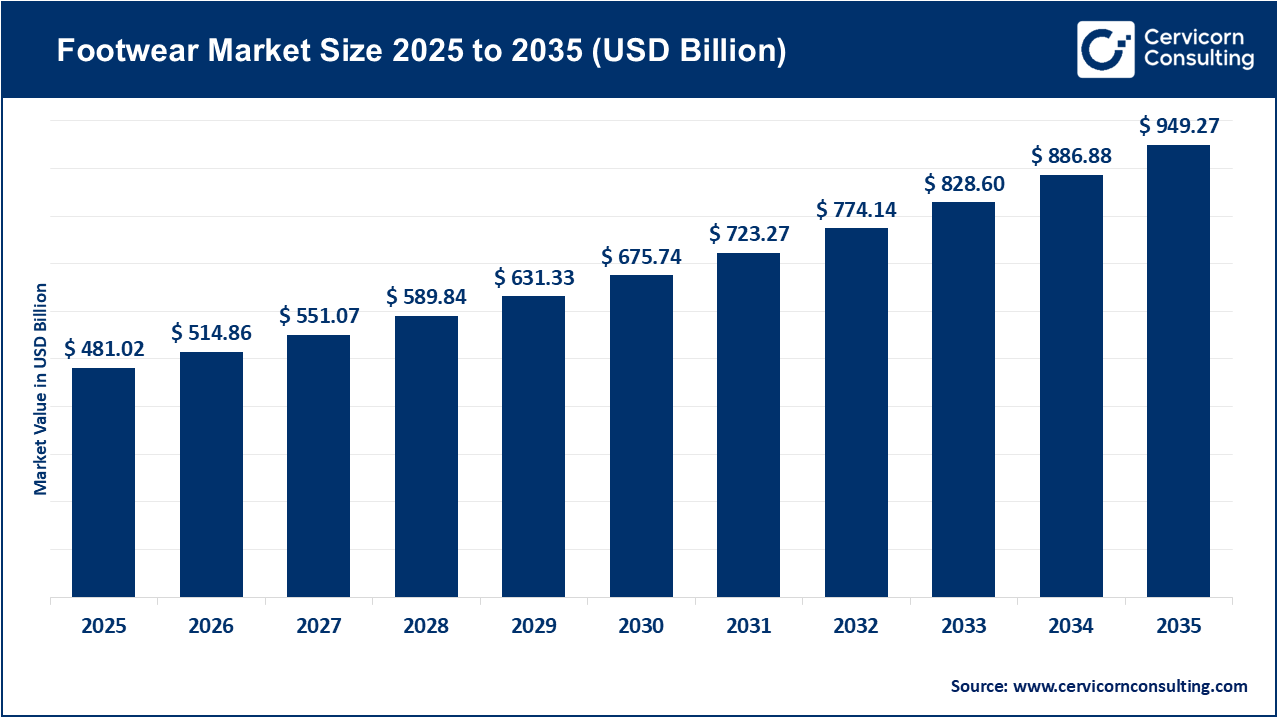

The global footwear market size was valued at USD 481.02 billion in 2025 and is expected to be worth around USD 949.27 billion by 2035, exhibiting a compound annual growth rate (CAGR) of 7.1% over the forecast period from 2026 to 2035. The footwear market's growth is mainly fueled by the increasing popularity of athleisure, which has blurred the lines between performance and everyday footwear. This trend reflects a growing global focus on physical fitness and higher engagement in sports and outdoor activities. Consumers now favour footwear that offers comfort and versatility for work, casual outings, and outdoor recreation alike. At the same time, environmentally conscious consumers, especially Gen Z and Millennials, are prompting brands to adopt sustainable practices. These trends have also heightened health awareness worldwide and accelerated direct-to-consumer (DTC) strategies by key brands like Nike and Adidas, with rising DTC sales influencing the industry's current and future business models.

Sustainability has shifted from a niche marketing tactic to an integral part of footwear operations. Increasing demand for eco-friendly products and stricter environmental regulations are driving brands to adopt circular business models that incorporate recycled textiles, bio-based foams, and sustainable leather alternatives. This shift is expected to reduce environmental impacts associated with traditional manufacturing. Additionally, companies are investing in technologies that support the "right to repair" and improve end-of-life management for footwear. Financial incentives and tax breaks in certain regions further promote the adoption of green manufacturing practices.

Digital Technologies and the Onset of Smart Shoe Technology

The integration of digital technologies is opening new opportunities for "smart" or "phygital" products in the footwear market. Specifically, technologies such as biometric sensors and microchips in shoe soles enable features like step counting. More advanced smart footwear can measure a person's steps, provide real-time coaching to prevent injury, and support remote patient monitoring, including integration with healthcare providers for mobility concerns. This technology is bridging the gap between the footwear and wearables industry, creating several high-margin opportunities for brands that can manage complex data ecosystems. Beyond product innovation, digital integration is also transforming footwear manufacturing through increased use of 3D printing and automated "micro-factories," which allow real-time hyper-personalization of footwear, enabling shoes to be custom-molded instantly.

1. Recent Corporate Disruption and Innovation Initiatives

A significant recent milestone in the footwear market is the disruption of Nike and Adidas's duopoly, with newer brands that are more flexible, innovation-driven, and focused on performance. For example, companies like AG and Hoka, which own proprietary cushioning technologies, follow a "niche to mass" commercialization strategy to directly compete with established market leaders in running shoes and lifestyle footwear categories. This expansion reflects a larger industry trend, where advancements in comfort, design, and performance technology increasingly drive product sales through brand loyalty.

2. Government Policy Mandates and Sustainability Framework

The European Union’s Ecodesign for Sustainable Products Regulation (ESPR) is a major growth driver for the market. This regulatory environment requires the use of “Digital Product Passports” for footwear, which provides detailed information about the product’s supply chain, material composition, and recyclability. This regulation aims to establish a global standard for encouraging manufacturers to adopt transparent, sustainable practices in order to sell into the European market. It also promotes the public narrative of environmental responsibility from consumer to producer.

3. Technological Advancements in Production Efficiency

Adidas made a significant breakthrough in the large footwear market by launching a 4D midsole created via digital light synthesis using 3d printing technology. This market is shifting from using 3D printing mainly for prototypes to transitioning toward large-scale production. The Adidas 4D midsole was created with a complex lattice structure that enables tuned cushioning technology and provides better energy return, which is not possible with traditional injection-molded construction. This allows for improved production efficiency and enables brands to respond more quickly to localized demand.

4. Consolidation Data Information through Mergers of Brands

Market consolidation through mergers and acquisitions is reshaping competition across the industry. The Tapestry-Capri business deal is a relevant example of how brand mergers or acquisitions influence footwear brands like Michael Kors and Coach, which are primarily interested in luxury fashion. Brand consolidations allow large fashion groups to accelerate and utilize their supply chain power, as well as share material and design innovation across multiple labels. This enables expansion of the high costs involved in developing sustainable or smart materials across their brand portfolios. As a result, from an independent brand perspective, however, this trend creates an additional level of competitive disadvantage.

Report Scope

| Area of Focus | Details |

| Market Size in 2026 | USD 514.86 Billion |

| Market Size in 2035 | USD 949.27 Billion |

| CAGR from 2026 to 2035 | 7.10% |

| Dominant Region | Asia-Pacific |

| Fastest Growing Region | North America |

| Key Segments | Type, End User, Distribution Channel, Region |

| Key Companies | Nike, Inc., Adidas AG, Skechers USA, Inc., Puma SE, New Balance Athletics, Inc., ASICS Corporation, Under Armour, Inc., VF Corporation, Crocs, Inc., ANTA Sports Products Ltd., Li-Ning Company Limited, Deichmann SE, Bata Corporation, The ALDO Group, Fila Holdings Corp |

The footwear market is segmented by region into North America, Europe, Asia-Pacific, and LAMEA. Here is a brief overview of each region:

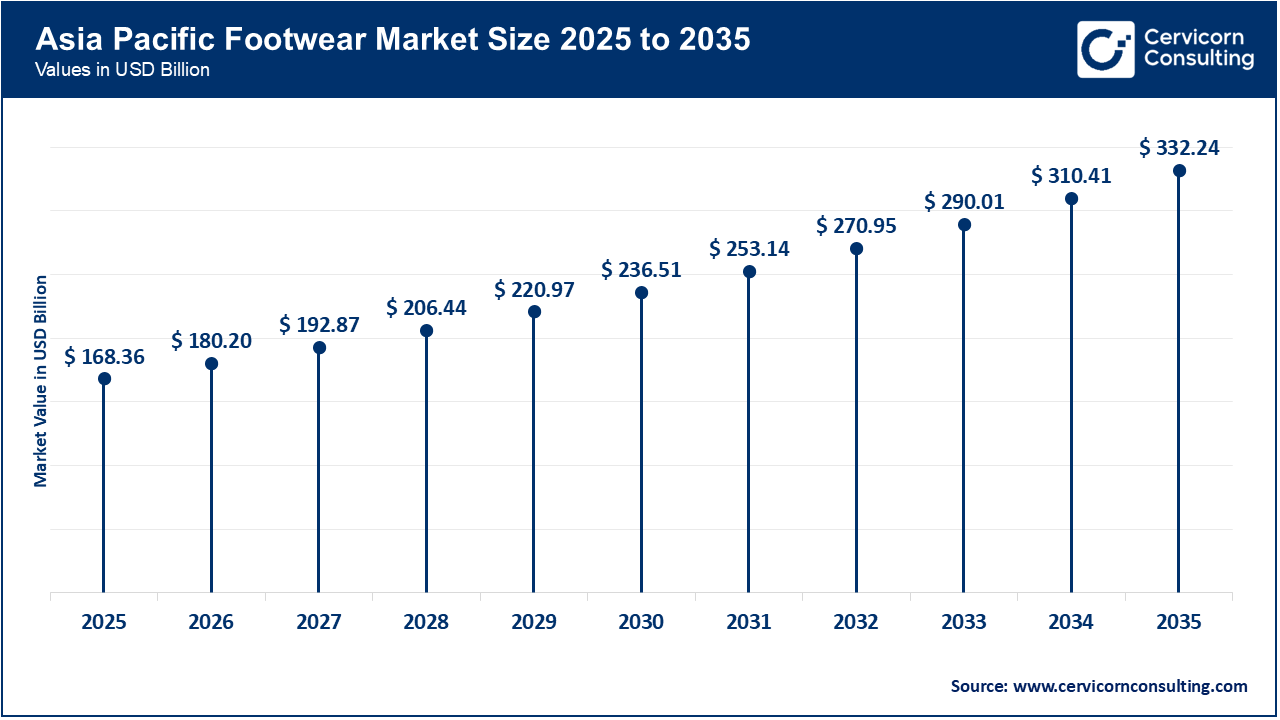

The global footwear market size was valued at USD 168.36 billion in 2025 and is expected to reach around USD 332.24 billion by 2035. The Asia-Pacific region continues to lead the market due to significant demographic and economic shifts. Rapid growth of the middle class across China, India, and Southeast Asia has shifted footwear from a basic need to an important symbol of lifestyle and identity. Increasing disposable income has enabled these countries to focus more on higher-end footwear categories, ranging from professional sports gear to luxury fashion. Besides economic growth, trends like China's "Guochao," or the "national tide," are becoming more popular. This trend reflects a growing preference for domestic brands among consumers, especially those that successfully combine modern technology with cultural heritage.

Recent Developments:

The North America footwear market size was estimated at USD 144.31 billion in 2025 and is forecasted to grow around USD 284.78 billion by 2035. North America is the fastest-growing region in the market mainly due to rapid digital transformation and the strong expansion of omnichannel retail strategies. The region has become a leader in direct-to-consumer (D2C) models, with major brands increasingly focusing on their digital platforms instead of traditional channels to gain greater control over brand positioning and consumer data. D2C has evolved beyond a sales channel, reshaping the traditional supply chain and enabling real-time data analytics to support inventory management and product development.

Recent Developments:

The Europe footwear market size was reached at USD 125.07 billion in 2025 and is projected to hit around USD 246.81 billion by 2035. Europe market growth is growth is driven by increasingly strict regulatory frameworks combined with a well-informed and eco-conscious consumer base. Policies such as the European Green Deal and the introduction of "Digital Product Passports" have required brands to support sustainability claims with clear, verifiable, and transparent supply chain policies. As a result, European consumers are increasingly demanding transparency concerning material sourcing, labor practices, and the environmental impact of products. This shift is transforming sustainability from just a feature into a core competitive advantage.

Recent Developments

Footwear Market Share, By Region, 2025 (%)

| Region | Revenue Share, 2025 (%) |

| Asia Pacific | 35% |

| North America | 30% |

| Europe | 26% |

| LAMEA | 9% |

The LAMEA footwear market was valued at USD 43.29 billion in 2025 and is anticipated to reach around USD 85.43 billion by 2035. The LAMEA region presents a strong long-term growth opportunity due to rapid urbanization and organized retail infrastructure. The emergence of modern shopping malls is transforming a fragmented Middle Eastern and African market into a cohesive retail landscape for global brands. This infrastructure has notable implications for brand placement, as organized stores allow global brands to combine their presence with experiential retail environments that appeal to the young, brand-conscious consumer base, thereby accelerating overall market presence.

Recent Developments

The footwear market is segmented into type, end user, distribution channel, and region.

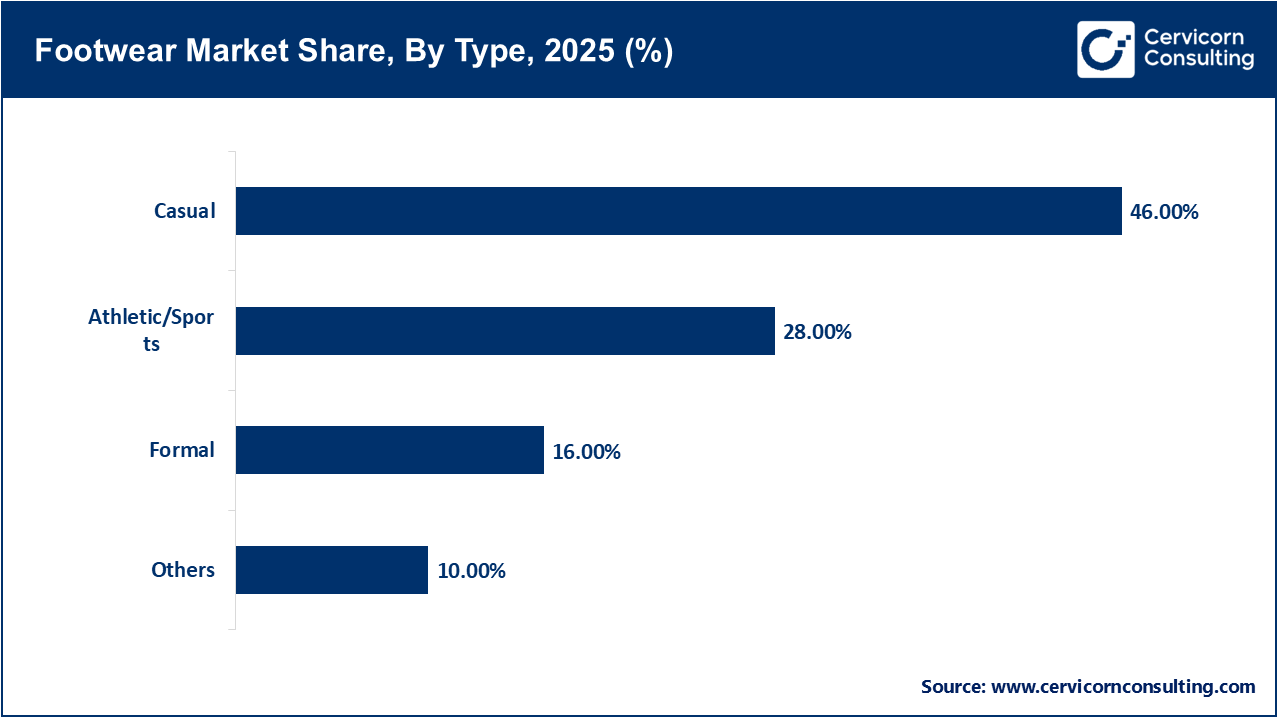

Casual footwear is the dominant segment of the footwear market because of its design for everyday comfort and regular use across work, education, and social activities. These shoes easily fit different lifestyles and occasions, making them a practical choice for daily wear. As professional dress codes have become more relaxed globally, the demand for versatile casual shoes has continued to grow. The casual footwear segment attracts a wide demographic, from budget-conscious consumers to those interested in entry-level luxury loafers or sneakers.

Athletic and sports footwear is the fastest-growing segment of the market, primarily because of the "aspirational" aspect of the products. Consumers buy athletic shoes not just for performance and comfort, but also to reflect their commitment to an active lifestyle. Previously, growth in athletic footwear came from limited-edition releases and collaborations with influencers or athletes, but now sneaker culture has become a major driver of growth in athletic footwear. This segment leads in technological innovation, with brands constantly developing the lightest foams, most responsive carbon plates, and highly breathable materials.

The men's footwear segment holds a leadership position in the footwear market, especially in athletic footwear and the luxury formal category. This leadership has been developed through footwear inspired by the early stages of sneakerhead culture, as well as by integrating technical innovation focused on male athletes. For example, consumers are beginning to shift away from traditional formal shoes toward "hybrid" footwear that combines the aesthetics of a dress shoe with the comfort of an athletic sole. This reflects a change in the modern male consumer's attitudes toward footwear.

Footwear Market Share, By End User, 2025 (%)

| End User | Revenue Share, 2025 (%) |

| Men | 48% |

| Women | 38% |

| Kids | 14% |

The women's segment is the fastest-growing user group in the market, mainly due to increasing women’s participation in the workforce across countries, which raises demand for both casual and formal footwear. The women’s footwear category is expanding rapidly and evolving as brands shift from generic designs to products specifically developed for female biomechanics, rather than simply resizing existing styles. Additionally, growth is further supported by strong demand for women-specific performance footwear, running shoes, yoga-inspired footwear, and the rapidly growing "power sneaker" segment for professional and everyday use.

Supermarkets and hypermarkets lead the segment because of their easy accessibility and one-stop shopping experience. These retailers capture a large share of essential footwear sales by offering high-volume, affordable footwear typically associated with basic trainers, flip-flops, and children's shoes. Consumers prefer purchasing footwear in "one-stop shops" because they can buy their daily essentials and footwear in the same trip. Additionally, for a large portion of the global population, traditional retail stores remain a necessary touchpoint, allowing customers to feel for fit, comfort, and perform immediate quality checks before purchase.

Footwear Market Share, By Distribution Channel, 2025 (%)

| Distribution Channel | Revenue Share, 2025 (%) |

| Supermarket/Hypermarket | 38% |

| Online/E-Commerce | 28% |

| Specialty Store | 20% |

| Others | 14% |

Online and e-commerce are the fastest-growing distribution channels, primarily because they remove geographic barriers and enable brands and retailers to reach consumers directly across regions. Advanced technology such as AR for virtual try-on and improved sizing algorithms have reduced the traditional barriers that required in-store fitting. Furthermore, many large global brands are increasingly shifting toward a direct-to-consumer (DTC) model to eliminate wholesale distribution channels, improve profit margins, and gain direct access to consumer data.

By Type

By End User

By Distribution Channel

By Region

Chapter 1. Market Introduction and Overview

1.1 Market Definition and Scope

1.1.1 Overview of Footwear

1.1.2 Scope of the Study

1.1.3 Research Timeframe

1.2 Research Methodology and Approach

1.2.1 Methodology Overview

1.2.2 Data Sources and Validation

1.2.3 Key Assumptions and Limitations

Chapter 2. Executive Summary

2.1 Market Highlights and Snapshot

2.2 Key Insights by Segments

2.2.1 By Type Overview

2.2.2 By End User Overview

2.2.3 By Distribution Channel Overview

2.3 Competitive Overview

Chapter 3. Global Impact Analysis

3.1 Russia-Ukraine Conflict: Global Market Implications

3.2 Regulatory and Policy Changes Impacting Global Markets

Chapter 4. Market Dynamics and Trends

4.1 Market Dynamics

4.1.1 Market Drivers

4.1.1.1 Increase in Health Awareness and Participation in Athletics

4.1.1.2 Increased Demand for Sustainable and Eco-friendly Materials

4.1.2 Market Restraints

4.1.2.1 Cost and Supply chain volatility for Raw Materials

4.1.2.2 Stringent Environmental Regulations and Manufacturing Compliance

4.1.3 Market Opportunities

4.1.3.1 Utilization of Smart Technology & Wearable Performance Tracking

4.1.3.2 Strategic Collaborations with Luxury Fashion and Entertainment Brands

4.1.4 Market Challenges

4.1.4.1 Market Shortening of Consumer Fashion Cycles and Trends

4.1.4.2 Ethical Labor Practices and Human Rights Compliance in Sourcing

4.2 Market Trends

Chapter 5. Premium Insights and Analysis

5.1 Global Footwear Market Dynamics, Impact Analysis

5.2 Porter’s Five Forces Analysis

5.2.1 Bargaining Power of Suppliers

5.2.2 Bargaining Power of Buyers

5.2.3 Threat of Substitute Products

5.2.4 Rivalry among Existing Firms

5.2.5 Threat of New Entrants

5.3 PESTEL Analysis

5.4 Value Chain Analysis

5.5 Product Pricing Analysis

5.6 Vendor Landscape

5.6.1 List of Buyers

5.6.2 List of Suppliers

Chapter 6. Footwear Market, By Type

6.1 Global Footwear Market Snapshot, By Type

6.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2035

6.1.1.1 Casual

6.1.1.2 Athletic/Sports

6.1.1.3 Formal

6.1.1.4 Others

Chapter 7. Footwear Market, By End User

7.1 Global Footwear Market Snapshot, By End User

7.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2035

7.1.1.1 Men

7.1.1.2 Women

7.1.1.3 Kids

Chapter 8. Footwear Market, By Distribution Channel

8.1 Global Footwear Market Snapshot, By Distribution Channel

8.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2035

8.1.1.1 Supermarket/Hypermarket

8.1.1.2 Online/E-Commerce

8.1.1.3 Specialty Store

8.1.1.4 Others

Chapter 9. Footwear Market, By Region

9.1 Overview

9.2 Footwear Market Revenue Share, By Region 2024 (%)

9.3 Global Footwear Market, By Region

9.3.1 Market Size and Forecast

9.4 North America

9.4.1 North America Footwear Market Revenue, 2022-2035 ($Billion)

9.4.2 Market Size and Forecast

9.4.3 North America Footwear Market, By Country

9.4.4 U.S.

9.4.4.1 U.S. Footwear Market Revenue, 2022-2035 ($Billion)

9.4.4.2 Market Size and Forecast

9.4.4.3 U.S. Market Segmental Analysis

9.4.5 Canada

9.4.5.1 Canada Footwear Market Revenue, 2022-2035 ($Billion)

9.4.5.2 Market Size and Forecast

9.4.5.3 Canada Market Segmental Analysis

9.4.6 Mexico

9.4.6.1 Mexico Footwear Market Revenue, 2022-2035 ($Billion)

9.4.6.2 Market Size and Forecast

9.4.6.3 Mexico Market Segmental Analysis

9.5 Europe

9.5.1 Europe Footwear Market Revenue, 2022-2035 ($Billion)

9.5.2 Market Size and Forecast

9.5.3 Europe Footwear Market, By Country

9.5.4 UK

9.5.4.1 UK Footwear Market Revenue, 2022-2035 ($Billion)

9.5.4.2 Market Size and Forecast

9.5.4.3 UKMarket Segmental Analysis

9.5.5 France

9.5.5.1 France Footwear Market Revenue, 2022-2035 ($Billion)

9.5.5.2 Market Size and Forecast

9.5.5.3 FranceMarket Segmental Analysis

9.5.6 Germany

9.5.6.1 Germany Footwear Market Revenue, 2022-2035 ($Billion)

9.5.6.2 Market Size and Forecast

9.5.6.3 GermanyMarket Segmental Analysis

9.5.7 Rest of Europe

9.5.7.1 Rest of Europe Footwear Market Revenue, 2022-2035 ($Billion)

9.5.7.2 Market Size and Forecast

9.5.7.3 Rest of EuropeMarket Segmental Analysis

9.6 Asia Pacific

9.6.1 Asia Pacific Footwear Market Revenue, 2022-2035 ($Billion)

9.6.2 Market Size and Forecast

9.6.3 Asia Pacific Footwear Market, By Country

9.6.4 China

9.6.4.1 China Footwear Market Revenue, 2022-2035 ($Billion)

9.6.4.2 Market Size and Forecast

9.6.4.3 ChinaMarket Segmental Analysis

9.6.5 Japan

9.6.5.1 Japan Footwear Market Revenue, 2022-2035 ($Billion)

9.6.5.2 Market Size and Forecast

9.6.5.3 JapanMarket Segmental Analysis

9.6.6 India

9.6.6.1 India Footwear Market Revenue, 2022-2035 ($Billion)

9.6.6.2 Market Size and Forecast

9.6.6.3 IndiaMarket Segmental Analysis

9.6.7 Australia

9.6.7.1 Australia Footwear Market Revenue, 2022-2035 ($Billion)

9.6.7.2 Market Size and Forecast

9.6.7.3 AustraliaMarket Segmental Analysis

9.6.8 Rest of Asia Pacific

9.6.8.1 Rest of Asia Pacific Footwear Market Revenue, 2022-2035 ($Billion)

9.6.8.2 Market Size and Forecast

9.6.8.3 Rest of Asia PacificMarket Segmental Analysis

9.7 LAMEA

9.7.1 LAMEA Footwear Market Revenue, 2022-2035 ($Billion)

9.7.2 Market Size and Forecast

9.7.3 LAMEA Footwear Market, By Country

9.7.4 GCC

9.7.4.1 GCC Footwear Market Revenue, 2022-2035 ($Billion)

9.7.4.2 Market Size and Forecast

9.7.4.3 GCCMarket Segmental Analysis

9.7.5 Africa

9.7.5.1 Africa Footwear Market Revenue, 2022-2035 ($Billion)

9.7.5.2 Market Size and Forecast

9.7.5.3 AfricaMarket Segmental Analysis

9.7.6 Brazil

9.7.6.1 Brazil Footwear Market Revenue, 2022-2035 ($Billion)

9.7.6.2 Market Size and Forecast

9.7.6.3 BrazilMarket Segmental Analysis

9.7.7 Rest of LAMEA

9.7.7.1 Rest of LAMEA Footwear Market Revenue, 2022-2035 ($Billion)

9.7.7.2 Market Size and Forecast

9.7.7.3 Rest of LAMEAMarket Segmental Analysis

Chapter 10. Competitive Landscape

10.1 Competitor Strategic Analysis

10.1.1 Top Player Positioning/Market Share Analysis

10.1.2 Top Winning Strategies, By Company, 2022-2024

10.1.3 Competitive Analysis By Revenue, 2022-2024

10.2 Recent Developments by the Market Contributors (2024)

Chapter 11. Company Profiles

11.1 Nike, Inc.

11.1.1 Company Snapshot

11.1.2 Company and Business Overview

11.1.3 Financial KPIs

11.1.4 Product/Service Portfolio

11.1.5 Strategic Growth

11.1.6 Global Footprints

11.1.7 Recent Development

11.1.8 SWOT Analysis

11.2 Adidas AG

11.3 Skechers USA, Inc.

11.4 Puma SE

11.5 New Balance Athletics, Inc.

11.6 ASICS Corporation

11.7 VF Corporation

11.8 Crocs, Inc.

11.9 ANTA Sports Products Ltd.

11.10 Li-Ning Company Limited

11.11 Deichmann SE

11.12 Bata Corporation

11.13 The ALDO Group

11.14 Fila Holdings Corp