The global contract research organization (CRO) services market size was valued at USD 78.78 billion in 2025 and is expected to be worth around USD 240.34 billion by 2035, exhibiting a compound annual growth rate (CAGR) of 11.8% over the forecast period from 2026 to 2035. The CRO services market is experiencing steady growth driven by increasing R&D investment from pharmaceutical, biotechnology, and medical device companies, as well as the growing complexity of drug development. As a result, the demand for cost-effective, flexible, and time-efficient clinical and preclinical research solutions has accelerated the outsourcing of drug discovery, development, and regulatory services to CROs worldwide.

Increasing trial complexity through advancements in biologics, cell and gene therapy, personalized medicine, and rare disease research is causing more sponsors to depend on specialty CRO expertise. The globalisation of clinical research, rising regulatory scrutiny, and the need for faster access to new products are driving demand for integrated CRO service perspectives.

Contract Research Organization Services Strengthen Global Drug Development

The CRO Service Market has been expanding due to increased reliance on outsourced research by pharmaceutical companies, biotechnology firms, and medical device manufacturers during drug development. CROs offer support throughout the entire product development process, from the discovery stage to finalising FDA submissions and post-marketing surveillance.

CRO services include clinical trial management, laboratory testing, data analysis, regulatory consulting, and pharmacovigilance. These services are crucial for reducing development time, lowering costs, and ensuring compliance with international regulatory standards.

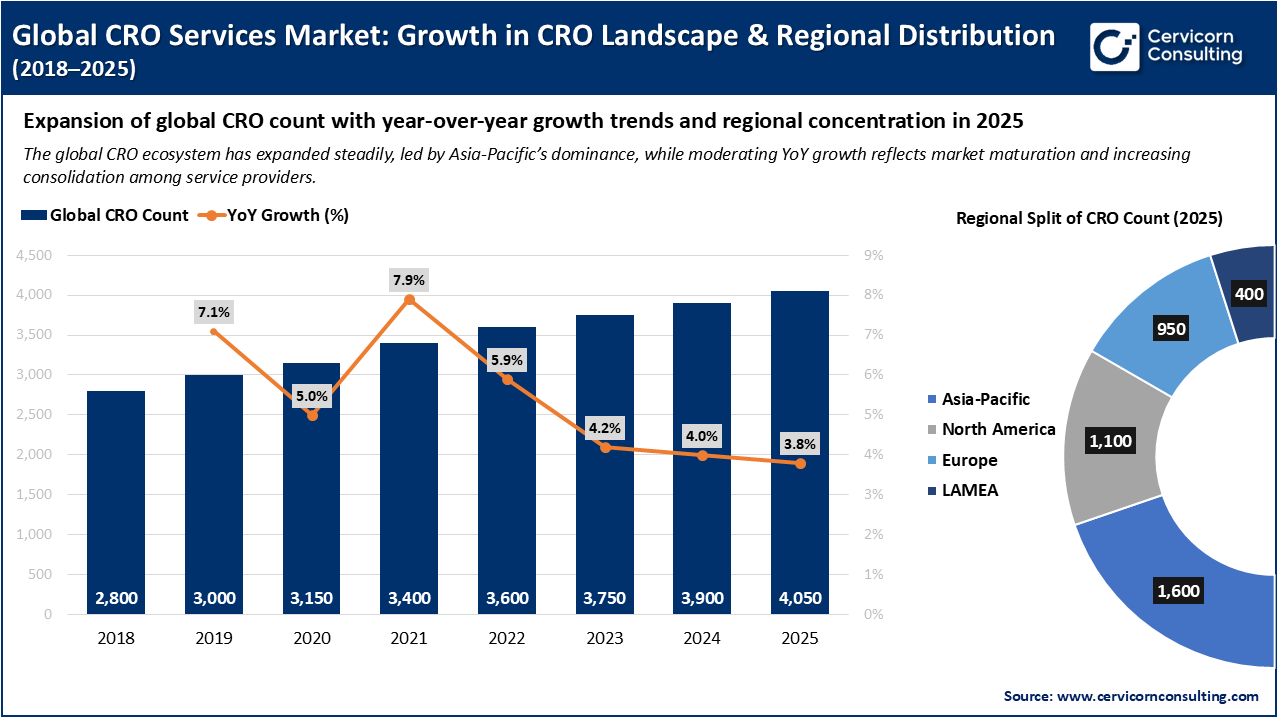

Global CRO Services Market: Expansion of CRO Landscape and Regional Concentration (2018–2025)

The global CRO ecosystem is experiencing steady growth, with the number of CROs increasing from around 2,800 in 2018 to more than 4,050 by 2025. However, the year-over-year growth rate is gradually slowing, which shows that the market is maturing and becoming more consolidated. Asia-Pacific is expected to become the leading region in 2025, holding the largest share of CROs. This growth is mainly driven by cost advantages, rising clinical trial activity, and strong pharmaceutical R&D. North America and Europe continue to be important mature markets with well-established research infrastructure.

Developments in CRO Services market

1. Expansion of Cell & Gene Therapy Drives Specialized CRO Demand

With the rapid growth of cell and gene therapy development in 2025, there has been a significant increase in demand for contract research organizations (CROS) with high-tech capabilities supporting viral vector production, biomarker testing, and complex regulatory submissions. These therapies require specialized trial designs, fewer patients per trial, and longer follow-up periods for participants, which makes niche and highly-skilled CROS essential drivers of innovation in these fields.

2. Late-Stage and Post-Approval Research Gains Momentum

There has been increased regulatory focus by authorities on monitoring product safety and assessing their real-world effectiveness, leading to higher demand for Phase III and Phase IV studies as well as post-market studies. CROS offering pharmacovigilance, real-world evidence generation, and health economic outcomes research (HEOR) services have all experienced significant growth, especially in the Oncology, Immunology, and Rare Disease sectors.

3. Sustainability and Ethical Research Practices Become Strategic Priorities

As part of the increased emphasis by sponsors on ensuring CROS have evidence of their commitment to ethical research conduct, sustainability practices, and diversity in clinical trials, the use of decentralized trial models has reduced patient travel emissions while the adoption of paperless data management systems has lessened an organization’s overall environmental impact. Additionally, regulatory agencies are keenly focused on ensuring that clinical trial designs are inclusive regarding patient demographics, further emphasising the importance of CROS' expertise in patient engagement and recruitment strategies.

4. Industry 4.0 Adoption Transforms Clinical Research Operations

The rapid growth of the CRO industry has been driven by digital transformations involving artificial intelligence-powered analytics, automation, and cloud-based clinical trial management systems. Advanced data analysis tools and techniques have improved the ability to monitor clinical trials, manage risks through a risk-based quality approach, and utilise predictive enrollment models. Automation has decreased the manual work needed to handle higher trial volumes, despite the ongoing shortage of talent.

Report Scope

| Area of Focus | Details |

| Market Size in 2026 | USD 88.08 Billion |

| Market Size in 2035 | USD 240.34 Billion |

| CAGR 2026 to 2035 | 11.80% |

| Dominant Region | Asia-Pacific |

| Key Segments | Type, Application, Modality, End User, Region |

| Key Companies | IQVIA Holdings Inc., ICON plc, Laboratory Corporation of America Holdings , Syneos Health, Inc., PPD, Inc. (Thermo Fisher Scientific), Charles River Laboratories International, Inc., Parexel International Corporation, Medpace Holdings, Inc., WuXi AppTec Co., Ltd., Thermo Fisher Scientific Inc., Pharmaceutical Product Development (PPD), PSI CRO AG, Premier Research, Worldwide Clinical Trials |

Rising Demand for Specialized, High-Complexity Drug Development Services

Increasing Outsourcing Amid Workforce Constraints and Operational Pressures

High Operational Costs and Technology Investment Requirements

Stringent Regulatory Requirements and Compliance Complexity

Expansion of Decentralized, Digital, and Data-Driven Clinical Trials

Accelerated Growth in Emerging Pharmaceutical and Biotech Markets

Talent Shortages and Increasing Trial Complexity

Data Security Risks, Quality Consistency, and Global Supply Chain Dependencies

The Contract Research Organization (CRO) Services market is segmented into various regions, including North America, Europe, Asia-Pacific, and LAMEA. Here is a brief overview of each region:

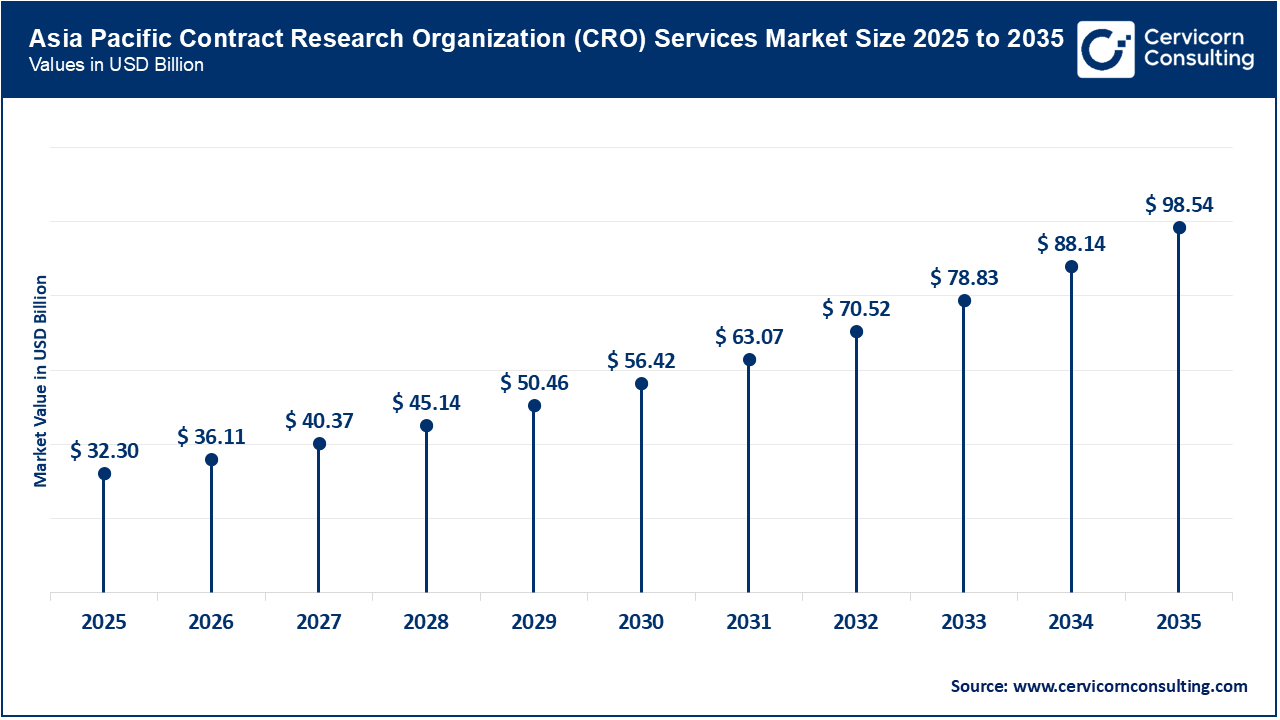

The Asia-Pacific CRO services market size was valued at USD 32.30 billion in 2025 and is expected to surpass around USD 98.54 billion by 2035. The Asia-Pacific is expanding rapidly and is expected to continue gaining market share through 2035. This growth is fueled by a rapidly expanding pharmaceutical manufacturing sector, rising clinical trial volumes, large and diverse patient populations, and relatively lower operational costs. Consequently, countries such as China, India, South Korea, Japan, and Australia are emerging as key global hubs for both early- and late-phase clinical research. There is increasing government support for clinical research throughout Asia-Pacific, ongoing improvements in regulatory harmonisation with global standards, and significant increases in Foreign Direct Investment (FDI) from multinational pharmaceutical and biotechnology companies. This makes Asia-Pacific an even more attractive location for conducting clinical trials, especially in oncology, infectious diseases, and metabolic diseases, due to shortened patient recruitment timelines.

Recent Developments:

The North America CRO services market size was estimated at USD 21.27 billion in 2025 and is estimated to record around USD 64.89 billion by 2035. North America market grows due to significant spending on pharmaceutical R&D, the presence of many global biopharma companies, and advanced clinical trial infrastructure. The United States is expected to be the largest market in North America as it has many more ongoing clinical trials than any other country and is a leader in the research and development of cell and gene therapies and biologics.

North America is leading in digital transformation in clinical research with high levels of use of artificial intelligence (AI)-based data analytics, real world evidence (RWE) studies, and decentralised clinical trial models. The ongoing use of sponsor-large full-service CRO partnerships will continue to bolster long-term market stability.

Recent Developments:

The Europe CRO services market size was reached at USD 17.33 billion in 2025 and is forecasted to report USD 52.87 billion by 2035. The Europe is expected to experience steady growth as it is well established and has a mature market, with strong regulatory and payer systems, healthcare service quality and access, and extensive therapeutic expertise throughout Europe. Countries with the highest demand for CRO services in Europe will include Germany, the United Kingdom, France, and the Netherlands, due to their high levels of clinical trial activity and the number of pharmaceuticals headquartered in these countries. In addition to these factors, the demand for post-marketing surveillance (PMS), real-world evidence (RWE) studies, and clinical evaluation studies on medical devices is driving growth in the European market. There are also initiatives to protect patient data and establish ethical standards in the conduct of clinical trials, which require experienced CROs.

Recent Developments:

CRO Services Market Share, By Region, 2025 (%)

| Region | Revenue Share, 2025 (%) |

| Asia-Pacific | 41% |

| North America | 27% |

| Europe | 22% |

| LAMEA | 10% |

he LAMEA CRO services market was valued at USD 7.88 billion in 2025 and is anticipated to reach around USD 24.03 billion by 2035. The Latin American market is growing due to increased clinical trial activity, improved regulations, and a large pool of eligible patients. With many patients being treated naively and a shorter timeframe for conducting clinical trials, Brazil, Mexico, and Argentina have become popular locations for multinational clinical trials. Currently, Latin America accounts for a small part of the global CRO services market, but as sponsors show more interest in the region, more investigators will conduct studies, and government support for clinical research will continue to grow. Additionally, the MEA market for CRO services is expected to experience steady and moderate growth. This growth is mainly driven by increased investment in healthcare, the development of clinical research infrastructure, and a move toward diversifying clinical trial sites. Countries such as Saudi Arabia, UAE, and South Africa are emerging as regional research hubs.

Recent Developments:

The contract research organization (CRO) services market is segmented into type, application, end user, and geography.

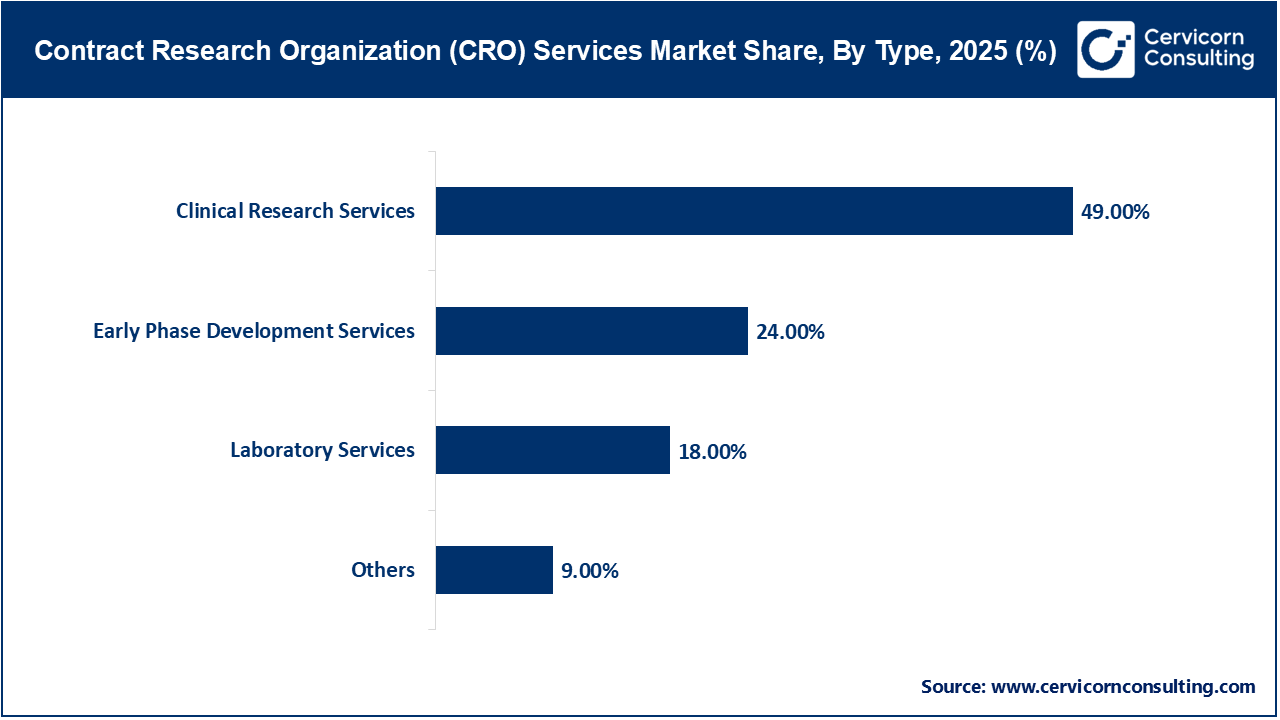

Clinical research services dominate the CRO services market due to the high cost, long duration, and operational complexity associated with Phase I–IV clinical trials. These services include clinical operations, site monitoring, patient recruitment, clinical data management, regulatory submissions, and pharmacovigilance. This segment's leadership is strongly supported by the increasing number of late-stage trials in immunology, oncology, and rare diseases.

The fastest-growing market is early phase development services, driven by rising investments in precision medicine, cell and gene therapies, and biologics. To accelerate development timelines and manage costs, emerging biotech companies are increasingly outsourcing preclinical, toxicology, PK/PD, and IND-enabling studies.

CRO services demand in oncology accounts for the largest share of the CRO services market. This is due to the high complexity of oncology clinical trials, biomarker-driven protocols, adaptive trial designs, and extended safety monitoring. Ongoing oncology pipelines focused on immunotherapy and targeted therapies will continue to fuel outsourcing.

CRO Services Market, By Application, 2025 (%)

| Application | Revenue Share, 2025 (%) |

| Oncology | 32% |

| Neurology | 14% |

| Cardiology | 12% |

| Infectious Disease | 15% |

| Metabolic Disorders | 13% |

| Nephrology | 6% |

| Others | 8% |

Infectious diseases and metabolic disorders are growing rapidly because of increased research in infectious diseases as part of global efforts for preparedness, vaccine and antiviral development, and the rising worldwide prevalence of metabolic conditions like diabetes and obesity, along with ongoing needs for long-term treatment.

The pharmaceutical and biotechnology companies represent the largest segment of end users due to their extensive R&D portfolios, numerous clinical trials, and ongoing shift toward strategic outsourcing and Functional Service Provider (FSP) models. Additionally, their increased use of virtual biotech companies continues to heighten their reliance on Contract Research Organization (CRO) partners.

CRO Services Market, By End User, 2025 (%)

| End User | Revenue Share, 2025 (%) |

| Pharmaceutical & Biotechnological Companies | 62% |

| Medical Device Companies | 18% |

| Academic & Research Institutes | 12% |

| Others | 8% |

Medical device companies are the fastest-growing end-user segment, driven by increased regulatory scrutiny, tighter post-marketing surveillance, and a rise in the use of implantable, digital, and combination medical devices.

IQVIA Holdings Inc.

ICON plc

Syneos Health, Inc.

Charles River Laboratories International, Inc.

By Type

By Application

By Modality

By End User

By Region