Hydrogen Fuel Cell Market Size and Growth 2025 to 2034

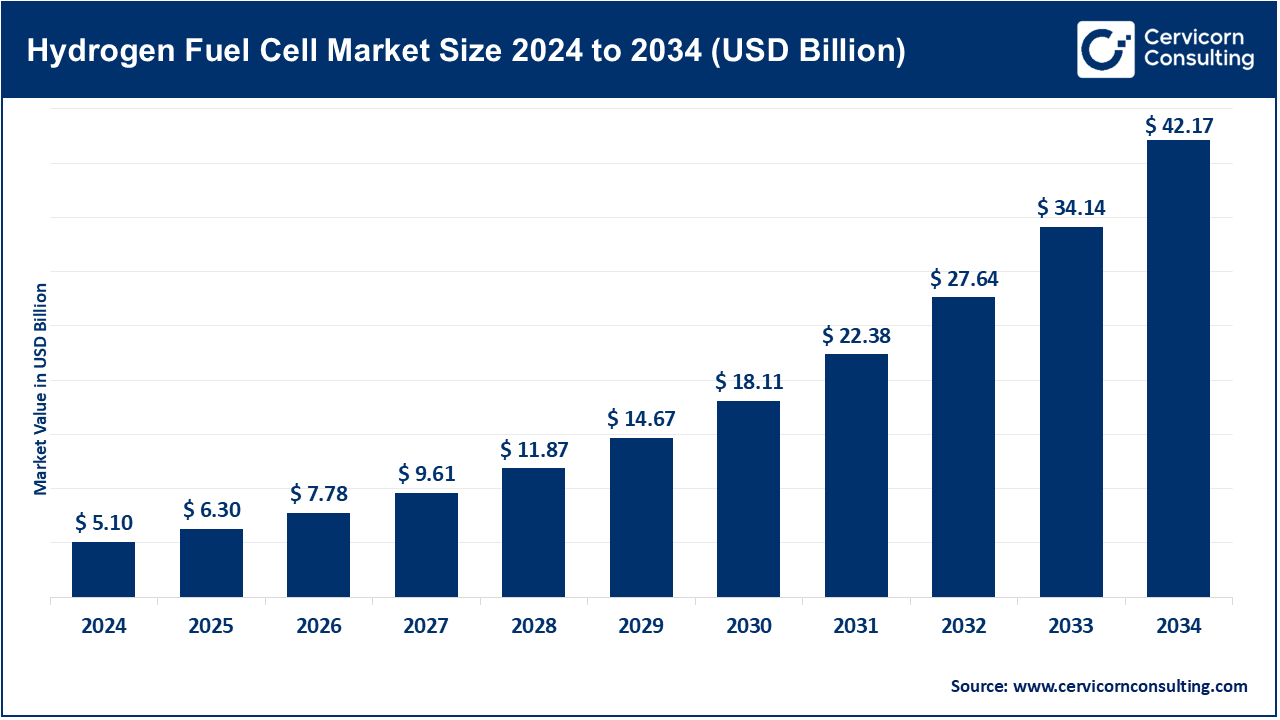

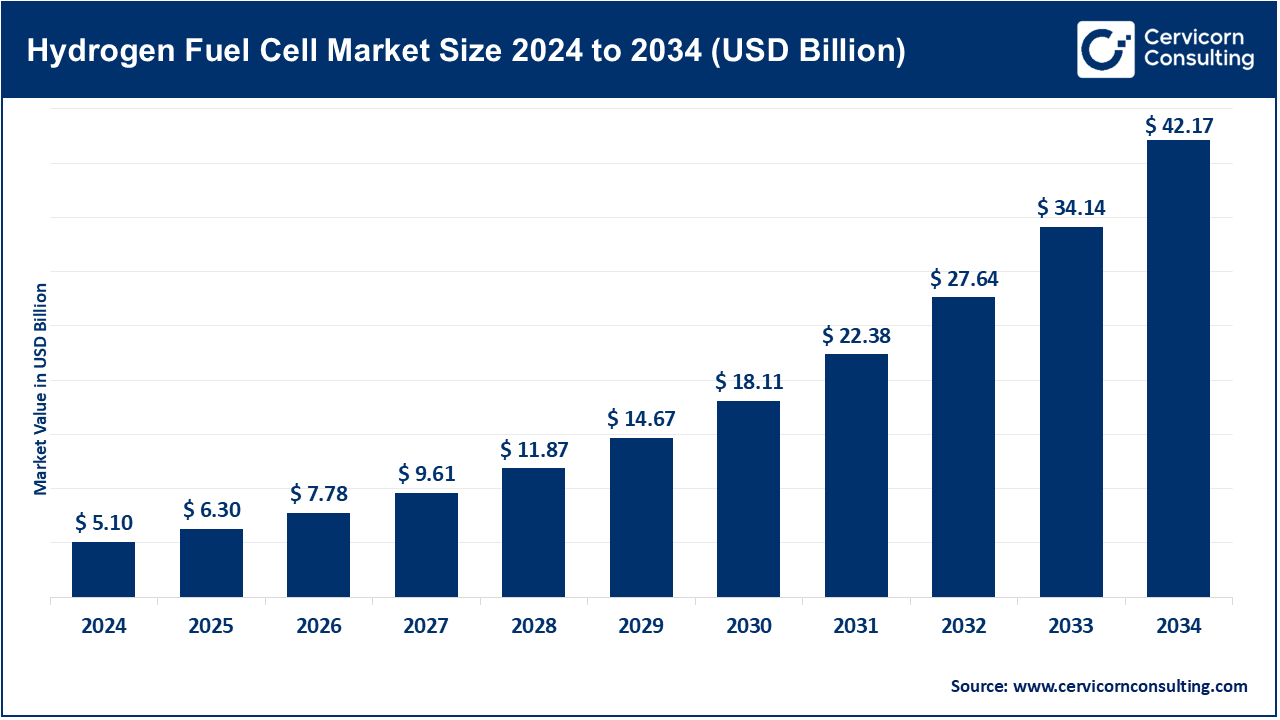

The global hydrogen fuel cell market size was estimated at USD 5.10 billion in 2024 and is expected to be worth around USD 42.17 billion by 2034, growing at a compound annual growth rate (CAGR) of 23.52% over the forecast period from 2025 to 2034.

The hydrogen fuel cells market growth is driven by an infrastructure development, growing concern over energy security, and the need for clean energy. Increasing and growing concern about the energy security also NestGen are impacting fuel cells use in the transportation ion, industrial operations, and stationary power generation processes because boast high efficiency while maintaining zero emissions. Specialized advancements in the production of the green hydrogen such as proton exchange membranes and compact stacks are enhancing cost effectiveness and scalability. Adoption is bolstered by international collaborations, governmental policies, funding for pilot projects, and other type of policy initiatives. Increased spending on R&D, expanded manufacturing capacities, and stronger collaboration across different sectors are all being pursued simultaneously by leading corporations which is anticipated to enhance the availability of hydrogen fuel cells, transforming energy systems to more sustainable, resilient, and low-carbon alternatives.

Hydrogen Fuel Cell Market Report Highlights

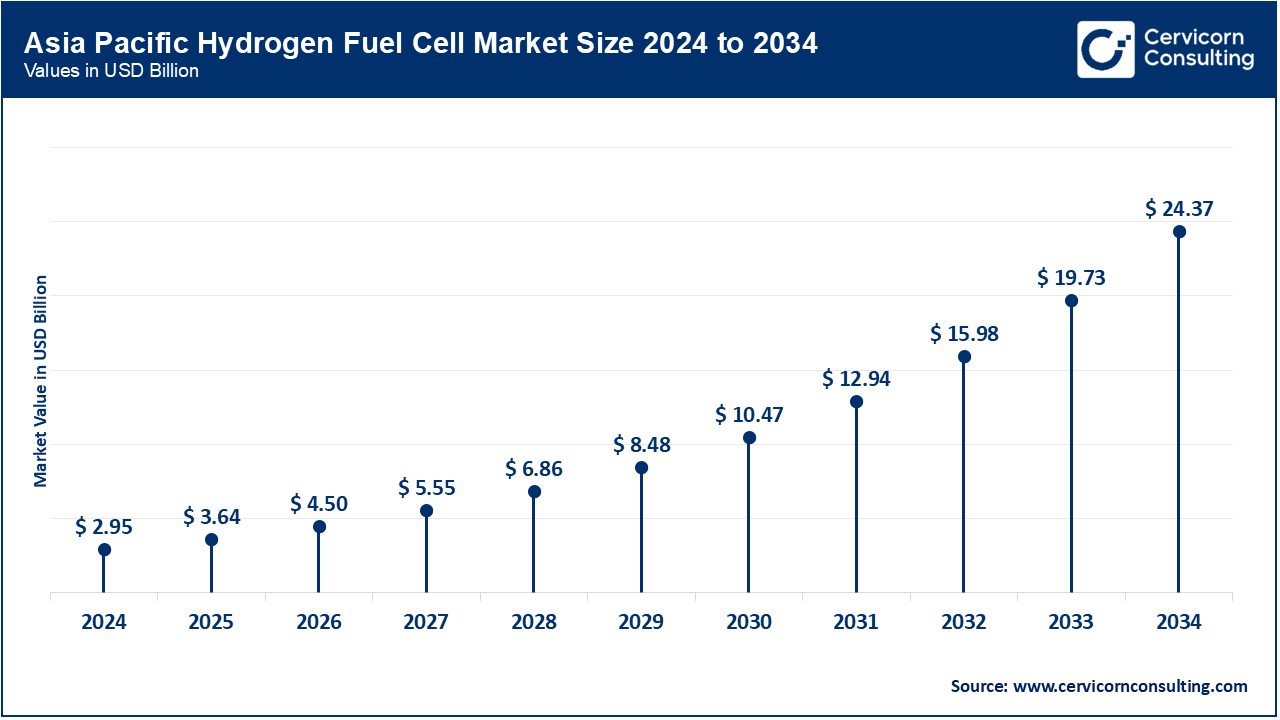

- By Region, Asia Pacific has accounted highest revenue share of around 57.80% in 2024.

- By Type, the air-cooled type segment has recorded a revenue share of around 67.40% in 2024. Air-cooled systems dominate due to their compact, cost-effective, and easier integration in portable and lightweight applications like drones and backup systems.

- By Technology, the polymer exchange membrane fuel cells (PEMFC) segment has recorded a revenue share of around 38.50% in 2024. Polymer Exchange Membrane Fuel Cells (PEMFC) lead due to their PEMFCs offer quick startup, high power density, and are widely used in vehicles, backed by strong OEM investment and global adoption.

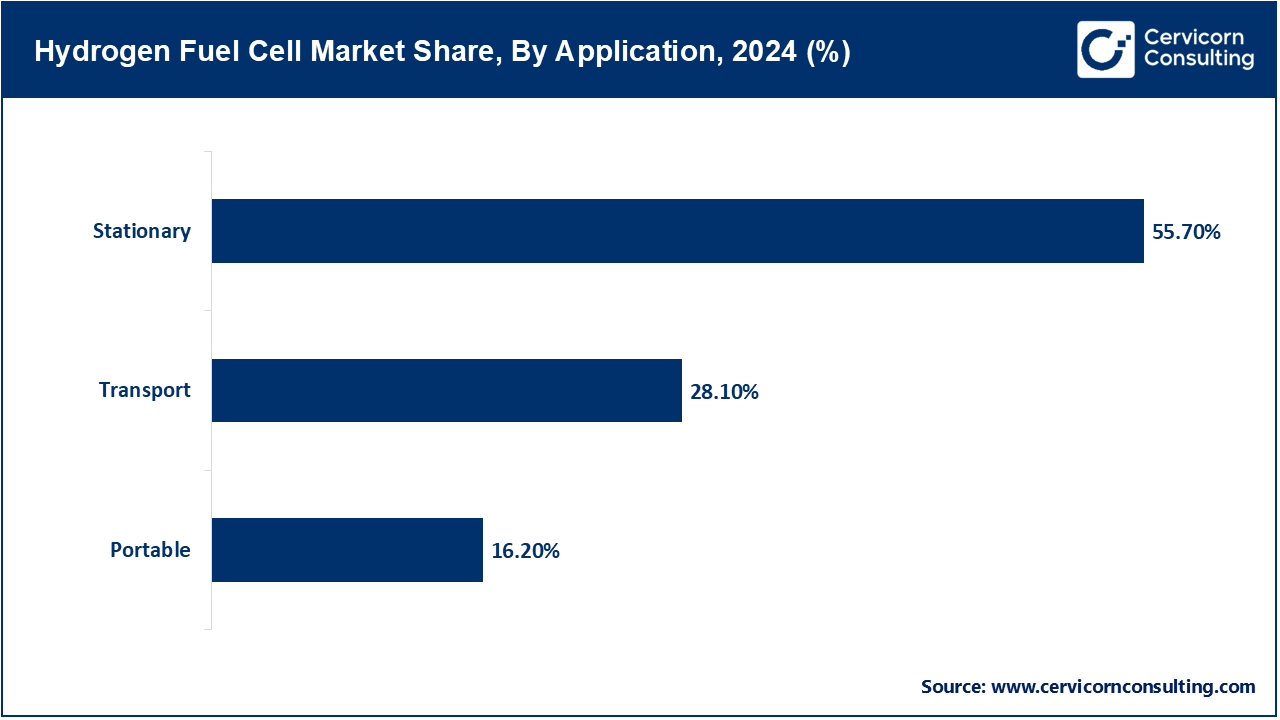

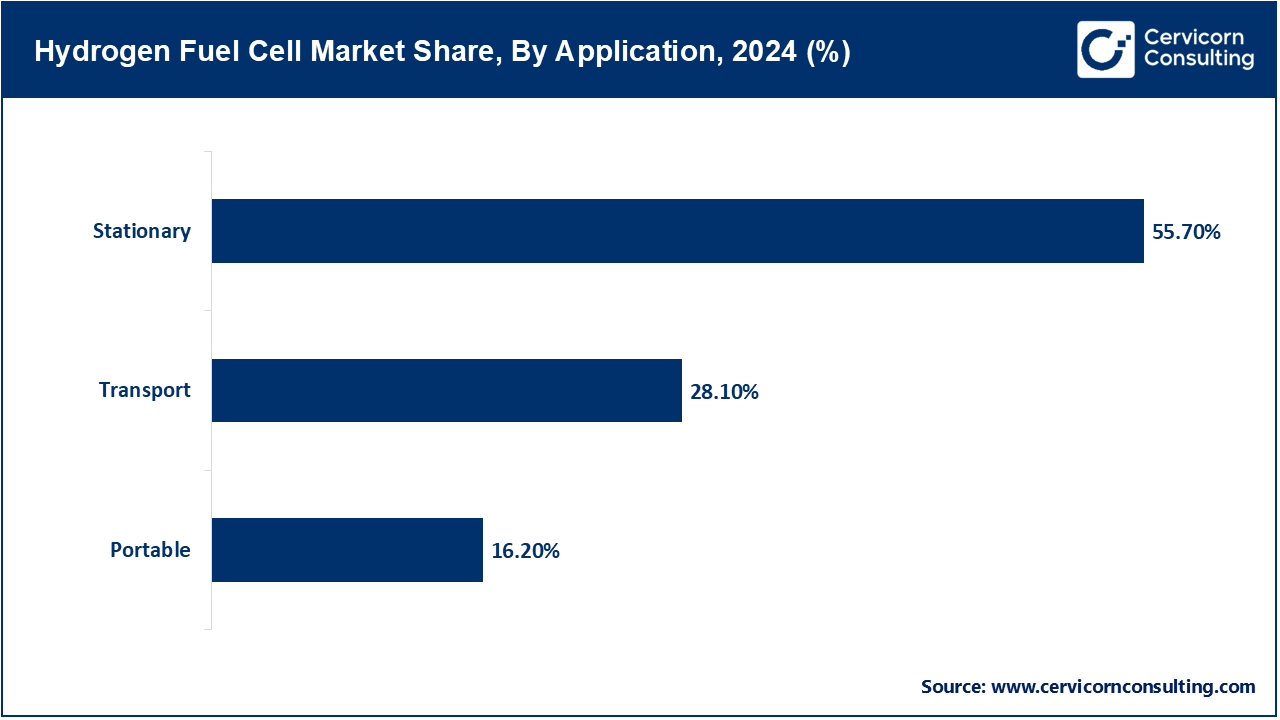

- By Application, the stationary segment has recorded revenue share of around 55.70% in 2024. Stationary fuel cells hold the largest application share as they meet rising demand for reliable, clean power in buildings and data centers, especially amid energy transition efforts.

- By Company Size, the large enterprises segment has recorded revenue share of around 69.60% in 2024. Large enterprises dominate due to their funding capacity, global reach, and ability to commercialize fuel cell systems at scale.

- By End User, the utilities segment has recorded revenue share of around 46.25% in 2024. Utilities lead the end-user segment due to their large-scale hydrogen integration for grid balancing, backup power, and storage in decarbonization strategies.

Hydrogen Fuel Cell Market Growth Factors

- Increased Fuel Cell R&D Spending by OEMs and Startups: Internal combustion engines are being replaced with hydrogen fuel cells, and OEMs are increasing R&D spending. Fuel-cell vehicle systems are now the focus of significant investment by leading automotive manufacturers and new market entrants. To illustrate, in May 2023 Komatsu disclosed the prototype of its hydrogen-powered excavator, which stems from the enhanced R&D focus on zero-emission construction equipment. These developments provide insight into greater industry support for diversified pathways towards electrification that extend beyond batteries. Innovations of this nature are anticipated to augment cost competitiveness and refine the efficiency of the cells. Sustained innovation also fuels the development of fuel cells for use in airplanes and ships, with agile breakthroughs from startups complementing established OEMs.

- Partnerships between automotive manufacturers and hydrogen suppliers: Addressing the issues related to hydrogen production and distribution continues to sustain collaborations between suppliers of hydrogen and automotive manufacturers. Their goal is to motivate technological and infrastructure developments and advancements. An example of these partnerships is Gore’s joint PEM fuel-cell system for heavy trucks with Hyundai and Kia which he initiated in January 2024. These collaborations join materials engineering and automotive engineering with a rigorous adherence to efficiency and cost targets. Commercial viability of these technologies tend to expedite risk mitigating. As logistics and transit fleets continue to be major carbon emissions sources, automotive manufacturers are expected to increase such collaborations. These accords reinforce programs focused on the creation of hydrogen ecosystems around the world.

- Increased uptake of fuel cells for trucks and buses: There is increasing use of fuel cells in heavy trucks and buses due to lack of effective rechargeable storage solutions in these vehicle segments. These industries have efficiency requirements which hinges on long ranges and rapid refueling. Additionally, New Flyer made headlines when it received its largest-ever order of 108 hydrogen buses from SamTrans of California. This fleet order confirms increasing confidence in hydrogen’s promise for efficient public transport systems. Publicly-operated fleet buses are significantly impacting the emissions profile of entire metropolitan regions. Furthermore, hydrogen enables the achievement of zero-emission compliance without operational or route limitations. Alongside private sector uptake, greater public funding will support momentum in the sector.

Hydrogen Fuel Cell Market Trends

- Advancements with green hydrogen from renewable energies: The production of green hydrogen through wind and solar energy is surmounting blue or grey hydrogen. It plays an important role in achieving full sustainability within hydrogen-powered frameworks. India recently instituted a green hydrogen export corridor on March 2023 that extends from the solar parks in Rajasthan to coastal terminals which aids global supply. This initiative is in parallel with the green hydrogen ambitions of the EU and Japan. Furthermore, projects globally are integrating renewable energy powered electrolysis to decarbonize the hydrogen value chain. These advancements further confirm that hydrogen is essential for long-term net-zero goals. This trend will also notably reduce lifecycle emissions.

- Hybridization with battery-electric systems for flexibility: There is increased utilization of hybrid powertrains which uses hydrogen fuel cells alongside battery powered systems as it permits greater adaptability within the systems. These systems advance energy efficiency, performance metrics, and grid compatibility. A California wildfire-resilient grid system integrated hydrogen fuel cells with batteries in February 2024 that offered a 48-hour backup which served immediate and long-term power needs. Use cases differ from emergency backup to mobile energy supply in trucks. From these use cases, hybridization levels out the demand as well, lessening peak grid strain. It serves as a practical solution for the adoption of fuel cells on a wider scope.

- Designs of modular and scalable fuel cell systems: Modular hydrogen systems are gaining importance to enable the outplacement of fuel cells in a variety of locations with minimal redesign efforts. These units help mitigate engineering effort and streamline the deployment of fuel cells in various locations. Starting from January 2025, EQUANS and INOCEL have implemented containerized modular fuel cell solutions for ports, data centers, and microgrids. This illustrates the effectiveness of modular fuel cells in remote and urban areas providing flexible system solutions. Users can adjust supply to fluctuating demand. Simplified maintenance, lower complexity for scaling, and easier integration are additional benefits of modular architecture. This demonstrates further movement towards tangible, plug-and-play hydrogen systems.

Report Scope

| Area of Focus |

Details |

| Market Size in 2025 |

USD 6.30 Billion |

| Expected Market Size in 2025 |

USD 42.17 Billion |

| Projected Market CAGR 2025 to 2034 |

23.52% |

| Dominant Region |

Asia-Pacific |

| Key Segments |

Type, Technology, Company Size, Application, End User, Region |

| Key Companies |

AFC Energy, Audi, Ballard Power Systems, Bloom Energy, BMW, Ceres Power, Cummins, Daimler, Doosan Fuel Cell, FuelCell Energy, Fuji Electric, Hyster-Yale, Honda Motor, Horizon Fuel Cell, Intelligent Energy, Kyocera, MAN SE, Nedstack Fuel Cell, Nikola |

Hydrogen Fuel Cell Market Dynamics

Market Drivers

- Faster refuelling vs. battery EVs in logistics applications: Logistics fleet operations benefit from fuel cell powered vehicles more than from battery-powered EVs due to charging times. Hydrogen powered vehicles refuelling takes less than 10 minutes which is optimal for fleet operations. Hyundai anticipates operational trials of their XCIENT hydrogen trucks will reach over 3 million kilometers throughout Europe by October 2024. These trucks operate within a logistics network where turnaround time is critical. Hydrogen fuel benefits long-haul and intercity travel. Commercial transport vehicles experience heavy reliance on fuel cells due to costly downtimes. These trucks operate within logistics networks where turnaround is critical. Logistics firms tend to prefer fuel cells due to high-cost downtime. This reason remains one of the strongest motivators for fuel cell adoption in commercial transport vehicles.

- Public-private partnerships in infrastructure development: Public-private partnerships are collaborating on projects, turning them into one complete entity. Companies are working alongside governments where hydrogen filling stations, electrolysers, and distribution networks will be built. The industrial clusters and transport corridors covered by the France PPP in July 2023 also includes a policy framework which gives it more value. The program prioritizes public funding complemented by corporate investment aimed at large-scale infrastructure. Other countries such as Germany, Japan, and California are also adopting the model for shared risk and co-investment. These collaborations further increase hydrogen deployment speed and also strengthen research and skill development in the sector.

- Electrification of Public Transit Systems: Buses powered with hydrogen aid transit authorities in attaining their objective of having vehicles with no tailpipe emissions. Hydrogen as an energy source also allows for uninterrupted operation with battery electric models on longer or steeper routes because of its quick “refueling” and long range. In December 2024, the Seoul Metropolitan Government added more than 500 hydrogen buses to its fleet as part of its climate action plan. The plan includes collaboration with Hyundai for vehicle and fueling station supply. These changes are backed both by national funding and local air quality objectives. For dense urban corridors, hydrogen provides a scalable, flexible solution. Acceptance is increasing due to improvements in air quality and operational noise levels.

Market Restraints

- Transport and storage concerns of hydrogen: Transport and storage issues stem from the highly flammable hydrogen gas, which manifests as public concern over leaks or explosions. While there is no public awareness of safety protocols, procedures in place are always no injury incidents such as the hydrogen leak at the German refueling station in April 2023. Lack of infrastructure designed to keep the public safe hinders even minor incidents from gaining public trust. Real-time monitoring is receiving increased attention, while regulation coupled with public campaigns aimed at mitigating perception risk is slowly resolving the issue at hand. Triangulating the perception challenge, trust, and mitigation is essential for long-term gains.

- Complex logistics of hydrogen supply chain: Transporting hydrogen in tanks or through pipelines requires a liquefaction process of some sort - expensive by all accounts. Apart from urbanized Japan, Germany, and California, fueling stations sit in stark contrast to rural areas and remote industrial zones-providing no access to on-site production or mobile refueling. Gap coverage is key and without solid hydrogen carriers and new innovations in the pipeline, competitiveness is stunted. The entire logistics structure must be redesigned to enable scalability alongside adoption.

- Postponements in policy execution or subsidy rollouts: Numerous governments champion and draft comprehensive hydrogen policies but encounter regulatory or fiscal hold-ups. These pose complications for investors and Original Equipment Manufacturers (OEMs) planning hydrogen projects. In August 2022, the EU's USD 6.13 billion hydrogen funding package suffered with approval delays, postponing multiple initiatives to 2024. Such stagnation halts infrastructure development and fleet transitions. Predictably timed returns on investments are essential to developers. Removing hurdles is now a primary focus. Policy alignment at the execution stage aids in closing gaps.

Market Opportunities

- Remote and off-grid fuel cell applications: In locations where there is no fuel power grid, fuel cells offer an emissions-friendly alternative solution. Off-grid fuel cells, for example, are quieter and more emission friendly than diesel generators. These off-grid fuel cells are quiet and more emissions friendly than diesel generators. An example of this is the implementation of dual battery and hydrogen fuel cell systems in Calistoga, California for wildfire plus resilience emergency backup power. The described system provides off-grid 48 hours of standby power and highlights the feasibility of using hydrogen for off-grid resilience and disaster recovery. Isolation, mining, defense locations can hold off-grid applications for these areas.

- Unmanned vehicles powered by hydrogen: Aerial vehicles and other machines using hydrogen work better for the system as they have continuity of operational time. The broader the industrial capabilities, the lighter the model. The introduction of UAVs hydrogen powered by Doosan Mobility marked new advancements in 2023 through a 2 hour flight requirement. Their use and support toward agriculture, surveying and search & rescue mission can greatly extend durations. Though not mainstream, the hydrogen UAV market already exists and is projected to shift greatly due to long missions.

- Integration of fuel cells in data centers and telecommunication towers: Data centers require continuous energy, which makes fuel cells a reliable backup or primary power source because of their low emissions and noise, and high availability. INOCEL and EQUANS launched modular hydrogen systems targeting data centers and telecommunications sites in January 2025, providing megawatt-scale capacity. These systems are quickly deployable and enhance energy resilience. Operators have reduced reliance on diesel. There is increasing demand for clean fuels as the digital infrastructure expands. Hydrogen is emerging as a long-term solution.

Market Challenges

- Understaffed skilled workforce for hydrogen technologies: There is a gap in the necessary qualifications for the workforce within the hydrogen subsector spanning engineering, safety, and operational roles. The developing industry requires an increased trained workforce at all tiers. An industry survey in 2024 predicts a global shortfall of 30% certified hydrogen technicians, stagnating progress in Germany and Japan. A number of academic institutions have started developing curriculum and offering courses pertaining to hydrogen technologies. Certain schools are starting to offer classes associated with hydrogen. There is also an emerging trend of retraining workers from the fossil fuel industry. Global targets and public readiness of the workforce are interlinked. Public and private partnerships are essential for developing syllabuses.

- Longer waiting periods for hydrogen refueling stations compared to EV chargers: The same fire safety and zoning restrictions pertinent to EV chargers equally apply to hydrogen stations, further delaying their approval. Lack of well-defined, coherent policy frameworks leads to these sorts of comprehensive delays. Los Angeles was set to receive a hydrogen station in Los Angeles in early 2023, but local revisions to permits pushed the installation back 6 months. These problems drain project budgets undermining competitiveness, especially among smaller businesses. Expedited national rollouts could be achieved with standardized permitting policies. Hydrogen access is being integrated into zoning policies, which is currently under revision by the government. Streamlining this is one of the most critical demands from industry.

- Long commercialization timelines for innovations: There is a glaring gap between the innovation and commercialization of hydrogen fuels. This can impede the rate of returns on investments and discourage early adopters. BMW and Toyota just recently in September 2023 spoke on their fuel cell vehicles with a prospective production date set for 2028, five years from now. This most often occurs with advanced stack or drivetrain systems. There is already a backlog due to the delays caused by pilot testing and regulatory approvals. Although some gaps can be funded, innovation balance and time-to-market remain critical.

Hydrogen Fuel Cell Market Segmental Analysis

Type Analysis

Air-Cooled: The air-cooled systems contributed the highest revenue share in the market. The air-cooled systems utilize air for both the heat control and cooling processes, thus, they are suitable for compact and lightweight systems with low to moderate power needs. They are vertically integrated in portable devices and small mobility platforms. Recently in July 2023, Ballard Power launched an advanced air-cooled PEM fuel cell stack designed for UAVs and small logistics vehicles, enhancing both lifespan and thermal efficiency. This launch was driven by the increasing last mile delivery and drone market. These systems have a lower level of complexity and a lower cost of construction and maintenance, which also enables greater accessibility in developing regions. Manufacturers are focusing on outdoor ruggedized designs for these systems.

Hydrogen Fuel Cell Market Revenue Share, By Type, 2024 (%)

| Type |

Revenue Share, 2024 (%) |

| Air-Cooled |

67.40% |

| Water-Cooled |

32.60% |

Water Cooled: Water cooled systems are well suited for high load application vehicles such as trucks, buses, and industrial equipment. These systems are effective for sustained high power consumption. Hyundai has recently implemented upgrades to their overheating wear and range capable hydrated trucks which utilizes water cooled fuel stack mounted systems. These advancements make prolonged transport routes more commercially viable. Public transit and transport logistics fleets heavily utilize these systems. Adoption rates are rising in the US, South Korea, and Europe. The long-term deployment of systems hinges on the efficiency of the cooling mechanisms employed.

Technology Analysis

Polymer Exchange Membrane Fuel Cells (PEMFC): The PEMFC segment has registered highest revenue share. Due to low operating temperature and quick start-up, PEMFCs can be used in portable and automotive applications. These are the most commercialized fuel cells. Toyota has already released the third-generation PEM fuel cell as of June 2024, featuring greater power density and lesser platinum use. It is intended for use in SUVs and light trucks. PEMFCs continue to lead in global FCEV deployments. Efforts are being made to increase retention levels. Partnerships are with OEM are increasing to include marines and railroads.

Direct Methanol Fuel Cells (DMFC): DMFCs are most appropriate for military and portable devices as they utilize liquid methanol fuel. In February of 2025, a Japanese electronics firm developed a compact fuel DMFC charger which provides over 15 hours of backup power greatly improving usability. DMFCs are still used in areas with unreliable access to grid power. They are increasingly being used for military purposes and for disaster management. Work continues in areas of energy density, methanol crossover, and other refinements. According to Frost & Sullivan, there is significant potential in DMFC developing markets.

Molten Carbonate Fuel Cells (MCFC): MCFCs are primarily utilized in stationary industrial and utility scale power systems since they operate at the highest temperature of all fuel cells. In addition, MCFCs can use natural gas or biogas as fuel. Recently, FuelCell Energy expanded the operation of their MCFC power plants in California to provide low-emission energy to wastewater facilities, thus aiding in the integration of carbon capture technologies. Adoption of MCFCs in decentralized power networks is on the rise. The extreme operating temperature allows for co-generation applications. Focus areas for the near future include longevity of the stacks and boosting system efficiency.

Phosphoric Acid Fuel Cells (PAFC): PAFCs employ phosphoric acid as an electrolyte which maintains stable output and is more useful for stationary power with integrated heat recovery. They work at intermediate temperatures which is best for hospitals and universities. In August 2022, Doosan Fuel Cell PAFC South Korea dispatched a PAFC system to a medical center to reduce dependence on diesel and allow for a 24/7 functioning system. The unit also supplied heat used for sterilization and HVAC systems. PAFCs are known for reliability and long operating hours, and competition is sparse in the mid-temperature region. There is a focus on improving thermal output and reducing size.

Others: This category incorporates the rarer SOFCs and AFCs fuel cells which are beneficial for their high efficiency and fuel flexibility. Their primary applications are in the stationary and aerospace industries. Bloom Energy's new modular SOFC system designed for hydrogen and biogas hybrids to be used at industrial parks was announced in January 2025. These systems allow multi-fuel flexibility and are designed for continuous operation. AFCs are regaining popularity due to their use in aerospace and defense applications. This category is driven by innovative technology.

Application Analysis

Portable: Powering portable fuel cells and other field and tactical applications with quiet clean sources of power. These systems are invaluable where traditional utility grid capacity is unserviced and the cost for power from diesel generators is too prohibitive. In Germany, in April 2023, SFC Energy announced next generation hydrogen powered flexible generator for responsive multifunctional emergency footprint capability. The unit helped backup areas severely flooded. These systems are gaining adoption in telecom towers as well. Portability and durability remain key R&D areas. The segment continues to be driven by miniaturization.

Stationary: The stationary segment accounted for the largest share of market revenue. Stationary fuel cells offer continuous or backup power to buildings, data centers, and utilities, giving a zero-emission alternative to diesel generators. Microsoft began a hydrogen fuel cell trial in November 2024 to replace gensets at a data center in Washington to ensure reliable uptime during grid outages which aids long-term climate goals. These systems are now being adopted in commercial real estate and hospitality. New emerging models are hybrids with solar and batteries. Stack life and efficiency remain critical.

Transport: Fuel cells offer long ranges and quick refueling, making them ideal for buses, trucks, and trains, where batteries still fall short. These vehicles emit only water vapor. Hyundai fuel cell stacks supported the operation of over 500 fuel cell buses added in Seoul in December 2024 as part of the city's green mobility initiative. The city aims to exceed 1,300 fuel cell electric buses (FCEBs) by 2026. Transport still accounts for the bulk of PEMFC applications. Adoption is accelerating due to infrastructure expansion. There is still keen interest from global OEMs.

End User Analysis

Defense: For military operations, supplied power packs, ground vehicles, and fuel cells equipped drones are needed for silent operation, extended range, and lean power in remote areas. In March 2023, the U.S. Army started field testing unmanned ground vehicles powered by fuel cells which boosts field mission stealth and endurance efficiency. Hydrogen is less logistically burdensome than diesel. Military agencies are making investments in off-grid energy technologies. Key competitive advantages include silent operation with low heat signature and modular integration.

Hydrogen Fuel Cell Market Revenue Share, By End User, 2024 (%)

| End User |

Revenue Share, 2024 (%) |

| Defense |

21.13% |

| Fuel Cell Vehicles |

32.62% |

| Utilities |

46.25% |

Fuel Cell Vehicles (FCEVs): FCEVs are powered by onboard generated hydrogen combustion electricity, offering long range and fast refueling when compared to battery vehicles. They are ideal for fleet vehicles and areas with existing refueling infrastructure. Joint development of a hydrogen-fueled SUV was announced in October 2023 by BMW and Toyota, targeting 2028 global production. This expands their engineering and market reach. FCEVs are being adopted for delivery vans and pickup trucks as well. There is rising consumer demand in Europe and the Asia-Pacific region. Focus is on fuel economy and cost equivalence.

Utilities: Hydrogen fuel cells are used by utilities to balance grids, manage peak load, and store renewable energy. These systems offer backup and baseload power with zero emissions. In August 2024, RWE of Germany commenced a pilot project which uses hydrogen fuel cells to provide supplementary power during low wind periods at offshore wind farms. This integration lessens curtailment and enhances grid resilience. Electric utilities regard fuel cells as potential replacements for gas peaker plants. Closed-loop electrolyzer to fuel cell systems remain in testing stages. Policy support seems to be fostering progress.

Company Size Analysis

Large Enterprises: The large enterprises have maintained a leading position in the market. Large corporations utilize hydrogen fuel cells on a logistical scale within the fleet management, logistics, and energy systems sectors. They often team up with tech companies to meet impact goals. In June 2023, Amazon enhanced hydrogen integration with Plug Power by outfitting fuel-cell forklifts and testing hydrogen delivery vans at its distribution centers. This is in line with its 2040 net-zero emissions commitment. Corporate buyers drive down technology costs. Their scale suffices for pilot-to-deployment transitions. There is strong funding appetite within e-commerce and retail.

Hydrogen Fuel Cell Market Revenue Share, By Company Size, 2024 (%)

| Company Size |

Revenue Share, 2024 (%) |

| Large Enterprises |

69.60% |

| Small and Medium Enterprises |

30.40% |

Small and Medium Enterprises (SMEs): Niche components, testing services, and ever more specialized applications enable small to medium enterprises (SMEs) to work on fuel cell innovation. They tend to be agile due to government grants. In February 2025, one UK-based SME revealed a lightweight, extended flight time hydrogen drone for agricultural aerial monitoring. These firms excel at miniaturization and specialize in other narrow domains. Their collaboration with universities is common. Their size facilitates rapid prototyping. Regulatory frameworks and IP protections are critical for SME expansion.

Hydrogen Fuel Cell Market Regional Analysis

The hydrogen fuel cell market is segmented into several key regions: North America, Europe, Asia-Pacific, and LAMEA (Latin America, Middle East, and Africa). Here’s an in-depth look at each region.

Why does the Asia-Pacific region hold the largest share in the hydrogen fuel cell market?

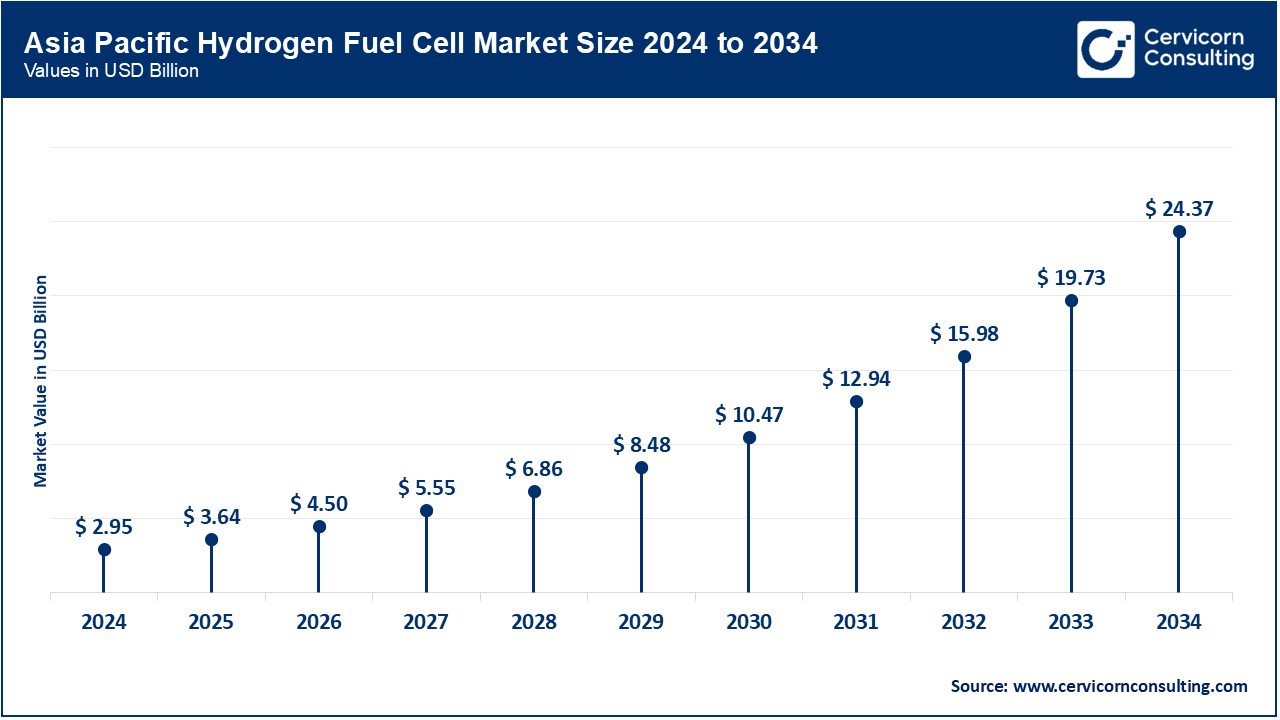

- The Asia-Pacific hydrogen fuel cell market size was valued at USD 2.95 billion in 2024 and is expected to reach around USD 24.37 billion by 2034.

The Asia-Pacific region holds the largest market share. The increasing dominant factors of highway construction, automotive industry, and decarbonization goals are increasing growth in the region. Japan, China, and South Korea are the leaders in the market. South Korea reaffirmed its green mobility strategy by planning to deploy 1,200 hydrogen buses and 50 refueling stations by 2026. Japan continues promoting hydrogen through its Basic Hydrogen Strategy and vehicle trials conducted in Tokyo. China is facilitating the use of hydrogen in urban transport and around heavy industry hubs. India and Australia are focusing on green hydrogen for national energy security. For manufacturing scale and offering potential, APAC is even more important.

Why is North America experiencing remarkable growth in the hydrogen fuel cell market?

- The North America hydrogen fuel cell market size was estimated at USD 0.84 billion in 2024 and is projected to hit around USD 6.96 billion by 2034.

The North America is on a remarkable growth trajectory thanks to certain policies developed for the clean energy transition, strengthening of federal subsidies, and interest and development from the automotive, logistics and stationary power industries. The U.S. seems to be in the lead with ongoing investment into hydrogen infrastructure, while Canada and Mexico are developing planning approaches to close the gap. In October 2023, the U.S. Department of Energy announced the launching of seven clean hydrogen hubs with $7 Billion of funding to support early adopter of clean hydrogen in transportation, and other sectors. The Canadian Government has a $0.3 billion commitment to hydrogen projects, with a strategically narrower focus towards green hydrogen exports. Mexico is considering hydrogen as a decarbonization option for cement and steel. Hydrogen powered rail is being piloted in the region as well. Increased partnership with the public and the private sector is needed to scale up.

What are the key drivers of the hydrogen fuel cell market in Europe?

- The Europe hydrogen fuel cell market size was reached at USD 1.08 billion in 2024 and is expected to surpass around USD 8.90 billion by 2034.

Europe is recognized around the world as the most advanced region in the world for the adoption of hydrogen fuel cells. The EU Hydrogen Strategy continues to provide favorable elements, and the climate targets are a critical component. Germany, France, and the Netherlands are leading in hydrogen infrastructure as well as de-carbonization of transport and industry. In April 2024 Germany introduced a funding program worth USD 1.06 billion for the installation of hydrogen truck and refueling stations along transcontinental freight corridors. France is increasing the number of Hydrogen buses under its national plan for green mobility. The UK and Spain are incorporating hydrogen into their energy storage systems. Italy and the Netherlands are concentrating on fuel cells in ports and shipping. Europe’s regulatory framework accelerates both demand and innovation.

Hydrogen Fuel Cell Market Revenue Share, By Region, 2024 (%)

| Region |

Revenue Share, 2024 (%) |

| North America |

16.50% |

| Europe |

21.10% |

| Asia-Pacific |

57.80% |

| LAMEA |

4.60% |

Why is LAMEA an emerging region in the hydrogen fuel cell market?

- The LAMEA hydrogen fuel cell market size was recorded at USD 0.23 billion in 2024 and is anticipated to grow around USD 1.94 billion by 2034.

LAMEA is working towards decarbonization goals set for the region and is an emerging market. Brazil is looking into hydrogen mobility for transportation and industrial applications and is working alongside the Middle East on hydrogen exports. NEOM Green Hydrogen Project in Saudi Arabia started infrastructure construction in June 2023 and hopes to hit their 2026 goal of 650 tons/day of green hydrogen. Brazil started feasibility studies for hydrogen-based trains and long-haul vehicles. Egypt is expanding hydrogen mobility and electrolyzer manufacturing, while the UAE is launching it into other parts of Africa where it hopes to capitalize from future solar-linked projects. Investment and policy is rapidly gaining traction.

Hydrogen Fuel Cell Market Top Companies

Recent Developments

The hydrogen fuel cell industry is driven by major players like AFC Energy, Audi, Ballard Power Systems, Bloom Energy, and BMW, who are leading innovation in clean mobility and power solutions. These companies are developing efficient fuel cell stacks, zero-emission vehicles, and scalable hydrogen infrastructure. In January 2024, Ballard Power Systems partnered with Quantron AG to roll out hydrogen trucks in Europe. BMW advanced its iX5 Hydrogen fleet, while Audi continued R&D under the Volkswagen Group. Bloom Energy expanded its SOFC tech for industrial use, and AFC Energy launched hydrogen-powered EV chargers. Together, they are reshaping the future of sustainable transport.

- In March 2025, Cummins Inc., along with Johnson Matthey, PHINIA, and Zircotec, has completed "Project Brunel", a UK-backed initiative to develop a 6.7-litre hydrogen internal combustion engine (H2-ICE) for medium-duty trucks and buses. The project achieved over 99% tailpipe CO2 reduction and ultra-low NOx emissions using advanced hydrogen injection and catalyst technologies. Supported by the Advanced Propulsion Centre UK, the engine offers near-zero emissions without needing a full vehicle redesign. Its scalable design is suitable for future heavy-duty and off-road applications, reinforcing the UK’s role in hydrogen innovation and sustainable transport.

- In October 2022, Kyocera is supporting the hydrogen economy through its advanced ceramic components designed for harsh conditions involved in hydrogen production, transport, and storage. These high-performance ceramics are critical in green hydrogen generation via electrolysis, where durability, corrosion resistance, and high-pressure tolerance are essential. The company delivers both individual parts and fully customized ceramic assemblies, using its expertise in shaping, coating, and brazing. In September 2022, Kyocera showcased these innovations at Hydrogen 2022, highlighting its role in enabling safe, efficient, and scalable hydrogen solutions. Its technologies align with global climate goals and are vital for a clean energy transition.

- In June 2025, BMW’s announcement to launch its first hydrogen-powered production SUV in 2028, likely based on the next-gen X5, signals a pivotal shift in its long-term mobility strategy. After extensive testing with the iX5 Hydrogen, BMW is doubling down on hydrogen as a complementary alternative to battery electric and internal combustion vehicles. This move addresses global EV market saturation, slow charging infrastructure, and consumer range anxiety. BMW is collaborating with Toyota to scale next-gen fuel cell systems, aiming for efficiency and cost-effectiveness. While limited refueling infrastructure remains a key barrier, growing investment across Europe and Asia is improving viability. BMW’s multi-powertrain approach ensures it remains flexible amid shifting regulations, technologies, and user demands, positioning hydrogen as a critical part of the clean mobility puzzle.

Market Segmentation

By Type

- Air-Cooled Type

- Water-Cooled Type

By Technology

- Direct Methanol Fuel Cells

- Molten Carbonate Fuel Cells

- Phosphoric Acid Fuel Cells

- Polymer Exchange Membrane Fuel Cells

- Others

By Company Size

- Large Enterprises

- Small and Medium Enterprises

By Application

- Portable

- Stationary

- Transport

By End User

- Defense

- Fuel Cell Vehicles

- Utilities

By Region

- North America

- APAC

- Europe

- LAMEA