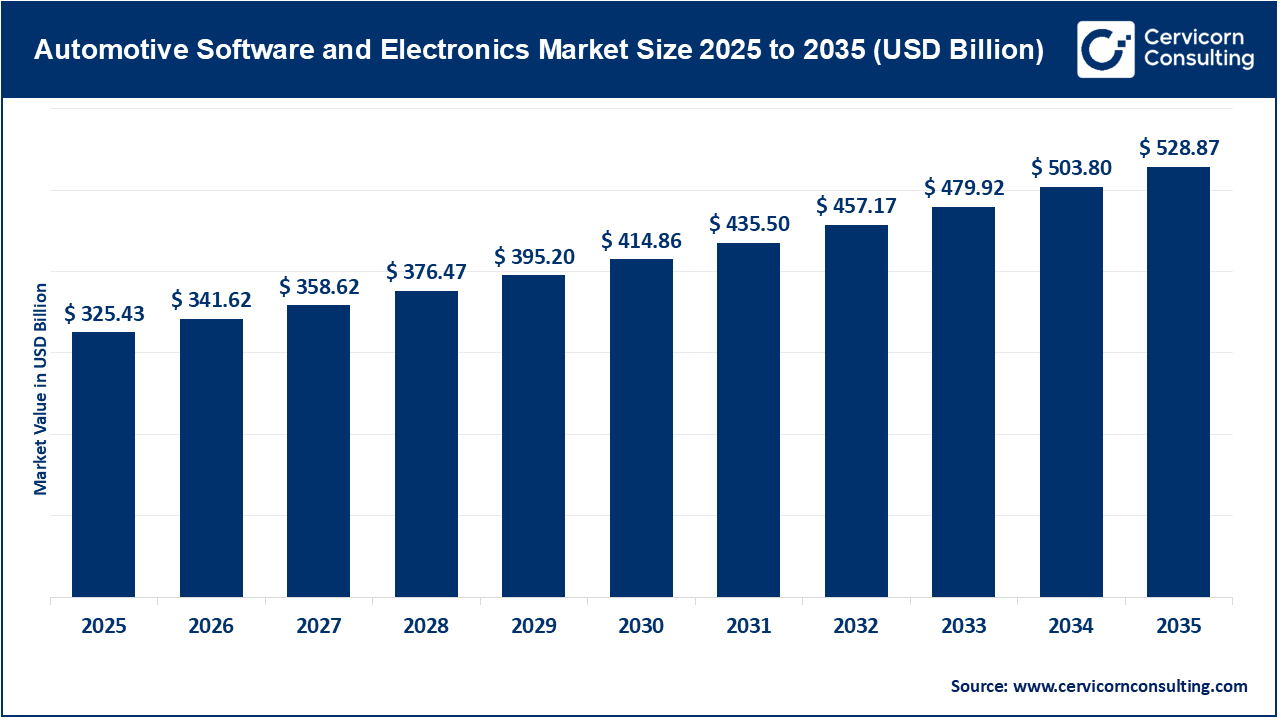

The global automotive software and electronics market size was accounted for USD 325.43 billion in 2025 and is expected to be worth around USD 528.87 billion by 2035, exhibiting at a compound annual growth rate (CAGR) of 5% over the forecast period from 2026 to 2035. The automotive software and electronics market is experiencing substantial growth by shifting from traditional Decentralized E/E architectures, which are characterized by over 100 distributed ECUs, to centralized and zonal architectures. This change is driven by the complexity, excessive wiring harnesses, and the limits on data processing speed imposed by modern applications. Centralized and "zonal" designs streamline vehicle architecture by consolidating computing power, reducing physical complexity and vehicle weight, and enabling high-speed data communication. Zonal controllers function as local hubs for sensors and actuators, simplifying data flow to the central computing unit and supporting advanced software-defined vehicle functionalities.

The shift is driven by changing consumer expectations and strict government regulations on emissions and safety. Consumers increasingly demand a seamless digital experience similar to their smartphone experience, which fuels the trend for customer-facing high-rate automotive infotainment systems and the adoption of AI systems tailored to the driver, owner, and passenger needs. Government regulation also fuels the need for higher-end electronics and systems that are versatile and functional across various applications. This regulatory push for advanced technology has facilitated the development of new revenue models, especially through software-as-a-service and feature-based offerings. Additionally, the evolving regulatory landscape helps solidify long-term growth plans for technological innovation within the automotive supply chain.

The Shift Toward Software-Defined Vehicle (SDV) Architectures Driving Market Growth

As the automotive industry transitions from relying on multiple Electronic Control Units (ECUs) in traditional setups to adopting a Software-Defined Vehicle (SDV) architecture that uses centralized and zonal computing, the market for automotive software and electronics is undergoing a major shift. SDV helps lower complexity, costs (including wiring and configuration), and the time needed to integrate advanced technologies like advanced driver assistance systems (ADAS), connected vehicles, and infotainment systems. Additionally, SDV frameworks support over-the-air (OTA) updates, allowing OEMs to continuously improve vehicle performance, add new features, and maintain safety and security standards over the vehicle's lifetime - fueling sustained demand for automotive software and electronics solutions.

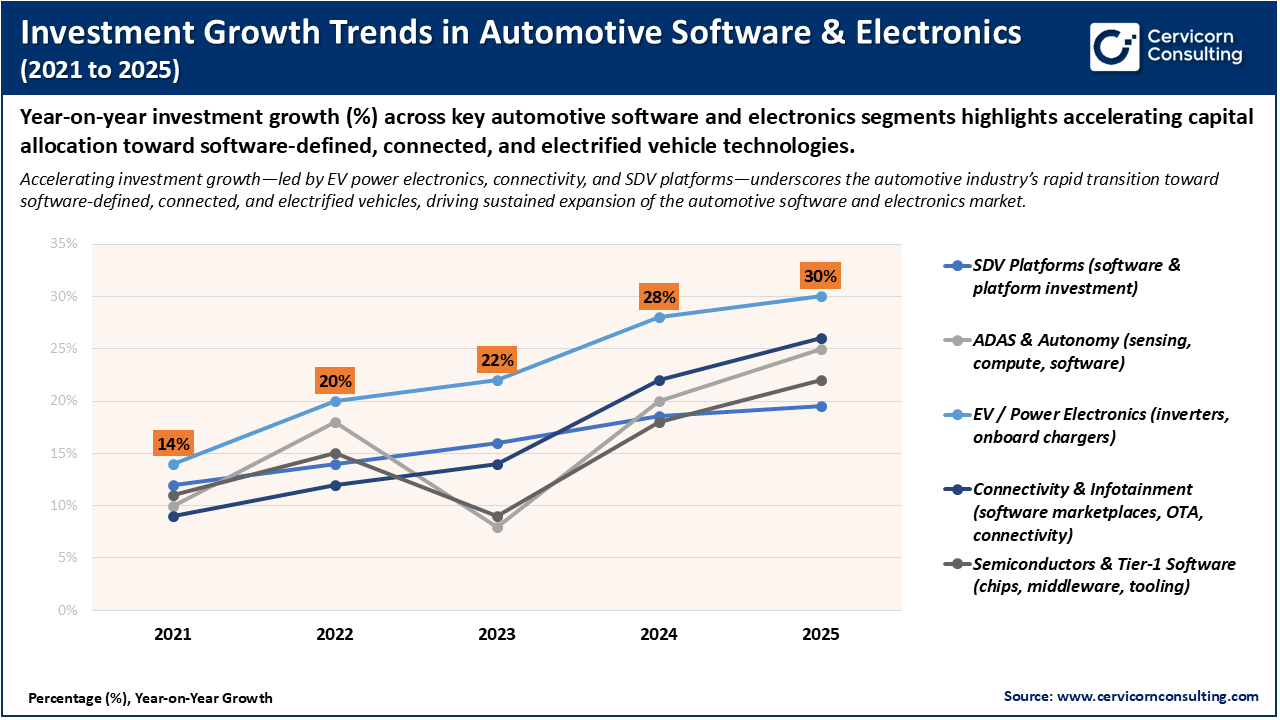

Investment Trend in Automotive Software and Electronics

The chart indicates a consistent and significant increase in year-on-year investment growth across major automotive software and electronics segments from 2021 to 2025. This trend highlights the ongoing transformation of the industry toward software-defined, connected, and electrified vehicles. The investment in EV power electronics is leading this growth, rising from the mid-teens to approximately 30%. This reflects the substantial capital being allocated to inverters, onboard chargers, and high-voltage architectures, which are essential for the development of electric vehicles. The strong upward trends in SDV platforms and connectivity and infotainment systems show that automakers are increasingly focusing on centralized computing, over-the-air updates, and new digital revenue streams. While investments in ADAS and semiconductors experience some short-term fluctuations, both segments recover after 2023. This recovery demonstrates a renewed emphasis on advanced sensing technologies, improved computing, and a more reliable semiconductor supply. Overall, these trends indicate that software and electronics are playing a growing role in shaping automotive platforms and are expected to remain central to industry investment in the coming years.

1. Significant Industry Advancements and Corporate Changes

A major milestone in the automotive electronics sector involves the introduction of next-generation system-on-chip (SoC) platforms, particularly the Nvidia DRIVE Thor. This ultra-high-performance chip can achieve 2,000 TFLOPS (teraflops) of performance, enabling the integration of various functions such as infotainment, digital instrument clusters, and level 4 autonomous driving onto a single system on a chip (SoC). This milestone in performance and capacity reduces the enormous compute demands of today's AI-driven vehicles and decreases the number of standalone processors needed. These hardware advancements also support the execution of the complex "V-cycle" of systems engineering processes, which are essential for developing, testing, and deploying advanced driver assistance systems in real-world environments.

2. Government Initiatives and the Development of Safety Standards

Government regulation is a key driver of growth in the automotive software and electronics market, based on safety measures and efforts to reduce carbon emissions. The European Union's General Safety Regulations (GSR) have mandated advanced safety features in all newly manufactured and sold vehicles, including Intelligent Speed Assistance (ISA), Advanced Emergency Braking (AEB), and many others. Similarly, global regulatory initiatives aim to lower CO2 levels, targeting a 15% reduction by 2025 and a 30% reduction by 2030. These pressures are encouraging updates to engine control units (ECUs) and electrification electronics approximately every two years. Such government regulations set a baseline for advanced electronic systems, as consumers must have these features or systems to purchase vehicles and maintain market access.

3. Public and Private Partnership and Cross-Industry Work

The increasing complexity of software in modern automobiles has led to more strategic partnerships between traditional automotive manufacturers and technology companies. A key development is greater coordination between OEMs and software development teams to create proprietary operating systems (OSs). The collaboration between Volkswagen's Cariad and various technology partners highlights the challenges faced by the automaker, which has shifted its focus toward software development. This partnership is crucial for closing the "software gap" and allows automotive companies to combine Silicon Valley-level software expertise with their manufacturing strengths.

4. Investments in 5G Infrastructure and Connectivity

The implementation of 5G infrastructure and Vehicle-to-Everything technology is a disruptive element in the connectivity sector. Significant investments in smart city infrastructure enable vehicles to interact in real-time with traffic signals, pedestrians, and other vehicles, creating a smarter and more responsive ecosystem. This plays a key role in how EV and autonomous systems will achieve widespread adoption. While some barriers related to consumer acceptance will remain, the projected 70% increase in EV infrastructure over the next five years represents a major commitment from governments and industry players. These technologies form the backbone of the "connected" aspect of the software-defined vehicle (SDV), which helps the electronic market grow beyond just vehicles and into the urban environment.

Report Scope

| Area of Focus | Details |

| Market Size in 2026 | USD 341.62 Billion |

| Market Size in 2035 | USD 528.87 Billion |

| CAGR 2026 to 2035 | 5% |

| Dominant Region | Asia-Pacific |

| Key Segments | Components, Application, Sales Channels, Region |

| Key Companies | Robert Bosch GmbH, Continental AG, Denso Corporation, NVIDIA Corporation, Aptiv PLC, NXP Semiconductors, Infineon Technologies, Texas Instruments, Renesas Electronics, STMicroelectronics, Harman International, Siemens Digital Industries Software, BlackBerry Limited, Aumovio SE (formerly part of Continental), Black Sesame Technologies |

The automotive software and electronics market is segmented into North America, Europe, Asia-Pacific, and LAMEA. Here is a brief overview of each region:

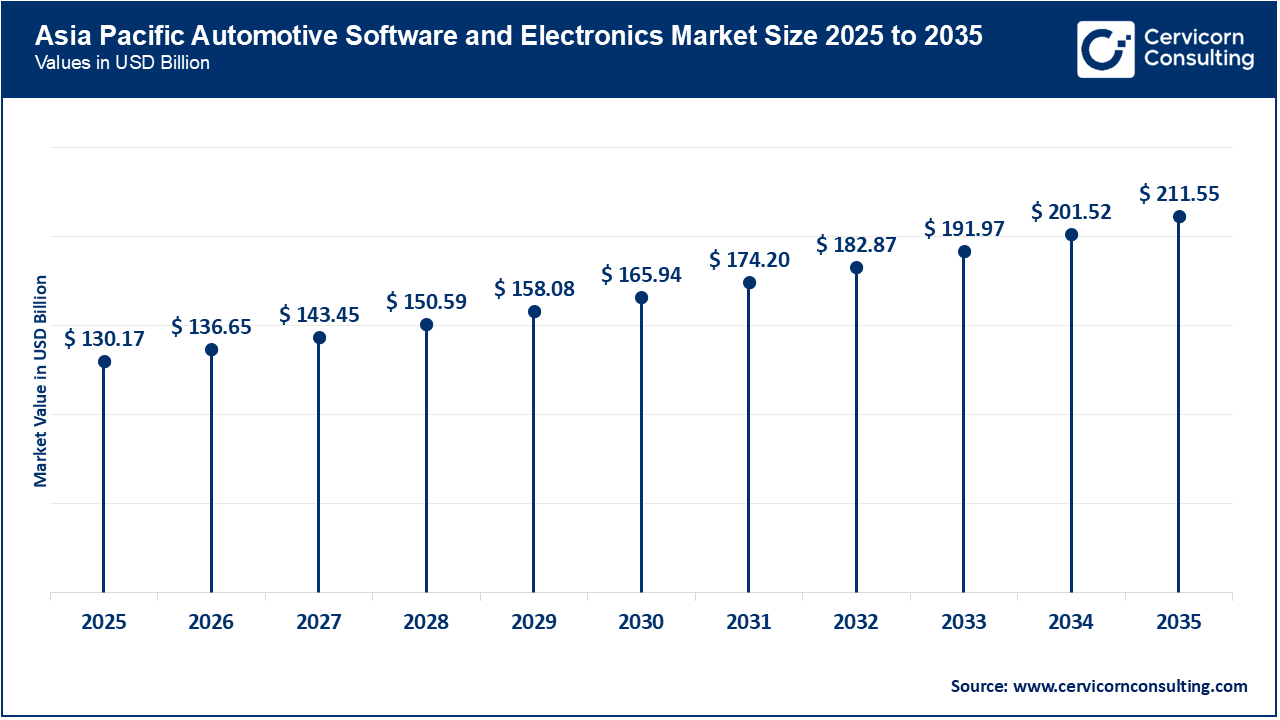

The Asia-Pacific automotive software and electronics market size was estimated at USD 130.17 billion in 2025 and is predicted to reach around USD 211.55 billion by 2035. Asia Pacific (APAC) dominates the global market, primarily driven by supportive new Energy Vehicle (NEV) policies and strong consumer demand for digitally advanced vehicles. In China, government subsidies and infrastructure investments encourage EV manufacturers to incorporate advanced software features as a key differentiator. Additionally, consumers increasingly see the vehicle as a "third living space," boosting demand for smart cockpits, multi-screen infotainment systems, and AI voice assistants to enhance on-the-go functionality.

Recent Developments:

The North America automotive software and electronics market size was valued at USD 97.63 billion in 2025 and is forecasted to grow around USD 158.66 billion by 2035. The North America market is driven by strong adoption of advanced software-defined vehicle technologies, including SAE Level 3 and higher autonomous driving systems and deep integration with cloud-based vehicle services. Additionally, Logistics and ride-sharing companies are accelerating their investments in multiple software solutions to improve fleet management, predictive maintenance, and autonomous delivery routes. Besides operational improvements, the National Highway Traffic Safety Administration (NHTSA) regulatory emphasis and supporting guidance have raised safety standards by promoting advanced active-safety electronics, contributing to sustained market growth.

The Europe automotive software and electronics market size was reached at USD 78.10 billion in 2025 and is projected to hit around USD 126.93 billion by 2035. The Europe is strongly influenced by strict environmental policies and rigorous safety standards. For instance, the "Fit for 55" package and Euro NCAP mandates compel legacy original equipment manufacturers (OEMs) to enhance engine management software and create more advanced active safety electronics to meet CO2 standards and ratings. Nevertheless, European luxury brands are taking the lead in Software-defined vehicles (SDVs) to counter technology companies that compete more fiercely for traditional automotive budgets, by improving telemetry operations with strong cybersecurity and high-quality coding.

Automotive Software and Electronics Market Share, By Region, 2025 (%)

| Region | Revenue Share, 2025 (%) |

| Asia Pacific | 40% |

| North America | 30% |

| Europe | 24% |

| LAMEA | 6% |

The LAMEA automotive software and electronics market was valued at USD 19.53 billion in 2025 and is anticipated to reach around USD 31.73 billion by 2035. The LAMEA market is gradually developing as a market with trends toward acceptance and use of automotive electronics for automotive processes and safety-focused environments. Latin America, especially in Mexico and Brazil, is emerging as a key manufacturing hub, with major Tier 1 suppliers establishing assembly operations to produce mid-level electronic components and structures for local markets and export. In the Middle East, notably in the UAE and Saudi Arabia, there is a significant push towards smart city integration of high-end connected vehicles, which is boosting demand for telematics and GPS-based software solutions that enhance logistics efficiency and fleet safety across large regions.

Recent Developments:

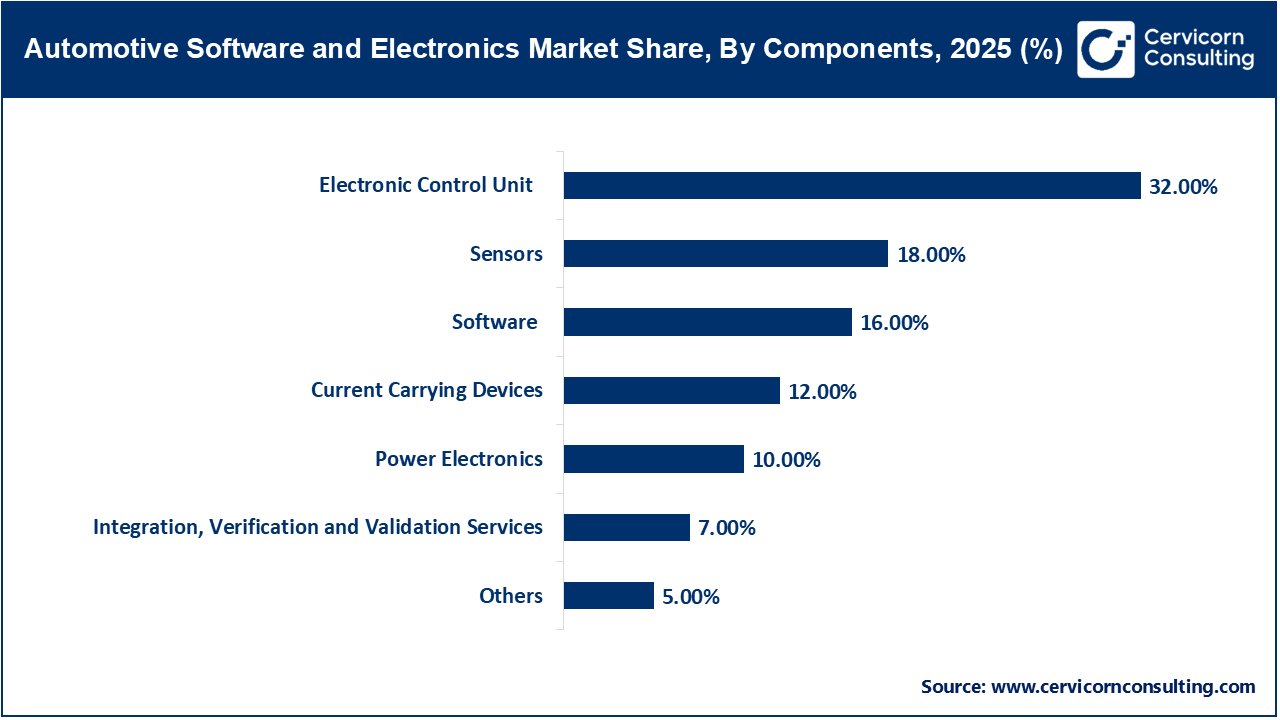

The automotive software and electronics market is segmented into components, application, sales channels, and region.

Electronic Control Units (ECUs) segment continues to dominate the market, because they are the core fundamental building blocks of vehicle electronic connectivity. The industry is moving toward the consolidation of centralization in the in-vehicle ECUs. However, many ECUs are still required for basic vehicle functions, such as powertrain, body, chassis, and utility systems. This ensures that they will still lead in revenue and shipment volume. The subsequent transition to electric and hybrid powertrains, including hydrogen fuel cell and battery management, has increased the need for specialized control units, which are critical components for the electricity propagation, range, and efficiency of the vehicle.

Software component is the fastest-growing segment, due to increasing demand in operating systems, middleware, and applications. Generally, software offers a higher profit margin than hardware and relies on the subscription and output revenue models that investors can find more attractive. The deployments of CI/CD in automotive engineering enable faster updates and introduce new features. The advancement of software has grown and become connected to the increase of vehicle function complexity which is now required to have millions of lines of code to run the vehicle safely and efficiently.

Advanced Driver Assistance Systems (ADAS) is the largest segment of the automotive electronics market, due to its widespread adoption across both luxury and mass-market vehicle segments. As ADAS technology, such as adaptive cruise control and blind-spot monitoring, has reached a high level of maturity, large-scale OEM production has achieved significant manufacturing efficiencies. Furthermore, strong recognition of ADAS safety benefits by insurance and regulators has supported adoption. Continued advances in ADAS technologies will continue to grow with better sensor-fusion and perception using Artificial Intelligent (AI), this will increasingly be the basis for future autonomous driving (AD) capabilities.

Automotive Software and Electronics Market Share, By Application, 2025 (%)

| Application | Revenue Share, 2025 (%) |

| ADAS | 30% |

| Safety Systems | 18% |

| Infotainment | 16% |

| Autonomous Driving | 12% |

| HMI | 8% |

| Body | 5% |

| Unexpected Services | 5% |

| Chassis | 4% |

| Powertrain | 2% |

Autonomous Driving (AD) technology is the fastest-growing segment of the market due to the rapid advances in AI and the increasing momentum toward commercial robotaxi deployment. The transition from Level 2+ combined assist to Level 3 and Level 4 autonomy will require substantially higher amounts of processor capacity, redundant sensors, and more complex software architectures. These technologies demand substantially to increase in electronic and software value per vehicle across companies.

The original equipment market (OEM) remains the dominant sales channel for the automotive software and electronics market, primarily because modern electronic systems are embedded into the structural and safety architecture of the vehicle and must be installed during the manufacturing process. OEMs control the primary software stack as well as the hardware specifications, acting as gatekeepers within the automotive electronics ecosystem. This dominance is shifting toward proprietary "walled garden" ecosystems, where manufacturers want to manage both the user experience and data flow throughout the vehicle.

Automotive Software and Electronics Market Share, By Sales Channels, 2025 (%)

| Sales Channels | Revenue Share, 2025 (%) |

| Original Equipment Market | 75% |

| Aftermarket | 25% |

The aftermarket is the fastest-growing segment in the market, mainly due to rising demand for connectivity and digital retrofitting. Car owners are upgrading their vehicles with features like smartphone integration, advanced telematics, and enhanced infotainment systems. The recovery of the aftermarket is further supported by the availability of modular electronic components that can be integrated into older cars. Additionally, aftermarket participants are leveraging vehicle connectivity to provide services through Original Equipment. Growth is driven by consumers’ desire for a continuous digital experience regardless of the vehicle's age.

By Components

By Application

By Sales Channels

By Region