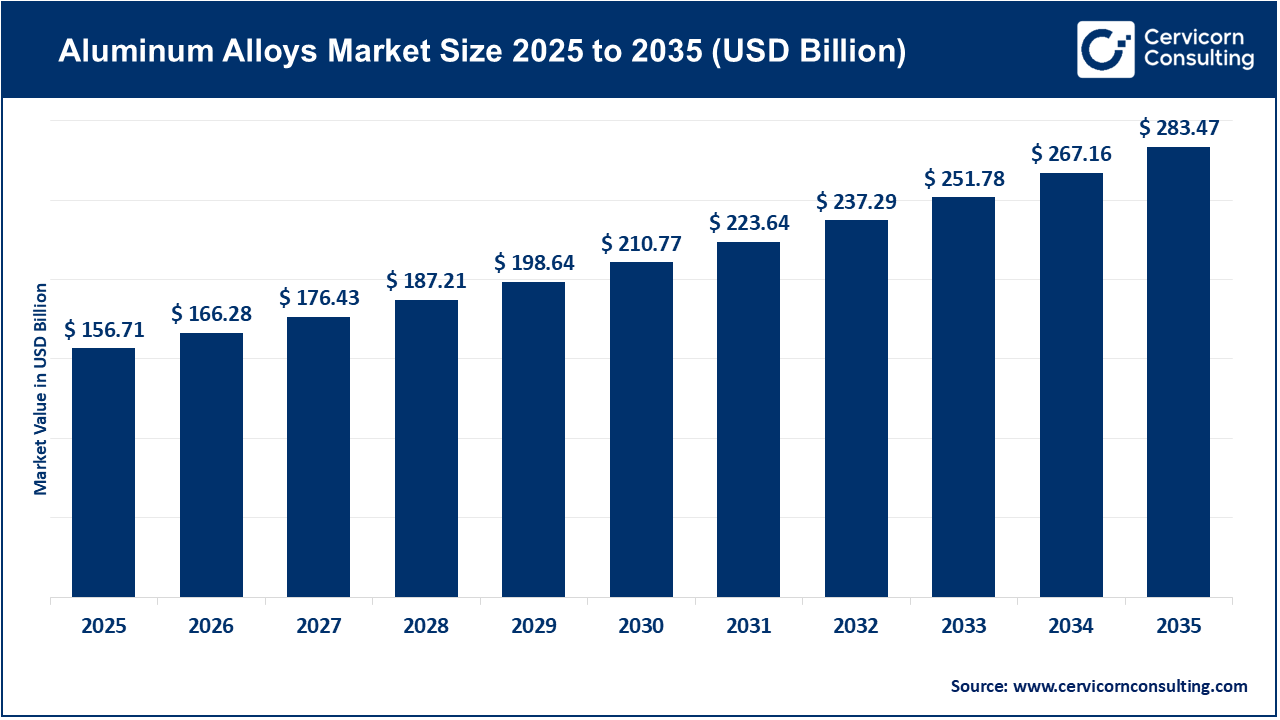

The global aluminum alloys market size was valued at USD 156.71 billion in 2025 and is expected to hit around USD 283.47 billion by 2035, exhibiting at a compound annual growth rate (CAGR) of 6.1% over the forecast period from 2026 to 2035. The main factors driving the aluminum alloys market are lightweighting and electrification. Manufacturers in the automotive and aerospace industries are increasingly adopting higher-strength aluminum alloys to improve fuel and energy efficiency, as well as to extend the range of electric vehicles. In addition, stricter decarbonization regulations and incentives for low-carbon metals are increasing the demand for recycled and low-carbon primary aluminum.

Several factors are contributing to the growth of the aluminum alloys market, including increased primary and secondary production in important regions and changes in trade flows. China continues to account for about 60% of global output, producing tens of millions of tonnes each year. However, growth in China is slowing as the government enforces a production cap. At the same time, producers and recyclers in the Gulf region have expanded their capacity, with GCC primary output reaching approximately 6.4 to 6.45 million tonnes in 2024. These developments, along with declining global stocks on the LME and changes to export rebates, are tightening supply and supporting both demand and prices for aluminum alloys.

What are the Trends and Application Areas in the Aluminum Alloys Market?

The aluminum alloys market is experiencing significant growth, primarily driven by the increasing demand for lightweight materials, the implementation of decarbonization policies, and the rapid electrification of various industries. In particular, sectors such as transportation and sustainable packaging are adopting high-strength aluminum alloys as substitutes for traditional materials like steel and copper. Additionally, the rising use of recycled aluminum is transforming production processes and influencing global trade dynamics within the industry.

Application Areas of Aluminum Alloys

The use of aluminum alloys has become increasingly prominent in a variety of sectors, including transportation, construction, packaging, aerospace, electrical, and industrial applications. Among these, transportation and construction industries represent the largest share of global demand, as the need for lightweight and durable materials continues to rise in these fields.

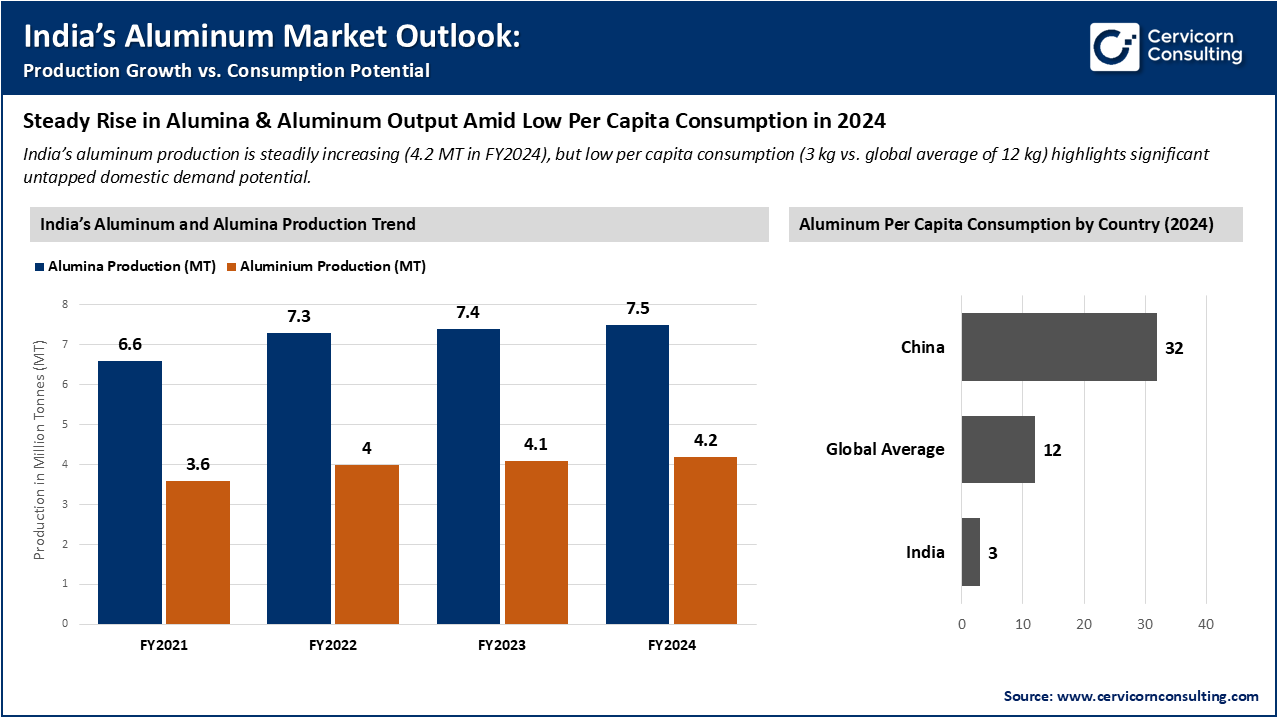

India’s Aluminum Industry: Rising Production with Significant Consumption Headroom

India’s rising alumina and aluminum production is strengthening domestic supply security, improving export competitiveness, and supporting downstream industries such as automotive, construction, packaging, and electrical equipment manufacturing. At the same time, the country’s low per capita aluminum consumption (3 kg versus the global average of 12 kg) signals strong untapped demand potential, which is expected to drive future market expansion through infrastructure growth, EV adoption, renewable energy projects, smart cities development, and increasing substitution of steel and plastic with lightweight aluminum alloys.

1. China’s Export Policy Changes and Alloy Trade Rebalancing (2024–2025)

During 2024 and 2025, China changed its export rebate policies and strengthened environmental regulations on primary aluminum production. At the same time, the country increased exports of higher value-added aluminum alloys. China’s primary aluminum output stayed close to the government’s capacity limit of about 45 million tonnes per year. Meanwhile, alloy exports grew as producers focused more on semi-fabricated and alloyed products.

This development is driving the market by changing global trade flows. It is encouraging more downstream alloy processing within China and reducing exports of raw metal. As a result, global buyers are becoming more dependent on Chinese alloy semis. This trend is affecting regional pricing and encouraging other producing regions to increase their capacity for secondary and value-added alloy production.

2. Carbon Border Adjustment Mechanism (CBAM) Implementation by the European Union (2023–2026 Transition)

The European Union has started the transition phase of its Carbon Border Adjustment Mechanism (CBAM), which covers aluminum as one of the key sectors. Under this phase, importers are required to report the embedded carbon emissions in aluminum products. Financial adjustments are expected to be introduced once the mechanism is fully implemented.

This policy is having a considerable impact on the aluminum alloys market by increasing the demand for low-carbon and recycled alloys. Producers in regions like the Middle East and Canada, where smelting operations use hydro or gas power, are gaining a competitive edge. In contrast, producers with higher carbon emissions are experiencing increased cost pressures. As a result, the policy is driving global investments in green aluminum and secondary alloy production, as companies seek to maintain their access to the European market.

3. Expansion of Low-Carbon Alloy Production by Emirates Global Aluminium (EGA)

Emirates Global Aluminium has increased both production and international sales of its low-carbon aluminum products under the CelestiAL brand, which are produced using solar power. The UAE produces more than 2.5 million tonnes of primary aluminum each year, and a significant share is exported as value-added alloy products.

This achievement is driving the growth of the market by setting a new standard for green alloy supply in the automotive, construction, and packaging industries. As global manufacturers focus on reducing Scope 3 emissions, the demand for low-carbon aluminum alloys is rising. This is increasing the need for renewable-powered alloy production and supporting long-term supply agreements.

4. United States Tariff and Domestic Production Measures

The United States continues to enforce Section 232 tariffs on specific aluminum imports, while also promoting the restart of domestic smelters and investments in alloy production. Although the country produces about 1 million tonnes of primary aluminum each year, it still relies heavily on imports to meet the demand for aluminum and alloy products.

These trade and industrial policy actions are significantly influencing the aluminum alloys market. By encouraging the reshoring of downstream alloy processing and strengthening regional supply security, these measures are shaping industry trends. The tariffs are also changing import and export patterns, leading to higher domestic alloy premiums. As a result, North American producers are increasingly investing in recycled and specialty alloy capacity to decrease dependence on foreign sources.

The aluminum alloys market is segmented into North America, Europe, Asia-Pacific, and LAMEA. Here is a brief overview of each region:

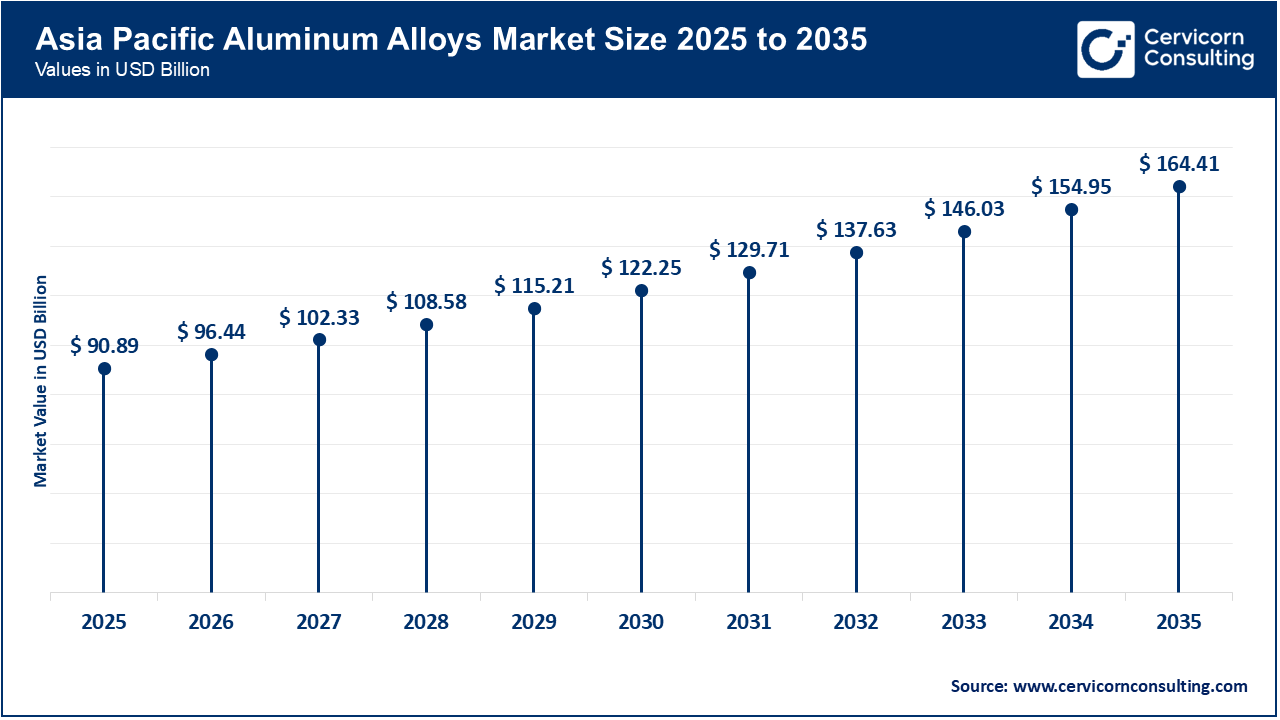

The Asia-Pacific aluminum alloys market size was valued at USD 90.89 billion in 2025 and is predicted to surpass around USD 164.41 billion by 2035. Asia Pacific is expected to sustain its leadership position over the coming decade. The region acts as the global manufacturing hub for automotive, construction materials, packaging, and electronics, creating consistent large-volume demand for both wrought and cast aluminum alloys. Rapid EV production growth, urban infrastructure expansion, and strong export-oriented semi-fabrication industries in China, India, Japan, and South Korea continue to reinforce the region’s market control.

China alone produces approximately 43–45 million metric tons of primary aluminum annually, accounting for nearly 60% of global output, with a significant portion converted into value-added alloy semis for domestic consumption and export. India has emerged as the second-largest producer in Asia, generating over 4 million metric tons annually, supporting rising domestic infrastructure and transport demand. Additionally, Asia Pacific accounts for more than 50% of global aluminum consumption, driven by automotive production and construction activities.

China and India Aluminum Alloys Market: A Quantitative Perspective

The North America aluminum alloys market size was estimated at USD 28.21 billion in 2025 and is forecasted to attain around USD 51.02 billion by 2035. North America represents a strategically important aluminum alloys market driven by automotive manufacturing, aerospace production, and government-led industrial policies encouraging domestic sourcing. While primary aluminum production remains relatively limited compared to Asia, the region is strengthening its secondary (recycled) aluminum ecosystem to meet sustainability and supply security objectives.

The United States produces roughly 1 million metric tons of primary aluminum annually, but consumes significantly more, making it a net importer of aluminum and alloy products. Secondary aluminum production in North America exceeds primary output, highlighting the region’s strong recycling infrastructure.

United States & Canada Aluminum Alloys Market: Key Data Points

The Europe aluminum alloys market size was reached at USD 25.07 billion in 2025 and is projected to surpass around USD 45.36 billion by 2035. Europe’s aluminum alloys market is increasingly shaped by sustainability regulations, renewable energy adoption, and advanced automotive manufacturing. The European Union’s carbon reporting requirements and green procurement standards are encouraging demand for low-carbon and recycled aluminum alloys. Automotive lightweighting, rail infrastructure upgrades, and building retrofits are major consumption drivers.

Europe produces approximately 3–4 million metric tons of primary aluminum annually, significantly lower than its consumption levels, resulting in reliance on imports from Canada and the Middle East. However, Europe leads in recycling efficiency, with aluminum beverage can recycling rates exceeding 70–75% in several countries. The region is also a major consumer of high-performance automotive sheet alloys.

Germany, France & Nordic Region: Quantitative Insights

Aluminum Alloys Market Share, By Region, 2025 (%)

| Region | Revenue Share, 2025 (%) |

| Asia Pacific | 58% |

| North America | 18% |

| Europe | 16% |

| LAMEA (Latin America, Middle East & Africa) | 8% |

The LAMEA aluminum alloys market was valued at USD 12.54 billion in 2025 and is anticipated to reach around USD 22.68 billion by 2035. The Middle East has emerged as a major global supplier of primary aluminum and alloy products, supported by competitively priced energy and large-scale integrated smelting operations. Countries such as the UAE, Bahrain, and Saudi Arabia produce significant export volumes, supplying Europe, Asia, and North America with both primary metal and value-added alloy products.

The Gulf Cooperation Council (GCC) region collectively produces over 6 million metric tons of primary aluminum annually, with most output destined for export markets. Producers are increasingly focusing on certified low-carbon aluminum to attract automotive and industrial buyers

UAE & Bahrain: Market Highlights

The aluminum alloys market is segmented into product, end-user, and region.

Wrought alloy remains the dominant product segment in the aluminum alloys market. This is largely because it is widely used in sheet, plate, and extrusion forms for construction, automotive body structures, packaging foil, and various industrial applications. The main factors behind its continued dominance are its superior mechanical strength, corrosion resistance, and formability, which make it suitable for structural and load-bearing components such as vehicle body panels, façade systems, and rail coaches. The consistent global demand for 5000- and 6000-series wrought alloys in transportation and building applications further supports the large-scale use of these materials.

Aluminum Alloys Market Share, By Product, 2025 (%)

| Product | Revenue Share, 2025 (%) |

| Wrought Alloy | 68% |

| Cast Alloy | 32% |

Cast alloy is currently the fastest-growing product segment in the market. This growth is mainly driven by increasing demand from electric vehicles, lightweight machinery, and complex structural applications. The adoption of high-pressure die casting and structural casting technologies has enabled the production of motor housings, transmission cases, battery enclosures, and large integrated vehicle components. The ability of cast alloys to form complex shapes efficiently, along with the rise in electric vehicle production and industrial automation, is encouraging further investment in advanced casting technologies and supporting the rapid expansion of this segment.

The automotive and transportation sector remains the largest end-user. Manufacturers are increasingly focusing on lightweight materials to improve fuel efficiency, extend the driving range of electric vehicles, and comply with emission regulations. Aluminum alloys are commonly used in body-in-white structures, crash management systems, wheels, battery enclosures, and engine components. As a result, the transportation industry is one of the biggest consumers of both wrought and cast aluminum alloys. The rising electrification of vehicles and the growing use of aluminum in each vehicle are expected to further strengthen the dominance of this segment in the coming years.

Aluminum Alloys Market Share, By End-User, 2025 (%)

| End-User | Revenue Share, 2025 (%) |

| Automotive & Transportation | 31% |

| Construction | 24% |

| Packaging | 16% |

| Machinery & Equipment | 11% |

| Consumer Durables | 8% |

| Electronics | 6% |

| Others | 4% |

The electronics and electrical sector is also experiencing significant growth in the use of aluminum alloys. The increased adoption of aluminum in heat sinks, power transmission lines, EV charging infrastructure, and renewable energy systems is driving this trend. The high thermal conductivity and lightweight nature of aluminum make it suitable for high-performance electronic devices and for modernizing power grids. The global expansion of renewable energy capacity and data infrastructure is fueling the demand for conductive and heat-resistant aluminum alloys.

By Product

By End-user

By Region