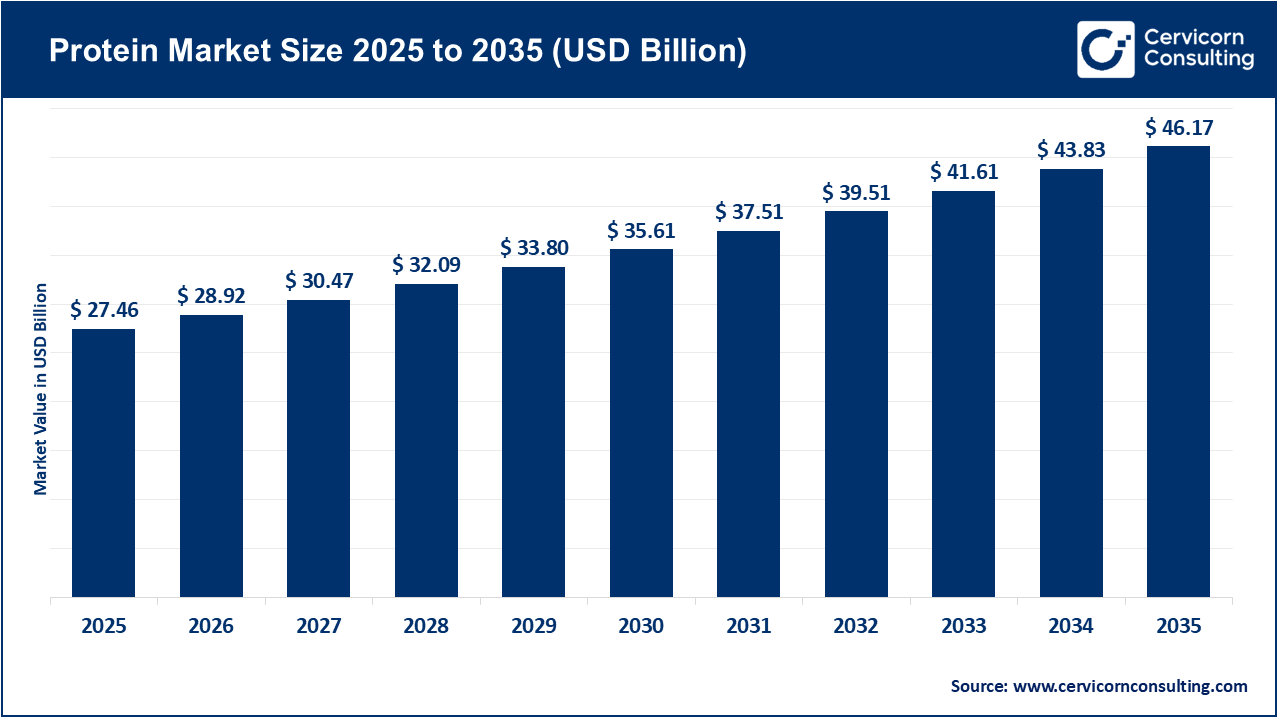

The global protein market size was valued at USD 27.46 billion in 2025 and is expected to be worth around USD 46.17 billion by 2035, exhibiting at a compound annual growth rate (CAGR) of 5.4% over the forecast period from 2026 to 2035. The global protein market is undergoing major changes due to shifting demographics and the fast growth of the middle class in developing countries. The increasing number of older consumers is also driving demand for protein-fortified products that help with muscle loss, mobility, and active lifestyles. At the same time, the feed and feed additives sector is growing rapidly to meet the rising need for protein. Soybean remains the main driver of protein growth, supporting both livestock production and the development of new plant-based proteins.

Protein consumption is now shaped by lifestyle choices and environmental concerns, in addition to its basic nutrition and health benefits. Protein is no longer just for athletes or fitness consumers, but has become a key part of health and wellness for a wider population. Conventional protein sources are also seeing strong growth, driven by the expansion of the finfish aquaculture industry, which is expected to reach about 942,392 thousand tons by 2024. This shows the growing role of aquatic protein in food security and economic growth through sustainable protein production. The feed additives market is also important for improving the efficiency of animal protein production.

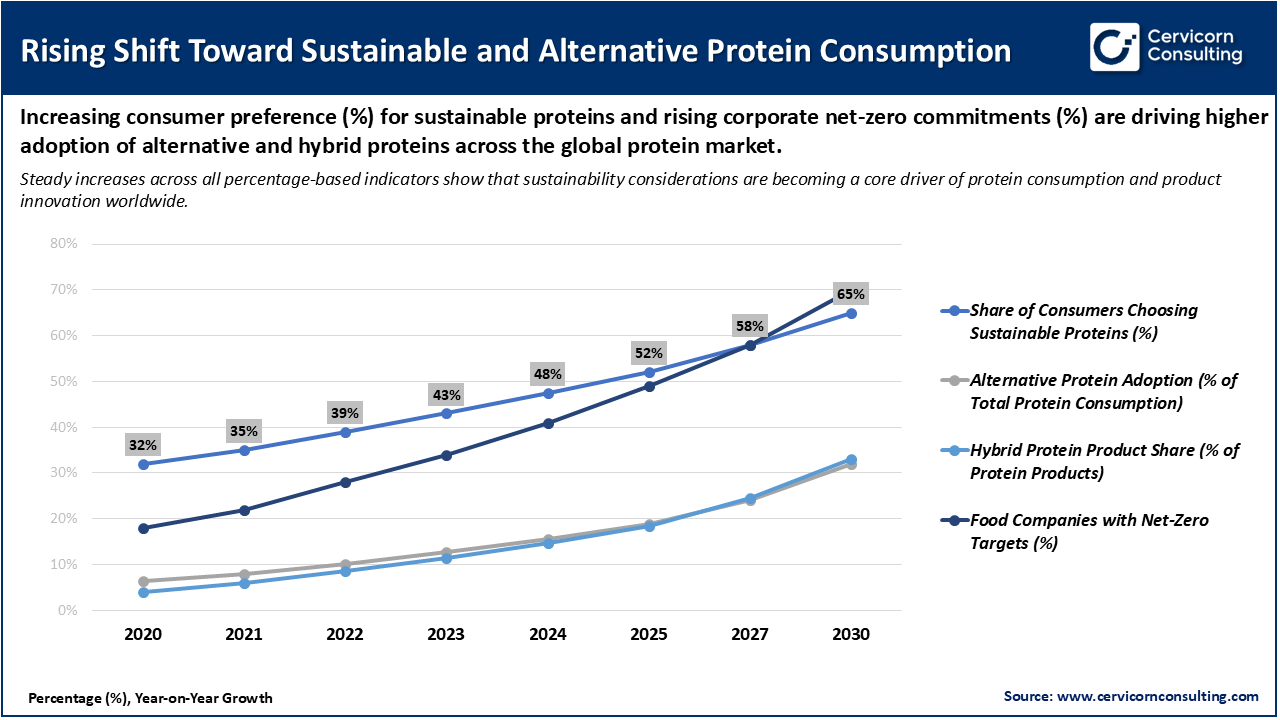

Sustainability-Driven Shift Toward Alternative and Hybrid Protein Sources

The shift toward sustainable practices has become a major driver of the global protein market due to both consumer preferences and corporate ESG mandates in a post-COVID-19 era. The global food system is a significant source of environmental pressure, leading to the adoption of sustainable proteins, including single-cell proteins, microalgae, and insects. This is most evident in the dairy and meat sectors, where corporate leaders aim to achieve "net zero" greenhouse gas emissions by 2030 and 2050. Beyond mere substitution, this trend is not just about replacing animal proteins with life-cycle assessed sustainable options but about a net expansion of the protein portfolio to include hybrid products with both animal and plant sources that collectively deliver taste without the environmental footprints.

The chart shows a steady and rapid increase in sustainable and alternative protein consumption from 2020 to 2030. The percentage of consumers choosing sustainable proteins grows from around 32% to 65%. There is also a sharp rise in the share of alternative proteins in total protein consumption and in the use of hybrid protein products, which indicates a move away from traditional animal proteins. Simultaneously, a growing number of food companies are adopting net-zero targets. These ESG-focused strategies, together with rising consumer demand, are expected to drive the shift in the global protein market toward more sustainable and lower-impact protein sources.

1. Recent Corporate Development and Capacity Growth

Corporate milestones in 2024 have focused on demonstrating the capacity to expand to achieve price parity with conventional sources of protein. In April 2024, a significant industrial milestone was reached when a sustainable single-cell protein plant was announced as fully operational, marking a notable shift from experimental to commercial-scale production. The further advancements made in the plant-based subsegment reflect the concentrated capacity growth for pea protein isolates, where production loads are projected to achieve new peaks by late 2024 to service the diversifying snack and bakery segments. These capacity expansions are essential for stabilizing supply chains and unit cost reductions for premium protein ingredients to meet the needs of mass market food manufacturers.

2. Government Policy and Regulatory Framework Milestones

Beyond government leadership, fundamental elements such as vision, goals, and autonomy were critical success factors in 2024 and 2025, as they provided the regulatory clarity needed for market development. In China, the ongoing "Made in China 2025" policy emphasises a strong commitment to integrating future food innovation. Collaborative initiatives within national food security are evident and require significant effort. Data shows a rise in cultured meat patents and research activity from 2020 to 2024, supported early on by government-initiated safety assessment frameworks established at the start of cultured meat market development.

3. Technological Breakthroughs in Protein Synthesis

Another milestone advances technological improvements in protein synthesis efficiency and solutions for supporting alternative protein sources. Notable achievements include designing bioreactors for cellular agriculture, which improve the scalability of applied science and enable efficient protein expression and metabolic control in lab-grown meat production systems. Meanwhile, microbial proteins incorporated into food technology have enhanced functionality, such as lactic acid, which aids in protein coagulation for dairy-style products. These developments help close the "flavor and texture gap" that previously hindered the widespread adoption of alternatives, creating a more seamless dietary experience and offering healthier choices.

4. Strategic Investments and Market Valuations

Market valuations in the protein sectors are growing due to strategically important investments, which enhance long-term outlooks and strengthen the value chains for alternatives to traditional food. In 2024, a USD 30 million investment from the Bezos Earth Fund marked a major milestone, aimed at speeding up the development of cellular agriculture and sustainable protein production. This fund represents just the beginning of a range of capital investments starting to flow into the food technology industry. Support from philanthropic organizations and the private sector is increasingly helping to bridge the "valley of death" that often hampers capital-heavy food technology innovations. These investments are already moving from concept creation to commercialization, enabling scalable and practical solutions.

Report Scope

| Area of Focus | Details |

| Market Size in 2026 | USD 28.92 Billion |

| Market Size in 2035 | USD 46.17 Billion |

| CAGR 2026 to 2035 | 5.40% |

| Dominant Region | North America |

| Fastest Growing Region | Asia-Pacific |

| Key Segments | Source, Form, Application, Region |

| Key Companies | Cargill, Incorporated, CHS Inc., Arla Foods Ingredients Group P/S, Kerry Group plc, Fonterra Co-operative Group Limited, International Flavors & Fragrances Inc., Glanbia plc, Roquette Frères S.A., DSM-Firmenich AG, Bunge Global SA, Ingredion Incorporated, PURIS Proteins, LLC, Archer-Daniels-Midland Company, Abbott |

The protein market is segmented into North America, Europe, Asia-Pacific, and LAMEA. Here is a brief overview of each region:

The Asia-Pacific protein market size was valued at USD 6.87 billion in 2025 and is predicted to surpass around USD 11.54 billion by 2035. Asia Pacific is experiencing rapid growth in the market due to urbanization and the expanding middle class. In countries like Singapore, the environment supports the development of alternative proteins to enhance food security. As urbanization continues, consumers' diets are shifting to include diverse and protein-rich foods that challenge traditional livestock products and dietary options. Moreover, developing economies in the Asia Pacific, such as Bangladesh, are witnessing changes in economic policies and population growth, which have increased the demand for affordable, nutrient-dense protein sources to meet rising nutritional standards.

Recent Developments:

The North America protein market size was reached at USD 9.89 billion in 2025 and is forecasted to record around USD 16.62 billion by 2035. In North America, the protein market consists of diverse and complex consumer segments. Consumers are sophisticated and consider protein macros an important part of a performance-driven lifestyle. Health and wellness trends are the main drivers in major categories, leading to a significant growth of protein-fortified products beyond traditional uses. Protein enrichment is increasingly common in snacks, beverages, and confectionery. Additionally, strong demand for "on the go" nutrition and convenience is a key reason for boosting innovation towards high-protein, convenient formats to meet the needs of health-conscious professionals and lifestyles.

Recent Developments:

The Europe protein market size was estimated at USD 7.69 billion in 2025 and is projected to hit around USD 12.93 billion by 2035. The Europe market depends on strict environmental regulations and a cultural shift toward sustainability. This is mainly driven by the European Green Deal strategy and 'Farm to Fork,' aimed at reducing reliance on imported proteins and rewarding companies for lowering their environmental impact. This environmentally driven culture is likely to speed up the adoption of plant-based proteins and support the development of the bio economy and protein economy through principles like precision fermentation.

Recent Developments:

Protein Market Share, By Region, 2025 (%)

| Region | Revenue Share, 2025 (%) |

| North America | 36% |

| Europe | 28% |

| Asia Pacific | 25% |

| LAMEA | 11% |

The LAMEA protein market was valued at USD 3.02 billion in 2025 and is anticipated to reach around USD 5.08 billion by 2035. The LAMEA market growth is primarily driven by population increase and steady economic stabilization. In Latin America, the protein market continues to grow due to its role as a global hub for animal protein production and export, supported by its natural resources. While the Middle East and Africa focus on food security and self-sufficiency, their governments subsidise economically viable regional production and enhance staple food formulations through protein to establish a secure food supply for the growing young population.

Recent Developments:

The protein market is segmented into source, form, application, and region.

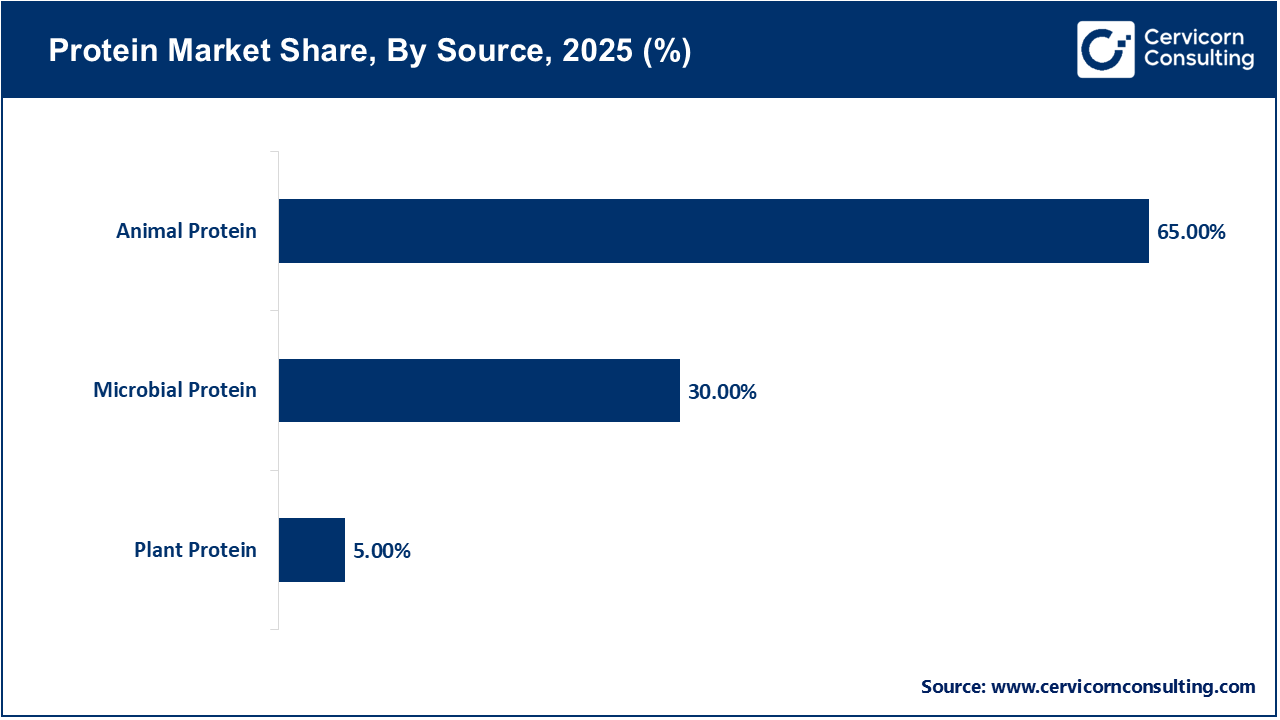

Animal-derived proteins dominate the global protein market, accounting for the largest share of total consumption, due to their well-established sensory profile and high amino acid bioavailability with super micronutrient value proposition. Meat, dairy, and eggs are likely offered as protein sources, supported by the global cold-chain and deeply rooted dietary habits. This dominance is further reinforced by the rapid expansion of aquaculture, which has emerged as a scalable and economically viable source of high-quality fish proteins to meet growing global protein per capita needs while supporting sustainable nutrition for the global population.

The plant-based protein segment is the fastest-growing part of the market due to the combination of health consciousness, environmental awareness, and ethical consumerism. The plant-based market is rapidly expanding, particularly in the earlier stages of the plant protein segment, which is being incorporated into convenient bakery and snack products to meet the increasing demand for vegan and flexitarian options. To support the transition toward broader adoption of plant protein formats, companies are actively exploring and commercializing alternative plant-based sources such as pea, soy, and wheat proteins.

Concentrates source segment leads to the market due to their lower cost and their versatility in functional properties. Concentrates typically contain between 60% and 80% percent protein. Concentrates are the industrial workhorse, found in everything from meat extenders to nutrition bars to standard protein powders. Protein concentrates offer functional benefits to food products, including water-holding capacity, emulsification, and gelation, which are highly attractive to large-scale food manufacturers seeking to increase the nutritional profile of their products at lower cost. Because of these properties, concentrates will remain the preferred option for large-scale fortification in the global food industry.

Protein Market Share, By Form, 2025 (%)

| Form | Revenue Share, 2025 (%) |

| Concentrates | 42% |

| Isolates | 30% |

| Hydrolysates | 20% |

| Others | 8% |

Hydrolysates are the fastest-growing segment of the market, primarily driven by rising demand for specialized nutrition and improved digestive efficiencies. These proteins are produced by the enzymatic hydrolysis, which breaks long protein chains into smaller peptides and amino acids that the human body can absorb much faster than intact proteins. Hydrolysates' rapid metabolism and uptake make them the preferred choice for high-performance products such as infant formula, clinical nutrition for the elderly, and sports supplements. As a result, manufacturers are making outsized technological investments to develop precision hydrolysis methods for producing specific bioactive peptides.

The food and beverage (F&B) segment remains the leading application for the market because protein as a macronutrient has become a lifestyle ingredient for consumers, especially for bodybuilders and athletes. This shift is increasingly evident in non-traditional applications such as dairy-free milks, meat analogues, and even the protein fortification of soft drinks. For example, the concept of "everyday fortification" has changed consumers' expectations, with protein now considered a standard ingredient for daily consumption occasions, including morning coffee, midday snacks, and evening meals.

Protein Market Share, By Application, 2025 (%)

| Application | Revenue Share, 2025 (%) |

| Food and Beverages | 58% |

| Personal Care and Cosmetics | 25% |

| Animal Feed | 10% |

| Dietary Supplements and Sport Nutrition's | 7% |

Dietary supplements and sports nutrition is the fastest-growing segment, due to the rapid expansion of "active lifestyle" consumers across all age groups. Growing demand for performance-focused nutrition has increased the use of premium protein forms. Premium protein forms are either isolates or hydrolysates, targeted to each amino acid supplementation effect. In addition, the rise of personalized nutrition and supplementation, where supplements want to tailor their product to the needs for consumer's metabolic needs and fitness goals, is another growth area where there is a valued willingness to pay premium prices for high-performance protein solutions.

By Source

By Form

By Application

By Region