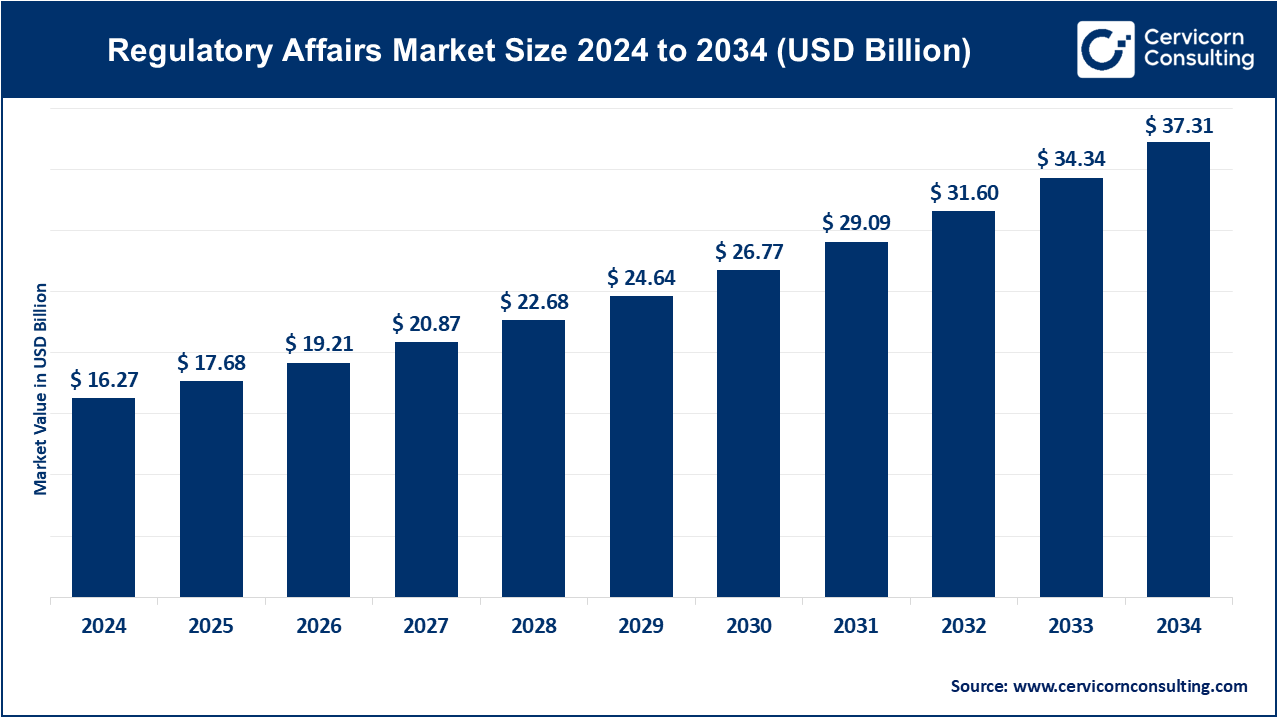

The global regulatory affairs market size was reached at USD 16.27 billion in 2024 and is expected to be worth around USD 37.31 billion by 2034, exhibiting a compound annual growth rate (CAGR) of 8.65% over the forecast period from 2025 to 2034.

The regulatory affairs market is being driven by the growing complexity and globalisation of the healthcare and pharmaceutical industries. As companies expand into foreign markets, they must navigate diverse and ever-changing regulatory demands, making professional guidance essential for navigating strict government controls. The increasing number of clinical trials, particularly for complex treatments such as biologics and gene therapies, has also heightened the need for regulatory expertise. Increased regulatory oversight by organisations such as the FDA, EMA, and others has further driven demand for trained professionals to manage approval processes, submissions, and post-marketing surveillance efficiently.

Market growth in regulatory affairs is also propelled by technological advancements and digital health innovations. AI-driven drug development, personalised medicine, and digital therapeutics have introduced new regulatory complexities, prompting companies to invest in regulatory professionals. Emerging markets in Asia-Pacific and Latin America, characterised by high pharmaceutical activity, are driving additional demand for local regulatory expertise. As regulations continue to evolve in response to public health concerns and technological advancements, the regulatory affairs market worldwide is poised for steady growth, offering opportunities in the pharmaceutical, medical device, and biotechnology sectors.

What are Regulatory Affairs?

Regulatory Affairs is a specialized field within healthcare, pharmaceuticals, and medical devices that ensures companies comply with all regulations and laws governing product development, approval, and marketing. It involves preparing regulatory submissions, communicating with regulatory agencies like the FDA or EMA, and ensuring ongoing compliance throughout a product�s lifecycle. Applications include drug and vaccine approvals, medical device certification, labeling compliance, clinical trial oversight, and post-market surveillance. Key benefits of regulatory affairs include faster product approvals, reduced legal risk, improved product safety, and enhanced global market access through adherence to international standards.

Regulatory Affairs: Key Industry Insights and Operational Trends

| Category | Insight |

| Drug Approval Time (FDA) | 10�12 months (standard); 6�8 months (priority review) |

| Electronic Submission Rate | Over 85% of global submissions are now electronic (eCTD, etc.) |

| Document Error Rate | 20�25% of initial filings require corrections due to data or formatting issues |

| Common Regulatory Delays | Caused by incomplete data, unclear clinical outcomes, or miscommunication |

| Professional Backgrounds | ~70% of RA professionals hold life sciences degrees (e.g., pharmacy, biology) |

| Global Regulatory Changes | 200+ significant updates to regulations occur annually worldwide |

| RA in Product Lifecycle | Involved from R&D through post-market compliance and labeling |

| Digital Tools Adoption | 55%+ use RIMS, AI-based systems for submission and compliance tracking |

| Outsourcing Trend | 35�40% of companies outsource parts of RA to manage cost and complexity |

| Regulatory Collaboration | RA teams work closely with QA, Clinical, Legal, R&D, and Marketing departments |

Digital Transformation and Use of AI in Regulatory Processes

Regulatory Affairs teams are increasingly relying on electronic platforms such as Regulatory Information Management Systems (RIMS), artificial intelligence document review software, and eCTD (Electronic Common Technical Document) tools. These platforms improve accuracy, reduce submission time, and facilitate global compliance.

Increasing Emphasis on Regulatory Intelligence and Real-Time Updates

With 200+ global regulatory changes occurring each year, companies are investing in regulatory intelligence tools to stay compliant and competitive. This trend focuses on tracking, analyzing, and responding to regulatory updates in real-time.

Global Regulatory Harmonization Initiatives

Agencies like ICH (International Council for Harmonisation) and IMDRF (International Medical Device Regulators Forum) are driving global harmonization efforts to align regulatory standards and reduce duplication of effort in multi-country submissions.

Rise of Regulatory Affairs Outsourcing

Due to growing complexity and cost pressures, many mid-size and even large life sciences companies are outsourcing regulatory functions to specialized firms for activities like dossier preparation, lifecycle management, and labeling compliance.

The regulatory affairs market is segmented into various regions, including North America, Europe, Asia-Pacific, and LAMEA.�

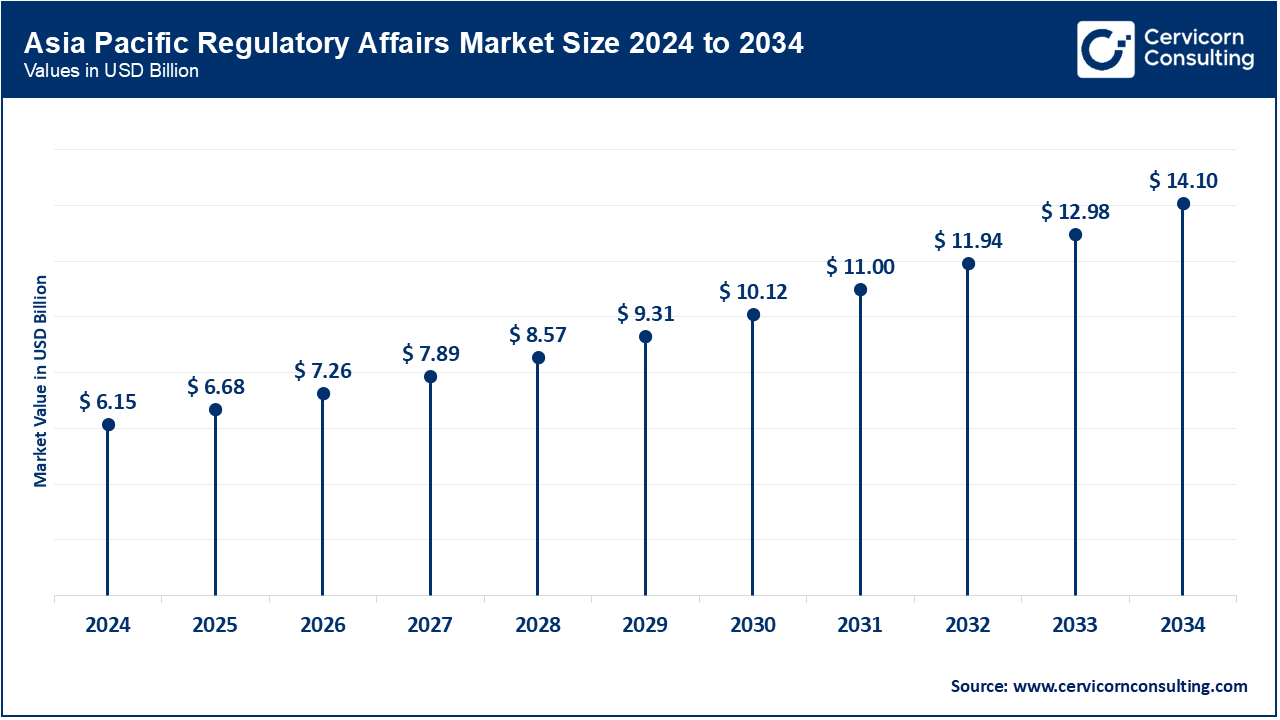

The Asia-Pacific regulatory affairs market size was valued at USD 6.15 billion in 2024 and is predicted to surpass around USD 14.10 billion by 2034. Asia-Pacific holds the dominant position in the market, driven by the rapid expansion of the pharmaceutical and biotech industries in countries like China, India, Japan, and South Korea. The APAC region boasts growing clinical trials, large patient pools, supportive government policies towards R&D, and shifting regulatory landscapes that are trending towards global norms. Furthermore, the cost advantages of regulatory services outsourcing in APAC have made the region a preferred business hub for global multinationals. China's NMPA reforms and India's CDSCO modernization are just some of the regulatory advancements that further reinforce the region's leadership in regulatory operations.

The North America regulatory affairs market size was estimated at USD 4.82 billion in 2024 and is rpojected to hit around USD 11.04 billion by 2034. North America is experiencing significant growth, due to increasing drug innovation, frequent FDA updates, and a high number of clinical trials, especially in the U.S. The region's stringent and ever-changing regulatory landscape creates continuous demand for experienced regulatory professionals and consulting organizations. The FDA's push for electronic submissions, real-world evidence, and expedited routes like Fast Track and Breakthrough Therapy approvals further increase the demand for regulatory professionals. Moreover, the presence of global pharmaceutical giants and CROs boosts the demand for both in-house and outsourced RA services.

The Europe regulatory affairs market size was accounted for USD 4.10 billion in 2024 and is forecasted to grow around USD 9.40 billion by 2034. Europe presents a mature and structured regulatory market, shaped by the EMA's centralized procedures and strong national regulatory authorities across member states. The region maintains strict compliance standards, particularly regarding the safety and quality of pharmaceuticals, biologics, and medical devices. The EU Medical Device Regulation (MDR) and In Vitro Diagnostic Regulation (IVDR) have imposed a significant regulatory burden, resulting in high demand for external regulatory services. Germany, the UK, and France serve as regulatory hubs owing to their innovation potential and market size.

Regulatory Affairs Market Revenue Share, By Region, 2024 (%)

| Region | Revenue Share, 2024 (%) |

| North America | 29.60% |

| Europe | 25.20% |

| Asia-Pacific | 37.80% |

| LAMEA | 7.40% |

The LAMEA regulatory affairs market size was valued at USD 1.20 billion in 2024 and is anticipated to reach around USD 2.76 billion by 2034. LAMEA represents an emerging market, gaining traction as pharmaceutical and medical device companies expand into untapped regions. Latin American countries like Brazil and Mexico are strengthening regulatory regimes with institutions like ANVISA and COFEPRIS, while Saudi Arabia and the UAE in the Middle East are streamlining drug and device registration processes to welcome global players. Despite infrastructure-related challenges in certain parts of Africa, increased investment in healthcare and regulatory strengthening is set to create new avenues for RA services in the region.

The regulatory affairs market is segmented into services, categories, indications, stages, service providers, organizations, end users, and regions. Based on services, the market is classified into legal representation, regulatory consulting, regulatory writing & publishing (publishing and writing), product registration & clinical trial applications, and others. Based on the categories, the market is categorised into drugs (innovator and generics), biologics (biotech, ATMP, and biosimilars), and medical devices (diagnostics and therapeutics). Based on indications, the market is categorised into oncology, cardiology, immunology, neurology, and others. Based on stages, the market is classified into preclinical, clinical studies, and post-market approval. Based on service providers, the market is categorised into in-house and outsourced. Based on organizations, the market is categorised into large, medium, and small. Based on end users, the market is categorised into medical device companies, biotechnology companies, and pharmaceutical companies.

Regulatory Writing & Publishing continues to dominate the regulatory affairs market, fueled by the rising volume of electronic submissions (eCTD), high-quality clinical documentation need, and the necessity to meet close submission deadlines. Publishing is the growth driver in this case, which is supported by regulatory digitization initiatives and document formatting, hyperlinking, and validation protocol complexity on the rise. Outsourced service is also on the rise, especially among small and mid-size companies that do not have in-house regulatory documentation expertise.

Regulatory Affairs Market Revenue Share, By Service Type, 2024 (%)

| Service Type | Revenue Share, 2024 (%) |

| Regulatory Writing & Publishing | 36.20% |

| Product Registration & Clinical Trial Applications | 25.80% |

| Regulatory Consulting | 16.60% |

| Legal Representation | 14.50% |

| Others | 6.90% |

Regulatory Consulting is the fastest-growing service segment, driven by increasing global compliance complexity, shifting regulatory landscapes, and the requirement for strategic guidance across the product life cycle. Companies, especially those entering new markets, require consulting partners to navigate diverse regulatory landscapes, reduce delays, and ensure successful product approvals. It is a significant segment for big pharma multinationals as well as up-and-coming biotechs seeking fast-track approvals and lower compliance exposure.

Drugs, particularly Innovator drugs, dominate the regulatory affairs market due to their extensive development pipelines, complex trial phases, and stringent regulatory pathways. Such drugs demand rigorous documentation, from clinical study protocols to pharmacovigilance reports, that makes regulatory assistance a requirement at each stage. With more breakthrough therapies coming into development, regulatory burden on innovator drugs continues to be high.

Biologics is the fastest-growing category, led by Biosimilars and Advanced Therapy Medicinal Products (ATMPs) such as gene and cell therapies. The surge in biologic drug development and approval is pushing regulatory teams to adapt to unique product attributes, stricter quality controls, and post-marketing surveillance requirements. These therapies demand advanced regulatory knowledge, increasing investment in biologics-focused RA services.

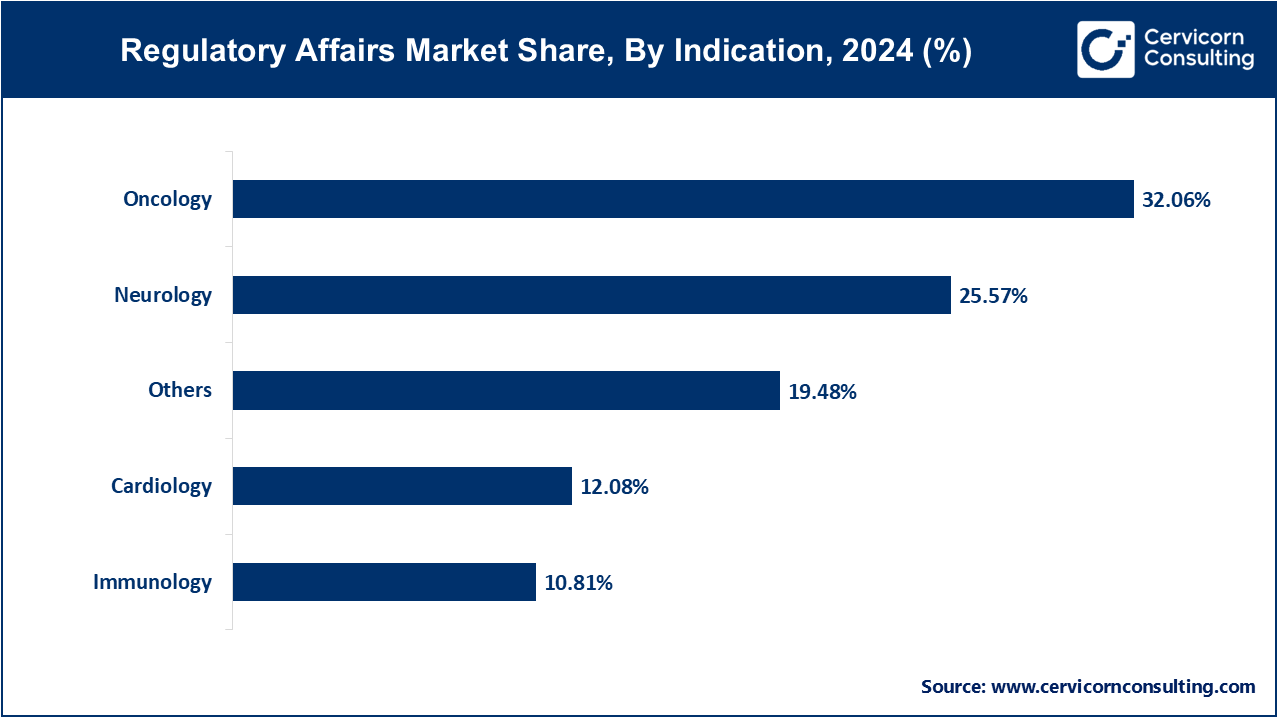

Oncology is the dominant therapeutic area within regulatory affairs due to the high volume of ongoing trials, accelerated pathways, and global focus on cancer treatments. Oncology drugs often qualify for special regulatory designations such as Fast Track or Breakthrough Therapy, intensifying the need for ongoing regulatory support and communication with health authorities across development stages.

Immunology represents the fastest-growing indication, driven by rising prevalence of autoimmune disorders and the expansion of biologic therapies targeting inflammatory conditions. Regulatory submissions in this area have grown rapidly due to complex safety profiles and biologic mechanisms of action, prompting a surge in demand for immunology-focused regulatory expertise.

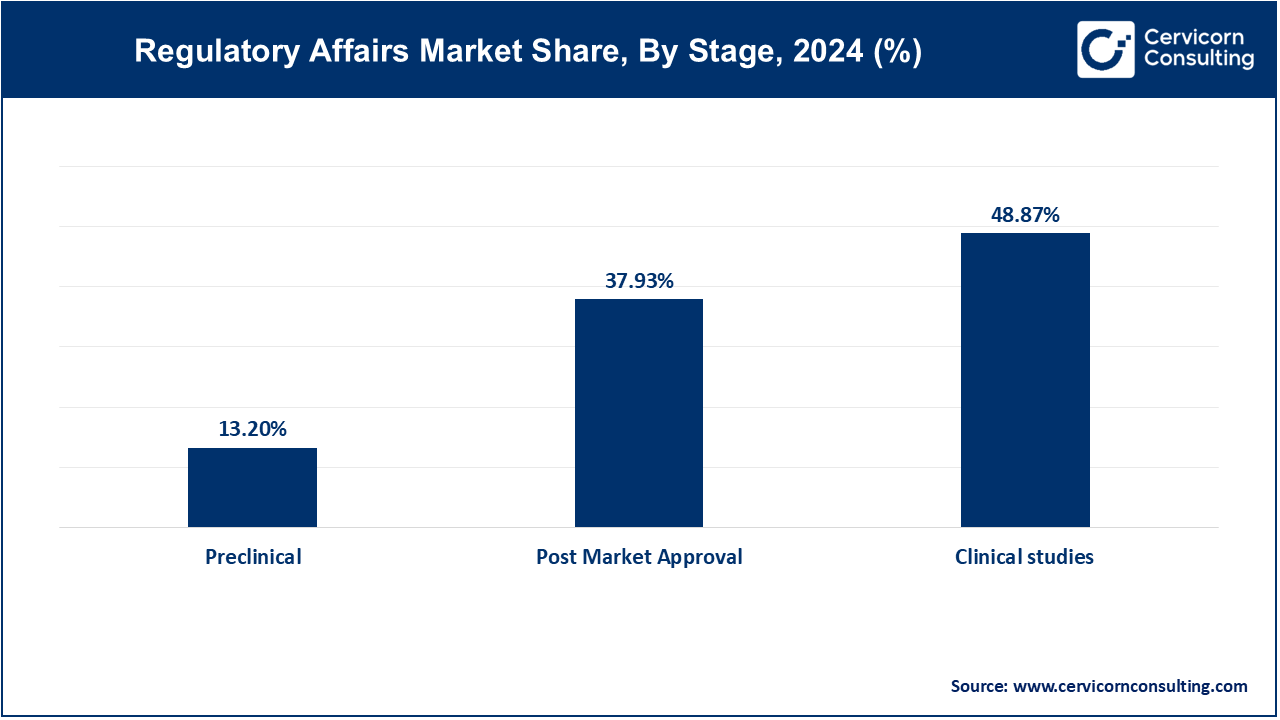

Clinical Studies continue to represent the largest stage segment due to the intense regulatory requirements during trial conduct, amendments, and interim analyses. Coordination with regulatory bodies is crucial during this phase for protocol approvals, adverse event reporting, and ensuring trial continuity across multiple regions and populations.

Post-Market Approval is the fastest-growing stage as global regulators emphasize real-world evidence, safety monitoring, and lifecycle management. Companies are now required to maintain ongoing compliance through risk evaluation plans, safety updates, and periodic audits, increasing the regulatory burden even after product launch.

The outsourced segment dominates the regulatory affairs market. This is due to many pharma and biotech companies outsourcing regulatory functions to specialized providers for cost efficiency and faster time-to-market. Outsourcing offers expertise in dossier preparation, submissions, and compliance, helping companies navigate complex global regulations while focusing on core R&D activities.

Regulatory Affairs Market Revenue Share, By Service Provider, 2024 (%)

| Service Provider | Revenue Share, 2024 (%) |

| Outsourced | 58.80% |

| In-house | 42.20% |

The in-house segment is the fastest-growing, as more companies build internal regulatory teams for better control over submission timelines and data security. Advances in digital tools and AI are helping these teams manage global regulations more efficiently. This trend is strong in companies with large portfolios seeking to retain institutional knowledge and streamline compliance.

The regulatory affairs market is highly competitive and fragmented, featuring a mix of global consulting firms, contract research organizations (CROs), and specialized regulatory service providers competing for market share. Major players include Parexel, IQVIA, ICON plc, Charles River Laboratories, and PharmaLex, among others. These companies offer comprehensive services, including regulatory strategy, submissions, compliance management, and post-market surveillance. The competition is fueled by increasing trends in outsourcing, the demand for region-specific expertise, and the rapidly evolving nature of regulatory requirements across different regions. Mergers, strategic alliances, and investments in digital regulatory technologies (including eCTD platforms and AI-based analytics) are common strategies employed by leading firms to expand their global presence and service capabilities. As regulatory complexity rises, particularly in biologics, ATMPs, and combination products, companies with robust domain expertise, widespread geographic coverage, and digital capabilities are achieving a competitive edge.

Market Segmentation

By Services

By Category

By Indication

By Stage

By Service Provider

By Organizations

By End User

By Region