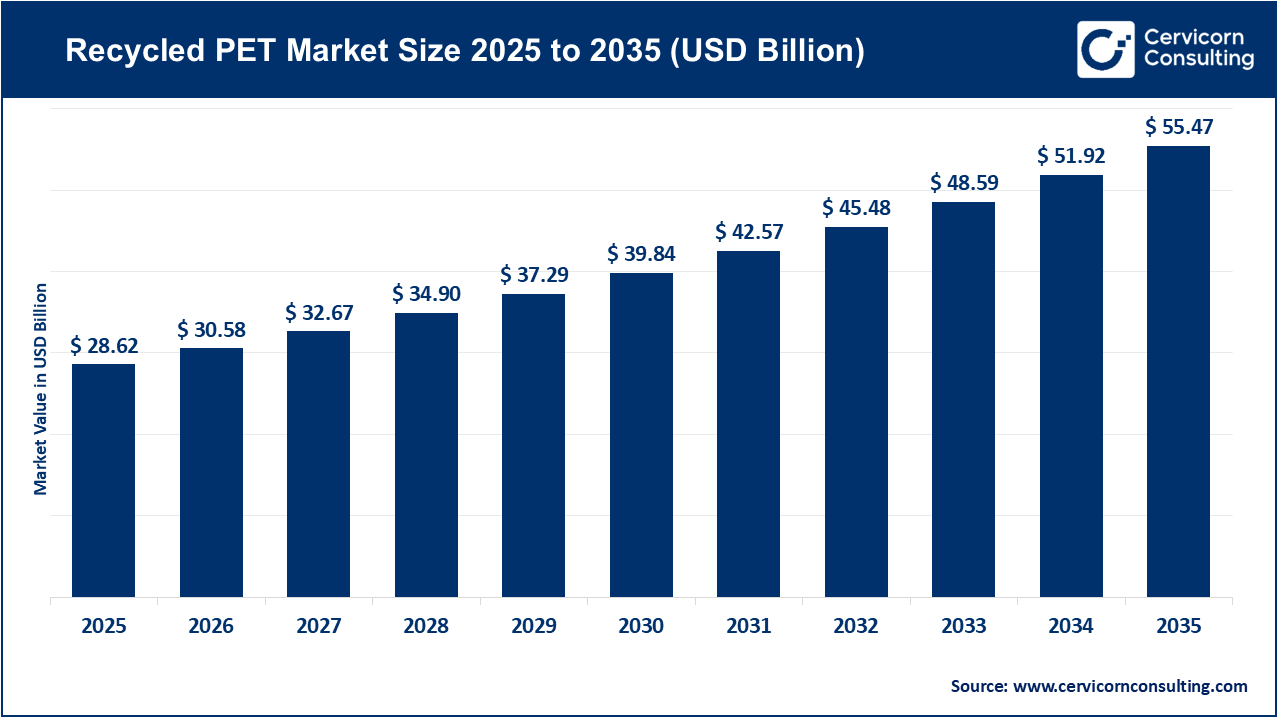

The global recycled PET (rPET) market size was valued at USD 28.62 billion in 2025 and is expected to be worth around USD 55.47 billion by 2035, exhibiting at a compound annual growth rate (CAGR) of 6.8% over the forecast period 2026 to 2035. The growth of rPET is mainly driven by demand-side sustainability rules, corporate recycled-content targets, and stronger collection systems. Governments and major brands are now setting mandatory recycled-content or deposit-return targets. As a result, beverage, food, and packaging manufacturers are required to source more rPET. Supply-chain commitments and consumer pressure are also increasing off-take agreements, which raises predictable demand for food-grade rPET. In response to this demand, large recyclers and converters are expanding their capacity. For example, Indorama has announced a significant increase in rPET output, with a multi-hundred-thousand-tonne capacity expansion and major capital investment. Specialist PCR producers such as ALPLA are also reporting several hundred thousand tons of installed or projected PCR output, including about 266,000 tons per year of rPET, to meet the needs of brands.

On the supply side, higher collection rates, technological improvements in washing, optical sorting, and advanced recycling processes, as well as new facility construction, are converting more bottle-bale feedstock into food-grade pellets. However, there are still regional gaps. In Europe, PET collection and sorting have accelerated, with collection rates reaching about 60% in 2022. Tray recycling capacity is also increasing rapidly, from about 57,000 tons per year in 2022 with plans to exceed 300,000 tons per year by 2025. In contrast, North American recycling rates are lower, with U.S. PET recycling at about 29% according to recent reports. This means that feedstock tightness and price fluctuations will continue to affect short-term market conditions. Overall, these regulatory, corporate procurement, and infrastructure trends are expected to support mid-single to high-single digit compound annual growth rates for rPET demand. However, competition with low-cost virgin PET and regional feedstock bottlenecks may limit growth.

Growing Consumer Preference for Eco-Friendly Packaging Driving the rPET Market

The demand for eco-friendly packaging, such as recycled PET (rPET), is increasing as consumers align their purchasing decisions with environmental values. Recent surveys show that about 72% of global shoppers prefer products with clear environmental credentials. Younger consumers, especially those in Generation Z, demonstrate even stronger preferences for sustainable options. Over 80% of consumers are willing to pay more for products in sustainable packaging, and many actively choose items based on recyclability and environmental impact. These changing attitudes are leading major brands to redesign their packaging strategies to maintain market share and attract environmentally conscious buyers. As a result, the rPET market is experiencing significant growth.

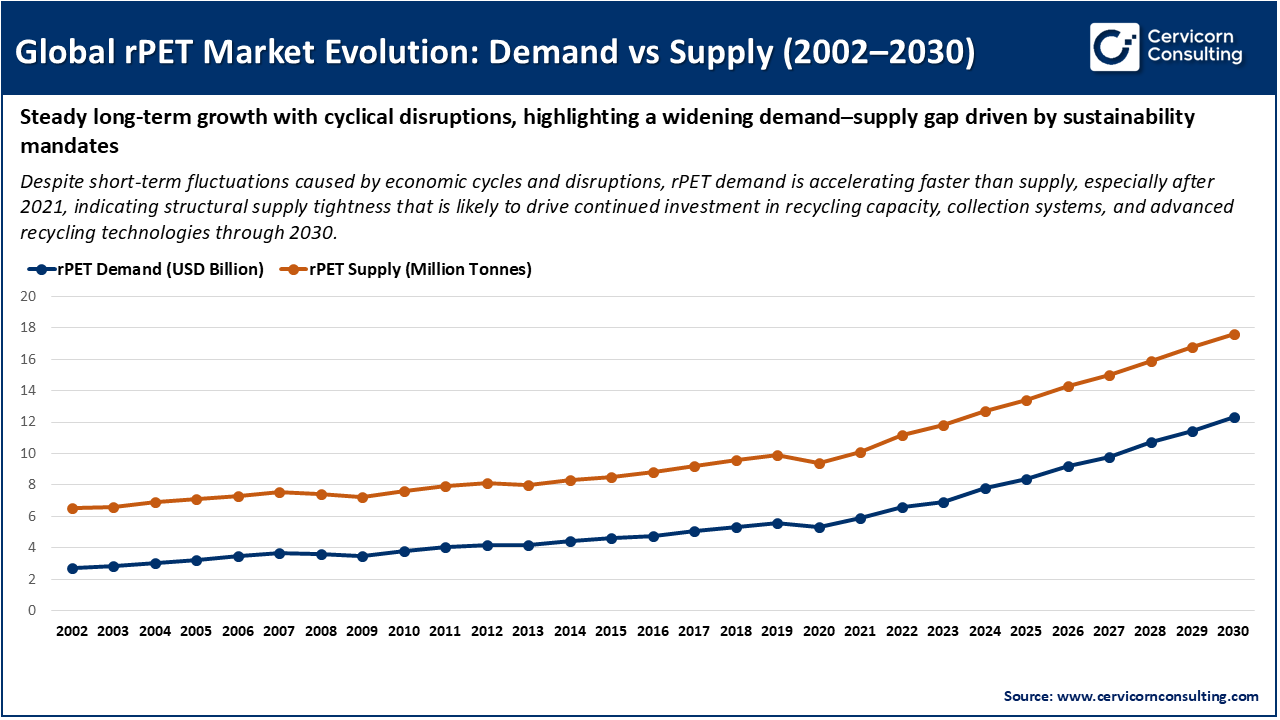

The global rPET market has shown steady growth in both demand and supply from 2002 to 2030, with some cyclical fluctuations driven by economic downturns such as the 2008–09 financial crisis and the 2020 pandemic. Supply has increased as a result of greater recycling capacity and better collection systems. However, since 2021, demand has grown at a faster rate, mainly due to regulatory requirements for recycled content and stronger sustainability commitments from brands. This has led to a widening gap between demand and supply, indicating that high-quality rPET will remain in short supply. As a result, there is a clear need for ongoing investment in recycling infrastructure to meet future market requirements.

Report Scope

| Area of Focus | Details |

| Market Size in 2026 | USD 30.58 Billion |

| Market Size in 2035 | USD 55.47 Billion |

| CAGR from 2026 to 2035 | 6.80% |

| Dominant Region | Asia-Pacific |

| Key Segments | Product Type, Type, Grade, Source, End Use, Region |

| Key Companies | Ergis Recycling, BariQ, Phoenix Technologies, Clear Path Recycling LLC, Libolon, Placon, M&G Chemicals, Evergreen Plastics, Inc., Zhejiang AnshunPettechsFibre Co. Ltd., Sorema, PolyQuest, Verdeco Recycling, Inc. |

1. EU Recycled Content Mandates for PET Bottles (2025–2030)

The Single-Use Plastics Directive introduced by the European Union requires that all PET beverage bottles include at least 25% recycled PET (rPET) by 2025, increasing to 30% by 2030. This regulation is driving a steady demand for food-grade rPET throughout Europe and among global exporters aiming to access this market. As a result, there is a clear incentive for investment in collection, processing, and recycling infrastructure to comply with these standards. These government requirements are advancing circularity in packaging and expanding the use of rPET beyond voluntary commitments, directly influencing the procurement strategies of major brands and recyclers.

2. Coca-Cola and PepsiCo Large rPET Off-Take Contracts

The global rPET market is experiencing significant growth as major beverage companies, including Coca-Cola and PepsiCo, have secured contracts for over 1.2 million tons of rPET supply through 2026. This development is encouraging recyclers such as Indorama, Alpek, and Plastipak to expand their production capacities worldwide. These long-term off-take agreements provide a reliable market for recycled PET, which supports new investments in recycling facilities and strengthens the overall economics of recycling. By committing to large volumes, these companies are helping to stabilize rPET prices and reduce risks for recyclers. This is particularly important as demand for rPET increases and competition for high-quality feedstock becomes more intense.

3. Srichakra Polyplast Triples rPET Capacity in India (2024)

Indian recycler Srichakra Polyplast commissioned two new Starlinger recycling lines in Hyderabad, increasing its annual rPET output to approximately 42,000 tons per year — a three-fold increase in capacity. This expansion reflects broader industry activity in Asia to meet rising demand from local packaging makers and export markets. By boosting domestic rPET production, such investments reduce reliance on imported recyclates, support regional collection systems, and help meeting tighter recycled content requirements pushed by both consumers and regulators across key markets.

4. Joint rPET Recycling Facilities by Indorama & PepsiCo in India

Indorama Ventures, in a joint venture with a PepsiCo bottler, is building two new PET recycling facilities in India with a combined annual capacity of about 100,000 tons of rPET. This project is a significant milestone in scaling food-grade rPET supply in one of the world’s fastest-growing packaging markets. Large-scale local capacity not only supports brand sustainability goals but also helps strengthen circular supply chains in India and Asia Pacific more broadly, where collection and recycling infrastructure are rapidly developing to meet both domestic consumption and export demand.

The Recycled PET market is segmented by region into North America, Europe, Asia-Pacific, and LAMEA. Here is a brief overview of each region:

The North America recycled PET (rPET) market size was estimated at USD 7.24 billion in 2025 and is expected to be worth around USD 14.03 billion by 2035. In North America, the rPET market growth is propelled by strong corporate sustainability commitments from major beverage and consumer goods companies, rising consumer demand for eco-friendly packaging, and evolving state/provincial regulations that target recycled content in plastics. These forces are driving investments in local recycling infrastructure and expanding rPET adoption across packaging and textile applications. While the overall regional growth rate has historically been more moderate than some other areas, North America continues to strengthen its role in circular packaging through increased rPET use, extended producer responsibility (EPR) plans and landfill reduction policies that support higher recycled content standards in major states and provinces.

Recent Developments:

The Europe recycled PET (rPET) market size was reached at USD 5.67 billion in 2025 and is predicted to surpass around USD 10.98 billion by 2035. Europe’s rPET market is strongly driven by robust regulatory mandates such as the EU Single-Use Plastics Directive requiring minimum recycled content in PET bottles and aggressive circular economy goals set by the European Commission. Governments across the EU have embraced deposit-return schemes, stringent recycling targets and extended producer responsibility (EPR) frameworks that ensure a reliable flow of collected PET for recycling. As a result, Europe remains a leader in rPET penetration - particularly in bottle-to-bottle and food-grade applications - and maintains advanced sorting and recycling infrastructure that sustain high collection and conversion rates.

Recent developments:

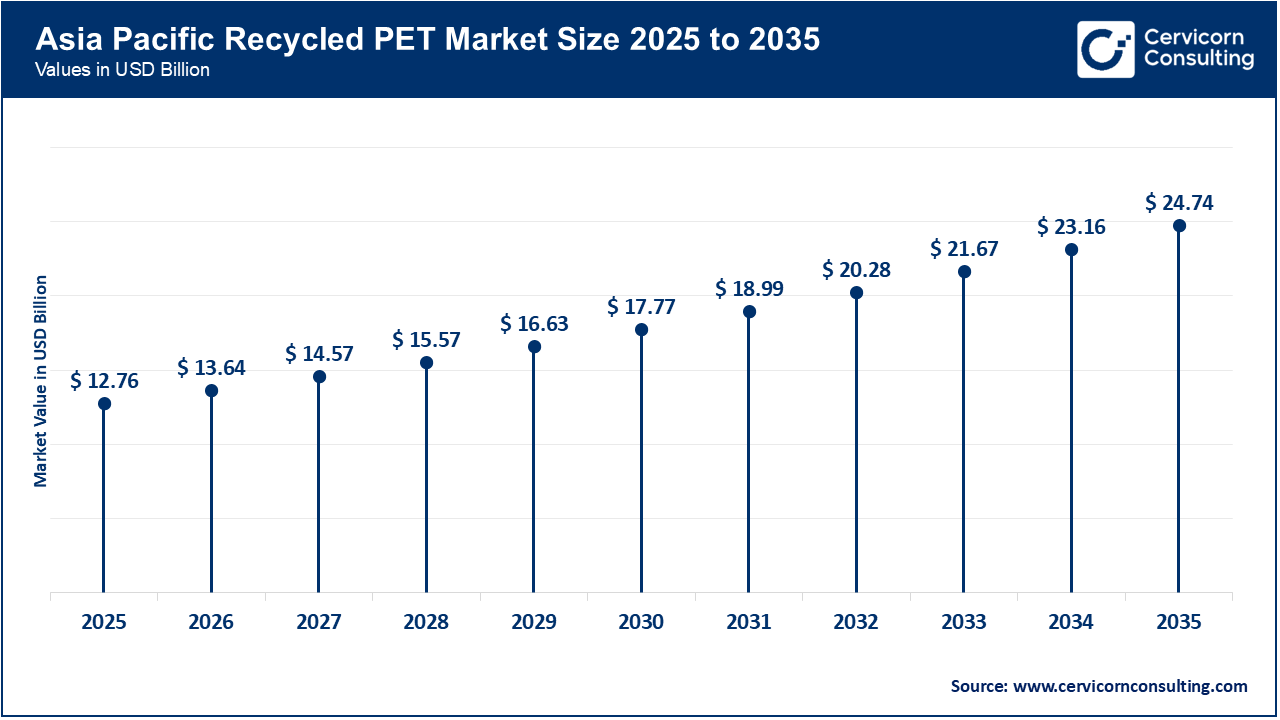

The Asia-Pacific recycled PET (rPET) market size was estimated at USD 12.76 billion in 2025 and is forecasted to hit around USD 24.74 billion by 2035. The Asia-Pacific rPET market is experiencing significant growth due to the rapid expansion of the packaging industry, ongoing urbanization, and stronger sustainability commitments from both governments and leading brands. At present, Asia-Pacific holds the largest share of global rPET demand, which is mainly attributed to increasing beverage consumption, the growth of textile manufacturing (particularly recycled polyester fiber), and greater investments in recycling infrastructure. The economic development of countries such as China and India is leading to higher capital expenditures in PET collection, mechanical recycling processes, and advanced technologies. As a result, the region is making progress toward meeting global sustainability targets.

Recent developments:

Recycled PET Market Share, By Region, 2025 (%)

| Region | Revenue Share, 2025 (%) |

| Asia Pacific | 44.60% |

| North America | 25.30% |

| Europe | 19.80% |

| LAMEA (Latin America, Middle East & Africa) | 10.30% |

The LAMEA recycled PET (rPET) market was valued at USD 2.95 billion in 2025 and is anticipated to reach around USD 5.71 billion by 2035. The development of the rPET market in the Latin America, Middle East, and Africa (LAMEA) region is significantly influenced by new governmental policies focused on reducing plastic pollution and encouraging recycling. As brands show greater interest in sustainable packaging and collection systems expand, the market is seeing notable changes. While many LAMEA countries still have lower infrastructure and collection rates compared to more developed regions, advancements in waste management, collaborations with global recyclers, and increasing environmental awareness are creating new opportunities for rPET, particularly in rapidly urbanizing economies.

Recent developments:

The Recycled PET market is segmented into product, raw material, application, and region.

Clear rPET continues to be the leading product type in the market. Its optical clarity and reliable performance make it the preferred material for food-grade, beverage, and premium packaging, where product visibility and fast qualification are important. Recent industry data indicates that clear rPET accounted for about 78% of the value and share in the rPET flakes and packaging market in 2025. Transparent rPET is especially dominant in beverage applications such as water, carbonated soft drinks, and juice. These categories together form a large and stable demand base for bottle-to-bottle recycling. Major bottling companies consistently choose transparent rPET for large-scale programs, which helps maintain high volumes and encourages further investment in clear rPET production.

Recycled PET Market Share, By Product Type, 2025 (%)

| Product Type | Revenue Share, 2025 (%) |

| Clear rPET | 78.2% |

| Colored rPET | 21.8% |

In contrast, colored rPET is expected to grow at a faster rate than clear rPET. This is because colored rPET can be made from a broader range of mixed or lower-grade feedstocks, is less expensive to process for non-food uses, and meets the increasing demand for colored and functional packaging, industrial trays, automotive parts, and some textile applications. Market studies predict that the colored rPET segment will achieve a higher compound annual growth rate in the coming years. For example, research estimates coloured rPET growth at around 8-8.5% CAGR. This growth is driven by converters and end-users who are replacing higher-cost materials with recycled content in applications that do not require optical clarity. The expansion of colored rPET is also being supported by new production lines and investments in sorting and decontamination technologies, which make it possible to upgrade previously unusable material streams into usable colored pellets.

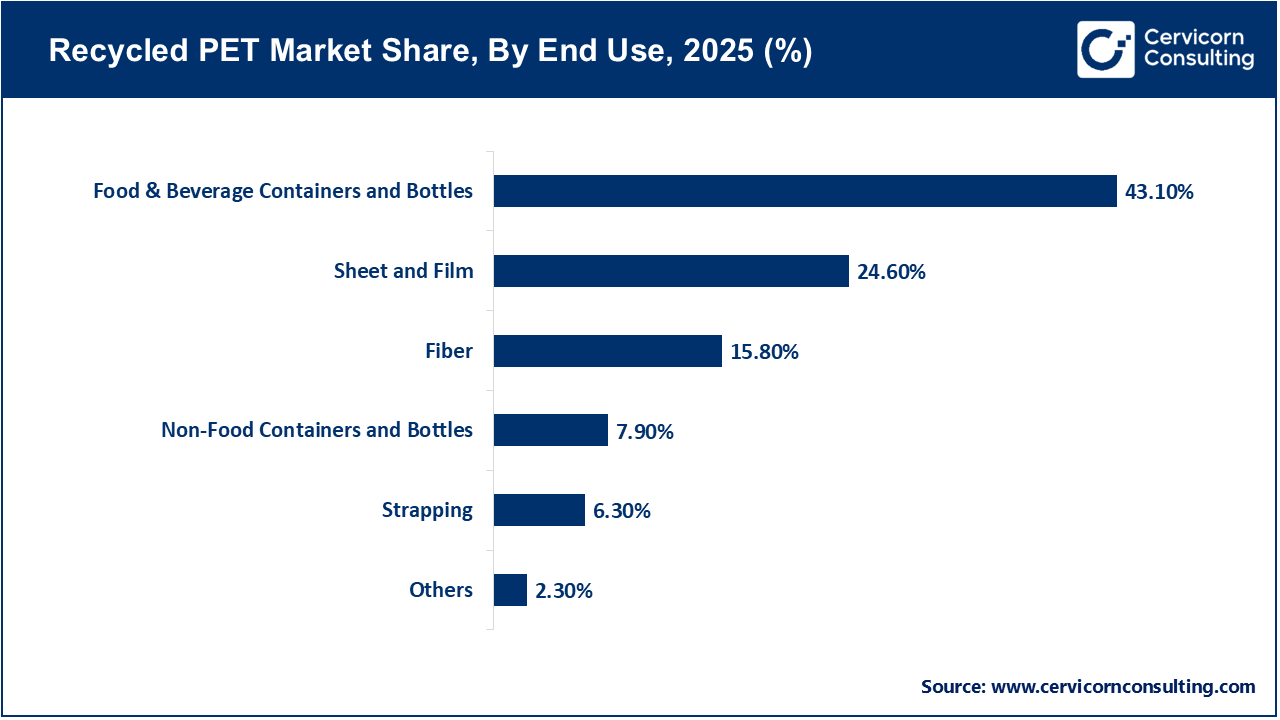

Food and beverage bottles and containers represent the largest end-use for rPET. This is mainly due to regulatory requirements for recycled content, brand targets, and the high global volume of bottled beverages. According to regional studies and market trackers, this category consistently holds the largest share of rPET demand. For example, food and beverage uses accounted for about 24% or more of rPET flakes demand in some U.S. analyses, and this segment leads global demand for transparent and bottle-grade rPET. Major brand commitments, such as multi-year agreements and recycled-content pledges, are expected to keep demand for bottle-grade rPET high and stable. The recent increase in 100% rPET bottle programs and new government content laws in Europe and some U.S. states are also supporting this trend.

The fiber segment, which includes recycled polyester yarns and fibers for apparel, home textiles, and technical textiles, is also growing quickly. Fashion brands, sportswear companies, and textile supply chains are setting ambitious recycled-content goals and adopting circular textile strategies. Market forecasts indicate that the recycled polyester and rPET fiber market will grow at a strong rate, with more recycled bottle feedstock being used for high-volume apparel and home textile production. Forecasts for recycled polyester and apparel fiber show multi-billion-dollar growth, and centralized sourcing programs by brands are expected to drive near-term demand. This trend creates a large outlet for collected PET, but it also increases competition with bottle-to-bottle recycling, making feedstock management an important issue for the entire rPET value chain.

By Product Type

By Type

By Source

By Grade

By End Use

By Region

Chapter 1. Market Introduction and Overview

1.1 Market Definition and Scope

1.1.1 Overview of Recycled PET

1.1.2 Scope of the Study

1.1.3 Research Timeframe

1.2 Research Methodology and Approach

1.2.1 Methodology Overview

1.2.2 Data Sources and Validation

1.2.3 Key Assumptions and Limitations

Chapter 2. Executive Summary

2.1 Market Highlights and Snapshot

2.2 Key Insights by Segments

2.2.1 By Product Type Overview

2.2.2 By Type Overview

2.2.3 By Source Overview

2.2.4 By Grade Overview

2.2.5 By End User Overview

2.3 Competitive Overview

Chapter 3. Global Impact Analysis

3.1 Russia-Ukraine Conflict: Global Market Implications

3.2 Regulatory and Policy Changes Impacting Global Markets

Chapter 4. Market Dynamics and Trends

4.1 Market Dynamics

4.1.1 Market Drivers

4.1.1.1 Regulatory Push for Recycled Content in Packaging

4.1.1.2 Brand Sustainability Commitments and Consumer Pressure

4.1.2 Market Restraints

4.1.2.1 Limited Availability of High-Quality Feedstock

4.1.2.2 Cost Competitiveness with Virgin PET

4.1.3 Market Challenges

4.1.3.1 Quality Consistency and Food-Grade Compliance

4.1.3.2 Infrastructure Gaps and Regional Imbalances

4.1.4 Market Opportunities

4.1.4.1 Expansion of Recycling Infrastructure in Emerging Markets

4.1.4.2 Technological Advancements in Recycling Processes

4.2 Market Trends

Chapter 5. Premium Insights and Analysis

5.1 Global Recycled PET Market Dynamics, Impact Analysis

5.2 Porter’s Five Forces Analysis

5.2.1 Bargaining Power of Suppliers

5.2.2 Bargaining Power of Buyers

5.2.3 Threat of Substitute Products

5.2.4 Rivalry among Existing Firms

5.2.5 Threat of New Entrants

5.3 PESTEL Analysis

5.4 Value Chain Analysis

5.5 Product Pricing Analysis

5.6 Vendor Landscape

5.6.1 List of Buyers

5.6.2 List of Suppliers

Chapter 6. Recycled PET Market, By Product Type

6.1 Global Recycled PET Market Snapshot, By Product Type

6.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

6.1.1.1 Clear rPET

6.1.1.2 Colored rPET

Chapter 7. Recycled PET Market, By Type

7.1 Global Recycled PET Market Snapshot, By Type

7.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

7.1.1.1 Flakes

7.1.1.2 Chips

Chapter 8. Recycled PET Market, By Source

8.1 Global Recycled PET Market Snapshot, By Source

8.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

8.1.1.1 Bottles and Containers

8.1.1.2 Films and Sheets

8.1.1.3 Others

Chapter 9. Recycled PET Market, By Grade

9.1 Global Recycled PET Market Snapshot, By Grade

9.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

9.1.1.1 Grade A

9.1.1.2 Grade B

Chapter 10. Recycled PET Market, By End-User

10.1 Global Recycled PET Market Snapshot, By End-User

10.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

10.1.1.1 Food & Beverage Containers and Bottles

10.1.1.2 Strapping

10.1.1.3 Fiber

10.1.1.4 Non-Food Containers and Bottles

10.1.1.5 Sheet and Film

10.1.1.6 Others

Chapter 11. Recycled PET Market, By Region

11.1 Overview

11.2 Recycled PET Market Revenue Share, By Region 2024 (%)

11.3 Global Recycled PET Market, By Region

11.3.1 Market Size and Forecast

11.4 North America

11.4.1 North America Recycled PET Market Revenue, 2022-2034 ($Billion)

11.4.2 Market Size and Forecast

11.4.3 North America Recycled PET Market, By Country

11.4.4 U.S.

11.4.4.1 U.S. Recycled PET Market Revenue, 2022-2034 ($Billion)

11.4.4.2 Market Size and Forecast

11.4.4.3 U.S. Market Segmental Analysis

11.4.5 Canada

11.4.5.1 Canada Recycled PET Market Revenue, 2022-2034 ($Billion)

11.4.5.2 Market Size and Forecast

11.4.5.3 Canada Market Segmental Analysis

11.4.6 Mexico

11.4.6.1 Mexico Recycled PET Market Revenue, 2022-2034 ($Billion)

11.4.6.2 Market Size and Forecast

11.4.6.3 Mexico Market Segmental Analysis

11.5 Europe

11.5.1 Europe Recycled PET Market Revenue, 2022-2034 ($Billion)

11.5.2 Market Size and Forecast

11.5.3 Europe Recycled PET Market, By Country

11.5.4 UK

11.5.4.1 UK Recycled PET Market Revenue, 2022-2034 ($Billion)

11.5.4.2 Market Size and Forecast

11.5.4.3 UKMarket Segmental Analysis

11.5.5 France

11.5.5.1 France Recycled PET Market Revenue, 2022-2034 ($Billion)

11.5.5.2 Market Size and Forecast

11.5.5.3 FranceMarket Segmental Analysis

11.5.6 Germany

11.5.6.1 Germany Recycled PET Market Revenue, 2022-2034 ($Billion)

11.5.6.2 Market Size and Forecast

11.5.6.3 GermanyMarket Segmental Analysis

11.5.7 Rest of Europe

11.5.7.1 Rest of Europe Recycled PET Market Revenue, 2022-2034 ($Billion)

11.5.7.2 Market Size and Forecast

11.5.7.3 Rest of EuropeMarket Segmental Analysis

11.6 Asia Pacific

11.6.1 Asia Pacific Recycled PET Market Revenue, 2022-2034 ($Billion)

11.6.2 Market Size and Forecast

11.6.3 Asia Pacific Recycled PET Market, By Country

11.6.4 China

11.6.4.1 China Recycled PET Market Revenue, 2022-2034 ($Billion)

11.6.4.2 Market Size and Forecast

11.6.4.3 ChinaMarket Segmental Analysis

11.6.5 Japan

11.6.5.1 Japan Recycled PET Market Revenue, 2022-2034 ($Billion)

11.6.5.2 Market Size and Forecast

11.6.5.3 JapanMarket Segmental Analysis

11.6.6 India

11.6.6.1 India Recycled PET Market Revenue, 2022-2034 ($Billion)

11.6.6.2 Market Size and Forecast

11.6.6.3 IndiaMarket Segmental Analysis

11.6.7 Australia

11.6.7.1 Australia Recycled PET Market Revenue, 2022-2034 ($Billion)

11.6.7.2 Market Size and Forecast

11.6.7.3 AustraliaMarket Segmental Analysis

11.6.8 Rest of Asia Pacific

11.6.8.1 Rest of Asia Pacific Recycled PET Market Revenue, 2022-2034 ($Billion)

11.6.8.2 Market Size and Forecast

11.6.8.3 Rest of Asia PacificMarket Segmental Analysis

11.7 LAMEA

11.7.1 LAMEA Recycled PET Market Revenue, 2022-2034 ($Billion)

11.7.2 Market Size and Forecast

11.7.3 LAMEA Recycled PET Market, By Country

11.7.4 GCC

11.7.4.1 GCC Recycled PET Market Revenue, 2022-2034 ($Billion)

11.7.4.2 Market Size and Forecast

11.7.4.3 GCCMarket Segmental Analysis

11.7.5 Africa

11.7.5.1 Africa Recycled PET Market Revenue, 2022-2034 ($Billion)

11.7.5.2 Market Size and Forecast

11.7.5.3 AfricaMarket Segmental Analysis

11.7.6 Brazil

11.7.6.1 Brazil Recycled PET Market Revenue, 2022-2034 ($Billion)

11.7.6.2 Market Size and Forecast

11.7.6.3 BrazilMarket Segmental Analysis

11.7.7 Rest of LAMEA

11.7.7.1 Rest of LAMEA Recycled PET Market Revenue, 2022-2034 ($Billion)

11.7.7.2 Market Size and Forecast

11.7.7.3 Rest of LAMEAMarket Segmental Analysis

Chapter 12. Competitive Landscape

12.1 Competitor Strategic Analysis

12.1.1 Top Player Positioning/Market Share Analysis

12.1.2 Top Winning Strategies, By Company, 2022-2024

12.1.3 Competitive Analysis By Revenue, 2022-2024

12.2 Recent Developments by the Market Contributors (2024)

Chapter 13. Company Profiles

13.1 Ergis Recycling

13.1.1 Company Snapshot

13.1.2 Company and Business Overview

13.1.3 Financial KPIs

13.1.4 Product/Service Portfolio

13.1.5 Strategic Growth

13.1.6 Global Footprints

13.1.7 Recent Development

13.1.8 SWOT Analysis

13.2 BariQ

13.3 Clear Path Recycling LLC

13.4 Phoenix Technologies

13.5 Libolon

13.6 Placon

13.7 M&G Chemicals

13.8 Evergreen Plastics, Inc.

13.9 Zhejiang AnshunPettechsFibre Co. Ltd.

13.10 Sorema

13.11 PolyQuest

13.12 Verdeco Recycling, Inc.