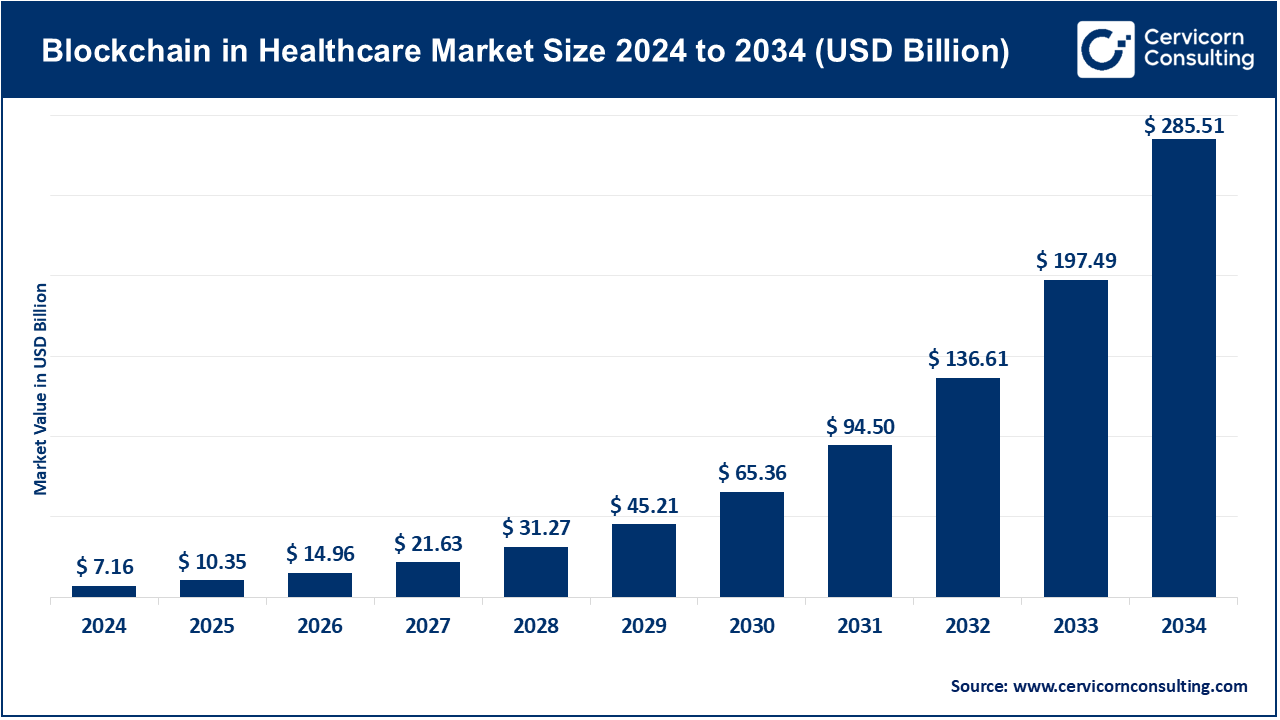

The global blockchain in healthcare market size was valued at USD 7.16 billion in 2024 and is anticipated to reach around USD 285.51 billion by 2034, growing at a compound annual growth rate (CAGR) of 61.5% over the forecast period from 2025 to 2034. The increasing need for specialized knowledge, regulatory assistance, and strategic health communication between hospitals, pharma, and clinical research organizations drives the need for blockchain in healthcare. Institutions are increasingly subcontracting tasks, such as evidence creation, real-world data analysis, and medical education, to provide timely access to the scientific literature. Growing complexity in therapeutic areas, especially with personalized medicine, advanced biologics, and high-value complex generics, is driving operational and quality efficiencies even further toward outsourcing solutions.

The positive effects of AI-enabled analytics, automation, and other digital technologies on medical affairs decision-making, regulatory compliance, and operational performance are noteworthy. Significant investments in R&D, the shift toward patient-centric, decentralized care, and the demand for cost control are considered foremost drivers of growth in the blockchain health care market. With a steady focus on innovation, compliance, and strategic alliances, the demand for blockchain technologies in health care will continue to grow in the coming years.

Demand for Specialized Services

A Synergistic Approach and Tech Advancement

Report Scope

| Area of Focus | Details |

| Market Size in 2025 | USD 10.35 Billion |

| Estimated Market Size in 2034 | USD 285.51 Billion |

| Projected CAGR 2025 to 2034 | 61.50% |

| Dominant Region | North America |

| Fastest Growing Region | Asia-Pacific |

| Key Segments | Component, Network Type, Deployment Mode, Application, End User, Region |

| Key Companies | Syneos Health, ICON plc, Parexel International, IBM Watson Health, Guardtime, Medable, Hashed Health, Healthereum, Chronicled, FarmaTrust |

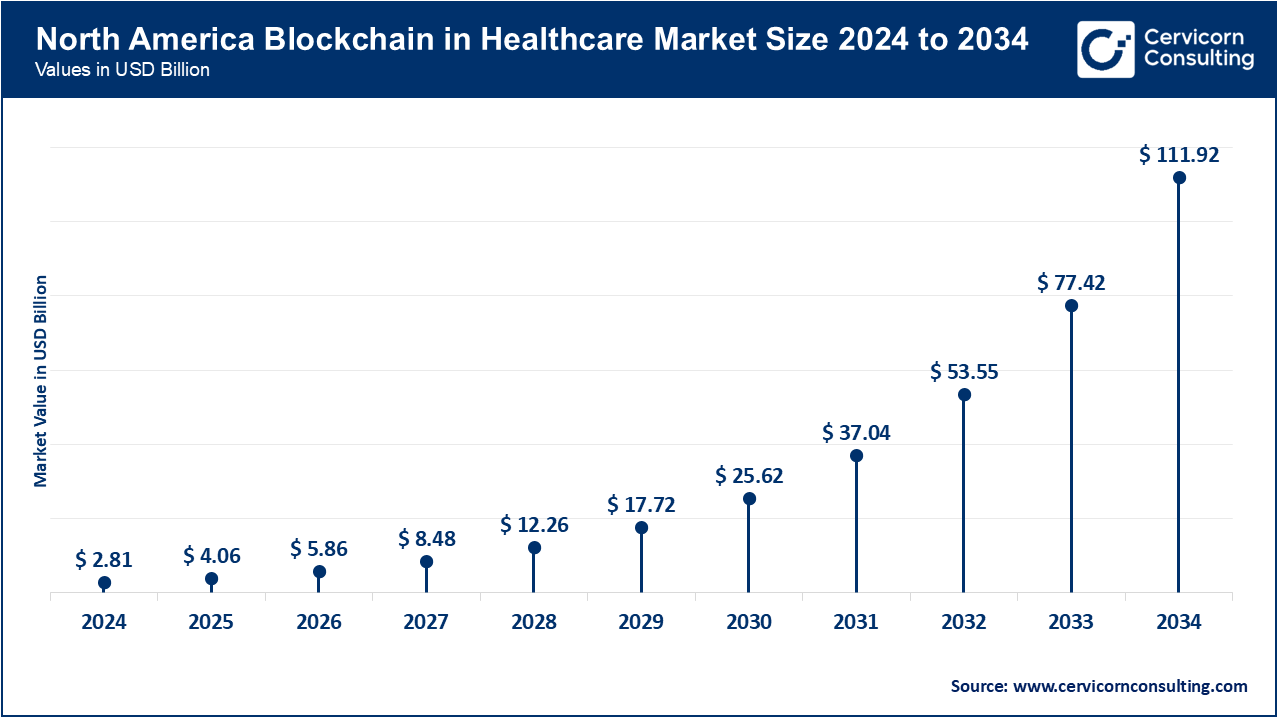

The blockchain in healthcare market is segmented into several key regions: North America, Europe, Asia-Pacific, and LAMEA (Latin America, Middle East, and Africa). Here’s an in-depth look at each region.

North America is dominating the market and has the best built and most developed healthcare market in the world, and has spends the most on R&D in Health care. As of March 2025, more than 65% the hospitals in the U.S. and most of the pharmaceutical FIRMS have begun outsourcing blockchain-enabled clinical trials, regulatory compliance, and medical communications. Major companies like Parexel, Syneos Health, and ICON have integrated AI-enabled blockchains systems that boost operational efficiency, access to real-time data, and patient safety. The countries in the region are adopting digital technologies focusing on decentralized care and the demand for remote home care. This increases the demand for outsourced blockchain technologies.

Europe is in 2nd place as the world’s second largest market. This is as a result of the Europe’s Policy-making and collaborations for outsourcing services like Parexel, ICON, and Covance. The use of Blockchain in Europe is mainly for the management of clinical trials, generation of real-world evidence and for regulatory filings. European governments focus on digital transformation and sustainable public spending in the health of the population. Takeda’s regional operational consolidation to Europe has streamlined operational efficiency and compliance. The collaborations of national healthcare services and outsourcing providers increases the reliability of services. Overall, Europe’s innovation and regulatory framework provides the foundation for consistent growth of the market.

In Asia-Pacific, Japan, India, and China are investing in blockchain for clinical trials, medical communications, and real-world evidence. China and South Korea are building public-private partnerships to strengthen local contracting expertise. Thailand, Indonesia, Vietnam, and the Philippines upgraded healthcare systems to modernize for therapeutic exports. The region is adopting patient-centered almost decentralized care. Oversized, outsourced, off-blockchain compliance and clinical data solutions are the primary means of managing compliance. Market growth is fueled by increased healthcare awareness and expanded healthcare infrastructure.

Blockchain in Healthcare Market Share, By Region, 2024 (%)

| Region | Revenue Share, 2024 (%) |

| North America | 39.20% |

| Europe | 27.30% |

| Asia-Pacific | 25.60% |

| LAMEA | 7.90% |

Growing healthcare systems, new investments in pharma, and expanded clinical research are the key drivers for LAMEA growth. Countries like Brazil, South Africa, and the UAE are adopting blockchain for regulatory compliance, clinical trial management, and pharmacovigilance. Through domestic partnerships, countries are reducing reliance on foreign expertise. The Saudi Health Initiative is an example of regulatory compliance, and patient safety, and safety improvements. The uptake of evidence-based chronic disease management is widely promoted for chronic disease. The region is anticipated to become a key growth region post-2026.

Platforms: Integrating solutions for secure and transparent healthcare operations will soon be less difficult with blockchain technology. These systems will let hospitals, pharmaceutical companies, and research institutions handle EHRs, clinical trials, and even control supply chains and compliance with regulations. As of June 2025, IBM, Guardtime, and Hyperledger will have introduced blockchain systems that interconnect hospital network with pharmaceutical organizations. This innovation will improve healthcare ecosystem data accuracy, traceability, and accessibility.

Blockchain in Healthcare Market Share, By Component, 2024 (%)

| Component | Revenue Share, 2024 (%) |

| Platforms | 62.40% |

| Services | 37.60% |

Services: Some of the blockchain healthcare services include outsourced support for clinical data management, adding new services around regulatory compliance, drug traceability, and even medical communications. By 2025, Syneos Health and ICON are expected to add AI-powered analytics and automate blockchain reporting, improving operational efficiency, compliance, and decision-making within hospitals and clinics, and even research organizations, thereby creating a new standard of evidence.

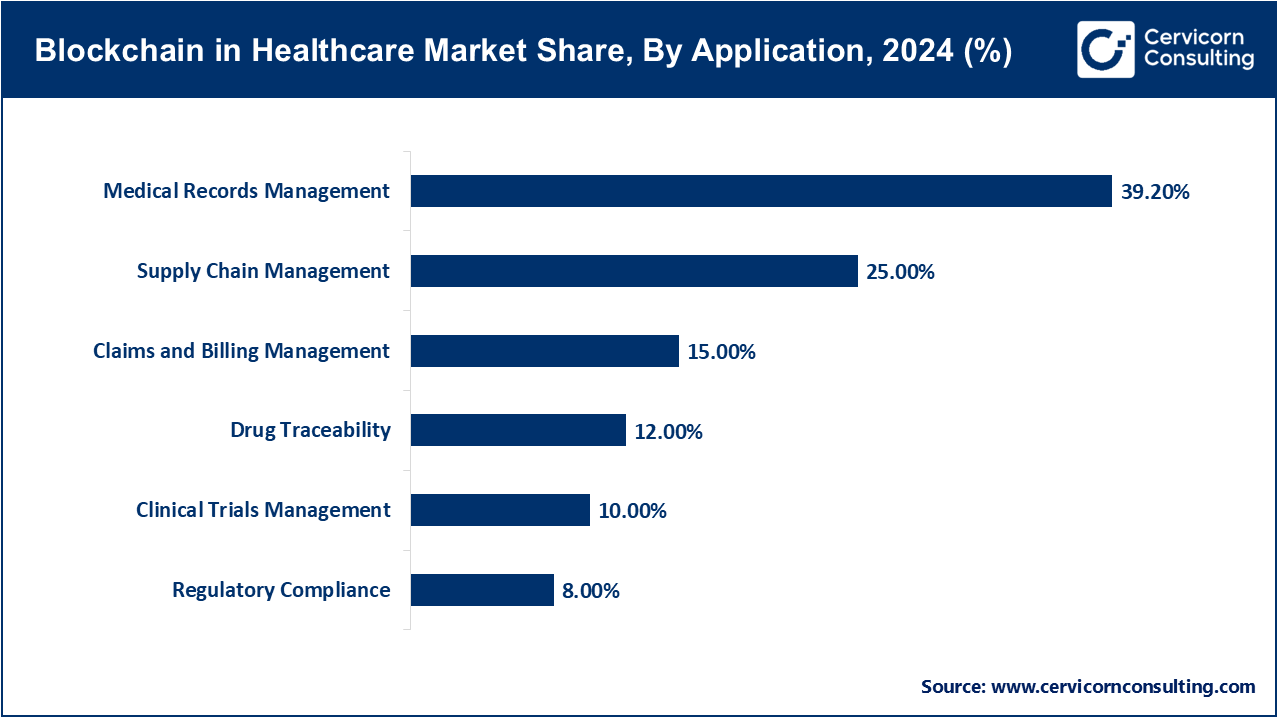

Managing Medical Records with Blockchain: Storing and sharing patient records and data securely and without risk of tampering is now possible with Blockchain technology. It makes sure only the correct and authorized individuals can access private and sensitive information. Hospitals can streamline their electronic health record (EHR) integration across departments and data providers while sticking to data privacy regulation compliance such as HIPAA in the United States and GDPR in Europe. By June 2025, the top hospitals in North America and Europe have all adopted blockchain-based EHR platforms. These platforms provide real-time access to patient histories, enable seamless partner collaboration, and maintain auditable records of all changes to patient files, which greatly reduces unnecessary errors and administrative overhead.

Managing Supply Chains with Blockchain: Ensuring all stages of the pharmaceutical supply chain, for instance from production to delivery, can be essential to combatting counterfeit drugs and the supply chain timely delivery of value medication. By May 2025, pharmaceutical companies in the United States and India adopted block chain technology to track and manage drugs, biologics, and medical devices. These systems ensure regulatory compliance for serialization and global traceability, especially for temperature-sensitive biologics and specialty medicines, as they automate shipment tracking, optimize inventory management, and track- monitor compliance.

Clinical Trials Management: Clinical trials management is made easier with the help of blockchain technology because it increases the efficiency of data management, maintaining protocols, real-time monitoring, patient recruitment, and even trial management oversight. In 2025, ICON and Parexel introduced blockchain-enabled clinical trial management across North America and Europe. These systems enhanced transparency for sponsors and regulators, made trial data easier to share securely, and reduced administrative bottlenecks. Also, integrated AI and blockchain technology help in trial reliability and efficacy with quicker decision-making, automated patient enrollment monitoring, and risk-based trial oversight.

Claims and Billing Management: In the U.S., healthcare providers and insurances utilized blockchain in 2025 to improve claims workflow. Blockchain solves the issues of fraud and administrative delays through automating the processes of claims submission, verification, and settlement. Smart contracts within the blockchain system allow real-time claims validation against treatment records. This directly reduces disputes and operational costs, thus improving patient satisfaction.

Drug Traceability: With blockchain technology's help on drug serialization, companies in Asia-Pacific have been monitoring and tracking the storage and shipment of drugs, biologics, and medical devices, up to the point of actively allowing cross-distribution network traceability certifications to be ascertained and validated. This is a must for high-value, temperature-sensitive drugs, and biologics, where spoilage is a matter of real-time visibility.

Regulatory Compliance: As of 2025, Syneos Health has incorporated and developed tools to track and audit blockchain submission data to enhance the approval of advanced therapies, including gene therapy and biologics, in several countries. This technology-driven approach will diminish submission-triggered human errors and the time it takes to submit for approval and it will document the submission for audit. This audit usability and traceability will help to maintain compliance and to reduce costs on the pharma side.

Hospitals & Clinics: Hospitals and clinics outsourced blockchain-enabled solutions for patient data management, supply chain optimization, and regulatory compliance for clinical decision support, automated reporting, and patient engagement systems, advanced hospital networks in North America partnered with these providers in 2025. Hospitals workflow optimization systems reduce administrative burdens and provide restricted documentation across partner institutions, and interdepartmental secure real-time patient access data windows.

Pharmaceutical & Biotechnology Companies: Across clinical trials, regulatory submissions, and therapeutic medical communications, pharma and biotech integrates blockchain within greater provisioned linear frameworks. By June 2025, U.S. and European firms collaborating with ICON, Parexel, and Syneos Health for integrative AI-assisted blockchain service provisioning coupled with clinical and regulatory workflow Crosses. These interconnected legal compliance systems provide secure data transmission and real-time monitoring, to comply with clinical trials and global regulations in real time.

Blockchain in Healthcare Market Share, By End User, 2024 (%)

| End User | Revenue Share, 2024 (%) |

| Hospitals & Clinics | 39.60% |

| Pharmaceutical & Biotechnology Companies | 24.50% |

| Research & Academic Institutes | 21.10% |

| Payers & Insurance Companies | 14.80% |

Research & Academic Institutes: From the bloc for multi-center, collaborative, and secure data sharing studies, Academic, and research institutions for were to advanced in 2025, European hospitals and universities blockchain to manage large-scale oncology, rare disease, and gene therapy projects. Creating and preserving secure collaboration to enhance research, the blockchain provides real-time data integrity, verifiable audit proximity, and breadth audit trail.

Insurance Companies & Payers: Insurance companies utilize blockchain to automate claims processing, improve fraud detection, and protect patient information. By May 2025, U.S. insurance payers will adopt blockchain to speed claim payments, cut administrative expenses, and enhance transparency between payers and providers. Automated smart contracts will verify claims against treatments and billings, streamlining operations and reducing inefficiencies.

On-Premise: On-premise blockchains offer organizations complete control over their infrastructure and compliance, and allow sensitive data to be kept on-site. In North America, hospitals and pharmaceutical firms relied on on-premise solutions in 2025 for sensitive clinical data, regulatory data, and patient data management in high-risk areas such as gene therapies, biologics, and personalized medicine. The in-house control of data handling manages data privacy and therefore, is optimal to deploy on-premise solutions in regions where the legal regulations on privacy and data protection are particularly stringent.

Blockchain in Healthcare Market Share, By Deployment Mode, 2024 (%)

| Deployment Mode | Revenue Share, 2024 (%) |

| On-Premise | 36.70% |

| Cloud-Based | 63.30% |

Cloud-Based: Cloud-based solutions offer blockchain technology immense flexibility in regard to costs, accessibility, and scalability. In 2025, companies Syneos Health, Parexel, and ICON deployed cloud-based blockchain technology across Europe and the Asia-Pacific region for cross-border management of clinical trials, regulation compliance monitoring, and secure data-sharing collaboration with other stakeholders. Distributing healthcare and research organizations cloud technology for collaboration cuts down on IT expenditures, makes it easier to integration across multiple locations, and fosters real-time collaboration capabilities.

Market Segmentation

By Component

By Network Type

By Deployment Mode

By Application

By End User

By Region