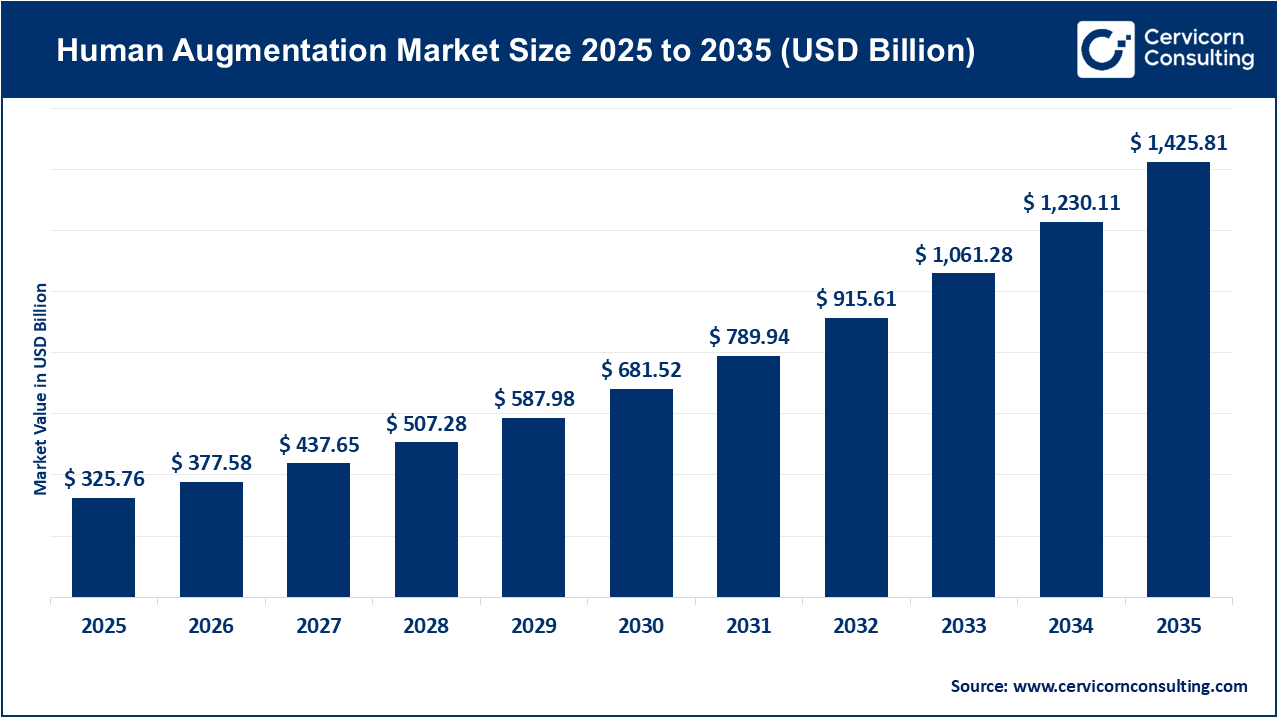

The human augmentation market size was valued at USD 325.76 billion in 2025 and is expected to be worth around USD 1,425.81 billion by 2035, exhibiting at a compound annual growth rate (CAGR) of 16.1% over the forecast period from 2026 to 2035. The market’s growth is driven by the rising demand for healthcare applications such as advanced prosthetics, bionic eyes and gait training.

The human augmentation market encompasses technologies designed to enhance, restore, or extend human physical, sensory, and cognitive capabilities through integrated hardware, software, and biological systems. These solutions include wearable devices, exoskeletons, augmented and virtual reality systems, biometric platforms, intelligent virtual assistants, and neural interface technologies that enable closer interaction between humans and machines.

As digital and biological systems become more interconnected, human augmentation is positioned as a foundational pillar of next-generation human–machine collaboration. The market is expected to witness continued innovation across neural interfaces, smart wearables, and intelligent robotics, gradually shifting augmentation from specialized use cases toward everyday human enhancement.

Rising Adoption of Augmentation in Healthcare & Rehabilitation

The growing burden of neurological disorders, mobility impairments, and age-related physical decline is driving strong adoption of human augmentation technologies in healthcare. Wearable exoskeletons, robotic rehabilitation devices, and brain–computer interface systems are increasingly used to help patients regain movement and independence. For instance, neural implant systems enabling paralyzed individuals to control digital devices using brain signals demonstrate how augmentation is moving into real clinical environments.

Similarly, hospitals and rehabilitation centers are deploying robotic exosuits that assist with gait training and post-stroke recovery, improving therapy efficiency and outcomes. This expanding medical utilization continues to push investment and innovation across the human augmentation ecosystem.

High Cost and Complex Integration

Despite rapid technological progress, high development costs and system complexity remain key restraints. Advanced sensors, AI processors, custom robotics, and implantable components significantly increase product pricing, limiting affordability for smaller healthcare facilities and individual consumers. In addition, integrating augmentation systems with existing hospital IT infrastructure, electronic health records, and industrial software platforms can be technically challenging. These barriers slow large-scale deployment, particularly in cost-sensitive regions and small enterprises.

Expansion of Augmented Workforces in Industry and Enterprise

Industrial digitization and labor shortages are creating strong opportunities for workforce augmentation. Manufacturing plants, warehouses, and logistics hubs are adopting exoskeletons and AR smart glasses to enhance worker strength, accuracy, and situational awareness. For example, AI-powered exosuits that provide real-time lifting assistance are reducing musculoskeletal injuries among warehouse workers.

Meanwhile, AR headsets are enabling technicians to view digital instructions overlaid on physical equipment, improving maintenance speed and reducing errors. As enterprises focus on productivity and worker safety, augmented workforce solutions are expected to become a core operational tool.

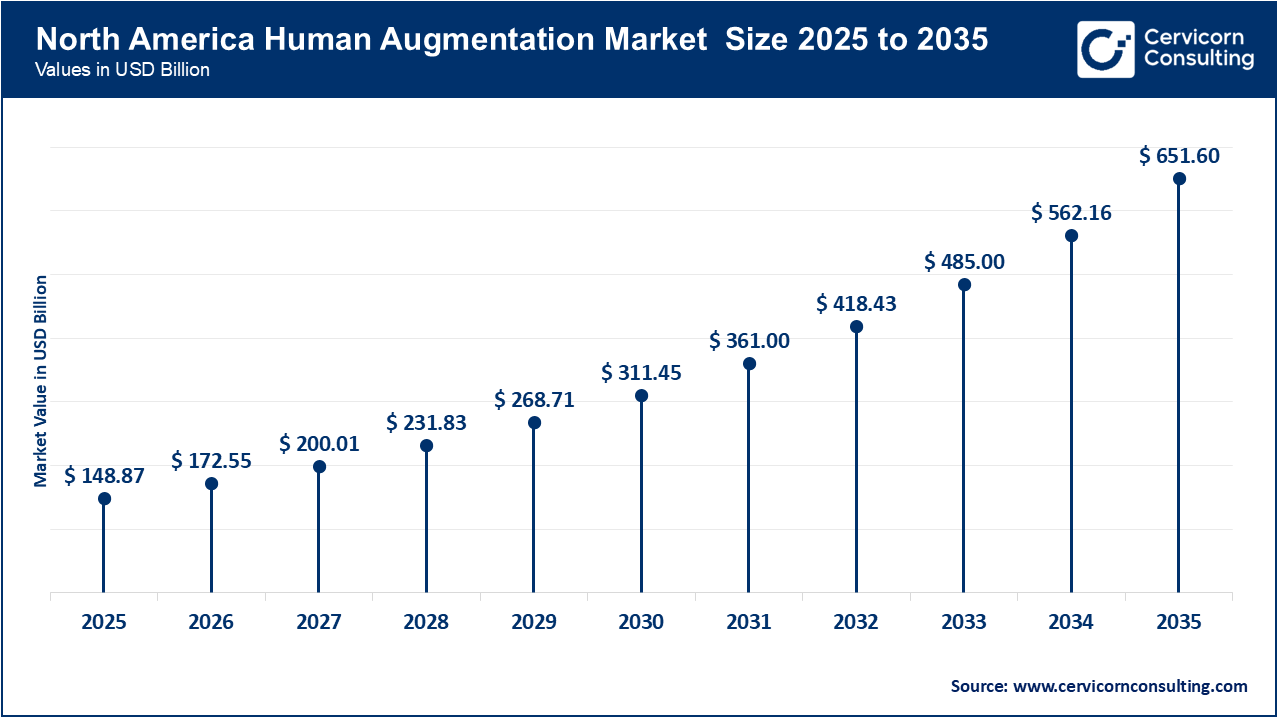

North America dominated the human augmentation landscape because the region sits at the intersection of advanced digital infrastructure, world-leading AI and robotics innovation, strong defense and healthcare spending, and early technology adoption culture. The ecosystem enables rapid transition from research to commercialization, allowing augmentation technologies to scale faster than in any other region. Rather than relying on a single growth pillar, North America benefits from multi-sector demand, healthcare, defense, industrial automation, consumer electronics, and enterprise productivity, creating sustained and diversified revenue streams for augmentation technologies.

Top Companies in North America for Human Augmentation Breakthroughs:

| Company | Augmentation Focus | Recent Breakthrough |

| Apple Inc. | AR/VR & Wearables | Apple launched Vision Pro, a mixed-reality headset blending AR/VR with spatial computing for professional and immersive experiences. |

| Microsoft Corporation | AR/VR & AI Integration | HoloLens mixed reality headset used in enterprise, healthcare, and industrial training. |

| Google LLC | Wearable/AR & AI | Google is expanding AI-centric wearable tech and AR capabilities and adding cognitive enhancements via software and cloud AI services. |

| Meta Platforms | VR Immersion | Meta Quest line of VR headsets and Ray-Ban Stories AR glasses under Reality Labs. |

| ReWalk Robotics | Wearable Exoskeletons | FDA-cleared exoskeletons enabling standing and walking for people with mobility impairments. |

| Neuralink Corp | Brain-Computer Interfaces | Implantable BCIs enabling direct neural control of devices; first human implants reported. |

Unites States Contribution & Potential in Human Augmentation Market

The United States stands at the center of global human augmentation innovation, driven by a combination of breakthrough technologies, deep engineering expertise, world-class research institutions, corporate leadership, and supportive government and clinical environments. U.S. contributions span neural interfaces, wearable robotics, augmented reality systems, and advanced biomedical devices, each with significant real-world milestones. U.S. companies like Neuralink have successfully performed multiple human device implantations. These implants connect directly with the brain to enable people with paralysis to control computers or assistive devices using neural activity.

The U.S. Department of Defense has sponsored augmentation projects that explore enhanced situational awareness, adaptive support suits, and sensory fusion systems for soldier safety and performance. Universities such as MIT, Stanford, Johns Hopkins, and Carnegie Mellon host flagship labs built around cognitive computing, robotics, neural engineering, and multisensory systems.

Asia Pacific is becoming one of the most active regions for real-world deployment of human augmentation technologies, particularly in robotics-assisted mobility, wearable health devices, smart prosthetics, and industrial exoskeletons. The region’s momentum is being shaped by aging populations, large-scale manufacturing ecosystems, and strong government-backed technology programs.

Rather than being driven by speculative growth narratives, Asia Pacific’s performance is visible through hospital adoption, factory deployment, and national robotics strategies across major economies.

Country-Level Potential in Asia Pacific Human Augmentation Market

“What Made Wearable Devices the Largest Product Segment in Human Augmentation Market?”

Wearable devices dominated the human augmentation landscape in 2025 due to their mass adoption, affordability, and expanding healthcare and productivity applications. Smartwatches, fitness trackers, smart rings, and smart glasses continuously collect physiological, motion, and environmental data, enabling real-time health insights and performance optimization. AI-enabled wearables now offer predictive alerts for cardiac irregularities, sleep disorders, and fatigue, transforming wearables from passive trackers into active health companions.

Human Augmentation Market Revenue Share, By Product, 2025 (%)

| Product | Revenue Share, 2025 (%) |

| Wearable Devices | 33% |

| Augmented Reality Devices | 22% |

| Virtual Reality Devices | 18% |

| Exoskeletons | 14% |

| Biometric Systems | 8% |

| Intelligent Virtual Assistants | 5% |

Augmented reality (AR) devices segment is witnessing the fastest growth as enterprises increasingly deploy AR smart glasses for training, remote assistance, and workflow visualization. AR overlays digital instructions, diagrams, and real-time data directly into a user’s field of view, significantly improving accuracy and reducing task completion time. In healthcare, surgeons use AR for pre-operative planning and image-guided procedures, while manufacturers use AR for equipment maintenance and assembly.

“The Body-worn Segment Led the Human Augmentation Market in 2025 with the Largest Share”

Body-worn augmentation dominated the human augmentation market in 2025 because of the widespread use of wearable health monitors, smart clothing, exoskeletons, and AR/VR headsets. These devices provide continuous, real-time interaction between humans and technology, offering direct physical or sensory enhancement. Healthcare monitoring, fitness optimization, and workplace safety applications drive strong adoption. The familiarity of wearable form factors and their non-invasive nature further support dominance across consumer and enterprise markets.

Human Augmentation Market Revenue Share, By Functionality, 2025 (%)

| Functionality | Revenue Share, 2025 (%) |

| Body-worn | 59% |

| Non Body-worn | 41% |

Non body-worn augmentation is the fastest-growing segment, driven by advances in implantable devices and brain-computer interfaces (BCIs). These technologies enable direct communication between the brain and external systems, allowing users to control computers, prosthetics, or wheelchairs using neural signals.

“AI Integration Segment Held the Largest Segment for Year 2025 in Human Augmentation Market”

AI integration dominated the human augmentation market because nearly all modern augmentation systems rely on machine learning for perception, prediction, and personalization. AI analyzes biometric signals, movement patterns, and contextual data to adapt device behavior in real time. For example, AI-powered exoskeletons adjust support based on user posture, while smart wearables predict health risks before symptoms appear. AI has become the core intelligence layer enabling augmentation technologies to function autonomously and intelligently.

Human Augmentation Market Share, By Technology, 2025 (%)

| Technology | Revenue Share, 2025 (%) |

| AI Integration | 55% |

| Quantum Computing Augmentation | 15% |

| Biohacking & Bio-augmentation | 30% |

Quantum computing augmentation is an emerging area focused on using quantum processors to solve complex optimization and simulation problems that classical computers struggle with. In the future, quantum-enhanced computing could accelerate drug discovery, genetic analysis, and neural network training, indirectly strengthening human augmentation systems.

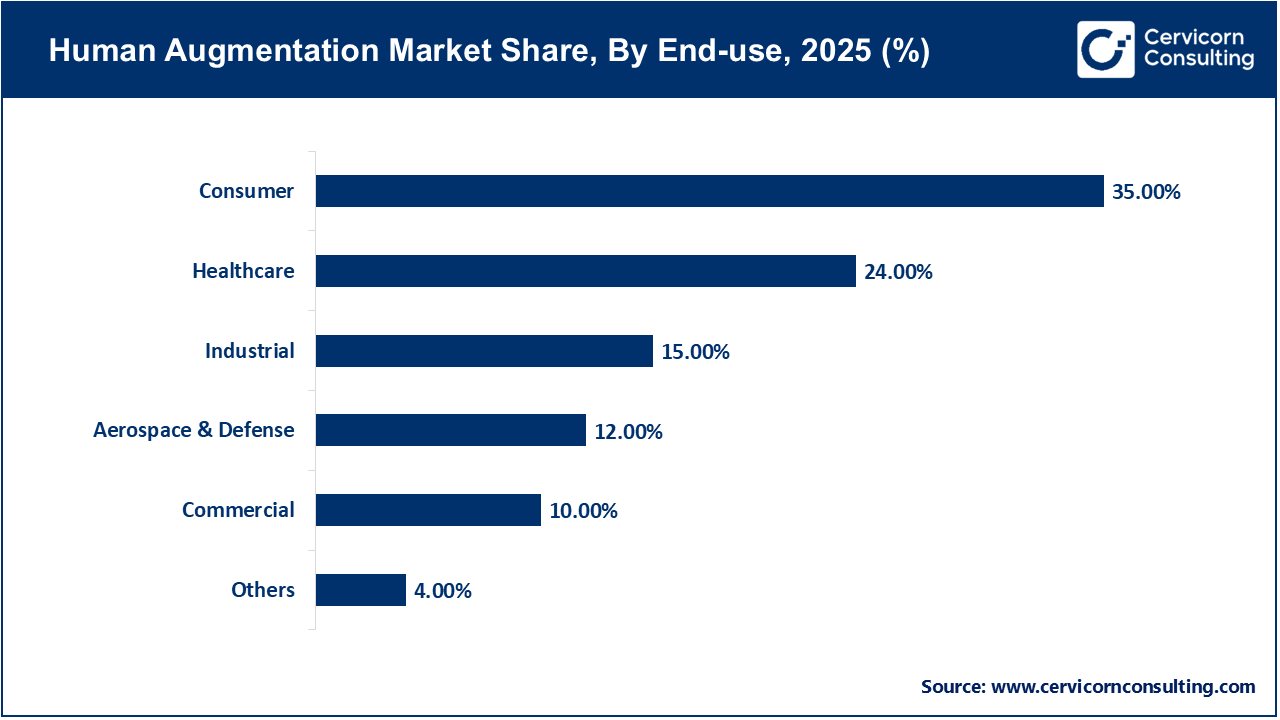

“The Healthcare Segment Dominated the Human Augmentation Market, Predicted to Stay Ahead”

Healthcare dominated in 2025 due to extensive use of augmentation in rehabilitation, diagnostics, remote monitoring, and surgery. AI-enabled prosthetics, robotic exoskeletons, smart implants, and wearable health sensors are transforming patient care. Hospitals increasingly rely on augmentation to reduce clinician workload, improve surgical precision, and support aging populations, making healthcare the largest revenue-generating end-use sector.

The commercial segment is expanding rapidly as organizations deploy human augmentation to improve workforce productivity, safety, and customer experience. Retailers use AR for virtual try-ons, manufacturers use smart glasses for remote assistance, and logistics firms deploy wearables for worker tracking and navigation.

| Company | Significance in Human Augmentation Market |

| Neuralink | A leading neurotechnology firm developing implantable brain-computer interfaces (BCIs) that allow neural signals to control computers and devices, pushing the frontier of cognitive augmentation. |

| Paradromics | Advanced high-data-rate brain-computer interface developer aiming to restore communication and movement for fully motor-impaired individuals using fully implantable neural systems. |

| Ekso Bionics | Pioneer in powered exoskeletons for medical rehabilitation and industrial augmentation, enabling people with mobility impairments to stand and walk and assisting workers with heavy tasks. |

| Samsung Electronics | Major technology provider integrating smart wearable devices and biometric sensors, enhancing human performance through real-time physiological feedback and AR/VR interfaces. |

| Google Aphabet | Drives AI-enhanced augmentation through AI, machine learning, and AR/VR innovations; involved in XR ecosystem development and next-gen human-technology interfaces. |

| Vuzix Corporation | Specializes in AR smart glasses and wearable display tech for enterprise, industrial, and healthcare augmentation, providing visual overlay information and hands-free interfaces. |

| Open Bionics | Innovator in 3D-printed bionic prosthetic arms, offering affordable and functional prosthetics with myoelectric control that empower amputees. |

By Product

By Functionality

By Technology

By End-use

By Region